Global Age Related Macular Degeneration Amd Disease Anti Vegf Market

Market Size in USD Billion

CAGR :

%

USD

14.60 Billion

USD

24.71 Billion

2024

2032

USD

14.60 Billion

USD

24.71 Billion

2024

2032

| 2025 –2032 | |

| USD 14.60 Billion | |

| USD 24.71 Billion | |

|

|

|

|

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Size

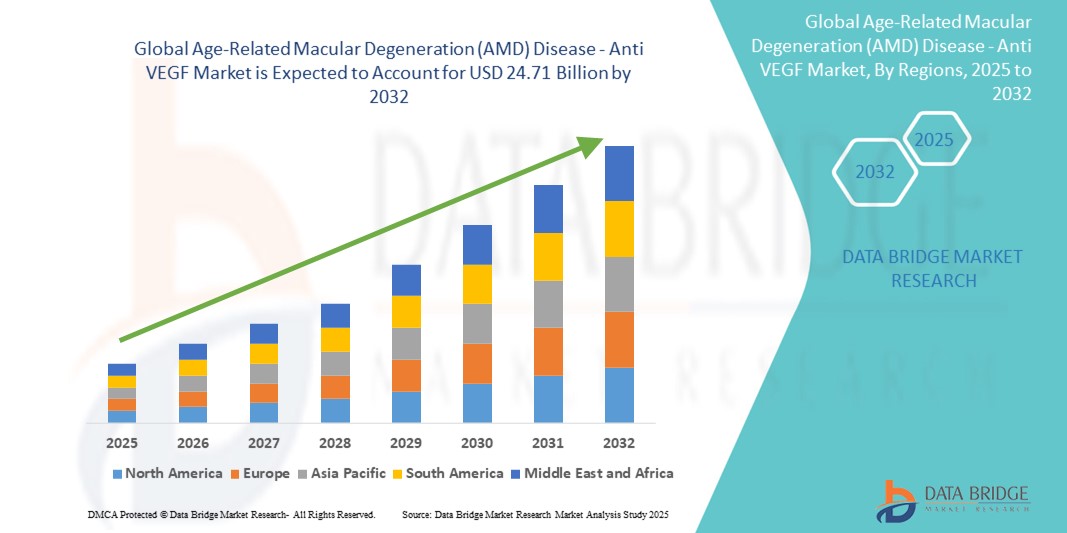

- The global age-related macular degeneration (AMD) disease - Anti VEGF market size was valued at USD 14.60 billion in 2024 and is expected to reach USD 24.71 billion by 2032, at a CAGR of 6.80% during the forecast period

- The market growth is largely driven by the rising geriatric population, growing prevalence of AMD, and increasing awareness about early detection and treatment of retinal disorders through intravitreal anti-VEGF therapies

- Furthermore, ongoing advancements in biologics, extended-duration formulations, and sustained-release delivery systems are enhancing therapeutic outcomes, fueling wider adoption of anti-VEGF agents. These converging factors are accelerating innovation and access in ophthalmic care, thereby significantly boosting the industry’s growth

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Analysis

- Anti-VEGF therapies, targeting abnormal blood vessel growth in the retina, have become essential in managing wet age-related macular degeneration (AMD), significantly delaying disease progression and improving visual outcomes, especially in elderly populations

- The increasing demand for anti-VEGF treatments is primarily driven by the growing aging population, rising global prevalence of AMD, and expanding access to ophthalmic diagnostics and intravitreal therapies across both developed and emerging markets

- North America dominated the age-related macular degeneration (AMD) disease - Anti VEGF market with the largest revenue share of 46.3% in 2024, underpinned by advanced healthcare infrastructure, a high volume of retinal specialists, strong reimbursement frameworks, and the early adoption of novel extended-release anti-VEGF drugs, particularly in the U.S.

