Global Aquaculture Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

1.97 Billion

USD

3.70 Billion

2025

2033

USD

1.97 Billion

USD

3.70 Billion

2025

2033

| 2026 –2033 | |

| USD 1.97 Billion | |

| USD 3.70 Billion | |

|

|

|

|

Aquaculture Healthcare Market Size

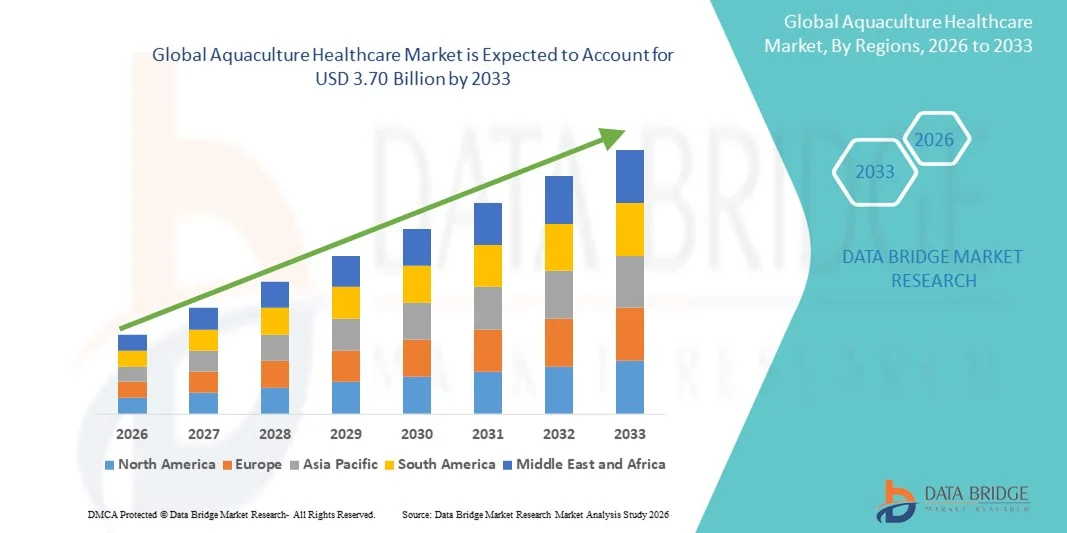

- The global aquaculture healthcare market size was valued at USD 1.97 billion in 2025 and is expected to reach USD 3.70 billion by 2033, at a CAGR of 8.22% during the forecast period

- The market growth is primarily driven by the increasing demand for sustainable aquaculture practices, rising aquaculture production, and advancements in fish and shrimp disease diagnostics and treatments

- In addition, growing awareness among producers regarding disease prevention, improved feed efficiency, and regulatory compliance is boosting the adoption of vaccines, antibiotics, probiotics, and other healthcare solutions, positioning aquaculture healthcare as an essential component of modern aquaculture operations. These factors are collectively propelling market expansion globally

Aquaculture Healthcare Market Analysis

- Aquaculture healthcare, encompassing vaccines, antibiotics, probiotics, and diagnostic solutions for fish and shrimp, is becoming an indispensable part of modern aquaculture operations due to its role in disease prevention, improved productivity, and sustainability in both freshwater and marine farming systems

- The rising demand for aquaculture healthcare solutions is primarily driven by increasing aquaculture production, growing awareness of disease management, and the need for sustainable practices to meet the global protein demand

- North America dominated the aquaculture healthcare market with the largest revenue share of 42.5% in 2025, characterized by advanced aquaculture farming practices, high adoption of innovative healthcare solutions, strong regulatory frameworks, and active presence of key industry players focusing on vaccines, probiotics, and disease diagnostics

- Asia-Pacific is expected to be the fastest-growing region in the aquaculture healthcare market during the forecast period due to expanding aquaculture production, increasing investments in disease management, and rising demand for high-quality seafood

- Vaccines segment dominated the aquaculture healthcare market with a market share of 38.7% in 2025, supported by their effectiveness in preventing bacterial and viral infections and reducing reliance on antibiotics, thereby promoting sustainable aquaculture practices

