Global Almond Protein Market

Market Size in USD Billion

CAGR :

%

USD

4.63 Billion

USD

7.27 Billion

2024

2032

USD

4.63 Billion

USD

7.27 Billion

2024

2032

| 2025 –2032 | |

| USD 4.63 Billion | |

| USD 7.27 Billion | |

|

|

|

|

Almond Protein Market Size

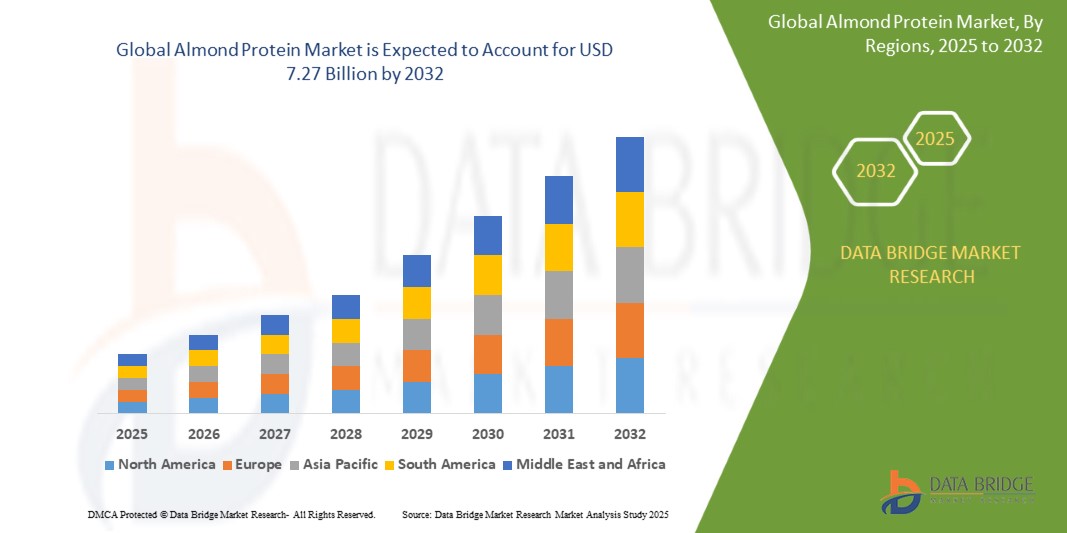

- The global Almond Protein market size was valued at USD 4.63 billion in 2024 and is expected to reach USD 7.27 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the rising demand for plant-based and allergen-free protein alternatives, driven by increasing vegan and flexitarian populations, health-conscious consumer behavior, and growing awareness about nutritional benefits of almonds

- Growing incorporation of almond protein in clean-label food and beverage products, coupled with innovation in almond-based protein formulations, is further accelerating global market expansion

Almond Protein Market Analysis

- Almond protein is increasingly being used as a key ingredient in food and beverage formulations such as protein bars, meal replacements, and dairy alternatives due to its clean label appeal, digestibility, and favorable amino acid profile

- Manufacturers are expanding their product lines to cater to demand in sports nutrition, infant formula, and functional foods, supported by technological advancements in almond processing and protein extraction

- North America dominated the almond protein market with the largest revenue share of 38% in 2024, driven by a strong emphasis on health and wellness, growing consumer shift toward plant-based diets, and robust almond production infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global Almond Protein market, driven by growing lactose intolerance among consumers, government support for sustainable food systems, and expanding demand for dairy alternatives and clean-label ingredients in emerging economies such as China, India, and Indonesia

- The conventional segment dominated the market with the largest market revenue share of 69.4% in 2024, driven by its widespread availability, lower production costs, and consistent supply chain integration with food manufacturers. Most large-scale food and beverage companies opt for conventional almond protein due to its cost-efficiency and suitability for mass production. The stability and scalability of conventional almond protein products continue to support their use across diverse application segments including nutrition bars, beverages, and bakery goods

Report Scope and Almond Protein Market Segmentation

|

Attributes |

Almond Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Almond Protein Market Trends

“Growing Use of Almond Protein in Dairy Alternatives”

- Rising incidences of lactose intolerance, dairy allergies, and a shift toward vegan diets are boosting demand for almond protein in dairy alternatives such as almond milk, yogurt, cheese, and ice cream. Consumers are increasingly turning to these plant-based products for both health and ethical reasons.

- Almond protein delivers a smooth, creamy texture and has a mild, neutral flavor, making it ideal for replicating the mouthfeel of traditional dairy products without compromising on taste. Its versatility enhances the overall sensory appeal of plant-based offerings.

- Health-conscious consumers actively seek dairy-free alternatives that contain simple, recognizable ingredients with functional health benefits. Almond protein offers a clean-label solution with plant-based nutrition that aligns with modern dietary preferences.

