Global Agricultural Surfactant Market

Market Size in USD Billion

CAGR :

%

USD

1.56 Billion

USD

2.52 Billion

2024

2032

USD

1.56 Billion

USD

2.52 Billion

2024

2032

| 2025 –2032 | |

| USD 1.56 Billion | |

| USD 2.52 Billion | |

|

|

|

|

Agricultural Surfactant Market Size

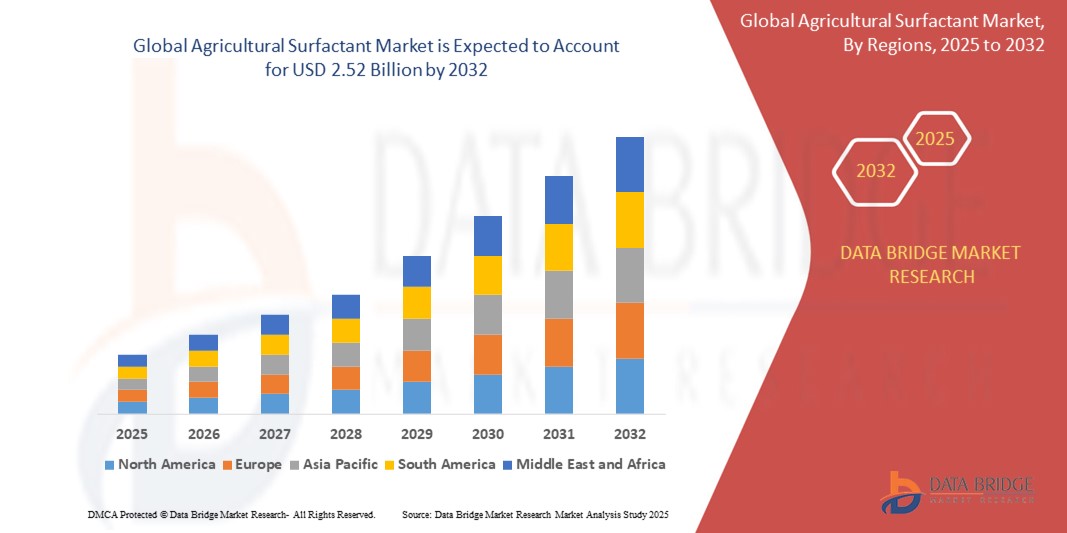

- The global agricultural surfactant market size was valued at USD 1.56 billion in 2024 and is expected to reach USD 2.52 billion by 2032, at a CAGR of 6.20 % during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and efficient crop protection solutions, rising global food demand, and advancements in agricultural practices that incorporate precision farming and the use of agrochemicals

- Furthermore, the market is also propelled by the rising awareness among farmers about the benefits of surfactants in enhancing the effectiveness of pesticides, herbicides, and fertilizers, leading to improved crop yield and reduced input costs.

Agricultural Surfactant Market Analysis

- The agricultural surfactant market is witnessing steady growth as manufacturers focus on enhancing product formulations to improve the performance and compatibility of agrochemicals. This trend is encouraging collaborations between chemical companies and agricultural technology providers to support innovation in crop protection products

- The current market landscape shows a shift toward the use of non-ionic surfactants due to their versatility and effectiveness across a range of pesticide applications. Surfactant producers are also investing in research to create more biodegradable and plant-derived alternatives that align with sustainable farming practices

- North America is estimated to hold the largest revenue share of the agricultural surfactant market in 2025, with figures ranging from 30% to 36% based on available reports. This is attributed to the region's established agricultural industry, high expenditure on agriculture, and strong adoption of advanced farming techniques and products

- Asia-Pacific is projected to be the fastest-growing region in the agricultural surfactant market during the forecast period due to increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, India, and Japan

- The non-ionic segment dominates the largest market revenue share of 29% in 2025, driven by its broad compatibility with various agrochemicals and its effectiveness in reducing surface tension for better spray coverage. Farmers often prefer non-ionic surfactants for their versatility and ability to enhance the performance of a wide range of pesticides and fertilizers

