Global Anti Ageing Products Market

Market Size in USD Billion

CAGR :

%

USD

50.92 Billion

USD

80.55 Billion

2024

2032

USD

50.92 Billion

USD

80.55 Billion

2024

2032

| 2025 –2032 | |

| USD 50.92 Billion | |

| USD 80.55 Billion | |

|

|

|

|

Anti-Ageing Products Market Size

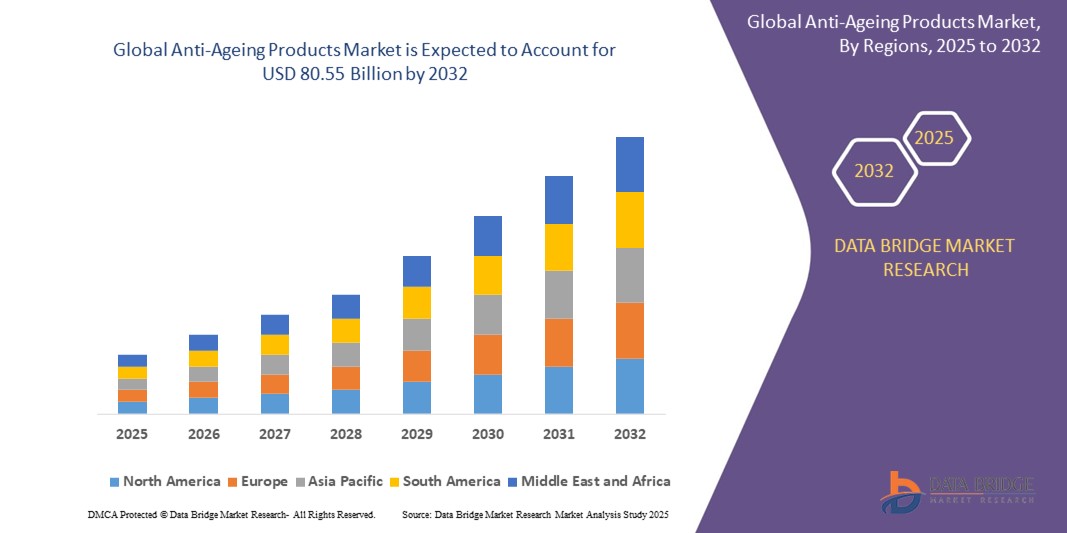

- The global anti-ageing products market size was valued at USD 50.92 billion in 2024 and is expected to reach USD 80.55 billion by 2032, at a CAGR of 5.90% during the forecast period

- Market growth is primarily driven by increased consumer awareness regarding skin health, appearance, and preventive skincare, especially among millennials and aging populations globally

- Moreover, technological innovations in formulation, including the use of peptides, retinoids, and stem cell technology, along with increased marketing and e-commerce penetration, are fueling the adoption of anti-ageing products, propelling the market’s steady expansion

Anti-Ageing Products Market Analysis

- Anti-Ageing Products, including facial creams, serums, and treatments, have become essential components in modern skincare routines due to their ability to target wrinkles, fine lines, and other signs of aging, promoting youthful and healthier skin appearance

- The rising demand is largely influenced by increasing geriatric populations, growing beauty consciousness, and the influence of social media and celebrity endorsements, which are encouraging younger consumers to adopt anti-aging solutions early

- North America dominates the anti-ageing products market with the largest revenue share of 31.11%, in 2024. This dominance is driven by a high consumer awareness of anti-aging products, a strong demand for advanced skincare solutions, and the presence of major market players. The region benefits from high disposable incomes and a well-established beauty and personal care market

- Asia-Pacific is projected to witness the fastest CAGR of 10.25% during the forecast period of 2025 to 2032 in the anti-ageing products market, driven by rapid urbanization, increasing disposable incomes, and a growing focus on personal appearance in major economies such as China, Japan, and India

- The facial creams and lotions segment dominates with the largest market revenue share of 38.5% in 2024, driven by its widespread use for daily skin hydration and anti-wrinkle benefits. Consumers prefer these products for their ease of application and multi-functional properties

Report Scope and Anti-Ageing Products Market Segmentation

|

Attributes |

Anti-Ageing Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Ageing Products Market Trends

“Growing Demand for Natural and Personalized Solutions”

- A significant and accelerating trend in the global anti-ageing products market is the increasing consumer preference for natural and clean label products. This shift reflects a growing awareness of the potential side effects of synthetic chemicals and a desire for healthier skincare options

