Global Logistics Automation Market

Market Size in USD Billion

CAGR :

%

USD

36.43 Billion

USD

86.47 Billion

2024

2032

USD

36.43 Billion

USD

86.47 Billion

2024

2032

| 2025 –2032 | |

| USD 36.43 Billion | |

| USD 86.47 Billion | |

|

|

|

|

Logistics Automation Market Size

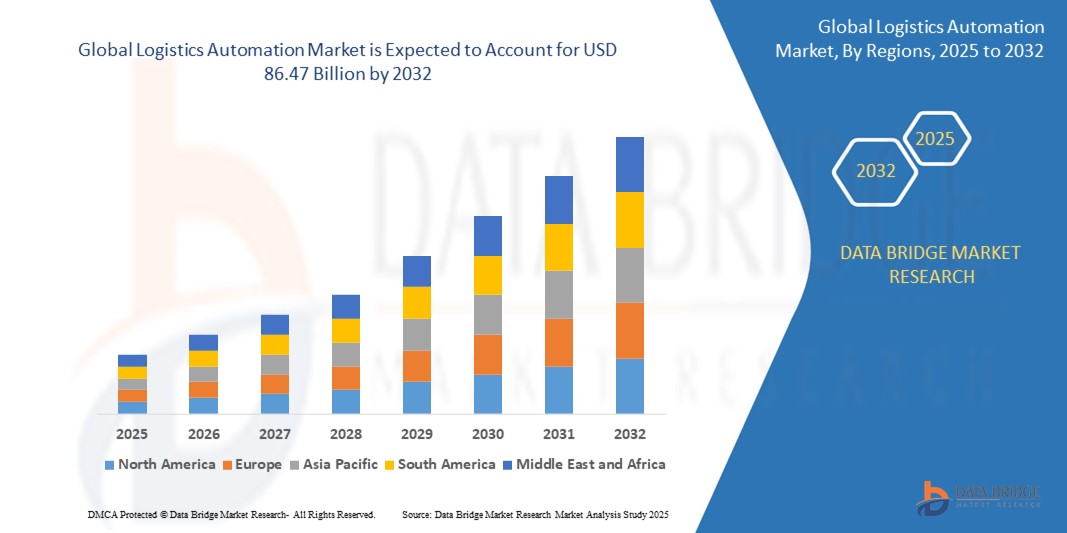

- The global logistics automation market size was valued at USD 36.43 billion in 2024 and is expected to reach USD 86.47 billion by 2032, at a CAGR of 11.41% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced technologies such as IoT, AI, and robotics in supply chain and warehouse operations, enabling improved efficiency, reduced operational costs, and real-time data insights.

- Furthermore, rising demand for faster, error-free, and contactless logistics processes particularly from e-commerce and retail sectors—is prompting businesses to invest in automated material handling, sorting, and transportation systems. These trends are significantly accelerating the deployment of logistics automation solutions, thereby boosting market expansion globally

Logistics Automation Market Analysis

- Logistics automation, which involves the use of robotics, AI, and IoT for streamlining supply chain and warehouse operations, is rapidly becoming a crucial element in both industrial and retail sectors due to its ability to enhance operational efficiency, reduce human error, and enable real-time data analysis

- The increasing demand for logistics automation is largely driven by the need for faster, cost-efficient supply chain operations, the rising adoption of e-commerce platforms, and the growing complexity of global trade networks

- North America is expected to dominate the logistics automation market, holding the largest revenue share of 40%, due to its advanced infrastructure, early adoption of technology, and a high level of investment from both private companies and government initiatives in automation and smart logistics solutions

- Asia-Pacific is projected to be the fastest-growing region in the logistics automation market during the forecast period, driven by rapid industrialization, expanding e-commerce, and a surge in demand for efficient logistics solutions in countries such as China and India

- Hardware segment is expected to dominate the logistics automation market with a largest market share of 67.1%, due to the increasing demand for automated transportation, the autonomous robots category holds the largest market share among hardware solutions. Autonomous guided vehicles are expected to draw most of the spending in autonomous robots

Report Scope and Logistics Automation Market Segmentation

|

Attributes |

Logistics Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Logistics Automation Market Trends

“Increased Adoption of AI and Robotics for Supply Chain Efficiency”

- A key and rapidly growing trend in the global logistics automation market is the increasing integration of artificial intelligence (AI) and robotics to optimize supply chain management and operational efficiency. The combination of these technologies is transforming logistics operations by reducing manual labor, minimizing errors, and enhancing decision-making processes

