Global Agoraphobia Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

1.99 Billion

2025

2033

USD

1.54 Billion

USD

1.99 Billion

2025

2033

| 2026 –2033 | |

| USD 1.54 Billion | |

| USD 1.99 Billion | |

|

|

|

|

Agoraphobia Treatment Market Size

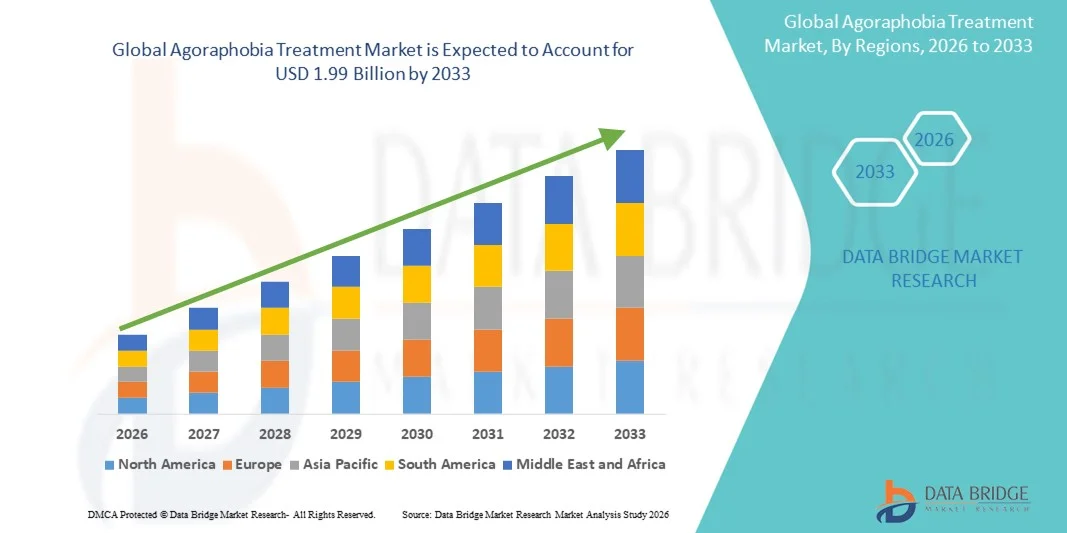

- The global agoraphobia treatment market size was valued at USD 1.54 billion in 2025 and is expected to reach USD 1.99 billion by 2033, at a CAGR of 3.2% during the forecast period

- The market growth is largely fueled by the increasing prevalence of anxiety disorders, growing awareness of mental health issues, and rising adoption of advanced pharmacological and therapeutic interventions for anxiety management

- Furthermore, expanding access to telepsychiatry, online therapy platforms, and integrated mental health care services is enabling more patients to seek timely treatment. These converging factors are accelerating the uptake of effective agoraphobia treatments, thereby significantly boosting the industry's growth

Agoraphobia Treatment Market Analysis

- Agoraphobia treatments, including therapy, medication, and emerging interventions, are increasingly vital components of mental health care due to their effectiveness in reducing anxiety, improving patient quality of life, and enabling greater social functioning

- The escalating demand for agoraphobia treatment is primarily fueled by the rising prevalence of anxiety disorders, growing awareness of mental health issues, and increasing adoption of telepsychiatry and online therapy platforms that facilitate easier access to care

- North America dominated the agoraphobia treatment market with the largest revenue share of 38.9% in 2025, characterized by early adoption of advanced mental health services, high healthcare expenditure, and a strong presence of key pharmaceutical and therapy providers, with the U.S. experiencing substantial growth in treatment uptake through clinics, hospitals, and online therapy platforms

- Asia-Pacific is expected to be the fastest-growing region in the agoraphobia treatment market during the forecast period due to increasing awareness of mental health, improving healthcare infrastructure, and rising disposable incomes that enable access to therapy and medication-based treatments

