Global Anisakiasis Treatment Market

Market Size in USD Million

CAGR :

%

USD

822.85 Million

USD

1,126.13 Million

2025

2033

USD

822.85 Million

USD

1,126.13 Million

2025

2033

| 2026 –2033 | |

| USD 822.85 Million | |

| USD 1,126.13 Million | |

|

|

|

|

Anisakiasis Treatment Market Size

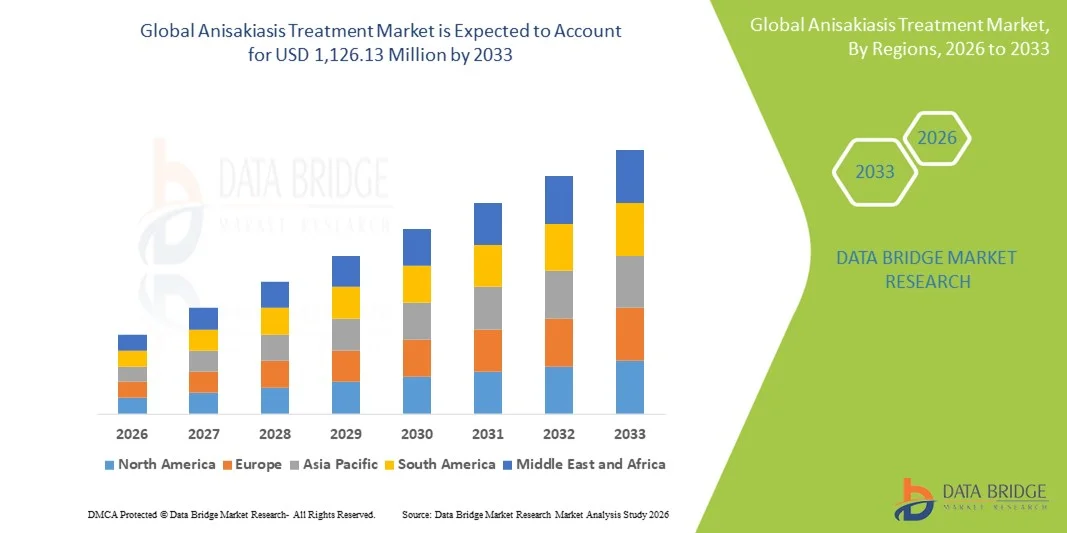

- The global anisakiasis treatment market size was valued at USD 822.85 million in 2025 and is expected to reach USD 1,126.13 million by 2033, at a CAGR of 4.00% during the forecast period

- The market growth is largely fueled by the rising incidence of anisakiasis infections linked to increased global consumption of raw and undercooked seafood, driving steady demand for diagnostic and therapeutic interventions

- Furthermore, growing awareness among healthcare providers about parasitic gastrointestinal disorders, along with advancements in endoscopic and pharmacological treatment options, is establishing targeted anisakiasis management as a necessary clinical focus. These converging factors are supporting wider adoption of specialized treatment approaches, thereby contributing to the industry's overall expansion

Anisakiasis Treatment Market Analysis

- Anisakiasis treatment, focused on managing infections caused by Anisakis parasites through endoscopic extraction, antiparasitic medications, and supportive therapy, is becoming increasingly significant in seafood-consuming regions as healthcare systems enhance capabilities for rapid identification and treatment of gastrointestinal parasitic diseases

- The rising demand for anisakiasis treatment is primarily driven by expanding global consumption of raw or minimally cooked fish, increased clinical recognition of foodborne parasitic illnesses, and higher awareness among consumers and health professionals together contributing to steady market

- North America dominated the anisakiasis treatment market with a revenue share of 38.2% in 2025, supported by advanced diagnostic infrastructure, strong clinical reporting mechanisms, and increasing seafood consumption patterns, with the U.S. experiencing a continuous rise in endoscopy-confirmed cases detected in emergency and gastroenterology settings

