Global Automated Whole Breast Ultrasound Market

Market Size in USD Billion

CAGR :

%

USD

2.72 Billion

USD

8.61 Billion

2025

2033

USD

2.72 Billion

USD

8.61 Billion

2025

2033

| 2026 –2033 | |

| USD 2.72 Billion | |

| USD 8.61 Billion | |

|

|

|

|

Automated Whole-Breast Ultrasound Market Size

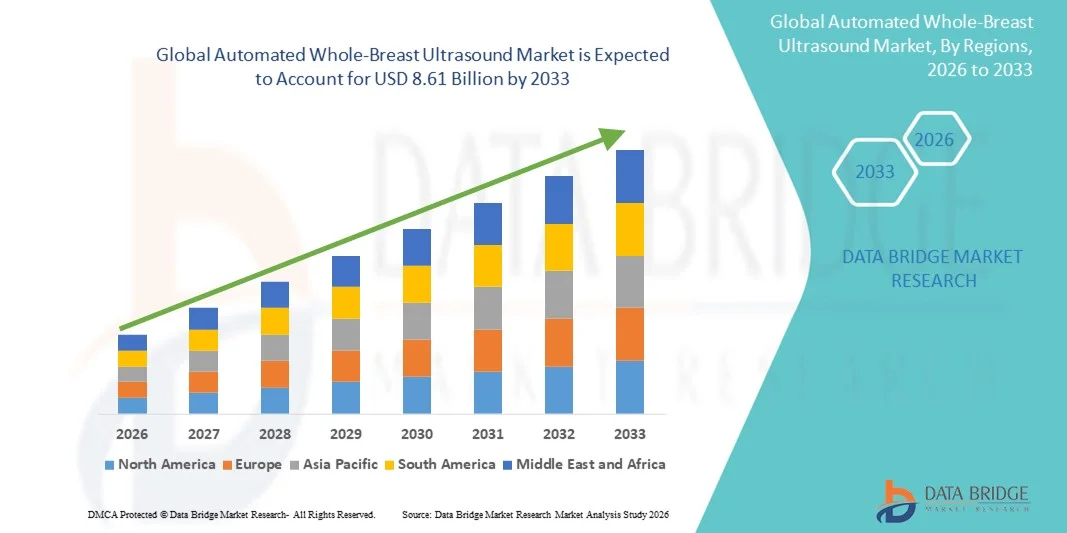

- The global automated whole-breast ultrasound market size was valued at USD 2.72 billion in 2025 and is expected to reach USD 8.61 billion by 2033, at a CAGR of 15.5% during the forecast period

- The market growth is largely fueled by the rising prevalence of breast cancer worldwide and increasing demand for advanced, non‑invasive diagnostic imaging solutions, especially those that improve early detection and screening accuracy for dense breast tissue compared with traditional methods

- Furthermore, technological advancements such as AI‑enabled imaging analysis, improved resolution, and automation are enhancing diagnostic reliability and workflow efficiency, encouraging adoption across hospitals, diagnostic centers, and specialized clinics. These converging factors are accelerating uptake of automated whole‑breast ultrasound systems, thereby significantly boosting the industry’s growth

Automated Whole-Breast Ultrasound Market Analysis

- Automated Whole-Breast Ultrasound (AWBU) systems, providing advanced, non‑ionizing whole‑breast imaging primarily for breast cancer screening and evaluation, are increasingly vital components of modern diagnostic imaging workflows due to their ability to improve early detection especially in women with dense breast tissue and to enhance clinical accuracy and workflow efficiency in hospitals, diagnostic centers, and breast clinics

- The escalating adoption of automated whole-breast ultrasound is primarily fueled by rising global breast cancer incidence, increasing emphasis on early detection, and continuous technological innovations such as AI‑assisted imaging and 3D volumetric scanning that improve lesion detection and diagnostic reliability compared with conventional methods

- North America dominated the automated whole-breast ultrasound market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, strong breast cancer screening programs, supportive reimbursement policies, and high awareness of supplemental imaging needs for dense breast populations, with the U.S. experiencing substantial adoption of AWBU technologies across hospitals and diagnostic centers

