Global Aircraft Exterior Lighting Market

Market Size in USD Billion

CAGR :

%

USD

166.37 Billion

USD

247.68 Billion

2024

2032

USD

166.37 Billion

USD

247.68 Billion

2024

2032

| 2025 –2032 | |

| USD 166.37 Billion | |

| USD 247.68 Billion | |

|

|

|

|

Aircraft Exterior Lighting Market Size

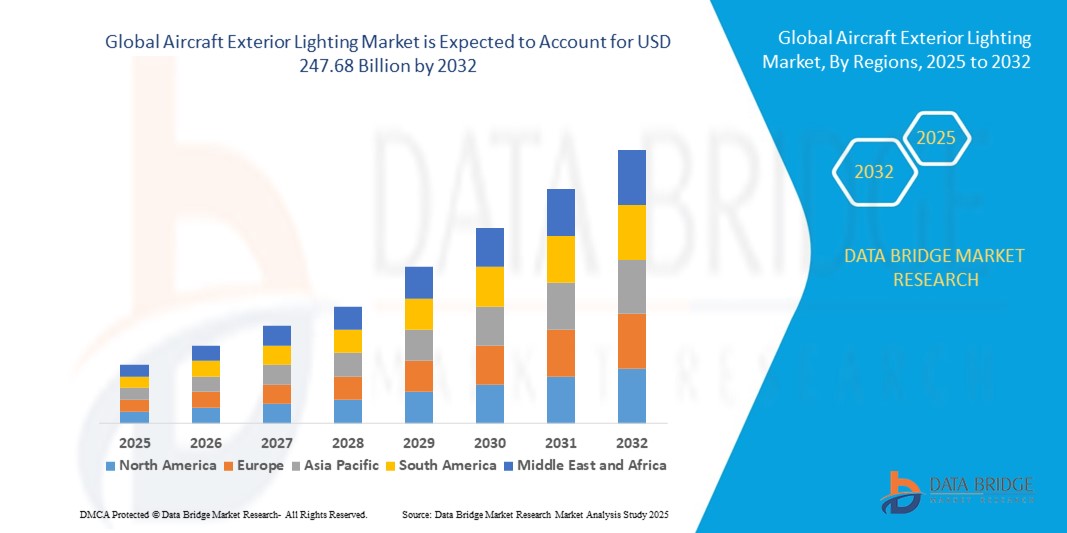

- The global aircraft exterior lighting market size was valued at USD 166.37 billion in 2024 and is expected to reach USD 247.68 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing demand for enhanced visibility and safety in aircraft operations, especially during night-time flights and adverse weather conditions. Airlines and aircraft manufacturers are emphasizing the integration of advanced lighting technologies to meet strict aviation safety regulations and improve operational efficiency

- Furthermore, the ongoing modernization of commercial and military aircraft fleets, along with the rise in air travel globally, is driving the adoption of energy-efficient and long-lasting LED-based exterior lighting systems. These innovations not only improve visibility but also reduce maintenance costs and energy consumption, thereby significantly boosting the aircraft exterior lighting industry’s growth

Aircraft Exterior Lighting Market Analysis

- Aircraft exterior lighting, including position lights, anti-collision lights, landing lights, and taxi lights, plays a vital role in ensuring visibility, safety, and communication for aircraft during ground operations and flight

- The escalating demand for advanced exterior lighting systems is primarily fueled by the rising number of commercial and military aircraft deliveries, increased focus on flight safety, and the growing trend of aircraft modernization and fleet expansion

- North America dominated the aircraft exterior lighting market with the largest revenue share of 38.7% in 2024, driven by strong aviation infrastructure, high defense expenditure, and the presence of key aircraft manufacturers and lighting technology providers in the region

- Asia-Pacific is expected to be the fastest-growing region in the aircraft exterior lighting market during the forecast period, with a projected CAGR of 8.5% from 2025 to 2032, owing to rapid growth in air passenger traffic, increasing demand for new aircraft, and expanding airline fleets in countries such as China, India, and Japan

- The LED segment dominated with the largest market share of 72.5% in 2024, attributed to its longer operational life, energy efficiency, low maintenance, and reduced weight compared to traditional lighting systems. LED systems are increasingly adopted across all aircraft categories due to their reliability and ability to meet stringent regulatory standards

Report Scope and Aircraft Exterior Lighting Market Segmentation

|

Attributes |

Aircraft Exterior Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aircraft Exterior Lighting Market Trends

Rising Demand for Advanced Visibility and Safety Features

- A significant and accelerating trend in the global aircraft exterior lighting market is the growing emphasis on safety, efficiency, and compliance with aviation regulations, driving the demand for advanced exterior lighting systems

- Modern aircraft are increasingly equipped with high-intensity landing lights, navigation lights, and anti-collision strobe lights, ensuring optimal visibility during take-off, landing, and night operations.

