Global Antihistamine Drugs Market

Market Size in USD Billion

CAGR :

%

USD

305.85 Billion

USD

620.71 Billion

2024

2032

USD

305.85 Billion

USD

620.71 Billion

2024

2032

| 2025 –2032 | |

| USD 305.85 Billion | |

| USD 620.71 Billion | |

|

|

|

|

Antihistamine Drugs Market Size

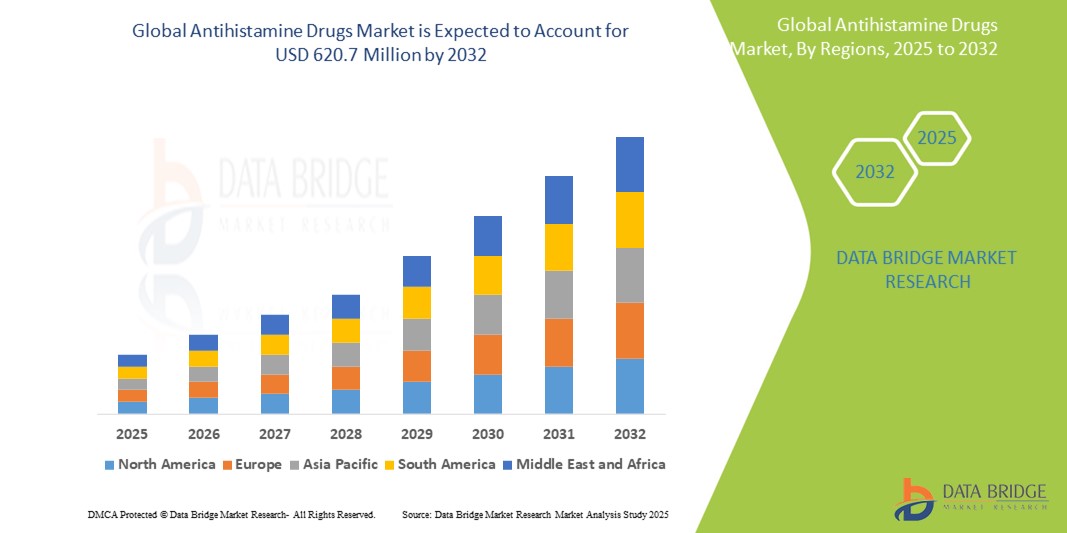

- The global antihistamine drugs market size was valued at USD 305.85 million in 2024 and is expected to reach USD 620.71 million by 2032, at a CAGR of 9.25% during the forecast period

- The market growth is largely driven by the increasing prevalence of allergic conditions such as allergic rhinitis, urticaria, and atopic dermatitis, coupled with heightened awareness and diagnosis rates across both developed and emerging regions

- Furthermore, growing demand for over-the-counter (OTC) antihistamines, advancements in second- and third-generation antihistamines with fewer sedative effects, and the expansion of e-pharmacy platforms are establishing antihistamines as a frontline therapeutic option. These converging factors are accelerating the adoption of antihistamine medications, thereby significantly boosting the industry's growth

Antihistamine Drugs Market Analysis

- Antihistamine drugs, used to block or reduce histamine-mediated allergic reactions, are becoming essential components in managing a wide range of allergic conditions such as hay fever, urticaria, and anaphylaxis in both acute and chronic care settings due to their rapid onset of action and broad therapeutic applicability

- The escalating demand for antihistamines is primarily fueled by the rising prevalence of allergic disorders globally, increasing self-medication trends, and growing awareness of allergy management solutions, especially non-sedating second-generation formulations

- North America dominated the antihistamine drugs market with the largest revenue share of 39.2% in 2024, characterized by high allergy prevalence, strong over-the-counter drug adoption, and the presence of major pharmaceutical companies, with the U.S. witnessing significant growth due to seasonal allergy peaks and consumer shift toward non-prescription antihistamines

- Asia-Pacific is expected to be the fastest growing region in the antihistamine drugs market during the forecast period due to increasing healthcare access, rising allergic disease incidence, and growing pharmaceutical investments

- The oral segment dominated the antihistamine drugs market with a market share of 61.9% in 2024, driven by its convenience, rapid symptom relief, and broad availability across prescription and non-prescription channels

Report Scope and Antihistamine Drugs Market Segmentation

|

Attributes |

Antihistamine Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antihistamine Drugs Market Trends

“Shift Toward Second-Generation and Non-Sedating Formulations”

- A significant and accelerating trend in the global antihistamine drugs market is the growing preference for second-generation antihistamines due to their reduced sedative effects and improved safety profiles. These newer formulations are increasingly favored by both healthcare providers and patients for long-term allergy management

- For instance, drugs such as loratadine (Claritin), fexofenadine (Allegra), and cetirizine (Zyrtec) are widely used for their minimal central nervous system penetration, resulting in fewer drowsiness-related side effects, thus enhancing patient compliance, especially in daily or work-related environments

