Global Automotive Logistics Market

Market Size in USD Billion

CAGR :

%

USD

321.60 Billion

USD

613.40 Billion

2024

2032

USD

321.60 Billion

USD

613.40 Billion

2024

2032

| 2025 –2032 | |

| USD 321.60 Billion | |

| USD 613.40 Billion | |

|

|

|

|

Automotive Logistic Market Size

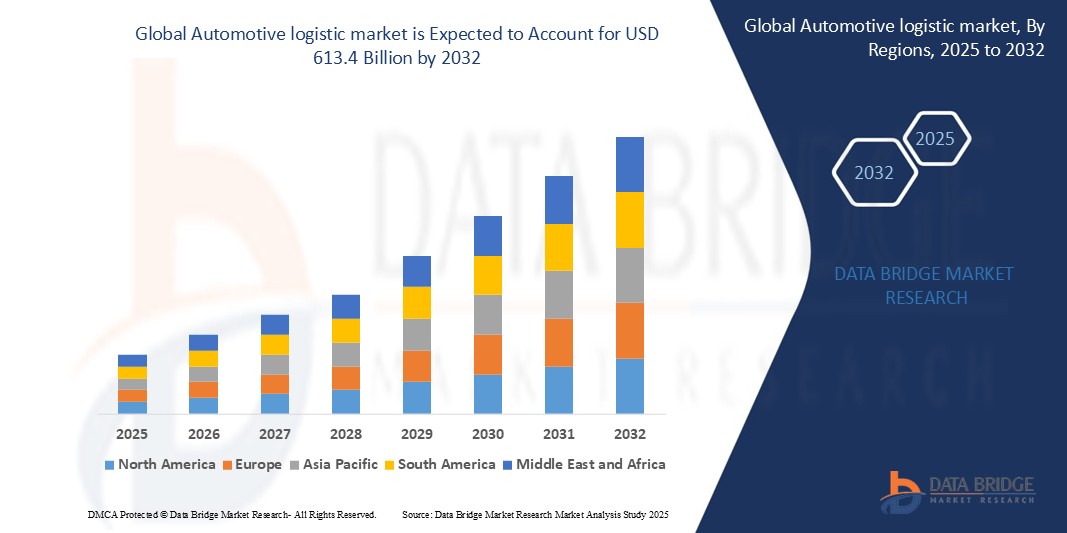

- The Global Automotive Logistics Market was valued at USD 321.6 billion in 2025 and is projected to reach USD 613.4 billion by 2032, growing at a CAGR of 9.7% during the forecast period.

- Market growth is driven by the rising demand for efficient vehicle transportation, growing production of electric and connected vehicles, and the increasing need for seamless global supply chains. Advanced logistics technologies such as real-time tracking, automated warehousing, and digital freight platforms are transforming traditional logistics into streamlined, tech-enabled operations. Additionally, expanding automotive exports, rising aftermarket activity, and infrastructure development in emerging economies continue to support robust growth across developed and developing regions.

Automotive Logistic Market Analysis

- Automotive logistics leverages advanced technologies such as GPS tracking, RFID, automated warehousing, and transportation management systems (TMS) to optimize supply chain operations, reduce transit times, and enhance inventory accuracy. These tools enable real-time monitoring, route optimization, and streamlined coordination across global logistics networks.

- The integration of autonomous transport vehicles, digital freight platforms, and AI-powered analytics is significantly boosting supply chain efficiency and reducing reliance on manual coordination. These innovations are particularly impactful in large-scale manufacturing and international distribution environments.

- North America leads the automotive logistics market in 2025, supported by well-developed infrastructure, widespread adoption of connected logistics solutions, and robust automotive manufacturing and aftermarket sectors. The U.S. stands out with its early adoption of smart logistics platforms and advanced fleet management systems.

- Asia-Pacific is projected to register the highest CAGR, fueled by the surge in vehicle production, rising automotive exports, and rapid digitization of logistics in key markets such as China, India, and Japan.

- Among logistics components, transportation services (road, rail, maritime, air) account for the largest market share, while software solutions for supply chain visibility and predictive analytics are growing rapidly. The increasing integration of IoT, AI, and automation is revolutionizing how vehicles and parts move across global markets.