- Technological advancements in LED and laser-based lighting solutions are gaining traction due to their low power consumption, longer operational life, and improved illumination compared to traditional incandescent or halogen systems

- Leading manufacturers are also focusing on integrating smart diagnostics and health monitoring into exterior lighting systems, allowing real-time status tracking and predictive maintenance to reduce downtime and operational costs

- Increased air travel demand, fleet modernization programs, and a global push toward enhancing passenger safety have made high-performance exterior lighting systems a critical component of both commercial and military aircraft

- Moreover, with stricter international safety regulations by bodies such as the FAA and EASA, airlines and OEMs are increasingly prioritizing the adoption of compliant and energy-efficient lighting solutions across new aircraft and retrofit programs

Aircraft Exterior Lighting Market Dynamics

Driver

Growing Need Due to Rising Safety Regulations and Night Operation Requirements

- The increasing emphasis on aircraft safety and regulatory compliance, combined with the rising number of night-time flights and poor weather operations, is a significant driver behind the growing demand for advanced aircraft exterior lighting systems

- For instance, in March 2024, Collins Aerospace launched an upgraded exterior LED lighting system for narrow-body aircraft, designed to enhance visibility and meet stringent FAA requirements for night operations and low-visibility conditions. Such developments are expected to significantly contribute to the growth of the Aircraft Exterior Lighting industry during the forecast period

- Airlines and aircraft operators are increasingly focusing on enhancing visibility for pilots, ground crew, and other air traffic through high-intensity lighting systems such as anti-collision lights, taxi lights, wing inspection lights, and logo lights

- Moreover, with the increasing frequency of night take-offs and landings globally, the integration of durable, energy-efficient, and weather-resistant lighting solutions is becoming essential for operational safety

- The trend toward retrofitting existing aircraft fleets with advanced LED-based lighting systems is also gaining momentum, as airlines seek to reduce maintenance costs, improve energy efficiency, and ensure regulatory compliance. These systems offer longer lifespans and significantly lower power consumption compared to traditional halogen or incandescent lights

Restraint/Challenge

High Initial Cost and Complex Certification Requirements

- One of the major restraints in the aircraft exterior lighting market is the high initial cost of advanced lighting systems, particularly LED and laser-based solutions. While these systems offer long-term cost savings, their upfront price and installation costs remain a barrier for smaller carriers or budget-conscious operators

- In addition, the aircraft lighting systems are subject to rigorous certification and testing requirements by aviation authorities such as the FAA and EASA, which can lead to longer product development cycles and increased compliance costs

- The stringent testing for vibration resistance, temperature tolerance, and electromagnetic interference compatibility further adds to development complexity. This often limits the entry of new players into the market and can slow the rollout of innovative lighting technologies

- Furthermore, the retrofitting of lighting systems on older aircraft models can be both technically challenging and expensive, due to differences in electrical compatibility and design architecture

- To overcome these challenges, manufacturers are focusing on modular designs, cost-effective production techniques, and improved collaboration with certification bodies to streamline approvals and reduce delays in product rollouts

Aircraft Exterior Lighting Market Scope

The market is segmented on the basis of aircraft type, light type, light source, fit type, end user, and sales channel.

- By Aircraft Type

On the basis of aircraft type, the aircraft exterior lighting market is segmented into commercial aviation, business jets and general aviation, military aviation, and helicopters. The commercial aviation segment dominated the largest market revenue share of 41.2% in 2024, driven by the rapid expansion of airline fleets, increased global air travel demand, and the growing emphasis on fuel-efficient aircraft featuring advanced lighting systems. Airlines are prioritizing energy-efficient and long-lasting LED exterior lights to reduce operational costs and improve visibility and safety during night-time operations.

