Global Anesthesia Respiratory And Sleep Therapy Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.35 Billion

USD

15.32 Billion

2024

2032

USD

10.35 Billion

USD

15.32 Billion

2024

2032

| 2025 –2032 | |

| USD 10.35 Billion | |

| USD 15.32 Billion | |

|

|

|

|

Anesthesia, Respiratory and Sleep Therapy Devices Market Size

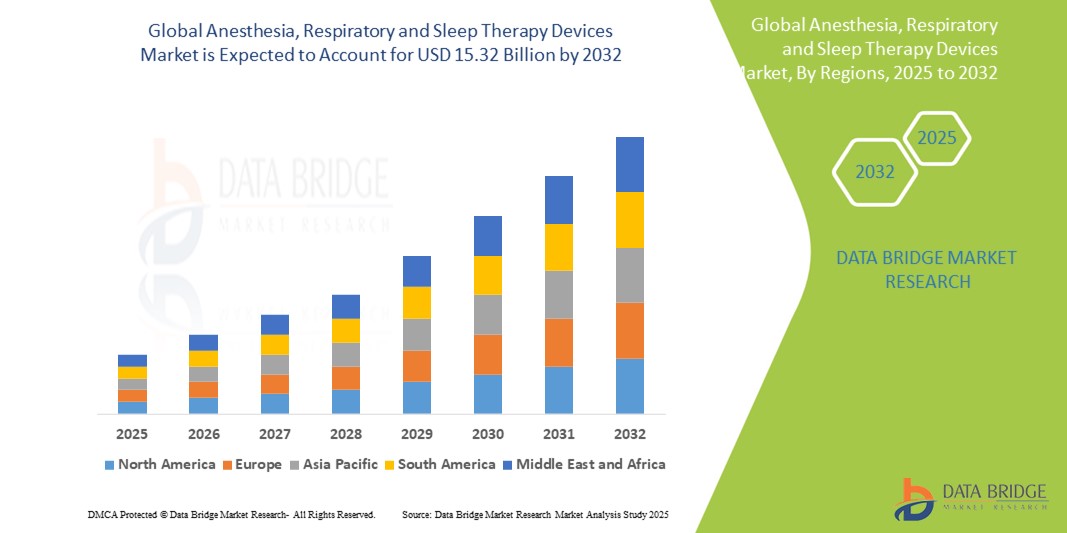

- The global anesthesia, respiratory and sleep therapy devices market size was valued at USD 10.35 billion in 2024 and is expected to reach USD 15.32 billion by 2032, at a CAGR of 5.02% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory disorders such as COPD, sleep apnea, and asthma, coupled with rising surgical volumes that demand advanced anesthesia delivery systems. The surge in geriatric populations and the growing need for post-operative respiratory care are also key drivers propelling the adoption of these devices across healthcare settings

- Furthermore, advancements in technology—such as portable and wireless respiratory devices, smart CPAP machines, and integrated monitoring systems—are transforming patient care delivery. These innovations are enhancing treatment compliance, improving patient outcomes, and supporting home-based care. Such converging factors are accelerating the uptake of Anesthesia, Respiratory, and Sleep Therapy Devices solutions, thereby significantly boosting the industry's growth

Anesthesia, Respiratory and Sleep Therapy Devices Market Analysis

- Anesthesia, respiratory, and sleep therapy devices are increasingly essential components of modern healthcare infrastructure, providing critical support in surgical procedures, chronic respiratory disease management, and sleep disorder treatment across both hospital and homecare settings due to their enhanced functionality, portability, and remote monitoring capabilities

- The escalating demand for these devices is primarily fueled by the rising prevalence of conditions such as chronic obstructive pulmonary disease (COPD), obstructive sleep apnea (OSA), asthma, and the increasing number of surgical procedures globally. In addition, technological advancements such as smart CPAP machines, AI-integrated anesthesia workstations, and wireless respiratory monitors are reshaping patient care delivery

- North America dominated the anesthesia, respiratory and sleep therapy devices market with the largest revenue share of 38.3% in 2024, characterized by early adoption of advanced medical technologies, high healthcare spending, and a strong presence of key industry players. The U.S. is experiencing substantial growth in home-use respiratory and sleep therapy devices, driven by increasing awareness of sleep health and chronic respiratory conditions

- Asia-Pacific is expected to be the fastest growing region in the anesthesia, respiratory and sleep therapy devices market with CAGR of 7.8% during the forecast period due to increasing urbanization, rising healthcare infrastructure investments, expanding medical tourism, and growing awareness about respiratory and sleep disorders in countries such as China, India, and Japan

