Global Air Condition Market

Market Size in USD Billion

CAGR :

%

USD

178.76 Billion

USD

377.66 Billion

2024

2032

USD

178.76 Billion

USD

377.66 Billion

2024

2032

| 2025 –2032 | |

| USD 178.76 Billion | |

| USD 377.66 Billion | |

|

|

|

|

Air Condition Market Size

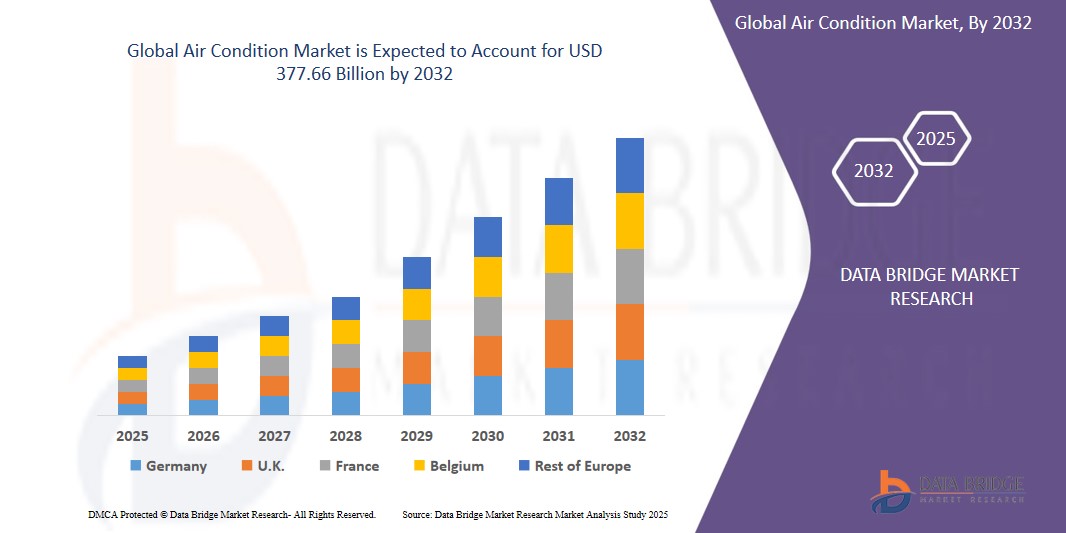

- The Global Air Condition Market size was valued at USD 178.76 billion in 2024 and is expected to reach USD 377.66 billion by 2032, at a CAGR of 9.8% during the forecast period

- The market growth is largely fuelled by rising global temperatures, increasing urbanization, and higher disposable incomes. Growing demand for energy-efficient and smart air conditioning systems, particularly in emerging economies, is also significantly driving the expansion of the global air conditioner market.

- Furthermore, the growth of the market is primarily driven by advancements in inverter and eco-friendly technologies, government incentives for energy-efficient appliances, rapid construction in residential and commercial sectors, and rising awareness of indoor air quality and thermal comfort worldwide.

Air Condition Market Analysis

- Global warming and prolonged heatwaves have significantly increased the demand for air conditioning systems. Urbanization, rising middle-class income, and lifestyle upgrades, especially in Asia-Pacific and the Middle East, are key contributors. Residential and commercial construction booms also continue to push sales of AC units worldwide.

- Manufacturers are focusing on inverter technology, smart thermostats, and IoT integration to meet growing energy efficiency standards. Eco-friendly refrigerants and green certifications are becoming industry norms. Consumer demand for quieter, faster-cooling, and low-maintenance units is also driving innovation, helping companies stay competitive in an evolving global market.

- Asia-Pacific dominates the global air conditioning market, accounting for approximately 55% of total market share. This growth is driven by rapid urbanization, rising disposable incomes, and increasing temperatures in countries like China, India, and Southeast Asia. Expanding construction activities and growing demand for residential and commercial cooling solutions fuel regional dominance.

- The Middle East & Africa region is projected to be the fastest-growing in the global air conditioning market. Driven by extreme climatic conditions, rapid urbanization, and infrastructure development, particularly in Gulf countries, the region is witnessing surging demand for cooling solutions, with strong investments in smart and energy-efficient HVAC technologies.

- The Window AC segment is expected to dominate the air conditioner market with approximately 45% market share, driven by its cost-effectiveness, simplicity, and strong demand in residential sectors across developing regions like Asia-Pacific and Latin America.

