Global Automotive Active Health Monitoring System Market

Market Size in USD Billion

CAGR :

%

USD

19.76 Billion

USD

127.98 Billion

2024

2032

USD

19.76 Billion

USD

127.98 Billion

2024

2032

| 2025 –2032 | |

| USD 19.76 Billion | |

| USD 127.98 Billion | |

|

|

|

|

What is the Global Automotive Active Health Monitoring System Market Size and Growth Rate?

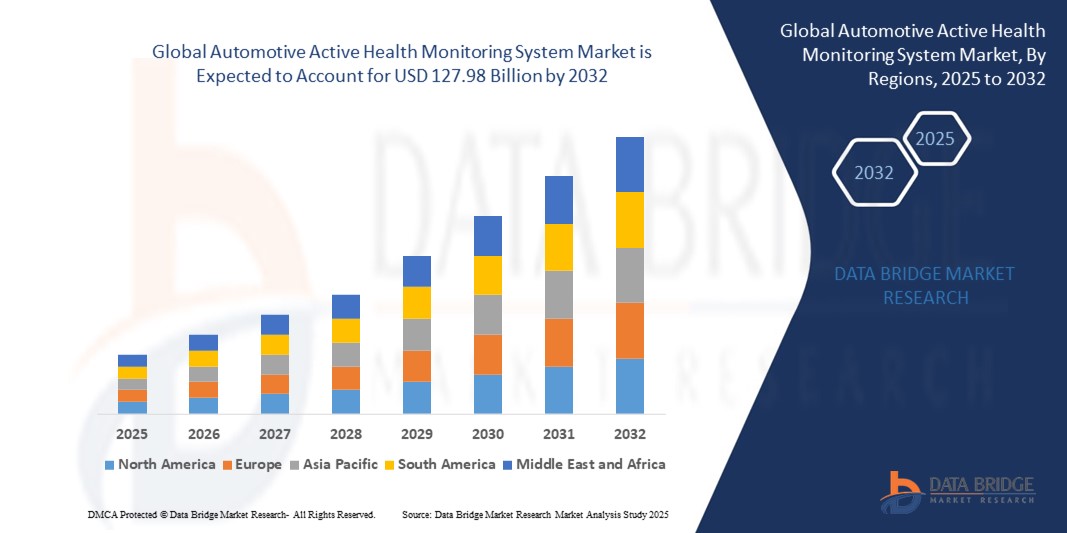

- The global automotive active health monitoring system market size was valued at USD 19.76 billion in 2024 and is expected to reach USD 127.98 billion by 2032, at a CAGR of 26.30% during the forecast period

- The automotive active health monitoring system market is rapidly advancing with the integration of cutting-edge technologies such as AI, IoT, and biosensors. The latest methods include real-time monitoring of driver health metrics, enhancing safety and comfort. This market's growth is driven by increasing demand for preventive healthcare and smart vehicle innovations, promoting a safer driving experience and improved overall wellness

What are the Major Takeaways of Automotive Active Health Monitoring System Market?

- The increasing emphasis on driver and passenger safety is significantly driving the adoption of active health monitoring systems in vehicles. These systems play a crucial role in preventing accidents by continuously monitoring vital health metrics such as heart rate and fatigue levels. For instance, technologies that detect driver drowsiness can alert drivers to take breaks, reducing the risk of accidents caused by fatigue-induced errors, and thereby enhancing overall road safety

- Europe dominated the automotive active health monitoring system market with the largest revenue share of 38.5% in 2024, driven by strict road safety regulations, rising health concerns, and strong adoption of advanced driver assistance systems (ADAS)

- Asia-Pacific market is expected to grow at the fastest CAGR of 8.32% from 2025 to 2032, driven by urbanization, increasing disposable incomes, and rapid technological adoption in countries such as China, Japan, and India

- The driver seat segment dominated the market with the largest share of 55.6% in 2024, driven by the growing integration of seat-embedded sensors that monitor vital parameters such as heart rate, respiration, and posture

Report Scope and Automotive Active Health Monitoring System Market Segmentation

|

Attributes |

Automotive Active Health Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Active Health Monitoring System Market?