- Asia-Pacific is expected to be the fastest-growing region due to high seafood intake, growing medical awareness, and increased case identification in countries such as Japan, South Korea, and China, contributing significantly to future market share gains

- The endoscopy segment dominated the market with a 46.8% share in 2025, driven by its effectiveness in immediate parasite removal, rapid patient stabilization, and its position as the gold-standard first-line procedure across hospitals and gastrointestinal clinics worldwide

Report Scope and Anisakiasis Treatment Market Segmentation

|

Attributes |

Anisakiasis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Anisakiasis Treatment Market Trends

Rising Precision Through Advanced Endoscopic and Diagnostic Integration

- A significant and accelerating trend in the global anisakiasis treatment market is the deepening integration of advanced endoscopic technologies and real-time diagnostic imaging systems, enabling faster detection, improved parasite visualization, and more efficient clinical intervention for gastrointestinal parasitic infections

- For instance, modern high-definition endoscopy platforms equipped with enhanced imaging modes allow clinicians to identify larvae more accurately and remove them with greater precision during procedures, significantly improving patient outcomes

- AI-assisted diagnostic tools are increasingly being used to analyze gastrointestinal imaging, identify parasite-related abnormalities earlier, and enhance decision-making, while some hospitals are implementing smart workflow systems to streamline endoscopy scheduling and follow-up care

- The seamless integration of diagnostic imaging, AI-supported clinical software, and minimally invasive endoscopic tools enables centralized, coordinated care that improves treatment accuracy and operational efficiency across gastroenterology departments

- This trend toward more intelligent, precise, and technologically advanced treatment pathways is reshaping expectations for managing parasitic gastrointestinal infections, prompting companies and medical device developers to invest in innovation that enhances detection and therapeutic success rates

- The demand for anisakiasis treatment solutions supported by enhanced diagnostic and endoscopic integration is growing steadily across hospitals and specialty clinics as healthcare providers prioritize accuracy, speed, and minimally invasive procedures

Anisakiasis Treatment Market Dynamics

Drive

Growing Need Due to Rising Seafood Consumption and Increased Clinical Awareness

- The increasing global consumption of raw or undercooked seafood, combined with rising clinical awareness of foodborne parasitic infections, is a significant driver for the heightened demand for anisakiasis treatment solutions

- For instance, in recent years, hospitals and research institutions in Japan and Europe have reported a measurable increase in diagnosed anisakiasis cases, leading to expanded deployment of endoscopic resources and improved clinical reporting systems

- As consumers become more aware of the risks associated with parasitic infections, healthcare providers are emphasizing timely diagnosis through endoscopy, imaging, and serological tests, offering a strong improvement over delayed or incorrect identification of symptoms

- Furthermore, the growing adoption of advanced diagnostic tools and the expansion of gastroenterology departments in high-risk regions are making anisakiasis treatment more accessible and effective, supporting broader adoption of modern treatment techniques

- The emphasis on rapid intervention, improved patient management, and the ability to remove larvae immediately through endoscopy are key factors propelling the demand for structured anisakiasis care across hospitals and specialty centers

- The trend toward upgrading diagnostic capabilities and increasing clinical preparedness in regions with high seafood consumption further contributes to the growth of the anisakiasis treatment market

Restraint/Challenge

Limited Awareness Issues and Regulatory Compliance Hurdles

- Concerns surrounding limited public awareness of anisakiasis symptoms and the underdiagnosis of parasitic infections pose a significant challenge to broader adoption of standardized treatment pathways, particularly in regions lacking strong healthcare infrastructure

- For instance, delayed diagnosis caused by symptom similarity to other gastrointestinal disorders often results in mismanagement, discouraging consistent investment in specialized detection tools and contributing to underreporting in many countries

- Addressing these challenges through expanded clinician training, increased public health guidance, and improved diagnostic protocol implementation is crucial for ensuring accurate and timely treatment, while hospitals emphasize standardized procedures and updated clinical guidelines to improve case identification