- For instance, Procter & Gamble’s Olay launched its Olay Regenerist Whip Fragrance-Free range in early 2024, featuring vitamin B3 and peptides, targeting health-conscious users seeking non-irritant and safe ingredients

- Similarly, L'Oréal’s Skin Genius AI tool, introduced in 2023, enables users to receive personalized skincare recommendations based on AI-driven analysis of selfies, promoting tailored anti-aging solutions

- The integration of technology is also enhancing user experience. For Instance, AI-powered skincare analysis tools help consumers identify their specific needs and recommend suitable anti-aging products. Furthermore, the trend of "skinimalism" is influencing consumers to opt for multi-functional products that simplify their skincare routines

- The seamless integration of anti-aging products into overall wellness routines is also becoming increasingly prevalent. Consumers are looking beyond topical treatments and incorporating supplements, nutraceuticals, and ingestible beauty products into their regimens to address aging concerns from within

- This trend towards more natural, personalized, and holistic anti-aging solutions is reshaping product development and marketing strategies. Consequently, companies are focusing on research and innovation to develop effective and safe formulations that cater to these evolving consumer preferences

- The demand for transparency regarding product ingredients and ethical sourcing is growing rapidly across both developed and developing markets, as consumers increasingly prioritize the efficacy and the safety and sustainability of their anti-aging choices

Anti-Ageing Products Market Dynamics

Driver

“Increasing Aging Population and Focus on Personal Appearance”

- The increasing aging global population, coupled with a heightened focus on maintaining a youthful appearance and overall well-being, is a significant driver for the heightened demand for anti-ageing products

- According to the United Nations, over 1.5 billion people will be aged 65+ by 2050, creating a large consumer base for age-defying skincare

- In March 2024, NIVEA launched the Q10 Dual Action serum, targeting sugar-induced aging, showcasing innovation tailored for older demographics with science-backed formulations

- As consumers become more aware of the importance of proactive skincare and the availability of diverse anti-aging options, they are increasingly incorporating these products into their daily routines. Rising disposable incomes in many regions also enable consumers to spend more on premium and specialized anti-aging treatments

- Furthermore, the influence of social media and the emphasis on self-care and personal grooming are making anti-ageing products an integral part of many individuals' lifestyles. The desire to maintain a youthful look for longer, driven by both personal aspirations and societal expectations, continues to propel market growth

- The convenience of readily available anti-aging products through various distribution channels, including online platforms and specialty stores, along with increasing awareness about the benefits of early intervention in addressing signs of aging, are key factors driving market growth in both developed and emerging economies

Restraint/Challenge

“Concerns Regarding Product Safety and the Rise of Counterfeit Products”

- Concerns surrounding the safety and potential side effects of certain chemical-based anti-aging ingredients, including parabens and sulfates, pose a challenge to broader market adoption for some consumer segments. The increasing demand for natural and organic alternatives reflects these concerns

- For Instance, Johnson & Johnson faced scrutiny in 2023 when several skincare products were criticized for including controversial preservatives, prompting a shift in brand positioning toward clean-label solutions

- In addition, counterfeit skincare goods, particularly on e-commerce platforms such Amazon and eBay, remain a major challenge. In 2022, Interpol’s Operation Pangea XV seized over USD 11 million worth of fake cosmetics, including anti-aging creams

- The prevalence of counterfeit anti-ageing products, particularly through online channels, poses a significant threat to both consumers and reputable brands. These counterfeit products often contain harmful substances and can lead to adverse skin reactions, damaging consumer confidence in the market

- While regulations are in place to combat counterfeiting, the ease of online distribution makes it a persistent challenge. Educating consumers about the risks of purchasing from unauthorized sources and implementing stricter quality control measures are essential to mitigate this restraint. The relatively high cost of some advanced anti-aging treatments can also be a barrier for price-sensitive consumers

- Overcoming these challenges through stringent safety standards, consumer education on identifying genuine products, and the development of more affordable yet effective anti-aging options will be vital for sustained and healthy market growth

Anti-Ageing Products Market Scope

The market is segmented on the basis of product, target group, ingredient, treatment, and distribution channel.

By Product

On the basis of product, the anti-ageing products market is segmented into facial creams and lotions, serums and concentrates, under eye creams, and others. The facial creams and lotions segment dominates with the largest market revenue share of 38.5% in 2024, driven by its widespread use for daily skin hydration and anti-wrinkle benefits. Consumers prefer these products for their ease of application and multi-functional properties.

