Global Aluminum Nitride Ceramics Market

Market Size in USD Million

CAGR :

%

USD

455.60 Million

USD

678.28 Million

2024

2032

USD

455.60 Million

USD

678.28 Million

2024

2032

| 2025 –2032 | |

| USD 455.60 Million | |

| USD 678.28 Million | |

|

|

|

|

Aluminum Nitride Ceramics Market Size

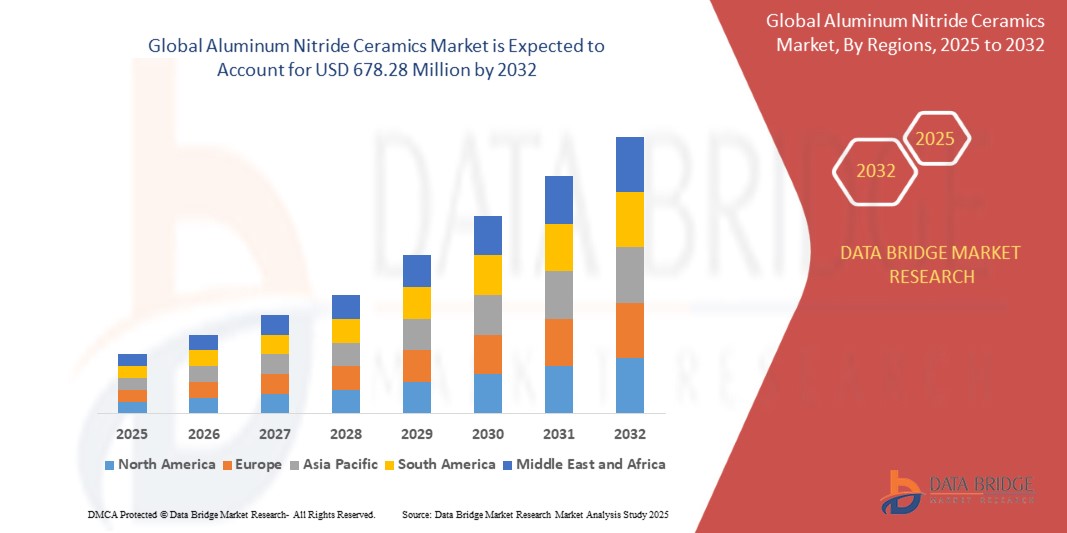

- The global aluminum nitride ceramics market size was valued at USD 455.60 million in 2024 and is expected to reach USD 678.28 million by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance materials in electronics, automotive, and aerospace sectors, due to aluminum nitride's exceptional thermal conductivity and electrical insulation properties

- Rising investments in semiconductor manufacturing, along with the trend toward miniaturization of electronic devices, are further accelerating the adoption of aluminum nitride ceramics in thermal management applications

Aluminum Nitride Ceramics Market Analysis

- The aluminum nitride ceramics market is gaining significant traction due to its superior characteristics compared to conventional ceramics, particularly in high-temperature and high-frequency applications. With the proliferation of 5G infrastructure, electric vehicles, and renewable energy systems, aluminum nitride ceramics are increasingly utilized in substrates, heat sinks, and circuit boards

- Moreover, the rising demand for environmentally friendly and reliable materials in industrial processing equipment and LEDs is expected to further drive market expansion. Manufacturers are focusing on product innovations, enhancing material purity, and forming strategic partnerships with end-use industries to strengthen their competitive position in the global market

- North America dominated the aluminum nitride ceramics market with the largest revenue share in 2024, driven by the rising demand for high-performance thermal interface materials, increased investments in semiconductor manufacturing, and growing adoption in aerospace and defense sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global aluminum nitride ceramics market, driven by large-scale production facilities, booming electronics and automotive industries, and growing demand for high thermal conductivity materials in countries such as China, Japan, and South Korea

- The technical grade segment held the largest market revenue share in 2024, attributed to its wide usage in thermal management solutions across electronic and electrical components. This grade is preferred in applications requiring high thermal conductivity and electrical insulation, such as substrates for power semiconductors and heat sinks. The cost-effectiveness and compatibility of technical grade aluminum nitride with mass manufacturing also make it a favorable option for original equipment manufacturers

