Global Analgesics Market

Market Size in USD Billion

CAGR :

%

USD

56.23 Billion

USD

81.14 Billion

2024

2032

USD

56.23 Billion

USD

81.14 Billion

2024

2032

| 2025 –2032 | |

| USD 56.23 Billion | |

| USD 81.14 Billion | |

|

|

|

|

Analgesics Market Size

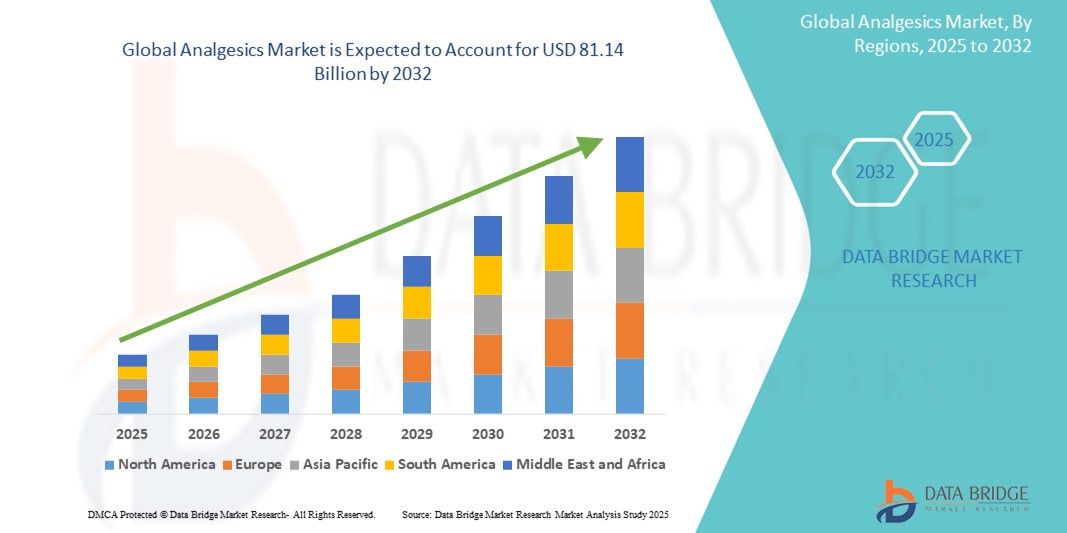

- The global analgesics market size was valued at USD 56.23 billion in 2024 and is expected to reach USD 81.14 billion by 2032, at a CAGR of 4.69% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic pain conditions, increasing geriatric population, and expanding use of over-the-counter (OTC) pain relief solutions, which have positioned analgesics as an essential part of global healthcare systems

- Furthermore, heightened consumer awareness, technological advancements in drug delivery mechanisms, and a shift toward non-opioid and safer alternatives are reinforcing the market. These converging factors are accelerating the demand for both prescription and non-prescription analgesics, thereby significantly boosting the industry's growth

Analgesics Market Analysis

- Analgesics, encompassing both opioid and non-opioid pain relievers, are critical in managing acute and chronic pain across diverse medical conditions, making them a fundamental component of global healthcare systems due to their effectiveness, accessibility, and wide therapeutic range

- The growing demand for analgesics is primarily fueled by an increasing global burden of chronic diseases such as arthritis, cancer, and cardiovascular conditions, coupled with rising surgical procedures and a rapidly aging population

- North America dominated the analgesics market with the largest revenue share of 38.1% in 2024, driven by a well-established healthcare infrastructure, high awareness of pain management options, and robust pharmaceutical R&D, with the U.S. leading in both prescription and over-the-counter analgesic consumption

- Asia-Pacific is expected to be the fastest growing region in the analgesics market during the forecast period due to improving healthcare access, expanding middle-class population, and growing demand for cost-effective pain management solutions

- Chronic pain segment dominated the analgesics market with a market share of 61.8% in 2024, driven by its association with long-term conditions such as arthritis, cancer, and neuropathic disorders

Report Scope and Analgesics Market Segmentation

|

Attributes |

Analgesics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Analgesics Market Trends

“Shift Toward Non-Opioid and Safer Pain Management Solutions”

- A significant and accelerating trend in the global analgesics market is the growing shift toward non-opioid pain relief options, driven by heightened awareness of opioid dependency risks and regulatory efforts to curb opioid abuse. This shift is redefining treatment protocols and influencing the development of innovative, safer analgesic therapies

