Global Otc Medications Market

Market Size in USD Billion

CAGR :

%

USD

52.47 Billion

USD

93.57 Billion

2024

2032

USD

52.47 Billion

USD

93.57 Billion

2024

2032

| 2025 –2032 | |

| USD 52.47 Billion | |

| USD 93.57 Billion | |

|

|

|

|

Over-the-Counter (OTC) Medications Market Size

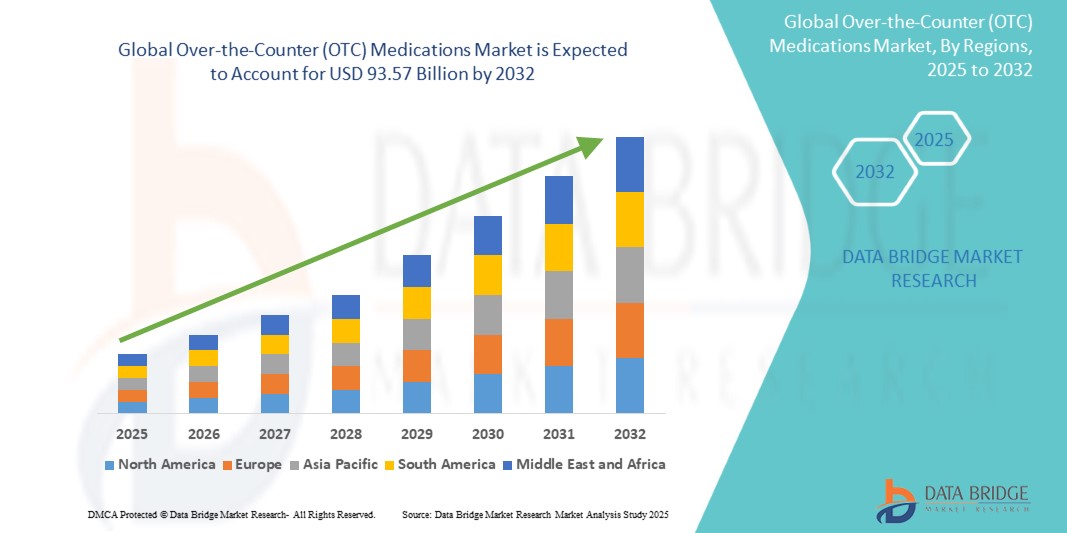

- The global over-the-counter (OTC) medications market size was valued at USD 52.47 billion in 2024 and is expected to reach USD 93.57 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the increasing preference for self-medication, rising health awareness among consumers, and the growing accessibility of OTC products through both physical retail channels and e-commerce platforms

- Furthermore, the expanding geriatric population, along with the rising prevalence of minor health issues such as colds, headaches, and digestive problems, is driving the demand for convenient and affordable treatment options. These converging factors are accelerating the adoption of OTC medications, thereby significantly boosting the industry's growth

Over-the-Counter (OTC) Medications Market Analysis

- OTC medications, encompassing a wide range of non-prescription drugs used to treat common ailments, play a crucial role in self-care and minor health condition management globally, driven by increasing consumer awareness and demand for convenient healthcare solutions

- The escalating demand for OTC medications is primarily fueled by growing health consciousness, the rising prevalence of chronic and lifestyle-related diseases, and increasing accessibility through pharmacies, supermarkets, and online retail channels

- North America dominates the over-the-counter (OTC) medications market with the largest revenue share of 42.5% in 2024, characterized by high healthcare expenditure, well-established pharmaceutical distribution networks, and a strong culture of self-medication supported by regulatory frameworks that facilitate OTC product availability

- Asia-Pacific is expected to be the fastest growing region in the over-the-counter (OTC) medications market during the forecast period due to expanding healthcare infrastructure, increasing urbanization, rising disposable incomes, and growing consumer preference for accessible and affordable treatment options

- Analgesics segment dominates the over-the-counter (OTC) medications market with a market share of 33% in 2024, driven by its widespread use for pain relief and fever management, ease of availability, and well-established safety profiles

Report Scope and Over-the-Counter (OTC) Medications Market Segmentation

|

Attributes |

Over-the-Counter (OTC) Medications Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Over-the-Counter (OTC) Medications Market Trends

“Growing Consumer Preference for Digital Health and Personalized Self-Care”

- A significant and accelerating trend in the global OTC medications market is the increasing adoption of digital health platforms and mobile health applications that empower consumers to manage their health and wellness proactively. These technologies facilitate easier access to information, personalized recommendations, and streamlined purchasing of OTC products.

