Global Amines Market

Market Size in USD Million

CAGR :

%

USD

19,578.15 Million

USD

26,794.05 Million

2022

2030

USD

19,578.15 Million

USD

26,794.05 Million

2022

2030

| 2023 –2030 | |

| USD 19,578.15 Million | |

| USD 26,794.05 Million | |

|

|

|

|

Amines Market Analysis and Size

Amines are key essentials for human life because they are important for building amino acids. These amino acids are building blocks of proteins in living organisms. Amines also help in the synthesis of numerous dopamine, histamine, serotonin, vitamins, epinephrine, and norepinephrine, among others. The increasing prevalence of chronic medical conditions is promoting the usage of the amines for the development of medication process and novel drugs. As a result, the need for amines in the pharmaceutical market is considerably increasing which is expected to enhance the market growth.

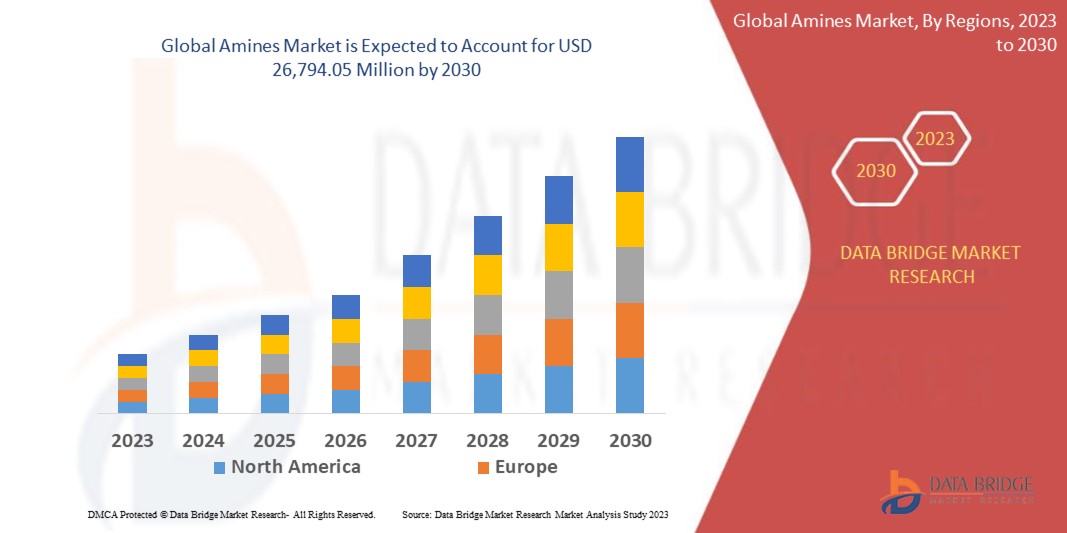

Data Bridge Market Research analyses that the amines market is expected to reach USD 26,794.05 million by 2030, which was USD 19,578.15 million in 2022, registering a CAGR of 4.00% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Amines Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 - 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Ethanolamine, Alkylamines, Fatty Amines, Ethylene Amine, Amino Methyl Propanol (AMP), Specialty Amines, Ethanol Amines), Application (Agricultural Chemicals, Cleaning Products, Gas Treatment, Personal Care Products, Petroleum, Water Treatment, Others), Function (Solvent, Chelating Agent, Corrosion Inhibitor, Bleach Activators, Surfactants), |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Alkyl Amines Chemicals Limited (India), Kao Corporation (Japan), Albemarle Corporation (U.S.), Evonik Industries AG (Germany), BASF SE (Germany), Eastman Chemical Company (U.S.), Huntsman International LLC (U.S.), Solvay (Belgium), DuPont (U.S.), BALAJI AMINES (India), Indo Amines Limited (India), NOF CORPORATION (Japan), Celanese Corporation (U.S.), INEOS (U.K.), SABIC (Saudi Arabia), Air Products and Chemicals, Inc. (U.S.), Nouryon (Netherland), Global Amines Company Pte. Ltd. (Singapore) |

|

Market Opportunities |

|

Market Definition

Amines are organic compounds that contains nitrogen atoms with a lone pair. These are derivatives of ammonia which have one or more than one hydrogen atom substituted by either aryl or alkyl group. Amines have an irreplaceable position in human life because they are used in several personal care products, wastewater treatment, crop protection chemicals, gas treatment, pharmaceuticals, paints and coating, dyes, solvents, and many others.

