Global Allergy Vaccine Market

Market Size in USD Billion

CAGR :

%

USD

1.43 Billion

USD

3.38 Billion

2024

2032

USD

1.43 Billion

USD

3.38 Billion

2024

2032

| 2025 –2032 | |

| USD 1.43 Billion | |

| USD 3.38 Billion | |

|

|

|

|

Allergy Vaccine Market Size

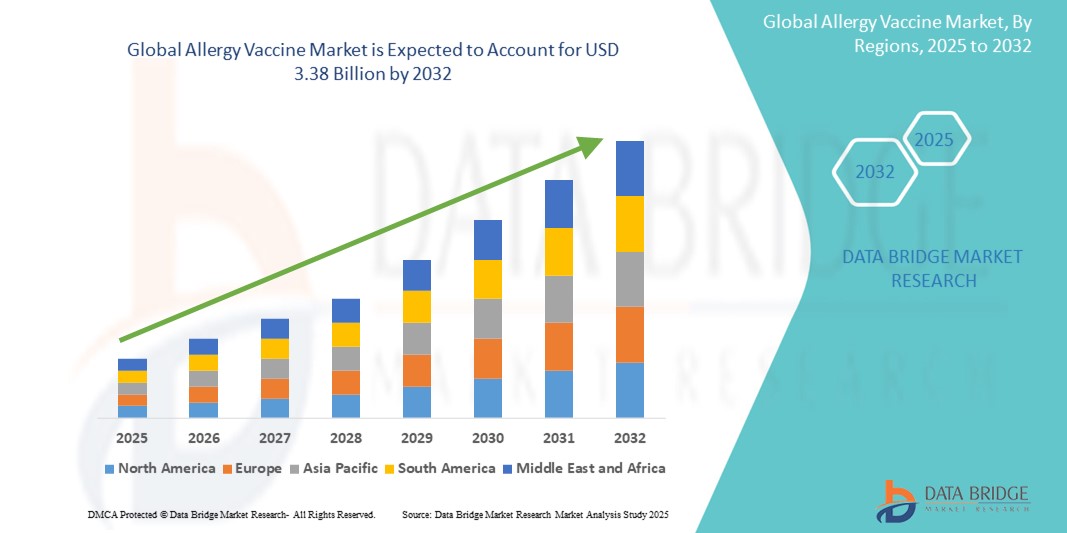

- The global allergy vaccine market size was valued at USD 1.43 billion in 2024 and is expected to reach USD 3.38 billion by 2032, at a CAGR of 11.32% during the forecast period

- The market growth is largely fueled by the increasing prevalence of allergic disorders such as allergic rhinitis, asthma, and food allergies, along with growing awareness and diagnosis rates, especially in developed and urbanizing regions

- Furthermore, rising consumer demand for long-term and effective immunotherapy options over symptomatic treatments is positioning allergy vaccines as a preferred therapeutic choice. These converging factors are accelerating the adoption of allergen-specific immunotherapies, thereby significantly boosting the industry's growth

Allergy Vaccine Market Analysis

- Allergy vaccines, also known as allergen immunotherapy, are increasingly recognized as essential components in the long-term management of allergic conditions such as hay fever, asthma, and insect sting allergies, due to their ability to modify the disease course and provide sustained relief by desensitizing the immune system to specific allergens

- The growing demand for allergy vaccines is primarily driven by the global rise in allergy prevalence, increased awareness of immunotherapy's long-term benefits, and the limitations of conventional symptomatic treatments

- North America dominated the allergy vaccine market with the largest revenue share of 41.7% in 2024, supported by a high burden of allergic diseases, increasing adoption of advanced immunotherapies, and strong healthcare expenditure, with the U.S. leading in clinical research, approvals, and availability of allergy vaccine formulations across diverse patient groups

- Asia-Pacific is expected to be the fastest growing region in the allergy vaccine market during the forecast period due to rising urban pollution, improved access to healthcare, and growing awareness of allergic diseases and their treatments

- Subcutaneous immunotherapy (SCIT) segment dominated the allergy vaccine market with a market share of 48.1 % in 2024, driven by its proven efficacy, long-lasting immune tolerance, and widespread use in treating allergic rhinitis and allergic asthma

Report Scope and Allergy Vaccine Market Segmentation

|

Attributes |

Allergy Vaccine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Allergy Vaccine Market Trends

“Rising Preference for Long-Term Immunotherapy Over Symptomatic Relief”

