Global Agriculture Robots Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

12.47 Billion

2024

2032

USD

2.00 Billion

USD

12.47 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 12.47 Billion | |

|

|

|

|

What is the Global Agriculture Robots Market Size and Growth Rate?

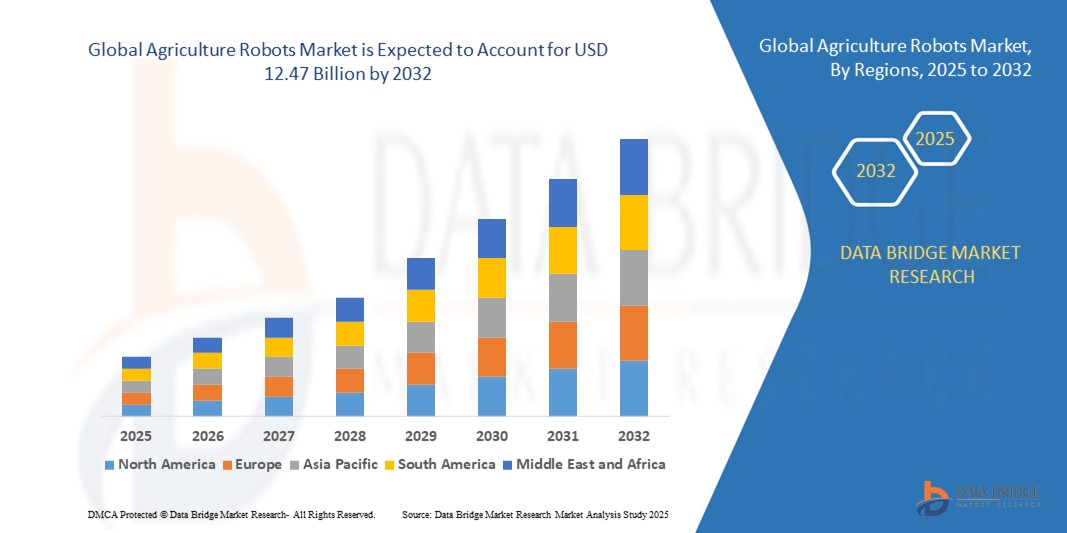

- The global agriculture robots market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 12.47 billion by 2032, at a CAGR of 25.70% during the forecast period

- The agriculture robots market is poised for significant growth, driven by several key factors. The increasing demand for sustainable and organic farming methods is a primary driver, as consumers and producers asuch as seek environmentally friendly solutions. In addition, the global labor shortage and the need for a skilled workforce in the agriculture sector are influencing the adoption of robots to fill this gap

- The dairy industry, in particular, requires improved efficiency and productivity, further propelling the market. However, the high initial investment cost for agriculture robots remains a significant restraint. Despite this, opportunities abound through collaboration and partnerships among industry players and the expansion of smart farming practices, including IoT integration. The market also faces challenges, such as the integration of robotic technology with existing agricultural equipment and infrastructure, which requires careful planning and adaptation

What are the Major Takeaways of Agriculture Robots Market?

- As the global agricultural sector faces growing scrutiny over its environmental impact, the shift towards sustainable and organic Farming practices has become a significant trend. This transition is driven by consumers' rising awareness of food safety, environmental conservation, and health benefits associated with organic produce. In response, the agriculture industry is adopting advanced technologies to meet these new demands efficiently and economically

- Agriculture robots are playing a crucial role in this transformation. These robots help farmers implement sustainable practices by enhancing precision in planting, fertilizing, and harvesting. For instance, robots equipped with sensors and AI can optimize resource usage, reducing waste and minimizing the ecological footprint of farming activities. They also support organic farming by automating weeding and pest control without relying on synthetic chemicals

- North America dominated the agriculture robots market with the largest revenue share of 37.91% in 2024, driven by the increasing adoption of precision farming, shortage of agricultural labor, and strong investments in advanced robotic solutions

- Asia-Pacific agriculture robots market is poised to grow at the fastest CAGR of 8.84% during 2025 to 2032, driven by rapid population growth, rising food demand, and government-backed digital farming initiatives in countries such as China, Japan, and India

- The Farming Robots segment dominated the market with the largest share of 42.6% in 2024, driven by their widespread adoption for tasks such as planting, weeding, and harvesting

Report Scope and Agriculture Robots Market Segmentation

|

Attributes |

Agriculture Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agriculture Robots Market?

