Global Amniocentesis Needle Market

Market Size in USD Million

CAGR :

%

USD

195.21 Million

USD

264.30 Million

2024

2032

USD

195.21 Million

USD

264.30 Million

2024

2032

| 2025 –2032 | |

| USD 195.21 Million | |

| USD 264.30 Million | |

|

|

|

|

Amniocentesis Needle Market Size

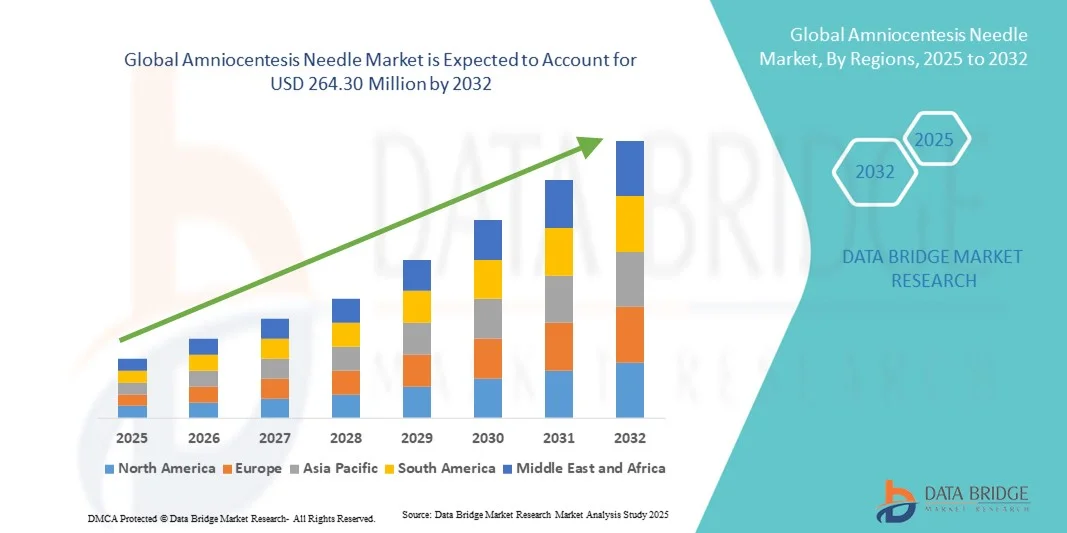

- The global amniocentesis needle market size was valued at USD 195.21 million in 2024 and is expected to reach USD 264.30 million by 2032, at a CAGR of 3.86% during the forecast period

- The market growth is largely fueled by the increasing demand for prenatal genetic testing, driven by factors such as a rising median age for first-time mothers and growing awareness of genetic disorders

- Furthermore, advancements in needle design and techniques, along with the rising prevalence of high-risk pregnancies, are establishing amniocentesis as a vital tool in modern obstetrics. These converging factors are accelerating the uptake of amniocentesis needle solutions, thereby significantly boosting the industry's growth

Amniocentesis Needle Market Analysis

- Amniocentesis needles, used for the extraction of amniotic fluid to assess fetal health and detect genetic disorders, are increasingly vital components of prenatal diagnostic procedures in both hospitals and specialized clinics due to their accuracy, safety, and minimally invasive nature

- The escalating demand for amniocentesis needles is primarily fueled by the growing awareness of prenatal genetic testing, rising maternal age, and increasing prevalence of high-risk pregnancies, which drive the adoption of early diagnostic interventions

- North America dominated the amniocentesis needle market with the largest revenue share of 39.8% in 2024, characterized by advanced healthcare infrastructure, high adoption of prenatal diagnostic procedures, and a strong presence of key market players, with the U.S. experiencing substantial growth due to technological advancements in needle design and widespread integration into obstetric care

- Asia-Pacific is expected to be the fastest growing region in the amniocentesis needle market during the forecast period due to increasing access to healthcare services, rising awareness of prenatal diagnostics, and government initiatives supporting maternal health

- 100–150 mm needle segment dominated the amniocentesis needle market with a market share of 42.8% in 2024, driven by its optimal balance of safety and procedural efficiency

Report Scope and Amniocentesis Needle Market Segmentation

|

Attributes |

Amniocentesis Needle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Amniocentesis Needle Market Trends

Advancements in Needle Design and Safety Features

- A significant and accelerating trend in the global amniocentesis needle market is the development of ultra-thin, ergonomic, and safety-enhanced needles, which improve procedural accuracy while minimizing patient discomfort and risk of complications

- For instance, the Quincke and Chiba needle variants have been redesigned with thinner shafts and flexible tips to reduce fetal injury and enhance ease of insertion during prenatal diagnostic procedures