- Therapy segment dominated the agoraphobia treatment market with a market share of 46.8% in 2025, driven by its established efficacy in managing symptoms such as panic attacks, rapid heart rate, and hyperventilation, and by its integration into both clinical and digital care delivery channels

Report Scope and Agoraphobia Treatment Market Segmentation

|

Attributes |

Agoraphobia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Agoraphobia Treatment Market Trends

Rising Adoption of Digital and AI-Enabled Therapy Platforms

- A significant and accelerating trend in the global agoraphobia treatment market is the increasing adoption of digital therapeutics and AI-enabled therapy platforms that provide remote access to cognitive-behavioral therapy (CBT) and other interventions

- For instance, platforms such as Talkspace and Cerebral allow patients to access licensed therapists via smartphones or computers, enabling treatment from the safety of their homes and reducing barriers to care

- AI integration in treatment platforms facilitates personalized therapy recommendations, progress tracking, and adaptive intervention strategies based on patient response patterns. For instance, Woebot uses AI-driven conversational agents to provide cognitive behavioral therapy exercises and monitor mood trends

- The integration of digital therapy solutions with telepsychiatry and wearable devices enables real-time monitoring of physiological and psychological indicators, allowing for more informed treatment adjustments and patient engagement

- This trend towards accessible, intelligent, and personalized therapy solutions is reshaping patient expectations for mental health care. Consequently, companies such as Mindstrong and Talkiatry are developing AI-enabled treatment plans with continuous monitoring and personalized interventions

- The demand for digital and AI-assisted therapy solutions is growing rapidly across both developed and emerging markets, as patients increasingly prioritize convenience, accessibility, and personalized care

- Growing collaborations between mental health startups and traditional healthcare providers are expanding treatment accessibility and creating hybrid care models. For instance, SilverCloud Health partners with hospitals to integrate online CBT programs into standard care

- Increasing integration of wearable technology to track stress and physiological markers is enhancing personalized treatment, helping clinicians adjust therapy intensity and monitor patient progress. For instance, Fitbit and Apple Watch data are being incorporated into digital therapy platforms for real-time insights

Agoraphobia Treatment Market Dynamics

Driver

Increasing Prevalence of Anxiety Disorders and Rising Mental Health Awareness

- The growing prevalence of anxiety disorders and heightened awareness of mental health issues are significant drivers for the rising demand for agoraphobia treatments

- For instance, in March 2025, the Anxiety & Depression Association of America reported that nearly 18% of U.S. adults experience anxiety disorders annually, highlighting the urgent need for effective treatment solutions

- As patients and caregivers become more informed about the impact of untreated agoraphobia, there is increased adoption of therapy, medication, and integrated care approaches to manage symptoms

- Furthermore, the expansion of telepsychiatry, online therapy platforms, and clinic-based mental health services is making treatment more accessible, convenient, and effective for patients across age groups

- Growing government initiatives and NGO-led campaigns aimed at reducing stigma around mental health issues are also encouraging more individuals to seek timely intervention

- The combination of rising disorder prevalence, awareness campaigns, and better access to care is propelling market growth globally

- Increasing insurance coverage and reimbursement policies for mental health treatments are making therapy and medication more affordable, thereby boosting adoption

- The development of targeted therapies for comorbid conditions, such as depression or panic disorder, is expanding the patient base for agoraphobia treatments

Restraint/Challenge

Limited Access to Trained Professionals and Treatment Costs

- Shortages of trained mental health professionals and uneven access to therapy in remote or underserved regions pose significant challenges to market growth

- For instance, in rural India and parts of Africa, the scarcity of licensed therapists limits the availability of evidence-based interventions, delaying or preventing timely treatment

- High costs of therapy sessions, prescription medications, and AI-enabled digital therapy platforms can deter patients, particularly in low-income regions or among uninsured populations

- In addition, social stigma surrounding mental health treatment in certain cultures can prevent patients from seeking therapy, further restraining market adoption

- Limited awareness about the long-term benefits of early intervention and integrated treatment options can also reduce patient engagement and adherence to prescribed therapies

- Overcoming these challenges through telehealth expansion, subsidized therapy programs, and patient education will be critical for sustained market growth

- Regulatory variations across countries can delay approval and adoption of new therapies, creating barriers for global market expansion

- Data privacy and security concerns related to digital therapy platforms can make patients hesitant to share sensitive health information, impacting platform adoption

Agoraphobia Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, symptoms, dosage, route of administration, end-users, and distribution channels.