- Asia-Pacific is expected to be the fastest‑growing region in the automated whole-breast ultrasound market during the forecast period due to increasing breast cancer prevalence, expanding healthcare infrastructure, rising investments in diagnostic imaging technologies, and growing adoption in countries such as China, Japan, India, and South Korea

- The Automated Breast Ultrasound System (ABUS) segment dominated the automated whole-breast ultrasound market with a market share of 43.7% in 2025, driven by its established clinical use in high‑volume screening and standardized imaging protocols

Report Scope and Automated Whole-Breast Ultrasound Market Segmentation

|

Attributes |

Automated Whole-Breast Ultrasound Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Automated Whole-Breast Ultrasound Market Trends

Enhanced Diagnostic Accuracy Through AI and 3D Imaging

- A significant and accelerating trend in the global automated whole-breast ultrasound market is the growing integration of artificial intelligence (AI) and advanced 3D volumetric imaging, enabling more precise lesion detection and improved diagnostic confidence

- For instance, the QView AWBU platform utilizes AI-assisted algorithms to highlight suspicious regions and provides 3D reconstruction, helping radiologists focus on areas requiring further evaluation

- AI integration allows systems to learn breast tissue patterns over time, enhancing detection accuracy and reducing false positives, while 3D imaging provides comprehensive visualization of dense breast tissue for better clinical assessment

- The seamless combination of AWBU systems with hospital PACS and radiology workflow software facilitates centralized review, reporting, and image storage, enhancing operational efficiency and reducing diagnostic turnaround times

- Integration with telemedicine platforms is gaining traction, allowing remote consultation and second opinions, thereby expanding AWBU utility in rural and underserved regions

- Portable and compact AWBU devices are emerging as a trend, offering flexibility for mobile screening units and on-site diagnostics in community clinics and outreach programs

- This trend toward AI-enabled, 3D-capable, and workflow-integrated imaging systems is reshaping clinical expectations for breast cancer screening, prompting companies such as iCAD to develop solutions that combine automated imaging with advanced analytics

- The demand for AWBU systems with AI and 3D integration is growing rapidly across both hospital and diagnostic center settings, as healthcare providers increasingly prioritize early detection, efficiency, and diagnostic confidence

Automated Whole-Breast Ultrasound Market Dynamics

Driver

Rising Breast Cancer Incidence and Screening Awareness

- The increasing prevalence of breast cancer worldwide, coupled with growing awareness of the importance of early detection, is a significant driver for the heightened demand for automated whole-breast ultrasound systems

- For instance, in March 2025, GE Healthcare announced the deployment of its Seno Iris AWBU system in leading U.S. hospitals to enhance dense breast screening, a move expected to drive market growth during the forecast period

- As healthcare providers seek to reduce missed diagnoses, AWBU systems offer advanced features such as automated lesion mapping, volumetric imaging, and integration with radiology reporting software, providing a compelling alternative to conventional ultrasound screening

- Furthermore, government and NGO-led breast cancer screening initiatives are increasing the adoption of AWBU, especially in high-risk populations and regions with established screening programs

- The capability to streamline workflow, reduce operator dependency, and improve patient throughput is propelling the adoption of AWBU in both hospital and diagnostic center settings, making it a critical tool for modern breast imaging

- Technological advancements, including enhanced image resolution and automated report generation, are driving hospitals to upgrade existing ultrasound infrastructure with AWBU systems

- The growing trend of personalized medicine and risk-based breast screening programs is encouraging the adoption of AWBU systems to tailor imaging frequency and methods according to patient risk profiles

- Collaborations between imaging device manufacturers and healthcare providers to implement pilot AWBU programs in high-volume hospitals are expanding market penetration and validating clinical efficacy

Restraint/Challenge

High Costs and Limited Awareness in Emerging Market

- The relatively high cost of automated whole-breast ultrasound systems compared with conventional ultrasound equipment poses a significant challenge to broader market penetration, particularly in price-sensitive regions

- For instance, smaller clinics in Southeast Asia and Africa often hesitate to adopt AWBU due to budget constraints and limited awareness of its clinical advantages over standard ultrasound

- Addressing these challenges through cost-effective product offerings, leasing models, and training programs is crucial for increasing adoption in emerging markets and building clinical confidence among healthcare providers