- Food and beverage companies are expanding their product lines with almond protein-based dairy alternatives to meet evolving consumer expectations and tap into the rapidly growing plant-based segment. Innovation in formulation is becoming a key competitive advantage.

- For instance, Califia Farms launched almond-based protein milk that delivers 8g of plant protein per serving. This product caters to consumers looking for a balance between nutritional value, clean ingredients, and the familiar taste of dairy-like beverages.

Almond Protein Market Dynamics

Driver

“Surge in Demand for Plant-Based and Allergen-Friendly Proteins”

- The global adoption of vegan, vegetarian, and flexitarian diets is accelerating, creating strong demand for plant-based proteins such as almond protein. Consumers are re-evaluating their food choices with a focus on sustainability and health.

- Almond protein is naturally free from top allergens such as soy, gluten, and lactose, making it suitable for individuals with food sensitivities. This allergen-friendly profile boosts its appeal across a wide consumer base seeking safer dietary options.

- Environmental concerns about the carbon footprint and water usage of animal protein are pushing demand toward more sustainable, plant-derived alternatives. Almond protein is considered a more eco-conscious choice when compared to traditional dairy.

- In addition to protein, almonds offer healthy fats, dietary fiber, and essential micronutrients, making almond protein a functional ingredient that supports wellness trends. It is especially favored among clean-label and health-driven product formulations.

- For instance, Orgain has introduced clean-label protein shakes using almond protein to cater to allergen-sensitive, vegan, and environmentally aware consumers who seek convenient yet nutritious meal replacements.

Restraint/Challenge

“High Production Cost and Limited Protein Content in Almonds”

- Almonds contain a lower protein concentration compared to soy or pea, requiring larger quantities to match protein levels. This increases the raw material input and overall cost of almond protein-based products.

- Extracting protein from almonds is a complex, multi-stage process involving mechanical and chemical steps, which results in higher operational expenses and lower production efficiency.

- The elevated processing and ingredient costs translate into premium product pricing, which limits affordability and slows adoption in price-sensitive regions or mainstream consumer segments.

- Almond farming is highly dependent on specific climate conditions, especially adequate water supply. Volatility in weather patterns can impact yield, affecting both supply consistency and market prices.

- For instance, severe drought conditions in California—where most of the world’s almonds are grown—have disrupted harvests and tightened supply, leading to increased production costs for almond-based protein manufacturers.

Almond Protein Market Scope

The market is segmented on the basis of nature, application, and distribution channel.

• By Nature

On the basis of nature, the almond protein market is segmented into organic and conventional. The conventional segment dominated the market with the largest market revenue share of 69.4% in 2024, driven by its widespread availability, lower production costs, and consistent supply chain integration with food manufacturers. Most large-scale food and beverage companies opt for conventional almond protein due to its cost-efficiency and suitability for mass production. The stability and scalability of conventional almond protein products continue to support their use across diverse application segments including nutrition bars, beverages, and bakery goods.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing global demand for clean-label, non-GMO, and pesticide-free products. Health-conscious consumers increasingly prefer organic almond protein for its perceived health benefits and environmental sustainability. Its use in premium product lines and personal care formulations is also contributing to this segment's rapid growth.

• By Application

On the basis of application, the almond protein market is segmented into bakery and confectionery, beverages, and personal care. The bakery and confectionery segment held the largest market revenue share in 2024, driven by the rising incorporation of almond protein in cookies, protein bars, cakes, and energy bites. The ingredient is valued for its mild flavor, gluten-free profile, and ability to enhance both texture and nutrition in baked goods.

The beverages segment is expected to witness the fastest growth rate from 2025 to 2032, due to increased demand for plant-based protein drinks, smoothies, and shakes. Almond protein blends easily with other ingredients and supports clean-label claims, making it ideal for health beverages and meal replacements. Its growing use in ready-to-drink (RTD) products is particularly significant in North America and Europe.

• By Distribution Channel

On the basis of distribution channel, the almond protein market is segmented into online, supermarkets, and convenience stores. The supermarkets segment held the largest market share in 2024, owing to a wide range of product availability, in-store promotions, and easy access to trusted brands. Supermarkets continue to be a preferred choice for consumers seeking health and wellness food products under one roof.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing digitalization, direct-to-consumer brand launches, and a preference for home delivery of specialty nutrition products. E-commerce platforms allow greater visibility of clean-label and niche protein offerings, particularly organic and allergen-friendly options, expanding access for a broader consumer base.

