Global Ankylosing Spondylitis As Market

Market Size in USD Billion

CAGR :

%

USD

6.82 Billion

USD

13.08 Billion

2025

2033

USD

6.82 Billion

USD

13.08 Billion

2025

2033

| 2026 –2033 | |

| USD 6.82 Billion | |

| USD 13.08 Billion | |

|

|

|

|

Ankylosing Spondylitis (AS) Market Size

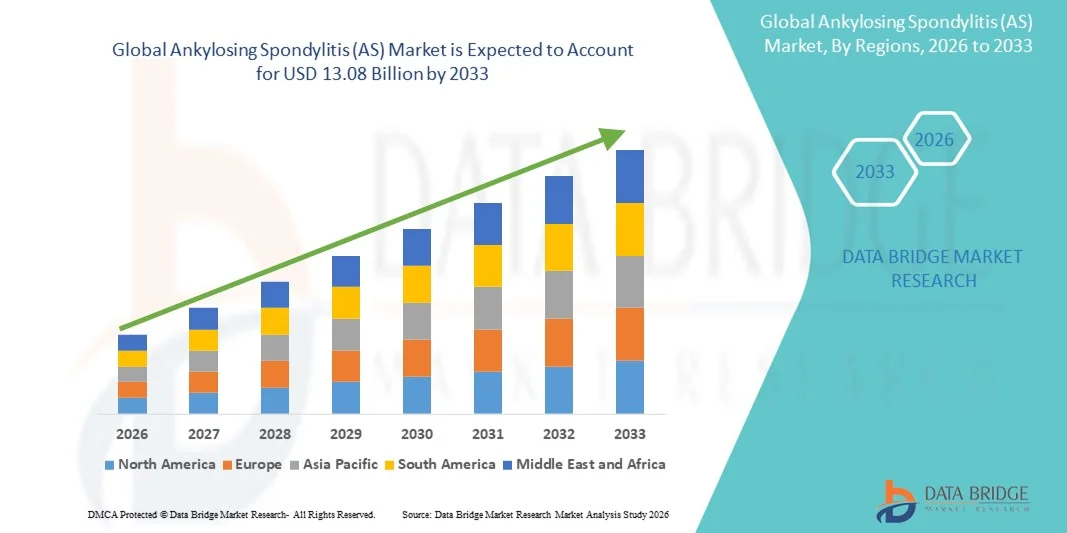

- The global Ankylosing Spondylitis (AS) market size was valued at USD 6.82 billion in 2025 and is expected to reach USD 13.08 billion by 2033, at a CAGR of 8.48% during the forecast period

- The market growth is largely fueled by increasing prevalence of autoimmune and inflammatory disorders, along with advancements in biologics, targeted therapies, and diagnostic tools for early detection and management of AS

- Furthermore, rising awareness among patients and healthcare providers about the benefits of personalized treatment regimens, combined with growing investments in R&D for novel therapeutics, is driving demand for effective and safer treatment options. These converging factors are accelerating the adoption of innovative AS therapies, thereby significantly boosting the industry's growth

Ankylosing Spondylitis (AS) Market Analysis

- Ankylosing Spondylitis (AS), a chronic inflammatory disease primarily affecting the spine and sacroiliac joints, is increasingly recognized as a major contributor to reduced quality of life and functional disability, driving demand for effective management strategies across both developed and emerging markets

- The escalating demand for Ankylosing Spondylitis (AS) treatments is primarily fueled by increasing disease prevalence, rising awareness among patients and healthcare providers, and advancements in biologics, targeted therapies, and personalized treatment approaches that improve patient outcomes

- North America dominated the Ankylosing Spondylitis (AS) market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and the presence of major pharmaceutical companies leading R&D efforts, with the U.S. witnessing significant uptake of biologics and novel therapeutics for Ankylosing Spondylitis (AS) management

- Asia-Pacific is expected to be the fastest growing region in the Ankylosing Spondylitis (AS) market during the forecast period due to increasing healthcare access, rising disposable incomes, and growing awareness about early diagnosis and treatment of autoimmune disorders

- Biologics segment dominated the Ankylosing Spondylitis (AS) market with a market share of 45.8% in 2025, driven by their proven efficacy in controlling inflammation, slowing disease progression, and improving patient quality of life