- Pharmaceutical advancements are driving sustained innovation in antihistamine delivery methods, including extended-release tablets and orally disintegrating formulations. Companies such as Johnson & Johnson and Sanofi continue to invest in research that enhances bioavailability and patient convenience

- The OTC availability of many non-sedating antihistamines further boosts their accessibility and fosters self-medication trends, particularly in regions with high allergy incidence and increasing consumer health awareness

- Moreover, combination therapies that integrate antihistamines with decongestants or corticosteroids are gaining traction for enhanced efficacy in treating multi-symptom allergies. These novel combinations are reshaping consumer expectations, pushing drugmakers to deliver more comprehensive allergy relief solutions

- The trend toward non-sedating, fast-acting, and patient-friendly antihistamines is fundamentally reshaping the allergy therapeutics landscape, as both healthcare systems and consumers demand safer, more convenient, and effective treatment options

Antihistamine Drugs Market Dynamics

Driver

“Rising Allergy Prevalence and Self-Medication Practices”

- The rising global prevalence of allergic conditions such as rhinitis, conjunctivitis, urticaria, and food allergies is a major factor fueling the demand for antihistamine drugs. Lifestyle changes, urban pollution, and genetic predisposition contribute to this rising incidence, prompting consistent demand for effective symptomatic relief

- For instance, the World Allergy Organization estimates that over 20–30% of the global population now suffers from allergic rhinitis, driving both prescription and OTC antihistamine drug sales worldwide

- Increasing patient awareness and the widespread availability of OTC antihistamines have led to a surge in self-medication, especially for mild-to-moderate allergies. Retail pharmacy expansion and e-commerce platforms have further facilitated access to these drugs

- In addition, advancements in antihistamine formulations that ensure faster onset of action and fewer side effects are improving patient adherence and satisfaction, encouraging continued market growth

Restraint/Challenge

“Side Effects and Regulatory Limitations on Certain Formulations”

- Despite their widespread use, antihistamines—particularly first-generation formulations—pose risks such as drowsiness, dizziness, and impaired motor function, which can limit their use in working adults and the elderly. These adverse effects remain a significant restraint to broader usage

- For instance, first-generation antihistamines such as diphenhydramine and chlorpheniramine are still used globally but are often accompanied by warnings about sedation and impaired alertness, which restrict their usage in certain demographics

- In addition, regulatory bodies in regions such as the EU and North America enforce stringent safety evaluations and restrictions on certain compounds due to potential adverse events or misuse

- Moreover, inappropriate use, such as overuse of OTC antihistamines without medical guidance, can lead to drug resistance or rebound symptoms. These concerns necessitate continuous consumer education and careful monitoring by regulatory authorities

- Overcoming these challenges requires stronger post-marketing surveillance, the development of safer formulations, and public health initiatives to guide responsible usage, ensuring sustainable growth of the antihistamine drugs market

Antihistamine Drugs Market Scope

The market is segmented on the basis of type, indication, dosage form, route of administration, end-users, and distribution channel.

- By Type

On the basis of type, the antihistamine drugs market is segmented into prescription-based and over-the-counter (OTC). The OTC segment dominated the market with the largest market revenue share in 2024, driven by the widespread availability and ease of access to antihistamines for common allergic symptoms such as hay fever and urticaria. Consumers prefer OTC options due to their convenience, cost-effectiveness, and the growing trend of self-medication. Key OTC drugs such as loratadine and cetirizine continue to witness strong sales through retail and online pharmacies.

The prescription-based segment is anticipated to witness steady growth from 2025 to 2032, fueled by rising cases of chronic allergic conditions and severe allergic reactions requiring stronger or combination therapies. Prescription formulations often target specific conditions and include higher dosages or dual-action mechanisms not available OTC.

- By Indication

On the basis of indication, the antihistamine drugs market is segmented into urticaria, allergy, dermatitis, and others. The allergy segment held the largest market share in 2024, attributed to the high global prevalence of seasonal allergic rhinitis, food allergies, and respiratory allergies. Increasing air pollution and climate-related changes contribute to the expanding patient pool.

The urticaria segment is expected to grow at the fastest pace during the forecast period, due to rising awareness and diagnosis rates, particularly for chronic spontaneous urticaria (CSU), which requires consistent therapeutic management through antihistamines.

- By Dosage Form

On the basis of dosage form, the antihistamine drugs market is segmented into tablets, capsules, and others. The tablet segment dominated the market with the highest revenue share in 2024, owing to its convenience, rapid onset of action, and widespread availability in both OTC and prescription forms.

The capsule segment is projected to witness fastest growth during the forecast period, supported by innovations in extended-release formulations that improve dosing compliance and reduce frequency of intake.

- By Route Of Administration

On the basis of route of administration, the antihistamine drugs market is segmented into oral, parenteral, and others. The oral segment held the dominant share of 61.9% in 2024 due to its non-invasive nature, ease of administration, and suitability for self-treatment. Oral antihistamines are commonly preferred for conditions such as allergic rhinitis and urticaria.

