Global Automatic Baby Swing Market

Market Size in USD Million

CAGR :

%

USD

31.41 Million

USD

34.01 Million

2024

2032

USD

31.41 Million

USD

34.01 Million

2024

2032

| 2025 –2032 | |

| USD 31.41 Million | |

| USD 34.01 Million | |

|

|

|

|

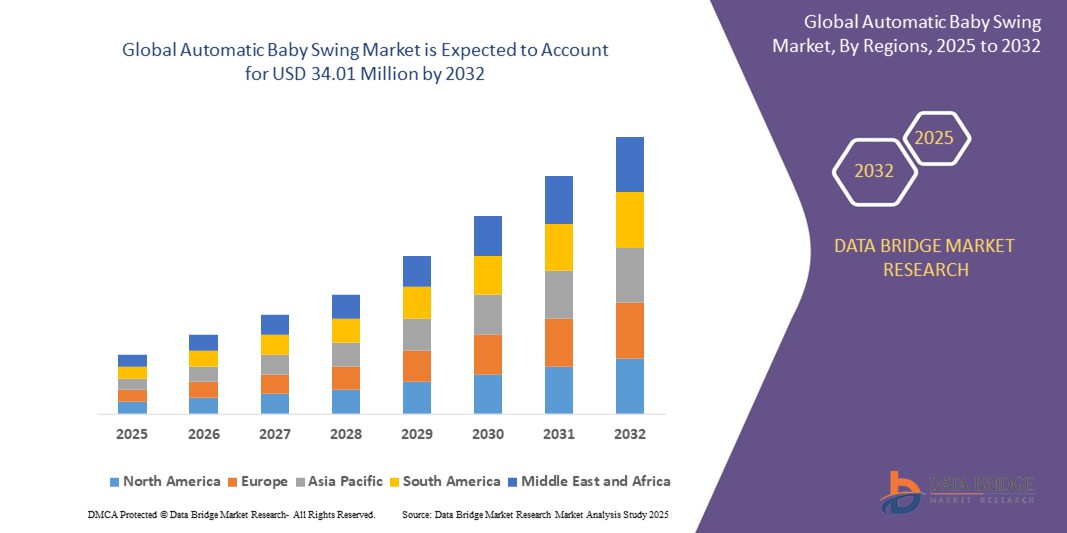

What is the Global Automatic Baby Swing Market Size and Growth Rate?

- The global automatic baby swing market size was valued at USD 31.41 million in 2024 and is expected to reach USD 34.01 million by 2032, at a CAGR of 1.00% during the forecast period

- The global automatic baby swing market is experiencing steady growth driven by increasing demand for products that aid in infant soothing and parenting convenience. Automatic baby swings are favored by parents seeking devices that can mimic soothing motions, such as rocking or swinging, to calm their infants effectively

- Factors contributing to market expansion include rising birth rates in developing regions, coupled with growing disposable incomes, which enable higher spending on baby care products

- Technological advancements have led to innovations in automatic swings, such as customizable swing speeds, recline positions, and integrated music or sound features, enhancing their appeal among consumers. Furthermore, the trend towards compact and portable designs has facilitated their use both indoors and outdoors, catering to modern lifestyles

What are the Major Takeaways of Automatic Baby Swing Market?

- The automatic baby swing market is benefiting from increasing birth rates in emerging economies and rising disposable incomes globally. As economies develop and families experience improved financial stability, parents are prioritizing products that enhance the comfort and well-being of their infants. Automatic baby swings, with their ability to provide soothing motions that mimic human touch, are particularly appealing to busy parents seeking efficient solution

- This demographic shift drives demand and opens up opportunities for market expansion into previously underserved regions. Manufacturers can capitalize on this trend by offering affordable yet feature-rich products tailored to the needs of diverse consumer segments, thereby solidifying their market presence and stimulating further growth

- North America dominated the automatic baby swing market with the largest revenue share of 37.56% in 2024, driven by strong consumer awareness, advanced parenting technologies, and the increasing adoption of smart baby care solutions

- Asia-Pacific automatic baby swing market is projected to grow at the fastest CAGR of 8.25% from 2025 to 2032, owing to rising disposable incomes, urban living, and increasing digitalization in countries such as China, India, and Japan

- The full-sized automatic baby swing segment dominated the market with the largest revenue share of 52.6% in 2024, owing to its enhanced stability, multi-functional features, and suitability for long-term indoor use

Report Scope and Automatic Baby Swing Market Segmentation

|

Attributes |

Automatic Baby Swing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automatic Baby Swing Market?