Report Scope and Aquaculture Healthcare Market Segmentation

|

Attributes |

Aquaculture Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Aquaculture Healthcare Market Trends

Adoption of Precision and IoT-Based Monitoring Systems

- A significant and accelerating trend in the global aquaculture healthcare market is the adoption of precision monitoring systems integrated with IoT-enabled sensors for real-time tracking of water quality, fish health, and disease outbreaks, enhancing farm management efficiency

- For instance, eFishery IoT Feeders allow farmers to monitor feeding behavior remotely while optimizing feed usage and detecting abnormal patterns in fish activity. Similarly, AquaManager platforms provide centralized dashboards to track health indicators, water parameters, and treatment schedules

- AI and IoT integration in aquaculture healthcare enables predictive disease management, automated alerts for abnormal fish behavior, and optimized dosing of vaccines or probiotics. For instance, Innovasea systems utilize AI to detect early signs of disease and send actionable alerts to farm operators for preventive intervention

- The seamless integration of monitoring devices with farm management software facilitates centralized control over multiple aquaculture units, enabling efficient decision-making and resource allocation across large-scale operations

- This trend toward intelligent, data-driven aquaculture operations is reshaping industry standards, prompting companies such as BioMar and Benchmark Genetics to develop AI-enabled healthcare solutions with predictive disease analytics and automated treatment recommendations

- The demand for IoT and AI-enabled healthcare solutions is growing rapidly across both intensive and semi-intensive aquaculture farms, as operators increasingly prioritize efficiency, disease prevention, and sustainable production practices

- Increasing collaborations between technology providers and aquaculture farms to co-develop customized healthcare solutions are further accelerating adoption and innovation in the market

- Growing investment in R&D for alternative healthcare solutions, such as plant-based vaccines and probiotics, is creating new opportunities for sustainable and eco-friendly disease management in aquaculture

Aquaculture Healthcare Market Dynamics

Driver

Rising Demand for Sustainable and High-Quality Aquaculture Products

- The growing global demand for high-quality, disease-free seafood, coupled with stricter sustainability and food safety standards, is a significant driver for the increased adoption of aquaculture healthcare solutions

- For instance, in March 2025, Benchmark Genetics announced the deployment of enhanced health management protocols for salmon farming, integrating vaccines, probiotics, and monitoring systems to ensure optimal fish health

- As consumers and regulatory bodies demand safer, sustainable, and traceable seafood, aquaculture healthcare solutions offer essential interventions such as vaccines, probiotics, and diagnostic testing to reduce disease risks

- Furthermore, the expansion of commercial aquaculture farms and the need to minimize mortality and improve growth performance are making healthcare interventions indispensable for efficient farm management

- Adoption of automated feeding, vaccination, and monitoring systems allows operators to ensure consistent fish health, enhance product quality, and comply with global food safety regulations, driving market growth

- Rising awareness among aquaculture operators about cost savings from disease prevention versus treatment is further boosting demand for preventive healthcare solutions

- Increasing government support and subsidies for sustainable aquaculture practices are encouraging farms to adopt advanced healthcare technologies

Restraint/Challenge

High Costs and Regulatory Compliance Complexity

- The relatively high costs of advanced vaccines, diagnostic tools, and automated healthcare systems pose a significant challenge for small and medium aquaculture operators, limiting broader market adoption

- For instance, advanced AI-based disease detection systems from Innovasea or eFishery involve substantial initial investment and maintenance expenses, which can deter smaller farm operators

- Stringent regulatory frameworks for aquaculture healthcare products, including approvals for vaccines, antibiotics, and probiotics, create additional compliance hurdles for manufacturers and farm operators

- Furthermore, variability in regulations across regions increases operational complexity, requiring extensive testing, documentation, and adherence to local guidelines, slowing product deployment

- Overcoming these challenges through cost-effective solutions, standardized regulatory pathways, and farmer education on effective healthcare management will be crucial for sustained market growth

- Limited awareness and technical expertise among small-scale aquaculture farmers in implementing advanced healthcare solutions can restrict market penetration in developing regions

- Supply chain constraints and occasional shortages of vaccines or probiotics during peak demand periods can delay timely disease management, posing a challenge to market growth

Aquaculture Healthcare Market Scope

The market is segmented on the basis of product type, infection, route of administration, species, and distribution channel.

