Global Anti Obesity Medication Market

Market Size in USD Billion

CAGR :

%

USD

8.71 Billion

USD

78.37 Billion

2024

2032

USD

8.71 Billion

USD

78.37 Billion

2024

2032

| 2025 –2032 | |

| USD 8.71 Billion | |

| USD 78.37 Billion | |

|

|

|

|

Anti-Obesity Medication Market Size

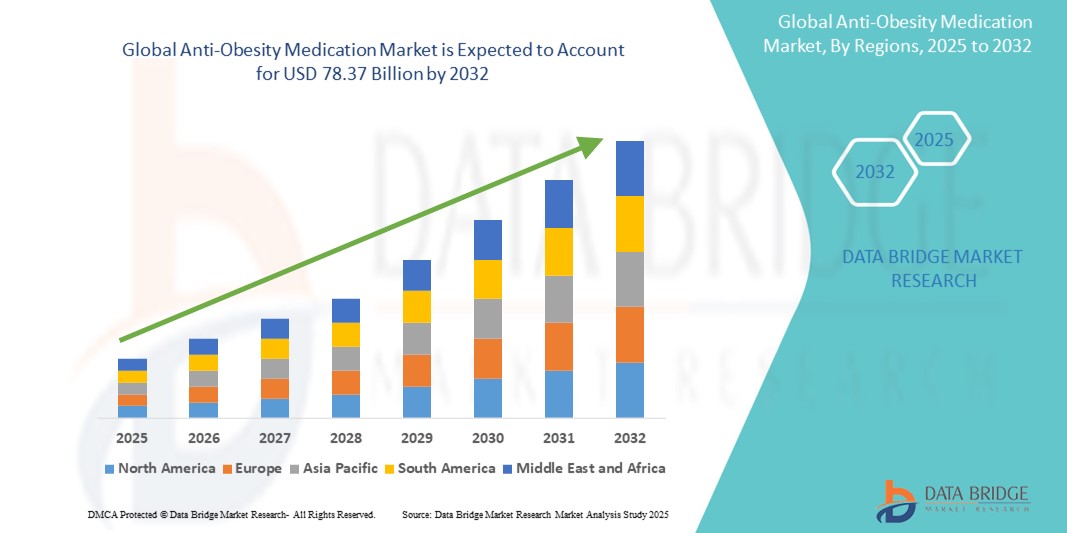

- The global anti-obesity medication market size was valued at USD 8.71 billion in 2024 and is expected to reach USD 78.37 billion by 2032, at a CAGR of 31.60% during the forecast period

- The market growth is largely fueled by the rising global prevalence of obesity and associated chronic conditions such as type 2 diabetes, cardiovascular diseases, and hypertension, prompting increased demand for effective pharmacological interventions. The burden of obesity is compelling healthcare systems and pharmaceutical companies to prioritize anti-obesity drug development and access

- Furthermore, growing consumer awareness regarding weight management, advancements in drug delivery technologies, and the emergence of combination therapies are establishing anti-obesity medications as a cornerstone of long-term obesity treatment. These converging factors are accelerating the uptake of anti-obesity medication solutions, thereby significantly boosting the industry's growth

Anti-Obesity Medication Market Analysis

- Anti-obesity medications, designed to support weight loss by suppressing appetite, blocking fat absorption, or increasing metabolism, are becoming crucial tools in combating the global obesity epidemic, especially when combined with lifestyle modifications and clinical supervision. These solutions are increasingly integrated into chronic disease management frameworks for improved health outcomes

- The escalating demand for anti-obesity medications is primarily fueled by the rising prevalence of obesity-related conditions such as type 2 diabetes, cardiovascular diseases, and sleep apnea, alongside growing awareness of the long-term health risks associated with excess weight

- North America dominated the anti-obesity medication market with the largest revenue share of 39.7% in 2024, driven by widespread obesity prevalence, supportive reimbursement policies, and the early adoption of newly approved anti-obesity drugs such as GLP-1 receptor agonists. The U.S., in particular, is witnessing strong growth in prescriptions as more primary care providers adopt pharmacologic treatment for obesity alongside lifestyle interventions

