Global Anti Coccidial Drugs Market

Market Size in USD Million

CAGR :

%

USD

1,242.48 Million

USD

3,103.95 Million

2022

2030

USD

1,242.48 Million

USD

3,103.95 Million

2022

2030

| 2023 –2030 | |

| USD 1,242.48 Million | |

| USD 3,103.95 Million | |

|

|

|

|

Anti-Coccidial Drugs Market Analysis and Size

A major adoption of pet animals, which includes dogs, cats, and even horses, as companions of human beings has been witnessed during the recent years. The data stated by Kingsdale Animal Hospital in January 2022 showed that coccidia is one of the most common intestinal parasites found in dogs, and the occurrence of coccidia is 50 % in dogs, with a variation in incidence.

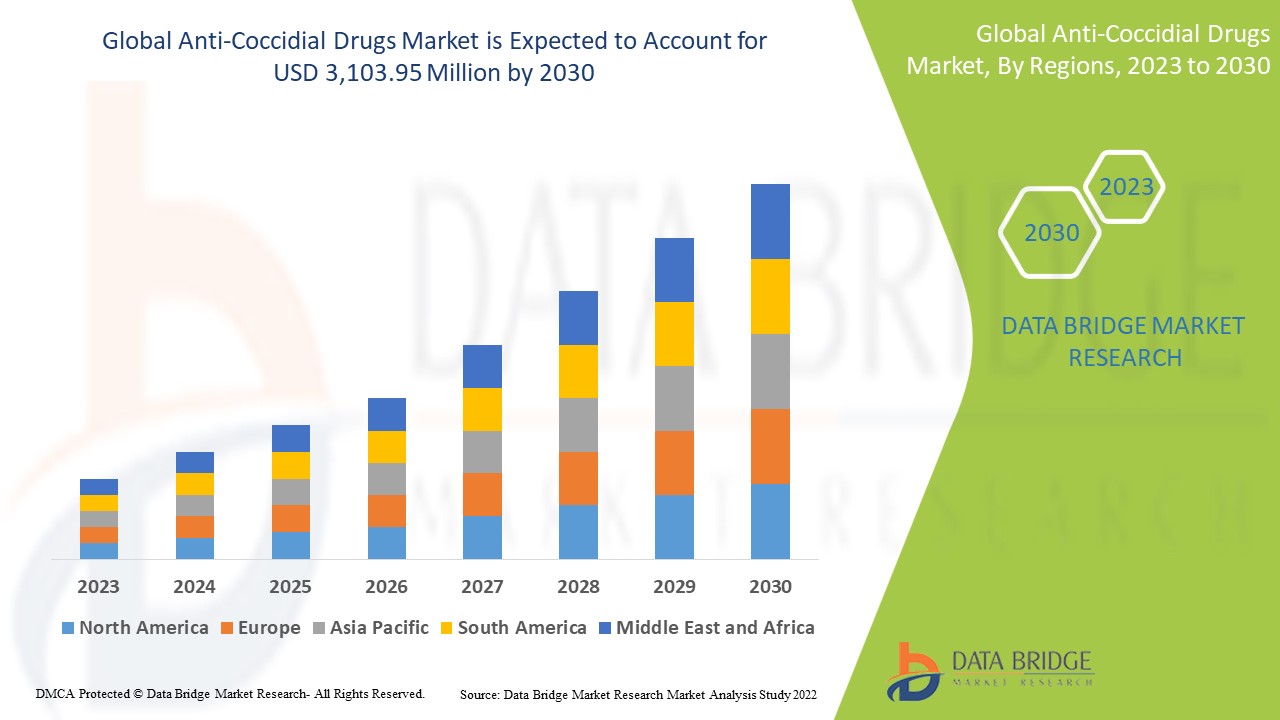

Data Bridge Market Research analyses a growth rate in the global anti-coccidial drugs market in the forecast period 2023-2030. The expected CAGR of the global anti-coccidial drugs market tends to be around 9.2% in the mentioned forecast period. The market was valued at USD 1,242.48 million in 2022 and would grow to USD 3,103.95 million by 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Anti-Coccidial Drugs Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Synthetic Drugs, Polyether Antibiotics or Ionophores, Combination Anti-Coccidial Drugs, Others), Animals (Swine, Fish, Cattle, Poultry, Others),End-Users (Hospitals, Homecare, Specialty Clinics, Others), Distribution Channel (Hospital Pharmacy, Online Pharmacy, Retail Pharmacy) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Impextraco NV (Belgium), Vetoquinol (France), Phibro Animal Health Corporation (U.S.), Huvepharma (Bulgaria), Virbac (France), Bayer AG (Germany), Merck & Co., Inc (U.S.), Novartis AG (Switzerland)., Zoetis (U.S.)., Elanco (U.S.), Ceva (France)., ProBioGen AG (Germany) |

