Market Analysis and Size

The audiology devices market is largely influenced by the growing focus of manufacturers creating products that incorporate cutting-edge technology and collaborating with other organizations to facilitate faster endorsement and advertising of their products. Moreover, the growing inclination for the remote devices owing to its advantages and acknowledgment by the more established populace are projected to affect the growth of the market positively during the forecast period.

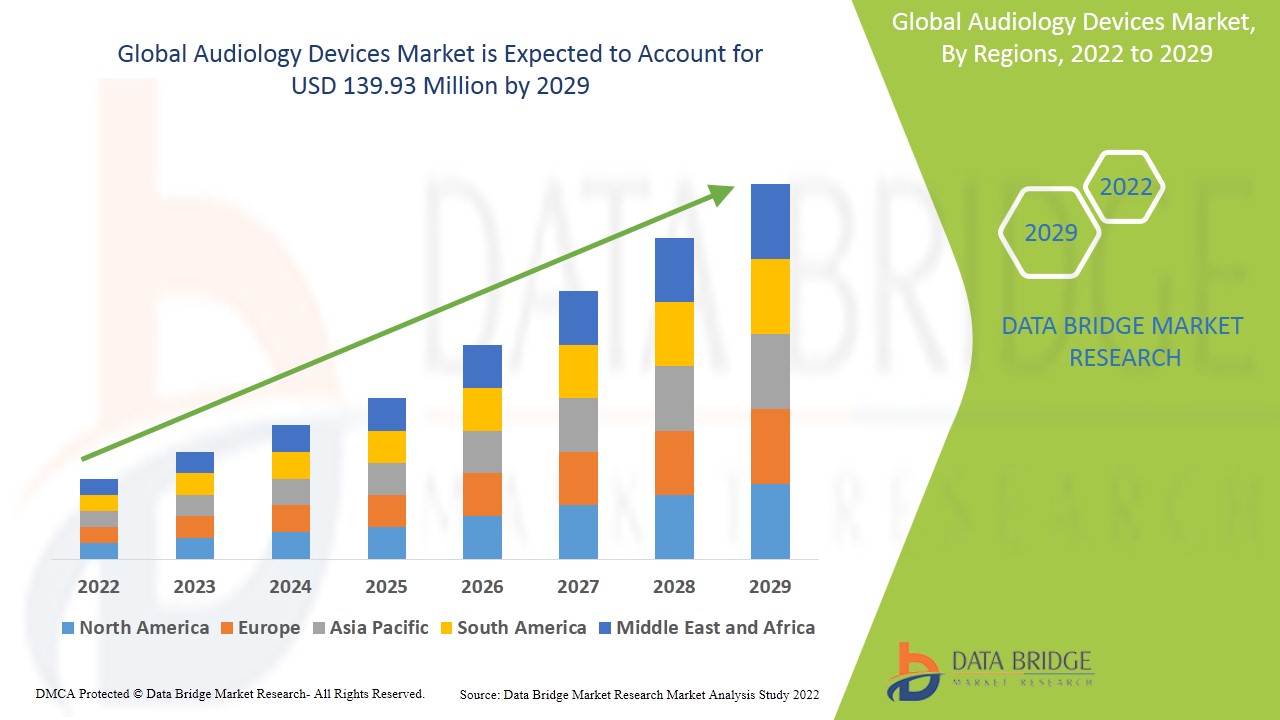

- Data Bridge Market Research analyses that the audiology devices market is expected to reach the value of USD 139.93 million by the year 2029, at a CAGR of 5.45% during the forecast period. The “Bone Anchored Aids for Hearing” accounts for the largest product segment in the audiology devices market, which is expected to grow with a CAGR of 6.5% within the forecast period of 2022 to 2029.

Market Definition

Audiology devices are electronic devices that audiologists use to diagnose and treat hearing loss and impairment. These devices can also be used to test or monitor hearing. The size, shape, features, and hearing conditions of these devices vary. The audiology devices are intended for both diagnostic and therapeutic purposes in the treatment of hearing impairments.

Audiology Devices Market Dynamics

Drivers

-

High Prevalence of Hearing Problems

The rising incidence of impairment and loss of hearing among populations especially amongst ageing population is the most significant factor driving the growth for this market. Growing population across the globe also results in increased percentage of the people with hearing issues which is expected to accelerate the overall growth of the market.

