Global Agammaglobulinemia Treatment Market

Market Size in USD Billion

CAGR :

%

USD

14.00 Billion

USD

20.68 Billion

2024

2032

USD

14.00 Billion

USD

20.68 Billion

2024

2032

| 2025 –2032 | |

| USD 14.00 Billion | |

| USD 20.68 Billion | |

|

|

|

|

Agammaglobulinemia Treatment Market Size

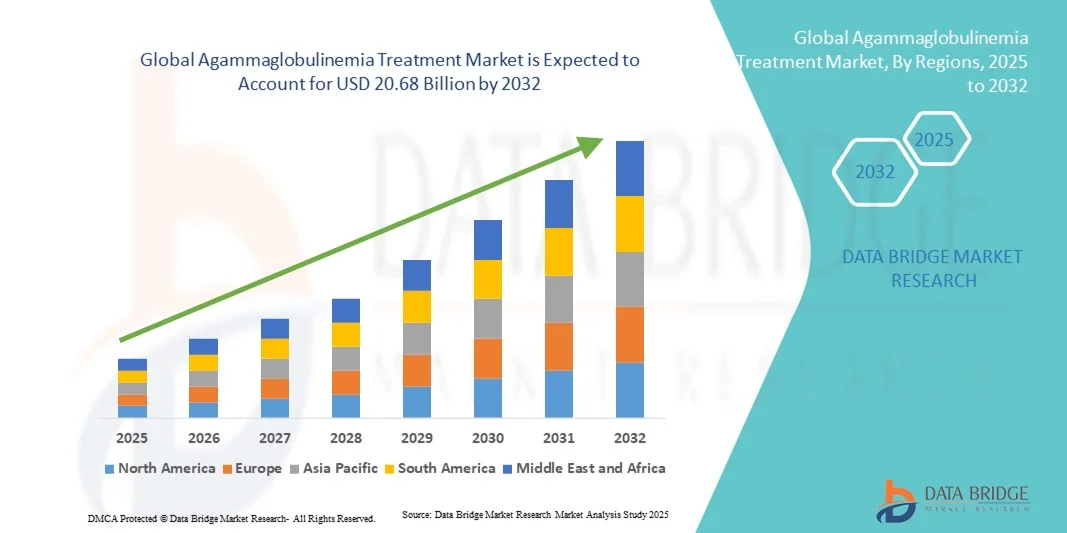

- The global agammaglobulinemia treatment market size was valued at USD 14.00 billion in 2024 and is expected to reach USD 20.68 billion by 2032, at a CAGR of 6.90% during the forecast period

- The market growth is primarily driven by increasing awareness and diagnosis of primary immunodeficiency disorders, along with advancements in immunoglobulin replacement therapies and targeted drug development

- Furthermore, the growing focus on personalized medicine and the rising number of clinical studies evaluating novel biologics and gene therapies are strengthening treatment efficacy and accessibility. These factors are collectively propelling the adoption of advanced therapies, thereby significantly contributing to the expansion of the global agammaglobulinemia treatment market

Agammaglobulinemia Treatment Market Analysis

- Agammaglobulinemia treatment, encompassing gammaglobulin therapy and antibiotics, is essential for managing this rare immune disorder by restoring antibody levels and reducing infection risk among patients with genetic immunodeficiency conditions

- The increasing demand for agammaglobulinemia treatment is primarily driven by advancements in genetic diagnosis, the availability of improved immunoglobulin formulations, and the growing recognition of rare diseases among healthcare providers and patients

- North America dominated the global agammaglobulinemia treatment market with the largest revenue share of 42.3% in 2024, supported by robust healthcare infrastructure, strong reimbursement frameworks, and the presence of leading biopharmaceutical companies developing advanced immunotherapies

- Asia-Pacific is expected to be the fastest-growing region in the agammaglobulinemia treatment market during the forecast period, driven by increasing healthcare investments, improving diagnostic networks, and rising awareness of primary immunodeficiency disorders