Report Scope and Ankylosing Spondylitis (AS) Market Segmentation

|

Attributes |

Ankylosing Spondylitis (AS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ankylosing Spondylitis (AS) Market Trends

Shift Toward Advanced Biologics and Personalized Therapy

- A significant and accelerating trend in the global AS market is the growing adoption of advanced biologics, interleukin inhibitors, JAK inhibitors, and personalized treatment approaches, offering better disease management and improved patient outcomes

- For instance, Bimekizumab (BIMZELX), a dual IL‑17A/IL‑17F inhibitor, provides new therapeutic options for patients who do not respond to TNF inhibitors, expanding treatment possibilities

- Personalized medicine integration enables therapies tailored to individual patient genetics, biomarkers, and disease profiles, improving efficacy and reducing adverse effects

- Early diagnosis facilitated by advanced imaging techniques (MRI/CT) and genetic testing allows timely initiation of therapy, which can improve long-term outcomes and reduce complications

- Increasing investment in research and development is driving innovation in novel therapeutics and combination therapies for AS, addressing unmet patient needs

- Digital health tools, including telemedicine and remote monitoring apps, are enabling better disease management, adherence tracking, and patient engagement

- This trend toward targeted, individualized, and more effective treatment paradigms is reshaping patient and physician expectations, creating increased demand for comprehensive AS management solutions

- The demand for therapies that combine efficacy, safety, and personalized approaches is growing rapidly across both developed and emerging markets, as patients and healthcare providers prioritize optimal disease control

Ankylosing Spondylitis (AS) Market Dynamics

Driver

Rising Prevalence and Increased Awareness Driving Therapy Adoption

- The growing prevalence of AS globally, coupled with rising awareness among patients and healthcare professionals, is a significant driver for increasing demand for advanced therapies

- For instance, the approval and clinical adoption of IL‑17 and JAK inhibitors improves symptom management and slows disease progression, encouraging therapy uptake

- Personalized medicine strategies allow clinicians to select treatments based on individual patient profiles, enhancing treatment efficacy and adherence

- Expanding healthcare infrastructure, including increased access to rheumatologists, diagnostic tools, and reimbursement support, facilitates early treatment initiation and long-term management

- Increased patient advocacy and educational campaigns are raising disease awareness and encouraging timely diagnosis, driving therapy adoption

- Adoption of digital health solutions for remote monitoring, telemedicine consultations, and treatment adherence tracking is supporting better disease management and market growth

- The unmet need for patients non-responsive to traditional therapies stimulates R&D investment, pipeline expansion, and overall market growth, promoting the development of novel treatment options

Restraint/Challenge

High Cost, Safety Concerns, and Regulatory Barriers

- The high cost of biologic and advanced targeted therapies remains a significant challenge, particularly in low- and middle-income regions or for patients without sufficient insurance coverage

- For instance, limited awareness and underdiagnosis due to inadequate healthcare infrastructure can reduce the addressable patient population in certain regions

- Safety concerns and potential long-term adverse effects associated with biologic or immunomodulatory drugs may limit patient adoption and physician prescribing, especially in mild cases

- Regulatory hurdles and complex manufacturing processes for biologics and biosimilars can slow the introduction of new therapies, particularly in emerging markets

- Variations in global reimbursement policies, healthcare funding, and drug pricing result in uneven adoption worldwide, restricting market growth outside high-income countries

- Limited availability of advanced therapies in rural or remote regions can prevent patients from accessing optimal care, further restraining market expansion

- Patient hesitancy due to concerns about side effects, lifelong therapy requirements, and injection-based treatments can slow adoption, especially among newly diagnosed patients

- Overcoming these challenges through affordable treatment options, patient education, and supportive regulatory frameworks will be critical for sustained market expansion

Ankylosing Spondylitis (AS) Market Scope

The market is segmented on the basis of drug type, application, molecule, route of administration, and end user.

- By Drug Type

On the basis of drug type, the AS market is segmented into Non-steroidal Anti-Inflammatory Drugs (NSAIDs), TNF blockers, Immunosuppressive drugs, Anti-Inflammatory drugs, Steroids, JAK inhibitors, and others. The TNF blockers segment dominated the market with the largest revenue share in 2025, driven by their established efficacy in controlling inflammation and slowing disease progression. TNF blockers are often preferred by rheumatologists for moderate to severe AS cases due to their long-term clinical data supporting improved patient outcomes. The segment also benefits from widespread awareness among physicians and patients, coupled with insurance coverage in developed regions. High adoption rates in adult populations and integration into standard treatment protocols further support market dominance. Moreover, ongoing clinical studies continue to reinforce the effectiveness and safety of TNF inhibitors, sustaining their leading position in the market.