- A significant and accelerating trend in the global allergy vaccine market is the growing preference for allergen-specific immunotherapy (AIT) over conventional symptomatic treatments such as antihistamines and corticosteroids. This shift is driven by the ability of allergy vaccines to provide long-term relief and modify the underlying immune response rather than offering temporary symptom control

- For instance, companies such as ALK-Abelló and Stallergenes Greer are advancing sublingual and subcutaneous immunotherapy options that target common allergens such as pollen, dust mites, and pet dander, offering patients personalized and disease-modifying solutions

- Allergy vaccines, particularly SCIT and SLIT, are increasingly favored in clinical practice for their ability to induce immune tolerance and reduce the need for long-term medication use. Innovations in vaccine formulations, such as adjuvant-enhanced extracts and recombinant allergens, are further improving efficacy and safety profiles

- The convenience of home-based administration of sublingual allergy tablets has contributed to rising consumer demand, especially in regions with well-established telehealth and pharmacy infrastructure. For example, Oralair and Grazax tablets are being adopted widely in Europe and North America due to their ease of use and proven clinical benefits

- This trend is also supported by growing clinical evidence, favorable reimbursement policies in developed countries, and an increased focus on personalized medicine. As a result, more patients and healthcare providers are embracing immunotherapy as a long-term strategy for allergy management

- The rising demand for disease-modifying allergy treatments is prompting pharmaceutical companies to invest in R&D and expand their product pipelines, leading to a steady flow of novel vaccine candidates and regulatory approvals, further boosting market growth across all age groups

Allergy Vaccine Market Dynamics

Driver

“Increased Allergy Prevalence and Growing Demand for Long-Term Treatment Solutions”

- The global surge in allergic conditions—such as allergic rhinitis, food allergies, and asthma—driven by environmental pollution, urbanization, and changing lifestyles, is a key driver behind the growing demand for allergy vaccines

- For instance, according to the World Allergy Organization, over 30% of the global population is affected by allergic diseases, prompting greater attention towards immunotherapy as a sustainable and effective treatment option

- Allergy vaccines offer significant advantages by targeting the root cause of allergic reactions, helping patients reduce dependency on daily medications and improving long-term health outcomes. This has led to increased adoption, especially among pediatric and high-risk populations

- Rising healthcare awareness, government initiatives promoting preventive care, and the inclusion of allergy vaccines in treatment guidelines by leading associations are further accelerating market uptake

- In addition, pharmaceutical firms are developing more convenient administration routes and tailored formulations that cater to specific geographic and allergen profiles, thus expanding access and improving patient adherence

Restraint/Challenge

“Limited Awareness and Accessibility in Low-Income Regions”

- Despite growing demand, the allergy vaccine market faces significant barriers in many developing regions due to limited awareness of immunotherapy, inadequate diagnostic infrastructure, and lower healthcare expenditure

- For instance, while Europe and North America have well-established allergy diagnosis and treatment pathways, many low- and middle-income countries still rely heavily on symptomatic therapies due to lack of trained allergists, poor access to allergy testing, and minimal reimbursement support

- In addition, the long treatment duration required for immunotherapy—typically spanning three to five years—can deter patient adherence and add to the overall cost burden, especially in regions without comprehensive insurance coverage

- Companies must address these challenges by increasing physician education, expanding patient support programs, and partnering with local healthcare providers to improve diagnostic and treatment access

- Regulatory challenges also persist, particularly in regions where allergen standardization and approval pathways are less defined, potentially delaying product launches and limiting the availability of new immunotherapy options

- Tackling these issues through cross-sector collaborations, international clinical guidelines, and public health education campaigns will be crucial for unlocking the full potential of the global allergy vaccine market

Allergy Vaccine Market Scope

The market is segmented on the basis of type, application, end-users, and distribution channel.

- By Type

On the basis of type, the allergy vaccine market is segmented into sublingual immunotherapy (SLIT) and subcutaneous immunotherapy (SCIT). The subcutaneous immunotherapy segment dominated the market with the largest market revenue share of 48.1% in 2024, driven by its longstanding clinical use, high efficacy in treating multiple allergen sensitivities, and broad acceptance among allergists. SCIT is often the preferred method in regions with advanced healthcare infrastructure due to its ability to deliver long-term desensitization under professional supervision.

The sublingual immunotherapy segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, owing to its non-invasive, convenient, and home-based administration model. SLIT is gaining popularity in both pediatric and adult populations due to improved patient adherence and a favorable safety profile. Growing approval and commercialization of SLIT tablets for allergens such as grass, ragweed, and dust mites are expected to further propel this segment’s expansion.