- The gammaglobulin treatment segment dominated the agammaglobulinemia treatment market with a market share of 56.9% in 2024, attributed to its proven clinical efficacy, widespread adoption for antibody replacement, and ongoing innovation in intravenous and subcutaneous delivery routes

Report Scope and Agammaglobulinemia Treatment Market Segmentation

|

Attributes |

Agammaglobulinemia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Agammaglobulinemia Treatment Market Trends

Advancements in Gene Therapy and Personalized Immunoglobulin Formulations

- A significant and accelerating trend in the global agammaglobulinemia treatment market is the increasing focus on gene therapy and the development of personalized immunoglobulin replacement therapies to provide long-term or curative treatment options for patients with genetic immunodeficiency

- For instance, ongoing research into X-linked agammaglobulinemia (XLA) gene therapy using lentiviral and CRISPR-based approaches is showing promising results in restoring B-cell function and reducing dependency on lifelong immunoglobulin infusions

- The introduction of next-generation subcutaneous immunoglobulin (SCIG) products with enhanced stability and ease of self-administration is improving patient compliance and quality of life, while reducing hospital visits. Furthermore, patient-tailored immunoglobulin dosing and digital health monitoring tools are enabling more effective, individualized management of antibody deficiencies

- The integration of AI-driven diagnostics and predictive analytics in immunology is helping clinicians identify agammaglobulinemia subtypes earlier and optimize therapy outcomes based on genetic and clinical data. Through these technologies, healthcare providers can monitor infection risk and adjust treatment schedules more accurately

- This trend toward precision medicine and gene-based innovation is fundamentally reshaping treatment expectations and care strategies in immunodeficiency management. Consequently, companies such as Takeda and CSL Behring are investing in advanced biologics and gene-correction programs targeting XLA and other congenital antibody deficiencies

- The demand for next-generation therapies that combine genetic correction with sustained immunoprotection is growing rapidly across both pediatric and adult patient populations, as clinicians increasingly prioritize durable, low-burden treatment solutions

Agammaglobulinemia Treatment Market Dynamics

Driver

Rising Diagnosis Rates and Growing Demand for Immunoglobulin Therapies

- The increasing global awareness of primary immunodeficiency disorders and improvements in genetic testing capabilities are significant drivers for the growing demand for agammaglobulinemia treatment

- For instance, in March 2024, CSL Behring expanded its immunoglobulin manufacturing capacity to meet rising demand for intravenous and subcutaneous formulations globally, ensuring improved accessibility and continuity of care

- As early diagnosis becomes more common due to newborn screening and advanced genomic tools, more patients are being identified at treatable stages, driving consistent demand for gammaglobulin therapy and adjunct antibiotics

- Furthermore, healthcare providers and patients are increasingly adopting self-administered subcutaneous immunoglobulin (SCIG) therapies that offer flexibility, safety, and better adherence, contributing to market expansion across homecare and specialty clinic settings

- The convenience of at-home infusion, reduced hospital dependency, and improved patient-reported outcomes are key factors supporting the adoption of immunoglobulin replacement therapy as the standard of care in both developed and emerging markets. The trend toward long-acting and recombinant formulations further reinforces market growth

Restraint/Challenge

High Treatment Costs and Limited Gene Therapy Accessibility

- The high cost of lifelong immunoglobulin replacement therapy and limited availability of curative gene therapies pose significant challenges to equitable access and affordability of agammaglobulinemia treatment

- For instance, patients in low- and middle-income countries often face financial and logistical barriers to consistent immunoglobulin supply due to dependence on plasma donations and complex cold-chain distribution systems

- Addressing these economic and logistical hurdles through regional plasma collection initiatives, insurance coverage expansion, and public-private partnerships is crucial for improving access and sustainability. Companies such as Grifols and Octapharma are investing in supply chain strengthening to mitigate these limitations