- Furthermore, integrating AWBU into existing radiology workflows requires additional staff training and infrastructure investment, which can be a barrier for some healthcare facilities

- Overcoming these challenges through affordable solutions, awareness campaigns, and workflow-friendly designs will be vital for sustained growth of the Automated Whole-Breast Ultrasound market globally

- Regulatory hurdles, including varying country-specific medical device approvals and compliance requirements, may slow the entry of new AWBU technologies into certain regions

- Limited reimbursement policies in some developing countries restrict hospitals and diagnostic centers from investing in AWBU systems, limiting wider adoption despite proven clinical benefits

- Ensuring standardization of training, quality control, and image interpretation protocols across different clinical settings remains a challenge that could impact market growth

Automated Whole-Breast Ultrasound Market Scope

The market is segmented on the basis of product type, end user, equipment, and application

- By Product Type

On the basis of product type, the automated whole-breast ultrasound market is segmented into Automated Breast Ultrasound System (ABUS) and Automated Breast Volume Scanner (ABVS). The Automated Breast Ultrasound System (ABUS) segment dominated the market with the largest revenue share of 43.7% in 2025, driven by its established use in high-volume screening programs and standardized imaging protocols. ABUS offers improved diagnostic accuracy, particularly in women with dense breast tissue, and allows radiologists to capture comprehensive breast images with minimal operator dependency. Hospitals and diagnostic centers prefer ABUS for its integration with PACS and radiology workflow systems, enabling faster image review and reporting. Its proven clinical reliability, widespread adoption, and compatibility with AI-assisted lesion detection further reinforce its leading position. The strong presence of key manufacturers promoting ABUS solutions in developed regions also contributes to its market dominance.

The Automated Breast Volume Scanner (ABVS) segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising adoption in emerging markets and increasing awareness of its advantages for supplemental screening. ABVS offers 3D imaging capabilities and volumetric analysis, enabling better visualization of complex lesions. Its non-invasive nature and compatibility with telemedicine initiatives are attracting diagnostic centers aiming to expand breast cancer screening coverage. Technological advancements improving image resolution and automation further accelerate ABVS adoption. Moreover, growing investments by manufacturers to enhance software analytics and workflow efficiency are expected to drive strong market growth for ABVS in both hospitals and clinics.

- By End User

On the basis of end user, the automated whole-breast ultrasound market is segmented into hospitals, diagnostic imaging centers, clinics, and others. The hospitals segment dominated the market with the largest revenue share of 45% in 2025, owing to their extensive screening programs, advanced infrastructure, and ability to integrate AWBU systems with existing radiology departments. Hospitals benefit from ABUS and ABVS adoption as it improves diagnostic throughput, reduces missed lesions, and facilitates better patient management. Large-scale hospital networks also have the budget and technical expertise to implement AI-assisted AWBU systems, supporting higher adoption rates. In addition, hospitals are key partners in clinical studies validating AWBU efficacy, further solidifying their dominant market share.

The diagnostic imaging centers segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing outsourcing of breast imaging services and growing awareness of AWBU’s clinical advantages. Imaging centers are rapidly upgrading their equipment to attract referrals for supplemental screening, especially in urban areas. The flexibility of AWBU systems allows centers to provide high-quality imaging at lower operational costs compared with traditional methods. Partnerships with AI software providers and telemedicine services are also enabling imaging centers to expand service offerings, contributing to the segment’s fast growth.

- By Equipment

On the basis of equipment, the automated whole-breast ultrasound market is segmented into monitor and arm with the ultrasound transducer. The arm with ultrasound transducer segment dominated the market with the largest share of 50% in 2025, as it is the core component responsible for automated scanning, precise positioning, and volumetric imaging. Its advanced robotic and motorized design ensures consistent image acquisition with minimal operator dependency. The arm’s integration with AI-assisted software further enhances lesion detection and workflow efficiency. Hospitals and imaging centers prioritize high-quality arms with transducers for reliable and repeatable screening, reinforcing this segment’s dominance. Manufacturers are continuously improving arm designs to support faster scanning times and improved patient comfort, maintaining its leading market position.