- The respiratory devices segment dominated the anesthesia, respiratory and sleep therapy devices market, with a market revenue share of 41.6% in 2024, driven by the increasing prevalence of chronic respiratory conditions such as COPD, asthma, and respiratory infections. Demand for oxygen concentrators, nebulizers, and ventilators surged particularly post-pandemic and continues due to aging populations and rising air pollution

Report Scope and Anesthesia, Respiratory and Sleep Therapy Devices Market Segmentation

|

Attributes |

Anesthesia, Respiratory and Sleep Therapy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anesthesia, Respiratory and Sleep Therapy Devices Market Trends

“Transforming Respiratory and Sleep Care Through Smart Connectivity and Automation”

- A significant and rapidly evolving trend in the global anesthesia, respiratory and sleep therapy devices market is the integration of intelligent connectivity solutions with advanced healthcare technologies, enhancing patient care, comfort, and monitoring efficiency

- For instance, companies are leveraging smart technology to connect devices such as CPAP machines, ventilators, and nebulizers with cloud-based platforms and mobile apps that provide real-time monitoring, usage analytics, and patient adherence data to clinicians and caregivers

- Modern sleep therapy devices can now adjust air pressure automatically based on patient needs using advanced algorithms, improving both efficacy and comfort. In addition, features such as Bluetooth and Wi-Fi connectivity allow healthcare providers to remotely manage settings, receive alerts, and offer telehealth support without requiring in-person visits

- Integration with virtual assistants and mobile platforms is also gaining traction. Devices can now remind users to complete breathing therapy sessions, monitor environmental conditions affecting respiratory health, and even sync with wearable devices to offer a holistic view of sleep patterns and respiratory function

- This move toward smarter, interconnected devices is empowering patients with greater control over their treatment while enabling clinicians to make more informed decisions through continuous, data-driven insights

- Companies such as ResMed and Philips are at the forefront of this transformation, offering smart CPAP and BiPAP systems equipped with user-friendly apps, auto-titration features, and cloud-based data analytics, driving a new era of personalized respiratory care

Anesthesia, Respiratory and Sleep Therapy Devices Market Dynamics

Driver

“Growing Need Due to Rising Respiratory Disease Burden and Homecare Adoption”

- The increasing prevalence of chronic respiratory conditions such as asthma, COPD, and obstructive sleep apnea, coupled with a rising geriatric population, is significantly driving the demand for advanced anesthesia, respiratory, and sleep therapy devices

- For instance, in April 2024, ResMed launched its latest generation of connected CPAP devices that offer real-time remote monitoring and data sharing, enabling healthcare professionals to optimize treatment outcomes for patients with sleep apnea. These technological strides are expected to further accelerate market growth during the forecast period

- As patients and caregivers seek more effective and comfortable respiratory care solutions, the availability of devices with features such as automatic pressure adjustment, wireless connectivity, and app integration has made at-home care more accessible and appealing

- Furthermore, the global push toward decentralized healthcare and the increasing popularity of home-based treatments are making these devices integral to chronic disease management. Smart inhalers, wearable respiratory monitors, and portable ventilators are increasingly being adopted to reduce hospital visits and manage conditions proactively

- The ability to monitor therapy compliance, track respiratory metrics in real-time, and share data seamlessly with providers is enhancing both patient engagement and treatment efficacy. This digital shift is transforming traditional respiratory care models, making them more patient-centric and outcomes-driven

Restraint/Challenge

“High Device Costs and Limited Access in Developing Regions”

- The relatively high cost of advanced anesthesia, respiratory, and sleep therapy devices remains a key challenge, especially in low- and middle-income countries where healthcare budgets are limited. Portable ventilators, high-end CPAP machines, and integrated monitoring systems may not be affordable for a large segment of the population

- For instance, smart CPAP devices with auto-adjusting pressure and wireless connectivity can cost significantly more than basic models, restricting access for patients in resource-constrained settings

- In addition, disparities in healthcare infrastructure and reimbursement policies hinder the widespread adoption of these technologies in emerging markets. Limited awareness and lack of trained personnel for device management can further delay uptake

- To overcome these challenges, industry players are focusing on developing cost-effective solutions tailored for diverse regional needs, and governments are working to expand access through subsidized programs and public-private partnerships

- Expanding telehealth support, enhancing device interoperability, and simplifying user interfaces will be critical to ensuring broader access and sustained growth of the market globally

Anesthesia, Respiratory and Sleep Therapy Devices Market Scope

The market is segmented on the basis of device type, application, and end user.