|

Market Opportunities |

|

Market Definition

Coccidiosis is caused due to single-celled parasites (protozoa) called Eimeria, which undergo a simple gut life cycle. Any such drug which is used to combat the progression of coccidiosis in birds or animals, both non-food producing and food-producing, is known as an anticoccidial. Its symptoms include weight loss, feces containing mucus or blood, dehydration, mild intermittent to severe diarrhea, and decreased breeding.

Global Anti-Coccidial Drugs Market Dynamics

Drivers

- Increasing share of animal ownership

Due to the promising economic condition, the highly developed economies represent a major large share of companion animal ownership. For instance, the Pet Food Manufacturers Association reported that in 2021, 17 million (59% of) households in the U.K. owned pets. These pet owners are more worried and aware of the safety of their pets. This creates an opportunity to diagnose fungal and bacterial diseases such as coccidiosis, which is an infection that is caused by the fungus coccidioides immitis among animals. This is projected to contribute to the overall market growth during the forecast period.

- Rising expenditure on pet healthcare

Pet owners are investing in their pets hugely, such as in health insurance for pets, leading to rising expenditure on their health, thus acting as a major driver for market growth. For instance, according to the North American Pet Health Insurance Association (NAPHIA), around 4.41 million pets were insured in North America at the end of 2021. Furthermore, as per American Pet Products Association, USD 123.6 billion was spent on pets and animals in the U.S. in 2021, which augmented from about USD 99.0 billion in 2020. This expenditure by pet owners is likely to boost market growth over the forecast period.

Opportunities

- The growing burden of coccidiosis in target animals

The wide prevcalence of coccidiosis among the target animals of specific age demands the wide availability of the anticoccidial drugs. For instance, Eimeria is a genus of apicomplexan parasites, that includes several species capable of causing the disease coccidiosis in animals such as dogs, cattle, poultry, cats, and smaller ruminants such as sheep and goats. According to the research article "Coccidiosis of Cattle" published in August 2022, approximately 20 or more Eimeria species have been identified in cattle feces worldwide. Thus, this factor creates more opportunities for market growth.

- Increasing prevalence of isospora species

According to the Merck and Co. Inc. data updated in August 2022 on "Coccidiosis of Cats and Dogs", the isospora species is a common coccidiosis of cats and dogs. Approximately every cat gets infected by isospora felis in its lifetime. Moreover, as per the source mentioned above, coccidiosis usually occurs in young animals in facilities with potential contamination and high population. Thus, this disease may become a problem in breeding or boarding catteries and kennels. This burden of coccidiosis among companion animals creates many different opportunities for developing anticoccidial drugs. This is projected to contribute to segment growth.

Restraints/Challenges

- Limited studies and surveys

There are very limited studies and surveys that are hampering the growth of the market. Not many studies and awareness have been spread about this disease, and thus, this hampers the market's growth.

- High cost of drugs

The huge expenditure associated with anti-coccidial medications hampers the market growth. Different polyether antibiotics or ionophores, combination anti-coccidial drugs are of high cost which restricts the growth of the market.

This global anti-coccidial drugs market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global anti-coccidial drugs market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Global Anti-Coccidial Drugs Market

The outbreak of COVID-19 showed an adverse impact on the global anti-coccidial drugs market . According to the article "The Initial Months of COVID-19: Dog Owners' Veterinary-Related Concerns," published in February 2021, dog owners feared that COVID-19 infection might lead to a decrease in disease diagnoses for pets. Moreover, the study showed that like many other professions, veterinarians were majorly impacted by the onset of COVID-19 in the initial phase of the pandemic. Thus, standard practices such as routine animal checkups, diagnoses, and surgeries were disturbed. These reduced services lowered the coccidiosis diagnosis, therefore, hampering the market growth.

But, in the post-pandemic era, poultry consumption and the adoption of companion animals increased. This led to a higher demand for diagnosis of poultry coccidiosis and companion animal coccidiosis. Thus, on the basis of above factors, the COVID-19 pandemic considerably impacted the market.