The serums and concentrates segment is expected to witness the fastest CAGR of 19.4% from 2025 to 2032, fueled by rising demand for potent, targeted treatments that address fine lines, pigmentation, and skin elasticity. Under eye creams are also gaining traction, especially among aging populations concerned with delicate eye-area skin. Overall, the growing awareness about skin health and the availability of innovative formulations are propelling growth across all product types.

By Target Group

On the basis of target group, the anti-ageing products market is segmented into male and female. The female segment holds the largest market revenue share of 71.2% in 2024, supported by strong consumer awareness and a tradition of higher skincare product consumption. Marketing efforts and product innovation largely focus on female consumers, emphasizing beauty and anti-aging benefits.

The male segment is anticipated to experience the fastest CAGR of 17.8% between 2025 and 2032, driven by increasing grooming habits and the normalization of male skincare routines. Men are increasingly adopting anti-aging solutions tailored to address their unique skin concerns such as oiliness and thickness. This emerging consumer base is contributing significantly to overall market expansion.

By Ingredient

On the basis of ingredient, the anti-ageing products market is segmented into retinoids, hyaluronic acids, alpha hydroxy acids (AHAs), and others. The retinoid segment dominates with a market revenue share of 42.7% in 2024, largely due to its proven efficacy in reducing wrinkles and promoting skin renewal. Consumers and dermatologists widely endorse retinoids, solidifying their market leadership.

The hyaluronic acid segment is expected to record the fastest growth rate of 20.5% over the forecast period, fueled by its hydration and plumping benefits that improve skin texture and reduce the appearance of aging. AHAs also contribute to significant market share by offering exfoliation and brightening effects, popular among consumers seeking smoother, younger-looking skin. Innovation in ingredient combinations continues to drive product launches and consumer interest.

By Treatment

On the basis of treatment, the anti-ageing products market is segmented into body care and facial care. The facial care segment accounts for the largest market revenue share of 65.3% in 2024, as consumers primarily focus on facial skin aging concerns such as wrinkles, dark spots, and loss of elasticity. The face’s constant exposure to environmental factors makes facial care products essential in anti-aging routines.

The body care segment is anticipated to witness steady growth due to rising consumer awareness of the importance of treating aging skin beyond the face, targeting areas such as hands, neck, and décolletage. Innovations in body lotions and creams that improve firmness and hydration are expanding the market. The growing emphasis on holistic skincare is supporting growth across both treatment segments.

By Distribution Channel

On the basis of distribution channel, the anti-ageing products market is segmented into pharmacies, stores, and online stores. Pharmacies lead with the largest market revenue share of 45.9% in 2024, driven by consumer trust in pharmacist-recommended, clinically tested products. The availability of professional skincare advice enhances pharmacy sales. Physical retail stores also maintain a strong presence by providing tactile product experiences and in-person consultations.

The online stores segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, fueled by convenience, broad product selections, competitive pricing, and digital marketing strategies targeting tech-savvy consumers. The rise of influencer endorsements and direct-to-consumer brands further accelerates online sales, reshaping purchasing behaviors globally.

Anti-Ageing Products Market Regional Analysis

- North America dominates the anti-ageing products market with the largest revenue share of 31.11%, in 2024. This dominance is driven by a high consumer awareness of anti-aging products, a strong demand for advanced skincare solutions, and the presence of major market players. The region benefits from high disposable incomes and a well-established beauty and personal care market

- Consumers in North America highly value effective anti-aging products that address concerns such as wrinkles, fine lines, and skin elasticity. The preference for scientifically backed and technologically advanced formulations, along with the influence of beauty trends and media, fuels market growth in this region. The U.S. represents the largest market within North America, contributing significantly to the region's leading position

U.S. Anti-Ageing Products Market Insight

The U.S. anti-ageing products market to grow at a CAGR of 8.8% within North America in 2024. This is attributed to the swift uptake of advanced skincare routines and a strong emphasis on maintaining a youthful appearance. The market is driven by a combination of factors, including a wide availability of products across various price points, the strong presence of both domestic and international brands, and the significant influence of dermatological advancements and celebrity endorsements.

Canada Anti-Ageing Products Market Insight

The Canadian anti-ageing products market is also experiencing steady growth, mirroring trends in the U.S. market. Consumers are increasingly seeking effective anti-aging solutions, and the market benefits from a rising awareness of skincare ingredients and technologies. The strong retail infrastructure and the growing popularity of online shopping contribute to the accessibility of a wide range of anti-aging products across Canada.

