Global Agricultural Biotechnology Market

Market Size in USD Billion

CAGR :

%

USD

167.58 Billion

USD

384.52 Billion

2024

2032

USD

167.58 Billion

USD

384.52 Billion

2024

2032

| 2025 –2032 | |

| USD 167.58 Billion | |

| USD 384.52 Billion | |

|

|

|

|

Agricultural Biotechnology Market Size

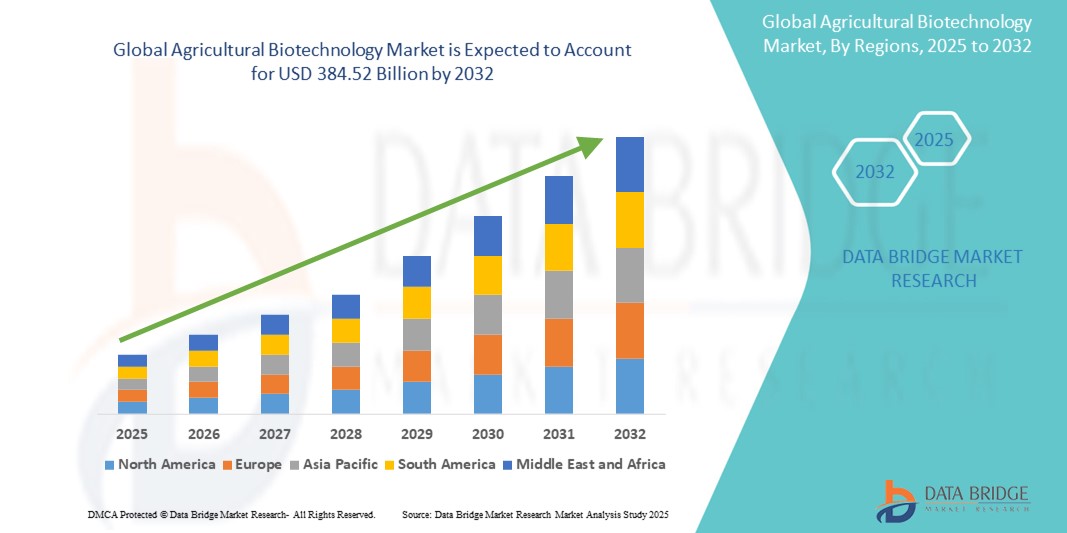

- The global agricultural biotechnology market size was valued at USD 167.58 billion in 2024 and is expected to reach USD 384.52 billion by 2032, at a CAGR of 10.94% during the forecast period

- The market growth is largely fueled by increasing demand for high-yield, pest-resistant, and climate-resilient crops amid global food security concerns, driving the adoption of genetically modified organisms and advanced biotechnological tools in agriculture

- Furthermore, rising investments in research and development, along with supportive government policies and technological advancements in genome editing and synthetic biology, are accelerating innovation and commercialization in the sector, thereby significantly boosting the industry's growth

Agricultural Biotechnology Market Analysis

- Agricultural biotechnology, involving the use of scientific tools and techniques to modify living organisms for agricultural improvement, is becoming increasingly vital to enhance crop productivity, pest resistance, and climate adaptability across both plant and animal systems

- The escalating demand for agricultural biotechnology is primarily fueled by the global need for sustainable food production, growing population pressures, and advancements in genetic engineering, genome editing, and synthetic biology that enable more efficient and resilient agricultural practices

- North America dominated the agricultural biotechnology market with a share of 41.87% in 2024, due to strong investment in biotech research, favorable regulatory support, and widespread adoption of genetically modified crops

- Asia-Pacific is expected to be the fastest growing region in the agricultural biotechnology market during the forecast period due to the rapid modernization of agriculture, growing food demand, and increasing investment in biotech research

- Plants segment dominated the market with a market share of 42.6% in 2024, due to the widespread adoption of plant-based antiviral solutions in agriculture and the development of genetically modified crops with built-in viral immunity. The global focus on crop biosecurity and sustainable farming practices continues to support growth in this segment

Report Scope and Agricultural Biotechnology Market Segmentation

|

Attributes |

Agricultural Biotechnology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agricultural Biotechnology Market Trends

“Growing Demand for Genetically Modified Crops”

- A notable and accelerating trend in the agricultural biotechnology market is the increasing global demand for genetically modified (GM) crops that offer enhanced yields, pest resistance, and tolerance to environmental stress