Integration of AI and Biosensors for Predictive Health Insights

- A key emerging trend in the global automotive active health monitoring system market is the integration of artificial intelligence (AI) with advanced biosensors to monitor driver vitals such as heart rate, respiration, and fatigue levels in real time

- Automakers are embedding sensors in steering wheels, seats, and seatbelts, enabling continuous data collection that is analyzed through AI-driven algorithms to detect anomalies such as drowsiness or stress

- For instance, Ford Motor Company has tested driver seat sensors that monitor heart activity, while Hyundai is exploring AI-powered in-vehicle healthcare features to alert drivers during emergencies

- The seamless integration of AI-based analytics with vehicle infotainment and connected systems allows proactive interventions, such as activating alerts, reducing speed, or guiding vehicles to safe stops during medical risks

- This trend is reshaping the automotive sector by merging mobility with personalized healthcare, positioning vehicles as proactive wellness companions

What are the Key Drivers of Automotive Active Health Monitoring System Market?

- Growing awareness of road safety and the rising number of accidents caused by driver fatigue and medical emergencies are fueling demand for active health monitoring systems

- For instance, in March 2024, FORVIA Faurecia (France) partnered with Saint-Gobain Sekurit to integrate health-monitoring smart glass and biometric sensing technologies in vehicles, enhancing driver safety

- Increasing adoption of connected cars and in-vehicle telematics supports the deployment of real-time health data sharing with emergency services or healthcare providers

- Rising consumer demand for personalized, tech-enabled driving experiences is driving automotive OEMs and Tier-1 suppliers to incorporate AI-based healthcare features

- The convenience of early detection of health issues, preventive alerts, and integration with wearable devices further accelerates adoption in both passenger vehicles and luxury cars

Which Factor is Challenging the Growth of the Automotive Active Health Monitoring System Market?

- A key challenge is the privacy and data security concern associated with continuous biometric monitoring, as sensitive health data can be vulnerable to misuse or breaches

- For instance, high-profile cases of data leaks in connected vehicle ecosystems have raised questions about consumer trust in adopting in-car health monitoring solutions

- The high cost of integrating biosensors, AI platforms, and cloud-based data processing also creates barriers, especially in price-sensitive markets

- Moreover, lack of standardized regulations for health data collection, storage, and cross-border sharing in the automotive industry adds complexity for OEMs

- Companies are working to address these challenges through end-to-end encryption, anonymized health data storage, and compliance with global standards such as GDPR and HIPAA

- Overcoming these concerns while making the systems affordable and user-friendly will be crucial for mass adoption

How is the Automotive Active Health Monitoring System Market Segmented?

The market is segmented on the basis of location, component, deployment type, application, sales channel, and vehicle type.

- By Location

On the basis of location, the automotive active health monitoring system market is segmented into driver seat and dashboard. The driver seat segment dominated the market with the largest share of 55.6% in 2024, driven by the growing integration of seat-embedded sensors that monitor vital parameters such as heart rate, respiration, and posture. Automotive OEMs are increasingly embedding sensors into driver seats to enhance safety and reduce the risk of accidents caused by fatigue or sudden health issues. Moreover, integration with advanced driver assistance systems (ADAS) ensures automatic alerts or vehicle slowdowns during emergencies.

The dashboard segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, fueled by rising demand for connected infotainment systems with built-in health monitoring features. The dashboard allows seamless visualization of real-time health data, improving user engagement and preventive diagnostics.

- By Component

Based on components, the market is segmented into sensors, infotainment system, and others. The sensors segment accounted for the largest market revenue share of 47.3% in 2024, as sensors form the backbone of active health monitoring by tracking metrics such as pulse, blood sugar levels, oxygen saturation, and driver fatigue indicators. Their miniaturization, cost-effectiveness, and reliability drive widespread adoption across passenger and commercial vehicles.

The infotainment system segment is anticipated to grow at the fastest CAGR of 22.4% from 2025 to 2032, owing to the rising consumer preference for connected cars and real-time health data integration into infotainment displays. Infotainment systems provide health monitoring insights and integrate with smartphones and cloud services for seamless telemedicine and emergency response. As automakers push toward holistic in-cabin experiences, infotainment-driven health monitoring is gaining momentum.