The technological advancement, cost-effective and efficient devices (such as wireless devices), and widespread acceptance of novel devices amongst the geriatric population is also expected to fuel market growth. Moreover, the supportive government initiatives for easy access to hearing aid also cushions the market’s growth within the forecasted period.

Opportunities

Furthermore, the improved diagnostic performance and treatment decisions such as the advancements in PC-based audiometers and hybrid audiometers can easily be integrated with standard computers and operating systems, which extend profitable opportunities to the market players in the forecast period of 2022 to 2029. Moreover, a positive regulatory scenario will further expand the audiology devices market's growth rate in the future.

Restraints/Challenges

On the other hand, a social disgrace associated with deafness is expected to obstruct market growth. Also, the high prices associated with hearing impairment solutions especially surgery based are projected to challenge the audiology devices market in the forecast period of 2022-2029.

This audiology devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the audiology devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Audiology Devices Market

COVID-19 had a negative effect on the market. Deaf or hard-of-hearing hospital patients faced additional challenges as a result of the pandemic. Moreover, the demand for the audiology devices showcased the downward curve. The limitations associated with treatments also restrict the growth of the market. However, the COVID-19 pandemic has accelerated the adoption of the telehealth across the globe. Many healthcare professionals are switching to the tele-audiology to avoid the patient traffic which is projected to create favorable circumstances for the market.

Recent Developments

- In July 2020, The Cochlear Nucleus Kanso 2 Sound Processor, Nucleus 7 Sound Processor for Nucleus 22 Implant recipients, and Custom Sound Pro fitting software have all been approved by the US FDA.

- In February 2021, GN Hearing (Denmark) has introduced ReSound Key, a hearing aid line that expands global access to the company's proven and award-winning hearing technology.

- In October 2020, Starkey (US) has teamed up with OrCam Technologies (Israel) to provide hearing and vision-impaired people with assistive technology. In collaboration with Starkey's Livio Edge AI hearing aids, OrCam was able to use the advanced computer vision and machine learning methods they had developed to transmit the visual world through audio.

Global Audiology Devices Market Scope

The audiology devices market is segmented on the basis of product, type, technology, sales channels, disease type and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Bone Anchored Aids for Hearing

- Cochlear Implants

- Hearing Aids

- Diagnostic Devices

- Tympanometers

- Audiometers

- Otoscopes

On the basis of product, the audiology devices market is segmented into bone anchored aids for hearing, cochlear implants, hearing aids, diagnostic devices, tympanometers, audiometers and otoscopes. The bone anchored aids for hearing is anticipated to witness highest growth within the product segment.

Type

- RITE (Receiver-in-the-Ear) Aids

- ITE (In-the-Ear) Aids

- BTE (Behind-the-Ear) Aids

- Canal Hearing Aids

On the basis of type, the audiology devices market is segmented into RITE (Receiver-in-the-Ear) Aids, ITE (In-the-Ear) Aids, BTE (Behind-the-Ear) Aids and Canal Hearing Aids. The canal hearing aids is sub-segmented into ITC (In-the-Canal), CIC (Completely-in-Canal) and IIC (Invisible-in-Canal).

Technology

- Digital

- Analogue

On the basis of technology, the audiology devices market is segmented into digital and analogue. The digital hearing aids is projected to dominate the technology segment owing to its fast adaptability.

Sales Channel

- Retail Sales

- Government Purchases

- E-Commerce

On the basis of level of sales channel, the audiology devices market is segmented into retail sales, government purchases and e-commerce.

Disease Type

- Otosclerosis

- Meniere’s Disease

- Acoustic Tumors

- Otitis Media

- Others

On the basis of disease type, the audiology devices market is segmented into otosclerosis, meniere’s disease, acoustic tumors, otitis media and others

End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Research Institutes

On the basis of end-user, the audiology devices market is segmented into hospitals, ambulatory surgical centers (ASCs) and research institutes.

Audiology Devices Market Regional Analysis/Insights

The audiology devices market is analyzed and market size insights and trends are provided by country, product, type, technology, sales channels, disease type and end user as referenced above.

