Global Antibiotic Coated Surgical Implant Drug Market

Market Size in USD Billion

CAGR :

%

USD

1.12 Billion

USD

2.41 Billion

2024

2032

USD

1.12 Billion

USD

2.41 Billion

2024

2032

| 2025 –2032 | |

| USD 1.12 Billion | |

| USD 2.41 Billion | |

|

|

|

|

Antibiotic-Coated Surgical Implant Drug Market Size

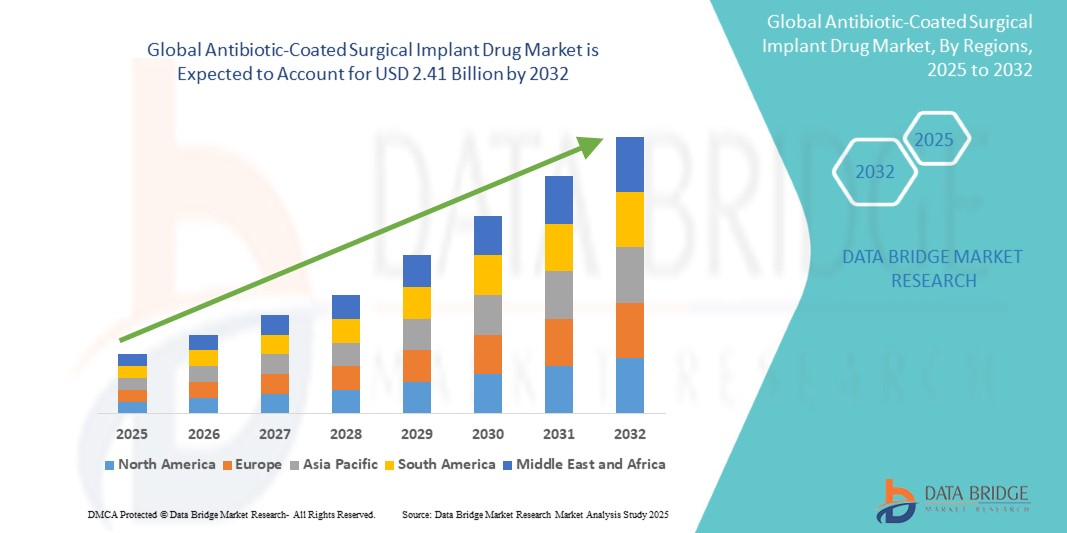

- The global antibiotic-coated surgical implant drug market size was valued at USD 1.12 billion in 2024 and is expected to reach USD 2.41 billion by 2032, at a CAGR of 10.02% during the forecast period

- The market expansion is primarily driven by the increasing incidence of surgical site infections (SSIs) and the rising global volume of implant-based procedures, necessitating enhanced antimicrobial protection in surgical implants

- In addition, growing awareness among healthcare providers about infection prevention, along with advancements in coating technologies and biocompatible drug delivery systems, is reinforcing the demand for antibiotic-coated surgical implants. These collective trends are propelling the adoption of coated implants, thereby strengthening the market’s overall growth trajectory

Antibiotic-Coated Surgical Implant Drug Market Analysis

- Antibiotic-coated surgical implants, which deliver localized antimicrobial protection, are becoming essential components in modern surgical care across orthopedic, cardiovascular, dental, and neurological procedures due to their infection-prevention capabilities and improved post-operative outcomes

- The growing number of implant-based surgeries, rising prevalence of surgical site infections (SSIs), and increasing concerns over antibiotic resistance are key drivers fueling the demand for these coated implants, particularly in high-risk surgical applications

- North America dominated the antibiotic-coated surgical implant drug market with the largest revenue share of 42.8% in 2024, attributed to high surgical volumes, advanced healthcare infrastructure, and early adoption of innovative medical technologies, with the U.S. leading due to strong presence of key manufacturers and high demand in orthopedic and cardiac procedures

- Asia-Pacific is expected to be the fastest growing region in the antibiotic-coated surgical implant drug market during the forecast period due to rising healthcare investments, growing elderly population, and increasing access to surgical care across emerging economies such as China and India