- For instance, companies such as Eli Lilly and Pfizer have invested in non-opioid treatments such as NGF inhibitors and other biologics for managing chronic pain without the addictive potential of opioids. Similarly, the market has seen an increase in demand for topical analgesics and extended-release NSAIDs that offer prolonged relief with reduced systemic side effects

- The push toward non-opioid options is also fostering research into alternative drug classes, including cannabinoids, antidepressants, and neuromodulators, particularly for neuropathic and musculoskeletal pain. This diversification of treatment options supports personalized pain management strategies and helps mitigate the public health impact of opioid overuse

- In addition, healthcare providers and payers are increasingly favoring non-opioid analgesics in treatment guidelines and reimbursement frameworks, further accelerating their adoption. Telemedicine platforms and digital health tools are also facilitating easier access to OTC and non-opioid prescription medications, particularly in underserved or remote areas

- This trend towards safer, diversified, and more accessible pain management is driving innovation across the industry. Pharmaceutical firms are responding by expanding their non-opioid portfolios and forming strategic collaborations to accelerate development timelines, such as GSK’s partnerships for developing novel non-addictive analgesics

- The rising global preference for non-opioid analgesics reflects a broader emphasis on long-term safety, regulatory compliance, and patient-centric care, with both consumers and practitioners seeking effective pain relief with minimal risk of dependency

Analgesics Market Dynamics

Driver

“Rising Global Burden of Chronic Pain and Increasing Surgical Interventions”

- The growing incidence of chronic conditions such as osteoarthritis, fibromyalgia, cancer, and post-surgical pain is a major driver propelling the demand for analgesics across global markets. These conditions often require consistent and long-term pain management solutions, making analgesics an indispensable part of treatment regimens

- For instance, in 2024, an estimated 1.7 billion people globally were affected by musculoskeletal conditions requiring pain relief, according to WHO data. This rising burden, along with an increase in elective and emergency surgical procedures, is fueling steady demand for both prescription and OTC analgesics

- Furthermore, the aging global population, particularly in countries such as Japan, the U.S., and across Europe, has significantly contributed to the chronic pain burden, thereby boosting analgesic consumption. Elderly patients frequently suffer from multiple pain-related conditions and often require safer alternatives, driving growth in the non-opioid segment

- Healthcare providers are increasingly incorporating pain management protocols in outpatient and home-based care, contributing to the growth of oral and topical analgesic formulations. Patient preference for non-invasive, easy-to-administer medications aligns with the growing popularity of these delivery modes

- As the focus on quality of life and pain mitigation becomes more prominent in healthcare systems, especially in oncology and palliative care, analgesics continue to gain importance, ensuring long-term growth prospects for the market

Restraint/Challenge

“Opioid Abuse Risk and Stringent Regulatory Landscape”

- The widespread misuse and dependency associated with opioid-based analgesics represent a significant challenge for the global analgesics market, leading to tightening regulatory frameworks, prescribing limitations, and heightened scrutiny from public health agencies

- For instance, regulatory agencies such as the FDA (U.S.) and EMA (Europe) have introduced rigorous guidelines for opioid prescriptions, labeling requirements, and risk management strategies to address the opioid epidemic. These policies, while necessary for public safety, limit opioid accessibility and pose hurdles for manufacturers

- Public backlash, class-action lawsuits, and reputational damage surrounding opioid-related crises have forced companies such as Purdue Pharma and Johnson & Johnson to re-evaluate their analgesic portfolios and invest in non-opioid innovations, often under regulatory or legal pressure

- In addition, the development of new analgesic drugs faces high clinical trial costs and complex approval processes, especially for novel non-opioid candidates. Companies must navigate safety concerns, efficacy benchmarks, and long-term impact evaluations, which can delay product launches

- Cost remains a barrier in some regions, where advanced analgesics may not be reimbursed or affordable, especially for chronic use. While generics and OTC options have improved accessibility, newer, targeted therapies often come with premium pricing

Analgesics Market Scope

The market is segmented on the basis of pain type, drug class, type, application, route of administration, end-users, and distribution channel.

- By Pain Type

On the basis of pain type, the analgesics market is segmented into acute and chronic. The chronic pain segment dominated the market with the largest market revenue share of 61.8% in 2024, driven by the rising prevalence of long-term conditions such as arthritis, cancer, and neuropathy. Patients experiencing chronic pain often require consistent pain management, leading to higher and recurring consumption of analgesics.

The acute pain segment is anticipated to witness substantial growth from 2025 to 2032, fueled by the growing number of surgeries, dental procedures, injuries, and trauma-related hospital admissions. Acute pain medications are frequently used in both inpatient and outpatient settings for rapid symptom relief.

