Global Antimony Free Polyesters Market

Market Size in USD Million

CAGR :

%

USD

921.10 Million

USD

2,216.25 Million

2024

2032

USD

921.10 Million

USD

2,216.25 Million

2024

2032

| 2025 –2032 | |

| USD 921.10 Million | |

| USD 2,216.25 Million | |

|

|

|

|

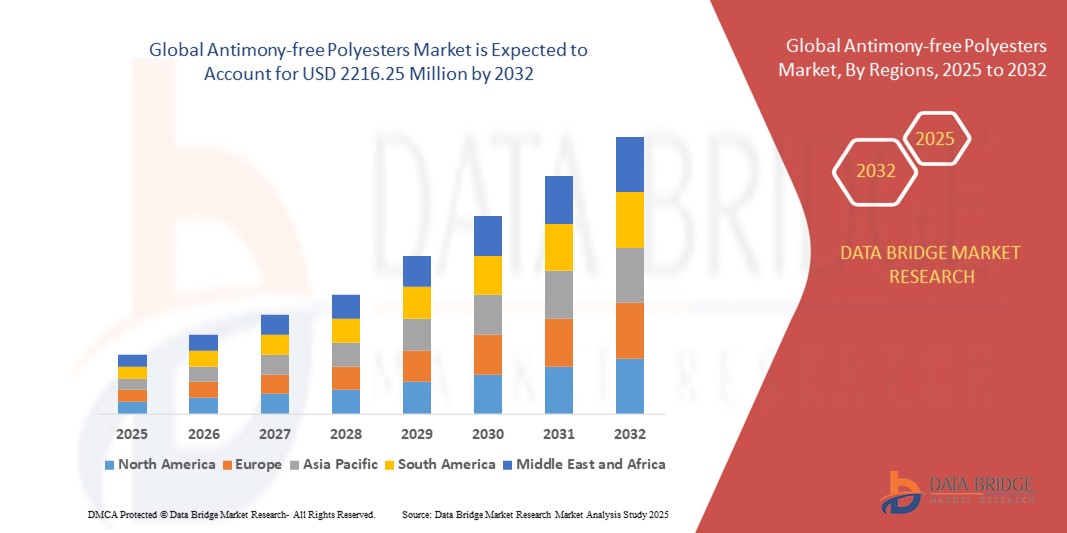

What is the Global Antimony-free Polyesters Market Size and Growth Rate?

- The global antimony-free polyesters market size was valued at USD 921.10 Million in 2024 and is expected to reach USD 2216.25 Million by 2032, at a CAGR of11.60% during the forecast period

- Antimony-free polyesters are environmentally friendly polymers manufactured without the use of antimony catalysts, making them safer for packaging, textiles, and industrial applications. The rising emphasis on sustainable materials and stringent regulatory standards are expected to drive market expansion from 2024 to 2032

What are the Major Takeaways of Antimony-free Polyesters Market?

- Increasing consumer and regulatory demand for eco-friendly and non-toxic materials is driving adoption in food packaging, textiles, and consumer goods

- The market is benefitting from growing health and environmental concerns, as antimony-free alternatives reduce contamination risks and align with global sustainability goals.

- Technological advancements in catalyst systems are enabling improved performance and cost efficiency, further boosting market penetration across industrial sectors

- Asia Pacific dominated the antimony-free polyesters market with the largest revenue share of 41.26% in 2024, driven by rapid industrialization, growing textile and packaging industries, and rising demand for eco-friendly materials

- North America is expected to register the fastest CAGR of 12.14% from 2025 to 2032, driven by rising adoption of sustainable polymers in packaging, textiles, and high-performance automotive components

- The Polyethylene Terephthalate (PET) segment dominated the market with the largest revenue share of 52.4% in 2024, driven by its extensive use in packaging, textiles, and consumer goods due to its durability, recyclability, and cost-effectiveness

Report Scope and Antimony-free Polyesters Market Segmentation

|

Attributes |

Antimony-free Polyesters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Antimony-free Polyesters Market?

Shift Toward Sustainable and High-Performance Polyester Solutions

- A major trend in the global antimony-free polyesters market is the rising demand for eco-friendly, high-performance, and antimony-free materials as industries and consumers prioritize health, safety, and sustainability

- Manufacturers are focusing on non-toxic catalysts, recyclable resins, and energy-efficient production processes to meet regulatory standards and align with global environmental initiatives

- For instance, in 2024, Indorama Ventures launched a new range of antimony-free PET resins designed for food-grade applications, meeting EU and FDA compliance while reducing heavy-metal contamination risks

- Technological advancements such as bio-based feedstocks, advanced polymerization techniques, and enhanced thermal stability are improving performance in packaging, textiles, and industrial applications

- The shift is further supported by growing consumer awareness regarding health hazards of antimony-based products and the rising adoption of circular economy models in polyester production

- Companies including Toray Advanced Materials and Mitsubishi Polyester Film are investing in closed-loop recycling and low-emission technologies to strengthen their sustainable portfolios

- This trend is accelerating the global transition toward safe, durable, and environmentally responsible polyester solutions, opening new opportunities across packaging, apparel, and industrial sectors

What are the Key Drivers of Antimony-free Polyesters Market?