- In addition, the limited number of clinical sites equipped to perform advanced gene therapy procedures restricts global accessibility, delaying adoption despite promising clinical trial outcomes. While ongoing collaborations are expanding access, infrastructure gaps remain significant

- Although progress is being made toward more cost-effective production and wider availability, the high financial burden and regional disparities continue to hinder large-scale adoption, particularly in resource-constrained healthcare systems

- Overcoming these challenges through cost-optimization strategies, regulatory harmonization, and global awareness campaigns will be essential to ensure long-term growth and patient accessibility in the agammaglobulinemia treatment market

Agammaglobulinemia Treatment Market Scope

The market is segmented on the basis of type, treatment, route of administration, distribution channel, and end users.

- By Type

On the basis of type, the agammaglobulinemia treatment market is segmented into Autosomal Recessive Agammaglobulinemia, X-linked Agammaglobulinemia with Growth Hormone Deficiency, and X-linked Agammaglobulinemia (XLA). The X-linked Agammaglobulinemia (XLA) segment dominated the market with the largest market revenue share in 2024, owing to its higher prevalence and extensive research focus. This form, caused by BTK gene mutations, represents the majority of diagnosed agammaglobulinemia cases and remains the key target for gene-based and immunoglobulin therapies. Continuous clinical advancements, established diagnostic protocols, and strong presence of patient registries across North America and Europe have reinforced this dominance. Early screening and improved genetic counseling are enhancing detection rates, ensuring stable market growth for XLA treatment solutions. The consistent inclusion of XLA in rare disease funding programs and ongoing pharmaceutical innovation further secure its leading position.

The Autosomal Recessive Agammaglobulinemia segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by improvements in next-generation sequencing and molecular diagnostic accessibility. Growing awareness of non-X-linked genetic variants and enhanced clinician understanding of atypical immunodeficiency presentations are broadening the identified patient base. Increasing research into mutation-specific therapies and rare disease mapping initiatives is fostering stronger clinical interest in these subtypes. The expansion of genetic testing programs in emerging markets and collaborative studies among academic institutions are contributing to early diagnosis. Rising investments from biotech companies in niche rare disease segments are expected to accelerate therapeutic development and adoption for this subtype.

- By Treatment

On the basis of treatment, the market is segmented into Gammaglobulin and Antibiotics. The Gammaglobulin segment dominated the market with a revenue share of 56.9% in 2024, as it remains the cornerstone therapy for restoring immune function in agammaglobulinemia patients. Intravenous and subcutaneous immunoglobulin formulations are widely used to prevent infections and improve survival rates across pediatric and adult populations. Continuous product innovations, including extended half-life and recombinant formulations, are enhancing clinical outcomes and patient convenience. Robust reimbursement frameworks and expanded plasma collection infrastructure are further driving the market. Hospitals and specialty clinics remain primary treatment centers due to the clinical supervision required for immunoglobulin infusions. The strong clinical efficacy, long-standing regulatory approvals, and broad therapeutic coverage underpin the dominance of this segment.

The Antibiotics segment is expected to witness the fastest growth from 2025 to 2032, supported by its role in adjunctive and prophylactic treatment alongside immunoglobulin therapy. Rising antimicrobial resistance has led to a focus on personalized antibiotic regimens tailored to immunocompromised patients. Increased infection surveillance programs in hospitals and outpatient settings are enhancing antibiotic usage precision. The development of targeted antimicrobial agents for chronic respiratory and sinus infections associated with immunodeficiencies is stimulating market expansion. Integration of telemedicine-based antibiotic monitoring is also supporting effective infection management. The combination of preventive antibiotic strategies and improved access to specialized care is expected to boost growth within this segment during the forecast period.