“Enhanced Convenience through AI and Voice Integration”

- A key trend transforming the automatic baby swing market is the integration of artificial intelligence (AI) and voice assistant technologies such as Amazon Alexa, Google Assistant, and Apple HomeKit, offering hands-free control and smart scheduling functionalities to parents

- Modern automatic baby swings are increasingly equipped with smart sensors and machine learning algorithms that adjust swing speed, music, and vibration based on the baby's behavior or sleep patterns. For instance, some advanced models automatically respond to a baby’s crying by altering motion or playing soothing sounds

- Voice control enables parents to activate or adjust swings using simple verbal commands, making it easier to manage childcare routines while multitasking. Integration with smart home ecosystems also allows syncing swing usage with lighting, temperature, or white noise systems

- Companies such as 4moms and Nuna are innovating with Bluetooth- and Wi-Fi-enabled swings, where AI is used to track baby activity and optimize soothing functions for better sleep and comfort. Some even send alerts or usage summaries to the parent’s smartphone for better monitoring

- As digital parenting solutions evolve, the demand for intelligent, responsive, and connected baby care products is rising sharply, establishing AI-enabled baby swings as a next-gen convenience for tech-savvy parents

- This trend reflects the broader move toward automated and data-driven parenting tools, reshaping consumer expectations in the baby care space by offering smarter, safer, and more adaptive experiences

What are the Key Drivers of Automatic Baby Swing Market?

- One of the primary drivers of the automatic baby swing market is the increasing demand for convenience-focused parenting products that help soothe babies with minimal manual intervention, especially among dual-income households and urban parents

- Rising awareness around infant development and sleep patterns is encouraging the adoption of baby swings that offer customized motion settings, calming features, and remote operability. For instance, in January 2024, Kids2 launched a smart swing with app connectivity that allows personalized control over motion and music settings

- The rise of tech-integrated nurseries and the growing acceptance of smart baby gear are further propelling market growth. Parents are now seeking devices that monitor usage, integrate with smartphones, and reduce physical fatigue

- In addition, the booming e-commerce ecosystem is expanding access to premium and imported products, helping brands reach new parents in tier-2 and tier-3 cities globally. Social media influence and parenting blogs also play a role in promoting smart swings with digital features

- The need for portable, compact, and multipurpose products that blend functionality with aesthetics is also shaping purchase decisions, especially among millennial and Gen Z parents who value both performance and design

Which Factor is challenging the Growth of the Automatic Baby Swing Market?

- A major challenge for the automatic baby swing market is the high price point of AI- and voice-enabled swings, making them less accessible to price-sensitive consumers, especially in developing markets

- While basic models are available at lower costs, advanced versions with Bluetooth, voice control, mobile apps, and adaptive algorithms often carry a premium. This limits their adoption among middle-income families and in regions with low digital penetration

- Furthermore, concerns around electromagnetic radiation and battery safety in baby products persist among cautious parents, potentially hampering the appeal of overly connected devices

- Another hurdle is regulatory scrutiny and the need for compliance with stringent child safety standards, particularly in North America and Europe. Non-compliance or faulty features may lead to recalls, harming brand reputation and consumer trust

- Companies must also address durability concerns, as frequent usage, motor function, and battery limitations can reduce product lifespan. Enhancing component quality and providing post-sale support will be essential to drive long-term adoption

- Overcoming these challenges will require manufacturers to focus on cost optimization, compliance assurance, and consumer education on the benefits and safety of smart baby swings, ensuring a broader market reach and sustained growth

How is the Automatic Baby Swing Market Segmented?

The market is segmented on the basis of product type, material, price, age group, application, end use, and distribution channel.

• By Product Type

On the basis of product type, the automatic baby swing market is segmented into Full-Sized Automatic Baby Swing, Portable Automatic Baby Swing, and Others. The Full-Sized Automatic Baby Swing segment dominated the market with the largest revenue share of 52.6% in 2024, owing to its enhanced stability, multi-functional features, and suitability for long-term indoor use. These swings are often equipped with advanced soothing modes, adjustable recline positions, and built-in toys or music modules, making them ideal for home setups.

The Portable Automatic Baby Swing segment is expected to register the fastest CAGR from 2025 to 2032, driven by the increasing demand for compact, travel-friendly solutions that parents can use on-the-go or in smaller living spaces. Their lightweight design and battery-operated models cater to modern urban lifestyles.