- The orthopedic implant segment dominated the antibiotic-coated surgical implant drug market with a market share of 48.2% in 2024, driven by the high incidence of joint replacements, trauma surgeries, and associated infection risks, where antibiotic-coated solutions offer critical preventive advantages

Report Scope and Antibiotic-Coated Surgical Implant Drug Market Segmentation

|

Attributes |

Antibiotic-Coated Surgical Implant Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antibiotic-Coated Surgical Implant Drug Market Trends

“Targeted Drug Delivery and Next-Generation Coating Technologies”

- A significant and accelerating trend in the global antibiotic-coated surgical implant drug market is the advancement of coating technologies that allow for localized, sustained, and targeted antibiotic delivery directly at the surgical site. This innovation is significantly improving infection prevention outcomes in high-risk surgeries involving orthopedic, cardiovascular, and dental implants

- For instance, Zimmer Biomet’s gentamicin-coated knee implants provide immediate and localized antimicrobial activity, reducing infection risks without systemic antibiotic exposure. Similarly, Stryker has developed vancomycin-releasing coatings for trauma implants to combat early bacterial colonization

- These advanced coatings utilize intelligent drug-release mechanisms triggered by infection-prone conditions such as pH changes or bacterial biofilm formation. This enables implants to respond dynamically to the surgical environment, increasing effectiveness while reducing systemic side effects. Companies such as DePuy Synthes are exploring multi-antibiotic coatings to broaden protection against resistant strains

- The integration of smart drug-release features and biocompatible materials facilitates safer post-operative recovery, shorter hospital stays, and lower re-operation rates. These trends align with the global push to minimize hospital-acquired infections (HAIs) and reduce reliance on systemic antibiotics

- The growing collaboration between device manufacturers and pharmaceutical companies to co-develop antibiotic-coated implants is also reshaping innovation pipelines and accelerating market entry of these hybrid products

- This trend towards more intelligent, localized, and bioresponsive antimicrobial implant solutions is fundamentally redefining expectations for surgical infection control. As a result, companies such as Heraeus Medical and Medtronic are intensifying efforts to expand their antibiotic-coated implant portfolios for both elective and trauma-based surgeries

- The demand for coated implants offering precise infection protection is rising rapidly across orthopedic, dental, and cardiovascular domains, as healthcare providers seek solutions that combine clinical efficacy with improved patient outcomes

Antibiotic-Coated Surgical Implant Drug Market Dynamics

Driver

“Rising Surgical Site Infections and Implant-Based Procedure Volumes”

- The increasing number of implant-based surgeries, coupled with the rising incidence of surgical site infections (SSIs), is a major driver fueling the demand for antibiotic-coated surgical implants. These coatings provide localized infection protection, reduce systemic antibiotic use, and improve surgical outcomes

- For instance, in May 2024, Heraeus Medical expanded its availability of gentamicin-coated bone cements across multiple European markets, addressing the growing need for infection-resistant implants in joint replacement procedures. Such advancements are accelerating the adoption of drug-coated implants in high-risk orthopedic and trauma surgeries

- As patient populations age and implant procedures increase globally, especially in orthopedics and cardiovascular care, the need for enhanced post-surgical infection control is growing rapidly. Antibiotic-coated implants serve as a critical preventive measure in managing infection-prone procedures among elderly, diabetic, and immunocompromised patients

- Furthermore, growing awareness among clinicians about the long-term benefits of infection-preventive implants, along with cost savings from reduced complications and reoperations, is propelling market growth. Endorsements from regulatory and clinical bodies for targeted use in high-risk patients are also supporting adoption across hospitals and surgical centers

- The convergence of high procedure volumes, infection risk mitigation needs, and technological improvements in coating delivery systems is expected to drive sustained market growth across developed and emerging regions

Restraint/Challenge

“Antibiotic Resistance Concerns and Regulatory Barriers”

- A key challenge facing the global antibiotic-coated surgical implant drug market is growing concern over antibiotic resistance and the complex regulatory environment for drug-device combination products. These concerns are leading to stricter approval pathways and cautious adoption in some regions

- For instance, regulatory agencies such as the U.S. FDA and EMA require extensive clinical trials and long-term safety data to validate the efficacy and resistance management profile of antibiotic-coated implants, which can delay product launches and increase development costs