- Asia-Pacific is expected to be the fastest growing region in the age-related macular degeneration (AMD) disease - Anti VEGF market during the forecast period due to increasing geriatric demographics, improving healthcare accessibility, and rising awareness of vision preservation treatments

- Wet AMD segment dominated the age-related macular degeneration (AMD) disease - Anti VEGF market with a share of 90% in 2024, driven by the availability and efficacy of anti-VEGF therapies for this form of AMD, which causes rapid central vision loss and requires prompt clinical intervention

Report Scope and Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Segmentation

|

Attributes |

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Trends

“Advancement of Extended-Duration and Sustained-Delivery Therapies”

- A significant and growing trend in the AMD – anti-VEGF market is the shift toward extended-duration and sustained-delivery treatment solutions, aimed at reducing injection frequency and improving patient adherence in managing wet AMD. This trend is being driven by innovations such as the Port Delivery System (PDS) with ranibizumab, as well as investigational long-acting biologics and gene therapy approaches

- For instance, Genentech’s PDS allows continuous release of ranibizumab over several months with fewer clinic visits, significantly reducing the burden of frequent intravitreal injections. Similarly, emerging agents such as faricimab offer dual pathway inhibition and extended dosing intervals up to 16 weeks, enhancing convenience for patients and physicians asuch as

- These advanced therapies address one of the key limitations of traditional anti-VEGF treatments frequent dosing which often leads to treatment fatigue and suboptimal outcomes due to missed or delayed appointments. Sustained-delivery approaches are improving long-term visual outcomes by promoting consistent therapeutic exposure

- Furthermore, the trend toward combination therapies and novel drug delivery systems (e.g., biodegradable implants) supports the evolution of AMD treatment into more patient-centric care models. With the increasing global burden of AMD, especially in aging populations, the demand for long-acting anti-VEGF solutions is expected to accelerate

- This shift is reshaping how clinicians approach AMD care, aligning with payer priorities for cost-effective outcomes and creating new opportunities for pharmaceutical and biotech firms to differentiate through innovation

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Dynamics

Driver

“Rising AMD Prevalence and Aging Population Fueling Demand”

- The increasing prevalence of AMD globally, driven by a rapidly aging population, is a key factor propelling demand for anti-VEGF therapies. According to WHO estimates, the number of people aged 60 and older will double by 2050, with a significant portion expected to experience some degree of vision impairment due to retinal diseases such as AMD

- For instance, wet AMD, though less common than dry AMD, leads to rapid central vision loss and requires immediate and ongoing treatment with anti-VEGF injections to prevent irreversible damage. The rising incidence of wet AMD is prompting healthcare systems and providers to adopt early and aggressive therapeutic interventions

- Moreover, growing public awareness, improvements in retinal imaging diagnostics (such as OCT), and expanding access to ophthalmic services in developing markets are supporting early diagnosis and consistent treatment, further driving market growth

- Pharmaceutical companies are investing in research to develop next-generation therapies that offer extended durability and better visual outcomes. Collaborations and regulatory approvals for such innovations are supporting strong pipeline momentum and commercial expansion, particularly in developed economies

Restraint/Challenge

“Treatment Burden and Cost Implications Affecting Adherence”

- The need for frequent intravitreal injections often every 4 to 8 weeks poses a significant challenge in the AMD – anti-VEGF market, particularly for elderly patients with mobility issues or limited access to specialized eye care. This high treatment burden can result in poor adherence, suboptimal outcomes, and disease progression

- For instance, real-world data has shown that many patients receive fewer injections than recommended in clinical trials, leading to a decline in visual acuity over time. This non-adherence is especially common in resource-limited settings where regular follow-ups are difficult

- In addition, the high cost of branded anti-VEGF therapies such as Eylea, Lucentis, and Vabysmo can be a barrier to treatment, particularly in markets with limited reimbursement coverage or where generic alternatives are unavailable. Although biosimilars such as ranibizumab-nuna are beginning to enter the market, affordability remains a concern for many patients

- Addressing these challenges through the development of cost-effective biosimilars, long-acting delivery options, patient assistance programs, and infrastructure improvements in ophthalmic care access will be critical to ensuring broader and sustained market growth

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Scope

The market is segmented on the basis of type, end user, and distribution channel.

- By Type

On the basis of type, the age-related macular degeneration (AMD) Disease - Anti VEGF market is segmented into Dry AMD and Wet AMD. The Wet AMD segment dominated the market with the largest revenue share of 90% in 2024, attributed to the widespread use and clinical effectiveness of anti-VEGF therapies in treating neovascular AMD, which causes rapid vision loss and requires active medical intervention. Wet AMD patients typically receive consistent intravitreal injections, making them a primary target population for anti-VEGF drug manufacturers.