The parenteral segment is expected to register growth during forecast period in hospital and emergency settings where rapid action is needed for severe allergic reactions or anaphylaxis.

- By End User

On the basis of end-users, the market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment led the market in 2024 due to the need for immediate and intensive care for acute allergic reactions and the availability of injectable antihistamines.

The homecare segment is expected to grow significantly over the forecast period, driven by increased consumer awareness and self-management of mild allergic conditions using OTC antihistamines and telehealth support

- By Distribution Channel

On the basis of distribution channel, the antihistamine drugs market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The retail pharmacy segment accounted for the largest market share in 2024, due to the ease of access to both OTC and prescription drugs, especially in urban and suburban areas.

The online pharmacy segment is expected to experience the fastest growth from 2025 to 2032, supported by the digital transformation of healthcare, rising smartphone penetration, and the convenience of home delivery services.

Antihistamine Drugs Market Regional Analysis

- North America dominated the antihistamine drugs market with the largest revenue share of 39.2% in 2024, characterized by high allergy prevalence, strong over-the-counter drug adoption, and the presence of major pharmaceutical companies, with the U.S. witnessing significant growth due to seasonal allergy peaks and consumer shift toward non-prescription antihistamines

- Consumers in the region prioritize fast-acting and accessible treatment options, leading to strong demand for both prescription and OTC formulations across retail and online pharmacies

- This dominant market position is further supported by high healthcare spending, increasing awareness of allergy management, and robust pharmaceutical distribution networks, making antihistamines a routine part of allergy care for both acute and chronic conditions

U.S. Antihistamine Drugs Market Insight

The U.S. antihistamine drugs market captured the largest revenue share of 79.2% in 2024 within North America, fueled by the high incidence of seasonal allergies, asthma, and other allergic conditions. Consumers increasingly seek fast, accessible relief through OTC and prescription antihistamines, supported by favorable reimbursement policies and a strong retail pharmacy network. The widespread availability of combination therapies and advanced formulations, along with proactive awareness campaigns on allergy management, further propels market growth.

Europe Antihistamine Drugs Market Insight

The Europe antihistamine drugs market is projected to grow at a steady CAGR throughout the forecast period, driven by rising environmental allergens and growing awareness of allergic conditions. Stringent healthcare regulations and high standards of medical care are fostering the uptake of prescription-based treatments. In addition, consumer preference for non-sedative, second-generation antihistamines is expanding the market, especially in countries such as Germany, France, and the U.K., where allergy diagnoses and treatment adherence are comparatively higher.

U.K. Antihistamine Drugs Market Insight

The U.K. antihistamine drugs market is anticipated to grow at a notable CAGR during the forecast period, attributed to a high prevalence of hay fever and skin allergies. Increased public health initiatives and consumer education on self-care contribute to growing OTC sales. The expansion of e-pharmacies, alongside robust NHS support for allergy treatment, enhances accessibility, especially during peak allergy seasons.

Germany Antihistamine Drugs Market Insight

The Germany antihistamine drugs market is expected to grow at a considerable CAGR during the forecast period, driven by the country’s high environmental allergen levels and strong regulatory oversight. German consumers favor non-drowsy and long-acting formulations, and the market benefits from physician-led allergy management and a well-established insurance system. Innovations in dual-action therapies and combination products are gaining traction in both hospital and retail channels.

Asia-Pacific Antihistamine Drugs Market Insight

The Asia-Pacific antihistamine drugs market is poised to grow at the fastest CAGR of 23.1% during the forecast period of 2025 to 2032, led by increasing pollution, urbanization, and rising awareness of allergic diseases in countries such as China, India, and Japan. Expanding healthcare infrastructure and growing access to OTC medications are propelling demand. Governments promoting universal healthcare access and the rise of e-pharmacies are further enhancing regional market penetration.

Japan Antihistamine Drugs Market Insight

The Japan antihistamine drugs market is experiencing significant growth, driven by a culture focused on early diagnosis, preventive care, and consumer demand for advanced therapies. High prevalence of cedar pollen-induced hay fever supports year-round demand. Japanese consumers favor second-generation antihistamines with minimal side effects, and digital health platforms are increasingly used to manage allergy symptoms and refill prescriptions conveniently.

India Antihistamine Drugs Market Insight

The India antihistamine drugs market accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by increasing cases of respiratory and skin allergies, rapid urbanization, and an expanding pharmaceutical retail sector. High population density and rising pollution levels contribute to demand growth. The growing availability of affordable OTC antihistamines, supported by local manufacturers and government-backed healthcare initiatives, are key drivers expanding access to treatment across urban and rural regions.

Antihistamine Drugs Market Share

The antihistamine drugs industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Akorn Operation Company LLC (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- Prestige Consumer Healthcare Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Almirall, S.A (Spain)

- Zenomed Healthcare Private Limited (India)

- Cadila Pharmaceuticals (India)

What are the Recent Developments in Global Antihistamine Drugs Market?