- For instance, AI-powered robots and autonomous mobile robots (AMRs) are being deployed in warehouses and distribution centers to automate inventory management, order fulfillment, and packaging. Companies like Amazon have already implemented robotic systems to improve warehouse operations, while others are following suit, increasing the demand for automation solutions

- AI integration in logistics automation enables features such as predictive analytics to optimize routes and delivery schedules, reducing transportation costs and improving delivery accuracy. Real-time data from AI systems can also suggest improvements in warehouse layout, inventory stock levels, and labor allocation to enhance overall supply chain performance

- The seamless integration of AI and robotics with IoT devices and cloud-based platforms is driving real-time visibility into supply chain operations, enabling companies to respond quickly to disruptions and streamline workflows. By incorporating advanced analytics, businesses can enhance supply chain forecasting and ensure better demand planning

- This trend toward greater automation, efficiency, and real-time decision-making is reshaping the logistics industry, with companies such as Dematic, Zebra Technologies, and Kiva Systems leading the charge in automation innovation

- The demand for AI and robotics-driven solutions is expanding rapidly across various sectors, including e-commerce, retail, manufacturing, and pharmaceuticals, as businesses seek to reduce costs, improve operational efficiency, and enhance customer experience

Logistics Automation Market Dynamics

Driver

“Rising Demand for Efficiency and Cost Reduction in Supply Chain Operations”

- The growing need for increased efficiency and cost reduction within logistics and supply chain operations is driving the demand for logistics automation solutions

- For instance, in January 2024, DHL launched an AI-powered robotic sorting system to improve parcel processing efficiency, reduce errors, and minimize human labor. Such innovations are expected to propel the logistics automation industry forward

- As businesses strive to streamline their supply chains, automation offers substantial benefits such as faster processing, reduced labor costs, and improved accuracy. Automation solutions in warehousing, transportation, and inventory management help reduce operational costs while meeting the rising demands of e-commerce and global trade

- The increasing complexity of supply chains, driven by globalization and the demand for real-time delivery, has led companies to seek automated solutions that can enhance operational efficiency. Automated systems allow businesses to achieve faster and more reliable deliveries, improving overall customer satisfaction

- The need for scalable and adaptable logistics operations to support growing volumes of goods is also accelerating the adoption of automation. Key technologies, such as autonomous vehicles, drones, and robotic sorting systems, are becoming central to the logistics industry’s digital transformation

- This drive for efficiency and cost-effective solutions is pushing logistics companies, including leaders such as FedEx, UPS, and Maersk, to adopt cutting-edge technologies to remain competitive, fueling the growth of the logistics automation market

Restraint/Challenge

“High Initial Investment and Integration Challenges”

- One of the primary challenges hindering the widespread adoption of logistics automation is the high initial investment required for automation systems, including robotics, AI solutions, and autonomous vehicles. Many small and medium-sized businesses may find it difficult to justify such investments, especially if they have limited budgets or slower returns on investment

- For instance, the implementation of automated systems such as robotic sorting solutions or autonomous delivery vehicles often requires significant capital outlay for equipment, software, and infrastructure. These expenses can be a barrier for companies that are not financially equipped to bear such costs

- The integration of new automation technologies with existing legacy systems can be complex and time-consuming, further contributing to the resistance towards full-scale automation. Companies may need to overhaul their entire logistics and supply chain infrastructure, which involves substantial effort, expertise, and ongoing maintenance

- Another challenge is the shortage of skilled workforce to manage and maintain advanced logistics automation systems. As the industry becomes more reliant on AI and robotics, there is a growing need for specialized skills that are not yet widely available in the workforce, posing a challenge to smooth implementation and ongoing operation

- Despite the long-term cost benefits, the upfront complexity and expense of implementing logistics automation solutions often create hesitation among companies, particularly in industries with tighter margins. This results in a slower adoption rate in certain sectors of the market

- Overcoming these challenges through cost-effective solutions, better integration strategies, and talent development will be crucial for driving the broader adoption of logistics automation technologies

Logistics Automation Market Scope

The market is segmented on the basis of component, function, logistics type, organization size, software application, mode of freight transport, application, and end user

By Component

On the basis of component, the logistics automation market is segmented into hardware, software, and services. The hardware segment is expected to capture the largest revenue share of 67.1%, driven by the increasing adoption of automated equipment, such as robotics, conveyors, autonomous vehicles, and drones. These hardware systems are essential for streamlining operations in warehousing, transportation, and sorting facilities, offering enhanced efficiency and reducing manual labor costs.

