Global Antiemetics Market

Market Size in USD Billion

CAGR :

%

USD

39.68 Billion

USD

61.87 Billion

2025

2033

USD

39.68 Billion

USD

61.87 Billion

2025

2033

| 2026 –2033 | |

| USD 39.68 Billion | |

| USD 61.87 Billion | |

|

|

|

|

Antiemetics Market Size

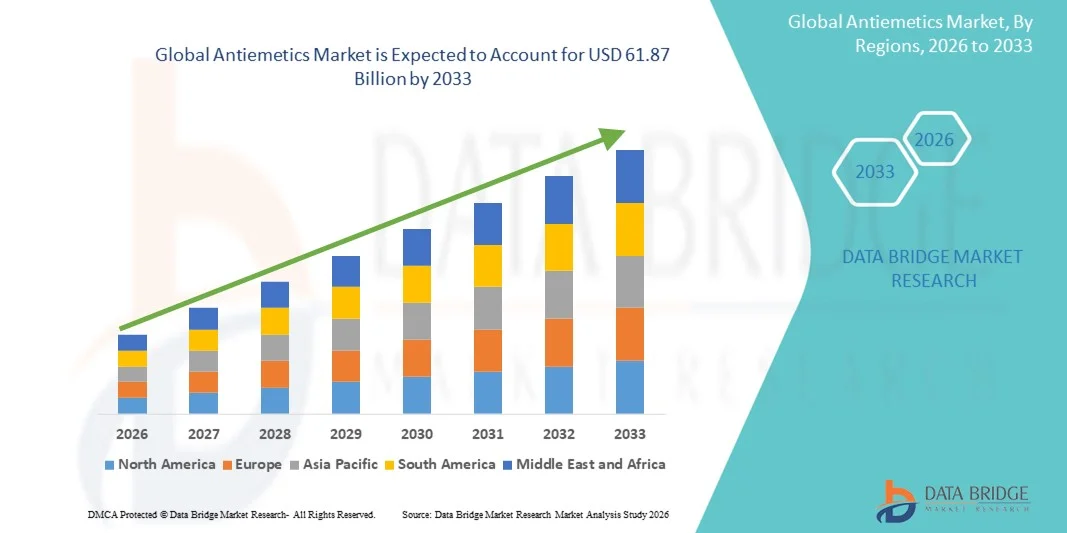

- The global antiemetics market size was valued at USD 39.68 billion in 2025 and is expected to reach USD 61.87 billion by 2033, at a CAGR of 5.71% during the forecast period

- The market growth is primarily driven by the rising prevalence of chemotherapy-induced nausea and vomiting (CINV), postoperative nausea and vomiting (PONV), gastrointestinal disorders, and motion sickness, along with increasing cancer incidence worldwide

- In addition, growing awareness of symptom management, improved access to healthcare, and the development of more effective, fast-acting, and patient-friendly antiemetic therapies are positioning antiemetics as a critical component of supportive care, thereby significantly accelerating market growth

Antiemetics Market Analysis

- Antiemetics, medicines designed to prevent and treat nausea and vomiting associated with chemotherapy, post‑operative procedures, gastrointestinal disorders, and motion sickness, are becoming increasingly critical in healthcare due to their effectiveness, varied formulations, and broad clinical applications

- The escalating demand for antiemetics is primarily fueled by the rising global incidence of cancer and chemotherapy‑induced nausea and vomiting (CINV), increasing surgical procedures, expanding supportive care awareness, and improved access to healthcare, particularly in emerging markets

- North America dominated the antiemetics market with the largest revenue share of 39.4% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative antiemetic therapies, widespread use in oncology and post‑operative care, and a strong presence of pharmaceutical leaders

- Asia‑Pacific is expected to be the fastest‑growing region in the antiemetics market during the forecast period, driven by expanding healthcare access, rising cancer prevalence, improving treatment availability, and growing awareness of supportive therapies in countries such as China, India, and Japan

- The 5-HT3 Receptor Antagonists segment dominated the antiemetics market with a market share of 30.6% in 2025, due to its high clinical efficacy in preventing chemotherapy-induced nausea and vomiting (CINV) and postoperative nausea and vomiting (PONV), widespread adoption in oncology and surgical care, rapid onset of action, favorable safety profile, and availability in multiple delivery forms

Report Scope and Antiemetics Market Segmentation

|

Attributes |

Antiemetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Antiemetics Market Trends

Personalized and Digital Therapeutic Support Integration

- A significant and accelerating trend in the global antiemetics market is the integration of personalized treatment protocols and digital health tools, enabling tailored antiemetic regimens based on patient risk profiles, treatment responses, and real‑time symptom tracking