The countries covered in the audiology devices market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the audiology devices market because of the advancement in the audiology systems, an increase in the number of audiologists, and the introduction of innovative digital platforms by current providers within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 due to the increasing geriatric population and age-related hearing problems, constantly improving healthcare infrastructure, rising health care expenditures, and increasing product awareness in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The audiology devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for audiology devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the audiology devices market. The data is available for historic period 2010-2020.

Competitive Landscape and Audiology Devices Market Share Analysis

The audiology devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to audiology devices market.

Some of the major players operating in the audiology devices market are Demant A/S, GN Store Nord A/S, Sonova, Starkey Laboratories, Inc., Siemens, Natus Medical Incorporated, MED-EL Medical Electronics, MedRx, Benson Medical, Medtronic, MicroTech, Cochlear Ltd., WS Audiology A/S, Advanced Bionics AG and affiliates, Auditdata, and Nurotron Biotechnology Co. Ltd., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUDIOLOGY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUDIOLOGY DEVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUDIOLOGY DEVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 EPIMEDIOLOGY

5.1 PREVALENCE OF SENSORINEURAL HEARING LOSS, BY AGE GROUP

5.2 PREVALENCE OF CONDUCTIVE HEARING LOSS, BY AGE GROUP

6 PREMIUM INSIGHTS

6.1 PESTAL ANALYSIS

6.2 PORTER’S FIVE FORCES

6.3 KEY STRATEGIC INITIATIVES

6.3.1 HEARING CONSERVATION PROGRAMS

6.3.2 OTHERS

6.4 TECHNOLOGICAL INOVATIONS

7 INDUSTRY INSIGHTS

8 REGULATORY FRAMWORK

9 GLOBAL AUDIOLOGY DEVICES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 HEARING AID DEVICES

9.2.1 RECEIVER-IN-THE-EAR HEARING AIDS

9.2.1.1. MICRO RIC/RITE

9.2.1.1.1. RECHARGABLE

9.2.1.1.1.1 MARKET VALUE (USD MN)

9.2.1.1.1.2 MARKET VOLUME (UNITS)

9.2.1.1.1.3 AVERAGE SELLINF PRICE (USD)

9.2.1.1.2. NON-RECHARGABLE

9.2.1.1.2.1 MARKET VALUE (USD MN)

9.2.1.1.2.2 MARKET VOLUME (UNITS)

9.2.1.1.2.3 AVERAGE SELLINF PRICE (USD)

9.2.1.2. STANDARD RIC/RITE

9.2.1.2.1. RECHARGABLE

9.2.1.2.1.1 MARKET VALUE (USD MN)

9.2.1.2.1.2 MARKET VOLUME (UNITS)

9.2.1.2.1.3 AVERAGE SELLINF PRICE (USD)

9.2.1.2.2. NON-RECHARGABLE

9.2.1.2.2.1 MARKET VALUE (USD MN)

9.2.1.2.2.2 MARKET VOLUME (UNITS)

9.2.1.2.2.3 AVERAGE SELLINF PRICE (USD)

9.2.2 BEHIND-THE-EAR HEARING AIDS

9.2.2.1. MINI BEHIND-THE EAR (BTE)

9.2.2.1.1. RECHARGABLE

9.2.2.1.1.1 MARKET VALUE (USD MN)

9.2.2.1.1.2 MARKET VOLUME (UNITS)

9.2.2.1.1.3 AVERAGE SELLINF PRICE (USD)