The services segment, which includes consulting, system integration, and maintenance services, is also poised for significant expansion. As more companies adopt logistics automation, the need for specialized services to integrate and maintain these complex systems will grow. Companies are looking for end-to-end support, including strategic consulting, to ensure that automation solutions are seamlessly integrated into their existing infrastructure.

By Function

On the basis of function, the logistics automation market is segmented into inventory and storage management, and transportation logistics. The inventory and storage management segment is anticipated to hold the largest market revenue share in 2025, driven by the growing demand for efficient warehousing and inventory management solutions. Automated systems, such as robotic picking systems, conveyor belts, and automated storage and retrieval systems (ASRS), are increasingly adopted to streamline the management of inventory and optimize warehouse operations.

The transportation logistics segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing demand for automation in transportation networks and last-mile delivery solutions. Technologies like autonomous vehicles, drones, and automated freight systems are being integrated into the logistics value chain to optimize the transportation of goods. These solutions offer improved route planning, cost reduction, and faster delivery times, making them highly sought after in industries that rely on quick and efficient transportation, such as e-commerce and global trade.

By Logistics Type

On the basis of logistics type, the logistics automation market is segmented into sales logistics, production logistics, recovery logistics, and procurement logistics. The sales logistics segment is expected to hold the largest market revenue share in 2025, driven by the increasing demand for efficient order fulfillment and timely deliveries, especially within the e-commerce sector. Automated systems such as robotic sorting, automatic packing, and warehouse management systems (WMS) play a crucial role in speeding up the order fulfillment process, improving inventory accuracy, and reducing operational costs.

The production logistics segment is anticipated to witness significant growth, owing to the increasing demand for automation in manufacturing and production processes. Automation solutions, including automated guided vehicles (AGVs), robotic arms, and conveyor systems, are being widely adopted in production facilities to streamline material handling, assembly processes, and product movements.

By Organization Size

On the basis of organization size, the logistics automation market is segmented into large enterprise, small and medium-sized enterprises (SMEs). The large enterprises segment accounted for the largest market revenue share in 2024, driven by their substantial investments in advanced automation technologies to streamline complex logistics operations across global supply chains. These organizations benefit from economies of scale and require integrated solutions for inventory management, transportation automation, and warehouse optimization.

The SMEs segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the increasing affordability and accessibility of cloud-based automation solutions. SMEs are increasingly adopting scalable logistics technologies such as automated inventory tools, transport management systems (TMS), and robotic process automation (RPA) to enhance competitiveness, improve delivery accuracy, and reduce operational cost.

By Software Application

On the basis of software application, the logistics automation market is segmented into inventory management, order management, yard management, shipping management, labor management, vendor management, customer support, and other. The inventory management segment accounted for the largest market revenue share in 2024, driven by the increasing need for accurate, real-time tracking of goods across warehouses and distribution centers. Automation in inventory management helps businesses minimize stockouts and overstocking, reduce manual errors, and improve operational efficiency through technologies such as barcode scanning, RFID, and automated storage and retrieval systems (ASRS).

The order management and shipping management segments are also gaining traction, supported by the rapid growth of e-commerce and omnichannel retailing. These applications facilitate seamless processing of high order volumes, faster fulfillment, and better customer satisfaction.

The yard management and labor management segments are witnessing increasing adoption in large warehouses and logistics hubs, where operational complexity requires precise coordination and resource optimization. Automated systems help manage dock scheduling, vehicle tracking, workforce planning, and productivity monitoring.

The vendor management and customer support segments are expected to grow steadily, as companies seek to automate procurement processes and enhance customer experience through real-time communication and service updates

By Mode of Freight Transport

On the basis of mode of freight transport, the logistics automation market is segmented into air, road, and sea. The road transport segment accounted for the largest market revenue share in 2024, driven by the high volume of domestic and regional freight movements, particularly across e-commerce, retail, and FMCG sectors. Automation technologies are being widely adopted in this mode to enhance route optimization, fleet tracking, and delivery scheduling. Real-time data analytics and telematics solutions are improving driver performance and shipment visibility, contributing to higher efficiency and reduced operational costs.

The air freight segment is experiencing increasing adoption of automation for time-sensitive and high-value shipments, with technologies such as automated cargo handling systems, AI-driven demand forecasting, and smart baggage solutions gaining momentum at major airports and logistics hubs.

The sea freight segment is also witnessing significant growth, supported by the integration of port automation, smart containers, and IoT-based tracking systems. As global trade continues to expand, shipping companies are leveraging logistics automation to optimize loading/unloading operations, reduce turnaround times, and improve supply chain transparency

By Application

On the basis of application, the logistics automation market is segmented into transportation, infotainment system, safety and alerting system, and others. The transportation segment accounted for the largest market revenue share in 2024, driven by the growing demand for end-to-end visibility, route optimization, and real-time tracking of shipments. Automation solutions in this segment include advanced transport management systems (TMS), autonomous vehicles, and AI-powered route planning tools that significantly enhance delivery speed, accuracy, and cost efficiency.