- By Route of Administration

On the basis of route of administration, the market is segmented into Oral, Intravenous, and Others. The Intravenous route dominated the global agammaglobulinemia treatment market in 2024, due to its ability to deliver rapid, high-dose antibody replacement for effective infection prevention. Intravenous immunoglobulin (IVIG) is a well-established treatment with robust clinical data supporting its efficacy in managing severe antibody deficiencies. Hospitals and infusion centers remain key settings for IV administration, ensuring safety and dosage control under medical supervision. Continuous innovation in IVIG formulations has reduced infusion times and adverse reactions, improving patient adherence. Widespread healthcare infrastructure supporting IV therapy contributes to sustained dominance. Strong physician familiarity and favorable reimbursement policies make intravenous therapy the preferred administration route.

The Oral segment is projected to record the fastest CAGR from 2025 to 2032, driven by growing research into oral antibiotic therapies and experimental oral immunoglobulin formulations. Oral treatments are increasingly preferred for mild infections and long-term prophylaxis, particularly in outpatient and homecare environments. The ease of administration, lower treatment cost, and reduced hospital visits make oral options attractive for chronic disease management. Technological advancements in drug delivery systems are improving the bioavailability of oral formulations. The shift toward patient-centric care and increased telehealth adoption are enabling better adherence to oral therapy regimens. As clinical validation progresses, oral routes are expected to capture a larger share of maintenance treatments.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. The Hospital Pharmacies segment dominated the market with the largest share in 2024, attributed to the concentration of immunoglobulin therapy and complex infection management within hospital settings. Hospitals serve as centralized distribution points for IVIG infusions and antibiotic administration under controlled conditions. The established cold-chain infrastructure for biologics and direct linkage to inpatient and outpatient immunology units support strong performance of this segment. Hospitals also benefit from institutional purchasing agreements and consistent patient referrals. The need for physician oversight and immediate access to emergency care further reinforces the reliance on hospital pharmacies. Favorable reimbursement and integrated care delivery systems continue to drive hospital-based pharmaceutical demand.

The Online Pharmacies segment is anticipated to grow at the fastest rate from 2025 to 2032, supported by the rapid digitalization of healthcare and increasing preference for convenient medication access. E-pharmacy platforms are expanding capabilities to manage temperature-sensitive biologics, supported by advanced logistics and cold-chain solutions. Patients receiving subcutaneous immunoglobulin therapy increasingly prefer online delivery due to home-based treatment convenience. Integration of e-prescription systems, digital payment options, and teleconsultation services is facilitating seamless patient access. The growing regulatory support for telepharmacy operations in developed and emerging markets is further accelerating adoption. Rising internet penetration and healthcare e-commerce expansion are expected to make online pharmacies a key growth avenue in the coming years.

- By End Users

On the basis of end users, the market is divided into Hospitals, Homecare, Specialty Clinics, and Others. The Hospitals segment dominated the global market in 2024, driven by the concentration of advanced diagnostic, therapeutic, and infusion capabilities in hospital settings. Hospitals provide comprehensive care, including IVIG therapy, acute infection management, and genetic testing, making them the primary centers for diagnosis and treatment. Strong clinical infrastructure and multidisciplinary care models support accurate monitoring and ongoing patient management. The availability of highly trained specialists, along with access to advanced medical equipment, further enhances hospital-based treatment delivery. Hospitals also play a critical role in initiating therapy before transitioning patients to home-based care. Their established reimbursement systems and centralized drug procurement ensure sustained market leadership.

The Homecare segment is projected to be the fastest-growing from 2025 to 2032, fueled by the increasing adoption of subcutaneous immunoglobulin (SCIG) therapy and the expansion of home infusion programs. Home-based treatment offers significant convenience, cost savings, and improved patient comfort, particularly for those requiring lifelong therapy. Portable infusion devices, nurse-led home training, and telehealth monitoring are enabling patients to self-administer safely. Healthcare providers and payers are increasingly supporting homecare to reduce hospital burden and optimize resource utilization. Advances in SCIG formulations and infusion technology are further improving patient autonomy and adherence. The combination of patient preference, economic efficiency, and healthcare system support is expected to drive strong growth in this segment over the forecast period.