- In addition, the relatively limited availability of specialized endoscopic equipment and the need for regulatory approval of advanced diagnostic technologies can act as barriers for facilities in low-resource or rural environments

- While accessibility is gradually improving, the perceived complexity and cost associated with advanced diagnostics may still hinder adoption, especially among smaller healthcare centers that lack sufficient equipment or trained specialists

- Overcoming these challenges through targeted awareness campaigns, broader clinical education, infrastructure upgrades, and supportive regulatory pathways will be vital for expanding the reach and effectiveness of anisakiasis treatment worldwide

Anisakiasis Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, dosage, route of administration, demographic, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the anisakiasis treatment market is segmented into albendazole, surgery, and others. The albendazole segment dominated the market with the largest revenue share in 2025, driven by its established role as the most widely prescribed antiparasitic medication for gastrointestinal nematode infections. Its strong clinical efficacy, straightforward dosing, and suitability across adult and pediatric populations strengthen its use in emergency and outpatient settings. The availability of both branded and generic versions ensures broad affordability, especially in regions with high seafood consumption. Healthcare providers also prefer albendazole due to its well-documented safety profile and inclusion in global parasitic disease management guidelines. As hospital and clinic awareness increases worldwide, albendazole continues to serve as the primary therapeutic option even in mild to moderate cases.

The surgery segment is anticipated to witness the fastest growth rate during the forecast period, driven by the rising adoption of endoscopic extraction as a definitive and immediate intervention for anisakiasis. Endoscopic removal of larvae provides near-instant symptom relief, reduces the risk of complications, and is often preferred in acute or severe presentations. Technological advancements in minimally invasive endoscopy systems, higher availability of specialized GI facilities, and improved physician training contribute to its accelerating demand. As diagnostic accuracy improves in developed regions, more patients undergo therapeutic endoscopy at the time of diagnosis, naturally expanding the surgical intervention segment. A growing number of hospitals globally are integrating advanced endoscopy units, further supporting the segment’s strong growth trajectory.

- By Diagnosis

On the basis of diagnosis, the market is segmented into endoscopy, serologic testing, biopsy, and others. The endoscopy segment held the largest market revenue share of 46.8% in 2025, as it remains the gold standard for both diagnosing and treating anisakiasis by enabling direct visualization and immediate removal of larvae. This dual diagnostic-therapeutic advantage positions endoscopy as the most dependable approach in emergency care settings. Hospitals continually invest in advanced imaging technologies, such as high-definition endoscopes and narrow-band imaging, which further enhance detection accuracy. Rising adoption of endoscopy for abdominal pain evaluation also increases incidental identification of the parasite. Its high success rate and ability to prevent complications support strong utilization across developed healthcare systems.

The serologic testing segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing recognition of chronic hypersensitivity reactions associated with Anisakis infections. Serologic assays offer a non-invasive alternative for identifying patients who present with allergic or delayed gastrointestinal symptoms. Improvements in immunoassay sensitivity and laboratory infrastructure across Asia-Pacific and Europe are encouraging broader adoption. As clinicians become more aware of foodborne parasitic allergens, serology is increasingly used in both initial diagnosis and follow-up care. The rising burden of seafood-related allergic reactions also supports the expanding use of serologic testing panels worldwide.

- By Dosage

On the basis of dosage, the market is segmented into tablet and suspension. The tablet segment dominated the market in 2025, supported by its widespread use in adult patients and consistent availability across hospital and retail pharmacies. Tablet formulations of albendazole remain the standard due to their stability, ease of storage, and long shelf life, making them ideal for large-scale distribution. Most global treatment guidelines recommend tablet-based albendazole as the first-line oral therapy, reinforcing strong clinical preference. Tablets also enable convenient fixed-dose regimens, which simplify patient compliance and reduce the such aslihood of dosing errors. Their lower cost compared to liquid forms further strengthens their dominance across emerging and developed markets asuch as.