Report Scope and Automotive Logistic Market Segmentation

|

Attributes |

Automotive logistic market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

The automotive logistics sector is undergoing a digital transformation, with significant opportunities emerging from the adoption of AI-driven route optimization, IoT-based fleet tracking, and automated warehousing. These technologies help improve shipment accuracy, reduce operational costs, and enable predictive logistics planning for automakers and suppliers.

The rapid growth of electric vehicle production presents major opportunities for logistics providers offering specialized services for battery transport, temperature-sensitive components, and hazardous materials compliance. The need for customized handling and regional EV infrastructure development is opening new avenues for market expansion. |

|

Value Added Data Infosets |

In addition to insights on market value, CAGR, segmentation, and regional trends,Global Automotive Logistics Market Report includes comprehensive analysis of technology adoption across logistics functions, ROI benchmarks for automation and digital tracking systems, and integration feasibility with OEM manufacturing platforms. It also provides vehicle supply chain case studies, fleet performance lifecycle analytics, and comparative models for traditional vs. electric vehicle logistics. The report incorporates strategic frameworks such as PESTLE Analysis, Porter’s Five Forces, and evaluations of trade regulations, customs policies, and sustainability mandates to support informed decision-making for investors, manufacturers, and logistics providers. |

Automotive Logistic Market Trends

“Smart Logistics Driven by Automation, Digitalization, and EV Supply Chain Transformation”

• A major trend shaping the automotive logistics market is the integration of AI-powered route planning, autonomous delivery vehicles, and real-time tracking systems to improve supply chain accuracy, reduce delivery time, and lower operational costs.

• Logistics providers and OEMs are increasingly investing in digital twin technology to simulate supply chain workflows, predict bottlenecks, and optimize warehouse operations—enhancing resilience and flexibility in global logistics networks.

• The shift toward electric vehicle (EV) production is driving demand for specialized logistics solutions including temperature-controlled battery transport, hazardous material handling, and reverse logistics for recycling components.

• Predictive analytics and IoT-enabled telematics are becoming essential tools in fleet management, allowing companies to monitor driver behavior, fuel efficiency, vehicle health, and shipment status in real-time.

• There is a growing adoption of blockchain-based platforms to improve transparency, security, and traceability in cross-border logistics, particularly for high-value automotive parts and just-in-sequence delivery systems.

Automotive Logistic Market Dynamics

Driver

“Growing Demand for End-to-End Supply Chain Visibility and Real-Time Tracking”

- The rising complexity of global automotive supply chains—driven by JIT (just-in-time) manufacturing, multi-tier suppliers, and increasing model variety—is fueling demand for digital logistics platforms that offer real-time visibility and inventory tracking.

- Automakers and logistics providers are adopting GPS, RFID, and telematics solutions to monitor the movement of components, reduce delays, and enhance responsiveness to disruptions in global trade and production.

- The rise of electric vehicles (EVs) and connected cars is increasing the need for specialized logistics operations, including hazardous material handling, battery tracking, and EV-specific part transport, further emphasizing real-time control and transparency.

- With growing consumer expectations for faster delivery and order traceability, OEMs are integrating AI-driven logistics planning tools to optimize distribution networks and lower overall delivery costs.

- Governments and regional trade blocs are promoting smart logistics infrastructure through investment in ports, smart highways, and digital customs processes—creating favorable conditions for high-tech logistics adoption.

Restraint/Challenge

“High Implementation Costs and Fragmented Logistics Ecosystem”

- A key challenge in the automotive logistics market is the high initial investment required for deploying advanced technologies such as automation systems, telematics platforms, and digital freight matching tools.

- Smaller logistics providers, particularly in developing markets, often lack the capital or digital maturity to adopt next-generation logistics systems—leading to inefficiencies and slow adoption across the ecosystem.

- The logistics value chain remains fragmented, with multiple stakeholders (suppliers, transporters, customs agents) using disconnected legacy systems, which hinders seamless data integration and real-time collaboration.

- Limited standardization of logistics data formats and APIs across OEMs and third-party providers creates interoperability challenges, slowing down automation and digital transformation initiatives.

- Cybersecurity concerns and data privacy regulations are adding layers of complexity for companies that seek to digitize their supply chains, particularly when handling sensitive shipment or proprietary vehicle data.