- For instance, platforms such as WebMD and Healthline provide consumers with symptom checkers and product guides, enabling more informed self-medication decisions. In addition, digital tools such as mobile apps from leading pharmacies allow consumers to order OTC products, receive medication reminders, and track their health progress conveniently

- Personalized self-care is further enhanced by advances in data analytics and AI, enabling recommendations tailored to individual health profiles, lifestyles, and preferences. Some companies are developing AI-powered virtual assistants to guide consumers in selecting appropriate OTC medications or supplements based on symptoms and medical history.

- The rise of telemedicine services also complements OTC usage by offering quick consultations and prescriptions, reducing the need for in-person visits for minor ailments, and driving demand for complementary OTC remedies

- This trend towards digital engagement and personalized health solutions is reshaping consumer expectations, with greater demand for OTC products that are accessible, convenient, and aligned with individual needs. Consequently, companies such as Amazon Pharmacy and CVS Health are investing heavily in integrated digital health ecosystems that combine OTC product sales with personalized care management tools

- The demand for OTC medications supported by digital health innovations is rapidly growing worldwide, as consumers increasingly prioritize convenience, safety, and holistic self-care approaches

Over-the-Counter (OTC) Medications Market Dynamics

Driver

“Rising Consumer Awareness and Growing Preference for Self-Medication”

- The increasing health awareness among consumers worldwide, combined with a growing preference for self-care and self-medication, is a significant driver boosting demand for OTC medications

- For instance, in early 2024, major pharmaceutical companies such as Johnson & Johnson and Bayer expanded their OTC product portfolios to include innovative formulations targeting common ailments, reflecting the rising consumer inclination towards convenient and accessible healthcare solutions

- As healthcare costs rise and access to healthcare providers remains challenging in some regions, consumers are increasingly turning to OTC products for immediate relief from minor health conditions such as pain, cold, digestive issues, and allergies

- Furthermore, the expanding geriatric population and the increasing prevalence of lifestyle-related disorders are driving consistent demand for OTC medications, particularly in categories such as analgesics, gastrointestinal products, and vitamins & supplements

- The growing availability of OTC products through multiple distribution channels — including retail pharmacies, supermarkets, and especially online platforms — enhances accessibility and supports the rising trend of self-care. In addition, regulatory bodies in several countries are facilitating easier access by approving more drugs for OTC sale. This combination of factors is propelling the sustained growth of the OTC medications market globally

Restraint/Challenge

“Concerns Regarding Product Safety and Regulatory Compliance”

- Concerns related to the safety, efficacy, and potential misuse of OTC medications pose significant challenges to market expansion. Consumers and regulatory authorities remain cautious about incorrect self-diagnosis, overdosing, and adverse drug interactions when OTC products are used without professional supervision

- For instance, reports of adverse effects from unsupervised use of analgesics and weight-loss supplements have led to increased scrutiny by agencies such as the FDA and EMA, resulting in stricter regulations and labeling requirements to ensure consumer safety

- Ensuring compliance with diverse and evolving regulatory frameworks across countries can be complex and costly for manufacturers, especially when launching new products or expanding into emerging markets. In addition, counterfeit and substandard OTC products in some regions undermine consumer trust and pose health risks

- The availability of numerous generic and unregulated products at lower prices also creates challenges related to product quality and consumer confidence. This can hinder the willingness of some consumers to opt for branded OTC products despite their perceived higher safety and efficacy

Over-the-Counter (OTC) Medications Market Scope

The market is segmented on the basis of product type, dosage form, category, and distribution channel.

- By Product Type

On the basis of product type, the over-the-counter (OTC) medications market is segmented into cough, cold, and flu products; analgesics; dermatology products; gastrointestinal products; vitamins, minerals, and supplements (VMS); weight-loss/dietary products; ophthalmic products; sleeping aids; and other product types. The analgesics segment dominated the largest market revenue share of 33% in 2024, driven by the high prevalence of pain-related conditions and the widespread use of OTC pain relief medications for headache, muscle pain, and arthritis. Analgesics are preferred due to their rapid onset of action and broad availability, making them essential in household medicine cabinets globally.

The vitamins, minerals, and supplements (VMS) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer health consciousness, aging populations, and rising demand for preventive healthcare products. The growing trend toward natural and immunity-boosting supplements further supports this segment’s expansion.

