Global Spinal Implants Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

12.80 Billion

USD

20.56 Billion

2024

2032

USD

12.80 Billion

USD

20.56 Billion

2024

2032

| 2025 –2032 | |

| USD 12.80 Billion | |

| USD 20.56 Billion | |

|

|

|

|

Spinal Implants and Surgical Devices Market Size

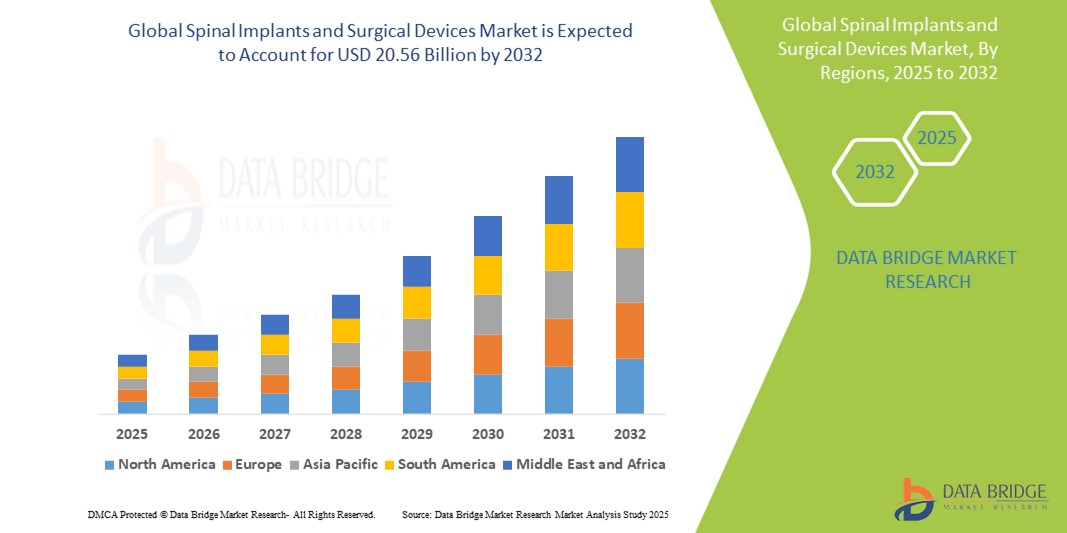

- The global spinal implants and surgical devices market size was valued at USD 12.80 billion in 2024 and is expected to reach USD 20.56 billion by 2032, at a CAGR of 6.10% during the forecast period

- This growth is driven by factors such as the rising prevalence of spinal disorders, increasing geriatric population, advancements in minimally invasive surgical techniques, and growing demand for spinal fusion and non-fusion devices

Spinal Implants and Surgical Devices Market Analysis

- Spinal implants and surgical devices are used to treat spinal disorders such as degenerative disc disease, scoliosis, spinal stenosis, and fractures, providing stability and facilitating spinal fusion or motion preservation

- The demand for these devices is significantly driven by the increasing incidence of spinal disorders, growing aging population, and technological advancements in implant materials and minimally invasive procedures

- North America is expected to dominate the spinal implants and surgical devices market with a market share of 48.8%, due to a well-established healthcare infrastructure, high demand for advanced spinal treatments, and widespread adoption of innovative technologies such as minimally invasive surgery and robotic-assisted procedures

- Asia-Pacific is expected to be the fastest growing region in the spinal implants and surgical devices market with a market share of 20.45%, during the forecast period due to by improving healthcare infrastructure, a rapidly aging population, and increasing incidence of spinal disorders

- Spinal fusion devices segment is expected to dominate the market with a market share of 58.9% due to its widespread use in treating chronic and degenerative spinal conditions such as spondylolisthesis and herniated discs

Report Scope and Spinal Implants and Surgical Devices Market Segmentation

|

Attributes |

Spinal Implants and Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spinal Implants and Surgical Devices Market Trends

“Technological Advancements in Minimally Invasive Spine Surgery (MISS) and Smart Implants”

- One prominent trend in the spinal implants and surgical devices market is the rapid advancement of minimally invasive spine surgery techniques and the emergence of smart, sensor-enabled implants