Global Amines Market Dynamics

Drivers

- Increasing demand for liquid detergent

The growing demand for liquid detergent is expected to drive the growth of the amines market during the forecast period. The demand for liquid detergent is growing rapidly because of the rising usage of washing machines and dishwashers in urban areas, changes in consumer lifestyle and improvement in living standards. Consumers are highly adopting liquid detergent due to its ability to break down stains in fabrics. Therefore, the increasing demand for liquid detergent will increase the market growth.

- Growing usage of triethanolamine in personal care and cosmetics products

Growing demand for moisturizers and creams because of increasing consumer disposable income and awareness regarding personal care is expected to boost the market growth. For instance, triethanolamine which is an ammonia compound used as a foaming agent or emulsifier in personal care and cosmetics products. Thus, the increasing usage of triethanolamine in personal care and cosmetics products is anticipated to drive the growth of the amines market.

Opportunities

- Surging development by market players to increase product line

The surging development and other innovations by market players further offer numerous opportunities for the market growth. For instance, in October 2019, Nouryon constructed a demonstration facility in Stenungsund, Sweden to showcase a cutting-edge and more eco-friendly technological platform for synthesis of ethylene amines and their derivatives. This technique based on ethylene oxide allows the selective manufacturing of various end products. This is enabling Nouryon to increase the portfolio of its product line.

- Increasing development in wastewater treatment activities

The development of wastewater treatment plants in both developed and developing regions will create immense opportunities for market growth because amines improve water quality and act as corrosion inhibitors. The South African government contributed around USD 24 million to construct numerous wastewater treatment plants in 2019. Therefore, development in the wastewater treatment activities all over the globe promotes the market growth.

Restraints/ Challenge

- Stringent government rules associated with amines

Stringent government rules and regulations regarding the overexposure of amines, mainly methylamines, will hamper the growth of the market during the forecast period. Methylamines are harmful for human skin and may cause major market growth limitations.

- Fluctuating price of raw materials

Fluctuations in the price of raw materials which are used for the production of amine such as ethyl alcohol, industrial gases and ammonia, may have a direct impact on the overall growth of the amine market growth during the forecast period of 2023 to 2030.

This amines market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the amines market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2021, BASF announced to increase in their production capacity for key specialty amines. With this announcement, BASF is able to produce more of its key tertiary amines and polyetheramines market under the LupragenTM and Baxxodur® brands. These assets will complement a global network of specialty amines production plants in North America including those at Ludwigshafen, Germany, and in Nanjing, China.

- In 2020, Huntsman Corporation, a US-based company that manufactures and markets chemical products, acquired Gabriel Performance Products for $250 million. This acquaition is likely to widen the offering of Huntsman in a specialty products portfolio that will further increase curing and toughening agents and other additives used in a wide range of coatings, composite, adhesive applications.

Global Amines Market Scope

The amines market is segmented on the basis of type, application, function and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Ethanolamine

- Monoethanolamine

- Diethanolamine

- Triethanolamine

- Methyl Diethanolamine

- Alkylamines

- Methyl Amine

- Ethyl Amine

- Propyl Amine

- Fatty Amines

- Ethylene Amine

- Ethylenediamines

- Diethylenetriamine

- Tetraethylenepentamine

- Aminoethylpiperazine (AEP)

- Piperazine

- Amino Methyl Propanol (AMP)

- Specialty Amines

- Ethanol Amines

Application

- Agricultural Chemicals

- Cleaning Products

- Gas Treatment

- Personal Care Products

- Petroleum

- Water Treatment

- Others

End-use

- Rubber

- Personal Care Products

- Cleaning Products

- Adhesives

- Paints and Resins

- Agro Chemicals

- Oil and Petrochemical

- Other

Amines Market Regional Analysis/Insights

The amines market is analyzed and market size insights and trends are provided by country, type, application, function and end-use as referenced above.

The countries covered in the amines market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is expected to dominate the amines market owing to the rapidly growing FMCG industry in emerging economies such as India and China. Furthermore, growing government intervention in providing safe drinking water in economies such as India, China and Indonesia will further boost the market growth.

North America is expected to be the fastest developing region during the forecast period of 2023-2030 because of the increasing demand for amines from nutraceuticals and animal feed industries in this region. Furthermore, the strong demand of amines from the pharmaceutical industry will further boost the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Amines Market Share Analysis

The amines market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to amines market.

Some of the major players operating in the amines market are:

- Alkyl Amines Chemicals Limited (India)

- Kao Corporation (Japan)

- Albemarle Corporation (U.S.)

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Eastman Chemical Company (U.S.)

- Huntsman International LLC (U.S.)

- Solvay (Belgium), DuPont (U.S.)