9.2.2.1.2. NON-RECHARGABLE

9.2.2.1.2.1 MARKET VALUE (USD MN)

9.2.2.1.2.2 MARKET VOLUME (UNITS)

9.2.2.1.2.3 AVERAGE SELLINF PRICE (USD)

9.2.2.2. STANDARD BEHIND-THE EAR (BTE)

9.2.2.2.1. RECHARGABLE

9.2.2.2.1.1 MARKET VALUE (USD MN)

9.2.2.2.1.2 MARKET VOLUME (UNITS)

9.2.2.2.1.3 AVERAGE SELLINF PRICE (USD)

9.2.2.2.2. NON-RECHARGABLE

9.2.2.2.2.1 MARKET VALUE (USD MN)

9.2.2.2.2.2 MARKET VOLUME (UNITS)

9.2.2.2.2.3 AVERAGE SELLINF PRICE (USD)

9.2.2.3. POWER BEHIND-THE EAR (BTE)

9.2.2.3.1. RECHARGABLE

9.2.2.3.1.1 MARKET VALUE (USD MN)

9.2.2.3.1.2 MARKET VOLUME (UNITS)

9.2.2.3.1.3 AVERAGE SELLINF PRICE (USD)

9.2.2.3.2. NON-RECHARGABLE

9.2.2.3.2.1 MARKET VALUE (USD MN)

9.2.2.3.2.2 MARKET VOLUME (UNITS)

9.2.2.3.2.3 AVERAGE SELLINF PRICE (USD)

9.2.2.4. SINGLE-SIDED HEARING

9.2.2.4.1. RECHARGABLE

9.2.2.4.1.1 MARKET VALUE (USD MN)

9.2.2.4.1.2 MARKET VOLUME (UNITS)

9.2.2.4.1.3 AVERAGE SELLINF PRICE (USD)

9.2.2.4.2. NON-RECHARGABLE

9.2.2.4.2.1 MARKET VALUE (USD MN)

9.2.2.4.2.2 MARKET VOLUME (UNITS)

9.2.2.4.2.3 AVERAGE SELLINF PRICE (USD)

9.2.3 IN-THE-EAR HEARING AIDS

9.2.3.1. INVISIBLE-IN-THE CANAL (IIC)

9.2.3.1.1. RECHARGABLE

9.2.3.1.1.1 MARKET VALUE (USD MN)

9.2.3.1.1.2 MARKET VOLUME (UNITS)

9.2.3.1.1.3 AVERAGE SELLINF PRICE (USD)

9.2.3.1.2. NON-RECHARGABLE

9.2.3.1.2.1 MARKET VALUE (USD MN)

9.2.3.1.2.2 MARKET VOLUME (UNITS)

9.2.3.1.2.3 AVERAGE SELLINF PRICE (USD)

9.2.3.2. COMPLETELY-IN-THE CANAL (CIC)

9.2.3.2.1. RECHARGABLE

9.2.3.2.1.1 MARKET VALUE (USD MN)

9.2.3.2.1.2 MARKET VOLUME (UNITS)

9.2.3.2.1.3 AVERAGE SELLINF PRICE (USD)

9.2.3.2.2. NON-RECHARGABLE

9.2.3.2.2.1 MARKET VALUE (USD MN)

9.2.3.2.2.2 MARKET VOLUME (UNITS)

9.2.3.2.2.3 AVERAGE SELLINF PRICE (USD)

9.2.3.3. IN-THE CANAL (ITC)

9.2.3.3.1. RECHARGABLE

9.2.3.3.1.1 MARKET VALUE (USD MN)

9.2.3.3.1.2 MARKET VOLUME (UNITS)

9.2.3.3.1.3 AVERAGE SELLINF PRICE (USD)

9.2.3.3.2. NON-RECHARGABLE

9.2.3.3.2.1 MARKET VALUE (USD MN)

9.2.3.3.2.2 MARKET VOLUME (UNITS)

9.2.3.3.2.3 AVERAGE SELLINF PRICE (USD)

9.2.3.4. MINI-CANAL (MC) HEARING AIDS

9.2.3.4.1. RECHARGABLE

9.2.3.4.1.1 MARKET VALUE (USD MN)

9.2.3.4.1.2 MARKET VOLUME (UNITS)

9.2.3.4.1.3 AVERAGE SELLINF PRICE (USD)

9.2.3.4.2. NON-RECHARGABLE

9.2.3.4.2.1 MARKET VALUE (USD MN)

9.2.3.4.2.2 MARKET VOLUME (UNITS)

9.2.3.4.2.3 AVERAGE SELLINF PRICE (USD)

9.2.3.5. MICROPHONE-IN-HELIX (MIH) HEARING AIDS

9.2.3.5.1. RECHARGABLE

9.2.3.5.1.1 MARKET VALUE (USD MN)

9.2.3.5.1.2 MARKET VOLUME (UNITS)

9.2.3.5.1.3 AVERAGE SELLINF PRICE (USD)

9.2.3.5.2. NON-RECHARGABLE

9.2.3.5.2.1 MARKET VALUE (USD MN)

9.2.3.5.2.2 MARKET VOLUME (UNITS)

9.2.3.5.2.3 AVERAGE SELLINF PRICE (USD)

9.2.4 OTHER HEARING AID DEVICES

9.3 HEARING IMPLANTS

9.3.1 COCHLEAR IMPLANTS

9.3.1.1. BY PROCESSOR

9.3.1.1.1. BEHIND THE EAR PROCESSOR

9.3.1.1.1.1 MARKET VALUE (USD MN)

9.3.1.1.1.2 MARKET VOLUME (UNITS)

