Global Ar And Vr In Training Market

Market Size in USD Million

CAGR :

%

USD

3,538.99 Million

USD

235,490.60 Million

2024

2032

USD

3,538.99 Million

USD

235,490.60 Million

2024

2032

| 2025 –2032 | |

| USD 3,538.99 Million | |

| USD 235,490.60 Million | |

|

|

|

|

AR and VR in Training Market Size

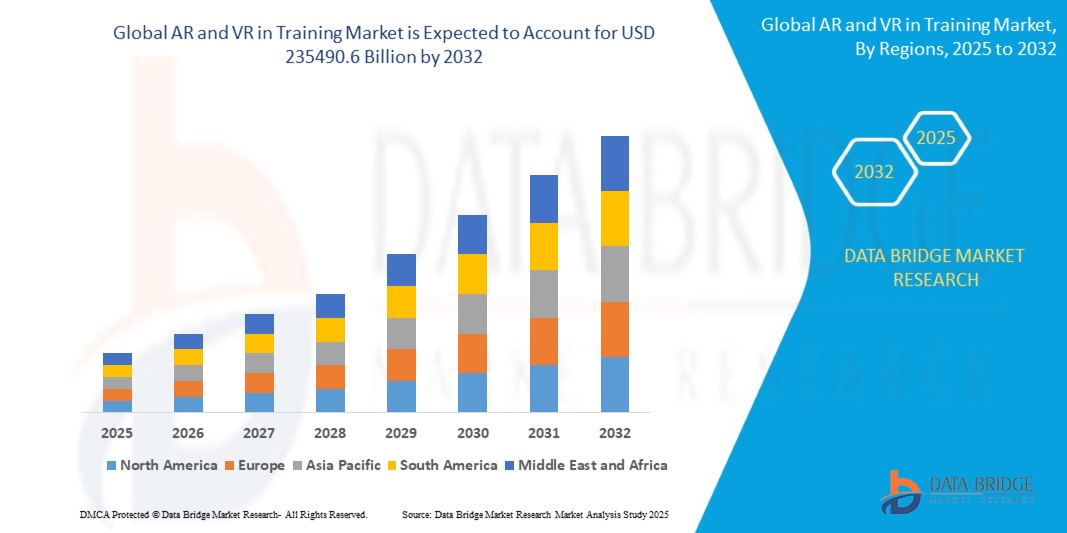

- The global AR and VR in training market size was valued at USD 3538.99 million in 2024 and is expected to reach USD 235490.6 million by 2032, at a CAGR of 69.00% during the forecast period

- This growth is driven by factors such as the increasing adoption of immersive technologies in corporate and educational training, advancements in AR and VR hardware and software, cost-effective remote learning solutions, and the rising demand for realistic, interactive, and engaging training experiences across industries such as healthcare, defense, manufacturing, and aviation

AR and VR in Training Market Analysis

- The market for augmented reality and virtual reality in training is gaining strong traction as industries shift from conventional methods to immersive learning experiences that enhance engagement and practical understanding

- Organizations are adopting these technologies to simulate realistic environments, enabling safer and more effective training that supports continuous learning and long-term skill development across various sectors

- North America is expected to dominate the AR and VR in Trainings market with 41.13% CAGR due to substantial investments in advanced technologies and a strong presence of major tech companies

- Asia-Pacific is expected to be the fastest growing region in the AR and VR in Training market during the forecast period due to rapid industrialization and technological advancements

- The software segment is expected to dominate the AR and VR in Training market with the largest share of 28.79% in 2025 due to due to its ability to offer scalable, customizable, and continuously upgradable platforms that support a wide range of immersive training applications

Report Scope and AR and VR in Training Market Segmentation

|

Attributes |

AR and VR in Training Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

AR and VR in Training Market Trends

“Personalized Immersive Training for Enhanced Learning Experiences”

- The current market for augmented reality and virtual reality in training is heavily focused on the trend of personalization, where training content is tailored to the individual needs and pace of each learner