Report Scope and Aluminum Nitride Ceramics Market Segmentation

|

Attributes |

Aluminum Nitride Ceramics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of High-Performance Ceramics in 5G and Power Electronics • Increasing Demand for Lightweight and Thermally Conductive Materials in Electric Vehicles |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aluminum Nitride Ceramics Market Trends

“Increasing Integration of Aluminum Nitride in Power Semiconductor Modules”

- The growing reliance on aluminum nitride in power electronics is driven by its high thermal conductivity, which surpasses 170 W/m·K, making it ideal for dissipating heat in densely packed electronic systems especially in electric vehicles and renewable energy infrastructure where thermal performance is critical for reliability and longevity

- The need for miniaturized, high-efficiency power modules is propelling manufacturers to shift from alumina to aluminum nitride substrates due to the latter’s better heat resistance and low dielectric loss which strengthens AlN’s position in high-voltage and high-frequency applications

- For instance, Mitsubishi Electric has incorporated AlN substrates into advanced IGBT modules enhancing heat dissipation and improving the lifespan of devices in electric mobility applications helping maintain performance under demanding conditions

- Aluminum nitride’s role in radio frequency (RF) modules and 5G telecommunications is expanding as its properties help maintain stable signal transmission and prevent overheating in compact base station designs supporting accelerated global 5G deployment

- Semiconductor companies such as Infineon Technologies have started using AlN ceramics in their GaN and SiC-based power devices benefiting from aluminum nitride’s superior thermal insulation and enabling safe operation in high-power, high-speed switching environments

Aluminum Nitride Ceramics Market Dynamics

Driver

“Rising Demand from Advanced Electronics and Power Devices”

- The surge in demand for aluminum nitride ceramics is largely fueled by the growing adoption of power electronics in electric vehicles renewable energy and smart devices which require materials that can withstand high temperatures and voltages while providing electrical insulation

- Its ability to manage heat in compact designs makes it essential for the miniaturization of electronic components used in telecommunications automotive electronics and high-performance computing where AlN prevents thermal damage in tightly packed circuits

- The expansion of 5G and wireless communication technologies is increasing the use of aluminum nitride substrates in RF modules and antenna systems as its thermal stability supports uninterrupted high-frequency transmission and reliable network performance

- The aerospace and defense sectors are adopting aluminum nitride ceramics in radar systems power modules and thermal shielding due to its robustness lightweight properties and resistance to thermal shock making it valuable in mission-critical environments

- For instance, Rogers Corporation has developed aluminum nitride-based circuit substrates for advanced radar and satellite communication systems enhancing operational efficiency while reducing the thermal load and component failure risks

Restraint/Challenge

“High Production Costs and Complex Manufacturing Processes”

- The manufacturing of aluminum nitride ceramics requires high-purity raw materials and precise sintering techniques which result in elevated production costs limiting its adoption in price-sensitive applications and among small-scale manufacturers

- Aluminum nitride is highly susceptible to hydrolysis necessitating specialized packaging and handling environments that increase logistical complexity and raise the total cost of ownership while reducing shelf life

- The lack of large-scale manufacturing capabilities in developing regions limits the global availability of aluminum nitride components leading to dependence on imports and extended lead times which hampers regional scalability

- More affordable alternatives such as alumina or boron nitride continue to dominate many applications where extreme thermal performance is not essential making it difficult for aluminum nitride to penetrate broader markets

- For instance, many LED and microchip packaging companies in consumer electronics still prefer alumina substrates due to their lower costs despite aluminum nitride offering better thermal conductivity and performance

Aluminum Nitride Ceramics Market Scope

The market is segmented on the basis of grade, method, form, and application.

• By Grade

On the basis of grade, the aluminum nitride ceramics market is segmented into technical grade and analytical grade. The technical grade segment held the largest market revenue share in 2024, attributed to its wide usage in thermal management solutions across electronic and electrical components. This grade is preferred in applications requiring high thermal conductivity and electrical insulation, such as substrates for power semiconductors and heat sinks. The cost-effectiveness and compatibility of technical grade aluminum nitride with mass manufacturing also make it a favorable option for original equipment manufacturers.