Agammaglobulinemia Treatment Market Regional Analysis

- North America dominated the global agammaglobulinemia treatment market with the largest revenue share of 42.3% in 2024, supported by robust healthcare infrastructure, strong reimbursement frameworks, and the presence of leading biopharmaceutical companies developing advanced immunotherapies

- Consumers and healthcare providers in North America increasingly emphasize early genetic testing, long-term disease management, and home-based immunoglobulin therapy, enhancing patient convenience and compliance

- The widespread adoption of telehealth platforms and remote patient monitoring solutions further supports ongoing treatment adherence and continuity of care. Continuous government support through rare disease funding programs and the expansion of plasma collection centers are fueling steady market growth across the U.S. and Canada.

U.S. Agammaglobulinemia Treatment Market Insight

The U.S. agammaglobulinemia treatment market captured the largest revenue share of 79% in 2024 within North America, driven by early diagnosis, advanced healthcare infrastructure, and a strong focus on rare disease management. The country benefits from robust clinical research activity and growing patient access to immunoglobulin replacement therapies. The availability of government funding and support for orphan drug development further accelerates innovation. Moreover, the adoption of home-based intravenous and subcutaneous immunoglobulin (IVIG/SCIG) therapies is increasing due to patient convenience. These factors collectively strengthen the U.S. position as a leader in the agammaglobulinemia treatment landscape.

Europe Agammaglobulinemia Treatment Market Insight

The Europe agammaglobulinemia treatment market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising awareness of primary immunodeficiency diseases (PIDs) and expanding access to specialized healthcare services. The implementation of rare disease registries across European nations is improving diagnosis rates and patient monitoring. Moreover, the growth of plasma collection facilities and collaborative programs among hospitals are enhancing immunoglobulin availability. Increasing support from healthcare authorities and the European Medicines Agency (EMA) for rare disease therapies further propels the regional market.

U.K. Agammaglobulinemia Treatment Market Insight

The U.K. agammaglobulinemia treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong investments in genomic research and early detection initiatives. The NHS’s focus on rare disease frameworks and improved patient referral systems is enabling earlier diagnosis and treatment intervention. Furthermore, the U.K.’s emphasis on equitable access to IVIG therapy through public healthcare systems supports sustainable market growth. Ongoing clinical studies exploring gene-based therapies also contribute to a promising treatment outlook for agammaglobulinemia patients.

Germany Agammaglobulinemia Treatment Market Insight

The Germany agammaglobulinemia treatment market is expected to expand at a considerable CAGR during the forecast period, owing to the nation’s advanced medical infrastructure and high healthcare spending. Germany’s focus on biopharmaceutical innovation and plasma product manufacturing is enhancing therapy availability and affordability. The country’s patient-centric healthcare policies and reimbursement support for immunoglobulin therapies encourage continuous adoption. In addition, collaborations between biotechnology firms and academic institutions are driving research into novel targeted therapies for agammaglobulinemia.

Asia-Pacific Agammaglobulinemia Treatment Market Insight

The Asia-Pacific agammaglobulinemia treatment market is poised to grow at the fastest CAGR of 23.4% during the forecast period of 2025 to 2032, driven by rising awareness of rare genetic disorders and expanding healthcare access in emerging economies such as China, Japan, and India. The region’s growing investment in plasma-derived therapies and public health initiatives for early diagnosis are key growth enablers. Moreover, regional collaborations to enhance genetic testing capabilities and treatment reimbursement policies are further supporting patient care advancement across APAC countries.

Japan Agammaglobulinemia Treatment Market Insight

The Japan agammaglobulinemia treatment market is gaining momentum due to the country’s technological advancements in healthcare and early adoption of precision medicine. Japan’s robust healthcare infrastructure supports comprehensive diagnostic testing and long-term treatment management for primary immunodeficiencies. Moreover, the country’s emphasis on home-based immunoglobulin therapy and aging demographics is increasing the demand for convenient and safer treatment options. Research efforts into gene-editing technologies and domestic plasma collection expansion are additional drivers of market growth.