- By Dosage Form

On the basis of dosage form, the over-the-counter (OTC) medications market is segmented into tablets, hard capsules, powders, ointments, soft capsules, liquids, and others. The tablets segment held the largest market share in 2024 due to their ease of manufacturing, convenient dosing, and widespread consumer familiarity. Tablets are preferred for a variety of OTC categories including analgesics, cold remedies, and gastrointestinal products.

The liquids segment is expected to experience the fastest growth over the forecast period, driven by increasing demand for pediatric and geriatric formulations, where swallowing tablets may be difficult. Liquid dosage forms are also favored for cough syrups, cold remedies, and vitamin supplements, enhancing user compliance.

- By Category

On the basis of category, the over-the-counter (OTC) medications market is divided into branded and generic drugs. The branded drugs segment lead with the higher market share in 2024, attributed to strong consumer trust, extensive marketing efforts, and product innovation from leading pharmaceutical companies. Branded OTC products often assure quality and efficacy, attracting repeat purchases.

However, the generic drugs segment is growing steadily during forecast period, due to increasing demand for affordable medication options, especially in price-sensitive regions and developing countries, where generic OTC products provide cost-effective alternatives.

- By Distribution Channel

On the basis of distribution channel, the over-the-counter (OTC) medications market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and other distribution channels. Retail pharmacies held the largest share of the market in 2024, owing to their widespread availability, trusted service, and immediate access to OTC products. They serve as the primary point of purchase for many consumers seeking convenient self-medication options.

The online pharmacy segment is witnessing the fastest growth rate during 2025 to 2032, propelled by the increasing acceptance of e-commerce, improved internet penetration, and the convenience of home delivery. Online platforms also offer a broader product selection and discreet purchasing options, which are especially attractive for sensitive health categories such as dermatology and sexual wellness OTC products.

Over-the-Counter (OTC) Medications Market Regional Analysis

- North America dominates the over-the-counter (OTC) medications market with the largest revenue share of 42.5% in 2024, driven by high healthcare expenditure, well-established pharmaceutical distribution networks, and a strong culture of self-medication supported by regulatory frameworks that facilitate OTC product availability

- Consumers in the region prioritize easy access to a wide range of OTC products, including analgesics, vitamins, and cold remedies, supported by extensive retail pharmacy networks and growing online pharmacy platforms. The region also benefits from favorable regulatory frameworks that encourage the availability of OTC drugs

- This widespread adoption is further supported by increasing chronic disease prevalence, rising geriatric population, and high disposable incomes, enabling consumers to invest in preventive and wellness products

U.S. Over-the-Counter (OTC) Medications Market Insight

The U.S. over-the-counter (OTC) medications market captured the largest revenue share of 76.1% in 2024 within North America, fueled by a mature healthcare system and strong consumer inclination toward self-medication and preventive health. American consumers routinely purchase OTC products for minor ailments, nutritional supplementation, and wellness maintenance. Factors such as convenient access through vast retail pharmacy networks, e-commerce growth, and direct-to-consumer advertising drive demand. In addition, regulatory support from the FDA for switching prescription drugs to OTC status further bolsters market expansion.

Europe Over-the-Counter (OTC) Medications Market Insight

The Europe over-the-counter (OTC) medications market is projected to grow at a substantial CAGR throughout the forecast period, primarily due to the region's aging population and rising healthcare expenditure. Consumers increasingly prefer non-prescription drugs for treating common illnesses such as colds, allergies, and indigestion. Strong pharmacy penetration, supportive regulatory reforms encouraging self-care, and heightened health awareness contribute to rising product adoption. Moreover, national healthcare systems’ efforts to reduce the burden on prescription services encourage OTC consumption across both urban and rural settings.

U.K. Over-the-Counter (OTC) Medications Market Insight

The U.K. over-the-counter (OTC) medications market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer reliance on self-care practices and a well-established retail pharmacy environment. Regulatory frameworks by the MHRA that support reclassification of prescription medications to OTC, combined with consumer trust in pharmacist guidance, are advancing market growth. Demand is particularly strong for analgesics, digestive remedies, and vitamins, with online pharmacies witnessing notable growth fueled by digital convenience and discreet purchasing options.