- By Drug Class

On the basis of drug class, the analgesics market is segmented into nonsteroidal anti-inflammatory drugs (NSAIDS), opioids, salicylates, and others. The NSAIDs segment dominated the market with the largest market revenue share of 47.5% in 2024, driven by their widespread usage in treating mild to moderate pain, lower risk of addiction compared to opioids, and OTC availability. Popular NSAIDs such as ibuprofen and naproxen remain staple options across diverse pain types

The opioids segment, is expected to witness fastest growth during forecast period, due to regulatory constraints and addiction concerns, continues to play a critical role in cancer and severe post-operative pain management. The salicylates segment, including drugs such as aspirin, is also expected to maintain steady demand for treating musculoskeletal and headache-related pain.

- By Type

On the basis of type, the analgesics market is segmented into prescription drugs and over-the-counter (OTC) drugs. The OTC drugs segment held the largest market revenue share of 56.7% in 2024, attributed to rising consumer inclination towards self-medication, increased accessibility through pharmacies and online platforms, and the availability of non-opioid alternatives for common pain conditions.

The prescription drugs segment is expected to grow steadily over the forecast period, driven by the increasing need for physician-managed treatment of complex conditions such as neuropathic and cancer pain, and the development of newer, safer prescription analgesics.

- By Application

On the basis of application, the analgesics market is segmented into musculoskeletal pain, surgical and trauma-related pain, cancer pain, neuropathic pain, migraines, obstetrical pain, fibromyalgia, pain due to burns, dental/facial pain, pediatric pain, and others. The musculoskeletal pain segment dominated the market with the largest revenue share of 28.4% in 2024, due to the high incidence of back pain, arthritis, and sports-related injuries.

The neuropathic pain segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the increasing prevalence of diabetes, multiple sclerosis, and other nerve-related disorders. Cancer pain also remains a significant driver, with continuous advancements in oncology care creating a strong need for effective pain relief options.

- By Route Of Administration

On the basis of route of administration, the analgesics market is segmented into oral, parenteral, and others. The oral segment held the largest market revenue share of 74.2% in 2024, attributed to patient convenience, affordability, and wide availability of oral analgesics across both prescription and OTC categories.

The parenteral segment is expected to experience robust growth from 2025 to 2032, especially in hospital settings where immediate pain relief is required during surgeries, post-operative care, or trauma interventions.

- By End User

On the basis of end-users, the analgesics market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment accounted for the largest market revenue share of 39.8% in 2024, driven by the increasing number of inpatient procedures, cancer treatments, and post-operative pain management cases.

The homecare segment is projected to grow significantly during forecast period, supported by the aging population, rise in chronic disease burden, and expansion of remote healthcare services. The increasing preference for home-based pain relief among elderly and long-term patients is a major growth contributor.

- By Distribution Channel

On the basis of distribution channel, the analgesics market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment held the largest market revenue share of 44.1% in 2024, owing to strong brick-and-mortar presence, high footfall for OTC drugs, and accessibility for non-prescription pain relievers.

The online pharmacy segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing internet penetration, growth in e-commerce adoption, and the convenience of doorstep delivery, especially for elderly or mobility-constrained consumers.

Analgesics Market Regional Analysis

- North America dominated the analgesics market with the largest revenue share of 38.1% in 2024, driven by a well-established healthcare infrastructure, high awareness of pain management options, and robust pharmaceutical R&D, with the U.S. leading in both prescription and over-the-counter analgesic consumption

- Consumers in the region exhibit a strong preference for convenient and fast-acting pain management solutions, including NSAIDs and opioid formulations

- The market is further propelled by rising healthcare expenditure, robust pharmaceutical R&D activities, and increasing awareness regarding pain management therapies, particularly in aging populations and post-operative care scenarios

U.S. Analgesics Market Insight

The U.S. analgesics market captured the largest revenue share of 78% in 2024 within North America, driven by high healthcare spending and a substantial burden of chronic pain conditions such as arthritis, migraines, and cancer-related pain. The strong demand for both prescription and OTC analgesics, particularly NSAIDs and opioids, continues to fuel growth. In addition, advancements in pain management therapies, increasing awareness, and favorable insurance coverage contribute to sustained market expansion. Efforts to balance opioid accessibility with regulatory control also influence market dynamics.

Europe Analgesics Market Insight

The Europe analgesics market is projected to expand at a robust CAGR throughout the forecast period, supported by rising incidences of musculoskeletal and neuropathic pain and the growing elderly population. Increasing preference for OTC medications for self-care, coupled with the strong presence of pharmaceutical giants and a highly regulated healthcare system, supports steady growth. Moreover, lifestyle-related disorders and post-surgical pain management are significant contributors to the increasing use of analgesics across the region.

