Global Anti Anxiety Drug Market

Market Size in USD Billion

CAGR :

%

USD

11.25 Billion

USD

16.63 Billion

2024

2032

USD

11.25 Billion

USD

16.63 Billion

2024

2032

| 2025 –2032 | |

| USD 11.25 Billion | |

| USD 16.63 Billion | |

|

|

|

Anti-Anxiety Drug Market Analysis

The anti-anxiety drug market has seen remarkable growth, largely driven by heightened awareness surrounding mental health issues and the increasing prevalence of anxiety disorders globally. Factors such as rising stress levels from work pressures, personal challenges, and global uncertainties have notably amplified the demand for anti-anxiety medications. Pharmaceutical companies are making strides in creating drugs that not only provide effective relief but also come with fewer side effects, spurring an exciting wave of innovation in the industry.

The surge in market demand is largely fueled by the advent of newer drug classes, such as selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs), which are gradually replacing older medications such as benzodiazepines. This shift is viewed as highly beneficial, as these newer drugs pose a much lower risk of addiction and adverse effects.

Furthermore, the increasing availability of healthcare services and the growing trend of people seeking professional help for mental health struggles are contributing to the market’s expansion. The rise of digital health solutions and telemedicine has made it more convenient for individuals to consult with healthcare professionals, further driving the demand for anti-anxiety treatments.

However, the market does face obstacles such as regulatory challenges, addiction concerns, and the premium cost of newer medications. Despite these challenges, the ongoing emphasis on mental health care suggests a promising future for the anti-anxiety drug market.

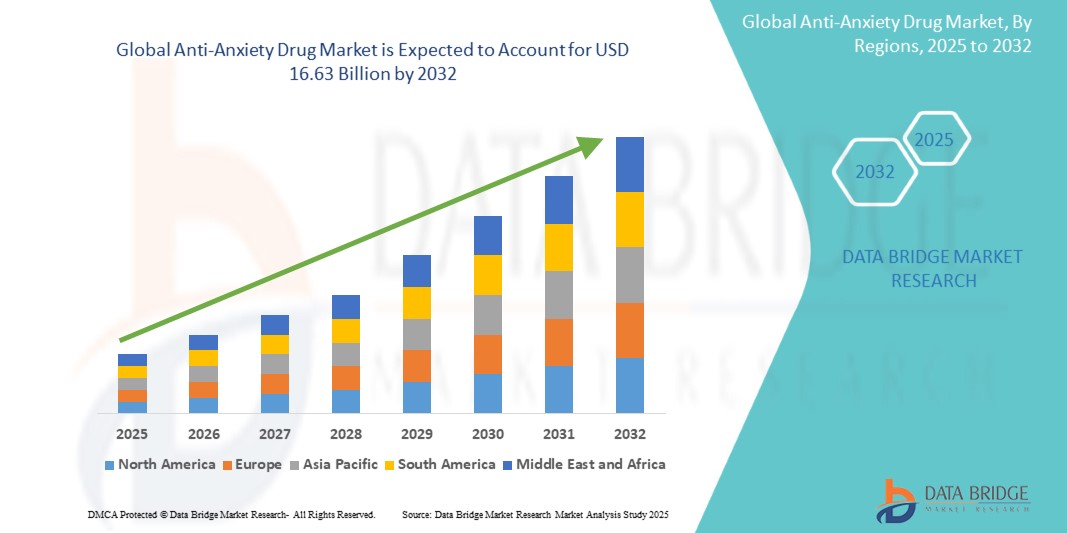

Anti-Anxiety Drug Market Size

The global Anti-Anxiety Drug market size was valued at USD 11.25 billion in 2024 and is projected to reach USD 16.63 billion by 2032, with a CAGR of 5.01% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Anti-Anxiety Drug Market Trends

“Increasing Shift Toward Non-Benzodiazepine Medications”

A notable trend in the anti-anxiety drug market is the increasing shift toward non-benzodiazepine medications, particularly selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs). These newer drug classes are gaining traction due to their effectiveness in treating anxiety disorders while posing a lower risk of addiction and side effects compared to traditional benzodiazepines. Patients and healthcare providers are increasingly opting for these alternatives as they offer long-term solutions without the risk of dependence commonly associated with benzodiazepines. This trend is also supported by growing concerns over the potential for misuse and the adverse effects of long-term benzodiazepine use, pushing pharmaceutical companies to focus on developing safer and more sustainable treatments. As awareness of mental health improves and demand for more reliable, safe treatments rises, the anti-anxiety drug market is seeing a shift toward these newer, less addictive options.