- In April 2025, Morepen Laboratories, a leading active pharmaceutical ingredient (API) manufacturer, received approval from the Center for Drug Evaluation under China’s National Medical Products Administration (NMPA) for its anti-allergy API, Loratadine. This regulatory milestone is expected to enable Morepen to gain a substantial foothold in the Chinese market and further strengthen its position as a major global supplier of Loratadine

- In April 2025, the U.S. Food and Drug Administration (FDA) approved Dupixent (dupilumab) for the treatment of chronic spontaneous urticaria (CSU) in adults and adolescents aged 12 and older who continue to experience symptoms despite treatment with H1 antihistamines.

- In October 2024, Alembic Pharmaceuticals announced that it had received final approval from the U.S. Food and Drug Administration (US FDA) for its Abbreviated New Drug Application (ANDA) for Alcaftadine Ophthalmic Solution. The approved product is deemed therapeutically equivalent to the reference listed drug (RLD), Lastacaft Solution, developed by AbbVie Inc

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTIHISTAMINE DRUGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTIHISTAMINE DRUGS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTIHISTAMINE DRUGS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR ANTIHISTAMINE DRUGS MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR ANTIHISTAMINE DRUGS MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR ANTIHISTAMINE DRUGS MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR ANTIHISTAMINE DRUGS MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR ANTIHISTAMINE DRUGS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

17.1 ECONOMIC DEVELOPMENT

18 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY THERAPY TYPE

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS)

18.1 OVERVIEW

18.2 MONOTHERAPY

18.3 COMBINATION THERAPY

19 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY DRUG CLASS

(NOTE: MARKET VALUE, MARKET VOLUME AND ASP WILL BE PROVIDED FOR ALL SEGMENTS AND SUB-SEGMENTS)

