Global Aspirin Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

3.18 Billion

2024

2032

USD

2.49 Billion

USD

3.18 Billion

2024

2032

| 2025 –2032 | |

| USD 2.49 Billion | |

| USD 3.18 Billion | |

|

|

|

|

Aspirin Market Size

- The global aspirin market was valued at USD 2.49 billion in 2024 and is expected to reach USD 3.18 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.10%, primarily driven by rising prevalence of cardiovascular diseases

- This growth is driven by increasing awareness of pain management solutions, growing demand for over-the-counter (OTC) medications, expanding applications in preventive healthcare, and continuous advancements in drug formulations to enhance efficacy and reduce side effects

Aspirin Market Analysis

- Aspirin has gained widespread acceptance due to its analgesic and anti-inflammatory properties, increasing demand for preventive healthcare, and growing adoption in cardiovascular disease management. Its proven efficacy in reducing pain, fever, and the risk of stroke has solidified its role in modern medicine

- The market is primarily driven by the increasing incidence of chronic diseases, expanding applications in over-the-counter (OTC) medications, and ongoing clinical research to enhance drug formulations. In addition, supportive regulatory approvals and government initiatives promoting affordable healthcare are further accelerating market growth

- For instance, in the U.S. and Canada, the demand for low-dose aspirin has surged due to its widespread use in heart disease prevention, contributing to sustained market growth

- Globally, aspirin continues to be a cornerstone in the pain relief and cardiovascular health sectors, with innovations such as effervescent tablets, combination therapies, and novel drug delivery systems driving industry transformation and ensuring long-term market sustainability

Report Scope and Aspirin Market Segmentation

|

Attributes |

Aspirin Key Market Insights |

|

Segments Covered |

|

|

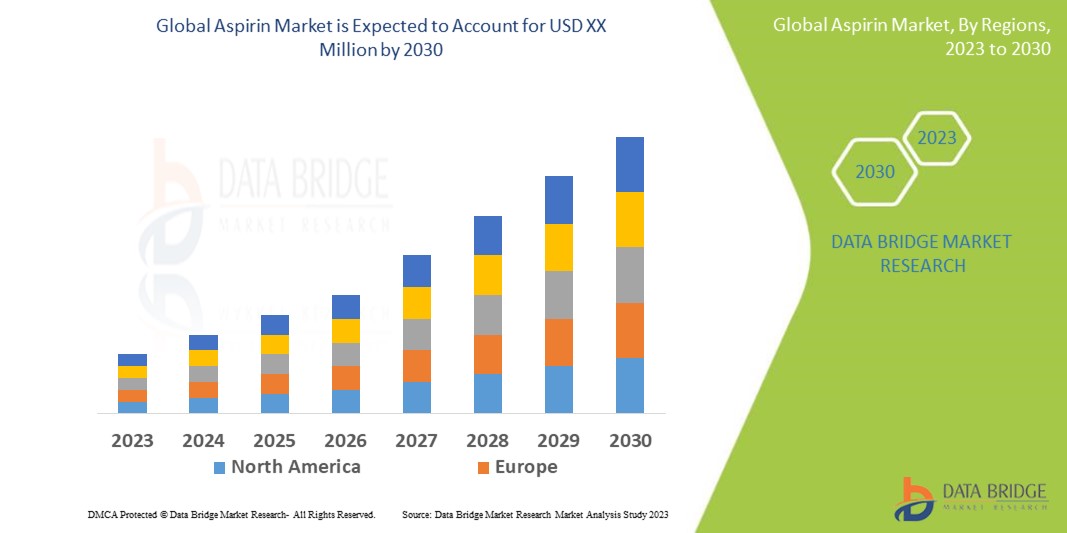

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Aspirin Market Trends

“Rising Integration of Aspirin in Preventive Healthcare Solutions”

- The increasing focus on preventive healthcare is driving demand for aspirin, widely recognized for its role in cardiovascular disease prevention and pain management

- Pharmaceutical and healthcare companies are expanding aspirin-based formulations in low-dose therapies, effervescent tablets, and fixed-dose combinations to cater to a growing health-conscious population