• By Device Type

On the basis of device type, the anesthesia, respiratory and sleep therapy devices market is segmented into anesthesia devices, respiratory devices, therapeutic obstructive sleep apnea devices, sleep diagnostic devices, and others. The respiratory devices segment dominated the largest market revenue share of 41.6% in 2024, driven by the increasing prevalence of chronic respiratory conditions such as COPD, asthma, and respiratory infections. Demand for oxygen concentrators, nebulizers, and ventilators surged particularly post-pandemic and continues due to aging populations and rising air pollution.

The therapeutic obstructive sleep apnea devices segment is anticipated to witness the fastest growth rate of 22.5% from 2025 to 2032, owing to growing awareness and diagnosis of sleep-related breathing disorders. CPAP and BiPAP machines are seeing increased adoption in both hospital and homecare settings, further boosted by telemonitoring-enabled models.

• By Application

On the basis of application, the anesthesia, respiratory and sleep therapy devices market is segmented into household, hospital, and others. The hospital segment held the largest market share in 2024, accounting for 49.3% of the total revenue, as hospitals continue to be the primary point-of-care for critical and surgical procedures requiring anesthesia, intensive respiratory support, and diagnostic sleep studies.

The household segment is expected to register the fastest CAGR of 23.1% during the forecast period, driven by the rising preference for home-based care. Increasing use of portable respiratory devices, home CPAP/BiPAP machines, and oxygen concentrators is supporting this growth, along with improved patient monitoring via connected health platforms.

• By End User

On the basis of end user, the anesthesia, respiratory and sleep therapy devices market is segmented into hospitals, ambulatory service centers, homecare, and clinics. The hospitals segment accounted for the largest revenue share of 45.7% in 2024, due to the high volume of surgical procedures and intensive care treatments, requiring anesthesia and respiratory support. Hospitals are also major adopters of sleep diagnostic equipment and advanced respiratory monitoring systems.

The homecare segment is projected to grow at the highest CAGR of 24.4% from 2025 to 2032, fueled by the increasing aging population, rising healthcare costs, and the demand for decentralized care. The integration of remote patient monitoring and compact, user-friendly devices is making home-based treatment more viable than ever.

Anesthesia, Respiratory and Sleep Therapy Devices Market Regional Analysis

- North America dominated the anesthesia, respiratory and sleep therapy devices market with the largest revenue share of 38.3% in 2024, driven by the rising prevalence of chronic respiratory conditions such as COPD, asthma, and sleep apnea, alongside increasing surgical procedures requiring anesthesia devices

- Consumers in the region increasingly prioritize advanced respiratory support technologies for both hospital and home settings, including CPAP, BiPAP, oxygen concentrators, and portable ventilators, due to growing awareness of sleep health and respiratory care

- This dominance is further reinforced by the presence of key market players, favorable reimbursement policies, strong distribution networks, and the region’s high healthcare spending, which collectively accelerate the adoption of cutting-edge anesthesia and respiratory care technologies

U.S. Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The U.S. anesthesia, respiratory and sleep therapy devices market captured the largest revenue share of 82.05% in 2024 within North America, driven by the increasing prevalence of respiratory disorders such as COPD, asthma, and sleep apnea. The growing adoption of home-based respiratory care, favorable reimbursement policies, and strong presence of key market players are supporting market expansion. Technological advancements in CPAP, BiPAP, and portable oxygen concentrators, coupled with the rising demand for remote patient monitoring, are further fueling growth in this segment.

Europe Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The Europe anesthesia, respiratory and sleep therapy devices market held a revenue share of 26.4% in 2024, and is projected to expand at a substantial CAGR during the forecast period, primarily driven by the aging population, stringent regulatory guidelines for patient safety, and the rise in surgical procedures. Increased awareness regarding sleep disorders and respiratory health, along with the availability of advanced therapeutic devices, is supporting market development. Countries such as Germany, France, and the U.K. are key contributors due to well-established healthcare infrastructures and early technology adoption.

U.K. Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The U.K. anesthesia, respiratory and sleep therapy devices market accounted for 18.2% of the Europe market share in 2024, and is anticipated to grow at a noteworthy CAGR, fueled by increasing diagnoses of sleep apnea, asthma, and other chronic respiratory conditions. The rise in day-care surgeries, telehealth expansion, and adoption of compact, patient-friendly devices for home care are contributing to this growth. National health initiatives and NHS investments in respiratory care infrastructure are also boosting demand.

Germany Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The Germany anesthesia, respiratory and sleep therapy devices market captured 21.6% of the Europe market in 2024, and is expected to expand at a considerable CAGR over the forecast period, driven by high healthcare spending, a strong emphasis on innovation, and growing geriatric population. Increased use of anesthesia machines in hospitals and the demand for non-invasive ventilation systems in chronic care are key growth factors. The country also benefits from strong manufacturing capabilities and rapid integration of digital health technologies.