The JAK inhibitors segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the introduction of novel oral therapies offering convenient administration and targeted mechanisms of action. JAK inhibitors provide an alternative for patients who are non-responsive to TNF blockers or IL-17 inhibitors, expanding treatment options. Increasing awareness of their efficacy, coupled with growing approvals in multiple countries, supports rapid adoption. These drugs also offer a lower frequency of hospital visits due to oral administration compared to injectable biologics. The segment’s growth is further accelerated by expanding clinical data and patient preference for non-injectable therapies. Market expansion is In addition supported by aggressive marketing by key pharmaceutical companies and favorable reimbursement policies in emerging regions.

- By Application

On the basis of application, the AS market is segmented into juveniles and adults. The adult segment dominated the market in 2025 due to the higher prevalence of AS among adult populations worldwide. Adults are more such asly to be diagnosed earlier due to noticeable symptoms such as chronic back pain, stiffness, and reduced spinal mobility, which prompts clinical intervention. The segment benefits from wider insurance coverage and greater physician focus on long-term disease management strategies. Adults also have better access to advanced therapies such as biologics and JAK inhibitors, boosting revenue generation. Moreover, ongoing awareness campaigns and adult-targeted patient support programs contribute to sustained adoption. Clinical guidelines consistently prioritize adult AS treatment, reinforcing this segment’s dominance.

The juvenile segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increased recognition of juvenile-onset AS and improved diagnostic tools, including MRI and genetic screening. Juveniles with early symptoms are increasingly being treated with advanced biologics to prevent long-term disability. Pediatric rheumatologists are adopting personalized treatment plans, further supporting market growth. Growing awareness among parents and caregivers regarding early intervention benefits enhances adoption rates. Expansion of pediatric clinical trials and approvals of age-appropriate formulations also contribute to the rapid growth of this segment.

- By Molecule

On the basis of molecule, the AS market is segmented into biologics, biosimilars, and small molecules. The biologics segment dominated the market with the largest revenue share of 45.8% in 2025, due to their proven efficacy in reducing inflammation, preventing spinal damage, and improving quality of life. Biologics such as TNF inhibitors and IL-17 inhibitors are standard-of-care treatments in moderate to severe AS, supported by long-term clinical evidence. The segment benefits from physician familiarity and strong patient adherence, as well as established reimbursement policies in key regions. Biologics also enable combination therapy approaches, enhancing therapeutic outcomes. Continuous pipeline innovations and extended patent protections for biologics sustain market dominance.

The biosimilars segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing availability of cost-effective alternatives to original biologics. Biosimilars provide similar efficacy and safety profiles as reference biologics but at reduced costs, improving patient accessibility. Growing government initiatives to encourage biosimilar adoption in emerging markets support rapid uptake. Insurance coverage and policy support further boost adoption rates. The expanding number of approved biosimilars, coupled with increasing physician confidence, contributes to segment growth. In addition, healthcare systems are increasingly emphasizing value-based care, making biosimilars a preferred option.

- By Route of Administration

On the basis of route of administration, the AS market is segmented into parenteral, oral, and others. The parenteral segment dominated the market in 2025, driven by the widespread use of injectable biologics such as TNF and IL-17 inhibitors. Parenteral administration ensures controlled drug delivery, high bioavailability, and consistent therapeutic effects, which are critical in managing chronic inflammatory conditions. The segment benefits from physician preference for injectable formulations with predictable pharmacokinetics. Patients undergoing parenteral therapy are closely monitored, improving adherence and outcomes. Moreover, healthcare provider guidance and insurance coverage make parenteral therapy widely accessible in developed regions. Ongoing clinical evidence supports the long-term safety and efficacy of parenteral biologics, maintaining dominance.