Automotive Logistic Market Scope

The market is segmented on the basis of component, transport mode, services, and vehicle type.

• By Component

The automotive logistics market is segmented into hardware, software, and services. The hardware segment dominates the market in 2025, driven by the increasing deployment of GPS tracking devices, RFID tags, telematics control units (TCUs), and IoT sensors across logistics fleets and warehouses. These technologies are essential for vehicle tracking, route optimization, and cargo security.

The software segment is projected to witness the highest CAGR from 2025 to 2032, fueled by the growing need for cloud-based transportation management systems (TMS), warehouse management software (WMS), and AI-powered logistics analytics platforms to optimize operations and enhance supply chain visibility.

• By Transport Mode

The market is categorized into rail, road, air, and marine. The road transport segment accounted for the largest share in 2025, supported by the dominance of just-in-time (JIT) deliveries and last-mile logistics operations across key automotive manufacturing hubs.

Marine logistics is expected to grow at the fastest rate due to the surge in international trade, rising automotive exports, and the need for efficient container handling solutions at ports.

• By Services

Key services in the automotive logistics market include inbound logistics, outbound logistics, warehousing & distribution, and aftermarket logistics. Inbound logistics leads the segment in 2025, driven by OEM reliance on the timely delivery of parts and components to assembly plants under lean manufacturing models.

Aftermarket logistics is anticipated to witness the fastest growth, fueled by rising vehicle parc, increasing demand for spare parts distribution, and e-commerce penetration in auto parts retail.

• By Vehicle Type

The market is segmented into passenger vehicles, commercial vehicles, and electric vehicles (EVs). Passenger vehicles dominate in 2025, owing to higher production volumes and extensive global distribution networks.

The EV segment is projected to grow rapidly from 2025 to 2032, driven by the expansion of EV manufacturing, specialized handling requirements for batteries, and the development of EV-specific logistics infrastructure.

Automotive logistic market Regional Analysis

- North America leads the global automotive logistics market in 2025, driven by the presence of leading automotive OEMs, mature supply chain infrastructure, and widespread adoption of advanced logistics technologies. The U.S. accounts for the largest share in the region, with high integration of telematics, RFID tracking, and autonomous fleet solutions across logistics operations.

Automotive giants and third-party logistics (3PL) providers are leveraging data analytics, cloud-based platforms, and AI-driven route optimization to manage complex inbound and outbound logistics across cross-border manufacturing corridors.

- Europe remains a major hub in the automotive logistics landscape due to strong automotive manufacturing bases in Germany, France, the UK, and Italy. The region is known for efficient multimodal transportation systems and stringent emission regulations, prompting the adoption of electric vehicle (EV) logistics and green warehousing solutions.

Smart logistics initiatives, such as digital twins and blockchain for parts traceability, are gaining momentum, supported by EU-funded programs focused on digital supply chain transformation and carbon-neutral logistics.

- Asia-Pacific is expected to witness the fastest CAGR from 2025 to 2032, owing to the rapid expansion of vehicle production in China, India, Japan, and South Korea. The region benefits from strong OEM footprints, growing e-commerce, and increasing adoption of automation in logistics hubs and ports.

China’s Belt and Road Initiative and India's logistics infrastructure push (Gati Shakti) are reshaping cross-border automotive supply chains. Demand for integrated logistics solutions, warehousing automation, and smart transportation management systems is surging in response to regional supply chain complexity.

- Middle East and Africa MEA is experiencing moderate growth in the automotive logistics market, supported by vehicle assembly expansions in countries like UAE, Saudi Arabia, and South Africa. Investments in smart port logistics, digital freight platforms, and warehouse management systems are rising as the region diversifies beyond oil.

Government-backed industrial zones and customs reforms are facilitating faster movement of automotive parts and finished vehicles across regional and international corridors.

- South America, led by Brazil and Argentina, is showing significant growth in automotive logistics as vehicle production stabilizes and exports increase. The region is adopting rail and intermodal logistics to reduce freight costs and improve delivery times.

Investments in logistics automation, container tracking, and EV-specific handling infrastructure are helping local suppliers and exporters meet global standards. Government programs to enhance transportation infrastructure are further boosting the regional automotive supply chain.