9.3.1.1.1.3 AVERAGE SELLINF PRICE (USD)

9.3.1.1.2. BODY WORN PROCESSOR

9.3.1.1.2.1 MARKET VALUE (USD MN)

9.3.1.1.2.2 MARKET VOLUME (UNITS)

9.3.1.1.2.3 AVERAGE SELLINF PRICE (USD)

9.3.1.2. BY TYPE

9.3.1.2.1. ABUTEMENT

9.3.1.2.2. MAGNET

9.3.1.2.3. HEADBAND

9.3.1.3. BY PPS RATE

9.3.1.3.1. 32000 PPS

9.3.1.3.2. 51000 PPS

9.3.1.3.3. 82000 PPS

9.3.1.4. BY BATTERY

9.3.1.4.1. RECHARGEABLE

9.3.1.4.2. NON RECHARGEABLE

9.3.2 BONE CONDUCTION DEVICES

9.3.2.1. BY PROCESSOR

9.3.2.1.1. BEHIND THE EAR PROCESSOR

9.3.2.1.1.1 MARKET VALUE (USD MN)

9.3.2.1.1.2 MARKET VOLUME (UNITS)

9.3.2.1.1.3 AVERAGE SELLINF PRICE (USD)

9.3.2.1.2. BODY WORN PROCESSOR

9.3.2.1.2.1 MARKET VALUE (USD MN)

9.3.2.1.2.2 MARKET VOLUME (UNITS)

9.3.2.1.2.3 AVERAGE SELLINF PRICE (USD)

9.3.2.2. BY TYPE

9.3.2.2.1. ABUTEMENT (PERCUTANEOUS)

9.3.2.2.2. HEADBANDS

9.3.2.2.3. MAGNETS (TRANSCUTANEOUS)

9.3.2.3. BY BATTERY

9.3.2.3.1. RECHARGEABLE

9.3.2.3.2. NON RECHARGEABLE

9.3.3 MIDDLE EAR IMPLANTS

9.3.3.1. BY PROCESSOR

9.3.3.1.1. BEHIND THE EAR PROCESSOR

9.3.3.1.1.1 MARKET VALUE (USD MN)

9.3.3.1.1.2 MARKET VOLUME (UNITS)

9.3.3.1.1.3 AVERAGE SELLINF PRICE (USD)

9.3.3.1.2. BODY WORN PROCESSOR

9.3.3.1.2.1 MARKET VALUE (USD MN)

9.3.3.1.2.2 MARKET VOLUME (UNITS)

9.3.3.1.2.3 AVERAGE SELLINF PRICE (USD)

9.3.3.2. BY TRANSDUCERS

9.3.3.2.1. PIEZOELECTRIC

9.3.3.2.2. ELECTROMAGNETIC

9.3.4 AUDITORY BRAIN STEM IMPLANTS

9.3.4.1. BYB PROCESSOR

9.3.4.1.1. BEHIND THE EAR PROCESSOR

9.3.4.1.1.1 MARKET VALUE (USD MN)

9.3.4.1.1.2 MARKET VOLUME (UNITS)

9.3.4.1.1.3 AVERAGE SELLINF PRICE (USD)

9.3.4.1.2. BODY WORN PROCESSOR

9.3.4.1.2.1 MARKET VALUE (USD MN)

9.3.4.1.2.2 MARKET VOLUME (UNITS)

9.3.4.1.2.3 AVERAGE SELLINF PRICE (USD)

9.3.4.2. BY ABI CHANNEL

9.3.4.2.1. SINGLE CHANNEL ABI SYSTEM

9.3.4.2.2. MULTI CHANNEL ABI SYSTEM

9.4 HEARING AID ACCESSORIES

9.4.1 HEARING AID BATTERIES

9.4.1.1. MARKET VALUE (USD MN)

9.4.1.2. MARKET VOLUME (UNITS)

9.4.1.3. AVERAGE SELLINF PRICE (USD)

9.4.2 WIRELESS ACCESSORIES

9.4.2.1. MICROPHONE

9.4.2.1.1. MARKET VALUE (USD MN)

9.4.2.1.2. MARKET VOLUME (UNITS)

9.4.2.1.3. AVERAGE SELLINF PRICE (USD)

9.4.2.2. RECEIVER

9.4.2.2.1. MARKET VALUE (USD MN)

9.4.2.2.2. MARKET VOLUME (UNITS)

9.4.2.2.3. AVERAGE SELLINF PRICE (USD)

9.4.2.3. REMOTE

9.4.2.3.1. MINI REMOTE MICROPHONE

9.4.2.3.1.1 MARKET VALUE (USD MN)

9.4.2.3.1.2 MARKET VOLUME (UNITS)

9.4.2.3.1.3 AVERAGE SELLINF PRICE (USD)

9.4.2.3.2. STANDARD REMOTE MICROPHONE

9.4.2.3.2.1 MARKET VALUE (USD MN)

9.4.2.3.2.2 MARKET VOLUME (UNITS)

9.4.2.3.2.3 AVERAGE SELLINF PRICE (USD)

9.4.3 HEARING PROTECTION

9.4.3.1. MARKET VALUE (USD MN)

9.4.3.2. MARKET VOLUME (UNITS)

9.4.3.3. AVERAGE SELLINF PRICE (USD)

9.4.4 WAX GUARD FILTERS

9.4.4.1. MARKET VALUE (USD MN)

9.4.4.2. MARKET VOLUME (UNITS)

9.4.4.3. AVERAGE SELLINF PRICE (USD)

9.4.5 OTHERS

10 GLOBAL AUDIOLOGY DEVICES MARKET, BY HEARING LOSS TYPE