- By Deployment Type

On the basis of deployment, the automotive active health monitoring system market is segmented into cloud-based and on-premises. The cloud-based segment held the largest revenue share of 59.8% in 2024, supported by the ability to store, analyze, and share health data remotely. Cloud platforms enable integration with healthcare providers, insurance systems, and telematics, enhancing predictive health analytics and improving driver well-being. Increasing partnerships between automotive OEMs and cloud providers also boost adoption.

The on-premises segment is expected to record the fastest CAGR of 18.9% during 2025–2032, primarily driven by demand for data privacy and immediate offline accessibility in regions with limited connectivity. Certain fleet operators and government institutions prefer on-premises deployment to maintain strict control over sensitive health data, ensuring compliance with data protection norms.

- By Application

On the basis of application, the market is segmented into pulse, blood sugar level, blood pressure, and others. The pulse monitoring segment dominated the market with a 41.5% revenue share in 2024, as it represents the most fundamental and widely adopted health parameter to detect fatigue, drowsiness, and early signs of cardiovascular issues. Automakers are embedding pulse detection sensors into steering wheels, seats, and seatbelts to provide real-time driver condition insights.

The blood sugar monitoring segment is projected to grow at the fastest CAGR of 23.1% from 2025 to 2032, driven by the rising prevalence of diabetes worldwide. Integrating non-invasive glucose monitoring technologies into automotive systems helps ensure passenger safety and caters to health-conscious users. OEMs and health-tech companies are actively collaborating to enhance accuracy and real-time alerts for diabetic drivers.

- By Sales Channel

Based on sales channel, the market is segmented into OEM and aftermarket. The OEM segment held the largest share of 62.7% in 2024, as leading automakers integrate health monitoring features during vehicle production to strengthen product differentiation and brand value. OEM-installed systems benefit from better sensor calibration, software integration, and compatibility with in-built safety systems, ensuring higher reliability and consumer trust.

The aftermarket segment is anticipated to grow at the fastest CAGR of 21.6% between 2025 and 2032, driven by rising consumer demand to upgrade existing vehicles with health monitoring features. Aftermarket providers offer affordable plug-and-play solutions such as steering wheel covers, seat add-ons, and infotainment-based health kits, making them accessible to a larger audience beyond luxury or premium car buyers.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger vehicle and commercial vehicle. The passenger vehicle segment dominated with the largest revenue share of 68.2% in 2024, driven by consumer demand for personalized safety, health-conscious driving, and integration with luxury car features. Increasing sales of premium cars, coupled with growing adoption of connected cars, has further accelerated the penetration of health monitoring technologies in passenger vehicles.

The commercial vehicle segment is expected to witness the fastest CAGR of 19.8% during 2025–2032, as fleet operators prioritize driver health monitoring to improve productivity, reduce accidents, and comply with workplace safety regulations. Health monitoring in commercial fleets is increasingly being integrated with telematics and fleet management solutions, allowing real-time monitoring of driver fatigue and medical emergencies.

Which Region Holds the Largest Share of the Automotive Active Health Monitoring System Market?

- Europe dominated the automotive active health monitoring system market with the largest revenue share of 38.5% in 2024, driven by strict road safety regulations, rising health concerns, and strong adoption of advanced driver assistance systems (ADAS)

- Consumers in the region place high importance on safety, health monitoring, and comfort, which is fueling demand for systems that track vital signs and alert drivers in case of fatigue or health risks

- The adoption is further supported by premium automakers in Germany, France, and Sweden, who are integrating advanced in-cabin sensors and AI-based health monitoring into luxury and mid-range vehicles

Germany Automotive Active Health Monitoring System Market Insight

The Germany market captured the largest share in Europe in 2024, supported by the country’s strong luxury car manufacturing base and innovation-driven ecosystem. German OEMs such as BMW, Mercedes-Benz, and Volkswagen are leading in integrating real-time health monitoring features, including heart-rate and fatigue detection. The government’s focus on road safety and smart mobility is accelerating adoption across passenger cars and commercial fleets.