19.1 OVERVIEW

19.2 FIRST GENERATION ANTIHISTAMINE (SEDATING)

19.2.1 BROMPHENIRAMINE

19.2.1.1. BY STREGHT

19.2.1.1.1. 1MG/1ML

19.2.1.1.2. 2 MG/5ML

19.2.1.1.3. OTHERS

19.2.1.2. BY DRUG TYPE

19.2.1.2.1. BRANDED

19.2.1.2.2. GENERICS

19.2.1.3. OTHERS

19.2.2 CARBINOXAMINE MALEATE

19.2.2.1. BY STREGHT

19.2.2.1.1. 4 MG

19.2.2.1.2. 10 MG

19.2.2.1.3. OTHERS

19.2.2.2. BY DRUG TYPE

19.2.2.2.1. BRANDED

19.2.2.2.2. GENERICS

19.2.2.3. OTHERS

19.2.3 CHLORPHENIRAMINE

19.2.3.1. BY STREGHT

19.2.3.1.1. 4 MG

19.2.3.1.2. 8 MG

19.2.3.1.3. 10 MG

19.2.3.1.4. OTHERS

19.2.3.2. BY DRUG TYPE

19.2.3.2.1. BRANDED

19.2.3.2.2. GENERICS

19.2.3.3. OTHERS

19.2.4 DIPHENHYDRAMINE

19.2.4.1. BY STREGHT

19.2.4.1.1. 25 MG

19.2.4.1.2. 50 MG

19.2.4.1.3. OTHERS

19.2.4.2. BY DRUG TYPE

19.2.4.2.1. BRANDED

19.2.4.2.2. GENERICS

19.2.4.3. OTHERS

19.2.5 HYDROXYZINE

19.2.5.1. BY STREGHT

19.2.5.1.1. 10 MG

19.2.5.1.2. 20 MG

19.2.5.1.3. 50 MG

19.2.5.1.4. OTHERS

19.2.5.2. BY DRUG TYPE

19.2.5.2.1. BRANDED

19.2.5.2.2. GENERICS

19.2.5.3. OTHERS

19.2.6 TRIPROLIDINE

19.2.6.1. BY STREGHT

19.2.6.1.1. 0.5MG/ML

19.2.6.1.2. 0.625MG/ML

19.2.6.1.3. OTHERS

19.2.6.2. BY DRUG TYPE

19.2.6.2.1. BRANDED

19.2.6.2.2. GENERICS

19.2.6.3. OTHERS

19.2.7 CLEMASTINE

19.2.7.1. BY STREGHT

19.2.7.1.1. 1.34MG

19.2.7.1.2. 2.68MG

19.2.7.1.3. OTHERS

19.2.7.2. BY DRUG TYPE

19.2.7.2.1. BRANDED

19.2.7.2.2. GENERICS

19.2.7.3. OTHERS

19.2.8 KETOTIFEN

19.2.8.1. BY STREGHT

19.2.8.1.1. 1MG

19.2.8.1.2. OTHERS

19.2.8.2. BY DRUG TYPE

19.2.8.2.1. BRANDED

19.2.8.2.2. GENERICS

19.2.8.3. OTHERS

19.2.9 PROMETHAZINE HYDROCHLORIDE

19.2.9.1. BY STREGHT

19.2.9.1.1. 12.5MG

19.2.9.1.2. 25MG

19.2.9.1.3. 50MG

19.2.9.1.4. OTHERS

19.2.9.2. BY DRUG TYPE

19.2.9.2.1. BRANDED

19.2.9.2.2. GENERICS

19.2.9.3. OTHERS

19.2.10 PROMETHAZINE TEOCLATE

19.2.10.1. BY STREGHT

19.2.10.1.1. 1.34MG

19.2.10.1.2. 2.68MG

19.2.10.1.3. OTHERS

19.2.10.2. BY DRUG TYPE

19.2.10.2.1. BRANDED

19.2.10.2.2. GENERICS

19.2.10.3. OTHERS

19.2.11 CYPROHEPTADINE

19.2.11.1. BY STREGHT

19.2.11.1.1. 4 MG

19.2.11.1.2. OTHERS

19.2.11.2. BY DRUG TYPE

19.2.11.2.1. BRANDED

19.2.11.2.2. GENERICS

19.2.11.3. OTHERS

19.2.12 CINNARIZINE

19.2.12.1. BY STREGHT

19.2.12.1.1. 15 MG

19.2.12.1.2. 25 MG

19.2.12.1.3. OTHERS

19.2.12.2. BY DRUG TYPE

19.2.12.2.1. BRANDED

19.2.12.2.2. GENERICS

19.2.12.3. OTHERS

19.2.13 ALIMEMAZINE

19.2.13.1. BY STREGHT

19.2.13.1.1. 1 MG

19.2.13.1.2. 10 MG

19.2.13.1.3. OTHERS

19.2.13.2. BY DRUG TYPE

19.2.13.2.1. BRANDED

19.2.13.2.2. GENERICS

19.2.13.3. OTHERS

19.2.14 OTHERS

19.3 SECOND GENERATION ANTIHISTAMINES (NON SEDATING)

19.3.1 AZELASTINE

19.3.1.1. BY STREGHT

19.3.1.1.1. 0.1% SOLUTION

19.3.1.1.2. 0.15% SOLUTION

19.3.1.2. BY DRUG TYPE

19.3.1.2.1. BRANDED

19.3.1.2.2. GENERICS

19.3.1.3. OTHERS

19.3.2 OLOPATADINE

19.3.2.1. BY STREGHT

19.3.2.1.1. 0.1% SOLUTION

19.3.2.1.2. 0.2% SOLUTION

19.3.2.2. BY DRUG TYPE

19.3.2.2.1. BRANDED

19.3.2.2.2. GENERICS

19.3.2.3. OTHERS

19.3.3 ACRIVASTINE

19.3.3.1. BY STREGHT

19.3.3.1.1. 8 MG

19.3.3.1.2. 60 MG

19.3.3.2. BY DRUG TYPE

19.3.3.2.1. BRANDED

19.3.3.2.2. GENERICS

19.3.3.3. OTHERS

19.3.4 BILASTINE

19.3.4.1. BY STREGHT

19.3.4.1.1. 10 MG

19.3.4.1.2. 20 MG

19.3.4.1.3. OTHERS

19.3.4.2. BY DRUG TYPE

19.3.4.2.1. BRANDED

19.3.4.2.2. GENERICS

19.3.4.3. OTHERS

19.3.5 DESLORATADINE

19.3.5.1. BY STREGHT

19.3.5.1.1. 2.5 MG

19.3.5.1.2. 5 MG

19.3.5.1.3. OTHERS

19.3.5.2. BY DRUG TYPE

19.3.5.2.1. BRANDED

19.3.5.2.2. GENERICS

19.3.5.3. OTHERS

19.3.6 FEXOFENADINE

19.3.6.1. BY STREGHT

19.3.6.1.1. 30 MG

19.3.6.1.2. 60 MG

19.3.6.1.3. 180 MG

19.3.6.1.4. OTHERS

19.3.6.2. BY DRUG TYPE

19.3.6.2.1. BRANDED

19.3.6.2.2. GENERICS

19.3.6.3. OTHERS

19.3.7 CETIRIZINE

19.3.7.1. BY STREGHT

19.3.7.1.1. 5 MG

19.3.7.1.2. 10 MG

19.3.7.1.3. OTHERS

19.3.7.2. BY DRUG TYPE

19.3.7.2.1. BRANDED

19.3.7.2.2. GENERICS

19.3.7.3. OTHERS

19.3.8 LEVOCETIRIZINE

19.3.8.1. BY STREGHT

19.3.8.1.1. 5 MG

19.3.8.1.2. 2.5 MG

19.3.8.1.3. OTHERS

19.3.8.2. BY DRUG TYPE

19.3.8.2.1. BRANDED

19.3.8.2.2. GENERICS

19.3.8.3. OTHERS

19.3.9 LORATADINE

19.3.9.1. BY STREGHT

19.3.9.1.1. 5 MG

19.3.9.1.2. 10 MG

19.3.9.1.3. OTHERS

19.3.9.2. BY DRUG TYPE

19.3.9.2.1. BRANDED

19.3.9.2.2. GENERICS

19.3.9.3. OTHERS

19.3.10 MIZOLASTINE

19.3.10.1. BY STREGHT

19.3.10.1.1. 10 MG

19.3.10.1.2. OTHERS

19.3.10.2. BY DRUG TYPE

19.3.10.2.1. BRANDED

19.3.10.2.2. GENERICS

19.3.10.3. OTHERS

19.3.11 RUPATADINE

19.3.11.1. BY STREGHT

19.3.11.1.1. 10 MG

19.3.11.1.2. OTHERS

19.3.11.2. BY DRUG TYPE

19.3.11.2.1. BRANDED

19.3.11.2.2. GENERICS

19.3.11.3. OTHERS

19.3.12 OTHERS

19.4 OTHER

20 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY ROUTE OF ADMINISTRATION