- Balaji Amines (India)

- Indo Amines Limited (India)

- NOF CORPORATION (Japan)

- Celanese Corporation (U.S.)

- INEOS (U.K.)

- SABIC (Saudi Arabia),

- Air Products and Chemicals, Inc.(U.S.)

- Nouryon (Netherland)

- Global Amines Company Pte. Ltd. (Singapore)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AMINES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AMINES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL AMINES MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 LOGISTIC COST SCENARIO

8.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL AMINES MARKET, BY TYPE, (2022-2031), (USD MILLION),(KILO TONS)

(ASP, VALUE AND VOLUME FOR EACH SEGMENT WILL BE PROVIDED)

10.1 OVERVIEW

10.2 ETHANOLAMINE

10.2.1 ETHANOLAMINE, BY TYPE

10.2.1.1. TRIETHANOLAMINE

10.2.1.2. DIETHANOLAMINE

10.2.1.3. MONOETHANOLAMINE

10.2.1.4. METHYL DIETHANOLAMINE

10.2.1.5. OTHERS

10.3 ALKYLAMINES

10.3.1 ALKYLAMINES, BY TYPE

10.3.1.1. ETHYLAMINES

10.3.1.2. METHYLAMINES

10.3.1.3. OTHERS

10.4 ETHYLENEAMINES

10.4.1 ETHYLENEAMINES, BY TYPE

10.4.1.1. ETHYLENEDIAMINE

10.4.1.2. TETRAETHYLENE ENEPENTAMINE

10.4.1.3. DIETHYLENTRIAMINE

10.4.1.4. OTHERS

10.5 FATTY AMINES

10.5.1 FATTY AMINES, BY TYPE

10.5.1.1. COCO AMINE

10.5.1.2. OLEYLAMINE

10.5.1.3. TALLOW AMINE

10.5.1.4. SOYA AMINE

10.5.1.5. OTHERS

10.6 SPECIALTY AMINES

10.6.1 SPECIALTY AMINES, BY TYPE

10.6.1.1. BAPMA

10.6.1.2. TEDA

10.6.1.3. DECHA

10.6.1.4. DCHA

10.6.1.5. OTHERS

10.7 AMINO METHYL PROPANOL (AMP)

10.8 ALIPHATIC AMINES

10.8.1 ALIPHATIC AMINES, BY TYPE

10.8.1.1. METHYL AMINE

10.8.1.2. ETHYL AMINE

10.8.1.3. N-PROPYL AMINE

10.8.1.4. ISOPROPYL AMINE

10.8.1.5. N-BUTYL AMINE

10.8.1.6. CYCLOHEXYL AMINE

10.8.1.7. OTHERS

10.9 AMINE DERIVATIVES

10.9.1 AMINE DERIVATIVES, BY TYPE

10.9.1.1. UREA

10.9.1.2. AZO COMPOUNDS

10.9.1.3. AMINO ALCOHOLS

10.9.1.4. AMINO ACIDS

10.9.1.5. IMINE & IMINO COMPOUNDS

10.9.1.6. OTHERS

10.1 AROMATIC AMINES

10.10.1 AROMATIC AMINES, BY TYPE

10.10.1.1. ANILINE

10.10.1.2. DIPHENYL AMINE

10.10.1.3. PHENYLENE DIAMINE

10.10.1.4. OTHERS

10.11 OTHERS

11 GLOBAL AMINES MARKET, BY FUNCTION, (2022-2031), (USD MILLION)

11.1 OVERVIEW

11.2 SOLVENT

11.3 CHELATING AGENT

11.4 CORROSION INHIBITORS

11.5 BLEACH ACTIVATORS

11.6 SURFACTANTS

11.7 OTHERS

12 GLOBAL AMINES MARKET, BY APPLICATION, (2022-2031), (USD MILLION)

12.1 OVERVIEW

12.2 WATER TREATMENT

12.2.1 WATER TREATMENT, BY AMINE TYPE

12.2.1.1. ETHANOLAMINE

12.2.1.2. ALKYLAMINES

12.2.1.3. ETHYLENEAMINES

12.2.1.4. FATTY AMINES

12.2.1.5. SPECIALTY AMINES

12.2.1.6. AMINO METHYL PROPANOL (AMP)

12.2.1.7. ALIPHATIC AMINES

12.2.1.8. AMINE DERIVATIVES

12.2.1.9. AROMATIC AMINES

12.2.1.10. OTHERS

12.3 CLEANING

12.3.1 CLEANING, BY AMINE TYPE

12.3.1.1. ETHANOLAMINE

12.3.1.2. ALKYLAMINES

12.3.1.3. ETHYLENEAMINES

12.3.1.4. FATTY AMINES

12.3.1.5. SPECIALTY AMINES

12.3.1.6. AMINO METHYL PROPANOL (AMP)

12.3.1.7. ALIPHATIC AMINES

12.3.1.8. AMINE DERIVATIVES

12.3.1.9. AROMATIC AMINES

12.3.1.10. OTHERS

12.4 AGRICULTURE

12.4.1 AGRICULTURE, BY AMINE TYPE

12.4.1.1. ETHANOLAMINE

12.4.1.2. ALKYLAMINES

12.4.1.3. ETHYLENEAMINES

12.4.1.4. FATTY AMINES

12.4.1.5. SPECIALTY AMINES

12.4.1.6. AMINO METHYL PROPANOL (AMP)

12.4.1.7. ALIPHATIC AMINES

12.4.1.8. AMINE DERIVATIVES