The analytical grade segment is expected to witness the fastest growth from 2025 to 2032, driven by rising adoption in advanced research and high-precision electronics. Analytical grade aluminum nitride offers ultra-high purity, making it essential in laboratory applications, aerospace systems, and optoelectronic devices. As technology advances and the demand for accuracy and performance rises, this segment is gaining momentum among premium material suppliers and specialty product developers.

• By Method

On the basis of method, the aluminum nitride ceramics market is segmented into carbothermal reduction method, direct nitridation method, and nitridation method. The carbothermal reduction method accounted for the largest revenue share in 2024 due to its efficiency in producing high-purity aluminum nitride with excellent thermal conductivity. This method is widely adopted by manufacturers to create substrates for power electronics and LED packages, particularly in high-volume production settings.

The direct nitridation method is expected to witness the fastest growth from 2025 to 2032, owing to its lower cost structure and environmentally favorable reaction process. The technique involves a simpler synthesis pathway and is gaining preference in developing economies where cost-sensitive, scalable manufacturing is crucial for market expansion.

• By Form

On the basis of form, the aluminum nitride ceramics market is segmented into powder, granules, and sheet. The powder segment dominated the market with the largest revenue share in 2024, supported by its broad usage in manufacturing thermal interface materials, composites, and ceramic substrates. Its fine particle structure makes it suitable for precision formulations in electronic components and advanced coating applications.

The sheet segment is expected to witness the fastest growth from 2025 to 2032, propelled by increasing applications in printed circuit boards and insulation layers in power electronic devices. Sheets offer structural flexibility and uniform thermal performance, making them ideal for integration into miniaturized and multilayer electronic architectures.

• By Application

On the basis of application, the aluminum nitride ceramics market is segmented into micro electronics, naval radio, power electronics, aeronautical system, automotive, emission control, and others. The power electronics segment led the market in 2024, driven by the surging demand for energy-efficient devices across electric vehicles, industrial drives, and renewable energy systems. Aluminum nitride is extensively used as a substrate material in these devices due to its exceptional thermal conductivity and dielectric properties.

The automotive segment is expected to witness the fastest growth from 2025 to 2032, with increasing integration of aluminum nitride in electric vehicle battery systems and sensor modules. Its role in managing heat and improving system reliability is gaining traction among automotive OEMs aiming to enhance performance and reduce failure rates in next-generation vehicles.

Aluminum Nitride Ceramics Market Regional Analysis

- North America dominated the aluminum nitride ceramics market with the largest revenue share in 2024, driven by the rising demand for high-performance thermal interface materials, increased investments in semiconductor manufacturing, and growing adoption in aerospace and defense sectors

- The region benefits from a strong innovation ecosystem, favorable government policies promoting domestic chip production, and a well-established base of advanced material manufacturers and defense contractors

- The growing shift toward electric vehicles, renewable energy systems, and 5G infrastructure in North America continues to fuel the need for materials such as aluminum nitride that offer superior thermal conductivity and dielectric properties

U.S. Aluminum Nitride Ceramics Market Insight

The U.S. aluminum nitride ceramics market captured the largest share in North America in 2024, supported by increased emphasis on strategic autonomy in semiconductor production and rising adoption in defense, communication, and energy applications. Companies across aerospace, automotive, and electronics industries are turning to aluminum nitride ceramics to enhance system efficiency, heat dissipation, and durability under extreme conditions. Government initiatives such as the CHIPS Act are further strengthening domestic manufacturing capabilities, making the U.S. a central hub for innovation and deployment of high-performance ceramics.

Europe Aluminum Nitride Ceramics Market Insight

The Europe aluminum nitride ceramics market is expected to witness the fastest growth from 2025 to 2032, fuelled by increasing investments in electric mobility, energy efficiency, and smart manufacturing. European industries are adopting aluminum nitride ceramics for use in high-voltage applications, power modules, and automotive electronics. Countries such as Germany and France are leading the charge with R&D in green technologies, and the region's strong focus on sustainability and industrial innovation is expected to drive continued adoption of high-thermal-conductivity materials.