- By Product Type

On the basis of product type, the aquaculture healthcare market is segmented into vaccines, drugs, and medicated feed additives. The vaccines segment dominated the market with the largest revenue share of 38.7% in 2025, driven by their effectiveness in preventing bacterial and viral infections and reducing mortality rates in aquaculture farms. Vaccines are increasingly preferred as preventive healthcare solutions that reduce reliance on antibiotics, promote sustainable aquaculture practices, and enhance product quality. The strong adoption of vaccines is supported by government regulations promoting disease-free seafood production and widespread R&D investments in novel vaccine technologies. In addition, large-scale commercial aquaculture operations prioritize vaccines for their long-term cost benefits and efficiency in maintaining fish and shrimp health.

The medicated feed additives segment is expected to witness the fastest growth rate of 22.1% from 2026 to 2033, fueled by increasing demand for integrated healthcare solutions that combine nutrition and disease prevention. Feed additives such as probiotics, immunostimulants, and prebiotics enhance growth, boost immunity, and improve survival rates, particularly in intensive aquaculture systems. The convenience of administering health solutions through feed, coupled with their positive impact on water quality and overall farm productivity, is driving rapid adoption across emerging aquaculture regions.

- By Infection

On the basis of infection, the market is segmented into fungal infections, viral infections, bacterial infections, and parasitic infections. The bacterial infections segment dominated the market with the largest revenue share of 40.2% in 2025 due to the high prevalence of bacterial diseases such as Aeromonas, Vibrio, and Streptococcus, which can cause significant mortality in fish and shrimp farms. Bacterial infections often require proactive management through vaccines, antibiotics, and probiotics, making this segment critical for aquaculture healthcare providers. The strong demand for bacterial disease control is further driven by consumer preference for safe, high-quality seafood and stricter regulations on disease management practices. Early diagnosis and preventive solutions are increasingly emphasized to minimize economic losses and maintain farm productivity.

The parasitic infections segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising awareness of protozoan and ectoparasite infections that affect both freshwater and marine species. Advanced treatments and preventive strategies, including medicated feeds and biological control methods, are increasingly adopted to reduce parasite-induced mortality. The growth is further supported by the introduction of innovative parasite control solutions that are eco-friendly and compatible with sustainable farming practices.

- By Route of Administration

On the basis of route of administration, the market is segmented into injectable, oral, and topical. The injectable segment dominated the market with the largest revenue share of 36.8% in 2025, driven by the precision and effectiveness of vaccines delivered via injection. Injectable solutions allow targeted immunity against bacterial and viral infections and are preferred in commercial operations for high-value species such as salmon and shrimp. The segment benefits from advancements in automated injection systems that reduce labor requirements and improve dosing accuracy. In addition, injectable administration ensures consistent bioavailability and strong immune responses, which is crucial for disease prevention.

The oral segment is expected to witness the fastest growth rate of 24.5% from 2026 to 2033, fueled by its ease of use and suitability for mass administration through feed or water. Oral healthcare solutions such as medicated feed and probiotics reduce stress on animals, simplify farm operations, and ensure continuous preventive care. The increasing adoption of oral vaccines and additives in intensive aquaculture systems is driving rapid market expansion, particularly in regions with large-scale commercial fish and shrimp farming.

- By Species

On the basis of species, the market is segmented into crustaceans and fishes. The fishes segment dominated the market with the largest revenue share of 44.1% in 2025 due to the high global production of farmed fish such as salmon, tilapia, and carp. Fish farming operations face a high risk of bacterial, viral, and parasitic infections, necessitating widespread adoption of vaccines, antibiotics, and probiotics. The dominance is further supported by large-scale commercial aquaculture setups in North America, Europe, and Asia-Pacific, where disease prevention is critical for profitability. Preventive healthcare in fish farming ensures improved survival rates, growth performance, and product quality for export markets.