12.4.1.9. AROMATIC AMINES

12.4.1.10. OTHERS

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY AMINE TYPE

12.5.1.1. ETHANOLAMINE

12.5.1.2. ALKYLAMINES

12.5.1.3. ETHYLENEAMINES

12.5.1.4. FATTY AMINES

12.5.1.5. SPECIALTY AMINES

12.5.1.6. AMINO METHYL PROPANOL (AMP)

12.5.1.7. ALIPHATIC AMINES

12.5.1.8. AMINE DERIVATIVES

12.5.1.9. AROMATIC AMINES

12.5.1.10. OTHERS

12.6 PAINT AND COATINGS

12.6.1 PAINT AND COATINGS, BY AMINE TYPE

12.6.1.1. ETHANOLAMINE

12.6.1.2. ALKYLAMINES

12.6.1.3. ETHYLENEAMINES

12.6.1.4. FATTY AMINES

12.6.1.5. SPECIALTY AMINES

12.6.1.6. AMINO METHYL PROPANOL (AMP)

12.6.1.7. ALIPHATIC AMINES

12.6.1.8. AMINE DERIVATIVES

12.6.1.9. AROMATIC AMINES

12.6.1.10. OTHERS

12.7 ADHESIVES AND RESINS

12.7.1 ADHESIVES AND RESINS, BY AMINE TYPE

12.7.1.1. ETHANOLAMINE

12.7.1.2. ALKYLAMINES

12.7.1.3. ETHYLENEAMINES

12.7.1.4. FATTY AMINES

12.7.1.5. SPECIALTY AMINES

12.7.1.6. AMINO METHYL PROPANOL (AMP)

12.7.1.7. ALIPHATIC AMINES

12.7.1.8. AMINE DERIVATIVES

12.7.1.9. AROMATIC AMINES

12.7.1.10. OTHERS

12.8 PHARMACEUTICALS

12.8.1 PHARMACEUTICALS, BY AMINE TYPE

12.8.1.1. ETHANOLAMINE

12.8.1.2. ALKYLAMINES

12.8.1.3. ETHYLENEAMINES

12.8.1.4. FATTY AMINES

12.8.1.5. SPECIALTY AMINES

12.8.1.6. AMINO METHYL PROPANOL (AMP)

12.8.1.7. ALIPHATIC AMINES

12.8.1.8. AMINE DERIVATIVES

12.8.1.9. AROMATIC AMINES

12.8.1.10. OTHERS

12.9 OIL AND PETROLEUM

12.9.1 OIL AND PETROLEUM, BY AMINE TYPE

12.9.1.1. ETHANOLAMINE

12.9.1.2. ALKYLAMINES

12.9.1.3. ETHYLENEAMINES

12.9.1.4. FATTY AMINES

12.9.1.5. SPECIALTY AMINES

12.9.1.6. AMINO METHYL PROPANOL (AMP)

12.9.1.7. ALIPHATIC AMINES

12.9.1.8. AMINE DERIVATIVES

12.9.1.9. AROMATIC AMINES

12.9.1.10. OTHERS

12.1 GAS TREATMENT

12.10.1 GAS TREATMENT, BY AMINE TYPE

12.10.1.1. ETHANOLAMINE

12.10.1.2. ALKYLAMINES

12.10.1.3. ETHYLENEAMINES

12.10.1.4. FATTY AMINES

12.10.1.5. SPECIALTY AMINES

12.10.1.6. AMINO METHYL PROPANOL (AMP)

12.10.1.7. ALIPHATIC AMINES

12.10.1.8. AMINE DERIVATIVES

12.10.1.9. AROMATIC AMINES

12.10.1.10. OTHERS

12.11 RUBBER

12.11.1 RUBBER, BY AMINE TYPE

12.11.1.1. ETHANOLAMINE

12.11.1.2. ALKYLAMINES

12.11.1.3. ETHYLENEAMINES

12.11.1.4. FATTY AMINES

12.11.1.5. SPECIALTY AMINES

12.11.1.6. AMINO METHYL PROPANOL (AMP)

12.11.1.7. ALIPHATIC AMINES

12.11.1.8. AMINE DERIVATIVES

12.11.1.9. AROMATIC AMINES

12.11.1.10. OTHERS

12.12 OTHERS

13 GLOBAL AMINES MARKET, BY GEOGRAPHY, (2022-2031), (USD MILLION) (KILO TONS)

Global AMINES Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 SWITZERLAND

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA

13.3.11 NEW ZEALAND

13.3.12 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL AMINES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL AMINES MARKET – DBMR AND SWOT ANALYSIS

16 GLOBAL AMINES MARKET- COMPANY PROFILES

16.1 ALKYL AMINES & CHEMICALS LTD. (AACL)

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 REVENUE ANALYSIS

16.1.4 RECENT UPDATES

16.2 AMINES & PLASTICIZERS LTD (APL)

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 REVENUE ANALYSIS

16.2.4 RECENT UPDATES

16.3 ARKEMA

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 REVENUE ANALYSIS

16.3.4 RECENT UPDATES

16.4 BALAJI AMINES

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 REVENUE ANALYSIS