20.1 OVERVIEW

20.2 ORAL

20.2.1 CAPSULES

20.2.2 TABLETS

20.2.3 OTHERS

20.3 PARENTERAL

20.3.1 INTRAVENEOUS

20.3.2 SUBCUTANEOUS

20.3.3 OTHERS

20.4 INTRANASAL

20.5 INTRAOCULAR

20.6 OTHERS

21 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY DRUG TYPE

21.1 OVERVIEW

21.2 BRANDED

21.2.1 ZYRTEC D

21.2.2 XYZAL

21.2.3 CLARINEX

21.2.4 OTHERS

21.3 GENERICS

22 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY PRESCRIPTION MODE

22.1 OVERVIEW

22.2 PRESCRIPTION-BASED

22.2.1 ASTELIN

22.2.2 ARBINOXA

22.2.3 OTHERS

22.3 OVER-THE-COUNTER (OTC)

23 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY POPULATION TYPE

23.1 OVERVIEW

23.2 BELOW 6 YEARS

23.3 6-15 YEARS

23.4 ABOVE 15 YEARS

24 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY GENDER

24.1 OVERVIEW

24.2 MALE

24.2.1 BELOW 6 YEARS

24.2.2 6-15 YEARS

24.2.3 ABOVE 15 YEARS

24.3 FEMALE

24.3.1 BELOW 6 YEARS

24.3.2 6-15 YEARS

24.3.3 ABOVE 15 YEARS

25 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY INDICATION

25.1 OVERVIEW

25.2 URTICARIA

25.3 ALLERGY

25.3.1 ALLERGIC RHINITIS

25.3.2 ALLERGIC CONJUNCTIVITIS

25.3.3 ALLERGIC DERMATOLOGICAL REACTION

25.3.4 OTHERS

25.4 DERMATITIS

25.5 SINUSITIS

25.6 PEPTIC ULCER

25.7 ZOLLINGER ELLISON SYNDROME

25.8 OTHER

26 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY END USER

26.1 OVERVIEW

26.2 HOSPITALS

26.2.1 PUBLIC

26.2.2 PRIVATE

26.3 SPECIALTY CLINICS

26.4 HOME HEALTHCARE

26.5 ACADEMIC AND RESEARCH INSTITUTE

26.6 OTHERS

27 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY DISTRIBUTION CHANNEL

27.1 OVERVIEW

27.2 DIRECT TENDER

27.3 RETAIL SALES

27.3.1 ONLINE PHARMACY

27.3.2 OFFLINE PHARMACY

27.4 OTHERS

28 GLOBAL ANTIHISTAMINE DRUGS MARKET, COMPANY LANDSCAPE

28.1 COMPANY SHARE ANALYSIS: GLOBAL

28.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

28.3 COMPANY SHARE ANALYSIS: EUROPE

28.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

28.5 MERGERS & ACQUISITIONS

28.6 NEW PRODUCT DEVELOPMENT & APPROVALS

28.7 EXPANSIONS

28.8 REGULATORY CHANGES

28.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

29 GLOBAL ANTIHISTAMINE DRUGS MARKET, BY REGION

GLOBAL ANTIHISTAMINE DRUGS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

29.1 NORTH AMERICA

29.1.1 U.S.

29.1.2 CANADA

29.1.3 MEXICO

29.2 EUROPE

29.2.1 GERMANY

29.2.2 U.K.

29.2.3 ITALY

29.2.4 FRANCE

29.2.5 SPAIN

29.2.6 RUSSIA

29.2.7 SWITZERLAND

29.2.8 TURKEY

29.2.9 BELGIUM

29.2.10 NETHERLANDS

29.2.11 DENMARK

29.2.12 SWEDEN

29.2.13 POLAND

29.2.14 NORWAY

29.2.15 FINLAND

29.2.16 REST OF EUROPE

29.3 ASIA-PACIFIC

29.3.1 JAPAN

29.3.2 CHINA

29.3.3 SOUTH KOREA

29.3.4 INDIA

29.3.5 SINGAPORE

29.3.6 THAILAND

29.3.7 INDONESIA

29.3.8 MALAYSIA