- The rising adoption of self-medication and awareness about chronic disease prevention is accelerating the integration of aspirin into daily healthcare routines

For instance

- In June 2024, Bayer AG introduced a new enteric-coated low-dose aspirin, enhancing gastrointestinal safety for long-term users

- In March 2024, Johnson & Johnson launched an Aspirin-Caffeine combination tablet, targeting consumers seeking fast pain relief and enhanced alertness

- In December 2023, Pfizer expanded its cardiovascular portfolio with an advanced Aspirin formulation designed for rapid absorption

- As the preventive healthcare sector grows, aspirin-based solutions will continue to evolve, supporting heart health, pain relief, and overall wellness in a globally aging population

Aspirin Market Dynamics

Driver

“Increasing Use of Aspirin in Cardiovascular Disease Prevention”

- The growing prevalence of cardiovascular diseases (CVDs) is a major driver of the aspirin market, as its antiplatelet properties help reduce the risk of heart attacks and strokes

- Healthcare providers and organizations are increasingly recommending low-dose aspirin therapy for individuals at risk of thrombosis and other CVD-related complications

- Government initiatives and clinical research validating aspirin’s role in heart health are further supporting its widespread adoption in preventive medicine

For instance

- In October 2024, the American Heart Association updated its guidelines on aspirin therapy for high-risk cardiovascular patients, reinforcing its importance in heart disease prevention

- In May 2024, Bayer AG partnered with global health organizations to promote aspirin use in preventing secondary heart attacks and strokes

- In November 2023, the European Society of Cardiology released a study highlighting the effectiveness of aspirin in reducing major adverse cardiovascular events

- As heart disease remains a leading global health concern, the demand for aspirin-based therapies will continue to rise, driving innovation in formulations and expanding its role in preventive healthcare

Opportunity

“Expanding Applications of Aspirin in Preventive Healthcare”

- The rising emphasis on preventive healthcare is creating significant opportunities for the aspirin market, as consumers and healthcare providers seek cost-effective solutions to manage cardiovascular risks and other chronic conditions

- Increasing investments in clinical research are exploring new therapeutic applications of aspirin, including its role in preventing colorectal cancer, Alzheimer’s disease, and inflammatory disorders

- Governments and public health organizations are promoting low-dose aspirin therapy as a preventive measure, expanding its adoption beyond traditional cardiovascular applications

For instance,

- In March 2025, the U.S. Preventive Services Task Force updated its recommendations on aspirin use for colorectal cancer prevention, increasing its medical acceptance

- In December 2024, a European Medicines Agency report highlighted ongoing trials assessing aspirin’s potential role in reducing Alzheimer’s disease progression

- In July 2024, Bayer AG announced a strategic initiative to expand aspirin-based preventive therapies, targeting emerging markets with high cardiovascular disease prevalence

- As global healthcare systems focus more on early intervention and disease prevention, the demand for aspirin in preventive medicine will continue to grow, driving new product innovations and expanding its market potential

Restraint/Challenge

“Concerns over Long-Term Use and Side Effects of Aspirin”

- Growing concerns regarding the long-term use of aspirin and its potential side effects are posing challenges to market growth, especially among elderly and high-risk patient groups

- Increased awareness of gastrointestinal bleeding, hemorrhagic stroke, and allergic reactions associated with prolonged aspirin consumption has led to cautious prescribing by healthcare professionals

- Regulatory agencies are tightening guidelines on low-dose aspirin therapy, limiting its widespread use for primary prevention and impacting market expansion

For instance,

- In January 2025, the U.S. Food and Drug Administration (FDA) issued updated warnings on Aspirin’s risks, particularly for patients without a history of cardiovascular disease

- In October 2024, the European Medicines Agency (EMA) introduced new labeling requirements for Aspirin-based drugs, highlighting potential gastrointestinal risks

- In June 2024, a study published in The Lancet reported an increased risk of bleeding complications in elderly patients using daily aspirin therapy, prompting medical debates on its long-term benefits