- There is also concern that widespread, non-targeted use of antibiotic coatings could contribute to localized resistance over time, particularly if not paired with proper antimicrobial stewardship. This leads to clinical hesitancy in adopting coated implants outside high-risk surgical cases

- In addition, the higher cost of coated implants compared to standard options may deter procurement in cost-sensitive or underfunded healthcare systems, limiting market reach in low- and middle-income regions. Despite long-term savings from infection prevention, upfront pricing remains a constraint for some institutions

- While several companies, including Smith+Nephew and Biomet, are emphasizing resistance-aware formulation strategies and cost-effective innovations, market expansion will depend on clearer regulatory frameworks, broader physician education, and global alignment on infection control best practices

- Overcoming these regulatory and cost-related challenges through next-generation coatings, strategic collaborations, and improved clinical validation will be critical to ensuring sustained market adoption and growth

Antibiotic-Coated Surgical Implant Drug Market Scop

The market is segmented on the basis of implant type, coating material, coating mechanism, application, and end user.

- By Implant Type

On the basis of implant type, the antibiotic-coated surgical implant drug market is segmented into orthopedic implants, dental implants, cardiovascular implants, neurological implants, and other surgical implants. The orthopedic implant segment dominated the market with the largest revenue share of 48.2% in 2024, driven by the high volume of joint replacement, trauma fixation, and spinal surgeries. These procedures have a heightened risk of post-operative infections, making antibiotic coatings crucial for infection control. The widespread clinical use and strong evidence supporting efficacy have reinforced the dominance of this segment across both developed and emerging healthcare markets.

The cardiovascular implant segment is expected to witness the fastest growth rate of 11.2% from 2025 to 2032, owing to increasing adoption of coated stents, pacemakers, and heart valves. Infection-related complications in cardiac surgeries can be life-threatening, and antibiotic-coated solutions offer significant benefits in terms of patient safety, especially among high-risk populations. Advancements in biocompatible coatings and localized drug delivery are further accelerating segment growth.

- By Coating Material

On the basis of coating material, the antibiotic-coated surgical implant drug market is segmented into silver-based coatings, copper-based coatings, polymer-based coatings, antibiotic-impregnated coatings, and iodine-based coatings. The silver-based coatings segment held the largest market revenue share in 2024 due to its broad-spectrum antimicrobial activity, proven clinical safety profile, and durability. Silver ions inhibit bacterial growth and are widely used across orthopedic and dental implants, contributing to their widespread adoption.

The antibiotic-impregnated coatings segment is expected to register the highest CAGR during the forecast period, driven by growing demand for localized antibiotic delivery that minimizes systemic side effects. Coatings embedded with antibiotics such as vancomycin or gentamicin are gaining traction in orthopedic trauma and revision surgeries, where the infection risk is elevated. Advances in sustained-release technology are also enhancing their therapeutic effectiveness.

- By Coating Mechanism

On the basis of coating mechanism, the antibiotic-coated surgical implant drug market is segmented into contact-killing surfaces, biocidal release coatings, and surface modification coatings. The biocidal release coatings segment dominated the market in 2024, as these coatings actively release antimicrobial agents over a specific duration, effectively eliminating bacterial threats at the implant interface. This approach ensures continuous protection during the critical post-operative period.

The surface modification coatings segment is projected to witness the fastest CAGR from 2025 to 2032. These coatings alter the implant’s surface properties such as charge, hydrophobicity, or roughness—to resist bacterial adhesion and biofilm formation without releasing any drugs. Their biocompatibility and reduced resistance risk make them attractive for long-term implant use.

- By Application

On the basis of application, the antibiotic-coated surgical implant drug market is segmented into orthopedic surgery, dental surgery, cardiovascular surgery, neurological surgery, and general surgery. The orthopedic surgery segment led the market with the largest revenue share in 2024, fueled by the high number of joint replacements and fracture fixation procedures globally. Infection control in orthopedic surgery is critical, and antibiotic-coated implants offer substantial benefits by reducing revision surgery rates and healthcare costs.

The dental surgery segment is expected to grow at the fastest pace over the forecast period due to increasing dental implant procedures and growing preference for antimicrobial protection, particularly in patients with diabetes or periodontal disease. Manufacturers are focusing on coated dental abutments and screws that prevent peri-implant infections.