Recent Developments:

- In March 2022, Amlan International developed two new natural alternatives to antibiotics for poultry and livestock, such as Phylox Feed and NeutraPath. Phylox Feed is a natural alternative to anticoccidial drugs and vaccines, that can help producers to increase profitability.

Global Anti-Coccidial Drugs Market Scope

The global anti-coccidial drugs market is segmented on the basis of type, animals, distribution channel and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Synthetic Drugs

- Polyether Antibiotics or Ionophores

- Combination Anti-Coccidial Drugs

- Others

Animals

- Swine

- Fish

- Cattle

- Poultry

- Others

End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Anti-Coccidial Drugs Market Regional Analysis/Insights

The global anti-coccidial drugs market is analysed and market size insights and trends are provided by type, animals, distribution channel and end-user as referenced above.

The major countries covered in the global anti-coccidial drugs market report are the U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America has been witnessing positive growth for the global anticoccidial drugs market throughout the forecasted period due to increased healthcare and R&D expenditure and the presence of skilled professionals.

Asia-Pacific dominates the market due to increased poultry farming and increased awareness for anti-coccidial drugs through advertisement and media and rapidly improving healthcare infrastructure in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Anti-coccidial Drugs Market Share Analysis

The global anti-coccidial drugs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global anti-coccidial drugs market

Key players operating in the global anti-coccidial drugs market include:

- Impextraco NV (Belgium)

- Vetoquinol (France)

- Phibro Animal Health Corporation (U.S.)

- Huvepharma (Bulgaria)

- Virbac (France)

- Bayer AG (Germany)

- Merck & Co., Inc (U.S.),

- Novartis AG (Switzerland).

- Zoetis (U.S.)

- Elanco (U.S.)

- Ceva (France).

- ProBioGen AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTI-COCCIDIAL DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTI-COCCIDIAL DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTI-COCCIDIAL DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 INDUSTRY INSIGHTS