United States

The United States dominates the global automotive logistics market in 2025, driven by its robust vehicle manufacturing base, strong presence of logistics service providers, and early adoption of digital logistics technologies.

Automakers are increasingly partnering with 3PLs to streamline inbound and outbound logistics, while EV manufacturers are investing in cold-chain and battery-safe logistics solutions. Integration of IoT, RFID, and predictive analytics is enhancing visibility and delivery accuracy across the U.S. automotive supply chain.

Germany

Germany leads the European automotive logistics market due to its role as Europe’s automotive hub, housing global OEMs like Volkswagen, BMW, and Mercedes-Benz.

The country’s well-established rail-road transport infrastructure, coupled with widespread use of warehouse automation and just-in-time (JIT) delivery systems, supports efficient logistics flows. As EV production scales up, Germany is witnessing rising demand for specialized logistics services for lithium-ion battery handling and recycling.

China

China is a critical growth engine for the global automotive logistics market, benefiting from large-scale vehicle production, rising EV output, and government-backed logistics modernization initiatives.

Major logistics players and OEMs are deploying AI-powered routing, port automation, and smart warehousing to handle increasing domestic and export vehicle volumes. The Belt and Road Initiative (BRI) also enhances China’s outbound automotive logistics reach across Asia and Europe.

Japan

Japan maintains a mature and technologically advanced automotive logistics sector, led by prominent automakers like Toyota, Honda, and Nissan.

Just-in-sequence delivery models, robotics in warehousing, and maritime logistics optimization are core components of Japan’s automotive logistics ecosystem. The country is also innovating in green logistics through hydrogen-powered transport and carbon-neutral warehousing systems.

India

India is emerging as a fast-growing automotive logistics market due to rapid expansion in vehicle production, strong government focus on supply chain infrastructure, and increasing exports.

Automakers are investing in multimodal transport solutions, connected vehicle tracking systems, and regional warehouse networks to improve cost-efficiency and reduce transit times. Growth in two-wheeler and EV manufacturing hubs further drives demand for specialized logistics services.

Global Automotive Logistics Market Share

The competitive landscape of the global automotive logistics market is defined by key players who leverage extensive networks, technological innovation, and strategic partnerships to capture market share. Leading companies such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, and Ceva Logistics dominate the market due to their comprehensive service offerings, global reach, and advanced logistics management technologies.

These market leaders focus on integrating digital solutions like IoT, AI-driven route optimization, and real-time tracking systems to enhance supply chain efficiency and reduce operational costs. Their ability to provide end-to-end logistics solutions — from inbound component logistics to outbound vehicle distribution — strengthens their foothold in the automotive sector.

Additionally, regional and niche logistics providers are gaining momentum by specializing in specific segments such as just-in-time delivery, aftermarket parts logistics, or sustainable transport solutions. The growing demand for green logistics and automation is encouraging investments from both established players and new entrants aiming to capture market share through innovation.

The competitive dynamics emphasize strategic collaborations, mergers & acquisitions, and technology adoption, with companies prioritizing seamless integration with automotive manufacturers’ digital ecosystems to offer scalable and agile logistics services worldwide.The following companies are recognized as major players in the Content Marketing Software market:

- DHL Supply Chain (Germany)

- CEVA Logistics (Switzerland)

- DB Schenker (Germany)

- Kuehne + Nagel International AG (Switzerland)

- Ryder System, Inc. (US)

- XPO Logistics, Inc. (US)

- DSV A/S (Denmark)

- BLG Logistics Group AG & Co. KG (Germany)

- SNCF Logistics (GEFCO) (France)

- Hitachi Transport System, Ltd. (Japan)

- Expeditors International of Washington, Inc. (US)

- Nippon Express Holdings, Inc. (Japan)

Latest Developments in Global Automotive Logistics Market

- April 2025: DHL Supply Chain launched its AI-powered SmartLog platform, integrating real-time route optimization and predictive demand forecasting to enhance automotive parts distribution efficiency and reduce delivery times.

- March 2025: Toyota Logistics Services introduced autonomous electric delivery vehicles in key manufacturing hubs, reducing emissions and improving last-mile delivery operations.