16.4.4 RECENT UPDATES

16.5 BASF SE

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 REVENUE ANALYSIS

16.5.4 RECENT UPDATES

16.6 DAICEL CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 REVENUE ANALYSIS

16.6.4 RECENT UPDATES

16.7 DOW INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 REVENUE ANALYSIS

16.7.4 RECENT UPDATES

16.8 EASTMAN CHEMICAL COMPANY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 REVENUE ANALYSIS

16.8.4 RECENT UPDATES

16.9 EVONIK INDUSTRIES AG

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 REVENUE ANALYSIS

16.9.4 RECENT UPDATES

16.1 GLOBAL AMINES COMPANY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 REVENUE ANALYSIS

16.10.4 RECENT UPDATES

16.11 HEXION INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 REVENUE ANALYSIS

16.11.4 RECENT UPDATES

16.12 HUNTSMAN CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 REVENUE ANALYSIS

16.12.4 RECENT UPDATES

16.13 INDO AMINES LIMITED (IAL)

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 REVENUE ANALYSIS

16.13.4 RECENT UPDATES

16.14 KAO CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 REVENUE ANALYSIS

16.14.4 RECENT UPDATES

16.15 KOEI CHEMICAL CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 REVENUE ANALYSIS

16.15.4 RECENT UPDATES

16.16 LANXESS

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 REVENUE ANALYSIS

16.16.4 RECENT UPDATES

16.17 LUXI CHEMICAL CO., LTD,

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 REVENUE ANALYSIS

16.17.4 RECENT UPDATES

16.18 MITSUBISHI GAS CHEMICAL COMPANY

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 REVENUE ANALYSIS

16.18.4 RECENT UPDATES

16.19 NOF CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 REVENUE ANALYSIS

16.19.4 RECENT UPDATES

16.2 SOLVAY

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 REVENUE ANALYSIS

16.20.4 RECENT UPDATES

16.21 STERLING AUXILIARIES PVT LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 REVENUE ANALYSIS

16.21.4 RECENT UPDATES

16.22 TOSOH CORPORATION

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 REVENUE ANALYSIS

16.22.4 RECENT UPDATES

16.23 VOLANT-CHEM CORP

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 REVENUE ANALYSIS

16.23.4 RECENT UPDATES

16.24 SABIC

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 REVENUE ANALYSIS

16.24.4 RECENT UPDATES

16.25 CELANESE CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 REVENUE ANALYSIS

16.25.4 RECENT UPDATES

16.26 INEOS GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 REVENUE ANALYSIS

16.26.4 RECENT UPDATES

16.27 TAMINCO CORPORATION

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 REVENUE ANALYSIS

16.27.4 RECENT UPDATES

16.28 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 REVENUE ANALYSIS

16.28.4 RECENT UPDATES

16.29 AKZO NOBEL N.V.

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 REVENUE ANALYSIS

16.29.4 RECENT UPDATES

16.3 CLARIANT AG

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 REVENUE ANALYSIS

16.30.4 RECENT UPDATES

17 QUESTIONNAIRE

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Amines Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Amines Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Amines Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.