- For instance, genetically engineered corn and soybeans are widely cultivated due to their ability to withstand herbicides and resist insect attacks, reducing the need for chemical treatments and improving efficiency

- These crops support sustainable farming practices by conserving resources, improving productivity, and contributing to food security, particularly in regions with challenging climates

- Companies are focusing on stacking multiple traits into single seeds, enabling crops to withstand a combination of biotic and abiotic stresses, such as drought, pests, and herbicides

- The trend is further fueled by rising global food demand and shrinking arable land, pushing stakeholders to adopt innovative solutions to enhance agricultural output

- As GM crop acreage expands in both developed and developing countries, agricultural biotechnology is becoming central to modern, high-efficiency farming systems

Agricultural Biotechnology Market Dynamics

Driver

“Increasing Adoption of Advanced Biotech Tools in Farming”

- The adoption of advanced biotechnology tools such as tissue culture, molecular diagnostics, marker-assisted selection, and genome editing is a key driver of the agricultural biotechnology market

- For instance, molecular breeding is enabling farmers to develop crops with improved nutritional profiles and resistance to diseases, pests, and environmental stresses

- These tools are revolutionizing traditional farming by accelerating crop development cycles and improving genetic accuracy, leading to higher yields and lower input costs

- The integration of biotech solutions in livestock production, including cloning and genetic enhancement, is also improving animal health and productivity. Governments across various regions are promoting biotechnology to improve food security and support sustainable agricultural development

- As the benefits of biotech-driven efficiency and resilience become more evident, adoption across large-scale farms and smallholders continues to rise

Restraint/Challenge

“Stringent Regulatory Framework for Genetically Modified Organisms”

- One of the major challenges facing the agricultural biotechnology market is the strict regulatory framework associated with genetically modified organisms (GMOs)

- For instance, regulatory approval processes are often prolonged due to extensive environmental, health, and safety evaluations, delaying product launches and increasing R&D costs

- These complex and region-specific regulations create uncertainty and hinder the rapid commercialization of biotech crops and livestock products

- Public resistance and ethical concerns regarding GMOs further complicate approval procedures, particularly in regions such as the European Union. Companies are required to invest significantly in compliance, documentation, and risk assessment to navigate these regulatory landscapes

- Addressing these regulatory hurdles is critical for improving market accessibility, accelerating innovation, and fostering broader adoption of agricultural biotechnology solutions

Agricultural Biotechnology Market Scope

The market is segmented on the basis of product type, trait type, organisms, application, and technology.

• By Product Type

On the basis of product type, the antiviral drugs market is segmented into crop protection products, transgenic seeds, and synthetic biology-enabled products. The transgenic seeds segment dominates the largest market revenue share in 2024, attributed to their vital role in developing virus-resistant crops that enhance yield and reduce dependency on chemical treatments. Transgenic seeds engineered to express antiviral traits help protect against a wide spectrum of plant viruses, ensuring stable crop productivity and reducing economic losses for farmers. The scalability of these seeds and their adaptability across various climatic conditions further bolster their adoption worldwide.

The synthetic biology-enabled products segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by advancements in bioengineering that allow for the design of tailor-made antiviral agents and crop protection solutions. These products leverage engineered biological systems to deliver precise viral resistance, offering superior effectiveness and sustainability. Increasing investments in synthetic biology by agri-tech and pharmaceutical firms are accelerating the development and commercialization of these next-generation antiviral solutions.

• By Trait Type

On the basis of trait type, the market is segmented into stacked, herbicide-tolerant, insect-resistant, and desirable and virus-resistant. The virus-resistant trait segment accounted for the largest revenue share in 2024, primarily due to the growing threat of viral outbreaks in staple crops such as rice, wheat, and maize. Virus-resistant traits enable plants to inhibit replication or transmission of specific viruses, significantly enhancing crop resilience and yield stability. These traits are vital for food security initiatives, especially in regions prone to plant viral epidemics.

The stacked traits segment is projected to record the fastest CAGR from 2025 to 2032, as they combine multiple traits—such as virus resistance, herbicide tolerance, and pest resistance—within a single crop variety. This multi-trait approach improves field performance and reduces the need for external chemical inputs, making it attractive for integrated pest and disease management systems.