Report Scope and Anti-Anxiety Drug Market Segmentation

|

Attributes |

Anti-Anxiety Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Key Market Players |

Aurobindo Pharma (India), AbbVie Inc. (U.S.), AstraZeneca (U.K.), Bristol-Myers Squibb Company (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Gedeon Richter Plc. (Hungary), Johnson & Johnson Services, Inc. (U.S.), Lilly (U.S.), Lundbeck (Denmark), Mind Medicine (MindMed) Inc. (Canada), Merck KGaA (Germany), Merck & Co., Inc. (U.S.), Neuphoria Therapeutics, Inc. (U.S.), Otsuka Holdings Co., Ltd. (Japan), Pfizer Inc. (U.S.), Pharmanovia (U.K.), Sanofi (France), Sun Pharmaceutical Industries Ltd. (India), Takeda Pharmaceutical Company Limited (Japan) and Teva Pharmaceutical Industries Ltd. (Israel) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Anti-Anxiety Drug Market Definition

An anti-anxiety drug is a type of medication used to alleviate symptoms of anxiety, a condition characterized by excessive worry, nervousness, and fear. These drugs work by targeting the brain’s neurotransmitters or receptors to help regulate mood and reduce the physiological effects of anxiety. Common types of anti-anxiety medications include benzodiazepines, selective serotonin reuptake inhibitors (SSRIs), serotonin-norepinephrine reuptake inhibitors (SNRIs), and beta-blockers, each with different mechanisms of action and side effect profiles. These medications are typically prescribed for anxiety disorders, such as generalized anxiety disorder (GAD), panic disorder, and social anxiety disorder.

Anti-Anxiety Drug Market Dynamics

Drivers

- Advancements in Drug Development and Innovation

Recent advancements in drug development are significantly driving the anti-anxiety drug market. Pharmaceutical companies are focused on creating more effective, safer, and less addictive treatments for anxiety disorders. Newer medications, such as serotonin-norepinephrine reuptake inhibitors (SNRIs) and novel formulations such as esketamine (SPRAVATO), are emerging as alternatives to traditional benzodiazepines, which have higher risks of dependence. For instance, the development of MM120 ODT, a lysergide-based drug being investigated for generalized anxiety disorder (GAD), represents a new frontier in anxiety treatment. These innovative medications aim to provide relief with fewer side effects and lower addiction potential, attracting greater interest from both healthcare providers and patients. As research continues to evolve, the market for anti-anxiety drugs is experiencing growth driven by the promise of more specialized and effective treatment options, offering patients safer alternatives and significantly expanding market opportunities.

- Growing Awareness and Acceptance of Mental Health Treatment

Increased awareness and the de-stigmatization of mental health have driven a surge in individuals seeking professional help for anxiety. As society becomes more open about mental health challenges, people are more likely to consult healthcare providers and explore treatment options, including medication. This shift is supported by campaigns, social media movements, and policies aimed at breaking down mental health stigmas. For instance, medications such as esketamine (SPRAVATO) for treatment-resistant depression and anxiety disorders have gained popularity due to their efficacy and growing acceptance. In addition, the incorporation of telemedicine and online mental health services has made treatment more accessible, allowing patients to easily access prescription medications. This increasing demand for anti-anxiety treatments and growing patient engagement is significantly driving market growth, with pharmaceutical companies focusing on innovation to meet this expanding need for effective and accessible mental health care.

Opportunities

- Expansion of Digital and Telehealth Services

The rise of digital health solutions and telemedicine presents a significant opportunity for the anti-anxiety drug market. With growing access to virtual healthcare platforms, patients can easily consult with healthcare providers remotely, making it easier for individuals to seek treatment for anxiety disorders. For instance, telemedicine platforms such as BetterHelp and Talkspace provide accessible mental health counseling, and these services often work in tandem with pharmaceutical treatments, creating a seamless experience for patients. In addition, digital therapeutics—such as apps designed to help manage anxiety—are gaining traction. These services allow for the continuous monitoring and management of anxiety symptoms, offering a holistic approach that complements medication. As telehealth continues to expand, it increases access to mental health care, thereby driving the demand for anti-anxiety drugs. This digital shift in healthcare is expected to fuel market growth by making treatments more accessible and increasing the number of patients seeking prescriptions.

- Growing Market for Personalized Medicine

The increasing focus on personalized medicine provides a unique opportunity for growth in the anti-anxiety drug market. Tailoring treatments to individual genetic profiles and unique health conditions can improve efficacy and reduce side effects, offering more targeted solutions for anxiety disorders. For instance, pharmacogenetic testing is being used to identify which antidepressants or anti-anxiety medications may work best for a patient based on their genetic makeup. The development of drugs such as esketamine (SPRAVATO), which is used for treatment-resistant depression and anxiety, highlights this trend towards personalized care. In addition, companies are exploring the use of biomarkers and genetic insights to create medications that cater to the specific needs of anxiety sufferers. As personalized medicine becomes more mainstream, it opens up new opportunities for drug developers to provide more effective and tailored solutions, potentially driving market growth by improving patient outcomes and broadening the drug’s application.

Restraints/Challenges

- Regulatory Hurdles and Approval Delays

A significant restraint in the anti-anxiety drug market is the complex and lengthy regulatory approval process. The development of new anti-anxiety medications often faces stringent safety and efficacy trials, which can delay market entry. For instance, medications such as MM120 ODT, being developed for generalized anxiety disorder (GAD), face rigorous testing before they can gain approval from regulatory bodies such as the FDA. These long approval timelines can slow down the commercialization of innovative treatments, limiting the speed at which new medications reach the market. Moreover, the high cost and complexity of conducting clinical trials, including patient recruitment and regulatory compliance, can discourage smaller companies from entering the market. This restraint can hinder the pace of innovation and slow overall market growth as companies may delay launching new therapies or focus on more easily approved alternatives.