29.3.9 PHILIPPINES

29.3.10 AUSTRALIA

29.3.11 NEW ZEALAND

29.3.12 VIETNAM

29.3.13 TAIWAN

29.3.14 REST OF ASIA-PACIFIC

29.4 SOUTH AMERICA

29.4.1 BRAZIL

29.4.2 ARGENTINA

29.4.3 REST OF SOUTH AMERICA

29.5 MIDDLE EAST AND AFRICA

29.5.1 SOUTH AFRICA

29.5.2 EGYPT

29.5.3 BAHRAIN

29.5.4 UNITED ARAB EMIRATES

29.5.5 KUWAIT

29.5.6 OMAN

29.5.7 QATAR

29.5.8 SAUDI ARABIA

29.5.9 REST OF MEA

29.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

30 GLOBAL ANTIHISTAMINE DRUGS MARKET, SWOT AND DBMR ANALYSIS

31 GLOBAL ANTIHISTAMINE DRUGS MARKET, COMPANY PROFILE

31.1 VITARIS INC.

31.1.1 COMPANY OVERVIEW

31.1.2 REVENUE ANALYSIS

31.1.3 GEOGRAPHIC PRESENCE

31.1.4 PRODUCT PORTFOLIO

31.1.5 RECENT DEVELOPMENTS

31.2 JOHNSON & JOHNSON SERVICES, INC.

31.2.1 COMPANY OVERVIEW

31.2.2 REVENUE ANALYSIS

31.2.3 GEOGRAPHIC PRESENCE

31.2.4 PRODUCT PORTFOLIO

31.2.5 RECENT DEVELOPMENTS

31.3 ACTAVIS ELIZABETH LLC

31.3.1 COMPANY OVERVIEW

31.3.2 REVENUE ANALYSIS

31.3.3 GEOGRAPHIC PRESENCE

31.3.4 PRODUCT PORTFOLIO

31.3.5 RECENT DEVELOPMENTS

31.4 APOTEX INC.

31.4.1 COMPANY OVERVIEW

31.4.2 REVENUE ANALYSIS

31.4.3 GEOGRAPHIC PRESENCE

31.4.4 PRODUCT PORTFOLIO

31.4.5 RECENT DEVELOPMENTS

31.5 CARACO PHARMACEUTICAL LABORATORIES, LTD (SUN PHARMACEUTICAL INDUSTRIES LTD)

31.5.1 COMPANY OVERVIEW

31.5.2 REVENUE ANALYSIS

31.5.3 GEOGRAPHIC PRESENCE

31.5.4 PRODUCT PORTFOLIO

31.5.5 RECENT DEVELOPMENTS

31.6 DR. REDDY’S LABORATORIES LTD.

31.6.1 COMPANY OVERVIEW

31.6.2 REVENUE ANALYSIS

31.6.3 GEOGRAPHIC PRESENCE

31.6.4 PRODUCT PORTFOLIO

31.6.5 RECENT DEVELOPMENTS

31.7 PERRIGO COMPANY PLC

31.7.1 COMPANY OVERVIEW

31.7.2 REVENUE ANALYSIS

31.7.3 GEOGRAPHIC PRESENCE

31.7.4 PRODUCT PORTFOLIO

31.7.5 RECENT DEVELOPMENTS

31.8 SANDOZ AG (NOVARTIS AG)

31.8.1 COMPANY OVERVIEW

31.8.2 REVENUE ANALYSIS

31.8.3 GEOGRAPHIC PRESENCE

31.8.4 PRODUCT PORTFOLIO

31.8.5 RECENT DEVELOPMENTS

31.9 WOCKHARDT USA

31.9.1 COMPANY OVERVIEW

31.9.2 REVENUE ANALYSIS

31.9.3 GEOGRAPHIC PRESENCE

31.9.4 PRODUCT PORTFOLIO

31.9.5 RECENT DEVELOPMENTS

31.1 PFIZER INC.

31.10.1 COMPANY OVERVIEW

31.10.2 REVENUE ANALYSIS

31.10.3 GEOGRAPHIC PRESENCE

31.10.4 PRODUCT PORTFOLIO

31.10.5 RECENT DEVELOPMENTS

31.11 TRINITY PHARMA (PTY) LTD.

31.11.1 COMPANY OVERVIEW

31.11.2 REVENUE ANALYSIS

31.11.3 GEOGRAPHIC PRESENCE

31.11.4 PRODUCT PORTFOLIO

31.11.5 RECENT DEVELOPMENTS

31.12 AVET PHARMACEUTICALS INC

31.12.1 COMPANY OVERVIEW

31.12.2 REVENUE ANALYSIS

31.12.3 GEOGRAPHIC PRESENCE

31.12.4 PRODUCT PORTFOLIO

31.12.5 RECENT DEVELOPMENTS

31.13 TEVA PHARMACEUTICALS USA, INC.

31.13.1 COMPANY OVERVIEW

31.13.2 REVENUE ANALYSIS

31.13.3 GEOGRAPHIC PRESENCE

31.13.4 PRODUCT PORTFOLIO

31.13.5 RECENT DEVELOPMENTS

31.14 CIPLA

