Global Automotive Digital Cockpit Market

Market Size in USD Billion

CAGR :

%

USD

28.43 Billion

USD

62.51 Billion

2024

2032

USD

28.43 Billion

USD

62.51 Billion

2024

2032

| 2025 –2032 | |

| USD 28.43 Billion | |

| USD 62.51 Billion | |

|

|

|

|

Automotive Digital Cockpit Market Size

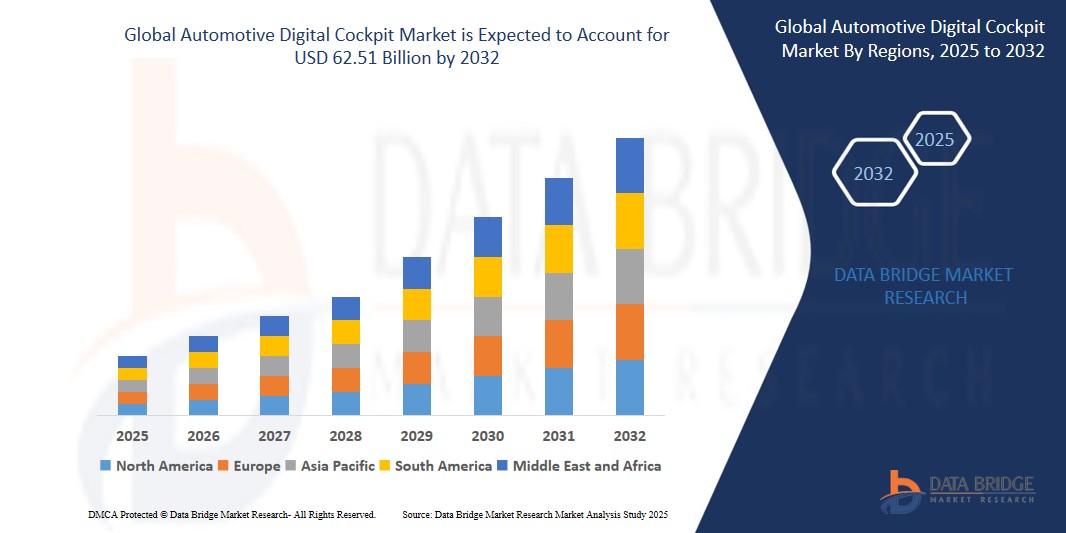

- The Global Automotive Digital Cockpit Market size was valued at USD 28.43 billion in 2024 and is expected to reach USD 62.51 billion by 2032, at a CAGR of 10.35% during the forecast period

- Growth is driven by rising demand for connected vehicles, advanced infotainment systems, and digital displays replacing analog clusters.

- Increasing adoption of electric and autonomous vehicles is boosting demand for high-tech, real-time digital interfaces.

- Advancements in AI, 5G, and cloud-based systems are enhancing cockpit functionalities and shaping the future of in-vehicle experiences.

Automotive Digital Cockpit Market Analysis

- Automotive Digital Cockpits are transforming in-vehicle experience by integrating digital instrument clusters, infotainment systems, and head-up displays into a unified interface, offering enhanced safety, connectivity, and user interaction.

- Market growth is driven by the rising adoption of connected and autonomous vehicles, increasing demand for real-time vehicle information, and consumer preference for intelligent, personalized driving experiences.

- Automakers are prioritizing digital cockpit solutions to differentiate vehicle models, improve driver assistance features, and support over-the-air updates for seamless software enhancements.

- Asia-Pacific dominates the Automotive Digital Cockpit Market with the largest revenue share of 36.46% in 2024, driven by increasing vehicle production, rising adoption of connected car technologies, and the growing demand for advanced infotainment systems across emerging economies.

- North America accounted for a significant market share of 29.14% in 2024, led by early technology adoption, high demand for connected vehicles, and the presence of key OEMs and Tier 1 suppliers.

- The digital instrument cluster segment dominates the market revenue share in 2024, driven by rising demand for high-resolution and customizable driver information systems. It allows real-time display of driving data, enhancing both convenience and safety.

Report Scope and Automotive Digital Cockpit Market Segmentation

|

Attributes |

Automotive Digital Cockpit Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Digital Cockpit Market Trends

“Growing Demand for Connected and Personalized In-Car Experiences”

- The increasing consumer expectation for advanced infotainment, real-time navigation, and seamless smartphone integration is a major driver for the automotive digital cockpit market.