- Innovations in needle materials, such as use of stainless steel alloys and coated surfaces, allow smoother penetration and reduced trauma, contributing to higher procedural success rates and patient confidence

- Integration with imaging technologies such as real-time ultrasound guidance is enhancing procedural precision, allowing clinicians to accurately target amniotic fluid pockets and reduce procedural risks

- This trend toward safer, more precise, and patient-friendly needles is fundamentally transforming clinician expectations for prenatal diagnostic procedures, with companies such as Cook Medical and Medline advancing these innovations

- The demand for advanced, safety-focused amniocentesis needles is growing rapidly across hospitals and specialized clinics, as healthcare providers increasingly prioritize procedural accuracy, patient comfort, and minimized complications

Amniocentesis Needle Market Dynamics

Driver

Increasing Demand Due to Rising Awareness of Prenatal Diagnostics

- The growing awareness of prenatal genetic testing and early detection of fetal anomalies is a significant driver for the heightened demand for amniocentesis needles

- For instance, in 2024, major hospitals in the U.S. reported a rising number of amniocentesis procedures in high-risk pregnancies, reflecting increased patient and clinician reliance on prenatal diagnostics

- As expectant parents become more informed about genetic disorders, procedures such as amniocentesis offer critical insights, allowing timely medical interventions and informed decision-making

- Furthermore, government initiatives and insurance coverage supporting prenatal testing are expanding access to amniocentesis procedures, encouraging broader adoption in both developed and emerging regions

- The availability of a variety of needle types (100–150 mm, smaller than 100 mm, larger than 150 mm) and procedure-specific tools enables hospitals and diagnostic centers to perform safe and efficient testing, further driving market growth

- Increasing prevalence of high-risk pregnancies, including advanced maternal age and genetic predispositions, is driving higher demand for amniocentesis procedures and related needles

- Expansion of maternal healthcare infrastructure in emerging regions is improving access to prenatal diagnostics, creating new growth opportunities for amniocentesis needle manufacturers

Restraint/Challenge

Risk of Procedural Complications and Regulatory Barriers

- Concerns regarding potential procedural complications, such as miscarriage, infection, or injury to the fetus, pose a significant challenge to broader market adoption of amniocentesis needles

- For instance, reports of needle-induced fetal injury have made some expectant parents and clinicians cautious about selecting amniocentesis over non-invasive alternatives

- Adherence to stringent regulatory standards and certification requirements across regions increases development and manufacturing costs, limiting rapid deployment of innovative needle designs

- In addition, the high cost of advanced safety-enhanced or procedure-specific needles can be a barrier for smaller clinics and budget-conscious healthcare facilities, restricting market penetration in emerging regions

- While procedural training and patient education are improving, perceived risks associated with invasive prenatal diagnostics can still hinder adoption, necessitating ongoing efforts to enhance safety protocols and regulatory compliance

- Limited availability of trained specialists to perform invasive prenatal procedures can restrict procedural adoption and needle utilization, particularly in rural or underdeveloped areas

- Competition from non-invasive prenatal testing (NIPT) methods, which reduce the perceived need for amniocentesis, poses a challenge to market growth in some regions

Amniocentesis Needle Market Scope

The market is segmented on the basis of type, procedure, and end user.

- By Type

On the basis of type, the amniocentesis needle market is segmented into 100–150 mm needles, larger than 150 mm needles, and smaller than 100 mm needles. The 100–150 mm needle segment dominated the market with the largest market revenue share of 42.8% in 2024, driven by its optimal balance between safety and procedural efficiency. These needles are widely preferred by clinicians for standard amniocentesis procedures due to their ease of handling and reduced risk of fetal injury. Hospitals and diagnostic centers commonly stock 100–150 mm needles because they accommodate a wide range of maternal and fetal conditions. Furthermore, the compatibility of these needles with ultrasound-guided procedures enhances procedural precision. Their established use in clinical practice and strong clinician familiarity contribute to sustained demand. The segment’s dominance is also supported by ongoing improvements in needle materials and coatings, which improve comfort and reduce complications.

The smaller than 100 mm needle segment is expected to witness the fastest growth rate from 2025 to 2035, fueled by rising demand for minimally invasive procedures in high-risk pregnancies. These shorter needles reduce procedural trauma and are particularly suitable for use in early-stage gestation or cases with limited amniotic fluid volume. Their growing adoption in specialized prenatal diagnostic centers is accelerating market growth. In addition, advancements in needle design and the increasing preference for precision tools in modern obstetrics are driving adoption. The aesthetic and ergonomic enhancements of these needles improve clinician confidence and patient comfort, making them highly sought-after in both developed and emerging regions.