- February 2025: DB Schenker rolled out a blockchain-based tracking system across its automotive supply chain network, boosting transparency, security, and traceability of vehicle components.

- January 2025: UPS upgraded its IoT-enabled fleet management system with advanced predictive maintenance and vehicle health monitoring, significantly reducing downtime in automotive logistics operations.

- December 2024: Maersk partnered with major automotive manufacturers to deploy robotic container handling solutions at ports, accelerating vehicle loading/unloading and cutting turnaround times.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE LOGISTICS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE LOGISTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CASE STUDIES

5.2 REGULATORY FRAMEWORK

5.3 TECHNOLOGICAL TRENDS

5.4 PRICING ANALYSIS

5.5 IMPORT/EXPORT ANALYSIS

5.6 VALUE CHAIN ANALYSIS

5.7 VOLUME (REGION-WISE)

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL AUTOMOTIVE LOGISTICS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVIF-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKETREV

6.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

6.7.1

7 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY OPERATIONS

7.1 OVERVIEW

7.2 INBOUND LOGISTICS

7.2.1 PURCHASING MATERIALS

7.2.2 RECEIVING MATERIALS

7.2.3 INVENTORY TRACKING & STORAGE

7.2.4 REVERSE LOGISTICS

7.3 OUTBOUND LOGISTICS

7.3.1 ORDER PROCESSING

7.3.2 PRODUCT PICKING & PACKING

7.3.3 SHIPMENT DISPATCH

7.4 AFTERMARKET

7.5 INTEGRATED SERVICES

7.6 OTHERS

8 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY LOGISTICS TYPE

8.1 OVERVIEW

8.2 LAND TRANSPORTION

8.2.1 PARCEL

8.2.2 SYSTEM FRIEGHT

8.2.3 CONTAINER SHIPMENT

8.3 AIR FRIEGHT

8.3.1 CHARTER SERVICES

8.3.2 INTERCONTINENTAL SUPPLY CHAIN

8.3.3 INTERMODAL SOLUTIONS

8.4 OCEAN FRIEGHT

8.4.1 LESS THAN CONTAINER LOAD

8.4.2 FULL CONTAINER LOAD

8.4.3 REEFER MANAGEMENT

9 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 WAREHOUSING

9.3 TRANSPORTATION

9.4 MATERIAL HANDLING

9.5 MANAGEMENT SERVICES

9.6 OTHERS

10 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 SMALL-SCALE ORGANIZATIONS