7 EPIDEMIOLOGY

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 MARKET ACCESS

9.1 10-YEAR MARKET FORECAST

9.2 ANNUAL NEW FDA APPROVED DRUGS

9.3 DRUGS MANUFACTURER AND DEALS

9.4 MAJOR DRUG UPTAKE

9.5 CURRENT TREATMENT PRACTICES

9.6 IMPACT OF UPCOMING THERAPY

10 PIPELINE ANALYSIS

Company Name Product Name

xx xx

xx xx

xx xx

xx xx

xx xx

xx xx

11 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY TYPE

11.1 OVERVIEW

11.2 SYNTHETIC DRUGS

11.2.1 ROBENIDINE

11.2.1.1. MARKET VALUE (USD MILLION)

11.2.1.2. MARKET VOLUME (UNITS)

11.2.1.3. AVERAGE SELLING PRICE (USD)

11.2.2 AMPROLIUM

11.2.2.1. MARKET VALUE (USD MILLION)

11.2.2.2. MARKET VOLUME (UNITS)

11.2.2.3. AVERAGE SELLING PRICE (USD)

11.2.3 ETHOPABATE

11.2.3.1. MARKET VALUE (USD MILLION)

11.2.3.2. MARKET VOLUME (UNITS)

11.2.3.3. AVERAGE SELLING PRICE (USD)

11.2.4 APRINOCID

11.2.4.1. MARKET VALUE (USD MILLION)

11.2.4.2. MARKET VOLUME (UNITS)

11.2.4.3. AVERAGE SELLING PRICE (USD)

11.2.5 CLOPIDOL

11.2.5.1. MARKET VALUE (USD MILLION)

11.2.5.2. MARKET VOLUME (UNITS)

11.2.5.3. AVERAGE SELLING PRICE (USD)

11.2.6 DECOQUINATE

11.2.6.1. MARKET VALUE (USD MILLION)

11.2.6.2. MARKET VOLUME (UNITS)

11.2.6.3. AVERAGE SELLING PRICE (USD)

11.2.7 DICLAZURIL

11.2.7.1. MARKET VALUE (USD MILLION)

11.2.7.2. MARKET VOLUME (UNITS)

11.2.7.3. AVERAGE SELLING PRICE (USD)

11.2.8 DINITOLMIDE

11.2.8.1. MARKET VALUE (USD MILLION)

11.2.8.2. MARKET VOLUME (UNITS)

11.2.8.3. AVERAGE SELLING PRICE (USD)

11.2.9 HALOFUGINONE

11.2.9.1. MARKET VALUE (USD MILLION)

11.2.9.2. MARKET VOLUME (UNITS)

11.2.9.3. AVERAGE SELLING PRICE (USD)

11.2.10 DEQUINATE

11.2.10.1. MARKET VALUE (USD MILLION)

11.2.10.2. MARKET VOLUME (UNITS)

11.2.10.3. AVERAGE SELLING PRICE (USD)

11.2.11 NICARBAZIN

11.2.11.1. MARKET VALUE (USD MILLION)

11.2.11.2. MARKET VOLUME (UNITS)

11.2.11.3. AVERAGE SELLING PRICE (USD)

11.2.12 SULFONAMIDES

11.2.12.1. MARKET VALUE (USD MILLION)

11.2.12.2. MARKET VOLUME (UNITS)

11.2.12.3. AVERAGE SELLING PRICE (USD)

11.2.13 OTHER

11.3 POLYETHER ANTIBIOTICS OR IONOPHORES

11.3.1 MONOVALENT IONOPHORES

11.3.1.1. MONENSIN

11.3.1.1.1. MARKET VALUE (USD MILLION)

11.3.1.1.2. MARKET VOLUME (UNITS)

11.3.1.1.3. AVERAGE SELLING PRICE (USD)

11.3.1.2. NARASIN

11.3.1.2.1. MARKET VALUE (USD MILLION)

11.3.1.2.2. MARKET VOLUME (UNITS)

11.3.1.2.3. AVERAGE SELLING PRICE (USD)

11.3.1.3. SALINOMYCIN

11.3.1.3.1. MARKET VALUE (USD MILLION)

11.3.1.3.2. MARKET VOLUME (UNITS)

11.3.1.3.3. AVERAGE SELLING PRICE (USD)

11.3.1.4. OTHER

11.3.2 MONOVALENT GLYCOSIDIC IONOPHORES

11.3.2.1. MADURAMICIN

11.3.2.1.1. MARKET VALUE (USD MILLION)

11.3.2.1.2. MARKET VOLUME (UNITS)

11.3.2.1.3. AVERAGE SELLING PRICE (USD)

11.3.2.2. SEMDURAMICIN

11.3.2.2.1. MARKET VALUE (USD MILLION)

11.3.2.2.2. MARKET VOLUME (UNITS)

11.3.2.2.3. AVERAGE SELLING PRICE (USD)

11.3.2.3. OTHER

11.3.3 DIVALENT IONOPHORES

11.3.3.1. LASALOCID

11.3.3.1.1. MARKET VALUE (USD MILLION)

11.3.3.1.2. MARKET VOLUME (UNITS)

11.3.3.1.3. AVERAGE SELLING PRICE (USD)

11.3.3.2. OTHER

11.4 COMBINATION ANTI-COCCIDIAL DRUGS

11.4.1 NICARBAZIN/NARASIN