Report Scope and Air Condition Market Segmentation

|

Attributes |

Air Condition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Air Condition Market Trends

“Rise of inverter and eco-friendly air conditioning technologies”

- Inverter technology optimizes compressor speed, significantly reducing power consumption compared to traditional ACs. This leads to lower electricity bills and less environmental impact, making inverter ACs highly popular among eco-conscious consumers and aligning with global energy-saving regulations.

- Inverter ACs provide faster cooling and maintain consistent temperatures by adjusting compressor speed dynamically. This technology reduces wear and tear on components, extends unit lifespan, and improves user comfort, driving consumer preference for inverter-based air conditioners worldwide.

- Eco-friendly air conditioners incorporate refrigerants like R32 and R290, which have lower Global Warming Potential (GWP) than older refrigerants. Adoption of these gases reduces greenhouse gas emissions, supporting international climate goals and attracting environmentally aware buyers.

- Many governments incentivize energy-efficient appliances and impose strict efficiency standards on air conditioners. These policies encourage manufacturers to develop inverter and eco-friendly models, accelerating market adoption and boosting innovation in greener HVAC technologies.

- Increasing awareness of climate change and rising electricity costs are driving consumers toward sustainable cooling solutions. The demand for inverter and eco-friendly ACs is growing rapidly, especially in emerging markets where energy costs and environmental concerns are escalating.

Air Condition Market Dynamics

Driver

“Rising energy costs drive demand for efficient cooling technologies”

- Rising energy prices have led consumers and businesses to seek air conditioning systems that consume less power. Efficient cooling technologies like inverter ACs help reduce electricity bills, making them a preferred choice for cost-conscious users across residential and commercial sectors.

- Higher energy consumption contributes to greater carbon emissions, prompting consumers to adopt energy-efficient cooling solutions. This shift supports sustainability goals and aligns with government regulations encouraging the use of eco-friendly air conditioners that minimize environmental impact.

- Energy cost concerns push manufacturers to innovate, developing advanced cooling technologies that optimize energy use. This includes inverter compressors, smart controls, and better insulation, resulting in products that deliver superior performance with reduced power consumption.

- For Instance, The CleanTechnica article highlights the rising demand for air conditioning amid global warming, which significantly increases electricity consumption and CO₂ emissions. It stresses the urgent need for super-efficient cooling technologies using energy-saving components and eco-friendly refrigerants. Without innovation, AC systems could double global emissions by 2050, especially as markets like India rapidly expand their cooling infrastructure, stressing power grids and the environment.

- Governments worldwide are implementing policies and incentives to promote energy-efficient appliances, including air conditioners. Rising energy costs make these incentives more attractive, accelerating the adoption of efficient cooling technologies and reducing overall national energy demand.

Restraint/Challenge

“High upfront costs limit adoption of advanced AC systems”

- Advanced air conditioning technologies, including inverter and eco-friendly models, generally come with higher upfront costs. This price difference discourages cost-conscious consumers, particularly in developing countries where affordability is a major factor influencing purchasing decisions, limiting the widespread adoption of these efficient systems.

- Installation costs for advanced air conditioning systems can be considerably higher than traditional units. These additional expenses add to the initial financial burden for consumers and businesses, making it difficult for many potential buyers to justify the investment despite the long-term energy savings benefits.

- Many consumers have limited understanding of the long-term energy savings and cost benefits associated with advanced air conditioning units. This lack of awareness reduces their willingness to invest upfront, as the immediate higher cost overshadows the potential future financial and environmental advantages.

- Financing options for purchasing advanced air conditioning systems are often either unavailable or come with high-interest rates. This financial barrier restricts access for many consumers, especially in emerging markets, slowing the adoption rate of energy-efficient cooling technologies despite their long-term benefits.

- Price sensitivity in emerging markets remains a significant challenge for the adoption of advanced air conditioning systems. Despite growing demand for energy-efficient products, many consumers prioritize upfront affordability over long-term savings, hindering the penetration of modern, eco-friendly AC technologies in these regions.

Air Condition Market Scope

The market is segmented on the basis of functional type, product, technology and application.

- By Type

The Window AC segment dominates with an estimated 38% revenue share in 2025, driven by its affordability, easy installation, and strong demand in residential and small commercial sectors, particularly in emerging markets seeking cost-effective cooling solutions.

The Window AC segment is anticipated to witness the fastest growth rate of around 21% CAGR due to increasing demand for affordable, compact, and easy-to-install cooling solutions in emerging economies, where rising temperatures and urbanization boost its popularity in residential and commercial sectors.