31.14.1 COMPANY OVERVIEW

31.14.2 REVENUE ANALYSIS

31.14.3 GEOGRAPHIC PRESENCE

31.14.4 PRODUCT PORTFOLIO

31.14.5 RECENT DEVELOPMENTS

31.15 TAJ PHARMA GROUP

31.15.1 COMPANY OVERVIEW

31.15.2 REVENUE ANALYSIS

31.15.3 GEOGRAPHIC PRESENCE

31.15.4 PRODUCT PORTFOLIO

31.15.5 RECENT DEVELOPMENTS

31.16 UCB S.A.

31.16.1 COMPANY OVERVIEW

31.16.2 REVENUE ANALYSIS

31.16.3 GEOGRAPHIC PRESENCE

31.16.4 PRODUCT PORTFOLIO

31.17 CAMBER PHARMACEUTICALS, INC

31.17.1 COMPANY OVERVIEW

31.17.2 REVENUE ANALYSIS

31.17.3 GEOGRAPHIC PRESENCE

31.17.4 PRODUCT PORTFOLIO

31.18 GLENMARK PHARMACEUTICALS INC., USA

31.18.1 COMPANY OVERVIEW

31.18.2 REVENUE ANALYSIS

31.18.3 GEOGRAPHIC PRESENCE

31.18.4 PRODUCT PORTFOLIO

31.19 WELLONA PHARMA

31.19.1 COMPANY OVERVIEW

31.19.2 REVENUE ANALYSIS

31.19.3 GEOGRAPHIC PRESENCE

31.19.4 PRODUCT PORTFOLIO

31.2 ADVACARE PHARMA

31.20.1 COMPANY OVERVIEW

31.20.2 REVENUE ANALYSIS

31.20.3 GEOGRAPHIC PRESENCE

31.20.4 PRODUCT PORTFOLIO

31.21 ERIS LIFESCIENCES

31.21.1 COMPANY OVERVIEW

31.21.2 REVENUE ANALYSIS

31.21.3 GEOGRAPHIC PRESENCE

31.21.4 PRODUCT PORTFOLIO

31.21.5 RECENT DEVELOPMENTS

31.22 SANOFI

31.22.1 COMPANY OVERVIEW

31.22.2 REVENUE ANALYSIS

31.22.3 GEOGRAPHIC PRESENCE

31.22.4 PRODUCT PORTFOLIO

31.22.5 RECENT DEVELOPMENTS

31.23 ADEN HEALTHCARE

31.23.1 COMPANY OVERVIEW

31.23.2 REVENUE ANALYSIS

31.23.3 GEOGRAPHIC PRESENCE

31.23.4 PRODUCT PORTFOLIO

31.23.5 RECENT DEVELOPMENTS

31.24 ORGANON GROUP OF COMPANIES

31.24.1 COMPANY OVERVIEW

31.24.2 REVENUE ANALYSIS

31.24.3 GEOGRAPHIC PRESENCE

31.24.4 PRODUCT PORTFOLIO

31.24.5 RECENT DEVELOPMENTS

31.25 MERCK & CO., INC

31.25.1 COMPANY OVERVIEW

31.25.2 REVENUE ANALYSIS

31.25.3 GEOGRAPHIC PRESENCE

31.25.4 PRODUCT PORTFOLIO

31.25.5 RECENT DEVELOPMENTS

31.26 LUPIN PHARMACEUTICALS, INC.

31.26.1 COMPANY OVERVIEW

31.26.2 REVENUE ANALYSIS

31.26.3 GEOGRAPHIC PRESENCE

31.26.4 PRODUCT PORTFOLIO

31.26.5 RECENT DEVELOPMENTS

31.27 ORBION PHARMACEUTICALS PRIVATE LTD

31.27.1 COMPANY OVERVIEW

31.27.2 REVENUE ANALYSIS

31.27.3 GEOGRAPHIC PRESENCE

31.27.4 PRODUCT PORTFOLIO

31.27.5 RECENT DEVELOPMENTS

31.28 SCIEGEN PHARMACEUTICALS INC

31.28.1 COMPANY OVERVIEW

31.28.2 REVENUE ANALYSIS

31.28.3 GEOGRAPHIC PRESENCE

31.28.4 PRODUCT PORTFOLIO

31.28.5 RECENT DEVELOPMENTS

31.29 STRIDES PHARMA GLOBAL PTE LTD

31.29.1 COMPANY OVERVIEW

31.29.2 REVENUE ANALYSIS

31.29.3 GEOGRAPHIC PRESENCE

31.29.4 PRODUCT PORTFOLIO

31.29.5 RECENT DEVELOPMENTS

31.3 SYNTHON B.V.

31.30.1 COMPANY OVERVIEW

31.30.2 REVENUE ANALYSIS

31.30.3 GEOGRAPHIC PRESENCE

31.30.4 PRODUCT PORTFOLIO

31.30.5 RECENT DEVELOPMENTS

32 REPORTS

33 CONCLUSION

34 QUESTIONNAIRE

35 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.