11.4.1.1. MARKET VALUE (USD MILLION)

11.4.1.2. MARKET VOLUME (UNITS)

11.4.1.3. AVERAGE SELLING PRICE (USD)

11.4.2 CLOPIDOL/ METHYL BENZOQUATE

11.4.2.1. MARKET VALUE (USD MILLION)

11.4.2.2. MARKET VOLUME (UNITS)

11.4.2.3. AVERAGE SELLING PRICE (USD)

11.4.3 OTHER

11.5 VACCINES

11.5.1 COCCIVAC-B

11.5.2 COCCIVACT

11.5.3 PARACOX-5

11.5.4 OTHER

11.6 OTHERS

12 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY ANIMAL TYPE

12.1 OVERVIEW

12.2 LIVESTOCK

12.2.1 CATTLE

12.2.2 SHEEP & GOATS

12.2.3 SWINE

12.2.4 OTHERS

12.3 POULTRY

12.3.1 CHICKENS

12.3.1.1. BROILERS

12.3.1.2. LAYERS

12.3.2 TURKEYS

12.3.3 DUCKS

12.3.4 OTHERS

12.4 FISH

12.5 OTHERS

13 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY DRUG TYPE

13.1 OVERVIEW

13.2 BRANDED

13.2.1 MAXIBAN

13.2.2 LERBEK

13.2.3 DECCOX

13.2.4 AMPROL

13.2.5 CORID

13.2.6 CLINACOX

13.2.7 AVATEC

13.2.8 MONTEBAN

13.2.9 COBAN

13.2.10 OTHER

13.3 GENERICS

14 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 ORAL

14.2.1 POWDERS

14.2.2 GRANULES

14.2.3 LIQUIDS

14.3 INJECTION

14.3.1 INTRAMUSCULARLY

14.3.2 SUBCUTANEOUSLY

14.4 OTHER

15 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY END USER

15.1 OVERVIEW

15.2 VETERINARY HOSPITALS

15.3 VETERINARY CARE

15.4 HOG PRODUCTION FARM

15.5 LIVESTOCK FARMS

15.6 POULTRY FARMS

15.7 OTHERS

16 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL PHARMACY

16.3.1 HOSPITAL ASSOCIATED PHARMACY

16.3.2 DRUG STORE

16.3.3 ONLINE PHARMACY

16.3.4 OTHER

16.4 OTHERS

17 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, BY GEOGRAPHY

18.1 GLOBAL ANTI-COCCIDIAL DRUGS MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1.1 NORTH AMERICA

18.1.1.1. U.S.

18.1.1.2. CANADA

18.1.1.3. MEXICO

18.1.2 EUROPE

18.1.2.1. GERMANY

18.1.2.2. U.K.

18.1.2.3. ITALY

18.1.2.4. FRANCE

18.1.2.5. SPAIN

18.1.2.6. RUSSIA

18.1.2.7. SWITZERLAND

18.1.2.8. TURKEY

18.1.2.9. BELGIUM

18.1.2.10. NETHERLANDS

18.1.2.11. DENMARK

18.1.2.12. SWEDEN

18.1.2.13. POLAND

18.1.2.14. NORWAY

18.1.2.15. FINLAND

18.1.2.16. REST OF EUROPE

18.1.3 ASIA-PACIFIC

18.1.3.1. JAPAN

18.1.3.2. CHINA

18.1.3.3. SOUTH KOREA

18.1.3.4. INDIA

18.1.3.5. SINGAPORE

18.1.3.6. THAILAND

18.1.3.7. INDONESIA

18.1.3.8. MALAYSIA

18.1.3.9. PHILIPPINES

18.1.3.10. AUSTRALIA

18.1.3.11. NEW ZEALAND

18.1.3.12. VIETNAM

18.1.3.13. TAIWAN

18.1.3.14. REST OF ASIA-PACIFIC

18.1.4 SOUTH AMERICA

18.1.4.1. BRAZIL

18.1.4.2. ARGENTINA

18.1.4.3. PERU

18.1.4.4. REST OF SOUTH AMERICA

18.1.5 MIDDLE EAST AND AFRICA

18.1.5.1. SOUTH AFRICA

18.1.5.2. EGYPT

18.1.5.3. BAHRAIN

18.1.5.4. UNITED ARAB EMIRATES

18.1.5.5. KUWAIT

18.1.5.6. OMAN

18.1.5.7. QATAR

18.1.5.8. SAUDI ARABIA

18.1.5.9. REST OF MEA

18.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, SWOT AND DBMR ANALYSIS

20 GLOBAL ANTI-COCCIDIAL DRUGS MARKET, COMPANY PROFILE

20.1 IMPEXTRACO NV

20.1.1 COMPANY OVERVIEW

20.1.2 REVENUE ANALYSIS

20.1.3 GEOGRAPHIC PRESENCE

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPEMNTS

20.2 VETOQUINOL

20.2.1 COMPANY OVERVIEW

20.2.2 REVENUE ANALYSIS

20.2.3 GEOGRAPHIC PRESENCE