- By Treatment

On the basis of treatment, the agoraphobia treatment market is segmented into therapy, medication, and others. The therapy segment dominated the market with the largest revenue share of 46.8% in 2025, driven by its effectiveness in managing anxiety-related symptoms such as panic attacks, hyperventilation, and trembling. Cognitive-behavioral therapy (CBT) and exposure therapy are widely recommended and have high patient adherence rates. Therapy adoption is increasing through teletherapy platforms, providing accessible care to patients who cannot visit clinics. Integration with AI and wearable devices enables real-time monitoring of stress and symptom patterns. Therapy is preferred due to minimal side effects compared to medications. For instance, online therapy apps such as Talkspace and Cerebral are enhancing therapy accessibility and patient engagement.

The medication segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing adoption of SSRIs, SNRIs, and other anti-anxiety drugs. Medications are often combined with therapy for severe cases, enhancing overall treatment outcomes. Pharmaceutical innovations such as long-acting formulations and patient-friendly dosing are fueling adoption. Rising healthcare coverage and awareness of early intervention are expanding the patient base. The segment also benefits from AI-assisted prescription management and online pharmacy distribution. For instance, platforms such as GoodRx and PillPack are improving access to prescribed medications.

- By Diagnosis

On the basis of diagnosis, the market is segmented into blood tests, physical examination, and others. The physical examination segment dominated the market in 2025, as it is the primary approach for identifying anxiety symptoms and excluding other conditions. Clinicians rely on structured interviews, symptom checklists, and mental health assessments to confirm diagnosis. This method is widely accessible across clinics and hospitals. It supports early intervention strategies, preventing complications from untreated agoraphobia. Physical examinations are cost-effective and can be performed in outpatient and inpatient settings. For instance, structured CBT assessments during clinic visits allow targeted therapy planning.

The blood tests segment is expected to witness the fastest growth over the forecast period due to advancements in biomarkers for stress hormones and neurotransmitter levels. Blood-based diagnostics can aid in early detection, monitor treatment response, and support personalized care plans. Integration with AI and digital health records allows data-driven decision-making. Blood tests are increasingly being explored in research settings to supplement clinical diagnosis. The approach helps clinicians tailor medications and therapy intensity. For instance, studies using cortisol and adrenaline markers are helping identify patients at risk of severe panic attacks.

- By Symptoms

On the basis of symptoms, the market is segmented into panic attack, rapid heart rate, dizziness, hyperventilation, flushing, hyperhidrosis, diarrhea, trembling, nausea, and others. The panic attack segment dominated the market in 2025 due to its high prevalence among agoraphobia patients. Panic attacks are severe, often prompting emergency visits, and significantly reduce quality of life. Both therapy and medication focus on managing panic attacks effectively. Wearable devices and teletherapy tools are being used to monitor attacks and provide timely interventions. Panic attack management is a priority for clinicians to improve overall patient outcomes. For instance, apps that track panic triggers and response patterns are aiding personalized therapy.

The rapid heart rate segment is expected to witness the fastest growth from 2026 to 2033, due to the rising awareness of physiological manifestations of agoraphobia. Monitoring heart rate spikes through wearables enables early detection of anxiety episodes. Data integration with teletherapy platforms allows clinicians to adjust treatment plans in real time. Patients are more engaged in their care due to instant feedback from devices. Rapid heart rate management supports better medication titration and therapy outcomes. For instance, Fitbit and Apple Watch integration with digital therapy platforms enhances personalized treatment.