The safety and alerting system segment is witnessing notable growth during the forecast period of 2025 to 2032 due to the need for enhanced operational safety, regulatory compliance, and real-time hazard detection. Automated alerts, predictive maintenance tools, and IoT-enabled sensors are helping logistics operators reduce accidents, downtime, and associated costs.

By End User

On the basis of end user, the logistics automation market is segmented into retail and e-commerce, manufacturing, oil, gas, and energy, food and beverage, post and parcel, groceries, general merchandise, apparel, fast moving consumer goods, pharmaceuticals and healthcare, logistics and transportation, automotive, aerospace and defense, food and beverage, chemicals, and others. The retail and e-commerce segment accounted for the largest market revenue share in 2024, fueled by the exponential growth of online shopping and the need for fast, accurate, and scalable logistics solutions. Automation enables these sectors to handle high volumes of orders with speed and precision, using technologies like automated sortation, robotics, and real-time inventory tracking

The pharmaceuticals and healthcare segment is witnessing significant growth during the forecast period of 2025 to 2032, driven by the demand for strict regulatory compliance, temperature-sensitive logistics, and traceability. Automation in this segment helps ensure accurate, timely delivery of medical products while minimizing human error

Logistics Automation Market Regional Analysis

- North America dominates the logistics automation market with the largest revenue share of 40%, driven by the rapid adoption of advanced technologies such as AI, robotics, and IoT within logistics and supply chain operations. The presence of major industry players and a well-established e-commerce ecosystem significantly contribute to market growth in the region

- Companies in the U.S. and Canada are increasingly investing in automation to enhance efficiency, reduce operational costs, and meet rising consumer expectations for faster delivery and order accuracy

- The region’s emphasis on digital transformation, coupled with high labor costs and a skilled workforce, has accelerated the deployment of automated systems in warehousing, inventory management, and transportation logistics. These factors collectively position North America as a leader in logistics automation adoption across various industry verticals

U.S. Logistics Automation Market Insight

The U.S. logistics automation market captured the largest revenue share within North America in 2025, driven by the rapid digitization of supply chains and the high adoption rate of advanced technologies, including robotics, AI, and IoT. Major logistics players and third-party logistics (3PL) providers are increasingly investing in automation to improve operational efficiency and reduce labor dependency. E-commerce giants like Amazon and Walmart are further accelerating automation adoption across fulfillment centers and delivery operations, positioning the U.S. as a global leader in logistics innovation

Europe Logistics Automation Market Insight

The European logistics automation market is expected to grow at a substantial CAGR over the forecast period, bolstered by stringent environmental regulations, labor shortages, and a strong push towards digital transformation in logistics. Key markets such as Germany, the U.K., and France are actively deploying warehouse automation, autonomous vehicles, and advanced analytics to meet rising consumer expectations. The region’s commitment to sustainability and efficiency is driving investment in smart logistics infrastructure across retail, manufacturing, and automotive sectors

U.K. Logistics Automation Market Insight

The U.K. logistics automation market is anticipated to expand at a noteworthy CAGR during the forecast period, supported by the growing need to optimize last-mile delivery and warehouse operations. The rapid growth of e-commerce and omnichannel retail, combined with the pressure of labor shortages and rising operational costs, is encouraging businesses to invest in automated storage systems, robotics, and AI-powered software solutions. Government initiatives promoting digital innovation and smart infrastructure are also contributing to market growth

Germany Logistics Automation Market Insight

Germany’s logistics automation market is expected to experience considerable growth, driven by the country's status as a manufacturing and logistics hub in Europe. With a strong industrial base, Germany is leading the adoption of Industry 4.0 technologies across logistics operations. The market is being propelled by increased demand for automated material handling, smart warehouses, and predictive analytics to enhance supply chain transparency and responsiveness. Emphasis on energy efficiency and sustainability further encourages the adoption of green automation solutions

Asia-Pacific Logistics Automation Market Insight

The Asia-Pacific logistics automation market is projected to register the fastest CAGR globally in 2025, driven by rising e-commerce penetration, rapid urbanization, and expanding manufacturing sectors in countries like China, India, and Southeast Asia. Government-led digital transformation initiatives, coupled with increasing foreign direct investments in logistics infrastructure, are fueling demand for automated solutions. APAC is also emerging as a production hub for automation equipment, contributing to cost-effective implementation across logistics operations