- These innovations reduce surgical trauma, minimize hospital stays, and enable real-time monitoring of spinal healing and implant performance, significantly enhancing clinical outcome

- For instance, smart spinal implants equipped with wireless sensors can transmit data on load, strain, and fusion progress, allowing surgeons to make timely, informed post-operative decisions, which is particularly valuable in complex fusion and deformity correction cases

- These technological breakthroughs are reshaping spinal surgery practices, improving recovery times, and fueling demand for next-generation spinal implants and surgical systems

Spinal Implants and Surgical Devices Market Dynamics

Driver

“Increasing Incidence of Spinal Disorders and Aging Population”

- The growing incidence of spinal disorders such as degenerative disc disease, herniated discs, scoliosis, and spinal stenosis is a major driver of the spinal implants and surgical devices market

- With the global population aging, there is a higher prevalence of musculoskeletal degeneration and chronic back pain, particularly among older adults who are more susceptible to spinal conditions requiring surgical intervention

- As the demand for effective spinal treatments rises, there is an increasing need for advanced spinal implants and surgical systems to improve patient mobility and quality of life

For instance,

- According to the Global Burden of Disease Study 2021, low back pain remains the leading cause of disability worldwide, particularly affecting older populations, thereby increasing the need for spinal surgeries and supportive implant technologies

- As a result of the increasing burden of spinal disorders and the aging demographic, the demand for spinal implants and surgical devices continues to grow, driving market expansion

Opportunity

“Integration of Artificial Intelligence and Robotics in Spinal Surgery”

- The integration of artificial intelligence (AI) and robotics into spinal surgery is creating significant opportunities by enhancing surgical precision, reducing complication rates, and improving patient outcomes

- AI algorithms can support preoperative planning by analyzing imaging data to recommend optimal implant placement, while robotic systems can assist in executing complex procedures with greater accuracy and stability

- These technologies not only shorten surgery duration but also reduce radiation exposure and post-operative recovery times, making spinal surgeries safer and more efficient

For instance,

- In September 2023, a study published in the Journal of Neurosurgery: Spine reported that robotic-assisted spinal surgery combined with AI-driven navigation systems led to a 30% reduction in surgical errors and a 25% improvement in implant placement accuracy, especially in minimally invasive procedures

- The adoption of AI and robotics in spinal procedures is poised to transform surgical practices, offering scalable solutions for personalized spine care and driving market growth through technological innovation.

Restraint/Challenge

“High Cost of Spinal Implants and Surgical Procedures Limiting Accessibility”

- The high cost associated with spinal implants and surgical procedures presents a major challenge, especially in low- and middle-income countries, where healthcare budgets and insurance coverage are often limited

- Advanced spinal implants, navigation systems, and robotic-assisted surgical tools can cost tens of thousands of dollars, significantly increasing the overall cost of treatment and hospital expenditure

- This financial burden may restrict access for patients and discourage smaller healthcare facilities from adopting newer technologies, leading to regional disparities in spinal care and delayed adoption of innovations

For instance,

- According to an April 2024 report by the International Society for the Advancement of Spine Surgery (ISASS), the average cost of spinal fusion surgery in the U.S. can exceed USD 80,000, with implants and surgical tools accounting for a substantial portion of the total expense. This cost barrier often results in delayed treatment or reliance on outdated surgical techniques

- Consequently, the high cost of spinal implants and procedures can hinder market penetration, slow adoption rates of advanced technologies, and contribute to unequal access to quality spinal care across regions

Spinal Implants and Surgical Devices Market Scope

The market is segmented on the basis of type, technology, product.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Product |

|

In 2025, the spinal fusion devices is projected to dominate the market with a largest share in product segment

The spinal fusion devices segment is expected to dominate the spinal implants and surgical devices market with the largest share of 58.9% in 2025 due to its widespread use in treating chronic and degenerative spinal conditions such as spondylolisthesis and herniated discs. The procedure's effectiveness in providing long-term spinal stability and pain relief contributes to its high adoption. In addition, advancements in biomaterials and minimally invasive fusion techniques are enhancing patient outcomes and recovery times, further boosting market demand.