Report Scope and Agricultural Surfactant Market Segmentation

|

Attributes |

Agricultural Surfactant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agricultural Surfactant Market Trends

“Growing Shift Toward Bio-Based Surfactants”

- Bio-based surfactants are becoming a preferred choice due to their eco-friendly nature and lower environmental impact

- For instance, a Canadian agrochemical company launched a corn-compatible bio-surfactant that showed no harmful soil residues after repeated use

- Farmers are shifting toward natural surfactant ingredients such as soy lecithin and alkyl polyglucosides for safer farming practices

- For instance, a rice farming community in Southeast Asia reported fewer crop burn incidents after switching to soy-based surfactants

- Regulatory pressure is motivating companies to reformulate products with safer, biodegradable surfactants

- Research and development efforts are expanding to produce high-performing bio-based surfactants that rival synthetic ones

- Leading agrochemical brands are launching bio-surfactants to cater to the growing organic farming sector

Agricultural Surfactant Market Dynamics

Driver

“Rising Demand for Enhanced Crop Protection and Productivity”

- The agricultural surfactant market is being driven by the rising demand for effective crop protection and improved productivity

- For instance, maize farmers in sub-Saharan Africa reported reduced pesticide use after adopting surfactants, improving both cost-efficiency and yield

- With the growing global population, there is increased pressure on agriculture to produce more with limited resources

- For instance, a study in India’s wheat belt found that farmers using surfactants cut fungicide use by nearly half while maintaining crop quality

- Precision agriculture benefits significantly from surfactants, ensuring even application of inputs across large areas

- In high-value crops such as fruits and vegetables, surfactants reduce crop loss by improving pest and disease control

- Sustainability is a key growth driver, with surfactants reducing runoff and enhancing environmental compatibility

Restraint/Challenge

“Environmental and Health Concerns Associated with Synthetic Surfactants”

- Synthetic surfactants are often petroleum-based and non-biodegradable, leading to long-term environmental accumulation

- For instance, studies in the Netherlands showed decreased microbial activity in soil treated with conventional surfactants

- Persistent use of synthetic surfactants disrupts aquatic ecosystems and contributes to chemical build-up in food crops

- Health risks are rising for farmers and surrounding communities due to surfactant-related chemical exposure

- Regulatory restrictions are growing, limiting the use of harmful surfactants and complicating compliance for manufacturers

- For instance, the European Union has banned several nonylphenol ethoxylates due to their toxic nature

- Transitioning to safer bio-based surfactants is costly and technically challenging, especially for small-scale farmers

Agricultural Surfactant Market Scope

The market is segmented on the basis of type, application, substrate, and crop type.

- By Type

On the basis of type, the agricultural surfactant market is segmented into non-ionic, anionic, amphoteric, and cationic. The non-ionic segment dominates the largest market revenue share of 29% in 2025, driven by its broad compatibility with various agrochemicals and its effectiveness in reducing surface tension for better spray coverage. Farmers often prefer non-ionic surfactants for their versatility and ability to enhance the performance of a wide range of pesticides and fertilizers.

The amphoteric segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for environmentally friendly and biodegradable surfactants with good compatibility across different pH levels. Their dual nature allows them to function effectively in both acidic and alkaline solutions, making them a sustainable choice for modern agriculture.

- By Application

On the basis of application, the agricultural surfactant market is segmented into herbicides, fungicides, insecticides, and others. The herbicides segment held the largest market revenue share of 50.1% in 2025, driven by the widespread use of herbicides in modern agriculture for weed management and ensuring optimal crop yields. The need for effective weed control in large-scale farming operations makes surfactants crucial for enhancing herbicide efficacy.

The fungicides segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing prevalence of fungal diseases in crops due to changing climatic conditions and the growing need for effective disease management solutions. Surfactants play a vital role in improving the spread and adhesion of fungicides on plant surfaces, thereby enhancing their protective action.