Asia-Pacific Anti-Ageing Products Market Insight

Asia-Pacific is projected to witness the fastest CAGR of 10.25% in the anti-ageing products market, driven by rapid urbanization, increasing disposable incomes, and a growing focus on personal appearance in major economies such as China, Japan, and India. The region benefits from a large and growing middle-class population with an increasing willingness to spend on beauty and skincare products. The rising influence of K-beauty and J-beauty trends globally also significantly contributes to the fast growth of the anti-aging market in this region.

China Anti-Ageing Products Market Insight

China represents one of the largest and fastest-growing markets for anti-ageing products in the Asia-Pacific region. The market is fueled by a large population base, increasing disposable incomes, and a strong emphasis on achieving youthful and healthy skin. The demand for both domestic and international brands is high, and the market is characterized by continuous product innovation and the rapid adoption of new beauty trends.

Japan Anti-Ageing Products Market Insight

Japan's anti-ageing products market is characterized by a sophisticated consumer base with a strong focus on high-quality and technologically advanced formulations. The market benefits from a long-standing culture of skincare and a preference for products that offer gentle yet effective anti-aging benefits. The aging population in Japan also contributes to a sustained demand for anti-aging solutions.

Rest of Asia-Pacific Anti-Ageing Products Market Insight

The rest of the Asia-Pacific region, including India, South Korea, and Southeast Asian countries, also presents significant growth opportunities in the anti-ageing products market. Increasing awareness about skincare, rising disposable incomes, and the growing influence of global beauty trends are driving market expansion in these countries. Each market has its unique preferences and demands, contributing to the overall rapid growth of the Asia-Pacific region.

Anti-Ageing Products Market Share

The anti-ageing products industry is primarily led by well-established companies, including:

- Shiseido Co., Ltd. (Japan)

- Johnson & Johnson Services, Inc. (India)

- Unilever (U.K.)

- Amway (U.S.)

- Procter & Gamble (U.S.)

- L'Oréal S.A. (France)

- Revlon (U.S.)

- Beiersdorf AG (Germany)

- Natura & Co (South America)

- Conair LLC (U.S.)

- Groupe Rocher (France)

- Kao Corporation (Japan)

- Estée Lauder Companies Inc. (U.S.)

- AVON Products (U.K.)

- OLAPLEX (U.S.)

- NEOSTRATA Company, Inc. (U.S.)

Latest Developments in Global Anti-Ageing Products Market

- In February 2025, Estée Lauder Companies (ELC) partnered with Serpin Pharma to create innovative skincare ingredients centered on longevity. Serpin Pharma specializes in anti-inflammatory research, focusing on a group of proteins known as Serine Protease Inhibitors, which aid the body in repairing inflamed cells. This collaboration highlights the increasing emphasis on scientifically advanced ingredients in anti-aging skincare

- In February 2025, NIVEA MEN launched the Age Defense skincare line, targeting common signs of aging such as wrinkles, dryness, rough texture, dullness, and loss of firmness. The range incorporates key ingredients such Thiamidol and Hyaluronic Acid to ensure effective results with a simplified routine. It features an advanced serum for reducing dark spots and fine lines, a hydrating serum with Pro-Retinol for lasting moisture, an eye cream addressing puffiness and dark circles, and a daily moisturizer with SPF 30 for sun protection and hydration. This launch reflects growing consumer demand for comprehensive yet straightforward anti-aging solutions

- In April 2024, NIVEA expanded its anti-aging portfolio by introducing the Q10 Dual Action serum, designed to combat sugar-induced skin aging and wrinkle formation. The serum’s formula aims to prevent protein glycation in the dermis layer, thereby protecting collagen and elastin from damage. This product launch demonstrates the industry’s focus on innovative science-based approaches to slow down skin aging

- In March 2024, L'Oréal Canada added SkinBetter Science, a medical aesthetic skincare brand, to its L’Oréal Dermatological Beauty (LDB) division. SkinBetter Science is currently distributed across Canada and available through its official website. This acquisition underscores L’Oréal’s strategy to expand its portfolio with clinically backed skincare brands

- In March 2024, Dermalogica introduced its Circular Hydration Serum, which combines hyaluronic acid and algae extracts to create a moisturizing matrix that provides rapid and long-lasting hydration. This combination forms a protective barrier that prevents moisture loss, enhancing skin hydration and health. The launch signals rising consumer interest in hydration-focused anti-aging treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.