The suspension segment is expected to witness the fastest growth from 2026 to 2033, driven by the need for flexible dosing in pediatric and geriatric populations and patients unable to swallow tablets. Liquid suspensions allow weight-adjusted dosing and improved palatability, supporting higher treatment adherence. Growing pediatric diagnosis of parasitic infections in Asia-Pacific and Latin America is fueling increased use of suspension formulations. Healthcare providers also recommend suspensions in cases requiring rapid gastrointestinal absorption. Pharmaceutical manufacturers are expanding production of albendazole suspensions, contributing to accelerated market adoption.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and others. The oral segment held the largest revenue share in 2025, as oral medications, primarily albendazole, remain the cornerstone of anisakiasis management in mild to moderate cases. Oral treatment offers accessibility, convenience, and cost efficiency, making it widely preferred in outpatient and primary care settings. Its non-invasive nature ensures ease of use for diverse patient groups, and its presence in essential medicine lists in multiple countries enhances availability. The majority of healthcare systems across Asia-Pacific, Europe, and North America rely on oral therapy for suspected parasitic infections, reinforcing segment stability. As awareness campaigns grow, oral formulations continue to be the first therapeutic step for patients presenting with early symptoms.

The “others” segment mainly endoscopic therapeutic interventions is expected to grow at the fastest CAGR from 2026 to 2033, driven by an increasing number of hospitals performing direct endoscopic extraction of larvae. These procedures provide immediate symptom resolution and eliminate the parasite without requiring extended pharmacologic therapy. Advancements in endoscope flexibility, visualization, and biopsy channel tools enhance precision, making the procedure more widely accessible. As diagnostic rates improve and gastrointestinal emergency capabilities expand globally, endoscopic treatment adoption is expected to rise rapidly.

- By Demographic

On the basis of demographic groups, the market is segmented into adult, pediatric, and geriatric populations. The adult segment dominated the market in 2025, largely due to higher exposure to raw seafood dishes such as sushi, ceviche, and sashimi, which are most commonly consumed by working-age individuals. Adults also represent the majority of patients seeking treatment for gastrointestinal symptoms, contributing to greater diagnostic rates. Their higher utilization of hospital and clinic services ensures greater detection accuracy, further increasing market share. Awareness campaigns regarding foodborne parasitic infections are primarily targeted at adults, enhancing early case identification. The demographic’s broad access to specialized gastroenterology care further supports its leading position.

The pediatric segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing detection of parasitic infections in children as healthcare systems improve monitoring and diagnostic capabilities. Pediatric patients often present with more acute symptoms, prompting parents to seek urgent medical evaluation, leading to earlier diagnosis. The demand for liquid suspension formulations aligns with the needs of this group, supporting a more robust treatment landscape. Rising educational campaigns around foodborne illnesses in schools and pediatric practices also contribute to greater awareness. As seafood consumption increases among families globally, the pediatric caseload is expected to expand steadily.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated the market in 2025, as hospitals remain the primary facilities equipped for endoscopic diagnosis and emergency treatment of anisakiasis. Most acute cases require immediate intervention, which is typically available only in hospital settings with advanced GI units. Hospitals also manage the majority of complications associated with parasitic infections, reinforcing their central role in treatment pathways. The high availability of diagnostic imaging, laboratory testing, and skilled specialists further supports the segment’s dominance. Increased investments in gastrointestinal care units across developed and emerging markets continue to expand hospital-based treatment capacity.