- By Substrate Type

On the basis of substrate type, the agricultural surfactant market is segmented into synthetic and bio-based. The synthetic segment held the largest market revenue share in 2025, driven by their cost-effectiveness and well-established performance characteristics in various agricultural applications. Synthetic surfactants have been traditionally dominant due to their consistent quality and wide availability.

The bio-based segment is expected to witness the fastest CAGR from 2025 to 2032, favored for increasing environmental concerns and the growing demand for sustainable agricultural practices. Bio-based surfactants, derived from renewable resources, are gaining traction as farmers and consumers prioritize eco-friendly solutions.

- By Crop Type

On the basis of crop type, the agricultural surfactant market is segmented into cereals and grains, fruits and vegetables, and others. The cereals and grains segment accounted for the largest market revenue share in 2024, driven by the extensive cultivation of crops such as corn, wheat, and rice globally, which require significant use of agrochemicals and thus surfactants for their application. The large acreage dedicated to these staple crops drives the demand for surfactants.

The fruits and vegetables segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing global consumption of fruits and vegetables and the need for high-quality produce, which often requires precise and effective application of plant protection products enhanced by surfactants. The focus on higher-value crops and the demand for residue-free produce are contributing to this growth.

Agricultural Surfactant Market Regional Analysis

- North America held a significant share of the agricultural surfactant market, driven by the large-scale agricultural practices and the high adoption rate of advanced farming techniques

- The demand is fueled by the need for effective adjuvants to enhance the performance of pesticides and herbicides in major agricultural regions within the U.S. and Canada. Farmers in this region prioritize maximizing crop yields and minimizing losses, leading to a consistent demand for high-quality surfactants

- Furthermore, stringent regulations regarding pesticide application are also contributing to the use of surfactants to improve efficacy and reduce environmental impact

U.S. Agricultural Surfactant Market Insight

The U.S. represents a substantial portion of the North American agricultural surfactant market. The extensive agricultural land and the focus on precision farming techniques contribute significantly to the high consumption of surfactants. The increasing adoption of genetically modified crops and the subsequent use of specific herbicides further drive the demand for compatible surfactants. Moreover, the presence of major agricultural chemical manufacturers and the well-established distribution channels support market growth in the U.S.

Europe Agricultural Surfactant Market Insight

The European agricultural surfactant market is characterized by stringent environmental regulations and a growing emphasis on sustainable agriculture. This influences the demand for eco-friendly and biodegradable surfactants. The market is driven by the need to improve the efficacy of crop protection products while adhering to these regulations. Key agricultural regions in countries such as France, Germany, and the U.K. contribute significantly to the market size. The increasing adoption of precision agriculture and integrated pest management practices also supports the demand for specialized surfactants.

U.K. Agricultural Surfactant Market Insight

The U.K. agricultural surfactant market is experiencing growth due to the intensification of farming practices and the need for effective crop protection solutions. The market is also influenced by the European Union's (and now the U.K.'s own) regulations regarding pesticide use, leading to a demand for adjuvants that enhance the performance of reduced-dosage applications. The focus on sustainable agriculture is also driving the adoption of bio-based surfactants.

Germany Agricultural Surfactant Market Insight

Germany represents a significant market for agricultural surfactants in Europe. The country's strong agricultural sector, coupled with a high awareness of environmental protection, drives the demand for advanced and environmentally compatible surfactant solutions. The market is characterized by a preference for high-quality products that can optimize the performance of agrochemicals while minimizing ecological impact.

Asia-Pacific Agricultural Surfactant Market Insight

The Asia-Pacific agricultural surfactant market is projected to witness the fastest growth during the forecast period. This growth is attributed to the expanding agricultural sector in countries such as China and India, coupled with increasing awareness among farmers regarding the benefits of using surfactants to improve crop yields. The rising adoption of modern farming techniques and the growing demand for food due to the increasing population are also fueling market expansion. Furthermore, government initiatives to promote agricultural productivity are likely to drive the demand for agricultural inputs, including surfactants.