- For instance, digital platforms and mobile apps are now being used alongside clinical care to monitor nausea and vomiting patterns, adjust antiemetic dosage schedules, and improve patient adherence, especially in oncology and postoperative care

- Personalized antiemetic strategies incorporate genetic, clinical, and lifestyle data to optimize drug selection and timing, potentially reducing side effects while enhancing efficacy for individual patients

- These digital and personalized approaches facilitate improved communication between patients and healthcare providers, enabling proactive management of nausea and vomiting symptoms across care settings

- Tele‑health enabled antiemetic prescribing and virtual follow‑ups are gaining traction, particularly in remote regions, improving access while reducing hospital visits. Increasing integration with electronic health records (EHRs) allows physicians to analyze treatment outcomes and refine antiemetic strategies for distinct patient populations

- This trend towards more precise, data‑driven antiemetic care is reshaping therapeutic expectations, with developers increasingly focusing on eHealth solutions tied to antiemetic prescriptions and symptom management support

- The demand for integrated personalized and digital antiemetic support is growing rapidly as healthcare systems prioritize outcomes, patient convenience, and reduced hospital readmissions

Antiemetics Market Dynamics

Driver

Increasing Prevalence of Cancer and Chemotherapy Treatments

- The rising global incidence of cancer and expanded use of chemotherapy protocols are key drivers for the heightened demand for antiemetics, as nausea and vomiting are common and debilitating side effects of cancer treatment

- For instance, more patients undergoing cancer therapy are prescribed antiemetic regimens to mitigate chemotherapy‑induced nausea and vomiting (CINV), directly boosting market uptake

- Improved cancer detection rates, broader access to oncology care, and enhanced survivorship are increasing long‑term antiemetic utilization across regions

- Healthcare systems are also emphasizing supportive care to improve patient quality of life, making effective antiemetic therapy an integral part of modern cancer treatment protocols

- Growing postoperative procedures and ambulatory surgeries worldwide are expanding antiemetic use for surgical nausea and vomiting management

- Rising travel and lifestyle‑related nausea cases are broadening antiemetic demand beyond traditional clinical settings into consumer health segments

- This trend towards comprehensive supportive care management underscores antiemetics’ essential role in oncology and expands their use across inpatient and outpatient settings

Restraint/Challenge

Side Effect Profiles and Regulatory Barriers

- Concerns surrounding the side effect profiles of certain antiemetic drugs and stringent regulatory requirements for new antiemetic approvals pose challenges to market growth

- For instance, regulatory bodies globally require extensive clinical data and safety evaluations before approving new drug classes or novel formulations, leading to longer time‑to‑market and higher R&D costs

- Some patients experience adverse reactions that limit drug choice or necessitate combination therapies, complicating treatment protocols and affecting prescription rates

- Regulatory hurdles vary by region, with emerging markets often facing delays in drug approvals, pricing negotiations, and reimbursement challenges that constrain broader access

- Patent expirations and generic competition pressure pricing and reduce revenue potential for innovative antiemetics

- Limited physician awareness of newer antiemetic classes can slow adoption, particularly in primary care and smaller clinics

- Addressing these challenges through enhanced safety profiles, robust clinical evidence, and streamlined regulatory pathways will be crucial for sustained market expansion

Antiemetics Market Scope

The market is segmented on the basis of drug class, application, end‑user, and distribution channel.

- By Drug Class

On the basis of drug class, the antiemetics market is segmented into 5‑HT3 receptor antagonists, dopamine antagonists, NK1 receptor antagonists, antihistamines (H1 histamine receptor antagonists), cannabinoids, benzodiazepines, anticholinergics, steroids, and others. The 5‑HT3 receptor antagonists segment dominated the market with a market share of 30.6% in 2025, driven by its high clinical efficacy in chemotherapy-induced nausea and vomiting (CINV) and postoperative nausea and vomiting (PONV). These drugs, including ondansetron and palonosetron, are widely recommended as first-line therapy due to their serotonin receptor-blocking mechanism. Their availability in oral and injectable forms allows use in hospitals, clinics, and outpatient settings. Generic versions improve affordability and accessibility, particularly in emerging markets. Next-generation formulations with longer action profiles and improved safety further support growth. Strong guideline recommendations in oncology and anesthesia ensure routine usage globally.

The cannabinoids segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding research, evolving regulations, and increased patient preference for alternative antiemetic therapies. Drugs such as dronabinol and nabilone provide options for patients unresponsive to conventional treatments. Regulatory relaxations in North America and Europe support broader clinical applications. Formulation innovations and increasing clinical evidence enhance adoption. Strategic launches and partnerships accelerate market penetration, especially in oncology and refractory GI disorder treatments. Patient preference for therapies with different side-effect profiles further drives the segment’s growth.