- For instance, in March 2024, Visteon Corporation launched a next-gen cockpit domain controller integrating infotainment and driver information on a single SoC (System on Chip), enhancing performance and reducing system complexity.

- Consumers seek digital features that align with their lifestyle, including voice commands, app mirroring, and customizable displays, which are best delivered through digital cockpit platforms.

- Automakers are integrating these features as standard or premium add-ons to attract tech-savvy customers and differentiate their offerings.

Automotive Digital Cockpit Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The growing emphasis on road safety and driver awareness has made the integration of ADAS with digital cockpits a significant driver.

- For example, in January 2024, DENSO Corporation announced a digital cockpit platform integrating driver monitoring systems with heads-up displays to alert drivers in real time.

- This integration enhances situational awareness and contributes to safer driving, particularly in vehicles with Level 2 and above autonomous features.

- As governments enforce stricter safety norms, demand for such integrated digital platforms continues to rise.

Restraint/Challenge

“High System Cost and Integration Challenges for Mass Market Adoption”

- The major restraint in the automotive digital cockpit market is the high cost of advanced display panels, software integration, and processor units.

- Small and budget vehicle manufacturers may find it economically unfeasible to include high-end cockpit features without affecting their profit margins.

- Moreover, integration with legacy vehicle architectures and maintaining system stability across various operating conditions pose technical challenges.

- These barriers limit the penetration of digital cockpit solutions in cost-sensitive markets such as Southeast Asia and parts of Latin America.

Automotive Digital Cockpit Market Scope

The market is segmented on the basis of equipment, vehicle type, electric vehicle type, and application.

- By Equipment

On the basis of equipment, the Automotive Digital Cockpit Market is segmented into digital instrument cluster, advanced head unit, head-up display (HUD), and camera-based driver monitoring system. The digital instrument cluster segment dominates the market revenue share in 2024, driven by rising demand for high-resolution and customizable driver information systems. It allows real-time display of driving data, enhancing both convenience and safety.

This segment is further categorized into LCD, OLED, and TFT-LCD. Among them, TFT-LCD holds the highest share owing to its affordability and sufficient visual performance.

The advanced head unit segment is growing steadily, supported by the integration of multimedia, navigation, and telematics functions within one console, catering to consumer preferences for infotainment and connectivity..

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger vehicle and commercial vehicle.The passenger vehicle segment holds the largest market revenue share in 2024, driven by increasing consumer demand for comfort, digital interfaces, and connected vehicle experiences.

The commercial vehicle segment is expected to grow at a substantial CAGR during the forecast period, owing to rising adoption of fleet digitization and the need for real-time diagnostics and monitoring to improve operational efficiency..

- By Electric Vehicle Type

On the basis of electric vehicle type, the market is segmented into battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV). The battery electric vehicle (BEV) segment accounted for the largest market share in 2024, driven by the rapid global shift towards sustainable transportation and the integration of advanced digital cockpit systems in fully electric models.

The HEV and PHEV segments are expected to show consistent growth, supported by government incentives and consumer demand for energy-efficient vehicles with smart dashboard features

- By Application

On the basis of application, the market is segmented into luxury cars and mid-segment cars. The luxury car segment holds the largest revenue share in 2024, as high-end vehicles prioritize state-of-the-art digital cockpit solutions to enhance driver experience, safety, and brand value.

The mid-segment car segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by increasing availability and affordability of digital cockpit components in mainstream vehicles, coupled with rising consumer expectations for smart features even in budget-friendly models.

Automotive Digital Cockpit Market Regional Analysis

- Asia-Pacific dominates the Automotive Digital Cockpit Market with the largest revenue share of 36.46% in 2024, driven by increasing vehicle production, rising adoption of connected car technologies, and the growing demand for advanced infotainment systems across emerging economies.

- The region’s rapid urbanization, expanding middle class, and government-backed digitalization efforts are fueling demand for feature-rich vehicles with digital cockpit capabilities.

- Countries like China, Japan, and South Korea lead the market due to strong automotive manufacturing ecosystems and consumer demand for tech-integrated driving experiences.