The Dry AMD segment, although less dominant in revenue share, is anticipated to witness steady growth during the forecast period due to increasing research and development in geographic atrophy treatment options and early-stage diagnostic tools. As pipeline therapies for dry AMD gain regulatory approval, the market segment is expected to expand further.

- By End User

On the basis of end user, the age-related macular degeneration (AMD) Disease - Anti VEGF market is segmented into hospitals, specialty clinics, ambulatory surgical centers, home healthcare, and others. The Hospitals segment held the largest revenue share of 46.7% in 2024, owing to the presence of advanced ophthalmic diagnostic equipment, availability of trained retinal specialists, and capacity to manage high volumes of patients requiring anti-VEGF injections. Hospitals also often serve as referral centers for complex or advanced-stage AMD cases.

The Specialty Clinics segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing number of standalone eye care centers offering specialized retina care. These clinics provide accessible and personalized treatment options, often with shorter wait times, attracting both urban and semi-urban populations seeking timely AMD care.

- By Distribution Channel

On the basis of distribution channel, the age-related macular degeneration (AMD) Disease - Anti VEGF market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market with a 58.3% revenue share in 2024, driven by bulk procurement of anti-VEGF drugs by public hospitals, government institutions, and large healthcare systems. These purchases ensure consistent availability and lower unit costs for high-volume centers.

The Retail Sales segment is projected to grow steadily due to increasing demand from private clinics and home healthcare providers. As awareness and accessibility of AMD treatments improve in both developed and emerging markets, patients are increasingly turning to pharmacies and retail chains for prescribed anti-VEGF therapies.

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Regional Analysis

- North America dominated the age-related macular degeneration (AMD) Disease - Anti VEGF market with the largest revenue share of 46.3% in 2024, underpinned by advanced healthcare infrastructure, a high volume of retinal specialists, strong reimbursement frameworks, and the early adoption of novel extended-release anti-VEGF drugs, particularly in the U.S.

- Patients and healthcare providers in the region prioritize early intervention and evidence-based treatment, supported by favorable reimbursement policies and the availability of leading anti-VEGF drugs such as Eylea, Lucentis, and Vabysmo

- The region’s market leadership is further reinforced by an aging population, well-established distribution networks, and ongoing innovation by key pharmaceutical players, solidifying North America’s position as a primary hub for AMD treatment and research

U.S. Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Insight

The U.S. age-related macular degeneration (AMD) Disease - Anti VEGF market captured the largest revenue share of 77% in North America in 2024, supported by a high prevalence of age-related vision disorders and early adoption of innovative retinal therapies. The country’s strong clinical infrastructure, high per capita healthcare spending, and well-established reimbursement landscape continue to drive widespread access to anti-VEGF injections such as Eylea, Lucentis, and Vabysmo. Moreover, the presence of major pharmaceutical players and ongoing advancements in extended-duration therapies reinforce the U.S. as a leader in AMD management.

Europe AMD – Anti-VEGF Market Insight

The Europe age-related macular degeneration (AMD) Disease - Anti VEGF market is projected to expand at a steady CAGR over the forecast period, primarily driven by the region’s aging population and increased awareness of early vision loss interventions. National screening programs, universal healthcare systems, and access to biosimilars are contributing to the broader adoption of anti-VEGF therapies across public and private settings. Growth is particularly robust in countries such as Germany and France, where aging demographics and public health investments support regular retinal care.

U.K. AMD – Anti-VEGF Market Insight

The U.K. age-related macular degeneration (AMD) Disease - Anti VEGF market is anticipated to grow at a notable CAGR during the forecast period, propelled by the National Health Service (NHS)’s structured retinal care pathways and emphasis on early detection and treatment. Wet AMD cases are commonly treated with NHS-funded anti-VEGF therapies, and new extended-interval options are gaining traction. Continued investments in ophthalmic services and increased adoption of biosimilars are expected to enhance access and affordability.

Germany AMD – Anti-VEGF Market Insight

The Germany age-related macular degeneration (AMD) Disease - Anti VEGF market is expected to expand significantly, driven by the country’s aging population, robust health insurance system, and preference for evidence-based care. Germany’s advanced diagnostic infrastructure and emphasis on treatment precision support the uptake of premium anti-VEGF therapies. Furthermore, the integration of long-acting treatment options and digital monitoring tools is shaping a more efficient and personalized AMD treatment landscape.