- By Application

On the basis of application, the antiemetics market is segmented into chemotherapy, motion sickness, gastroenteritis, general anesthetics, opioid analgesics, dizziness, pregnancy, food poisoning, emotional stress, and others. The chemotherapy segment dominated the market with a market share of 40% in 2025, driven by the high prevalence of cancer and the critical need to manage CINV effectively. Antiemetics are integral to oncology protocols to maintain patient quality of life and ensure treatment completion. Multi-drug regimens combining 5‑HT3 receptor antagonists, NK1 receptor antagonists, and steroids remain common in highly emetogenic chemotherapy. Adoption of updated clinical guidelines emphasizing prophylaxis contributes to stable segment dominance. The rise of targeted therapies and immunotherapies that also cause nausea expands the patient base. Higher per-patient drug spend in oncology further solidifies revenue share relative to other applications.

The motion sickness segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing global travel, tourism, and lifestyle-related motion sickness. Over-the-counter availability supports self-medication and broader adoption. Rising awareness and demand among younger, mobile populations boost growth. Novel fast-dissolving tablet formulations improve convenience for travelers. Public health campaigns and digital guidance further enhance adoption. Growth is supported by expansion in the travel and tourism sectors globally.

- By End‑User

On the basis of end-user, the antiemetics market is segmented into hospitals, clinics, pharmacies, and online pharmacies. The hospitals segment dominated the market in 2025, as most antiemetics are administered in inpatient settings for chemotherapy, surgical procedures, and severe gastrointestinal conditions. Hospitals maintain formularies with multiple antiemetic classes to manage acute and chronic nausea. High-volume usage in surgical and oncology care reinforces demand. Institutional purchasing and long-term contracts ensure steady revenue flows. Clinician training and familiarity support preference for hospital-administered antiemetics. Hospitals also drive guideline adoption, influencing broader prescription patterns.

The online pharmacies segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by e-commerce expansion, telemedicine prescriptions, and home delivery models. Digital platforms enhance convenience, affordability, and adherence. Patients with chronic or recurring nausea increasingly rely on online pharmacies. Integration with telehealth and subscription services supports seamless access. Expansion of internet infrastructure in emerging markets widens reach. Pandemic-era shifts in healthcare consumption accelerated online pharmacy utilization globally.

- By Distribution Channel

On the basis of distribution channel, the antiemetics market is segmented into retail pharmacy, hospital pharmacy, and online. The retail pharmacy segment dominated the market in 2025, driven by wide physical presence, trusted access, and availability of prescription and OTC antiemetics. Retail outlets stock a broad range of drug classes, facilitating patient choice. Insurance coverage and pharmacist recommendations support sales. Reliable supply chains ensure product availability across regions. Retail pharmacies serve multiple indications, including motion sickness, gastroenteritis, and pregnancy-related nausea. Established consumer trust makes retail the preferred traditional channel.

The online segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by expanding e-commerce platforms, telehealth prescriptions, and direct-to-patient delivery. Competitive pricing and convenience attract patients, particularly for maintenance therapy. Younger, tech-savvy populations increasingly purchase medications online. Digital prescribing platforms support subscription and recurring orders. Expanding internet access in emerging economies increases reach. Online distribution complements telemedicine use, especially in remote areas.

Antiemetics Market Regional Analysis

- North America dominated the antiemetics market with the largest revenue share of 39.4% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative antiemetic therapies, widespread use in oncology and post‑operative care, and a strong presence of pharmaceutical leaders

- Consumers and healthcare providers in the region prioritize effective management of chemotherapy-induced nausea and vomiting (CINV), postoperative nausea, and motion sickness, supporting widespread use of both hospital-administered and outpatient antiemetics

- The dominance is further supported by advanced healthcare facilities, high healthcare spending, increasing awareness of supportive care, and the availability of newer antiemetic drug classes, establishing North America as a key market for both hospitals and retail/online pharmacies

U.S. Antiemetics Market Insight

The U.S. antiemetics market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of cancer and the widespread adoption of chemotherapy protocols. Patients and healthcare providers are increasingly prioritizing effective management of chemotherapy-induced nausea and vomiting (CINV), postoperative nausea, and motion sickness. The growing use of hospital-administered therapies, coupled with strong demand for oral and injectable antiemetic formulations, further propels the market. Moreover, the adoption of guideline-recommended multi-drug antiemetic regimens and increasing awareness of supportive care in oncology significantly contribute to market expansion. Advanced healthcare infrastructure and reimbursement coverage also reinforce steady demand for antiemetic therapies.