Germany Aluminum Nitride Ceramics Market Insight

The Germany aluminum nitride ceramics market is expected to witness the fastest growth from 2025 to 2032, driven by the country’s leadership in automotive engineering and industrial automation. German manufacturers are increasingly using aluminum nitride in electric vehicle components, power electronics, and renewable energy systems for its superior heat resistance and insulation performance. With strong government support for technological innovation and environmental standards, Germany remains a key player in Europe’s transition toward advanced and sustainable materials.

U.K. Aluminum Nitride Ceramics Market Insight

The U.K. aluminum nitride ceramics market is expected to witness the fastest growth from 2025 to 2032, supported by investments in high‑performance electronics, aerospace technologies, and power management systems. British manufacturers and research institutions utilize aluminum nitride for its excellent thermal conductivity and electrical insulation in applications such as RF modules, power semiconductors, and LED systems. Increasing adoption of renewable energy systems and electrified transportation continues to drive demand, while government-backed initiatives focused on advanced materials and semiconductor innovation further enhance market momentum.

Asia-Pacific Aluminum Nitride Ceramics Market Insight

The Asia-Pacific aluminum nitride ceramics market is expected to witness the fastest growth from 2025 to 2032, attributed to the rising demand in electronics manufacturing hubs such as China, Japan, South Korea, and Taiwan. The region’s dominance in semiconductor fabrication, combined with favorable government policies and growing investments in 5G and electric vehicles, is accelerating the adoption of aluminum nitride ceramics. Furthermore, the availability of cost-effective raw materials and advanced production capabilities is expanding accessibility and competitiveness in the global market.

China Aluminum Nitride Ceramics Market Insight

The China aluminum nitride ceramics market is experiencing robust expansion, supported by national initiatives to boost domestic semiconductor capabilities and the rapid growth of the electric vehicle and consumer electronics industries. As the country strengthens its high-tech manufacturing infrastructure, aluminum nitride ceramics are increasingly being used in power devices, thermal management modules, and wireless communication components. China’s growing influence in the global electronics supply chain and its strong base of material suppliers are key factors driving its market growth.

Japan Aluminum Nitride Ceramics Market Insight

Japan is expected to witness the fastest growth from 2025 to 2032, backed by its leadership in microelectronics, LED production, and material science. Japanese manufacturers are leveraging the unique thermal and insulating properties of aluminum nitride for compact and high-efficiency electronic components. The nation’s focus on miniaturization, quality, and technological advancement is fostering the use of advanced ceramics in critical applications, including aerospace systems, electric vehicles, and power modules.

Aluminum Nitride Ceramics Market Share

The Aluminum Nitride Ceramics industry is primarily led by well-established companies, including:

- 3M (U.S.)

- CeramTec GmbH (Germany)

- CoorsTek Inc. (U.S.)

- FURUKAWA CO.,LTD (Japan)

- KYOCERA Corporation (Japan)

- MARUWA Co., Ltd. (Japan)

- Nishimura & Asahi (Japan)

- Precision Ceramics (U.K.)

- Surmet Corporation (U.S.)

- Tokuyama Corporation (Japan)

- Toyal Toyo Aluminium KK (Japan)

- Liaoning Desunmet Special Ceramic Manufacture Co. Ltd (China)

- The American Ceramic Society (U.S.)

- Thrutek Applied Materials (Taiwan)

- LEATEC Fine Ceramics Co., Ltd. (Taiwan)

- NIKKO CERAMICS, INC. (Japan)

- Yokowo Co., Ltd. (Japan)

- Ferrotec (USA) Corporation (U.S.)

- NIPPON CARBIDE INDUSTRIES CO., INC. (Japan)

- KCC CORPORATION (South Korea)

- Heraeus Holding (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aluminum Nitride Ceramics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aluminum Nitride Ceramics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aluminum Nitride Ceramics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.