France Automotive Active Health Monitoring System Market Insight

The France market is expected to grow steadily throughout the forecast period, driven by strong R&D activities and a rising demand for advanced vehicle safety features. French automakers such as Renault and Peugeot are increasingly adopting biometric monitoring solutions to align with EU safety mandates. Growing consumer interest in connected and health-focused driving experiences will continue to support market expansion.

Sweden Automotive Active Health Monitoring System Market Insight

The Sweden market is projected to grow at a significant CAGR, fueled by the country’s strong emphasis on innovation, safety, and sustainability in the automotive sector. Swedish OEM Volvo Cars is a pioneer in integrating in-cabin health and wellness technologies, contributing to higher adoption. The rise in electric and autonomous vehicles is also expected to boost demand for active health monitoring systems in Sweden.

Which Region is the Fastest Growing Region in the Automotive Active Health Monitoring System Market?

Asia-Pacific market is expected to grow at the fastest CAGR of 8.32% from 2025 to 2032, driven by urbanization, increasing disposable incomes, and rapid technological adoption in countries such as China, Japan, and India. Government initiatives supporting smart mobility, road safety, and digital health integration are key drivers of adoption in the region.

China Automotive Active Health Monitoring System Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, owing to its strong domestic automotive industry and rapid adoption of smart vehicle technologies. With government-backed smart city projects and the growing popularity of electric vehicles, Chinese automakers such as BYD and NIO are actively integrating health monitoring systems into their new models.

Japan Automotive Active Health Monitoring System Market Insight

The Japan market is gaining strong momentum, driven by the country’s tech-savvy culture, rapid urbanization, and preference for safe and connected driving experiences. Japanese automakers such as Toyota, Honda, and Nissan are increasingly focusing on biometric-based safety solutions, especially targeting elderly drivers. Integration of AI and IoT is expected to further propel adoption in the coming years.

India Automotive Active Health Monitoring System Market Insight

The India market is anticipated to expand at a remarkable CAGR, fueled by rising demand for affordable connected vehicles and government programs such as “Digital India” and road safety initiatives. Increasing interest from both local manufacturers (Tata Motors, Mahindra) and global OEMs in equipping vehicles with health and fatigue monitoring solutions is creating new growth opportunities.

Which are the Top Companies in Automotive Active Health Monitoring System Market?

The automotive active health monitoring system industry is primarily led by well-established companies, including:

- FORVIA Faurecia (France)

- Tata Elxsi (India)

- KritiKal Solutions (India)

- PARKER HANNIFIN CORP (U.S.)

- Plessey (U.K.)

- Qualcomm Technologies, Inc. (U.S.)

- Acellent Technologies, Inc. (U.S.)

- FLEX LTD (India)

- NXP Semiconductors (Netherlands)

- Analog Devices, Inc. (U.S.)

- GENTEX CORPORATION (U.S.)

- HARMAN International (U.S.)

- MOBIS INDIA LIMITED (South Korea)

- OMRON Corporation (Japan)

- Visage Technologies (Sweden)

What are the Recent Developments in Global Automotive Active Health Monitoring System Market?

- In December 2024, DENSO Corporation and Onsemi expanded their collaboration with a focus on developing next-generation technologies for self-driving and ADAS, building on more than a decade of partnership in supplying intelligent automotive sensors that enhance vehicle performance and connectivity. This step reinforces their long-term commitment to reducing traffic accidents and advancing autonomous mobility

- In December 2024, Roadzen Inc. partnered with Bosch to integrate Bosch's Mobility Solutions into its drivebuddy AI ADAS platform, with the goal of strengthening driver monitoring and assistance features for improved road safety. This integration highlights the industry’s move towards intelligent safety-driven driving solutions

- In June 2022, Hyundai Mobis launched the Smart Cabin, equipped with an integrated vital signs controller that monitors drivers’ posture, heart rate, brainwaves, and cabin CO2 levels to ensure safer driving conditions. This innovation represents a significant leap toward combining health monitoring with advanced vehicle safety

- In March 2022, B-Secur Ltd. unveiled its Advanced Auto Steering Wheel, featuring HeartKey ECG monitoring technology that authenticates drivers and tracks their ECG patterns using advanced algorithms and analytics. This breakthrough strengthens both vehicle security and personalized driver experiences

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.