Japan Agricultural Surfactant Market Insight

The Japan agricultural surfactant market is driven by the country's intensive farming practices and the need for efficient crop protection. Despite having a smaller agricultural land area compared to other countries in the region, the focus on high-yield agriculture and the adoption of advanced agrochemicals necessitates the use of surfactants. The market is also influenced by the demand for high-quality and specialized surfactants that can effectively enhance the performance of pesticides and fertilizers.

China Agricultural Surfactant Market Insight

China represents the largest market for agricultural surfactants in the Asia-Pacific region. The country's vast agricultural land and the increasing adoption of modern farming practices drive the high demand for surfactants. The need to enhance the efficacy of pesticides and herbicides to support the country's large-scale agricultural production is a key growth factor. Furthermore, the increasing availability of cost-effective surfactant options from domestic manufacturers also contributes to the market's expansion.

Agricultural Surfactant Market Share

The Agricultural Surfactant industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- Dow (U.S.)

- Evonik Industries AG (Germany)

- Solvay SA (Belgium)

- Huntsman International LLC (U.S.)

- Clariant AG (Switzerland)

- Helena Agri-Enterprises LLC (U.S.)

- Nufarm Canada (Australia)

- Croda International Plc. (U.K.)

- Stepan Company (U.S.)

- Chemsfield Co., Ltd. (South Korea)

- Shanghai Deborn Co., Ltd. (China)

- JINKE Company Limited (China)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- Monsanto Company (U.S.)

- Loveland Products, Inc. (U.S.)

- CEFIC (Belgium)

Latest Developments in Global Agricultural Surfactant Market

- In July 2024, Bionema Group, a leader in biocontrol technology, introduced Soil-Jet BSP100, a biodegradable surfactant designed for the sports and turf industry. Utilizing patented Polyether-Modified Polysiloxane technology, this innovation aims to enhance water and nutrient use efficiency, reduce soil water repellence, and accelerate water penetration. The launch aligns with the growing demand for sustainable plant health solutions, potentially setting a new standard in eco-friendly turf management link

- In October 2023, Nouryon, a global specialty chemicals leader, unveiled two new products at the SEPAWA Congress and Exhibition in Berlin, Berol Nexxt and Dissolvine GL Premium. Berol Nexxt is a next-generation surfactant and multifunctional hydrotrope designed to optimize performance in cleaning applications. Dissolvine GL Premium is the industry's most concentrated GLDA-based chelating agent, produced from a bio-based amino acid, offering high solubility over a wide pH range. These innovations reflect Nouryon's commitment to providing sustainable and high-performance solutions in the cleaning sector link

- In March 2022, Dow announced the expansion of its VORASURF Silicone Surfactants product line, aimed at supporting the rigid polyurethane foam industry. This development is focused on meeting the rising demand for sustainable and energy-efficient solutions, particularly in construction and spray applications. The move aligns with the market trend toward eco-friendly materials and is expected to strengthen Dow’s position in the performance materials segment while promoting greener building practices

- In September 2021, BASF implemented a strategic price increase for its non-ionic surfactants to address growing demand in the agricultural input market. The decision reflects escalating raw material costs and heightened need for crop protection chemicals such as herbicides and insecticides. This pricing strategy helps BASF sustain profitability and reinforces its leadership in the agricultural surfactants sector amid shifting market dynamics

- In March 2021, BASF SE expanded its footprint in the bio-based surfactants space through two key collaborations, including becoming the sole shareholder of Allied Carbon Solutions Co. Ltd. This moves highlights BASF’s focus on sustainable innovation and enhances its capabilities in plant-derived surfactant solutions. The partnerships are set to boost BASF’s influence in the green chemistry market and support long-term growth in environmentally friendly agricultural inputs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agricultural Surfactant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agricultural Surfactant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agricultural Surfactant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.