The military aviation segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, fueled by increasing defense budgets, aircraft modernization programs, and demand for night-vision-compatible and infrared lighting systems in combat and surveillance aircraft. Enhanced mission capability and operational safety in hostile environments continue to drive demand for advanced exterior lighting in this segment.

- By Light Type

On the basis of light type, the aircraft exterior lighting market is segmented into interior lights and exterior lights. The exterior lights segment held the largest revenue share of 64.8% in 2024, reflecting their indispensable role in promoting operational safety and regulatory compliance. These include landing lights, navigation lights, anti-collision lights, and taxi lights—critical for visibility during critical phases of flight such as take-off, landing, and taxiing, plus aiding other aircraft and ground personnel spotting the aircraft. Both day and night operations rely on consistent, high-intensity illumination and durable performance under varying environmental conditions. Trials in extreme weather and harsh settings affirm the segment’s reliability, and airport infrastructure expands demand further. Overall, safety-critical aviation standards continue to drive the dominance of exterior lighting systems.

The interior lights segment is projected to grow at a notable CAGR of 6.4%, motivated by rising emphasis on passenger comfort, cabin ambiance, and airline branding. Advances in cabin design now incorporate mood lighting, adaptive color temperature, and energy-efficient fixtures to enhance mood, reduce jetlag, and elevate the perceived quality of service. Premium and long-haul aircraft are increasingly outfitted with customizable LED interiors, offering differentiated cabin experiences. Cabin upgrade programs often include lighting customization. As passenger experience becomes a competitive differentiator, interior lights gain more visibility—and growth—in the aviation lighting market.

- By Light Source

On the basis of light source, the aircraft exterior lighting market is segmented into LED and Fluorescent. The LED segment dominated with the largest market share of 72.5% in 2024, due to its high energy efficiency, long lifespan, and reduced maintenance demands, as well as a lightweight design conducive to aerodynamics and fuel savings. LEDs deliver uniform light output, quicker switch-on times, and superior reliability in extremities of temperature and pressure. They meet stringent aviation regulations concerning brightness, color accuracy, and power consumption. The low power draw facilitates easier integration with aircraft electrical systems, enabling additional energy savings. Together, these benefits make LED lighting the go-to choice for modern aircraft, both new builds and interior/cabin upgrades.

The fluorescent segment is anticipated to decline gradually, though it remains in use for certain retrofit applications and older aircraft. While initially popular for its brightness and cost, fluorescent technology is being phased out due to its shorter lifespan, higher energy requirements, and need for ballast components. Older fleets that continue to operate depend on fluorescent systems, especially in regions where cost of upgrades is prohibitive. Gradual phase-out mandates and removal of manufacturing support further accelerate the shift away from fluorescent solutions.

- By Fit Type

On the basis of fit type, the aircraft exterior lighting market is segmented into Line Fit and Retrofit Fit. The line fit segment accounted for the highest revenue share of 57.3% in 2024, driven by factory-installed exterior lighting systems integrated with the aircraft’s design, wiring, and avionics at the point of manufacture. OEM partnerships with lighting specialists ensure seamless integration, optimal aerodynamics, and certification adherence from day one of an aircraft’s lifespan. Line-fit systems are installed as part of the original build, enabling designers to optimize performance, weight distribution, and maintenance cycles. Airline specifications for lighting assemblies often form part of new aircraft purchase contracts, reinforcing line-fit’s dominance.

The retrofit segment is projected to grow steadily at a CAGR of 6.8%, fueled by regulatory mandates, fleet modernization programs, and evolving expectations for energy efficiency and lighting performance. Aging fleets, especially those relying on halogen or fluorescent lighting, are prime targets for retrofits. Retrofitting allows airlines and operators to upgrade lighting systems without replacing the entire aircraft, offering cost-effective ways to meet new emission and maintenance standards. MRO providers and aircraft lessors often lead such retrofit initiatives. Retrofit demand similarly grows with the availability of modular, plug-and-play LED lighting kits and increasing retrofit certification pathways.