The oral segment is expected to witness the fastest growth from 2026 to 2033, driven by the introduction of JAK inhibitors and other oral small molecules offering patient-friendly administration. Oral therapies reduce hospital visits, improve convenience, and increase adherence compared to injectable treatments. Growing patient preference for non-invasive therapy options supports rapid adoption. Approvals of new oral molecules and increasing availability in emerging markets accelerate segment growth. Oral therapies are also being integrated into personalized treatment plans, enhancing their market potential. In addition, digital health tools for adherence monitoring further encourage adoption.

- By End User

On the basis of end user, the AS market is segmented into hospitals, clinics, research laboratories, and others. The hospital segment dominated the market in 2025 due to the concentration of advanced rheumatology services, infusion centers, and diagnostic facilities in hospital settings. Hospitals offer comprehensive disease management, including administration of biologics, monitoring, and follow-up care, which attracts adult and severe AS patients. The segment benefits from strong insurance coverage and reimbursement for high-cost therapies. Hospitals also provide access to multidisciplinary teams, improving patient outcomes. Growing collaborations between hospitals and pharmaceutical companies for clinical trials further reinforce dominance. Patient preference for hospital care ensures continuity of treatment and adherence.

The clinics segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the expansion of outpatient rheumatology practices and telemedicine services. Clinics provide convenient access to diagnostics and follow-up care, especially in urban and semi-urban regions. Increasing awareness among patients about early intervention and preventive care drives outpatient visits. Clinics are also adopting biosimilars and oral therapies, reducing the need for hospital-based administration. Growing healthcare infrastructure and insurance coverage in emerging markets support rapid adoption. The convenience, reduced waiting times, and patient-centric services make clinics a preferred option for many AS patients.

Ankylosing Spondylitis (AS) Market Regional Analysis

- North America dominated the Ankylosing Spondylitis (AS) market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and the presence of major pharmaceutical companies leading R&D efforts, with the U.S. witnessing significant uptake of biologics and novel therapeutics for Ankylosing Spondylitis (AS) management

- Patients in the region benefit from rapid adoption of TNF-α and IL-17 inhibitors, higher treatment compliance, and strong clinical guidance supporting biologic therapies, contributing to sustained market leadership

- This dominance is further supported by robust healthcare infrastructure, increased awareness of inflammatory rheumatic diseases, and a growing preference for targeted therapies that provide long-term symptom control and improved quality of life

The U.S. Ankylosing Spondylitis (AS) Insight

The U.S. Ankylosing Spondylitis (AS) market captured the largest revenue share within North America in 2025, driven by high treatment adoption rates and expanding access to biologics and biosimilars. Patients are increasingly prioritizing early diagnosis and long-term disease management using advanced therapies. The growing preference for self-injectable biologics, along with strong reimbursement support and widespread physician awareness, continues to accelerate market growth. Moreover, the integration of digital health platforms, tele-rheumatology services, and remote monitoring tools is contributing significantly to improved treatment accessibility and patient adherence.

Europe Ankylosing Spondylitis (AS) Insight

The Europe Ankylosing Spondylitis (AS) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by robust healthcare systems and an increasing emphasis on chronic disease management. The surge in awareness of inflammatory rheumatic disorders, combined with rising utilization of targeted therapies, is fostering widespread adoption. European patients are also drawn to improved treatment outcomes delivered by TNF-α and IL-17 inhibitors. The region is experiencing notable growth across hospitals, specialty clinics, and outpatient settings, with biologics forming a core part of treatment guidelines across major countries.

U.K. Ankylosing Spondylitis (AS) Insight

The U.K. Ankylosing Spondylitis (AS) market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by rising healthcare expenditure, broader access to biologics, and strong clinical management programs. Growing concern regarding chronic pain, mobility limitations, and long-term disability is encouraging early intervention and specialist consultation. The U.K.’s increasing adoption of digital health tools, combined with improved diagnostic pathways and supportive reimbursement policies, is expected to stimulate continued market expansion.

Germany Ankylosing Spondylitis (AS) Insight

The Germany Ankylosing Spondylitis (AS) market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of autoimmune disorders and demand for advanced therapies. Germany’s well-developed healthcare infrastructure, paired with its emphasis on high-quality clinical care, promotes increased adoption of biologics and biosimilars. The integration of specialized rheumatology centers, along with a strong focus on patient education and long-term disease monitoring, is further supporting sustained market growth across the country.