Almond Protein Market Regional Analysis

- North America dominated the almond protein market with the largest revenue share of 38% in 2024, driven by a strong emphasis on health and wellness, growing consumer shift toward plant-based diets, and robust almond production infrastructure

- Consumers in the region highly prefer almond protein for its clean-label properties, mild taste, and suitability in gluten-free, dairy-free, and vegan formulations across beverages, bakery items, and supplements

- This widespread adoption is further supported by rising fitness trends, increasing demand for sustainable protein sources, and continuous product innovation, establishing almond protein as a premium plant-based ingredient in both food and personal care industries

U.S. Almond Protein Market Insight

The U.S. almond protein market captured the largest revenue share of 83.5% in 2024 within North America, fuelled by its leading position in almond production and high demand for natural protein supplements. Consumers are increasingly choosing almond protein for use in protein bars, RTD shakes, and clean-label baking mixes. The country's strong focus on allergen-free and functional foods, combined with a rapidly expanding vegan consumer base, continues to propel market growth. In addition, the presence of major plant-based brands and investments in food-tech innovation further strengthen the market in the U.S.

Europe Almond Protein Market Insight

The Europe almond protein market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing consumer awareness about sustainable nutrition and the rising demand for dairy-free, organic products. Countries such as Germany, France, and the U.K. are at the forefront of adopting almond protein in bakery, confectionery, and personal care formulations. The region also benefits from favorable regulatory support for clean-label ingredients and an increasing number of ethical and flexitarian consumers seeking environmentally conscious protein alternatives.

Germany Almond Protein Market Insight

The Germany almond protein market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's strong focus on organic nutrition and environmentally responsible food sourcing. Germany’s health-conscious population is driving demand for protein-rich plant-based options, especially within functional foods and non-dairy beverages. Local manufacturers are also incorporating almond protein into premium skincare products, benefiting from its natural emollient and nourishing qualities. The market is further strengthened by widespread distribution through bio stores, pharmacies, and online wellness platforms.

U.K. Almond Protein Market Insight

The U.K. almond protein market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for vegan, dairy-free, and clean-label products. Almond protein is gaining popularity in bakery items, plant-based beverages, and sports nutrition supplements, supported by the country's strong retail presence of health and organic food brands. The U.K.’s growing flexitarian population, combined with rising awareness around sustainability and animal welfare, continues to propel demand for plant-based protein sources. Moreover, the expansion of e-commerce and private-label innovations in almond-based functional foods is further strengthening market growth across the region.

Asia-Pacific Almond Protein Market Insight

The Asia-Pacific almond protein market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of plant-based nutrition, rising disposable incomes, and growing prevalence of lactose intolerance in countries such as India, China, and Australia. Government support for sustainable agriculture and domestic almond processing is encouraging regional growth. Consumers are increasingly incorporating almond protein into health drinks, breakfast cereals, and wellness products. The region’s expanding vegan demographic and strong growth in functional food consumption are expected to further boost demand.

Japan Almond Protein Market Insight

The Japan almond protein market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's aging population, rising interest in plant-based nutrition, and demand for high-quality protein supplements. Almond protein is increasingly used in health foods, nutraceuticals, and premium skincare products due to its hypoallergenic and antioxidant-rich profile. Japanese consumers value clean-label ingredients, and almond protein fits well with the market’s preference for minimally processed, functional formulations. In addition, the strong presence of convenience health foods and innovations in plant-based beverages support continued market adoption in both retail and personal care sectors.

China Almond Protein Market Insight

The China almond protein market is witnessing strong growth, supported by rapid urbanization, increasing consumer awareness of plant-based diets, and the rising popularity of functional foods. Almond protein is gaining traction in dairy alternative products, protein-enriched snacks, and infant nutrition due to its digestibility and high nutrient density. The Chinese government’s initiatives to promote food innovation and sustainability are also encouraging local manufacturers to invest in almond protein-based offerings. With a growing middle-class population and demand for premium health products, China is emerging as a key market for almond protein in both food and beauty segments.

Almond Protein Market Share

The Almond Protein industry is primarily led by well-established companies, including:

- InovoBiologic Inc. (Canada)

- Celtic Sea Minerals (Ireland)

- Marigot Ltd. (U.K.)

- Maxicrop USA (U.S.)

- BioFlora, LLC (U.S.)

- Alesco S.r.l. (Italy)

- Humates And Seaweeds Pvt Ltd (India)

- HMHS Solutions Limited (U.K.)

- Sar Agrochemicals & Fertilizers Pvt. Ltd. (India)

- Noosh, Inc. (U.S.)

- BASF SE (Germany)

- BLUE DIAMOND GLOBAL INGREDIENTS DIVISION (U.S.)

Latest Developments in Global Almond Protein Market

- In January 2020, Blue Diamond Growers, a grower-owned cooperative and the leading processor and marketer of California almonds introduced its first major product of the year: Blue Diamond Almond Protein Powder. Available exclusively on Amazon, this new offering highlights Blue Diamond's latest innovation, featuring protein powder made from 100% pure almond protein sourced from premium California almonds

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Almond Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Almond Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Almond Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.