Germany Over-the-Counter (OTC) Medications Market Insight

The Germany over-the-counter (OTC) medications market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s strong pharmaceutical manufacturing base and high awareness of natural and preventive health products. Germans show a growing preference for herbal and homeopathic OTC remedies in addition to conventional categories. Stringent quality standards and high consumer trust in pharmacy-dispensed medications help maintain consistent demand. In addition, the country’s robust insurance system incentivizes preventive treatment, further propelling OTC usage.

Asia-Pacific Over-the-Counter (OTC) Medications Market Insight

The Asia-Pacific over-the-counter (OTC) medications market is poised to grow at the fastest CAGR of 22.6% during the forecast period of 2025 to 2032, driven by expanding populations, urbanization, and improving healthcare access across nations such as China, Japan, and India. A rising middle class and growing interest in personal wellness and preventive care are significantly influencing consumption patterns. Government initiatives promoting health awareness, increasing penetration of retail and online pharmacies, and a surge in demand for VMS (vitamins, minerals, and supplements) are key growth drivers in the region.

Japan Over-the-Counter (OTC) Medications Market Insight

The Japan over-the-counter (OTC) medications market is gaining momentum due to its aging population and cultural preference for self-care and natural remedies. The government’s efforts to promote self-medication, including tax incentives for OTC drug purchases, are accelerating market expansion. Japanese consumers frequently use OTC products to manage conditions such as colds, digestive issues, and minor pain. High product quality standards and interest in functional foods and supplements are further strengthening growth prospects in both urban and rural areas.

India Over-the-Counter (OTC) Medications Market Insight

The India over-the-counter (OTC) medications market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to its expanding healthcare consumer base, increased health literacy, and accessibility to affordable medicines. Growing demand for vitamins, digestive aids, and pain relievers is supported by a dense network of retail pharmacies and rising online pharmacy adoption. The Indian government's support for self-care initiatives and rising preference for ayurvedic and herbal remedies further enhance market penetration across urban and semi-urban regions.

Over-the-Counter (OTC) Medications Market Share

The over-the-counter (OTC) medications industry is primarily led by well-established companies, including:

- Johnson & Johnson Services, Inc. (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Bayer AG (Germany)

- Pfizer Inc. (U.S.)

- GSK plc (UK)

- Sanofi (France)

- Novartis AG (Switzerland)

- Abbott (U.S.)

- Perrigo Company plc (Ireland)

- Bristol-Myers Squibb Company (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla Limited (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Aurobindo Pharma Limited (India)

- Boehringer Ingelheim GmbH (Germany)

- Amneal Pharmaceuticals, Inc. (U.S.)

Latest Developments in Global Over-the-Counter (OTC) Medications Market

- In September 2024, Haleon, plc received U.S. FDA approval for Eroxon, a gel for the treatment of erectile dysfunction (ED). This marks a significant development as it is the first and only cleared OTC product for erectile dysfunction. This highlights a trend towards making more complex and previously prescription-only treatments available to consumers over-the-counter

- In August 2024, the U.S. FDA announced the approval of the First to Know a Home, over-the-counter syphilis diagnostic test by NOWDiagnostics. This is a first-of-its-kind kit to detect Treponema pallidum (syphilis) antibodies in human blood, underscoring the growing market for OTC diagnostic tests and empowering individuals with more immediate health insights

- In 2023, India began moving closer to establishing a streamlined regulatory framework for OTC drugs. The Drugs Technical Advisory Board (DTAB) approved recommendations from a special OTC sub-committee, proposing around 27-30 drugs (primarily analgesics, topical ointments, and cough-and-cold medications) for inclusion in India's first comprehensive OTC drugs list. This initiative also aims to allow pharmaceutical companies to advertise these brands, increasing public awareness and potentially reducing healthcare costs

- In 2023, the OTC market witnessed a strong focus on new drug formulations and enhanced delivery systems. Companies are developing fast-dissolving tablets, chewable pills, dissolvable strips, and nasal sprays to improve user experience, speed up onset of action, and offer more convenient administration methods. There's also an increasing integration of technology, such as mobile apps and wearable devices, to improve medication adherence and track health metrics

- In July 2023, several key product switches from prescription (Rx) to OTC status significantly impacted the market, particularly in North America. Notably, the accessibility of the emergency contraceptive pill, Plan B One-Step, without age restrictions, and the approval of Narcan and RiVive (naloxone nasal sprays for emergency opioid overdose treatment) and Opill (a progestin-only oral birth control pill, the first of its kind available without a prescription in the U.S.) have driven market growth by increasing consumer access to essential medications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.