- Personalized immersive training is gaining popularity because it allows users to engage with content that adapts to their learning style, improving both retention and performance

- Companies are increasingly investing in training modules that use real-time data to adjust scenarios and challenges based on user input and progress, offering a customized experience

- This trend supports more effective skill development, as learners can focus on areas where they need improvement while moving faster through content they already understand

- For instance, in corporate sales training, virtual simulations can adapt based on the decisions a learner makes during a customer interaction, creating a dynamic and user-specific learning path

- The growing emphasis on personalization is redefining how organizations approach training, making immersive technology not just engaging but also highly efficient for workforce development

AR and VR in Training Market Dynamics

Driver

“Growing Demand for Realistic and Engaging Training Methods”

- One of the main drivers of the augmented reality and virtual reality in training market is the need for realistic and engaging learning experiences that go beyond passive methods such as lectures and videos

- Immersive training environments mimic real-life scenarios, helping learners interact with content, make decisions, and experience outcomes in a safe and repeatable setting

- In healthcare, for instance, virtual reality is used by institutions such as the Cleveland Clinic to simulate surgeries, allowing medical students to practice complex procedures without putting patients at risk

- In manufacturing, companies such as Boeing use virtual environments to train workers on assembling aircraft components, significantly reducing errors and improving familiarity before handling real equipment

- This approach helps reduce training time and costs while increasing retention and workforce readiness, especially in high-risk fields such as aviation and defense

Opportunity

“Expansion into Soft Skills and Corporate Learning”

- A key opportunity in the augmented and virtual reality training market is its expanding role in soft skills development, with organizations using immersive tools to enhance communication, leadership, and emotional intelligence among employees

- Virtual simulations recreate real-world interpersonal scenarios such as handling customer complaints or delivering performance reviews, offering a controlled and repeatable environment for employees to build confidence and competence

- For instance, Accenture has integrated virtual reality modules into its employee training to help team members practice diversity and inclusion conversations, enabling deeper understanding and empathy through simulated interactions

- Companies are leveraging these tools to ensure consistency in training delivery across departments and geographies, making it easier to align workforce behavior with organizational values and expectations

- As remote and hybrid work models increase, immersive soft skills platforms provide accessible and engaging learning experiences that keep employees connected and professionally prepared

- In conclusion, the shift toward immersive corporate learning signals a broader move to prioritize behavioral development alongside technical training

Restraint/Challenge

“High Implementation Costs and Technical Barriers”

- One of the main restraints in adopting augmented and virtual reality for training is the high initial investment required for hardware such as headsets, motion sensors, and high-performance systems needed to run immersive applications

- Small and medium-sized enterprises often struggle to allocate sufficient budgets for immersive training programs, making return on investment a major concern especially when compared to traditional low-cost methods

- For instance, implementing a virtual training system for airline staff may require simulation-ready rooms and devices, which adds not only to setup costs but also to long-term expenses such as technical support and hardware maintenance

- A lack of in-house technical expertise can also slow adoption, as organizations may face challenges in managing system compatibility, frequent software updates, and troubleshooting issues during usage

- In addition, user discomfort such as motion sickness and eye strain continues to affect the overall learning experience, which in turn can reduce employee engagement and the effectiveness of training programs

- In conclusion, these financial and technical challenges pose significant barriers to wider adoption, especially for organizations without dedicated tech infrastructure

AR and VR in Training Market Scope

The market is segmented on the basis of component, end user, training type, application, and device type.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By End User |

|

|

By Training Type |

|

|

By Application

|

|

|

By Device Type |

|

In 2025, the software segment is projected to dominate the market with a largest share in component segment

The software segment is expected to dominate the AR and VR in training market with the largest share of 28.79% in 2025 due to its ability to offer scalable, customizable, and continuously upgradable platforms that support a wide range of immersive training applications. These software platforms enable real-time feedback, performance analytics, and scenario-based simulations, which enhance knowledge retention and skill development. They also support remote and multi-user training, reducing the need for physical infrastructure and increasing accessibility for global teams. Additionally, frequent software updates and integration with AI, machine learning, and cloud services allow organizations to continuously improve training content and delivery methods, making software the backbone of modern immersive learning ecosystems.