- Asia-Pacific is expected to be the fastest growing region in the anti-obesity medication market during the forecast period, projected to expand at a CAGR of 11.2% from 2025 to 2032, due to increasing urbanization, changing dietary habits, and rising awareness regarding obesity-related health risks. Emerging economies such as China and India are seeing significant investment in obesity care programs

- The Approved segment dominated the anti-obesity medication market with a market revenue share of 62.5% in 2024, driven by increasing regulatory approvals of new weight-loss drugs and the growing trust among healthcare professionals in evidence-backed therapies. The effectiveness and safety of these medications in managing obesity-related conditions have made them the preferred option in clinical settings

Report Scope and Anti-Obesity Medication Market Segmentation

|

Attributes |

Anti-Obesity Medication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Obesity Medication Market Trends

“Next-Gen Tech Empowering Anti-Obesity Therapies”

- A significant and accelerating trend in the global anti-obesity medication market is the emergence of AI-powered treatment personalization and voice-assisted telehealth solutions. Integration with digital health ecosystems—such as Amazon Alexa, Google Assistant, and Apple HealthKit—is improving patient engagement and adherence to therapy regimens

- For instance, AI-enabled platforms now guide patients on medication timing, dietary tracking, and exercise plans, offering reminders or updates via voice assistants. This hands-free support, particularly valuable for elderly or tech-averse users, is creating a more inclusive patient experience

- Several obesity management apps connected to anti-obesity medications now leverage AI to analyze user data and recommend optimized lifestyle and dosage plans. For instance, integrated devices can detect reduced activity levels or missed medication doses and notify users or healthcare providers

- Digital health companies are embedding anti-obesity medication support within smart home setups, enabling seamless interaction with daily routines, such as scheduling medication intake reminders with smart lighting or alarms triggered by inactivity patterns

- Companies like Noom, MyFitnessPal, and Roche are advancing AI capabilities within their platforms to support long-term weight management by continuously learning from user behavior and adapting care pathways accordingly

- This trend toward intelligent, user-adaptive, and voice-integrated obesity management is reshaping patient expectations. Pharmaceutical companies and digital health firms are increasingly investing in ecosystem-compatible medication delivery and adherence technologies to tap into this growing segment

Anti-Obesity Medication Market Dynamics

Driver

“Growing Need Due to Global Obesity Epidemic and Innovative Drug Pipeline”

- The escalating global obesity rates, especially in developed and middle-income countries, are significantly driving demand for effective and safe anti-obesity medications. According to WHO, over 1 billion people globally are classified as obese, highlighting an urgent need for pharmacological interventions

- Recent breakthroughs in drug development—such as GLP-1 receptor agonists (e.g., semaglutide, liraglutide) and dual agonists like tirzepatide—are demonstrating substantial efficacy in weight loss and are rapidly gaining regulatory approvals and clinical adoption

- In May 2024, Novo Nordisk announced expanded access to Wegovy (semaglutide) across multiple markets due to strong demand and favorable outcomes in cardiovascular risk reduction among obese individuals

- Pharmaceutical companies are leveraging AI to optimize clinical trials and identify novel targets for weight loss, enabling faster time-to-market and more precise patient targeting

- Furthermore, digital therapeutics paired with pharmacological treatments offer a hybrid model of care that supports long-term weight management, improving patient outcomes and retention

Restraint/Challenge

“Safety Concerns, Cost Barriers, and Long-Term Efficacy Questions”

- Concerns surrounding the potential side effects and long-term safety of anti-obesity medications pose a significant challenge to broader market adoption. Several drugs targeting weight loss have historically faced regulatory scrutiny or market withdrawal due to adverse effects, raising caution among physicians and patients alike

- For instance, high-profile safety issues with earlier-generation drugs like sibutramine have contributed to lingering skepticism regarding pharmaceutical weight-loss solutions

- Addressing these safety concerns through robust clinical trials, transparent adverse event reporting, and long-term efficacy data is crucial for building physician and patient confidence. Leading companies are investing heavily in post-marketing surveillance and risk mitigation strategies to reassure stakeholders