• By Organisms

On the basis of organisms, the market is segmented into plants, animals, and microbes. The plant segment held the largest revenue share of 42.6% in 2024, driven by the widespread adoption of plant-based antiviral solutions in agriculture and the development of genetically modified crops with built-in viral immunity. The global focus on crop biosecurity and sustainable farming practices continues to support growth in this segment.

The microbes segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing exploration of beneficial microorganisms in producing antiviral compounds and biocontrol agents. Engineered microbes are being used to synthesize antiviral proteins and RNA-based therapies, with applications spanning agriculture, medicine, and industrial biotechnology.

• By Application

On the basis of application, the antiviral drugs market is segmented into vaccine development, transgenic crops and animals, antibiotic development, nutritional supplements, flower culturing, and biofuels. The vaccine development segment led the market revenue in 2024, owing to the global emphasis on pandemic preparedness and the rising incidence of zoonotic and plant-based viral infections. Genetic tools and engineered organisms are extensively used to develop safe, effective antiviral vaccines at scale.

The transgenic crops and animals segment is projected to grow at the highest CAGR from 2025 to 2032, driven by advancements in genetic modification that enhance viral resistance and immune response. Transgenic livestock and crops engineered with antiviral genes help prevent viral transmission and disease outbreaks, reducing losses in agriculture and livestock farming.

• By Technology

On the basis of technology, the market is segmented into genome editing, synthetic biology, genetic engineering, marker-assisted breeding, plant breeding, germplasm, and other technologies. The genetic engineering segment accounted for the largest revenue share in 2024 due to its central role in introducing antiviral traits into crops, microbes, and animals. This technology enables precise DNA modifications that result in robust and specific viral immunity, ensuring high efficiency in virus control strategies.

The synthetic biology segment is expected to witness the fastest growth from 2025 to 2032, as it enables the design of novel biological systems and circuits capable of detecting and neutralizing viruses. The modularity and programmability of synthetic biology applications are revolutionizing antiviral drug development, particularly in personalized medicine and targeted agriculture.

Agricultural Biotechnology Market Regional Analysis

- North America dominated the agricultural biotechnology market with the largest revenue share of 41.87% in 2024, driven by strong investment in biotech research, favorable regulatory support, and widespread adoption of genetically modified crops

- Farmers and agri-businesses in the region benefit from high-yielding, virus- and pest-resistant biotech seeds, as well as advanced genomic technologies that enhance productivity and sustainability

- The presence of major biotechnology companies, coupled with the integration of digital agriculture platforms and precision farming, continues to drive regional market expansion across crops, livestock, and microbial applications

U.S. Agricultural Biotechnology Market Insight

The U.S. agricultural biotechnology market captured the largest revenue share in 2024 within North America, driven by the country's robust R&D ecosystem, widespread adoption of transgenic seeds, and strong government backing for biotech innovations. The U.S. leads in genome editing technologies such as CRISPR and synthetic biology, which are being widely applied to develop virus-resistant crops and livestock. The expansion of biofuel production and demand for biopesticides further reinforces market growth, supported by the presence of major players such as Corteva, Bayer, and Syngenta operating through strong domestic networks.

Europe Agricultural Biotechnology Market Insight

The Europe agricultural biotechnology market is projected to grow at a healthy CAGR during the forecast period, propelled by increasing interest in sustainable farming practices and stricter regulations on chemical inputs. European countries are progressively investing in plant breeding, germplasm research, and bio-based crop protection products to meet food security and climate resilience goals. Public-private partnerships and growing consumer acceptance of gene-edited crops—particularly those developed through non-transgenic methods—are fostering gradual yet impactful growth across the region.

U.K. Agricultural Biotechnology Market Insight

The U.K. agricultural biotechnology market is expected to witness steady growth during the forecast period, underpinned by post-Brexit regulatory flexibility and increased national investment in genome editing and synthetic biology. The government’s emphasis on food security and reduced dependence on imports is fostering innovation in crop improvement and bio-based solutions. The rise of agritech startups and collaborations with academic institutions are accelerating the development of biotech-based fertilizers, disease-resistant seeds, and livestock vaccines.

Germany Agricultural Biotechnology Market Insight

The Germany agricultural biotechnology market is anticipated to expand at a notable CAGR, driven by the country’s strong focus on research excellence and sustainability. Germany is actively investing in biotech-enabled climate-resilient crops and precision breeding tools. Despite stringent regulations on GMOs, innovation in microbial biotechnology, organic-compatible bioinputs, and marker-assisted plant breeding is supporting growth. Germany’s leading agricultural machinery and automation sector also complements biotech adoption through integrated precision agriculture solutions.