• By Material

On the basis of material, the market is segmented into Fabric, Metal, Plastic, Polyester, and Others. The Fabric segment held the largest revenue share of 34.9% in 2024, due to its widespread use in providing cushioned support and comfort for infants. Fabric materials, especially hypoallergenic and machine-washable options, are preferred for their safety and hygiene benefits.

The Plastic segment is anticipated to witness the fastest growth, supported by its use in structural components that offer durability and easy cleaning. Manufacturers are also innovating with eco-friendly plastic alternatives to cater to sustainability-conscious consumers.

• By Price

On the basis of price, the automatic baby swing market is segmented into Premium, Medium, and Economy. The Medium price segment dominated the market with the largest share of 46.3% in 2024, as it offers a balance between functionality and affordability. These models often include essential features such as multiple swing speeds, timer settings, and built-in melodies, making them attractive to middle-income families.

The Premium segment is projected to grow at the fastest CAGR during the forecast period, driven by increasing demand for feature-rich swings with AI integration, Bluetooth connectivity, and smart home compatibility.

• By Age Group

On the basis of age group, the market is segmented into Infant, Newborn, Toddler, and Child. The Infant segment led the market with a share of 44.1% in 2024, as automatic baby swings are primarily targeted at soothing and calming infants up to 6–12 months of age. The focus on motor skill development, safe sleep, and convenience for new parents is driving demand in this age category.

The toddler segment is anticipated to grow steadily, driven by product innovations that extend usability through adjustable seat settings and enhanced weight support.

• By Application

On the basis of application, the market is segmented into Residential, Commercial, Nursery, Orphanages & Child Care Centers, Hospitals, and Others. The residential segment dominated the market with the highest revenue share of 55.8% in 2024, driven by rising nuclear family setups, growing urbanization, and a surge in smart parenting solutions. The increasing influence of online product reviews and parenting communities further boosts product visibility in this segment.

The nurseries and child care centers segment is expected to witness strong growth, supported by the adoption of automatic baby swings to improve infant comfort and reduce caregiver burden in group care environments.

• By End Use

On the basis of end use, the market is bifurcated into Residential and Commercial. The residential segment held the dominant market share of 67.5% in 2024, owing to the preference for personal baby care products at home, coupled with a growing number of tech-savvy, working parents investing in automated infant solutions.

The commercial segment is set to grow at a notable pace due to rising installation of automatic swings in hospitals, pediatric clinics, and daycare centers aiming to provide better infant management facilities.

• By Distribution Channel

On the basis of distribution channel, the automatic baby swing market is segmented into Online and Offline. The online segment accounted for the largest market revenue share of 60.3% in 2024, driven by the rise in e-commerce platforms, attractive discounts, product reviews, and availability of a wide range of international and domestic brands. The convenience of home delivery and return policies also adds to its appeal.

The offline segment, which includes specialty baby stores and retail chains, is expected to witness steady growth, especially in regions where consumers prefer physical interaction before purchasing baby products.

Which Region Holds the Largest Share of the Automatic Baby Swing Market?

- North America dominated the automatic baby swing market with the largest revenue share of 37.56% in 2024, driven by strong consumer awareness, advanced parenting technologies, and the increasing adoption of smart baby care solutions

- Parents in the region prioritize convenience, safety, and remote operability, leading to high demand for automatic swings with features such as voice control, motion sensors, and mobile app connectivity

- The region benefits from a high level of disposable income, a culture of early adoption of parenting tech, and an established e-commerce infrastructure, making smart infant products such as automatic swings more accessible

U.S. Automatic Baby Swing Market Insight

U.S. dominated North America's revenue share in 2024, driven by rising interest in smart parenting tools, especially among millennial and Gen Z parents. The widespread use of connected devices and a preference for hands-free, AI-integrated baby swings is fueling the market. Brands such as 4moms and Graco lead innovation in this space, offering voice-controlled, app-integrated products that support modern lifestyles. The DIY baby tech trend and robust digital retail networks further accelerate product adoption.

Europe Automatic Baby Swing Market Insight

Europe automatic baby swing market is projected to witness steady growth over the forecast period, driven by heightened demand for safe, ergonomic, and automated infant care products. Parents across countries such as Germany, France, and the U.K. are increasingly embracing automatic swings that offer multi-functionality, compact design, and energy efficiency. The trend is amplified by increasing birth rates in certain countries and a growing culture of smart nurseries across new residential developments.