China Automotive Digital Cockpit Market Insight

he China Automotive Digital Cockpit Market held the largest share in Asia-Pacific in 2024, driven by the country's large-scale vehicle production and high-tech consumer preferences. Leading Chinese OEMs are increasingly incorporating digital instrument clusters and voice-activated infotainment systems to meet consumer expectations for modern vehicle experiences. Government policies supporting smart vehicles and electrification further bolster market growth.

Japan Automotive Digital Cockpit Market Insight

Japan's Automotive Digital Cockpit Market is expanding steadily due to its strong emphasis on innovation, quality, and user convenience. Japanese automakers are integrating head-up displays and multi-screen setups into vehicles to enhance safety and driver awareness. The country’s established electronics and automotive industries provide a robust foundation for digital cockpit adoption.

North America Automotive Digital Cockpit Market Insight

North America accounted for a significant market share of 29.14% in 2024, led by early technology adoption, high demand for connected vehicles, and the presence of key OEMs and Tier 1 suppliers. Consumer expectations for real-time navigation, voice control, and seamless smartphone integration are driving investment in next-gen cockpit platforms.

U.S. Automotive Digital Cockpit Market Insight

The U.S. dominates the North American market with over 73.11% revenue share in 2024, supported by high vehicle ownership rates and rising popularity of advanced driver assistance systems (ADAS). The shift toward electric and autonomous vehicles is accelerating the transition to fully digital, software-driven cockpits.

Europe Automotive Digital Cockpit Market Insight

Europe’s Automotive Digital Cockpit Market is growing at a steady pace, with a strong emphasis on driver safety, sustainability, and luxury. OEMs in Germany, France, and the U.K. are adopting digital interfaces to comply with regulatory mandates and consumer demand for in-vehicle connectivity. The region is also witnessing innovation in customizable displays and augmented reality dashboards.

Germany Automotive Digital Cockpit Market Insight

Germany remains a frontrunner due to its leadership in the premium and luxury vehicle segments. German automakers are pioneering the integration of curved displays, intelligent voice assistants, and ADAS-enhanced cockpit systems. The country's engineering excellence and focus on user-centric design support strong market penetration.

Automotive Digital Cockpit Market Share

The Automotive Digital Cockpit industry is primarily led by well-established companies, including:

- Robert Bosch GmbH(Germany)

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- Visteon Corporation(United States)

- Panasonic Corporation (Japan)

- HYUNDAI MOBIS(South Korea)

- Garmin Ltd.(Switzerland)

- Faurecia(France)

- Aptiv (Ireland)

- Pioneer Electronics Inc.(Japan)

- Valeo (France)

- Marelli Corporation(Japan)

- WayRay AG(Switzerland)

- DESAY Industry (China)

- YAZAKI Corporation(Japan)

- HARMAN International (United States)

- LUXOFT (Switzerland)

- Magna International Inc.(Canada)

- ZF Friedrichshafen AG (Germany)

- Japan Display Inc.(Japan)

- Toshiba Corporation(Japan)

Latest Developments in Global Automotive Digital Cockpit Market

- In March 2024, Visteon Corporation launched its next-generation cockpit domain controller integrating infotainment, instrument cluster, and head-up display on a single chip. This innovation reduces system complexity and enhances user experience, positioning Visteon as a leader in automotive cockpit solutions.

- In April 2024, Hyundai Mobis unveiled an AI-powered digital cockpit prototype designed specifically for electric vehicles (EVs). The cockpit features an extendable display and voice-activated controls, aiming to provide a more immersive and personalized driving experience for EV owners.

- In February 2024, DENSO Corporation announced the integration of camera-based driver monitoring systems with digital instrument clusters and head-up displays to enhance safety and alertness. This development supports advanced driver assistance systems (ADAS) and aligns with rising global safety regulations.

- In January 2024, Panasonic Corporation introduced a customizable OLED digital instrument cluster platform for mid-segment and luxury vehicles. The platform allows automakers to tailor user interfaces, improving driver engagement and brand differentiation in competitive markets.

- In March 2024, Continental AG partnered with WayRay AG to develop augmented reality (AR)-based heads-up displays for luxury vehicles. This collaboration focuses on delivering real-time navigation, hazard alerts, and enhanced situational awareness through holographic projections on the windshield.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.