- By Application

On the basis of application, the allergy vaccine market is segmented into allergic asthma, seasonal allergic rhinitis, peanut hypersensitivity, cat dander allergy, tree pollen hypersensitivity, grass pollen hypersensitivity, and others. Seasonal allergic rhinitis held the largest revenue share in 2024, driven by the global rise in pollen-related allergies, especially in urban regions. Immunotherapy targeting seasonal allergens such as grass, weed, and tree pollen is widely adopted due to its efficacy in reducing long-term symptoms and medication dependency.

Peanut hypersensitivity is expected to register the fastest CAGR from 2025 to 2032, supported by increasing food allergy prevalence and growing R&D in oral immunotherapy and epitope-based vaccines. Recent advances in precision medicine are driving the development of targeted immunotherapy for food allergies, particularly among children, contributing to this segment’s rapid growth.

- By End-Users

On the basis of end-users, the allergy vaccine market is categorized into clinics, hospitals, and others. The hospital segment led the market in 2024 with the largest revenue share due to comprehensive allergy diagnostic capabilities, access to emergency care for anaphylaxis, and availability of specialized allergists. Hospitals are often the first point of care for severe allergy patients, facilitating early diagnosis and initiation of immunotherapy.

The clinic segment is expected to witness the highest growth rate from 2025 to 2032, fueled by increasing outpatient visits, convenience of scheduled immunotherapy sessions, and expansion of allergy treatment services in primary care settings. Specialty allergy clinics, particularly in North America and Europe, are seeing rising demand due to shorter wait times and personalized treatment plans.

- By Distribution Channel

On the basis of distribution channel, the allergy vaccine market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2024, driven by controlled vaccine storage environments, physician-led immunotherapy distribution, and coordination with inpatient services.

The online pharmacy segment is anticipated to witness the fastest CAGR from 2025 to 2032, propelled by the increasing digitization of healthcare, convenience of home delivery, and rising consumer preference for online consultations. The growth of direct-to-consumer allergy treatments and e-prescription services is expanding access to allergy immunotherapy products, especially in developed markets.

Allergy Vaccine Market Regional Analysis

- North America dominated the allergy vaccine market with the largest revenue share of 41.7% in 2024, supported by a high burden of allergic diseases, increasing adoption of advanced immunotherapies, and strong healthcare expenditure

- Consumers in the region increasingly seek sustainable allergy management solutions that reduce reliance on daily medications, with subcutaneous and sublingual immunotherapy gaining widespread acceptance among both patients and healthcare providers

- This rising demand is further supported by advanced diagnostic capabilities, favorable reimbursement policies, and the presence of leading pharmaceutical players, positioning allergy vaccines as a core component of allergy care across both pediatric and adult populations

U.S. Allergy Vaccine Market Insight

The U.S. allergy vaccine market captured the largest revenue share of 78% in 2024 within North America, fueled by the high prevalence of allergic conditions such as asthma and allergic rhinitis. The growing preference for long-term immunotherapy over symptom-based treatments, alongside widespread access to specialized allergy clinics, continues to propel market expansion. Increasing awareness, coupled with favorable insurance coverage and strong R&D investments by domestic pharmaceutical companies, reinforces the adoption of SCIT and SLIT across diverse patient demographics.

Europe Allergy Vaccine Market Insight

The Europe allergy vaccine market is projected to grow at a significant CAGR over the forecast period, supported by rising allergy rates, structured immunotherapy guidelines, and widespread public health initiatives. Countries across the region are increasingly adopting evidence-based allergy management strategies, with SLIT gaining strong traction due to its safety and convenience. Government-funded healthcare systems, especially in Western Europe, are enabling broader access to immunotherapy, while advancements in recombinant allergens and adjuvant technologies continue to drive innovation.

U.K. Allergy Vaccine Market Insight

The U.K. allergy vaccine market is expected to grow steadily, driven by the increasing prevalence of seasonal allergies, particularly among children and young adults. The National Health Service (NHS) supports immunotherapy for moderate to severe allergic rhinitis and asthma cases, which aids market penetration. Ongoing efforts to improve allergy diagnosis and treatment, including public campaigns and specialist training, are further contributing to the demand for allergen vaccines in both urban and rural settings.

Germany Allergy Vaccine Market Insight

The Germany allergy vaccine market is poised for strong growth, backed by the country’s advanced healthcare infrastructure and a high number of certified allergists. Germany is a leading market for immunotherapy in Europe, with subcutaneous and sublingual treatments widely prescribed for respiratory and environmental allergies. Continued government support for allergy prevention and the inclusion of allergen vaccines in long-term care plans underscore Germany’s commitment to managing allergic diseases effectively.