U.K. Automatic Baby Swing Market Insight

U.K., the market is growing at a noteworthy pace, driven by increased awareness of smart baby gear and demand for aesthetic and tech-enabled swings. The presence of leading child product brands and easy access through retail and e-commerce platforms contribute to sustained growth. Features such as Bluetooth connectivity, music playback, and recline adjustability are particularly favored by parents in urban areas.

Germany Automatic Baby Swing Market Insight

Germany market is expanding steadily, supported by a strong focus on sustainability, safety compliance, and innovation. German consumers prefer baby swings that meet EU child safety certifications while offering high functionality and minimal design. Integration with home automation systems and eco-friendly materials are becoming key purchase drivers in this region.

Which Region is the Fastest Growing Region in the Automatic Baby Swing Market?

Asia-Pacific automatic baby swing market is projected to grow at the fastest CAGR of 8.25% from 2025 to 2032, owing to rising disposable incomes, urban living, and increasing digitalization in countries such as China, India, and Japan. Governments across the region are promoting smart parenting and healthcare solutions, while the expanding middle class is fueling demand for affordable, feature-rich baby swings. The growing number of nuclear families, along with greater parental concern for infant comfort and sleep quality, is driving strong product penetration in urban markets.

Japan Automatic Baby Swing Market Insight

Japan’s automatic baby swing market is thriving due to its tech-savvy population, aging caregiver base, and focus on compact, intelligent childcare solutions. High-quality manufacturing standards and a preference for voice-controlled, space-saving devices are pushing domestic and imported brands to develop specialized solutions for modern urban homes.

China Automatic Baby Swing Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, supported by a growing middle-class population, rapid urbanization, and high penetration of e-commerce platforms. With an expanding baby care product sector and widespread adoption of smart parenting devices, China is emerging as a critical market for domestic and international players offering AI-enabled and portable baby swings. Local innovation and government-backed smart city initiatives also play a pivotal role in market expansion.

Which are the Top Companies in Automatic Baby Swing Market?

The automatic baby swing industry is primarily led by well-established companies, including:

- 4moms (U.S.)

- BabyBjorn AB (Sweden)

- Dorel Industries (Canada)

- hauck GmbH & Co. KG (Germany)

- Joie International Co. Ltd. (U.K.)

- Kids2, LLC. (U.S.)

- L Inglesina Baby S.p.A. (Italy)

- Mamas & Papas (U.K.)

- Mattel Inc. (U.S.)

- Munchkin Inc. (U.S.)

- Newell Brands (U.S.)

- Nuna International BV (Netherlands)

- R for Rabbit Baby Products Pvt. Ltd. (India)

- SND Digital Retails LLP (India)

- Stokke AS (Norway)

- TinyTyke (U.S.)

What are the Recent Developments in Global Automatic Baby Swing Market?

- In May 2024, Graco, a baby gear brand under Newell Brands Inc., introduced its latest SmartSense Soothing Swing featuring three recline positions and a five-point harness system. The swing incorporates patented technology capable of detecting a baby's cries and responding with over 1,000 combinations of motions, sounds, songs, and vibrations. This innovation marks a major step forward in responsive baby care solutions

- In May 2024, Babies ‘R’ Us, a baby products retailer based in New Jersey, U.S., entered a shop-in-shop partnership with Kohl’s, a U.S. omnichannel retail chain, to establish Babies ‘R’ Us sections within 200 Kohl’s stores nationwide. This strategic move is aimed at expanding Babies ‘R’ Us' retail footprint and enhancing customer accessibility

- In March 2023, 4moms, a U.S.-based manufacturer of baby gear, rolled out its RockaRoo Baby Rocker equipped with five adjustable front-to-back motion settings and interactive toy balls for engagement. This launch further reinforces 4moms’ position as a leader in innovative baby swing technology

- In July 2022, 4moms unveiled the updated version of its MamaRoo Multi-Motion Baby Swing, incorporating feedback from parents. The new model retains the brand’s iconic five soothing motions and adds the “Find Your Roo” app feature, offering 25 customizable motion and speed combinations. This release reflects the brand’s continuous commitment to tailored comfort for infants

- In April 2022, Mattel, a leading U.S.-based baby toys company, announced a USD 50 million investment to expand its production facility in Escobedo, Mexico. This expansion is intended to streamline the company’s supply chain and meet rising global demand. This move demonstrates Mattel’s focus on manufacturing efficiency and capacity building

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.