U.K. Analgesics Market Insight

The U.K. analgesics market is anticipated to grow at a notable CAGR from 2025 to 2032, bolstered by increasing public health awareness and rising prevalence of chronic and acute pain conditions. Government emphasis on pain management guidelines and rising consumer trust in OTC pain relief products such as paracetamol and ibuprofen drive market growth. In addition, the country's robust retail pharmacy network and emphasis on non-opioid treatment alternatives support widespread product adoption.

Germany Analgesics Market Insight

The Germany analgesics market is expected to expand at a considerable CAGR from 2025 to 2032, supported by a well-established pharmaceutical infrastructure and increasing demand for safe and effective pain relief options. Germany’s aging population, combined with a high rate of surgeries and orthopedic conditions, continues to drive the consumption of analgesics. In addition, heightened regulatory scrutiny of opioid usage is encouraging the adoption of non-opioid analgesic alternatives, contributing to a shift in drug class preference.

Asia-Pacific Analgesics Market Insight

The Asia-Pacific analgesics market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising healthcare access, growing urbanization, and increasing incidence of chronic pain in countries such as China, India, and Japan. Government efforts to expand healthcare services and the rising popularity of OTC analgesics due to affordability and accessibility are key growth drivers. In addition, the growing middle-class population and increasing awareness around pain management therapies further support the market's rapid expansion.

Japan Analgesics Market Insight

The Japan analgesics market is gaining traction due to the country’s rapidly aging population and high demand for advanced pain relief treatments. With a cultural inclination towards preventive and long-term care, Japan sees high adoption of both traditional and modern analgesics. The market is also driven by extensive healthcare coverage, innovation in drug formulations, and a strong focus on palliative care solutions across hospitals and elderly care facilities.

India Analgesics Market Insight

The India analgesics market accounted for the largest revenue share in Asia Pacific in 2024, attributed to growing public awareness, a surge in chronic lifestyle diseases, and increasing availability of OTC pain medications. The country’s expanding healthcare infrastructure and the adoption of generic formulations at affordable prices are further fueling demand. Moreover, pain relief products see high penetration in both urban and rural areas, supported by strong pharmaceutical manufacturing capabilities and government initiatives promoting healthcare access

Analgesics Market Share

The analgesics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Lupin (India)

- Fresenius Kabi AG (Germany)

- Aurobindo Pharma (India)

- Cipla (U.S.)

- Bausch Health Companies Inc. (Canada)

- Amneal Pharmaceuticals LLC. (U.S.)

- Apotex Inc. (Canada)

- Lilly (U.S.)

What are the Recent Developments in Global Analgesics Market?

- In April 2023, Pfizer Inc. launched a novel formulation of Advil Dual Action in the U.S., combining ibuprofen and acetaminophen in a single tablet for enhanced multi-symptom pain relief. This innovation addresses consumer demand for more effective OTC solutions and reinforces Pfizer’s position as a leader in consumer healthcare by offering a simplified, yet powerful pain management option for everyday use

- In March 2023, Johnson & Johnson Consumer Health introduced a digital pain tracking app in Europe designed to complement its Tylenol and Motrin product lines. The app enables users to monitor pain intensity, frequency, and triggers, offering personalized product recommendations and improving medication adherence. This advancement highlights the company’s focus on digital health integration and patient-centered care in the analgesics space

- In March 2023, Haleon plc, the consumer health spin-off from GSK, expanded its Panadol range in Asia-Pacific with the launch of Panadol UltraPro. This new formulation is specifically designed to deliver fast-acting relief from moderate to severe pain, targeting growing urban populations experiencing lifestyle-related discomfort. The move supports Haleon’s strategy to deepen regional market penetration through targeted innovation

- In February 2023, Bayer AG announced a strategic collaboration with One Drop, a digital health company, to develop data-driven insights for chronic pain management using Bayer’s Aleve product line. The initiative aims to integrate real-time monitoring with personalized pain relief strategies, reflecting Bayer’s commitment to advancing digital therapeutics and holistic care in the analgesics market

- In January 2023, Teva Pharmaceuticals introduced a generic version of Celebrex (celecoxib) in the U.S. market, significantly improving affordability for patients seeking prescription NSAID therapies. This launch enhances Teva’s already broad analgesics portfolio and aligns with its mission to increase access to essential medications while maintaining high standards of efficacy and safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.