- By Procedure

On the basis of procedure, the amniocentesis needle market is segmented into amniocentesis procedures, amnioreduction procedures, fetal blood transfusion procedures, amnioinfusion procedures, and cordocentesis procedures. The amniocentesis procedures segment dominated the market in 2024 due to its routine use in prenatal genetic testing and fetal anomaly detection. Hospitals and diagnostic centers rely heavily on amniocentesis for early-stage diagnosis, making it the most frequently performed invasive prenatal procedure. The segment benefits from high awareness among healthcare providers and expectant parents regarding its diagnostic value. Advancements in needle technology, ultrasound guidance, and safety protocols have further reinforced its dominance. The segment’s strong presence in both developed and emerging markets ensures sustained revenue generation. Increased governmental support for prenatal care programs also encourages routine adoption of amniocentesis procedures.

The amnioreduction procedures segment is anticipated to witness the fastest growth during the forecast period, driven by the rising prevalence of polyhydramnios and other amniotic fluid-related complications. Clinicians increasingly rely on amnioreduction to manage excessive amniotic fluid, preventing preterm labor and other complications. The growing availability of specialized needles designed for safe fluid removal is accelerating adoption. Increasing maternal awareness and preference for proactive fetal care are also contributing factors. Hospitals and high-end prenatal care centers are investing in advanced equipment for these procedures. Innovations in procedural safety and patient comfort are further boosting the segment’s rapid growth trajectory.

- By End User

On the basis of end user, the amniocentesis needle market is segmented into hospitals, diagnostic centers, clinics, and other end users. The hospitals segment dominated the market in 2024 due to their capability to perform a wide range of prenatal diagnostic procedures and availability of trained specialists. Hospitals offer comprehensive prenatal care services, including amniocentesis, amnioreduction, and cordocentesis, which require advanced infrastructure and expert handling. The segment benefits from government initiatives and insurance coverage supporting maternal healthcare, making hospitals the preferred choice for high-risk pregnancies. Their dominance is reinforced by strong procedural volumes, established clinician trust, and access to the latest needle technologies. Hospitals also drive clinical trials and adoption of newer needle designs, contributing to market growth.

The diagnostic centers segment is expected to witness the fastest growth rate from 2025 to 2035, fueled by increasing outpatient prenatal testing and growing accessibility in urban and semi-urban regions. Diagnostic centers offer cost-effective and convenient solutions for expectant parents seeking prenatal diagnostics. Rising awareness of genetic testing, coupled with technological adoption, is expanding procedural volumes at these centers. The segment’s growth is further supported by collaborations with hospitals and maternity clinics to provide specialized testing services. Flexible appointment scheduling and less invasive testing options make diagnostic centers increasingly attractive for routine prenatal procedures. Advanced imaging and needle guidance systems at these centers also contribute to higher adoption rates.

Amniocentesis Needle Market Regional Analysis

- North America dominated the amniocentesis needle market with the largest revenue share of 39.8% in 2024, characterized by advanced healthcare infrastructure, high adoption of prenatal diagnostic procedures, and a strong presence of key market players, with the U.S. experiencing substantial growth due to technological advancements in needle design and widespread integration into obstetric care

- Healthcare providers and expectant parents in the region highly value the accuracy, safety, and reliability offered by modern amniocentesis needles, as well as their compatibility with ultrasound-guided procedures and other prenatal diagnostic tools

- This widespread adoption is further supported by high awareness of genetic testing, availability of trained specialists, and government initiatives promoting maternal health, establishing amniocentesis needles as a preferred solution in hospitals and diagnostic centers across North America

U.S. Amniocentesis Needle Market Insight

The U.S. amniocentesis needle market captured the largest revenue share of 82% in 2024 within North America, fueled by widespread adoption of prenatal diagnostic procedures and high awareness of genetic testing. Healthcare providers and expectant parents increasingly prioritize the accuracy, safety, and reliability offered by modern amniocentesis needles. The availability of trained specialists, advanced hospital infrastructure, and insurance coverage for prenatal testing further propels market growth. Moreover, integration with ultrasound-guided procedures and procedure-specific needle designs is significantly contributing to the market's expansion.

Europe Amniocentesis Needle Market Insight

The Europe amniocentesis needle market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent prenatal care regulations and increasing awareness of fetal genetic disorders. The rise in high-risk pregnancies, coupled with advancements in needle design, is fostering the adoption of amniocentesis procedures. European healthcare providers also value the safety, precision, and procedural efficiency of modern needles. The region is experiencing significant growth across hospitals, diagnostic centers, and specialized clinics, with amniocentesis increasingly incorporated into routine prenatal diagnostic protocols.