Asia-Pacific Agricultural Biotechnology Market Insight

The Asia-Pacific agricultural biotechnology market is poised to grow at the fastest CAGR from 2025 to 2032, driven by the rapid modernization of agriculture, growing food demand, and increasing investment in biotech research in countries such as China, India, and Japan. Government-led initiatives promoting biotech crop adoption and innovation hubs are accelerating development in transgenic crops, microbial solutions, and genome editing technologies. The region's significant population base and agrarian economies further support robust market expansion.

Japan Agricultural Biotechnology Market Insight

The Japan agricultural biotechnology market is experiencing steady growth due to strong R&D capabilities, precision breeding programs, and high-tech integration in agriculture. With limited arable land, the country focuses on maximizing yield and resource efficiency through advanced biotech tools. Genome editing technologies such as CRISPR are being employed in vegetable and rice breeding, while public support for food safety and sustainability initiatives is encouraging commercial adoption of biotech solutions in both plant and animal agriculture.

China Agricultural Biotechnology Market Insight

The China agricultural biotechnology market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s aggressive push toward agricultural modernization and self-sufficiency. China has made significant investments in genetic engineering, microbial biotech, and synthetic biology to develop pest- and virus-resistant crops, enhance livestock productivity, and boost bio-based fertilizers. The presence of large domestic biotech firms, combined with government support and growing export demand, continues to propel market growth across all key segments.

Agricultural Biotechnology Market Share

The agricultural biotechnology industry is primarily led by well-established companies, including:

- KWS SAAT SE & Co. KGaA (Germany)

- Dow (U.S.)

- Bayer AG (Germany)

- BASF (Germany)

- Thermo Fisher Scientific (U.S.)

- Sumitomo Chemical Co., Ltd (Japan)

- MITSUI & CO., LTD. (Japan)

- Novozymes (Denmark)

- Yield10 Bioscience Inc (U.S.)

- Kemin Industries Inc. (U.S.)

- Valent Biosciences (U.S.)

- Corteva (U.S.)

- DSM (Netherland)

- ADAMA (Israel)

- Cargill, Incorporated (U.S.)

- Nufarm Canada (Canada)

- DuPont. (U.S.)

- Eurofins (Luxembourg)

Latest Developments in Global Agricultural Biotechnology Market

- In June 2024, IPL Biologicals, in collaboration with Punjab Agricultural University, launched a new bio-fungicide called Agenor. This product is specifically designed to address the challenges faced by paddy farmers, such as fungal infections that threaten crop yields. Agenor exemplifies the growing trend toward bio-based agricultural solutions that promote sustainability and efficacy in pest management, reinforcing IPL Biologicals' commitment to innovative agricultural practices

- In May 2024, Syngenta's ADEPIDYN technology, a powerful fungicide, received approval in over 55 countries, reflecting its strong global demand among farmers. This innovative product effectively addresses fungal diseases while promoting sustainable crop protection. Syngenta anticipates that ADEPIDYN will achieve sales of one billion US dollars within the next eight years, underscoring its success and reinforcing the company’s leadership in agricultural technology and sustainable innovations

- In May 2024, Fermbox Bio launched EN3ZYME, a cellulose enzyme cocktail aimed at revolutionizing the transformation of agricultural waste into second-generation (2G) ethanol. This innovative product is designed to improve the cost-effectiveness and efficiency of converting pre-treated agricultural residues into fermentable sugars, thereby enhancing bioethanol production. This development supports sustainability in agriculture and also advances the synthetic biology sector's capabilities in renewable energy

- In October 2023, BASF announced a significant investment in a new fermentation plant at its Ludwigshafen site, with a high double-digit million euro amount dedicated to this project. Set to be operational in the latter half of 2025, the facility will focus on producing biological and biotechnology-based crop protection products. This strategic move aims to enhance BASF’s portfolio to meet the rising demand for sustainable agricultural solutions

- In September 2023, The ISAAA Inc. organized a study launch in the Philippines titled "Public Perception of Agricultural Biotechnology." This initiative aims to assess the understanding and attitudes of the public towards agricultural biotechnology, a critical area influencing the acceptance of modern farming techniques. By gathering insights, the study seeks to foster informed discussions and enhance stakeholder engagement in the biotechnology sector to support agricultural innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.