- By End User

On the basis of end user, the antibiotic-coated surgical implant drug market is segmented into hospitals, ambulatory surgical centers (ASCs), specialty clinics, research laboratories, and medical device manufacturers. The hospital segment dominated the market with the largest revenue share in 2024 due to the high volume of complex surgeries performed in inpatient settings and greater adoption of infection-control innovations. Large-scale procurement capabilities and established surgical infrastructure further support demand for coated implants in hospitals.

The ambulatory surgical centers (ASCs) segment is anticipated to witness the fastest growth from 2025 to 2032. As more minimally invasive surgeries are conducted in outpatient settings, there is increasing emphasis on fast recovery and infection prevention. Coated implants offer an added safety layer, making them ideal for ASCs aiming to reduce post-operative complications and readmissions.

Antibiotic-Coated Surgical Implant Drug Market Regional Analysis

- North America dominated the antibiotic-coated surgical implant drug market with the largest revenue share of 42.8% in 2024, attributed to high surgical volumes, advanced healthcare infrastructure, and early adoption of innovative medical technologies

- Healthcare providers in the region prioritize reducing surgical site infections through advanced technologies, and antibiotic-coated implants are widely adopted as part of infection control strategies, particularly in orthopedic and cardiovascular procedures

- The widespread use of coated implants is further supported by favorable reimbursement policies, strong presence of key medical device manufacturers, and increasing clinical awareness of the benefits of localized antimicrobial delivery, positioning North America as a leader in infection-preventive surgical solutions across both public and private healthcare sectors

U.S. Antibiotic-Coated Surgical Implant Drug Market Insight

The U.S. antibiotic-coated surgical implant drug market captured the largest revenue share of 79.2% in 2024 within North America, fueled by the high volume of complex surgical procedures and a strong emphasis on reducing surgical site infections (SSIs). Hospitals and surgical centers are increasingly adopting antibiotic-coated implants in orthopedic, cardiovascular, and neurological procedures to mitigate infection risks. In addition, the presence of major implant manufacturers, ongoing clinical trials, and favorable reimbursement structures are driving widespread usage, reinforcing the U.S. as a key leader in infection-preventive implant technology.

Europe Antibiotic-Coated Surgical Implant Drug Market Insight

The Europe antibiotic-coated surgical implant drug market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict infection control regulations and a well-established healthcare infrastructure. Increased demand for surgical implants in aging populations and rising awareness of antimicrobial resistance are prompting healthcare systems to adopt coated implants. Germany, the U.K., and France are witnessing accelerated adoption, especially in orthopedic and dental surgeries, due to robust R&D investments, institutional protocols, and a proactive approach to surgical safety and innovation.

U.K. Antibiotic-Coated Surgical Implant Drug Market Insight

The U.K. antibiotic-coated surgical implant drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by national efforts to curb hospital-acquired infections and promote antimicrobial stewardship. The National Health Service (NHS) supports the integration of antibiotic-releasing implants, particularly in high-risk procedures, such as joint replacements and cardiovascular interventions. Ongoing collaborations between universities and biotech companies to develop advanced coating technologies are also propelling the market, while increased elective surgeries post-COVID recovery continue to fuel demand.

Germany Antibiotic-Coated Surgical Implant Drug Market Insight

The Germany antibiotic-coated surgical implant drug market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s leadership in precision medical technologies and infection control initiatives. With a strong manufacturing base and government focus on patient safety, German hospitals are early adopters of coated implant technologies. The growing geriatric population and a high rate of orthopedic and dental implant surgeries further drive demand. In addition, innovations in biocompatible and dual-action coatings align with Germany’s sustainability and healthcare quality standards.

Asia-Pacific Antibiotic-Coated Surgical Implant Drug Market Insight

The Asia-Pacific antibiotic-coated surgical implant drug market is poised to grow at the fastest CAGR of 23.4% during the forecast period of 2025 to 2032, driven by rapid healthcare infrastructure development, rising surgical volumes, and increasing awareness of hospital-acquired infections. Emerging economies such as China, India, and Southeast Asian countries are witnessing growing investments in surgical technologies. Government support for infection prevention, coupled with increasing medical tourism, is enhancing the regional demand for advanced coated implant solutions across orthopedic and general surgeries.