Asia-Pacific AMD – Anti-VEGF Market Insight

The Asia-Pacific age-related macular degeneration (AMD) Disease - Anti VEGF market is poised to grow at the fastest CAGR of 22% during the forecast period (2025 to 2032), driven by rising life expectancy, improved ophthalmic awareness, and expanding healthcare access across the region. Countries such as China, Japan, and India are witnessing increased AMD diagnosis rates and accelerated adoption of anti-VEGF drugs through both public health initiatives and private sector expansion. Investment in medical infrastructure and digital health is further supporting regional growth.

Japan AMD – Anti-VEGF Market Insight

The Japan age-related macular degeneration (AMD) Disease - Anti VEGF market is gaining traction due to the country’s super-aged society, high prevalence of wet AMD, and advanced healthcare delivery systems. Japanese ophthalmologists frequently use anti-VEGF injections, and patients benefit from national insurance coverage that promotes timely intervention. Innovations in sustained-delivery drugs and home monitoring technologies are gaining interest, especially as the country emphasizes preventive and minimally invasive treatments.

India AMD – Anti-VEGF Market Insight

The India age-related macular degeneration (AMD) Disease - Anti VEGF market held the largest revenue share within Asia-Pacific in 2024, bolstered by rapid urbanization, growing elderly demographics, and increased accessibility to ophthalmic services. Expanding health insurance coverage, rising awareness campaigns, and the availability of affordable biosimilars are promoting treatment in both urban and tier-2/3 cities. Domestic pharmaceutical manufacturing and government health programs are expected to further strengthen the AMD care ecosystem in the coming years.

Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market Share

The age-related macular degeneration (AMD) Disease - Anti VEGF industry is primarily led by well-established companies, including:

- Genentech, Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Bayer AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Kodiak Sciences Inc. (U.S.)

- Samsung Bioepis Co., Ltd. (South Korea)

- Biogen Inc. (U.S.)

- Outlook Therapeutics, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Alcon Inc. (Switzerland)

- PanOptica, Inc. (U.S.)

- Graybug Vision, Inc. (U.S.)

- Ocular Therapeutix, Inc. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Oxurion NV (Belgium)

- Santen Pharmaceutical Co., Ltd. (Japan)

What are the Recent Developments in Global Age-Related Macular Degeneration (AMD) Disease - Anti VEGF Market?

- In May 2023, Genentech, a member of the Roche Group, announced the expanded availability of its Port Delivery System (PDS) with ranibizumab across multiple international markets. This long-acting implant offers continuous intravitreal drug delivery, significantly reducing the frequency of injections for patients with wet AMD. The rollout represents a major advancement in treatment convenience and reflects Genentech’s commitment to innovation in sustained drug delivery solutions for retinal diseases

- In April 2023, Regeneron Pharmaceuticals, Inc. and Bayer AG jointly announced positive results from their Phase 3 clinical trial of aflibercept 8 mg, a higher-dose formulation of Eylea designed to extend dosing intervals up to 16 weeks. The promising trial outcomes pave the way for regulatory approvals and commercialization, signaling a shift toward extended-duration therapies that reduce the burden on both patients and healthcare systems

- In March 2023, Outlook Therapeutics, Inc. submitted a Biologics License Application (BLA) to the U.S. FDA for ONS-5010 / Lytenava, an ophthalmic formulation of bevacizumab for the treatment of wet AMD. If approved, this would mark the first FDA-approved bevacizumab therapy for ocular use, offering a cost-effective alternative to existing anti-VEGF treatments and potentially reshaping the competitive landscape

- In February 2023, Samsung Bioepis and Biogen Inc. announced the European launch of Byooviz, a ranibizumab biosimilar referencing Lucentis. Byooviz’s entry into the market supports expanded access to anti-VEGF therapy at a lower cost, especially across publicly funded healthcare systems in Europe. This milestone reinforces the growing role of biosimilars in driving affordability and treatment accessibility in AMD care

- In January 2023, Kodiak Sciences Inc. released updated Phase 2 trial data for KSI-301 (tarcocimab tedromer), an investigational anti-VEGF therapy designed for extended durability and reduced injection frequency. Although facing mixed results in later stages, the early data demonstrated potential in reducing treatment burden. The ongoing development of KSI-301 illustrates the sector’s innovation focus on long-acting agents to improve patient adherence and outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.