U.K. Amniocentesis Needle Market Insight

The U.K. amniocentesis needle market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for early detection of fetal abnormalities and increasing maternal awareness of prenatal diagnostics. In addition, concerns regarding genetic disorders are encouraging both patients and clinicians to adopt minimally invasive procedures. The U.K.’s well-developed healthcare infrastructure and emphasis on maternal and fetal health, alongside the availability of advanced needle designs, are expected to continue stimulating market growth.

Germany Amniocentesis Needle Market Insight

The Germany amniocentesis needle market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of prenatal genetic testing and the demand for technologically advanced and safe needles. Germany’s robust healthcare infrastructure, coupled with a focus on precision medicine, promotes adoption of amniocentesis procedures in hospitals and specialized clinics. Integration of modern needle technologies with ultrasound guidance and procedural best practices is becoming increasingly prevalent, aligning with local expectations for high procedural safety and patient comfort.

Asia-Pacific Amniocentesis Needle Market Insight

The Asia-Pacific amniocentesis needle market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2035, driven by increasing awareness of prenatal diagnostics, rising maternal healthcare infrastructure, and growing adoption of advanced prenatal procedures in countries such as China, Japan, and India. The region's emphasis on improving maternal and fetal health, supported by government initiatives promoting prenatal care, is driving the adoption of amniocentesis needles. Furthermore, as APAC expands its healthcare services and access to specialty clinics, the affordability and availability of advanced needles are increasing for a wider patient base.

Japan Amniocentesis Needle Market Insight

The Japan amniocentesis needle market is gaining momentum due to the country’s advanced healthcare system, high prenatal care standards, and demand for precise, minimally invasive procedures. Adoption is driven by increasing maternal awareness of fetal health and the integration of ultrasound-guided needle technologies. In addition, Japan’s aging maternal population and emphasis on patient safety are such asly to spur demand for user-friendly, high-precision amniocentesis needles in both hospitals and specialized clinics.

India Amniocentesis Needle Market Insight

The India amniocentesis needle market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s expanding maternal healthcare infrastructure, rising awareness of genetic testing, and increasing access to prenatal diagnostic procedures. India represents one of the fastest-growing markets for prenatal care, and amniocentesis needles are becoming increasingly used in hospitals, diagnostic centers, and maternity clinics. Government initiatives supporting maternal health, coupled with the availability of affordable needle options and growing private healthcare networks, are key factors propelling market growth in India.

Amniocentesis Needle Market Share

The Amniocentesis Needle industry is primarily led by well-established companies, including:

- Cook (U.S.)

- CooperCompanies (U.S.)

- Smiths Group plc (U.K.)

- BD (U.S.)

- Medtronic (Ireland)

- Medline Industries, Inc. (U.S.)

- Stryker (U.S.)

- Teleflex Incorporated (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Laboratoire CCD (France)

- RI.MOS. Srl (Italy)

- Rocket Medical plc. (U.K.)

- Sterylab Srl (Italy)

- BPB Medica (Italy)

- Medex Medical (Italy)

- Vigeo Srl (Italy)

- Gima S.p.A. (Italy)

- Tsunami Medical (Italy)

- Integra LifeSciences Corporation (U.S.)

- Sonic Healthcare Limited (Australia)

What are the Recent Developments in Global Amniocentesis Needle Market?

- In July 2025, Researchers at Children's Hospital Colorado developed a less invasive technique to collect amniotic stem cells during vaginal delivery. This method utilizes a syringe to extract fluid from the vaginal canal or pooled fluid during delivery, offering a safer alternative to traditional amniocentesis and potentially reducing risks for both the fetus and the pregnant individual

- In August 2024, CooperSurgical announced a collaboration with a leading ultrasound technology supplier to integrate advanced imaging features into their amniocentesis needles. This partnership aims to enhance the overall effectiveness of prenatal diagnostics by incorporating cutting-edge imaging, which is expected to increase procedural accuracy and reduce complications

- In November 2023, Cook Medical introduced the EchoTip® amniocentesis needles, featuring enhanced ultrasound visibility. These needles are designed to improve the precision of needle placement during procedures, thereby increasing safety and reducing complications associated with amniocentesis

- In September 2023, Medtronic introduced a next-generation amniocentesis needle with enhanced safety features. The new product launch included a thinner gauge and improved echogenicity (better ultrasound visibility) in its design. This advancement was explicitly aimed at reducing patient discomfort and procedural risks, catering to the ongoing need for safer invasive prenatal diagnostic tools

- In December 2022, MDL launched a new line of amniocentesis needles designed for improved biopsy procedures. These needles feature echogenic tips to enhance visibility under ultrasound guidance, facilitating more accurate and safer amniocentesis procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.