- Rising health and environmental concerns regarding antimony leaching from conventional polyesters are driving the shift to safer, antimony-free alternatives

- For instance, in 2024, Ester Industries announced a USD 150 million expansion to produce antimony-free specialty polyesters for food & beverage packaging, supporting regulatory compliance and consumer safety

- Increasing demand for sustainable packaging from FMCG and e-commerce sectors is fueling adoption, especially as brands aim to meet net-zero and plastic reduction targets

- Rapid growth in technical textiles and automotive interiors is boosting usage of antimony-free polyesters due to their thermal stability and recyclability

- Advancements in catalyst technologies (e.g., titanium- and germanium-based systems) are enhancing production efficiency and reducing costs, making these materials more commercially viable

- Government initiatives offering tax incentives and green certification programs are further encouraging adoption across emerging and developed markets

Which Factor is challenging the Growth of the Antimony-free Polyesters Market?

- High production costs due to advanced catalysts and complex manufacturing processes remain a key barrier to large-scale adoption

- For instance, several mid-sized producers in Asia delayed capacity expansion plans in 2023 because of rising raw material and catalyst costs, impacting global supply

- Limited processing know-how and the need for specialized equipment pose challenges for manufacturers transitioning from conventional polyester production

- Lack of consumer awareness in emerging markets and the availability of low-cost antimony-based substitutes also restrict growth

- Addressing these challenges will require technology partnerships, cost-optimized production techniques, and scalable recycling infrastructure to reduce lifecycle costs

- Companies such as Toray and Indorama Ventures are focusing on R&D collaborations and regional manufacturing hubs to make antimony-free polyesters more accessible and competitive

How is the Antimony-free Polyesters Market Segmented?

The market is segmented on the basis of product type, catalyst, and end-use industry

- By Product Type

On the basis of product type, the antimony-free polyesters market is segmented into Polyethylene Terephthalate (PET), Polytrimethylene Terephthalate (PTT), and Polybutylene Terephthalate (PBT). The Polyethylene Terephthalate (PET) segment dominated the market with the largest revenue share of 52.4% in 2024, driven by its extensive use in packaging, textiles, and consumer goods due to its durability, recyclability, and cost-effectiveness. The Polytrimethylene Terephthalate (PTT) segment is projected to register the fastest CAGR from 2025 to 2032, fueled by rising demand for sustainable and high-performance fibers in apparel and carpets.

The Polybutylene Terephthalate (PBT) segment shows steady growth due to its increasing application in automotive and electronics for components requiring superior thermal stability and chemical resistance.

- By Catalyst

On the basis of catalyst, the market is segmented into Titanium-based Catalyst, Aluminum-based Catalyst, and Titanium-Magnesium-based Catalyst. The Titanium-based Catalyst segment accounted for the largest revenue share of 47.6% in 2024, owing to its efficiency in producing high-clarity and food-grade antimony-free polyesters suitable for packaging applications.

The Titanium-Magnesium-based Catalyst segment is anticipated to witness the fastest CAGR, supported by advancements in catalyst formulations that enhance polymerization rates and improve mechanical properties of final products.

- By End-use Industry

On the basis of end-use industry, the antimony-free polyesters market is segmented into Textile, Packaging, Automotive, and Construction. The Packaging segment dominated the market with a revenue share of 44.3% in 2024, driven by rising demand for antimony-free bottles and containers in food and beverage industries, supported by regulatory pressures for safer materials.

The Textile segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing adoption of eco-friendly fibers in apparel, home furnishings, and industrial fabrics.

Which Region Holds the Largest Share of the Antimony-free Polyesters Market?

- Asia Pacific dominated the antimony-free polyesters market with the largest revenue share of 41.26% in 2024, driven by rapid industrialization, growing textile and packaging industries, and rising demand for eco-friendly materials

- Expanding automotive production and construction activities in emerging economies such as China and India are boosting the adoption of antimony-free alternatives to meet stringent environmental regulations

- Increasing investments in advanced manufacturing technologies and the presence of major polyester producers further solidify Asia Pacific’s leading position in global supply and consumption

China Antimony-free Polyesters Market Insight

China captured the largest revenue share within Asia Pacific in 2024, supported by its robust textile sector, high packaging demand, and government initiatives promoting green manufacturing. The country’s expanding automotive and electronics industries are further accelerating the adoption of PET and PBT grades, positioning China as the largest producer and consumer of antimony-free polyesters.