Integration of Artificial Intelligence (AI) and Machine Vision for Precision Farming

- A significant and accelerating trend in the global agriculture robots market is the incorporation of AI, machine learning, and advanced vision systems to enable autonomous decision-making in tasks such as weeding, harvesting, seeding, and crop monitoring

- These technologies allow robots to identify plant health, detect pests, and optimize input usage such as fertilizers and pesticides, reducing operational costs and environmental impact

- For instance, Carbon Robotics (U.S.) has developed an AI-powered laser weeder capable of targeting and eliminating weeds with high precision, reducing the need for chemical herbicides

- The integration of AI-driven analytics enables real-time data collection, enhancing farmers’ ability to make predictive decisions and improve crop yield efficiency

- This trend is reshaping agricultural operations by making farming more sustainable, data-driven, and less labor-intensive, while improving scalability for large-scale farms

What are the Key Drivers of Agriculture Robots Market?

- The rising labor shortages in agriculture, combined with increasing labor costs, are pushing farmers to adopt automated solutions

- For instance, in June 2024, Deere & Company (U.S.) advanced its autonomous tractor program, integrating AI and computer vision to help farmers address labor constraints while maintaining productivity

- Growing demand for precision agriculture to maximize yields and minimize input wastage is driving the adoption of smart robots for seeding, crop monitoring, and harvesting

- The need for sustainable farming practices is also boosting demand, as agriculture robots help reduce chemical use, improve soil health, and optimize water consumption

- The convenience of deploying autonomous systems for 24/7 operations and their ability to perform repetitive and labor-intensive tasks more efficiently are strong factors propelling adoption globally

Which Factor is Challenging the Growth of the Agriculture Robots Market?

- High initial investment costs and the complexity of deploying advanced agricultural robotics are significant barriers for small and medium-scale farmers

- For instance, many AI-powered harvest robots are priced at a premium, making them less accessible to farmers in developing regions

- Another challenge is the lack of digital infrastructure and connectivity in rural areas, which limits the efficiency of cloud-based robotics and precision farming technologies

- Cybersecurity risks, data privacy concerns, and the need for regular software updates also pose challenges for large-scale adoption

- In addition, the limited technical expertise among farmers to operate and maintain advanced robotics systems slows market penetration

- Overcoming these hurdles through cost reduction, training programs, and government support initiatives will be essential to accelerate global adoption of agriculture robots

How is the Agriculture Robots Market Segmented?

The market is segmented on the basis of type, component, farming environment, application and end use.

- By Type

On the basis of type, the agriculture robots market is segmented into Farming Robots, Milking Robots, Unmanned Aerial Vehicles (Drones), and Others. The Farming Robots segment dominated the market with the largest share of 42.6% in 2024, driven by their widespread adoption for tasks such as planting, weeding, and harvesting. These robots reduce labor dependency and improve efficiency in large-scale farms. The integration of AI and computer vision further enhances their capability to optimize crop yields. Milking robots also contributed significantly to the market, particularly in developed regions where dairy automation is well established

The Unmanned Aerial Vehicles/Drone segment is projected to witness the fastest CAGR of 21.3% from 2025 to 2032, owing to their rising use in crop monitoring, pesticide spraying, and precision farming applications. Their cost-effectiveness and ability to cover large fields quickly position drones as a transformative force in modern agriculture.

- By Component

On the basis of component, the agriculture robots market is segmented into Hardware, Software, and Services. The Hardware segment accounted for the largest revenue share of 55.1% in 2024, as sensors, robotic arms, cameras, GPS modules, and automation units form the backbone of agricultural robotics. The increasing use of autonomous tractors, robotic harvesters, and drones has significantly boosted the demand for advanced hardware solutions. Hardware innovation is also driving cost reductions, making robots more accessible for mid-sized farms.

The Software segment is anticipated to record the fastest CAGR of 20.7% from 2025 to 2032, fueled by growing reliance on AI-driven platforms, predictive analytics, and farm management software. Cloud-based platforms for real-time monitoring, automation of decision-making, and precision agriculture applications are gaining momentum. Services such as training, maintenance, and integration support remain important, but software is emerging as the key enabler of long-term efficiency and scalability in agriculture robotics.