Clinics are expected to exhibit the fastest growth from 2026 to 2033, driven by a rise in outpatient visits for gastrointestinal symptoms and increasing availability of specialist gastroenterologists in clinic environments. Clinics are increasingly incorporating serologic testing and basic diagnostic tools, enabling early detection and referral when necessary. Their convenience, shorter wait times, and lower costs compared to hospitals attract a growing patient population. Many clinics now serve as initial diagnostic points in regions with high seafood consumption. As awareness improves, more mild to moderate cases are expected to be managed at the clinic level.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment held the largest market revenue share in 2025, supported by the centralization of acute anisakiasis treatment within hospital settings where endoscopies and immediate follow-up medications are administered. Hospital pharmacies ensure rapid access to albendazole, proton pump inhibitors, and other supportive therapies required in acute care. Tight integration between diagnostic departments and on-site pharmacies enhances continuity of care. Hospitals also maintain higher inventory levels for emergency parasitic treatments, reinforcing their leading market position.

The online pharmacy segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by increasing digital adoption among patients seeking convenient access to antiparasitic medications. E-prescription compatibility, home delivery options, and price transparency make online platforms particularly attractive in urban settings. As telehealth expands, more patients receive treatment plans remotely and order medications through digital channels. Growing internet penetration and improved regulatory oversight of online pharmacies further support the segment’s rapid expansion.

Anisakiasis Treatment Market Regional Analysis

- North America dominated the anisakiasis treatment market with a revenue share of 38.2% in 2025, supported by advanced diagnostic infrastructure, strong clinical reporting mechanisms, and increasing seafood consumption patterns, with the U.S. experiencing a continuous rise in endoscopy-confirmed cases detected in emergency and gastroenterology settings

- Consumers and healthcare providers in the region place high value on timely detection, effective therapeutic intervention, and improved patient outcomes, supported by robust hospital systems and gastrointestinal specialty care

- This growing focus on accurate diagnosis, coupled with rising seafood consumption and heightened awareness of gastrointestinal health risks, has positioned North America as the leading region for anisakiasis treatment adoption across both emergency and specialized care environments

U.S. Anisakiasis Treatment Market Insight

The U.S. anisakiasis treatment market captured the largest revenue share in 2025 within North America, driven by advanced diagnostic infrastructure and increasing clinical identification of seafood-borne parasitic infections. Hospitals and GI centers are witnessing a steady rise in patients presenting with acute gastrointestinal symptoms linked to raw or lightly cooked seafood consumption. Growing awareness among clinicians, combined with improved access to endoscopy and serologic testing, is strengthening market demand. Moreover, the expanding popularity of sushi, sashimi, ceviche, and poke bowls across the U.S. is contributing to higher case detection. The integration of advanced endoscopic technologies and updated clinical guidelines further propels treatment uptake.

Europe Anisakiasis Treatment Market Insight

The Europe anisakiasis treatment market is projected to expand at a notable CAGR throughout the forecast period, supported by strong food safety regulations and increased recognition of fish-borne parasites. Rising seafood consumption particularly raw, marinated, and lightly processed fish products is contributing to growing case incidence in Mediterranean and Western European countries. Healthcare facilities across Europe are adopting improved diagnostic tools, boosting early detection and effective treatment. Consumer focus on safe seafood handling and rising clinician awareness are fostering market growth. Furthermore, increased investments in hospital gastroenterology units are strengthening Europe’s treatment capacity.

U.K. Anisakiasis Treatment Market Insight

The U.K. anisakiasis treatment market is anticipated to grow at a significant CAGR during the forecast period, driven by heightened consumer awareness regarding seafood-related health risks and the rising popularity of imported raw fish dishes. Healthcare providers in the U.K. are increasingly identifying anisakiasis cases due to improved diagnostic vigilance and availability of specialized endoscopy services. Concerns surrounding foodborne parasites are pushing both consumers and regulators to emphasize rapid detection and appropriate care. In addition, strong adoption of advanced medical technologies and efficient clinical pathways supports market expansion.