Asia-Pacific Ankylosing Spondylitis (AS) Insight

The Asia-Pacific Ankylosing Spondylitis (AS) market is poised to grow at the fastest CAGR during the forecast period, driven by rising disease recognition, expanding healthcare access, and technological advancements in countries such as China, Japan, and India. The region’s growing preference for biologics and improved diagnostic capabilities is propelling treatment uptake. Furthermore, government initiatives supporting healthcare modernization, along with increasing availability of cost-effective biosimilars, are expanding access to AS therapies across diverse patient populations.

Japan Ankylosing Spondylitis (AS) Insight

The Japan Ankylosing Spondylitis (AS) market is gaining momentum due to the country’s advanced medical landscape, strong emphasis on early diagnosis, and rising awareness of rheumatic conditions. The market benefits from a culturally ingrained focus on healthcare quality and technological efficiency. The integration of biologics with digital monitoring platforms and coordinated care models is fueling growth. Moreover, Japan’s aging population is such asly to drive further demand for improved mobility, pain management, and long-term therapeutic solutions.

India Ankylosing Spondylitis (AS) Insight

The India Ankylosing Spondylitis (AS) market accounted for one of the largest revenue shares in the Asia-Pacific region in 2025, supported by rising awareness of autoimmune diseases, expansion of specialty healthcare facilities, and increasing availability of affordable biosimilars. India is witnessing rapid growth in rheumatology consultation rates, reflecting heightened disease recognition. The government’s push toward healthcare digitalization, combined with improving access to biologics and strong domestic pharmaceutical manufacturing capabilities, continues to propel market expansion across the country.

Ankylosing Spondylitis (AS) Market Share

The Ankylosing Spondylitis (AS) industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- UCB S.A. (Belgium)

- Merck & Co., Inc., (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Biocon Limited (India)

- Celltrion Inc. (South Korea)

- Samsung Bioepis Co., Ltd. (South Korea)

- Sandoz International GmbH (Switzerland)

- Zydus Lifesciences Limited (India)

- Intas Pharmaceuticals Ltd. (India)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Janssen Pharmaceutica NV (Belgium)

What are the Recent Developments in Global Ankylosing Spondylitis (AS) Market?

- In August 2025, gumokimab (AK111), a fully human anti-IL-17A monoclonal antibody, reported strong positive Phase 3 results for active ankylosing spondylitis. The therapy achieved all major efficacy endpoints such as ASAS20 and ASAS40, demonstrating meaningful reductions in disease activity, spinal inflammation, and mobility limitations. The study also highlighted improvements in patient-reported outcomes, including functional independence and daily activity performance

- In July 2025, ivarmacitinib, a selective JAK1 inhibitor, demonstrated robust and sustained efficacy in a Phase 2/3 clinical trial in adults with active AS. The therapy showed significant ASAS20 response rates through week 24, marking encouraging progress for an oral treatment option in a space dominated by injectables. The data also indicated improvements in pain, stiffness, and overall functional mobility, with a safety profile consistent with other JAK1 inhibitors

- In September 2024, Bimzelx (bimekizumab-bkzx), a dual IL-17A/IL-17F inhibitor developed by UCB, received U.S. FDA approval for the treatment of adults with active ankylosing spondylitis and non-radiographic axial spondyloarthritis. This approval expanded therapeutic options for AS patients, offering a drug that targets two inflammatory cytokines simultaneously, potentially delivering deeper suppression of inflammation. The FDA decision was based on a series of Phase 3 trials showing rapid improvements in symptoms, spinal mobility, imaging biomarkers, and quality of life

- In November 2023, UCB announced five-year long-term extension data from its bimekizumab clinical program, confirming durable efficacy and consistent safety in ankylosing spondylitis patients. The findings demonstrated sustained reduction in symptoms, long-term improvements in spinal flexibility, and continued suppression of inflammatory markers over a multi-year treatment period

- In December 2021, tofacitinib (Xeljanz/XR) became the first JAK inhibitor approved by the U.S. FDA for active ankylosing spondylitis, offering a new oral therapeutic pathway beyond NSAIDs and biologic injectables. The approval addressed an unmet need for patients who do not respond sufficiently to TNF inhibitors or prefer oral treatments. Clinical trials demonstrated meaningful improvements in back pain, spinal stiffness, and inflammatory symptoms, marking an important milestone in AS therapy diversification

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.