10.1 OVERVIEW

10.2 SENSORINEURAL HEARING LOSS

10.2.1 HEARING AID DEVICES

10.2.1.1. RECEIVER-IN-THE-EAR HEARING AIDS

10.2.1.2. BEHIND-THE-EAR HEARING AIDS

10.2.1.3. IN-THE-EAR HEARING AIDS

10.2.1.4. OTHER HEARING AID DEVICES

10.2.2 HEARING IMPLANTS

10.2.2.1. COCHLEAR IMPLANTS

10.2.2.2. BONE CONDUCTION DEVICES

10.2.2.3. MIDDLE EAR IMPLANTS

10.2.2.4. AUDITORY BRAIN STEM IMPLANTS

10.2.3 HEARING AID ACCESSORIES

10.2.3.1. HEARING AID BATTERIES

10.2.3.2. WIRELESS ACCESSORIES

10.2.3.3. HEARING PROTECTION

10.2.3.4. WAX GUARD FILTERS

10.2.3.5. OTHERS

10.3 CONDUCTIVE HEARING LOSS

10.3.1 HEARING AID DEVICES

10.3.1.1. RECEIVER-IN-THE-EAR HEARING AIDS

10.3.1.2. BEHIND-THE-EAR HEARING AIDS

10.3.1.3. IN-THE-EAR HEARING AIDS

10.3.1.4. OTHER HEARING AID DEVICES

10.3.2 HEARING IMPLANTS

10.3.2.1. COCHLEAR IMPLANTS

10.3.2.2. BONE CONDUCTION DEVICES

10.3.2.3. MIDDLE EAR IMPLANTS

10.3.2.4. AUDITORY BRAIN STEM IMPLANTS

10.3.3 HEARING AID ACCESSORIES

10.3.3.1. HEARING AID BATTERIES

10.3.3.2. WIRELESS ACCESSORIES

10.3.3.3. HEARING PROTECTION

10.3.3.4. WAX GUARD FILTERS

10.3.3.5. OTHERS

11 GLOBAL AUDIOLOGY DEVICES MARKET, BY PATIENT TYPE

11.1 OVERVIEW

11.2 GERIATRIC

11.3 ADULTS

11.4 PEDIATRICS

12 GLOBAL AUDIOLOGY DEVICES MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 DIGITAL SIGNAL PROCESSING

12.3 SMARTPHONE COMPATIBLE

12.4 ARTIFICIAL INTELLIGENCE

12.5 COMPRESSION

12.6 FM COMPATIBILITY

12.7 FEEDBACK MANAGEMENT SYSTEM

12.8 NOISE REDUCTION

12.8.1 DIGITAL NOISE REDUCTION

12.8.2 IMPULSE NOISE REDUCTION

12.8.3 WIND NOISE REDUCTION

12.9 DIRECTIONAL MICROPHONE SYSTEMS

12.1 DATA LOGGING

12.11 TELECOIL

12.12 OTHERS

13 GLOBAL AUDIOLOGY DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 CLINICS

13.3.1 AUDIOLOGY CLINICS

13.3.2 ENT CLINICS

13.4 HOME CARE SETTINGS

13.5 OTHERS

14 GLOBAL AUDIOLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT TENDER

14.3 RETAIL PHARMACY

14.4 HOSPITAL PHARMACY

14.5 ONLINE SALES

14.6 OTHERS

15 GLOBAL AUDIOLOGY DEVICES MARKET, BY GEOGRAPHY

GLOBAL AUDIOLOGY DEVICES MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.1.1. U.S. AUDIOLOGY DEVICES MARKET, BY PRODUCT TYPE

15.1.1.2. U.S. AUDIOLOGY DEVICES MARKET, BY HEARING LOSS TYPE

15.1.1.3. U.S. AUDIOLOGY DEVICES MARKET, BY PATIENT TYPE

15.1.1.4. U.S. AUDIOLOGY DEVICES MARKET, BY TECHNOLOGY

15.1.1.5. U.S. AUDIOLOGY DEVICES MARKET, BY END USER

15.1.1.6. U.S. AUDIOLOGY DEVICES MARKET, BY DISTRIBUTION CHANNEL

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 FRANCE

15.2.3 U.K.

15.2.4 ITALY

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 TURKEY

15.2.8 BELGIUM

15.2.9 NETHERLANDS

15.2.10 SWITZERLAND

15.2.11 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 AUSTRALIA

15.3.6 SINGAPORE

15.3.7 THAILAND

15.3.8 MALAYSIA

15.3.9 INDONESIA

15.3.10 PHILIPPINES

15.3.11 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 SAUDI ARABIA