- By Farming Environment

On the basis of farming environment, the agriculture robots market is segmented into Outdoor and Indoor. The Outdoor segment dominated with the largest market share of 63.8% in 2024, owing to the extensive use of agricultural robots in open-field farming for seeding, spraying, harvesting, and monitoring crops. Outdoor farming environments demand robust robots capable of navigating varied terrains and weather conditions, which has driven technological innovations in autonomous tractors and drones. The adoption of outdoor robots is particularly high in large-scale commercial farms across North America, Europe, and Asia.

The Indoor segment is expected to witness the fastest CAGR of 19.9% from 2025 to 2032, driven by the expansion of greenhouse farming, vertical farming, and hydroponics. Indoor robots are gaining traction for their ability to operate in controlled environments, ensuring year-round production and high-quality yields, which aligns with the rising demand for sustainable and localized food production.

- By Application

On the basis of application, the agriculture robots market is segmented into Field Farming, Dairy & Livestock Management, Harvest Management, Soil & Irrigation Management, Micro Spraying Robots, and Others. The Field Farming segment held the largest market share of 39.7% in 2024, as robotic solutions such as autonomous tractors, drones, and crop monitoring systems are heavily deployed for seeding, fertilizing, and weeding operations. Field farming automation is critical in addressing global labor shortages and ensuring higher productivity. Meanwhile, Dairy & Livestock Management robots, particularly automated milking systems, have seen rapid adoption in developed countries.

The Soil & Irrigation Management segment is projected to witness the fastest CAGR of 20.4% from 2025 to 2032, supported by growing concerns over water scarcity and the need for efficient resource utilization. Precision irrigation robots, coupled with IoT-enabled soil sensors, are transforming how farmers optimize water and nutrient distribution, enhancing sustainability and profitability.

- By End Use

On the basis of end use, the agriculture robots market is segmented into Farm Produce, Dairy, and Livestock. The Farm Produce segment dominated the market with a share of 47.8% in 2024, owing to the high demand for automation in crop cultivation, harvesting, and monitoring across large agricultural fields. Increasing global food demand and the push toward precision farming have accelerated the adoption of robots in crop management. Robots help farmers maximize yields, minimize waste, and reduce reliance on manual labor. The Dairy segment, particularly automated milking and feeding systems, also holds a significant share in the market

The Livestock segment is projected to witness the fastest CAGR of 19.5% from 2025 to 2032, driven by increasing adoption of robotic systems for feeding, cleaning, and monitoring animal health. Automation in livestock farming improves productivity and ensures better animal welfare, which is gaining importance globally.

Which Region Holds the Largest Share of the Agriculture Robots Market?

- North America dominated the agriculture robots market with the largest revenue share of 37.91% in 2024, driven by the increasing adoption of precision farming, shortage of agricultural labor, and strong investments in advanced robotic solutions

- Farmers in the region value automation, productivity gains, and integration with AI and IoT platforms that enhance decision-making and reduce operational costs

- The rise in large-scale farms, supportive government initiatives, and early adoption of next-generation technologies further strengthen North America’s position as a global leader in agriculture robots

U.S. Agriculture Robots Market Insight

U.S. agriculture robots market captured the largest revenue share in 2024 within North America, fueled by the growing use of autonomous tractors, robotic harvesters, and precision drones. Farmers are prioritizing efficiency and sustainability through advanced robotic solutions that optimize yields while reducing reliance on manual labor. The rising adoption of AI-driven platforms, coupled with demand for robot-assisted monitoring and spraying systems, further propels the market. In addition, collaborations between agri-tech startups and established equipment manufacturers are accelerating technological penetration across the sector.

Europe Agriculture Robots Market Insight

Europe agriculture robots market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by labor shortages, sustainability regulations, and the push for smart farming practices. The region is experiencing a surge in robotic dairy farms, automated harvesting machines, and crop-monitoring drones. European consumers and farmers are also focused on eco-friendly and energy-efficient robotics, aligned with strict sustainability standards. Integration of robotic technologies into both new farms and modernized operations is fueling widespread adoption across the region.