Germany Anisakiasis Treatment Market Insight

The Germany anisakiasis treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of gastrointestinal parasitic infections and a strong healthcare infrastructure. Germany’s emphasis on medical innovation and preventive diagnostics promotes widespread availability of endoscopy and serologic testing. Rising consumption of seafood products, including marinated and raw preparations, is contributing to higher detection rates. The country’s focus on high-quality medical care, stringent food safety standards, and advanced clinical capabilities drives continued growth in anisakiasis treatment adoption.

Asia-Pacific Anisakiasis Treatment Market Insight

The Asia-Pacific anisakiasis treatment market is poised to grow at the fastest CAGR during 2026 to 2033, supported by high seafood consumption and significant case prevalence in countries such as Japan, South Korea, and coastal China. Increasing diagnostic awareness, expanding hospital capacity, and rapid urbanization are accelerating treatment demand. Government initiatives aimed at improving food safety surveillance and healthcare modernization are further driving uptake. As APAC remains a global hub for seafood distribution and consumption, the need for effective diagnosis and treatment options continues to rise across both urban and coastal populations.

Japan Anisakiasis Treatment Market Insight

The Japan anisakiasis treatment market is gaining strong momentum due to the country’s exceptionally high raw seafood consumption and advanced medical infrastructure. Japan records some of the highest anisakiasis case numbers globally, driving consistent demand for endoscopy and antiparasitic treatment. Hospitals are equipped with cutting-edge gastrointestinal technologies, enabling rapid and accurate diagnosis. The widespread integration of medical IoT devices and imaging systems further strengthens patient management. In addition, Japan’s aging population increases the need for fast, minimally invasive care, supporting strong treatment market growth.

India Anisakiasis Treatment Market Insight

The India anisakiasis treatment market accounted for a sizeable revenue share in Asia Pacific in 2025, driven by rising seafood consumption across coastal cities and improved healthcare access. Growing middle-class awareness regarding foodborne illnesses and expanded diagnostic capabilities are supporting market development. India’s rapid modernization of hospital infrastructure, combined with increased availability of trained gastroenterologists, enhances treatment rates. The country’s expanding seafood imports and evolving dietary habits contribute to heightened clinical vigilance. In addition, government initiatives promoting food safety and digital health diagnostics are propelling sustained market growth.

Anisakiasis Treatment Market Share

The Anisakiasis Treatment industry is primarily led by well-established companies, including:

- GSK plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Cipla Limited (India)

- Dr. Reddy's Laboratories Ltd. (India)

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Olympus Corporation (Japan)

- FUJIFILM Holdings Corporation (Japan)

- HOYA Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland

- Karl Storz SE & Co. KG (Germany)

- ERBE Elektromedizin GmbH (Germany)

- Cook (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

What are the Recent Developments in Global Anisakiasis Treatment Market?

- In June 2025, a case report was published of ascites (abdominal fluid accumulation) caused by intestinal anisakiasis in a 63-year-old Japanese woman, where anti-Anisakis antibodies (IgG/IgE) confirmed the diagnosis and the patient recovered with supportive care

- In February 2024, researchers reported the first known case of invasive anisakiasis in Greece, which clinically mimicked a peritoneal malignancy. A young patient with repeated raw-fish consumption presented with subacute abdominal pain; imaging suggested an intra-abdominal tumor-such as mass

- In February 2024, a case was reported of a 53-year-old man in Japan whose small intestine (jejunal) wall showed thickening on CT; doctors used double-balloon enteroscopy to find and remove an Anisakis larva embedded in the jejunum

- In November 2023, a case report described how clinicians successfully used jumbo forceps to remove an Anisakis simplex larva that had deeply invaded the gastric mucosa. The larva was not removable using standard biopsy forceps because of how deeply it embedded in the stomach lining

- In July 2023, a case study from Spain reported a patient with intestinal obstruction caused by anisakiasis, who was treated surgically followed by physical therapy. The paper emphasized that anisakiasis should be considered in the differential diagnosis when imaging shows non-specific signs of intestinal obstruction, especially in regions with high fish consumption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.