The monitor segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing use of high-resolution displays for real-time visualization and image analysis. Enhanced monitors with touch-screen capabilities and AI overlay functions are attracting diagnostic centers and hospitals aiming for seamless interpretation. The growing trend of centralized radiology review and teleconsultation also drives monitor demand. Portable and multi-functional monitors further support expansion in emerging regions and mobile screening programs. Investments in ergonomic and software-integrated monitors are expected to accelerate adoption over the forecast period.

- By Application

On the basis of application, the automated whole-breast ultrasound market is segmented into pre-operative evaluation, screening, and others. The screening segment dominated the market with the largest revenue share of 48% in 2025, driven by the rising demand for early breast cancer detection, particularly in women with dense breast tissue. AWBU systems provide automated, standardized, and high-throughput imaging for large populations, making them ideal for organized screening programs. Hospitals and diagnostic centers prefer AWBU for screening as it improves lesion detection rates and reduces radiologist fatigue. Technological enhancements such as AI-assisted interpretation and 3D reconstruction support clinical confidence, reinforcing screening as the dominant application.

The pre-operative evaluation segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of AWBU systems for surgical planning and tumor localization. Surgeons and radiologists use AWBU data to assess lesion size, shape, and location, improving surgical accuracy and outcomes. Growing awareness of the benefits of pre-operative imaging and expanding minimally invasive procedures are contributing to adoption. AI-assisted volumetric analysis further enhances planning efficiency, attracting hospitals and specialized breast clinics. Rising investments in software analytics and integration with operative planning tools are expected to drive strong growth in this application segment.

Automated Whole-Breast Ultrasound Market Regional Analysis

- North America dominated the automated whole-breast ultrasound market with the largest revenue share of 41.5% in 2025, characterized by advanced healthcare infrastructure, strong breast cancer screening programs, supportive reimbursement policies, and high awareness of supplemental imaging needs for dense breast populations

- Healthcare providers in the region highly value the accuracy, AI-assisted lesion detection, and integration of AWBU systems with hospital PACS and radiology workflows, enabling efficient imaging, reporting, and patient management

- This widespread adoption is further supported by well-established reimbursement policies, high investment capacity, and the growing demand for supplemental screening for dense breast tissue, establishing AWBU systems as a preferred diagnostic solution for hospitals and diagnostic centers in North America

U.S. Automated Whole-Breast Ultrasound Market Insight

The U.S. automated whole-breast ultrasound market captured the largest revenue share of 82% in 2025 within North America, fueled by the widespread adoption of advanced diagnostic imaging and increasing focus on early breast cancer detection. Hospitals and diagnostic centers are increasingly implementing AWBU systems to improve screening accuracy, particularly for women with dense breast tissue. The growing demand for AI-assisted imaging and integration with radiology workflow software further propels the market. In addition, government and private screening programs, along with increasing awareness of supplemental imaging, are significantly contributing to market growth.

Europe Automated Whole-Breast Ultrasound Market Insight

The Europe automated whole-breast ultrasound market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by government-led breast cancer screening programs and stringent healthcare regulations. Increasing urbanization, growing awareness of early detection, and rising adoption of AI-assisted AWBU systems are fostering market growth. Hospitals and specialized breast clinics are adopting AWBU solutions for improved diagnostic accuracy. The integration of AWBU with PACS and workflow management systems is enhancing operational efficiency across Europe, supporting continued expansion.

U.K. Automated Whole-Breast Ultrasound Market Insight

The U.K. automated whole-breast ultrasound market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising focus on early breast cancer detection and technological advancements in diagnostic imaging. Healthcare providers are increasingly adopting AWBU systems for standardized screening, particularly in high-risk populations. In addition, the integration of AI-assisted imaging, 3D reconstruction, and workflow optimization tools is boosting operational efficiency in hospitals and imaging centers. The U.K.’s robust healthcare infrastructure and awareness campaigns are expected to sustain market growth.

Germany Automated Whole-Breast Ultrasound Market Insight

The Germany automated whole-breast ultrasound market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of breast cancer and increasing demand for technologically advanced diagnostic imaging. Hospitals and diagnostic centers are investing in AWBU systems to enhance early detection rates and clinical workflow efficiency. Germany’s well-developed healthcare infrastructure, combined with emphasis on precision medicine and innovation, promotes adoption of AWBU technologies. The integration of AI and 3D imaging with routine screening programs further strengthens market growth.