The crustaceans segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the rising demand for shrimp and prawn farming in Asia-Pacific and Latin America. Crustaceans are highly susceptible to viral and bacterial infections, prompting adoption of specialized vaccines, probiotics, and medicated feeds. The growth is supported by technological advancements in disease diagnostics and targeted healthcare solutions for crustaceans, along with increasing investments by shrimp farming companies to reduce losses from disease outbreaks.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into retail/aqua stores, online stores, and distributors. The distributors segment dominated the market with the largest revenue share of 41.5% in 2025 due to their extensive network, ability to supply bulk quantities, and strong relationships with commercial aquaculture farms. Distributors ensure timely delivery of vaccines, drugs, and medicated feed additives, which is crucial for farm operations. The dominance is further supported by partnerships with key manufacturers, ensuring product availability, technical support, and regulatory compliance.

The online stores segment is expected to witness the fastest growth rate of 26.3% from 2026 to 2033, driven by increasing internet penetration, e-commerce adoption, and convenience for small and medium-scale farmers. Online platforms provide easy access to healthcare products, detailed product information, and doorstep delivery. The rising digitalization of aquaculture operations and increasing farmer awareness of the benefits of online purchasing are accelerating growth in this segment, particularly in emerging markets.

Aquaculture Healthcare Market Regional Analysis

- North America dominated the aquaculture healthcare market with the largest revenue share of 42.5% in 2025, characterized by advanced aquaculture farming practices, high adoption of innovative healthcare solutions, strong regulatory frameworks, and active presence of key industry players focusing on vaccines, probiotics, and disease diagnostics

- Producers in the region prioritize preventive healthcare measures such as vaccines, probiotics, and diagnostic tools to maintain optimal fish and shrimp health, improve productivity, and comply with strict food safety regulations

- This strong adoption is further supported by high investment capacity, technologically advanced farming systems, and the presence of key industry players developing AI-enabled disease management solutions, establishing North America as a leading market for aquaculture healthcare in both commercial and research-focused farms

U.S. Aquaculture Healthcare Market Insight

The U.S. aquaculture healthcare market captured the largest revenue share of 79% in 2025 within North America, driven by the widespread adoption of advanced aquaculture practices and stringent regulatory standards for disease-free seafood production. Producers are increasingly prioritizing preventive solutions such as vaccines, probiotics, and diagnostic tools to maintain fish and shrimp health, improve productivity, and ensure food safety compliance. The growing trend of high-tech, intensive aquaculture systems, coupled with investments in AI-enabled disease monitoring and automated healthcare solutions, is further propelling market growth. Moreover, the demand for sustainable and high-quality seafood, supported by consumer awareness, continues to drive adoption across commercial farms and research facilities.

Europe Aquaculture Healthcare Market Insight

The Europe aquaculture healthcare market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory requirements for aquaculture product quality and food safety. Rising urbanization and increased seafood consumption are fostering the adoption of vaccines, medicated feeds, and diagnostic solutions. European producers are also drawn to the operational efficiency and disease prevention benefits these solutions provide. The region is witnessing significant growth across commercial, offshore, and inland aquaculture operations, with healthcare solutions being increasingly incorporated into both new and existing farming systems.

U.K. Aquaculture Healthcare Market Insight

The U.K. aquaculture healthcare market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising emphasis on sustainable seafood production and regulatory compliance for aquaculture operations. In addition, awareness of disease outbreaks and biosecurity concerns is encouraging both commercial and small-scale farmers to adopt preventive healthcare solutions. The U.K.’s well-developed aquaculture infrastructure, coupled with its robust supply chain for vaccines and medicated feeds, is expected to continue stimulating market growth.

Germany Aquaculture Healthcare Market Insight

The Germany aquaculture healthcare market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing adoption of advanced disease management and monitoring systems. Germany’s emphasis on innovation, sustainability, and high-quality seafood production promotes the use of vaccines, probiotics, and diagnostic tools, particularly in commercial and research-oriented aquaculture setups. Integration of automated healthcare solutions with farm management systems is also gaining traction, driven by strong consumer demand for safe and sustainably produced seafood.

Asia-Pacific Aquaculture Healthcare Market Insight

The Asia-Pacific aquaculture healthcare market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rapid growth in aquaculture production, rising disposable incomes, and increased awareness of disease prevention practices in countries such as China, India, and Japan. The region's inclination towards sustainable seafood production, supported by government initiatives and technological advancements, is driving adoption of vaccines, probiotics, and diagnostic tools. Furthermore, Asia-Pacific’s position as a leading aquaculture production hub ensures widespread accessibility and affordability of healthcare solutions for both small and large-scale farms.