Japan Antibiotic-Coated Surgical Implant Drug Market Insight

The Japan antibiotic-coated surgical implant drug market is gaining momentum due to its advanced healthcare system, high aging population, and a cultural emphasis on precision medicine. Japanese hospitals prioritize post-operative safety, especially in orthopedic and cardiovascular procedures, where coated implants are increasingly utilized. The integration of local research institutions and multinational companies in coating innovation supports growth, while the country’s focus on reducing antimicrobial resistance aligns with the adoption of such targeted drug-delivery implants.

India Antibiotic-Coated Surgical Implant Drug Market Insight

The India antibiotic-coated surgical implant drug market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country’s high surgical volumes, rapid urbanization, and rising healthcare investments. Indian hospitals are increasingly using coated implants to reduce post-operative infections, especially in joint and dental surgeries. The government's support for medical device manufacturing and infection control, combined with a growing network of specialty clinics, is accelerating adoption. The presence of cost-effective local manufacturers is also making coated implants more accessible across both public and private sectors.

Antibiotic-Coated Surgical Implant Drug Market Share

The antibiotic-coated surgical implant drug industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- DePuy Synthes (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (U.K.)

- B. Braun SE (Germany)

- Heraeus Medical GmbH (Germany)

- CONMED Corporation (U.S.)

- Biometrix Ltd. (Israel)

- Aesculap AG (Germany)

- Orthofix Medical Inc. (U.S.)

- Wright Medical Group N.V. (Netherlands)

- Coloplast A/S (Denmark)

- Integra LifeSciences (U.S.)

- Corin Group (U.K.)

- LimaCorporate S.p.A. (Italy)

- MicroPort Scientific Corporation (China)

- Mathys AG Bettlach (Switzerland)

- G21 Srl (Italy)

- Implantcast GmbH (Germany)

What are the Recent Developments in Global Antibiotic-Coated Surgical Implant Drug Market?

- In May 2023, Zimmer Biomet Holdings, Inc. announced the launch of a next-generation antibiotic-coated knee implant system in Europe, featuring a dual-layer release mechanism for sustained antibacterial protection. This innovation is designed to minimize the risk of periprosthetic joint infections (PJI) during and after knee arthroplasty, reinforcing the company’s focus on improving patient outcomes and setting new standards in implant safety. The development demonstrates Zimmer Biomet’s continued investment in infection control technologies within the surgical implant space

- In April 2023, DePuy Synthes, the orthopaedics company of Johnson & Johnson, entered into a research collaboration with a European university hospital to co-develop bioresorbable antibiotic coatings for trauma and spinal implants. The goal is to enhance localized drug delivery while reducing systemic antibiotic usage. This partnership underscores DePuy Synthes’ commitment to innovation and personalized surgical solutions in the fight against implant-related infections, especially in high-risk procedures

- In March 2023, Heraeus Medical GmbH expanded the global reach of its COPAL G+C bone cement product, which incorporates gentamicin and clindamycin, by obtaining regulatory approval for use in Southeast Asian countries. This strategic move addresses the growing demand for antibiotic-loaded implant materials in orthopedic surgeries, particularly in regions with rising surgical volumes and infection rates. The development highlights Heraeus’s role in advancing antimicrobial implant technologies for infection-prone surgical settings

- In February 2023, Biometrix Ltd. introduced a new line of antibiotic-coated titanium dental implants at the International Dental Show (IDS) in Cologne, Germany. Engineered to prevent peri-implantitis, these implants utilize a slow-release coating that minimizes microbial colonization without impacting osseointegration. This launch emphasizes the growing intersection of implant innovation and infection control in the dental market, with Biometrix positioning itself as a leader in precision antimicrobial implant solutions

- In January 2023, Medtronic plc initiated clinical trials in North America to evaluate the safety and efficacy of its antibiotic-coated cardiac pacemaker leads. Designed for patients at higher risk of endocarditis and bloodstream infections, the coating integrates rifampicin and minocycline to inhibit bacterial adhesion. This development showcases Medtronic’s proactive efforts to expand antibiotic coating applications beyond orthopedic implants, addressing unmet clinical needs in cardiovascular implant safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.