- By Dosage

On the basis of dosage, the market is segmented into tablet, injection, and others. The tablet segment dominated the market in 2025 due to convenience, high patient compliance, and the availability of oral anti-anxiety medications. Tablets allow flexible dosing and long-term management of agoraphobia symptoms. They are widely used in outpatient and home-based care. Tablet medications are compatible with combination therapies for enhanced efficacy. Tablets are also cost-effective compared to injections. For instance, SSRIs in tablet form remain the most commonly prescribed anti-anxiety treatment globally.

The injection segment is expected to witness the fastest growth over the forecast period due to hospital-administered treatments for acute panic episodes. Injectable formulations provide rapid onset of action for severe anxiety attacks. IV or intramuscular administration ensures precise dosing in critical cases. Hospitals and emergency care centers prefer injections for immediate relief. Integration with hospital monitoring systems improves treatment safety and efficacy. For instance, IV benzodiazepine administration in hospitals is increasingly used for acute agoraphobia management.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, intramuscular, and others. The oral segment dominated the market in 2025 due to ease of use, convenience, and strong patient adherence. Oral drugs can be self-administered at home, reducing hospital visits. Extended-release oral formulations enhance efficacy and minimize side effects. Oral medications are widely supported by therapy and follow-up programs. They are compatible with digital monitoring platforms for personalized care. For instance, SSRIs administered orally are standard first-line treatment worldwide.

The intravenous segment is expected to witness the fastest growth from 2026 to 2033 due to hospital-based treatments for severe panic episodes. IV administration provides rapid drug delivery for acute anxiety management. Hospitals prefer IV treatments for high-risk patients requiring immediate intervention. The segment benefits from technological integration with patient monitoring devices. Intravenous treatments ensure precise dosing and better control over severe symptoms. For instance, IV anxiolytics are increasingly used in emergency psychiatric care units.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The clinic segment dominated the market in 2025 due to accessibility of outpatient mental health services. Clinics offer therapy, counseling, and telepsychiatry for mild to moderate cases. They provide follow-up care and integration with digital health platforms. Clinics are preferred for early intervention and personalized care. Patients in urban and semi-urban areas favor clinic-based treatments. For instance, CBT sessions at outpatient clinics remain a primary therapy mode.

The hospital segment is expected to witness the fastest growth from 2026 to 2033, due to hospital-based mental health programs and inpatient care for severe cases. Hospitals provide specialized care teams and advanced monitoring for complex agoraphobia cases. Integration of digital therapeutics and wearable monitoring enhances treatment outcomes. Hospitals are increasingly adopting AI-assisted therapy and medication management systems. The segment is expanding in both developed and emerging markets. For instance, tertiary hospitals in the U.S. and Europe are integrating telepsychiatry with inpatient care.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment dominated the market in 2025 due to wide availability of prescription medications and over-the-counter anxiety management solutions. Retail pharmacies provide guidance on medication adherence and therapy integration. They are convenient for urban and semi-urban patients. Retail pharmacies support combination therapy distribution and enhance patient trust. They are also expanding services through in-store counseling programs. For instance, chain pharmacies such as CVS and Boots provide anti-anxiety medications with pharmacist support.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, due to e-pharmacy adoption, home delivery of medications, and teleconsultation integration. Online pharmacies provide privacy and convenience, especially in remote or underserved regions. They enhance adherence by offering reminders and subscription services. Patients benefit from faster access to medications without travel. Online platforms also integrate with teletherapy for complete mental health care. For instance, PillPack and GoodRx facilitate home delivery of prescribed medications for agoraphobia patients.