Japan Aquaculture Healthcare Market Insight

The Japan aquaculture healthcare market is gaining momentum due to the country’s advanced aquaculture technology, high seafood consumption, and focus on quality and sustainability. Japanese producers are increasingly adopting vaccines, probiotics, and AI-enabled monitoring systems to prevent disease outbreaks and enhance production efficiency. The integration of healthcare solutions with automated farm management systems is also fueling growth, particularly in commercial fish and shrimp farms. In addition, Japan’s aging aquaculture workforce is driving demand for easier-to-use, efficient healthcare interventions.

India Aquaculture Healthcare Market Insight

The India aquaculture healthcare market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid growth in fish and shrimp farming, expanding middle class, and increasing technological adoption. Preventive healthcare solutions such as vaccines, probiotics, and medicated feeds are gaining popularity in commercial and small-scale aquaculture operations. Government initiatives promoting sustainable aquaculture practices, coupled with the availability of affordable solutions and strong domestic manufacturing capabilities, are key factors driving market growth in India.

Aquaculture Healthcare Market Share

The Aquaculture Healthcare industry is primarily led by well-established companies, including:

- Zoetis Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Elanco Animal Health (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Benchmark Holdings plc (U.K.)

- Virbac S.A. (France)

- AquaBounty Technologies, Inc. (U.S.)

- Biomar Group (Denmark)

- Alltech Inc. (U.S.)

- Archer Daniels Midland Company (U.S.)

- Cargill, Incorporated (U.S.)

- Nutreco. (Netherlands)

- HIPRA (Spain)

- Bayer AG (Germany)

- Evonik Industries AG (Germany)

- Blue Ridge Aquaculture (U.S.)

- Syndel Laboratories (Canada)

- Vetoquinol (France)

- INVE Aquaculture (Belgium)

What are the Recent Developments in Global Aquaculture Healthcare Market?

- In April 2025, scientists in India announced that vaccines are being prepared for commercial use in aquaculture farms nationwide, marking a major advancement in fish health management aimed at reducing disease‑related losses. Researchers from the Indian Council of Agricultural Research (ICAR) revealed that six injectable, species‑ and disease‑specific fish vaccines, including those targeting Aeromonas in carp and Edwardsiella in other species

- In August 2024, Indian Immunologicals Limited signed an agreement with the Central Institute of Brackishwater Aquaculture (CIBA) to advance commercial development of a recombinant Viral Nervous Necrosis (VNN) vaccine for finfish. VNN is one of the most lethal viral diseases in aquaculture, and this collaboration aims to provide producers with a dedicated preventive measure against the pathogen, particularly benefiting brackishwater systems in India and other Asian markets

- In July 2024, Merck Animal Health completed its acquisition of Elanco Animal Health’s aqua business, significantly expanding its footprint in the aquaculture healthcare space with a broader portfolio of vaccines, anti‑parasitic treatments, water supplements, and nutritional products. This strategic move brings Merck capabilities for both warm‑water and cold‑water species, including innovative products such as the DNA‑based CLYNAV® and IMVIXA® sea lice treatments, positioning the company as a leading force in fish health and sustainable aquaculture solutions

- In June 2024, Merck Animal Health launched AquaVac Vibrio, a newly approved vaccine targeting Vibrio anguillarum, a major bacterial pathogen in salmon farming. Backed by approval from the European Medicines Agency, AquaVac Vibrio has demonstrated high efficacy in controlled trials across Norwegian salmon pens, marking a key development in bacterial disease prevention and strengthening producer options for health management in Atlantic salmon aquaculture

- In March 2023, Indian Immunologicals Ltd. (IIL) partnered with the Central Institute of Freshwater Aquaculture (CIFA) to commercially develop a vaccine targeting Hemorrhagic Septicemia, a major bacterial disease affecting freshwater fish species in India and worldwide. This collaboration represents a significant step for innovation in fish vaccines, aiming to reduce reliance on traditional anti‑infectives and economic losses due to disease in aquaculture farms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.