The services segment is expected to account for the largest share during the forecast period in component market

In 2025, the services segment is expected to dominate the market with the largest market share of 28.72% due to increasing demand for end-to-end support including consultation, integration, maintenance, and training services that help organizations effectively implement and scale augmented and virtual reality training solutions across various industries. As organizations across sectors such as healthcare, manufacturing, defense, and education increasingly adopt AR/VR for immersive training, they seek comprehensive service offerings that go beyond hardware and software. These organizations require expert consultation to identify suitable use cases, seamless integration with existing systems, ongoing technical support, and regular updates to ensure long-term effectiveness.

AR and VR in Training Market Regional Analysis

“North America Holds the Largest Share in the AR and VR in Training Market”

- North America holds the largest market share in the AR and VR in training sector, with 43.10% CAGR driven by substantial investments in advanced technologies and a strong presence of major tech companies

- The U.S. leads the region with significant adoption across industries such as healthcare, education, and corporate training

- Government initiatives and funding in the U.S. and Canada support the integration of immersive technologies into various training programs

- The presence of key players such as Google, Microsoft, and Apple contributes to the region's dominance in the market

- Educational institutions in North America are increasingly incorporating AR and VR tools to enhance learning experiences

“Asia-Pacific is Projected to Register the Highest CAGR in the AR and VR in Training Market”

- Asia Pacific is experiencing the highest growth rate in the AR and VR in training market, fueled by rapid industrialization and technological advancements

- Countries such as China, India, Japan, and South Korea are investing heavily in AR and VR technologies for training purposes

- The region's large population and increasing demand for skilled workforce development drive the adoption of immersive training solutions

- Government initiatives in countries such as China and India promote digitalization and the integration of AR and VR in educational and corporate sectors

- The growing presence of local startups and tech companies in Asia Pacific contributes to the region's rapid market expansion

AR and VR in Training Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The DiSTI Corporation (U.S.)

- Saab AB (Sweden)

- ExtraHop Networks (U.S.)

- Microsoft (U.S.)

- Broadcom (U.S.)

- WNS Limited (India)

- Hitachi (Japan)

- Splunk Inc. (U.S.)

- StackState (U.S.)

- SAP (Germany)

- BMC Software Inc. (U.S.)

- CA Technology Inc. (U.S.)

- Evolven Software Inc. (U.S.)

- IBM (U.S.)

- Oracle Corp. (U.S.)

- Vmware Inc. (U.S.)

- QinetiQ (U.K.)

- On24 Inc. (U.S.)

- Laerdal Medical Corporation (Norway)

- L-3 Link Simulation Training (U.S.)

- Kratos Defense Security Solutions, Inc. (U.S.)

- Cubic Corporation (U.S.)

- CAE Inc. (Canada)

- Bae Systems (U.K.)

- ANSYS, Inc (U.S.)

Latest Developments in Global AR and VR in Training Market

- In November 2023, EON Reality launched its Virtual Campus, an immersive educational platform aimed at revolutionizing the way students and professionals learn by providing interactive, real-world simulations in a virtual environment

- In January 2023, DigiLens Inc. unveiled Argo, a pair of smart glasses equipped with standalone augmented and extended reality capabilities, designed specifically to support hands-free, on-the-job training for enterprise and industrial workers

- In November 2022, Strivr introduced a strategic partner program to expand the use of virtual reality in workforce training, helping organizations improve employee performance through immersive learning experiences

- In March 2022, AjnaLens announced a collaboration with the Indian military to develop AR and VR-based training modules that enhance pilot training and optimize weapon systems for improved operational effectiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ar And Vr In Training Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ar And Vr In Training Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ar And Vr In Training Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.