- In addition, the relatively high cost of newly approved anti-obesity medications—such as GLP-1 receptor agonists—can be a barrier to access, especially in low- and middle-income countries or among uninsured populations. While some insurers are beginning to cover these therapies, out-of-pocket expenses remain a hurdle

- Overcoming these challenges through regulatory clarity, increased insurance reimbursement, and development of more affordable drug options will be essential for the sustained growth of the anti-obesity medication market

Anti-Obesity Medication Market Scope

The market is segmented on the basis of product, mechanism of action, and distribution channel.

- By Product

On the basis of product, the anti-obesity medication market is segmented into approved and off-label. The approved segment dominated the largest market revenue share of 62.5% in 2024, driven by increasing regulatory approvals of new weight-loss drugs and the growing trust among healthcare professionals in evidence-backed therapies. The effectiveness and safety of these medications in managing obesity-related conditions have made them the preferred option in clinical settings.

The off-label segment is anticipated to witness the fastest growth rate of 21.2% from 2025 to 2032, owing to the flexibility it offers physicians in prescribing medications not originally intended for obesity. This includes the use of certain antidiabetic or antidepressant drugs that demonstrate weight-reducing properties, especially in complex patient cases.

- By Mechanism of Action

On the basis of mechanism of action, the anti-obesity medication market is segmented into peripherally acting drugs and centrally acting drugs. The centrally acting drugs segment held the largest market revenue share in 2024, attributed to its strong efficacy in appetite suppression and satiety modulation through brain-targeted pathways. Drugs like GLP-1 receptor agonists fall under this category and are widely used in chronic obesity management.

The peripherally acting drugs segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their lower risk of neurological side effects and increased patient preference for gut-targeted mechanisms that inhibit fat absorption or digestion.

- By Distribution Channel

On the basis of distribution channel, the anti-obesity medication market is segmented into retail pharmacies, hospital pharmacies, and others. The retail pharmacies segment accounted for the largest market revenue share in 2024, as over-the-counter availability and increasing public awareness drive consumers to seek weight loss solutions independently. Accessibility, convenience, and growing penetration of chain pharmacies also support this trend.

The hospital pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing prescription of anti-obesity drugs during inpatient visits or weight-management programs supervised by healthcare professionals. Hospitals also benefit from insurance reimbursements, which make these treatments more affordable for patients.

Anti-Obesity Medication Market Regional Analysis

- North America dominated the anti-obesity medication market with the largest revenue share of 39.7% in 2024, driven by the rising prevalence of obesity, high healthcare expenditures, and the widespread availability of FDA-approved anti-obesity drugs. The presence of major pharmaceutical companies and growing awareness regarding the health risks associated with obesity further boost regional demand

- Consumers in the region are increasingly adopting pharmacological interventions due to enhanced access to healthcare services, support from healthcare providers, and greater acceptance of prescription-based obesity treatments

- This trend is further supported by rising lifestyle-related health conditions, high disposable incomes, and favorable reimbursement policies that promote access to weight management medications

U.S. Anti-Obesity Medication Market Insight

The U.S. anti-obesity medication market captured the largest revenue share of 81% in 2024 within North America, fueled by a growing number of obese and overweight individuals and the increasing prescription of anti-obesity medications such as GLP-1 receptor agonists. Innovations in drug development and the rising use of telehealth platforms for weight management consultations are also boosting the market. Additionally, government initiatives targeting obesity reduction and a strong clinical pipeline of anti-obesity drugs contribute to market growth.

Europe Anti-Obesity Medication Market Insight

The Europe anti-obesity medication market is projected to expand at a substantial CAGR during the forecast period, driven by rising obesity rates, increasing awareness of obesity-related complications, and the expansion of weight management programs across the region. European regulatory authorities are also increasingly supporting the use of safe and effective pharmacologic treatments for obesity. Moreover, rising investments in healthcare infrastructure and a focus on preventive healthcare support regional market development.