Agoraphobia Treatment Market Regional Analysis

- North America dominated the agoraphobia treatment market with the largest revenue share of 38.9% in 2025, characterized by early adoption of advanced mental health services, high healthcare expenditure, and a strong presence of key pharmaceutical and therapy providers, with the U.S. experiencing substantial growth in treatment uptake through clinics, hospitals, and online therapy platforms

- Consumers and patients in the region are increasingly seeking accessible and effective treatment solutions, including cognitive-behavioral therapy, exposure therapy, and pharmacological interventions

- This widespread adoption is further supported by a strong healthcare infrastructure, high healthcare expenditure, and growing integration of telepsychiatry and digital therapy platforms, establishing North America as a key hub for agoraphobia treatment services

U.S. Agoraphobia Treatment Market Insight

The U.S. agoraphobia treatment market captured the largest revenue share of 82% in 2025 within North America, fueled by growing awareness of mental health issues and increasing adoption of therapy and pharmacological interventions. Patients are prioritizing early access to effective treatments such as cognitive-behavioral therapy (CBT), exposure therapy, and anti-anxiety medications. The rising integration of telepsychiatry, online therapy platforms, and AI-enabled digital therapeutics is further driving market growth. In addition, the increasing focus on mental wellness and preventative care is encouraging patients to seek timely treatment. The U.S. healthcare infrastructure, combined with high healthcare expenditure and insurance coverage, supports widespread adoption of agoraphobia treatments. Moreover, innovative digital platforms that combine therapy, medication tracking, and remote consultations are significantly contributing to market expansion.

Europe Agoraphobia Treatment Market Insight

The Europe agoraphobia treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising mental health awareness and government initiatives promoting access to psychological care. Urbanization and an increase in stressful lifestyles are driving demand for both therapy and medication-based interventions. European patients are increasingly seeking integrated treatment plans combining digital therapy, counseling, and medication for effective symptom management. Countries such as Germany, France, and Italy are witnessing significant growth across outpatient clinics, hospitals, and telehealth platforms. In addition, the region emphasizes patient privacy and adherence to strict healthcare regulations, encouraging adoption of secure, certified mental health solutions. The preference for evidence-based therapy interventions, alongside expansion of telepsychiatry networks, supports market growth across both residential and clinical settings.

U.K. Agoraphobia Treatment Market Insight

The U.K. agoraphobia treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing adoption of mental health services and awareness campaigns. Rising prevalence of anxiety disorders, combined with societal acceptance of therapy, is encouraging patients to seek early intervention. Teletherapy, mobile mental health apps, and online counseling services are expanding access to treatment across urban and semi-urban areas. In addition, the NHS and private clinics are emphasizing integrated care approaches combining therapy and medication, improving patient outcomes. The availability of e-prescriptions and online pharmacies enhances treatment convenience. For instance, patients increasingly use telepsychiatry platforms to complement in-person therapy sessions, boosting adoption and market expansion.

Germany Agoraphobia Treatment Market Insight

The Germany agoraphobia treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by growing mental health awareness and government initiatives to improve access to therapy and medications. Patients are increasingly seeking advanced treatment solutions, including digital therapeutics, AI-assisted therapy, and personalized medication plans. Germany’s strong healthcare infrastructure, emphasis on innovation, and reimbursement support encourage widespread adoption of therapy and medication. The integration of wearable devices and mobile apps into clinical care is helping monitor patient progress and optimize treatment outcomes. In addition, increasing urbanization and high stress levels in workplaces are driving demand for professional mental health interventions. Clinics and hospitals in Germany are adopting hybrid care models that combine in-person and remote therapy to reach a larger patient base.

Asia-Pacific Agoraphobia Treatment Market Insight

The Asia-Pacific agoraphobia treatment market is poised to grow at the fastest CAGR of 25% during the forecast period, driven by increasing awareness of mental health, rapid urbanization, and improving healthcare infrastructure in countries such as China, Japan, and India. The adoption of digital therapy platforms, telepsychiatry, and online pharmacies is enhancing accessibility for patients across the region. Government initiatives promoting mental health awareness and early intervention are fueling treatment uptake. Furthermore, rising disposable incomes and urban lifestyles contribute to higher prevalence of anxiety disorders, increasing demand for both therapy and medication. The availability of affordable treatment options and local digital health startups expanding teletherapy services further propels growth. Integration of AI-driven monitoring and mobile therapy applications is enhancing patient adherence and treatment effectiveness.