- By End User

On the basis of end user, the aircraft exterior lighting market is segmented into Commercial and Military. The commercial segment led the market with a revenue share of 66.1% in 2024, driven by strong demand from airlines worldwide for advanced lighting systems that enhance safety, reduce fuel consumption through weight reduction, and improve brand identity via customizable lighting features. Commercial airlines benefit from the lower operational costs and maintenance requirements associated with modern lighting technologies. In-flight lighting contributes to passenger satisfaction, supports cabin branding, and reinforces aircraft identity. Regulations around aircraft visibility also compel commercial operators to maintain high standards for exterior lighting.

The military segment is projected to grow rapidly, propelled by rising investment in tactical aircraft platforms, unmanned aerial vehicles (UAVs), and next-generation defense jets demanding mission-ready, durable lighting systems. Military lighting must endure rigorous operational conditions and meet specialized specifications such as infrared stealth, enhanced visibility for night missions, and compatibility with camera-based reconnaissance.

- By Sales Channel

On the basis of sales channel, the aircraft exterior lighting market is segmented into original equipment manufacturer (OEM) and aftermarket. The original equipment manufacturer (OEM)segment held the dominant market share of 60.4% in 2024, attributed to new aircraft deliveries by manufacturers that partner with lighting technology providers to fulfill lighting needs, ensuring optimized design integration, certification, and warranties. OEM-installed lighting is baked into aircraft specifications, enabling airlines to start operations with high-quality, maintenance-optimized lighting systems. Integrated procurement by OEMs also ensures alignment with production schedules and economies of scale.

The aftermarket segment is expected to grow at a faster CAGR of 8.1%, supported by increasing retrofitting activities, replacement cycles, and demand for advanced lighting via MRO in aging fleets. As aircraft operational lifespans extend, owners invest in lighting upgrades to improve efficiency, meet emergent regulations, and reduce maintenance costs. The aftermarket growth is driven by cost-effective retrofit kits, increasing fuel efficiency concerns, and availability of certified lighting solutions tailored for replacement. Strong MRO infrastructure and lighting vendors expand aftermarket offerings to support retrofit demand.

Aircraft Exterior Lighting Market Regional Analysis

- North America dominated the global aircraft exterior lighting market in 2024, capturing the largest revenue share of 38.7%

- This dominance is attributed to the presence of a well-established aerospace industry, continuous advancements in lighting technologies, and a strong emphasis on aviation safety standards. The region is home to some of the world’s largest aircraft manufacturers and commercial airlines, such as Boeing and American Airlines, which are increasingly adopting LED-based and energy-efficient lighting systems

- Regulatory bodies such as the Federal Aviation Administration (FAA) are also pushing for enhanced visibility and environmental compliance, further encouraging innovation in exterior lighting products

U.S. Aircraft Exterior Lighting Market Insight

The U.S. global aircraft exterior lighting market accounted for the largest share of the North American market in 2024, contributing approximately 58% of the regional revenue. This leadership is fueled by rising investments in fleet modernization, growing commercial aviation traffic, and expanding military aviation programs. U.S.-based airlines are replacing older aircraft with newer, fuel-efficient models equipped with advanced lighting technologies that enhance visibility, reduce maintenance costs, and meet stringent FAA safety regulations. The integration of LED lighting in new aircraft, along with retrofit programs for legacy fleets, continues to drive substantial growth in the U.S. market.

Europe Aircraft Exterior Lighting Market Insight

The European aircraft exterior lighting market is projected to witness steady growth during the forecast period, supported by a robust aviation manufacturing ecosystem and stringent environmental and safety regulations. Countries such as Germany, France, and the U.K. are investing heavily in aviation infrastructure and sustainable aircraft technologies. The demand for LED and laser-based lighting solutions is rising across both commercial and defense aviation segments, as airlines and military agencies aim to improve fuel efficiency and reduce carbon emissions. In addition, the focus on replacing older lighting systems with energy-saving alternatives in regional carriers and general aviation is contributing to the region’s growth.

U.K. Aircraft Exterior Lighting Market Insight

The U.K. global aircraft exterior lighting market is anticipated to expand at a notable CAGR, driven by its strong defense and aerospace sectors. The country is witnessing increasing demand for next-generation aircraft lighting systems that align with evolving safety protocols and performance standards. Growth in commercial aviation and the expanding footprint of low-cost carriers are also boosting the need for reliable exterior lighting systems, especially for night operations and enhanced in-flight visibility. Moreover, the U.K.’s active involvement in international aviation programs continues to stimulate domestic production and adoption of advanced lighting technologies.