Asia-Pacific Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The Asia-Pacific anesthesia, respiratory and sleep therapy devices market is poised to grow at the fastest CAGR of 7.8% during the forecast period (2025–2032), owing to rising pollution levels, increasing incidence of respiratory disorders, and growing healthcare expenditures in emerging countries. Markets in China, India, and Japan are witnessing strong demand due to large patient pools, government-backed healthcare initiatives, and expanding access to medical devices in rural areas.

Japan Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The Japan anesthesia, respiratory and sleep therapy devices market held a share of 27.3% within the Asia-Pacific market in 2024, gaining traction due to the country’s advanced medical infrastructure and increasing elderly population suffering from respiratory illnesses and sleep disorders. The integration of digital health monitoring with sleep and respiratory therapy devices, along with high patient awareness, is accelerating market penetration. Japan's preference for minimally invasive and portable devices is also influencing product development and adoption.

China Anesthesia, Respiratory and Sleep Therapy Devices Market Insight

The China anesthesia, respiratory and sleep therapy devices market accounted for the largest revenue share of 41.8% within Asia-Pacific in 2024, due to rapid urbanization, a surge in chronic respiratory diseases, and strong investment in healthcare infrastructure. China's expanding middle class and the government's push for healthcare modernization have boosted demand for anesthesia and sleep therapy equipment. Moreover, the presence of domestic manufacturers offering cost-effective solutions is enhancing market growth across both hospital and home-care settings.

Anesthesia, Respiratory and Sleep Therapy Devices Market Share

The anesthesia, respiratory and sleep therapy devices industry is primarily led by well-established companies, including:

- Aerogen (Ireland)

- BD (U.S.)

- Medtronic (Ireland)

- Drägerwerk AG & Co. KGaA (Germany)

- GE HealthCare

- Koninklijke Philips N.V. (Netherlands)

- ResMed (U.S.)

- ICU Medical, Inc. (U.K.)

- Teleflex Incorporated (U.S.)

- SunMED Medical (U.S.)

- Hamilton Medical (Switzerland)

- 3M (U.S.)

- Ambu A/S (U.S.)

- Allied Medical LLC (U.S.)

- Rotech Healthcare Inc. (U.S.)

Latest Developments in Global Anesthesia, Respiratory and Sleep Therapy Devices Market

- In April 2023, Philips Healthcare, a global leader in medical technology, launched a comprehensive respiratory care initiative in South Africa aimed at expanding access to its advanced Anesthesia, Respiratory and Sleep Therapy Devices. This strategic effort focuses on enhancing care delivery for patients with chronic respiratory diseases through innovative solutions such as portable oxygen concentrators and home-use CPAP devices. By leveraging its global expertise and strong product portfolio, Philips is addressing local healthcare challenges while reinforcing its presence in the fast-growing African respiratory care market

- In March 2023, ResMed Inc., a key player in sleep and respiratory care, introduced an upgraded version of its AirSense 11 CPAP system tailored for the U.S. and European markets. The new device integrates digital health tools for sleep tracking, automated pressure adjustments, and remote patient monitoring, improving treatment adherence and outcomes for patients with obstructive sleep apnea. This launch underlines ResMed's commitment to driving innovation in sleep therapy through connected, patient-centric technologies

- In March 2023, GE HealthCare announced the deployment of its advanced anesthesia delivery systems in hospitals across India as part of its broader effort to modernize operating room technologies. These systems feature precision-controlled drug delivery, integrated monitoring capabilities, and reduced environmental impact, aligning with the growing demand for efficient perioperative care. This initiative supports the expansion of surgical infrastructure and anesthesia safety in emerging markets

- In February 2023, Fisher & Paykel Healthcare expanded its footprint in Latin America by establishing a new logistics and training hub in Brazil to support the delivery and use of its humidification and respiratory therapy solutions. The company emphasized improved clinician training, device availability, and after-sales service, reinforcing its position as a trusted provider of hospital-grade and home respiratory care equipment across developing healthcare systems

- In January 2023, Medtronic plc unveiled its next-generation Puritan Bennett ventilator platform at the Arab Health Exhibition in Dubai. Designed for both ICU and transport use, the system features intelligent ventilation algorithms, simplified user interfaces, and modular components to enhance ease of use and clinical performance. This product innovation demonstrates Medtronic’s commitment to addressing critical care demands in both high-acuity and remote care settings globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.