- Risk of Drug Misuse and Dependence

A key challenge in the anti-anxiety drug market is the risk of misuse and dependence, particularly with medications such as benzodiazepines, which are commonly prescribed for anxiety relief. The addictive potential of drugs such as alprazolam and diazepam has raised concerns over their long-term use, leading to restrictions on their prescription. In some cases, patients develop tolerance or physical dependence, which can result in misuse and other negative health outcomes. For instance, benzodiazepines have been linked to substance abuse disorders and overdose deaths, prompting regulatory bodies to tighten prescribing guidelines. As a result, there is growing pressure on pharmaceutical companies to develop safer alternatives with lower risks of dependence. This challenge impacts market growth by limiting the widespread use of certain anti-anxiety medications and encouraging the industry to focus on creating treatments with fewer addictive properties, driving the need for new innovations.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Anti-Anxiety Drug Market Scope

The market is segmented on the basis of disorder type, drug class, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Disorder Type

- Panic Disorder

- Agoraphobia

- Generalized Anxiety

- Social Anxiety

- Specific Phobia

- Others

Drug Class

- Selective Serotonin Reuptake Inhibitors (SSRIs)

- Benzodiazepines

- Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs)

- Beta-Blockers

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies/Drug Stores

- Online Pharmacies

Anti-Anxiety Drug Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, disorder type, drug class, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America is expected to dominate the anti-anxiety drug market. The region benefits from a combination of factors, including high levels of awareness and recognition of mental health issues, widespread access to healthcare, and advanced pharmaceutical research and development. In addition, mental health awareness campaigns and initiatives to combat the stigma surrounding mental health contribute to the increasing demand for anti-anxiety medications.

Asia Pacific is expected to exhibit the highest growth rate in the anti-anxiety drug market. Several factors contribute to this rapid growth, including the increasing prevalence of anxiety disorders due to rising stress levels, urbanization, and changing lifestyles in countries such as China, India, and Japan. As awareness of mental health issues improves across the region, more individuals are seeking treatment for anxiety, leading to a higher demand for anti-anxiety medications.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Anti-Anxiety Drug Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Anti-Anxiety Drug Market Leaders Operating in the Market Are:

- Aurobindo Pharma (India)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Gedeon Richter Plc. (Hungary)

- Johnson & Johnson Services, Inc. (U.S.)

- Lilly (U.S.)

- Lundbeck (Denmark)

- Mind Medicine (MindMed) Inc. (Canada)

- Merck KGaA (Germany)

- Merck & Co., Inc. (U.S.)

- Neuphoria Therapeutics, Inc. (U.S.)

- Otsuka Holdings Co., Ltd. (Japan)

- Pfizer Inc. (U.S.)

- Pharmanovia (U.K.)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

Latest Developments in Anti-Anxiety Drug Market

- In January 2025, Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) had approved a supplemental New Drug Application (sNDA) for SPRAVATO (esketamine) CIII nasal spray. This approval makes SPRAVATO the first and only monotherapy for adults with major depressive disorder (MDD) who have not responded adequately to at least two oral antidepressants

- In December 2024, Mind Medicine (MindMed) Inc. announced that the first patient had been dosed in its Phase 3 Voyage study of MM120 ODT, a pharmaceutically optimized version of lysergide D-tartrate (LSD) for treating generalized anxiety disorder (GAD). The Voyage study is the first of two Phase 3 trials assessing the efficacy and safety of MM120 ODT compared to a placebo, with an expected enrollment of around 200 participants in the United States. The second Phase 3 trial, the Panorama study, will be conducted in both the U.S. and Europe and is slated to begin in the first half of 2025

- In October 2024, AbbVie and Gedeon Richter Plc. announced a new agreement for the discovery, co-development, and licensing of novel targets aimed at treating neuropsychiatric conditions. This collaboration builds on their nearly two-decade-long partnership in central nervous system (CNS) projects, which has led to the global launch of products such as cariprazine (VRAYLAR / REAGILA) and the discovery of the investigational drug candidate ABBV-932, designed to treat bipolar depression and generalized anxiety disorder

- In September 2023, Pharmanovia announced the expansion of its neurology portfolio through the acquisition of 11 central nervous system (CNS) brands from Sanofi, a global healthcare company. These brands cover four key therapeutic areas with ongoing unmet needs in CNS disorders: psycholeptic, anxiolytic, anti-epileptic, and anti-psychotic

- In March 2023, Pharmanovia announced the expansion of its exclusive license and supply agreement with Aquestive Therapeutics, Inc. for its patented diazepam buccal film formulation. The expanded agreement now covers the rest of the world, excluding the U.S., Canada, and China. Diazepam, a member of the benzodiazepine class of medicines, is used to treat conditions such as anxiety, muscle spasms, and seizures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.