15.5.3 UAE

15.5.4 EGYPT

15.5.5 ISRAEL

15.5.6 REST OF MIDDLE EAST AND AFRICA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL AUDIOLOGY DEVICES MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL AUDIOLOGY DEVICES MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL AUDIOLOGY DEVICES MARKET, COMPANY PROFILE

18.1 SONOVA GROUP

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DEMANT A/S

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GN STORE NORD A/S

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 COCHLEAR LTD.

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 STARKEY LABORATORIES, INC.

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 AUDINA HEARING INSTRUMENTS, INC.

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 OTICON

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 WS AUDIOLOGY A/S

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 UNITRON

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 EARGO INC.

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.10.6 MDHEARING

18.10.7 COMPANY OVERVIEW

18.10.8 REVENUE ANALYSIS

18.10.9 GEOGRAPHIC PRESENCE

18.10.10 PRODUCT PORTFOLIO

18.10.11 RECENT DEVELOPMENTS

18.11 MEDTRONIC

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 ADVANCED BIONICS CORPORATION

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BOSTON SCIENTIFIC

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 BIOTRONIK

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 LIVA NOVA PLC

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 BERNAFON

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPEMENTS

18.17 NATUS MEDICAL INCORPORATED

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPEMENTS

18.18 SIEMENS AG

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPEMENTS

18.19 SONIC INNOVATIONS, INC.,

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPEMENTS

18.19.6 RECENT DEVELOPMENTS

18.2 SIVANTOS PTE. LTD.

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 AMPLIFON

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 AUSTAR

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 HORENTEK HEARING DIAGNOSTICS

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 ZOUNDS HEARING

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 SEBOTEK HEARING SYSTEMS, LLC.

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 NANO HEARING AIDS

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 EARLENS CORP.

18.27.1 COMPANY OVERVIEW

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 LIVELY HEARING CORPORATION

18.28.1 COMPANY OVERVIEW

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 BELTONE GROUP

18.29.1 COMPANY OVERVIEW

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHIC PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST Conclusion

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.