Global Biosensors Market

Market Size in USD Billion

CAGR :

%

USD

24.60 Billion

USD

54.21 Billion

2023

2030

USD

24.60 Billion

USD

54.21 Billion

2023

2030

| 2024 –2030 | |

| USD 24.60 Billion | |

| USD 54.21 Billion | |

|

|

|

|

Biosensors Market Analysis and Size

Major factors that are expected to boost the growth of the biosensors market in the forecast period are the incentives taken by the government and the rise in the regional demand. Biosensors have gained immense popularity in various sectors, including environmental monitoring, food and beverages, and home care diagnostics, among others. These are also being widely deployed in the field of plant biology to study metabolic processes.

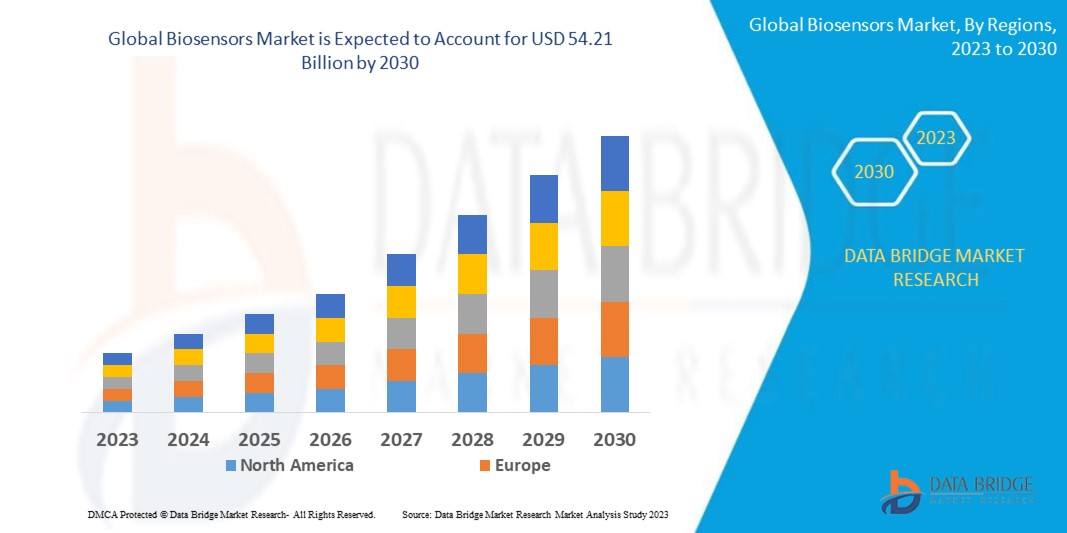

Global biosensors market was valued at USD 24.60 billion in 2022 and is expected to reach USD 54.21 billion by 2030, registering a CAGR of 9.30% during the forecast period of 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Biosensors Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 ((Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Technology (Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Nano mechanical Biosensors, Thermal Biosensors and Others), Product (Wearable Biosensors, Non-Wearable Biosensors), Application (Point Of Care (POC), Home Diagnostics and Biodefense, Environmental Monitoring, Food and Beverage Industry and Research Labs) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa |

|

Market Players Covered |

Abbott (U.S.), Johnson & Johnson Services, Inc. (U.S.), Medtronic (Ireland), DuPont (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Universal Biosensors (Australia), Sysmex Corporation (Japan), Nova Biomedical (U.S.), ACON Laboratories, Inc. (U.S.), General Electric (U.S.), Drägerwerk AG & Co. KGaA (Germany), Ercon Inc. (U.S.), Xsensio (Switzerland), Analog Devices, Inc. (U.S.), Animas LLC (U.S.), LifeSensors (U.S.), Siemens (Germany), F. Hoffmann-La Roche Ltd (Switzweland), i-SENS, Inc. (South Korea), and TaiDoc Technology Corporation (China), among others |

|

Market Opportunities |

|

Market Definition

Biosensors convert a biological response into electrical signals. A biosensor, which is a short form of the biological sensor, is an analytical device used for the detection of a chemical substance. In layman’s language, biosensors are used to detect the presence and volume of biological substances. Biosensors are used in many end-user verticals like the food and beverage industry.

Global Biosensors Market Dynamics

Drivers

- High Use in Medical Applications

The increase in demand for biosensors in a wide range of medical applications along with the diabetes population acts as one of the major factors driving the growth of biosensors market. The increased need for tiny diagnostic devices, and rise in awareness regarding early disease diagnosis drive the market further.

- Adoption of Sensors for Various Applications

The rise in the adoption of these sensors for temperature-sensitive applications in industries, including as food and beverages, textile, and healthcare, among accelerate the market. The deployment of the various sensors in household applications has a positive impact on the market.

- Increase in Demand for Point-Of-Care Testing Procedures

The increase in demand for point-of-care testing procedures further influence the market. The rise in the usage of biosensors for regular detection of pathogenic activities among consumers because of the prevalence of chronic and lifestyle-related ailments assist in the expansion of the market.

In addition, surge in investments, rapid urbanization and increase in demand to advanced technology positively affect the biosensors market.

Opportunity

- High Demand from Food Industry and Environmental Monitoring Applications

Furthermore, high demand from food industry and environmental monitoring applications extend profitable opportunities to the market players in the forecast period of 2023 to 2030. Also, extensive research and development activities will further expand the market.

Restraint/Challenge

- High Cost Associated with Research and Development

On the other hand, high cost associated with research and development, and long certification and approval cycles are expected to obstruct market growth. Also, reluctance in adopting new treatment practices, and pricing pressure in POC are projected to challenge the biosensors market in the forecast period of 2023 to 2030.

This biosensors market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on biosensors market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2021, Roche signed an agreement (Global Business Partnership Agreement) with Sysmex for delivering hematology testing solutions. The purpose of the agreement is to use the IT systems to lead to improved clinical decision-making

- In December 2020, Abbott unveiled news regarding FreeStyle Libre 2, a next-generation, sensor-based glucose monitoring technology. The technology received approval by Health Canada for adults and children

Global Biosensors Market Scope

The biosensors market is segmented on the basis of technology, product and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Nano mechanical Biosensors

- Thermal Biosensors

- Others

Product

- Wearable Biosensors

- Non-Wearable Biosensors

Application

- Point Of Care (POC)

- Home Diagnostics and Biodefense

- Environmental Monitoring

- Food and Beverage Industry

- Research Labs

Global Biosensors Market Region Analysis/Insights

The biosensors market is analyzed and market size insights and trends are provided by technology, product and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

The countries covered in the global biosensors market report are U.S., Canada, Mexico, Brazil, Argentina, the Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa.

North America dominates the biosensors market because of the rise in awareness about the demand for quality water for consumption and industrial purposes within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2023 to 2030 because of the increase in government initiatives in the region. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Biosensors Market Share Analysis

The biosensors market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to biosensors market.

Some of the major players operating in biosensors market are:

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- DuPont (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Universal Biosensors (Australia)

- Sysmex Corporation (Japan)

- Nova Biomedical (U.S.)

- ACON Laboratories, Inc. (U.S.)

- General Electric (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Ercon Inc. (U.S.)

- Xsensio (Switzerland)

- Analog Devices, Inc. (U.S.)

- Animas LLC (U.S.)

- LifeSensors (U.S.)

- Siemens (Germany)

- F. Hoffmann-La Roche Ltd (Switzweland)

- i-SENS, Inc. (South Korea)

- TaiDoc Technology Corporation (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Biosensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Biosensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Biosensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.