India Antimony-free Polyesters Market Insight

India is projected to grow significantly within Asia Pacific, driven by rising investments in sustainable textiles, increasing demand for safe food-grade packaging, and the expansion of domestic automotive manufacturing. Government policies promoting “Make in India” and stricter environmental norms are encouraging local production of antimony-free variants.

Which Region is the Fastest Growing Region in the Antimony-free Polyesters Market?

North America is expected to register the fastest CAGR of 12.14% from 2025 to 2032, driven by rising adoption of sustainable polymers in packaging, textiles, and high-performance automotive components. Stringent regulations on hazardous materials and growing consumer preference for eco-friendly products are accelerating the shift toward titanium-based catalysts and recyclable PET solutions. Advanced R&D initiatives and collaboration between global chemical players are further boosting innovation in high-performance antimony-free polyesters.

U.S. Antimony-free Polyesters Market Insight

The U.S. captured the largest revenue share within North America in 2024, fueled by increasing demand for lightweight automotive materials, sustainable packaging, and performance textiles. Leading chemical companies are investing in bio-based and recyclable polyester solutions, strengthening the U.S. as a key innovation hub.

Canada Antimony-free Polyesters Market Insight

Canada is witnessing substantial growth, supported by strong adoption of eco-friendly packaging in food and beverage industries and government incentives promoting sustainable materials. Expanding construction projects and rising use of high-durability polyesters in infrastructure are further contributing to market growth.

Which are the Top Companies in Antimony-free Polyesters Market?

The antimony-free polyesters industry is primarily led by well-established companies, including:

- Amerex Hubel Decon Polyester Co., Ltd. (China)

- TIANJIN GT NEW MATERIAL TECHNOLOGY CO., LTD. (China)

- TWD Fibres GmbH (Germany)

- PT Asia Pacific Fibers Tbk (Indonesia)

- Qingdao Pride Industry Co., Ltd. (China)

- HANGZHOU LEMMEJOY CHEMICAL FIBER CO., LTD. (China)

- Mitsubishi Polyester Film GmbH (Germany)

- Ester Industries (India)

- Indorama Ventures Public Company Limited (Thailand)

- Toray Advanced Materials Korea Inc. (South Korea)

- NAN YA PLASTICS CORPORATION (Taiwan)

- Leadex & Co. (Taiwan)

- ZHEJIANG DONGTAI NEW MATERIALS CO., LTD. (China)

What are the Recent Developments in Global Antimony-free Polyesters Market?

- In January 2024, Indorama Ventures Public Company Limited announced the expansion of its antimony-free PET resin production in Thailand, utilizing titanium-based catalysts to meet rising demand for safe and sustainable polyester in packaging and textiles. This initiative highlights the company’s commitment to minimizing environmental impact and adhering to global safety standards, while boosting manufacturing capacity in Asia Pacific. The move strengthens Indorama’s leadership in sustainable polyester and positions it to better serve both local and international markets

- In June 2022, Tianjin GT New Material Technology Co., Ltd. introduced antimony-free polyester fibers designed for sensitive applications such as children’s clothing and toys, ensuring compliance with EU safety standard EN71-3 that limits hazardous substances in kids’ products. This innovation reflects the company’s dedication to safer, eco-friendly materials and aligns with rising consumer awareness of chemical exposure risks. By expanding into health-conscious markets, the company strengthens its product portfolio and enhances its position in the global antimony-free polyester segment

- In April 2021, Toray Advanced Materials Korea Inc. launched antimony-free polyester knitted fabrics for sustainable apparel, offering superior moisture control, elasticity, and breathability while eliminating antimony-related health and environmental concerns. This development supports eco-conscious fashion brands and reinforces Toray’s commitment to delivering cleaner, safer material solutions. The innovation broadens Toray’s sustainable product offerings and advances the global shift toward non-toxic textiles in performance wear and everyday clothing

- In March 2021, Amerex Hubei Decon Polyester Co., Ltd. rolled out titanium-based antimony-free polyester chips with an annual production capacity of 2,000 tons, addressing increasing health and environmental concerns linked to antimony usage. The use of titanium catalysts ensures safer production without compromising quality standards, meeting the global demand for sustainable polyester solutions in packaging and textiles. This step strengthens Amerex’s role in regulatory compliance and demonstrates its proactive approach toward environmentally responsible manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antimony Free Polyesters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antimony Free Polyesters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antimony Free Polyesters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.