India Agammaglobulinemia Treatment Market Insight

The India agammaglobulinemia treatment market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by improving healthcare infrastructure, expanding diagnostic capabilities, and growing government focus on rare diseases. Increased awareness among healthcare professionals and patients is leading to earlier recognition of immunodeficiency conditions. Furthermore, local production of immunoglobulin formulations and the availability of affordable treatment options are expanding patient access. The rise of specialty clinics and telemedicine services is also enhancing continuity of care for patients requiring long-term immunoglobulin therapy.

Agammaglobulinemia Treatment Market Share

The Agammaglobulinemia Treatment industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- CSL Limited (Australia)

- Grifols, S.A. (Spain)

- Octapharma AG (Switzerland)

- Kedrion S.p.A (Italy)

- LFB (France)

- Biotest AG (Germany)

- Baxter. (U.S.)

- Kamada Ltd. (Israel)

- Bio Products Laboratory Ltd (U.K.)

- Shanghai RAAS Blood Products Co., Ltd. (China)

- Green Cross Corporation (South Korea)

- China Biologic Products Holdings, Inc. (China)

- ADMA Biologics, Inc. (U.S.)

- Genezen Therapeutics, Inc. (U.S.)

- Orchard Therapeutics Ltd (U.K.)

- Rocket Pharmaceuticals, Inc. (U.S.)

- Homology Medicines, Inc. (U.S.)

- Swedish Orphan Biovitrum AB (Sweden)

- Octapharma Plasma (U.S.)

What are the Recent Developments in Global Agammaglobulinemia Treatment Market?

- In December 2024, Takeda Pharmaceutical Company Limited announced that Japan’s Ministry of Health, Labour and Welfare approved HYQVIA 10% subcutaneous immunoglobulin (SCIG) combined with recombinant human hyaluronidase for treating agammaglobulinemia and hypogammaglobulinemia. This approval provides patients with a more flexible, less frequent dosing regimen administered once every 3–4 weeks enhancing convenience and adherence compared to traditional IVIG infusions

- In August 2024, the Immune Deficiency Foundation (IDF) showcased a breakthrough session titled “Gene Editing for X-linked Agammaglobulinemia” during its annual Primary Immunodeficiency (PI) Conference. Researchers presented progress on CRISPR/Cas9-based gene editing techniques designed to repair defective BTK genes within hematopoietic stem cells. This cutting-edge approach could potentially restore immune function in XLA patients, marking a significant evolution in rare disease therapeutics

- In March 2024, Genezen Therapeutics announced a strategic collaboration with Seattle Children’s Research Institute to advance a novel cell therapy program for X-linked agammaglobulinemia (XLA). The initiative aims to genetically modify a patient’s own stem cells to correct mutations in the BTK gene, responsible for defective B-cell development. This partnership represents a major step toward potentially curative therapies for XLA, shifting focus from lifelong immunoglobulin replacement to gene-based correction

- In June 2023, Dr. Donald Kohn of the University of California, Los Angeles (UCLA) received the Michael Blaese Research Grant from the Immune Deficiency Foundation to support the development of a CRISPR gene-editing strategy for XLA. His team is focusing on precisely inserting functional copies of the BTK gene into patient-derived hematopoietic stem cells, aiming to restore normal B-cell production. This research builds upon Kohn’s previous success in gene therapy for ADA-SCID and offers hope for a similar curative pathway for agammaglobulinemia

- In May 2023, a landmark registry study involving 240 patients with X-linked agammaglobulinemia was published in the Journal of Clinical Immunology. Conducted across the U.S., the study analyzed treatment patterns, infection frequency, and long-term outcomes. Results showed that 92% of patients were on immunoglobulin replacement therapy, with a subset also using prophylactic antibiotics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.