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPEMNTS

20.3 PHIBRO ANIMAL HEALTH CORPORATION

20.3.1 COMPANY OVERVIEW

20.3.2 REVENUE ANALYSIS

20.3.3 GEOGRAPHIC PRESENCE

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPEMNTS

20.4 HUVEPHARMA

20.4.1 COMPANY OVERVIEW

20.4.2 REVENUE ANALYSIS

20.4.3 GEOGRAPHIC PRESENCE

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPEMNTS

20.5 VIRBAC

20.5.1 COMPANY OVERVIEW

20.5.2 REVENUE ANALYSIS

20.5.3 GEOGRAPHIC PRESENCE

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPEMNTS

20.6 MERCK & CO.,INC

20.6.1 COMPANY OVERVIEW

20.6.2 REVENUE ANALYSIS

20.6.3 GEOGRAPHIC PRESENCE

20.6.4 PRODUCT PORTFOLIO

20.6.5 RECENT DEVELOPEMNTS

20.7 ZOETIS

20.7.1 COMPANY OVERVIEW

20.7.2 REVENUE ANALYSIS

20.7.3 GEOGRAPHIC PRESENCE

20.7.4 PRODUCT PORTFOLIO

20.7.5 RECENT DEVELOPEMNTS

20.8 ELANCO

20.8.1 COMPANY OVERVIEW

20.8.2 REVENUE ANALYSIS

20.8.3 GEOGRAPHIC PRESENCE

20.8.4 PRODUCT PORTFOLIO

20.8.5 RECENT DEVELOPEMNTS

20.9 CEVA

20.9.1 COMPANY OVERVIEW

20.9.2 REVENUE ANALYSIS

20.9.3 GEOGRAPHIC PRESENCE

20.9.4 PRODUCT PORTFOLIO

20.9.5 RECENT DEVELOPEMNTS

20.1 HIPRA

20.10.1 COMPANY OVERVIEW

20.10.2 REVENUE ANALYSIS

20.10.3 GEOGRAPHIC PRESENCE

20.10.4 PRODUCT PORTFOLIO

20.10.5 RECENT DEVELOPEMNTS

20.11 HUVEPHARMA

20.11.1 COMPANY OVERVIEW

20.11.2 REVENUE ANALYSIS

20.11.3 GEOGRAPHIC PRESENCE

20.11.4 PRODUCT PORTFOLIO

20.11.5 RECENT DEVELOPEMNTS

20.12 AURORA PHARMACEUTICAL, INC.

20.12.1 COMPANY OVERVIEW

20.12.2 REVENUE ANALYSIS

20.12.3 GEOGRAPHIC PRESENCE

20.12.4 PRODUCT PORTFOLIO

20.12.5 RECENT DEVELOPEMNTS

20.13 BOEHRINGER INGELHEIM LTD

20.13.1 COMPANY OVERVIEW

20.13.2 REVENUE ANALYSIS

20.13.3 GEOGRAPHIC PRESENCE

20.13.4 PRODUCT PORTFOLIO

20.13.5 RECENT DEVELOPEMNTS

20.14 CHINA ANIMAL HUSBANDRY GROUP

20.14.1 COMPANY OVERVIEW

20.14.2 REVENUE ANALYSIS

20.14.3 GEOGRAPHIC PRESENCE

20.14.4 PRODUCT PORTFOLIO

20.14.5 RECENT DEVELOPEMNTS

20.15 BAYER AG

20.15.1 COMPANY OVERVIEW

20.15.2 REVENUE ANALYSIS

20.15.3 GEOGRAPHIC PRESENCE

20.15.4 PRODUCT PORTFOLIO

20.15.5 RECENT DEVELOPEMNTS

20.16 BIOPROPERTIES PTY LTD

20.16.1 COMPANY OVERVIEW

20.16.2 REVENUE ANALYSIS

20.16.3 GEOGRAPHIC PRESENCE

20.16.4 PRODUCT PORTFOLIO

20.16.5 RECENT DEVELOPEMNTS

20.17 KEMIN INDUSTRIES, INC

20.17.1 COMPANY OVERVIEW

20.17.2 REVENUE ANALYSIS

20.17.3 GEOGRAPHIC PRESENCE

20.17.4 PRODUCT PORTFOLIO

20.17.5 RECENT DEVELOPEMNTS

20.18 QILU ANIMAL HEALTH PRODUCTS CO., LTD.

20.18.1 COMPANY OVERVIEW

20.18.2 REVENUE ANALYSIS

20.18.3 GEOGRAPHIC PRESENCE

20.18.4 PRODUCT PORTFOLIO

20.18.5 RECENT DEVELOPEMNTS

20.19 VENKYS INDIA

20.19.1 COMPANY OVERVIEW

20.19.2 REVENUE ANALYSIS

20.19.3 GEOGRAPHIC PRESENCE

20.19.4 PRODUCT PORTFOLIO

20.19.5 RECENT DEVELOPEMNTS

20.2 VETBIOCHEM INDIA PRIVATE LIMITED

20.20.1 COMPANY OVERVIEW

20.20.2 REVENUE ANALYSIS

20.20.3 GEOGRAPHIC PRESENCE

20.20.4 PRODUCT PORTFOLIO

20.20.5 RECENT DEVELOPEMNTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 RELATED REPORTS

22 CONCLUSION

23 QUESTIONNAIRE

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.