Europe Antiemetics Market Insight

The Europe antiemetics market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established oncology care systems and the growing need to manage CINV and postoperative nausea effectively. Increasing urbanization and access to modern healthcare facilities foster the adoption of antiemetics across hospitals, clinics, and retail pharmacies. European patients and physicians also value the efficacy and safety profiles of guideline-recommended antiemetic therapies. The region is experiencing significant growth across both inpatient and outpatient applications, with antiemetics being integrated into chemotherapy protocols, surgical care, and preventive care programs.

U.K. Antiemetics Market Insight

The U.K. antiemetics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of cancer and motion sickness, and the increasing focus on supportive care. Concerns regarding chemotherapy-induced and postoperative nausea are encouraging hospitals, clinics, and patients to adopt effective antiemetic solutions. The U.K.’s strong healthcare system, coupled with robust e-commerce and retail infrastructure, supports the availability of both prescription and over-the-counter antiemetics. Increasing awareness of multi-drug regimens and guideline adherence is expected to continue to stimulate market growth.

Germany Antiemetics Market Insight

The Germany antiemetics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of effective nausea and vomiting management and growing demand for technologically advanced healthcare solutions. Germany’s well-developed healthcare infrastructure, emphasis on evidence-based treatment, and availability of a wide range of antiemetic drug classes promote adoption across hospitals and clinics. Integration of digital tools for patient monitoring and adherence tracking is also gaining traction. The preference for safe, guideline-recommended antiemetic therapies aligns with local patient and physician expectations, supporting sustained market growth.

Asia-Pacific Antiemetics Market Insight

The Asia-Pacific antiemetics market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising cancer incidence, increasing surgical procedures, and expanding healthcare infrastructure in countries such as China, Japan, and India. The region's growing awareness of nausea management and supportive care, supported by government initiatives and modernization of hospitals, is driving adoption of antiemetics. Furthermore, as APAC emerges as a hub for pharmaceutical manufacturing and generic formulations, the affordability and accessibility of antiemetics are expanding to a wider patient base.

Japan Antiemetics Market Insight

The Japan antiemetics market is gaining momentum due to the country’s high prevalence of cancer, advanced healthcare infrastructure, and strong focus on supportive care. The Japanese market emphasizes patient quality of life, and the adoption of antiemetics is driven by increased chemotherapy and surgical procedures. Integration with hospital monitoring systems and adherence tracking technologies is fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-administer, effective antiemetic therapies in both inpatient and outpatient settings.

India Antiemetics Market Insight

The India antiemetics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rising cancer burden, growing awareness of supportive care, and expanding healthcare access. India stands as one of the largest markets for oral and injectable antiemetics, with increasing adoption across hospitals, clinics, and retail pharmacies. Government initiatives for cancer care, increasing hospital infrastructure, and the availability of affordable generic antiemetics are key factors propelling market growth. Moreover, growing telemedicine adoption and online pharmacy penetration are further facilitating access to antiemetic therapies.

Antiemetics Market Share

The Antiemetics industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Sanofi (France)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Baxter (U.S.)

- F. Hoffmann La Roche Ltd (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Ltd. (India)

- Aurobindo Pharma Ltd. (India)

- Zydus Lifesciences Ltd. (India)

- Lupin (India)

- AbbVie Inc. (U.S.)

- Eisai Co., Ltd. (Japan)

- Astellas Pharma Inc. (Japan)

What are the Recent Developments in Global Antiemetics Market?

- In October 2025, Helsinn announced that results from the MyRisk clinical trial showed AKYNZEO® demonstrated superior prevention of chemotherapy‑induced nausea and vomiting compared to the standard of care in patients receiving moderately emetogenic chemotherapy, with findings presented at the European Society for Medical Oncology (ESMO) Congress

- In August 2025, Heron Therapeutics highlighted commercial progress for CINVANTI (aprepitant) and APONVIE (aprepitant IV push for PONV) with expanded sales efforts in the U.S., leveraging both products’ roles in preventing chemotherapy‑induced and postoperative nausea and vomiting as part of broader antiemetic care strategies

- In April 2025, Helsinn Group submitted a new formulation of AKYNZEO® (fixed‑dose netupitant/palonosetron) to the European Medicines Agency (EMA) for regulatory review, aiming to improve prevention of chemotherapy‑induced nausea and vomiting and potentially launching the enhanced formulation in the first half of 2026 pending approval

- In June 2023, Eagle Pharmaceuticals highlighted the commercial expansion and physician uptake of Barhemsys®, the first FDA‑approved antiemetic for rescue treatment of postoperative nausea and vomiting (PONV) despite prophylaxis, with sales and clinical adoption increasing in the U.S. surgical care setting

- In January 2023, Glenmark Pharmaceuticals Ltd launched AKYNZEO® I.V. injection in India, a fixed‑dose combination of netupitant and palonosetron for the prevention of chemotherapy‑induced nausea and vomiting (CINV), expanding access to IV antiemetic therapy in the Indian oncology market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.