- As safety concerns continue to rise, manufacturers and healthcare providers must focus on risk mitigation strategies, patient education, and alternative formulations to sustain market confidence and growth

Aspirin Market Scope

The market is segmented on the basis of route of administration, dosage form, applications, dose type, availability, product type, end-user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Route of Administration |

|

|

By Dosage Form |

|

|

By Applications |

|

|

By Dose Type |

|

|

By Availability |

|

|

By Product Type |

|

|

By End User |

|

|

By Distribution Channel |

|

Aspirin Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Aspirin Market”

-

Asia-Pacific leads the global aspirin market, driven by rising cardiovascular disease prevalence, increasing pharmaceutical demand, and expanding healthcare infrastructure

- China and India dominate the region due to high domestic drug production, growing healthcare expenditures, and strong government support for generic medicine manufacturing

- Advancements in drug formulation, increasing adoption of pain management medications, and rising awareness of preventive healthcare have further strengthened market growth

- In addition, the presence of major pharmaceutical manufacturers, expanding retail pharmacy networks, and growing consumer demand for over-the-counter pain relief medications contribute to the region’s market dominance

“Europe is projected to register the Highest Growth Rate”

- Europe is expected to witness the highest growth rate in the aspirin market, driven by rising cardiovascular disease cases, increasing demand for pain management drugs, and growing preference for preventive healthcare solutions

- Germany and France are emerging as key markets due to strong pharmaceutical manufacturing capabilities, favorable healthcare policies, and rising investments in drug research and development

- Germany leads the region in aspirin production, with advanced drug formulation technologies and increasing adoption of over-the-counter (OTC) medications for pain relief

- France is witnessing strong market growth due to expanding geriatric population, increasing awareness of cardiovascular health, and rising demand for non-prescription analgesics

- Stringent regulatory approvals, growing healthcare expenditures, and strategic collaborations between pharmaceutical giants further contribute to Europe’s market expansion

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bayer AG (Germany)

- Suzhou Kuacai Information Technology Co., Ltd (China)

- Allegiant Health (U.S.)

- Endo, Inc. (U.S.)

- Anastacio Chemistry (Brazil)

- Cardinal Health (U.S.)

- Nanjing Pharmatechs Co., Ltd. (China)

- JQC (Huayin) Pharmaceutical Co., Ltd. (China)

- LNK International, Inc. (U.S.)

- Globela Pharma (India)

- Bal Pharma Limited (India)

- Trumac Healthcare (India)

- Perrigo Company plc (Ireland)

- Alta Laboratories Ltd (India)

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd. (China)

- Seqens (France)

- Umang Pharmatech Pvt. Ltd. (India)

- J.M. Loveridge Ltd (U.K.)

- Mayne Pharma Group Limited (Australia)

- St. Joseph's Aspirin (U.S.)

Latest Developments in Global Aspirin Market

- In February 2025, Boryung launched Rebetrix Capsules a combination of aspirin and rabeprazole, designed to reduce gastrointestinal bleeding risks associated with aspirin use through the protective effects of rabeprazole

- In January 2025, Preeclampsia Foundation in partnership with Patients & Purpose introduced GAP—SPIRIN, an evidence-based education campaign promoting the use of low-dose aspirin to prevent preeclampsia and address maternal health disparities

- In November 2023, Janssen presented new data at the American Heart Association's (AHA) 2023 Scientific Sessions, highlighting that combining XARELTO with aspirin can help reduce critical cardiovascular and adverse limb events

- In March 2023, the FDA approved Plx Pharma Inc.’S Sndas for Vazalore 325 mg and 81 mg, a liquid-filled aspirin capsule intended for patients with vascular disease and diabetes

- In July 2021, Dr. Reddy's Laboratories Ltd launched ROZAT GOLD in India, a fixed-dose combination (FDC) drug containing aspirin, rosuvastatin, and clopidogrel, designed for high-risk cardiovascular conditions such as chronic coronary artery disease and acute coronary syndrome

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.