The open surgery is expected to account for the largest share during the forecast period in type market

In 2025, the open surgery segment is expected to dominate the market with the largest market share of 56.8% due to its established clinical effectiveness and wide acceptance among surgeons for complex spinal procedures. It allows for direct visualization and access to the spine, which is crucial in cases involving severe deformities or trauma. Despite the rise of minimally invasive techniques, open surgery remains the preferred approach for treating intricate spinal conditions, especially in older or high-risk patients.

Spinal Implants and Surgical Devices Market Regional Analysis

“North America Holds the Largest Share in the Spinal Implants and Surgical Devices Market”

- North America dominates the spinal implants and surgical devices market with a market share of estimated 48.8%, driven, by a well-established healthcare infrastructure, high demand for advanced spinal treatments, and widespread adoption of innovative technologies such as minimally invasive surgery and robotic-assisted procedures

- U.S. holds a market share of 58%, due to the high prevalence of spinal disorders, increased healthcare spending, and the presence of major market players actively involved in product innovation and clinical trials

- Favorable reimbursement policies, a high number of spinal surgeries performed annually, and extensive R&D investments by top orthopedic and spine companies further contribute to market leadership in the region

- In addition, increasing awareness of spinal health, early diagnosis, and strong demand for motion-preserving technologies such as artificial discs are fueling growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Spinal Implants and Surgical Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the spinal implants and surgical devices market with a market share of 20.45%, driven by rapid expansion in healthcare infrastructure, increasing awareness about eye health, and rising surgical volumes

- Countries such as China, India, and Japan are emerging as major contributors due to a growing middle-class population, rising demand for advanced spinal surgeries, and greater healthcare access

- Japan, known for its technological expertise, continues to lead in the adoption of precision-guided surgical tools and smart implants, strengthening its role as a key market in the region

- India is projected to register the highest CAGR of 8.8% in the spinal implants and surgical devices market, supported by government initiatives to modernize healthcare, a surge in spinal injury cases, and a growing number of trained spine surgeons adopting minimally invasive techniques

Spinal Implants and Surgical Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (U.S.)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Globus Medical (U.S.)

- Exactech, Inc. (U.S.)

- Orthofix Medical Inc. (U.S.)

- ATEC Spine, Inc. (U.S.)

- Integra LifeSciences Corporation (U.S.)

- NORMAN NOBLE, INC (U.S.)

- XTANT MEDICAL (U.S.)

- Spine Wave, Inc. (U.S.)

- Captiva Spine, Inc (U.S.)

- Wenzel Spine (U.S.)

- Jayon Implants (India)

- Tecomet, Inc. (U.S.)

- SINTX Technologies, Inc (U.S.)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- GPC Medical Ltd. (India)

Latest Developments in Global Spinal Implants and Surgical Devices Market

- In January 2025, Stryker announced its acquisition of Inari Medical for USD 4.9 billion. Inari specializes in devices treating venous diseases, and this acquisition is expected to enhance Stryker's portfolio in peripheral vascular treatments

- In September 2024, Medtronic expanded its AiBLE spine surgery ecosystem by integrating the Mazor robotic guidance system with 5.1 software, making it the first spinal robotic system to combine AI, bone cutting, and graft delivery. This advancement enhances preoperative and intraoperative planning, improving surgical precision and patient outcomes

- In October 2023, Stryker launched the Monterey AL Interbody System, a 3D-printed anterior lumbar interbody fusion implant. This addition to Stryker's growing 3D-printed interbody device portfolio aims to offer improved customization and biocompatibility, leading to better patient outcomes and reduced recovery times

- In November 2023, Spinal Elements announced the full commercial release of its Ventana 3D-Printed Interbody Portfolio. The portfolio includes the Ventana C Anterior Cervical Interbody System, Ventana P/T Posterior Lumbar Interbody System, and Ventana L Lateral Lumbar Interbody System. These innovations are part of the company's MIS Ultra platform, focusing on minimally invasive surgical solutions

- In August 2023, Globus Medical completed its merger with NuVasive Inc., creating a combined entity that offers one of the most comprehensive musculoskeletal procedural solutions in the industry. This merger is expected to drive technological advancements across the care continuum

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.