Japan Agoraphobia Treatment Market Insight

The Japan agoraphobia treatment market is gaining momentum due to the country’s aging population, high awareness of mental health, and demand for convenient therapy solutions. Patients are increasingly seeking digital therapy platforms and telepsychiatry services, complemented by hospital and clinic-based care. The integration of wearable monitoring devices with therapy and medication tracking supports personalized treatment plans. Urbanization and high-stress lifestyles are driving demand for preventive and ongoing mental health care. In addition, Japan’s technologically advanced population is more receptive to AI-assisted therapy and online consultation tools. Clinics and hospitals are emphasizing hybrid care models combining in-person and remote treatment to improve patient engagement and outcomes.

India Agoraphobia Treatment Market Insight

The India agoraphobia treatment market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to increasing mental health awareness, rapid urbanization, and expanding access to therapy and medications. India has witnessed growing adoption of telepsychiatry and online therapy platforms, particularly in urban and semi-urban areas. Government initiatives and mental health campaigns are promoting early diagnosis and treatment of anxiety disorders. The affordability of therapy and medications, alongside the availability of domestic digital health startups, is further driving adoption. Clinics, hospitals, and online platforms are increasingly integrating therapy and medication management to improve outcomes. For instance, mobile apps and e-pharmacies are providing convenient access to treatment, enhancing adherence and reach across diverse patient populations.

Agoraphobia Treatment Market Share

The Agoraphobia Treatment industry is primarily led by well-established companies, including:

- Pfizer Inc., (U.S.)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc., (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- AbbVie Inc. (U.S.)

- Allergan plc (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Boehringer Ingelheim International GmbH (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- H. Lundbeck A/S (Denmark)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Amgen Inc. (U.S.)

What are the Recent Developments in Global Agoraphobia Treatment Market?

- In November 2025, a randomized controlled trial published in Journal of Medical Internet Research demonstrated that a mobile app‑based exposure therapy for panic disorder with or without agoraphobia significantly reduced symptoms for some users compared with waiting list or generic meditation‑app controls. The study highlights the growing role of mobile, app‑delivered interventions as a scalable, accessible option for anxiety disorders

- In May 2025, a brief but intensive four‑day treatment program Bergen 4-Day Treatment (B4DT) originally developed for panic disorders, was reported to deliver rapid and lasting symptom relief, with nearly 90% of patients experiencing major improvement within one week, and many maintaining gains months after treatment, indicating promise for rapid‑onset therapy approaches

- In November 2023, the therapy program gameChangeVR a virtual‑reality (VR) therapy for severe agoraphobic avoidance was formally approved by National Institute for Health and Care Excellence (NICE) for use in NHS mental‑health services in the UK. This marked the first time a VR‑based therapy for agoraphobia received regulatory approval for clinical use, potentially enabling thousands of housebound patients to access exposure therapy via VR headsets rather than only in‑person therapy

- In September 2022, German digital‑health startup Sympatient secured €7.5 million in Series A funding to expand its “digital anxiety clinic,” which offers the VR‑based program Invirto designed for home‑based treatment of agoraphobia, panic disorder, and social phobia. This funding boost highlights growing investor confidence in virtual and remote treatment modalities for anxiety disorders

- In May 2022, a randomized controlled trial protocol for self‑guided digital treatment combining psychoeducation and virtual reality exposure therapy for patients with panic disorder and agoraphobia was published, underlining the growing scientific interest in scalable, at‑home digital interventions for anxiety/phobia treatment. If successful, such trials may pave the way for widely accessible, low‑burden therapeutic options that reduce reliance on in‑person therapy sessions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.