- By Product

The temperature control segment held the largest market revenue share in 2025, driven by increasing demand for precise climate management, energy efficiency, and enhanced user comfort in residential, commercial, and industrial applications, supported by advancements in smart thermostat and sensor technologies.

The temperature control segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing adoption of smart thermostats, rising focus on energy efficiency, and increasing demand for automated climate regulation in homes and businesses.

- By Technology

The Inverter segment held the largest market revenue share in 2025, driven by its superior energy efficiency, ability to maintain consistent temperatures, and lower electricity consumption compared to conventional ACs. Growing consumer awareness about energy savings and environmental impact further boosts demand for inverter-based air conditioning systems globally.

The inverter segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for energy-efficient cooling solutions, advancements in inverter technology, government incentives, and rising consumer awareness about reducing electricity costs and environmental impact globally.

- By Application

The residential buildings segment held the largest market revenue share in 2025, driven by its superior energy efficiency, ability to maintain consistent temperatures, and lower electricity consumption compared to conventional ACs. Growing consumer awareness about energy savings and environmental impact further boosts demand for inverter-based air conditioning systems globally.

The residential buildings segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for energy-efficient cooling solutions, advancements in inverter technology, government incentives, and rising consumer awareness about reducing electricity costs and environmental impact globally.

Air Condition Market Regional Analysis

- Asia Pacific dominates the global air conditioning market, accounting for approximately 55% of the total market share. This dominance is fueled by rapid urbanization, rising disposable incomes, extreme weather conditions, and growing demand for residential and commercial cooling solutions across the region.

- Its dominance in the global air conditioning market is further strengthened by robust manufacturing infrastructure, presence of key industry players, supportive government policies promoting energy-efficient technologies, and increasing investments in smart and eco-friendly air conditioning solutions across emerging economies within the Asia Pacific region.

- the Asia Pacific region benefits from a large and growing population, rapid industrialization, and expanding commercial sectors, which drive continuous demand for advanced air conditioning systems. Increasing awareness about climate change also encourages adoption of energy-efficient and sustainable cooling technologies.

Asia Pacific Air Condition Market Insight

The Asia Pacific air condition market captured the largest revenue share of 55% within Asia Pacific in 2025, fueled by its expanding urban population, rising middle-class income levels, growing construction activities, and high temperatures. Government initiatives promoting energy-efficient systems and local manufacturing capabilities further contributed to the region’s dominant market position.

North America Air Condition Market Insight

The North America air condition market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by extreme climatic conditions, rapid urbanization, growing infrastructure development, and increasing demand for energy-efficient cooling systems across residential, commercial, and industrial sectors in the region.

Europe Air Condition Market Insight

The Europe air condition market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising summer temperatures, increased adoption of energy-efficient systems, green building initiatives, and growing demand for air conditioning in residential and commercial sectors.

Air Condition Market Share

The Air Condition industry is primarily led by well-established companies, including:

- Daikin Industries Ltd. (Japan)

- Carrier Global Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- LG Electronics Inc. (South Korea)

- Samsung Electronics Co., Ltd. (South Korea)

- Panasonic Corporation (Japan)

- Hitachi Ltd. (Japan)

- Fujitsu General Limited (Japan)

- Voltas Limited (India)

- Blue Star Limited (India)

- Haier Group Corporation (China)

- Gree Electric Appliances Inc. (China)

- Midea Group Co., Ltd. (China)

- Toshiba Corporation (Japan)

- Whirlpool Corporation (U.S.)

Latest Developments in Global Air Condition Market

- In March 2024, LG DUALCOOL Air Conditioner Unveiled at MCE 2024 in Milan, LG's DUALCOOL features a dual outlet structure, delivering up to 23% faster cooling and 6% faster heating compared to previous models. It emphasizes rapid temperature control and energy efficiency.

- In April 2024, Lennox introduced the SL25KCV, boasting a SEER2 rating of up to 26.00, making it one of the industry's most efficient air conditioners. It utilizes a low Global Warming Potential (GWP) refrigerant, aligning with environmental sustainability goals.

- In April 2024, MHI announced the launch of 31 new residential air conditioner models for the Japanese market, focusing on enhanced energy efficiency and user comfort across five different series..

- In March 2025, LG's Artcool AI Air Conditioner incorporates occupant detection technology, directing airflow based on room layout and human presence. It also features energy-saving modes activated when windows are detected open, enhancing both comfort and efficiency..

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.