U.K. Anti-Obesity Medication Market Insight

The U.K. anti-obesity medication market is anticipated to grow at a noteworthy CAGR, supported by public health initiatives such as NHS weight-loss services and increasing availability of anti-obesity medications. The growing demand for GLP-1 analogs and other approved medications, along with a supportive regulatory environment, drives adoption. A cultural shift toward proactive weight management and increasing online pharmacy platforms further contribute to growth.

Germany Anti-Obesity Medication Market Insight

The Germany anti-obesity medication market is expected to expand at a considerable CAGR, driven by high healthcare spending, a growing elderly population, and increasing use of pharmaceutical interventions for chronic weight management. The presence of advanced healthcare systems, insurance coverage, and awareness campaigns focusing on obesity-related diseases promote the adoption of prescription-based therapies.

Asia-Pacific Anti-Obesity Medication Market Insight

The Asia-Pacific anti-obesity medication market is poised to grow at the fastest CAGR of 11.2% from 2025 to 2032, driven by rapid urbanization, dietary shifts, and sedentary lifestyles that contribute to rising obesity levels. Countries such as China, Japan, and India are seeing growing demand for pharmaceutical weight-loss treatments, supported by improving healthcare infrastructure, expanding middle-class populations, and increased access to medications. Government initiatives promoting healthier lifestyles and the rising popularity of preventive health measures also bolster market growth.

Japan Anti-Obesity Medication Market Insight

The Japan anti-obesity medication market is gaining momentum, fueled by rising rates of metabolic disorders and increasing awareness of the health risks associated with obesity. The nation’s aging population and preventive health-focused culture are driving demand for safe and effective drug-based weight management solutions. In addition, Japan’s high technological and regulatory standards encourage the adoption of clinically validated and innovative anti-obesity drugs.

China Anti-Obesity Medication Market Insight

The China anti-obesity medication market accounted for the largest revenue share in Asia-Pacific in 2024, owing to the country’s expanding middle class, growing urban population, and the increasing prevalence of lifestyle-related diseases. The Chinese government is actively promoting public health campaigns focused on weight reduction, and the country has seen a rise in pharmaceutical investments aimed at developing and marketing anti-obesity products. Domestic and international pharmaceutical players are also accelerating clinical trials and market entries in China.

Anti-Obesity Medication Market Share

The anti-obesity medication industry is primarily led by well-established companies, including:

- Novo Nordisk A/S (Denmark)

- Lilly (U.S.)

- Structure Therapeutics, Inc. (China)

- Pfizer Inc. (U.S.)

- Amgen Inc. (U.S.)

- Sanofi (France)

- AstraZeneca (U.K)

- Hanmi Pharm.Co.,Ltd. (South Korea)

- Boehringer Ingelheim International GmbH (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Altimmune (U.S.)

Latest Developments in Global Anti-Obesity Medication Market

- In April 2025, Eli Lilly announced groundbreaking Phase 3 results for its oral GLP‑1 agonist orforglipron, showing comparable weight loss (~7.6–8% body weight) and improved HbA1C to injectables—but via a convenient daily pill. This marks the first oral alternative to semaglutide/Ozempic, with FDA submissions expected by late 2025

- In June 2025, Eli Lilly received approval in China for mazdutide (IBI362), a dual GLP‑1/glucagon agonist. Phase 3 data showed significant weight reductions in Chinese adults with overweight or obesity, reinforcing global momentum for advanced weight-loss biologics

- In May 2025, Amgen introduced MariTide, a once‑monthly GLP‑1 therapy, following trial results showing up to 16% weight loss over one year. Monthly injection schedules may enhance adherence compared to weekly options

- In April 2025, Pfizer discontinued its oral GLP‑1 candidate danuglipron after an unpredictable liver toxicity was observed in clinical trials, highlighting ongoing safety challenges in oral obesity drug development

- In May 2025, GLP‑1 prescriptions for weight management continued their steep rise in the U.S., with analysts projecting the obesity drug market to hit USD 100 billion by 2030. Wegovy, Saxenda, and Zepbound account for most current sales

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.