Japan Logistics Automation Market Insight

Japan’s logistics automation market is gaining momentum due to its aging workforce, high labor costs, and technological prowess. The country is leveraging robotics, AI, and autonomous mobile robots (AMRs) to address labor shortages and improve warehouse efficiency. Demand for precise, high-speed logistics processes, especially in urban areas and healthcare logistics, is accelerating the deployment of automation. Japan’s focus on smart city development and advanced infrastructure supports the integration of automated logistics systems across the supply chain

China Logistics Automation Market Insight

China captured the largest revenue share in the Asia-Pacific logistics automation market in 2025, driven by robust growth in e-commerce, manufacturing, and urban logistics. The government’s push for smart logistics and digital infrastructure under its “Made in China 2025” initiative is stimulating demand for warehouse robotics, autonomous delivery vehicles, and AI-driven logistics platforms. Strong domestic technology providers and rapid urban development are making China a dominant player in logistics automation innovation and deployment

Logistics Automation Market Share

The smart lock industry is primarily led by well-established companies, including:

- SAP SE (Germany)

- Oracle (U.S.)

- Honeywell International Inc. (U.S.)

- Daifuku Co., Ltd. (Japan)

- Dematic (U.S.)

- ek robotics GmbH (Germany)

- Hardis Group (France)

- Falcon Autotech (India)

- Grey Orange Pte. Ltd. (U.S.)

- Toshiba Corporation (Japan)

- Murata Machinery, Ltd (Japan)

- Zebra Technologies Corp. (U.S.)

- HighJump (U.S.)

- Jungheinrich AG (Germany)

- KNAPP AG (Austria)

- Locus Robotics (U.S.)

- Manhattan Associates (U.S.)

- System Logistics S.p.A (Italy)

- TGW LOGISTICS GROUP GMBH (Austria)

- Seegrid Corporation (U.S.)

Latest Developments in Global Logistics Automation Market

- In 2023, Dematic introduced advanced automation technologies at the newly developed KION logistics facility, designed to significantly improve the efficiency of customer deliveries throughout Europe. The centerpiece of the deployment is a highly dynamic Dematic Multishuttle system, featuring 110,000 storage locations and 150 high-speed shuttles, enabling automated storage and retrieval processes with heightened precision and throughput. This strategic implementation reflects a broader trend in the global logistics automation market, where leading companies are increasingly adopting intelligent, high-capacity systems to enhance operational agility and scalability

- In 2023, Swisslog unveiled its enhanced robotic CarryPick mobile system, incorporating a significantly increased operational speed and an innovative lifting turntable. This upgraded system facilitates faster, more adaptable storage and retrieval operations within goods-to-person logistics workflows, ultimately boosting overall warehouse efficiency and throughput. This development aligns with the growing global demand for agile, high-performance automation solutions in logistics. As companies face increasing pressure to optimize fulfillment speed and labor efficiency, particularly in e-commerce and omnichannel distribution, the adoption of advanced robotic systems like CarryPick reflects the market's shift toward scalable, flexible automation

- In 2022, o9 Solutions introduced Supply Sensing, a groundbreaking solution designed to help businesses proactively detect and mitigate potential supply chain disruptions. By translating macro-level shocks into localized insights relevant to a company's specific supply chain, the platform enables more informed decision-making and faster response times. This innovation highlights the growing importance of predictive analytics and real-time data in the logistics automation landscape. As global supply chains become more complex and susceptible to disruption, solutions like Supply Sensing are instrumental in enabling agile, automated responses

- In 2021, SAP launched SAP Yard Logistics, a comprehensive solution designed to optimize yard management processes, enabling businesses to efficiently handle all yard operations. By facilitating seamless planning and execution within the yard, SAP Yard Logistics offers both simple and complex scenarios, promoting sustainability and future-proof management practices. This advancement underscores the growing demand for integrated, automated solutions in logistics operations. As the logistics industry increasingly prioritizes efficiency and sustainability, SAP Yard Logistics serves as a key enabler of smarter, more sustainable yard management

- In 2021, Manhattan Associates unveiled Manhattan Active Warehouse Management, the first cloud-native enterprise-class warehouse management system (WMS) designed to integrate all aspects of distribution. This groundbreaking solution transforms warehouse operations by providing enhanced visibility, agility, and scalability, effectively addressing the evolving demands of modern business environments. Manhattan Active Warehouse Management represents a significant leap in the evolution of logistics automation, as businesses increasingly seek cloud-based, scalable solutions to enhance operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.