Germany Aircraft Exterior Lighting Market Insight

The Germany global aircraft exterior lighting market is expected to experience considerable growth in the Aircraft Exterior Lighting market, owing to its position as a leading innovator in the aerospace supply chain. German manufacturers are at the forefront of developing efficient and sustainable lighting systems for both commercial and military aircraft. The country’s emphasis on research and development, along with collaboration between public and private aerospace stakeholders, supports the integration of advanced materials and energy-efficient LED lights. Retrofit programs aimed at upgrading older fleets with modern lighting systems are also contributing to the overall market expansion.

Asia-Pacific Aircraft Exterior Lighting Market Insight

The Asia-Pacific global aircraft exterior lighting market region is projected to record the fastest CAGR of 8.5% during the forecast period from 2025 to 2032, emerging as a significant growth hub in the Aircraft Exterior Lighting market. This rapid expansion is driven by increased aircraft deliveries, growing air travel demand, and large-scale aviation infrastructure projects across countries such as China, India, and Japan. Government-led initiatives such as “Make in India” and China's support for COMAC (Commercial Aircraft Corporation of China) are bolstering domestic aircraft production and, in turn, boosting the demand for high-performance lighting systems. The adoption of LED lighting is rapidly rising due to its durability, low maintenance, and fuel-saving benefits.

Japan Aircraft Exterior Lighting Market Insight

The Japan aircraft exterior lighting market is experiencing healthy growth, supported by its technologically advanced aviation sector and strategic investments in both commercial and defense aircraft programs. Japanese airlines are investing in fleet upgrades, emphasizing reliability, safety, and operational efficiency. The country’s strong aerospace R&D base, coupled with its commitment to smart and sustainable technologies, is fostering the adoption of lightweight, high-intensity LED exterior lighting. These lighting solutions are essential for enhancing night-time visibility, runway operations, and reducing energy consumption during flights.

China Aircraft Exterior Lighting Market Insight

The China global aircraft exterior lighting market held the largest share of the Asia-Pacific Aircraft Exterior Lighting market in 2024, driven by the rapid growth of its commercial aviation sector and increasing investments in domestic aircraft manufacturing. The rising number of airline passengers, growing middle-class population, and expansion of regional airports have resulted in higher demand for new aircraft equipped with modern lighting systems. In addition, China’s aggressive pursuit of smart airport and smart aviation technologies is propelling the integration of advanced exterior lighting, particularly LED-based solutions, across its commercial and military fleets. The presence of several local manufacturers is also helping to lower costs and accelerate adoption.

Aircraft Exterior Lighting Market Share

The Aircraft Exterior Lighting industry is primarily led by well-established companies, including:

- Astronics Corporation (U.S.)

- Cobham Limited (U.S.)

- Diehl Stiftung & Co. KG (U.S.)

- Heads Up Technologies (U.S.)

- Safran (U.S.)

- Oxley Group (U.S.)

- Collins Aerospace (U.S.)

- SODERBERG MANUFACTURING COMPANY INC. (U.S.)

Latest Developments in Global Aircraft Exterior Lighting Market

- In February 2023, Astronics Corporation introduced its next-generation LED passenger exit path lighting system for commercial aircraft, offering enhanced visibility and safety during emergency evacuations, with FAA approval marking its suitability across fleet types

- In April 2023, Honeywell International expanded its exit path lighting portfolio, unveiling new LED and fluorescent systems designed for both fixed-wing and aerospace platforms—emphasizing energy efficiency and regulatory compliance

- In May 2023, Luminator Technology Group launched a new LED passenger exit path lighting system for commercial aircraft, designed to be more durable and energy-efficient compared to legacy solutions

- In June 2023, LEDtronics rolled out an LED passenger exit path lighting system for general aviation aircraft, noted for its affordability and ease of installation relative to traditional systems

- In July 2023, French aerospace firm Thales has entered exclusive negotiations to acquire cockpit radio and satcom specialist Cobham Aerospace Communications for around USD 1.1 billion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aircraft Exterior Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aircraft Exterior Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aircraft Exterior Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.