10.3 SEMI-URBAN MID SCALE ORGANIZATIONS

10.4 LARGE SCALE ORGANIZATIONS

11 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER CARS

11.3 COMMERCIAL VEHICLES

11.4 TWO-WHEELERS

11.5 HEAVY DUTY VEHICLES

11.6 ELECTRIC VEHICLES

12 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY TECHNOLOGY

12.1 OVERVIEW

12.2 IOT IN LOGISTICS

12.3 ANALYTICS & BIG DATA

12.4 ARTIFICAL INTELLIGENCE & MACHINE LEARNING

12.5 RFID

12.6 OTHERS

13 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY DISTRIBUTION

13.1 OVERVIEW

13.2 LOCAL

13.3 DOMESTIC

13.4 INTERNATIONAL

14 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 RAILWAYS

14.2.1 BY OPERATIONS

14.2.1.1. .INBOUND LOGISTICS

14.2.1.1.1. .PURCHASING MATERIALS

14.2.1.1.2. .RECEIVING MATERIALS

14.2.1.1.3. .INVENTORY TRACKING & STORAGE

14.2.1.1.4. .REVERSE LOGISTICS

14.2.1.2. .OUTBOUND LOGISTICS

14.2.1.2.1. .ORDER PROCESSING

14.2.1.2.2. .PRODUCT PICKING & PACKING

14.2.1.2.3. .SHIPMENT DISPATCH

14.2.1.3. .AFTERMARKET

14.2.1.4. .INTEGRATED SERVICES

14.2.1.5. .OTHERS

14.3 ROADWAYS

14.3.1 BY OPERATIONS

14.3.1.1. .OUTBOU

14.3.1.2. ND LOGISTICS

14.3.1.2.1. .PURCHASING MATERIALS

14.3.1.2.2. .RECEIVING MATERIALS

14.3.1.2.3. .INVENTORY TRACKING & STORAGE

14.3.1.2.4. .REVERSE LOGISTICS

14.3.1.3. .OUTBOUND LOGISTICS

14.3.1.3.1. .ORDER PROCESSING

14.3.1.3.2. .PRODUCT PICKING & PACKING

14.3.1.3.3. .SHIPMENT DISPATCH

14.3.1.4. .AFTERMARKET

14.3.1.5. .INTEGRATED SERVICES

14.3.1.6. .OTHERS

14.4 MARITIME

14.4.1 BY OPERATIONS

14.4.1.1. .INBOUND LOGISTICS

14.4.1.1.1. .PURCHASING MATERIALS

14.4.1.1.2. .RECEIVING MATERIALS

14.4.1.1.3. .INVENTORY TRACKING & STORAGE

14.4.1.1.4. .REVERSE LOGISTICS

14.4.1.2. .OUTBOUND LOGISTICS

14.4.1.2.1. .ORDER PROCESSING

14.4.1.2.2. .PRODUCT PICKING & PACKING

14.4.1.2.3. .SHIPMENT DISPATCH

14.4.1.3. .AFTERMARKET

14.4.1.4. .INTEGRATED SERVICES

14.4.1.5. .OTHERS

14.5 AIRWAYS

14.5.1 BY OPERATIONS

14.5.1.1. .INBOUND LOGISTICS

14.5.1.1.1. .PURCHASING MATERIALS

14.5.1.1.2. .RECEIVING MATERIALS

14.5.1.1.3. .INVENTORY TRACKING & STORAGE

14.5.1.1.4. .REVERSE LOGISTICS

14.5.1.2. .OUTBOUND LOGISTICS

14.5.1.2.1. .ORDER PROCESSING

14.5.1.2.2. .PRODUCT PICKING & PACKING

14.5.1.2.3. .SHIPMENT DISPATCH

14.5.1.3. .AFTERMARKET

14.5.1.4. .INTEGRATED SERVICES

14.5.1.5. .OTHERS

15 GLOBAL AUTOMOTIVE LOGISTICS MARKET, BY REGION

15.1 GLOBAL AUTOMOTIVE LOGISTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 FRANCE

15.3.3 U.K.

15.3.4 ITALY

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 TURKEY

15.3.8 BELGIUM

15.3.9 NETHERLANDS

15.3.10 SWITZERLAND

15.3.11 REST OF EUROPE

15.4 ASIA PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 AUSTRALIA

15.4.6 SINGAPORE

15.4.7 THAILAND

15.4.8 MALAYSIA

15.4.9 INDONESIA

15.4.10 PHILIPPINES

15.4.11 REST OF ASIA PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 U.A.E

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL AUTOMOTIVE LOGISTICS MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL AUTOMOTIVE LOGISTICS MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL AUTOMOTIVE LOGISTICS MARKET, COMPANY PROFILE

18.1 YUSEN LOGISTICS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BLG LOGISTICS GROUP AG & CO

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 CRANE WORLDWIDE LOGISTICS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 IMPERIAL LOGISTICS

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 PENSKE AUTOMOTIVE GROUP, INC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 NOATUM LOGISTICS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 XPO LOGISTICS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 RYDER SYSTEM, INC

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 SINOTRAINS LIMITED

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 KUEHNE+NAGEL

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 C.H. ROBINSON WORLDWIDE, INC

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 GEFCO

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 SCHNELLECKE GROUP AG & CO KG

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 DEUTSCHE POST AG

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 EXPEDITORS INTERNATIONAL

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 A.P. MOLLER-MAERSK

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 HELLMAN WORLDWIDE LOGISTICS

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 DSC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 CEVA LOGISTICS

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 NIPPON EXPRESS CO, LTD

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 BR WILLIAMS TRUCKING

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 RHENUS GROUP

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 KINTETSU WORLD EXPRESS PVT, LTD

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 HUB GROUP

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 TRANSPORT INTELLIGENCE PVT LTD

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 SNCF

18.26.1 COMPANY SNAPSHOT

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 PANALPINA

18.27.1 COMPANY SNAPSHOT

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 UNITED PARCEL SERVICE, INC

18.28.1 COMPANY SNAPSHOT

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.