Asia-Pacific Allergy Vaccine Market Insight

The Asia-Pacific allergy vaccine market is anticipated to expand at the fastest CAGR of 9.6% during the forecast period of 2025 to 2032, driven by rising pollution levels, growing urban populations, and increasing healthcare awareness. Countries such as China, Japan, and India are witnessing a notable surge in allergic conditions, prompting increased demand for early diagnosis and long-term treatment options. Government initiatives promoting allergy education and improved access to immunotherapy are facilitating broader market development in this region.

Japan Allergy Vaccine Market Insight

The Japan allergy vaccine market is growing steadily, supported by the country’s strong focus on preventive healthcare and widespread use of diagnostic allergy testing. With a high incidence of cedar pollen allergy and urban asthma, Japan has prioritized immunotherapy as part of its allergy management approach. Pharmaceutical companies are investing in advanced SLIT formulations tailored to local allergen profiles, and adoption is further encouraged by Japan’s digitally advanced, elder-friendly healthcare systems.

India Allergy Vaccine Market Insight

The India allergy vaccine market accounted for the largest revenue share in Asia Pacific in 2024, attributed to the increasing incidence of allergic disorders due to urban air pollution and changing lifestyles. The expanding middle class and improved healthcare access are boosting awareness and uptake of allergen immunotherapy, particularly in urban centers. Government initiatives to promote allergy care and the presence of domestic vaccine manufacturers are accelerating market growth, especially in the subcutaneous segment offered through outpatient clinics.

Allergy Vaccine Market Share

The allergy vaccine industry is primarily led by well-established companies, including:

- ALK-Abelló A/S (Denmark)

- Stallergenes Greer Ltd. (Switzerland)

- HAL Allergy B.V. (Netherlands)

- Allergy Therapeutics plc (U.K.)

- DBV Technologies S.A. (France)

- LETIFARM S.L. (Spain)

- Biomay AG (Austria)

- Circassia Group plc (U.K.)

- CSL Limited (Australia)

- Adamis Pharmaceuticals Corporation (U.S.)

- Intrommune Therapeutics, Inc. (U.S.)

- Immunomic Therapeutics, Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Anergis SA (Switzerland)

- Virometix AG (Switzerland)

- Sanofi (France)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- CuraVac GmbH (Germany)

- Laboratorios LETI, S.L.U. (Spain)

What are the Recent Developments in Global Allergy Vaccine Market?

- In April 2023, Stallergenes Greer, a global biopharmaceutical company specializing in allergen immunotherapy, announced the expansion of its sublingual immunotherapy (SLIT) tablet portfolio with the launch of a new birch pollen tablet in select European markets. This development aims to address the growing prevalence of tree pollen allergies and reinforces the company’s commitment to offering patient-friendly, evidence-based treatments tailored to regional allergen sensitivities. The new launch strengthens Stallergenes Greer's leadership in personalized allergy immunotherapy

- In March 2023, HAL Allergy Group, a leading European developer of allergen products, initiated a Phase III clinical trial to evaluate the efficacy and safety of its house dust mite subcutaneous immunotherapy (SCIT) candidate in pediatric populations. This trial marks a key step in expanding treatment options for children suffering from chronic respiratory allergies and reflects HAL's strategic focus on delivering long-term, disease-modifying therapies to underserved age groups

- In February 2023, ALK-Abelló A/S, a global leader in allergy immunotherapy, received regulatory approval in Japan for its SLIT tablet targeting Japanese cedar pollen allergy. This milestone aligns with ALK’s expansion strategy in Asia and responds to the country’s high prevalence of cedar pollen allergies. The product’s approval provides Japanese patients with a convenient, at-home treatment alternative during peak allergy seasons, underlining ALK’s focus on global accessibility and tailored solutions

- In January 2023, Anergis SA, a clinical-stage biopharmaceutical company based in Switzerland, announced a strategic R&D collaboration with Virometix AG to advance ultra-fast allergy immunotherapy candidates. The partnership focuses on leveraging virus-such as particle (VLP) technology to deliver short-course allergy vaccines with long-term efficacy. This initiative showcases a growing trend toward innovative platforms that reduce treatment duration while maintaining strong immune tolerance

- In January 2023, Allergy Therapeutics plc, a U.K.-based specialty pharmaceutical company, commenced a Phase I trial for its virus-such as particle-based peanut allergy vaccine candidate. This first-in-human trial represents a significant advancement in food allergy immunotherapy and signals the company’s efforts to diversify beyond respiratory allergies. The program highlights an industry-wide push toward addressing complex and life-threatening allergies with next-generation vaccine technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.