Asia-Pacific Automated Whole-Breast Ultrasound Market Insight

The Asia-Pacific automated whole-breast ultrasound market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by increasing breast cancer prevalence, expanding healthcare infrastructure, and rising awareness of early detection benefits in countries such as China, Japan, and India. Growing adoption of AI-assisted AWBU systems, telemedicine initiatives, and mobile screening units is boosting accessibility. Government programs promoting advanced diagnostic imaging and digital health adoption are further fueling market expansion across APAC.

Japan Automated Whole-Breast Ultrasound Market Insight

The Japan automated whole-breast ultrasound market is gaining momentum due to the country’s high-tech healthcare infrastructure, increasing demand for early breast cancer detection, and widespread adoption of AI-assisted imaging. Hospitals and specialized clinics are deploying AWBU systems for accurate, efficient, and standardized screening. Integration with other imaging technologies, workflow management systems, and telemedicine platforms is further driving growth. Japan’s aging population is such asly to increase demand for non-invasive and easy-to-use diagnostic solutions in both hospital and outpatient settings.

India Automated Whole-Breast Ultrasound Market Insight

The India automated whole-breast ultrasound market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding healthcare infrastructure, rising breast cancer incidence, and increasing awareness of early detection benefits. Hospitals, diagnostic centers, and clinics are rapidly adopting AWBU systems to improve screening coverage. Government initiatives promoting breast cancer awareness, combined with the availability of cost-effective AWBU solutions, are key factors propelling market growth. The growing private healthcare sector and increasing adoption of AI-assisted imaging further support expansion in India.

Automated Whole-Breast Ultrasound Market Share

The Automated Whole-Breast Ultrasound industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Hologic, Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- Mindray Medical International Limited (China)

- SonoCiné, Inc. (U.S.)

- QView Medical, Inc. (U.S.)

- ALPINION Medical Systems Co., Ltd. (South Korea)

- BK Medical Holding Company, Inc. (U.S.)

- Fukuda Denshi Co., Ltd. (Japan)

- Konica Minolta, Inc. (Japan)

- QT Imaging, Inc. (Canada)

- Seno Medical Instruments, Inc. (U.S.)

- Telemed Medical Systems srl (Italy)

- SuperSonic Imagine (France)

- U Systems, Inc. (U.S.)

- Esaote SpA (Italy)

- Lunit Inc. (South Korea)

What are the Recent Developments in Global Automated Whole-Breast Ultrasound Market?

- In March 2025, GE HealthCare launched the AI‑enabled Invenia ABUS Premium automated breast ultrasound system, featuring advanced machine‑guided scan quality tools and faster imaging capabilities designed to enhance supplemental screening accuracy for dense breast tissues and reduce exam variability in clinical practice

- In April 2024, iSono Health was recognized by Frost & Sullivan with the United States New Product Innovation Award for its ATUSA system, highlighting its impact on patient comfort, automated imaging quality, and diagnostic workflow improvements across clinical settings as a wearable AWBU solution

- In January 2023, Abdul Latif Jameel Health partnered with iSono Health to distribute the AI‑driven portable ATUSA 3D breast ultrasound scanner across the Global South, extending the reach of advanced AWBU technology to over 30 countries including regions in the Middle East, Africa, South Asia, and Southeast Asia to improve access to automated breast imaging

- In May 2022, the U.S. Food and Drug Administration cleared iSono Health’s ATUSA™, the world’s first automated and wearable 3D breast ultrasound system, enabling portable, automated whole‑breast imaging with 3D visualization and machine‑learning‑ready data capture, which aimed to improve accessibility and consistency of breast screening at point of care

- In October 2021, Delphinus Medical Technologies announced U.S. FDA approval for its SoftVue™ 3D Whole Breast Ultrasound Tomography System, a 3D automated whole‑breast ultrasound device intended to be used as an adjunct to mammography for screening asymptomatic women with dense breast tissue, marking a significant regulatory milestone that expanded clinical screening options in dense breast imaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.