U.K. Agriculture Robots Market Insight

U.K. agriculture robots market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s focus on food security, automation in horticulture, and rising demand for agricultural drones. Labor shortages post-Brexit are further driving reliance on robotic harvesting solutions. The U.K.’s strong agri-tech ecosystem, government-funded innovation programs, and expanding precision farming practices continue to stimulate market growth.

Germany Agriculture Robots Market Insight

Germany agriculture robots market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s emphasis on sustainability, advanced engineering capabilities, and demand for robotics in livestock management and crop production. German farms are increasingly integrating robotics with IoT and AI-powered platforms to improve efficiency and align with strict EU sustainability targets. This makes Germany a frontrunner in adopting privacy-conscious, eco-innovative robotic farming solutions.

Which Region is the Fastest Growing Region in the Agriculture Robots Market?

Asia-Pacific agriculture robots market is poised to grow at the fastest CAGR of 8.84% during 2025 to 2032, driven by rapid population growth, rising food demand, and government-backed digital farming initiatives in countries such as China, Japan, and India. The region is becoming a manufacturing hub for agricultural robots, which is reducing costs and increasing accessibility for local farmers. Moreover, technological advancements in drone-based crop monitoring, autonomous tractors, and robotic harvesters are driving exponential adoption.

Japan Agriculture Robots Market Insight

Japan agriculture robots market is gaining momentum due to the country’s aging farmer population, shrinking workforce, and tech-driven culture. Robotics are increasingly being used in rice planting, crop monitoring, and automated harvesting. The strong integration of IoT, AI, and robotics in precision farming, combined with government support for smart agriculture, is fueling rapid adoption across Japan’s farming sector.

China Agriculture Robots Market Insight

China agriculture robots market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to large-scale agricultural modernization, rapid urbanization, and government investment in agri-tech. The country is witnessing widespread adoption of robotic drones, smart tractors, and automated irrigation systems. Strong domestic manufacturing capabilities and affordable robotic solutions are driving accessibility, making China a leading force in the regional Agriculture Robots market.

Which are the Top Companies in Agriculture Robots Market?

The agriculture robots industry is primarily led by well-established companies, including:

- YANMAR HOLDINGS CO., LTD. (Japan)

- AGCO Corporation (U.S.)

- Deere & Company (U.S.)

- DeLaval (Sweden)

- KUBOTA Corporation (Japan)

- Kinze Manufacturing (U.S.)

- Yamaha Motor Co., Ltd. (Japan)

- FarmWise Labs (U.S.)

- Autonomous Solutions, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Carbon Robotics (U.S.)

- Vision Robotics Corporation (U.S.)

- ECOROBOTIX SA (Switzerland)

- Harvest Automation (U.S.)

- AGROBOT (Spain)

- Lely (Netherlands)

- Harvest CROO Robotics LLC (U.S.)

- Naïo Technologies (France)

- Robo Global Index, LLC (U.S.)

What are the Recent Developments in Global Agriculture Robots Market?

- In February 2024, Naio Technologies and CAMSO entered into a research and development partnership, focusing on agricultural robot tracks to improve field accessibility and minimize carbon emissions. This collaboration strengthened innovation and technological advancement and enhanced market competitiveness. The partnership is expected to accelerate the adoption of sustainable robotic farming solutions globally

- In February 2024, CNH Industrial N.V. invested in Bem Agro, a Brazilian startup specializing in AI-powered agronomic mapping solutions. Through Bem Agro's aerial imaging technology, the company aims to boost its precision farming portfolio, optimize crop management, and reduce herbicide usage. This strategic move reinforces CNH Industrial’s commitment to advancing digital agriculture and sustainability

- In November 2023, according to NetTantra Technologies, Japan’s large-scale greenhouse farming sector adopted AI robots developed by pioneering ventures. These robots, equipped with image recognition and robotic arms, performed tasks such as harvesting, sorting, and packaging by identifying ripe tomatoes. This transformation marks a crucial step toward automation and efficiency in Japan’s agricultural industry

- In April 2023, GEA Group Aktiengesellschaft deepened its collaboration with Kerbl, a livestock farming products supplier, through the GEA Exclusive Program. The partnership leverages Kerbl’s expertise and distribution network to expand GEA’s agricultural solutions and market reach. This alliance strengthens GEA’s presence in global livestock farming with innovative and accessible technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.