Global Automotive Plastics Market

Market Size in USD Billion

CAGR :

%

USD

33.84 Billion

USD

79.13 Billion

2024

2032

USD

33.84 Billion

USD

79.13 Billion

2024

2032

| 2025 –2032 | |

| USD 33.84 Billion | |

| USD 79.13 Billion | |

|

|

|

|

Automotive Plastics Market Size

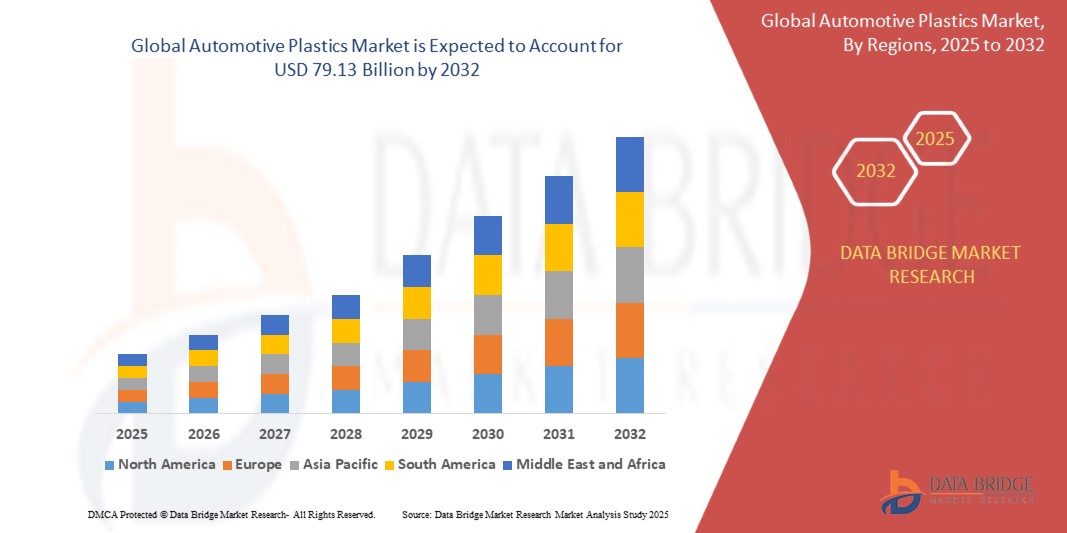

- The global automotive plastics market was valued at USD 33.84 billion in 2024 and is expected to reach USD 79.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by increasing demand for lightweight vehicles

- This growth is driven by the stringent government regulations on sustainability and the growing adoption of electric vehicles (EVs)

Automotive Plastics Market Analysis

- Automotive plastics has gained widespread acceptance due to its lightweight, durability, and high-performance characteristics, driving demand in vehicle manufacturing, electric vehicles (EVs), and sustainability initiatives. Its proven ability to enhance fuel efficiency, reduce carbon emissions, and improve crash safety has solidified its role in modern automotive engineering

- The market is primarily driven by increasing demand for lightweight materials, stringent government regulations on emissions, and the rising adoption of EVs. In addition, advancements in bio-based plastics and investments in automotive interiors are further accelerating market growth

- Asia-Pacific dominates the automotive plastics market due to its strong automotive manufacturing base, increasing vehicle production, and rapid adoption of sustainable materials

- For instance, in China and India, the demand for lightweight plastics has surged due to stringent fuel efficiency norms and growing EV production, contributing to sustained market expansion

- Globally, automotive plastics continues to be a cornerstone in vehicle design and sustainability, with innovations such as recyclable polymers, composite materials, and advanced manufacturing techniques driving industry transformation and ensuring long-term market sustainability

Report Scope and Automotive Plastics Market Segmentation

|

Attributes |

Automotive Plastics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Plastics Market Trends

“Rising Integration of Automotive Plastics in Sustainable Vehicle Manufacturing”

- The increasing focus on sustainability is driving demand for automotive plastics, widely recognized for its role in lightweight vehicle design and fuel efficiency improvement

- Automakers are expanding the use of high-performance plastics in electric vehicles (EVs), interior components, and structural applications to enhance durability and reduce overall carbon footprint

- The rising adoption of bio-based polymers and recyclable materials is accelerating the shift towards eco-friendly vehicle production, aligning with stringent government regulations on emissions

For instance,

- In February 2024, Tesla incorporated advanced polymer composites in its latest EV model, enhancing battery efficiency and overall vehicle weight reduction

- In October 2023, Toyota introduced a new recyclable plastic dashboard, reinforcing its commitment to sustainable automotive manufacturing

- In July 2023, BASF partnered with leading automakers to develop bio-based plastics for next-generation EV interiors, ensuring higher durability and lower environmental impact

- As the automotive industry continues to prioritize sustainability, automotive plastics will play a crucial role in vehicle innovation, driving efficiency, durability, and compliance with global emission standards

Automotive Plastics Market Dynamics

Driver

“Growing Demand for Lightweight Vehicles”

- Increasing fuel efficiency and reducing carbon emissions are key priorities for the automotive industry, driving the adoption of lightweight plastics as an alternative to metals.

- Automakers are incorporating high-performance polymers in vehicle interiors, exteriors, and under-the-hood components to enhance durability, safety, and design flexibility

- The rising penetration of electric vehicles (EVs) further accelerates the need for lightweight materials, as reducing vehicle weight directly improves battery performance and driving range

For instance,

- In March 2024, Ford integrated polycarbonate-based components into its new EV lineup to reduce vehicle weight and enhance energy efficiency

- In November 2023, General Motors partnered with BASF to develop high-strength plastic composites for structural applications, replacing traditional metal parts.

- In August 2023, Hyundai announced the use of bio-based plastics in its next-gen vehicle interiors, reinforcing its commitment to sustainable mobility

- With stricter government regulations on fuel efficiency and emissions, the demand for automotive plastics will continue to grow, driving innovation in lightweight vehicle design and sustainable manufacturing

Opportunity

“Expansion of Bio-Based and Recyclable Automotive Plastics”

- Growing environmental concerns and stringent government regulations are creating opportunities for bio-based and recyclable plastics, reducing reliance on fossil fuel-derived materials

- Automakers are investing in sustainable plastic alternatives to meet carbon neutrality goals, improve end-of-life recyclability, and enhance brand sustainability efforts

- The increasing adoption of circular economy principles in automotive manufacturing is driving demand for recycled polymers, minimizing waste and lowering production costs

For instance,

- In January 2024, BMW launched a new initiative to incorporate ocean-recycled plastics into its vehicle interiors, supporting its sustainability strategy

- In September 2023, Volkswagen partnered with biopolymer manufacturers to integrate plant-based plastics into its upcoming EV models

- In June 2023, Stellantis committed to using at least 50% recycled plastics in its next-generation vehicle components to reduce environmental impact

- As the automotive industry accelerates its shift towards eco-friendly materials, bio-based and recyclable plastics will unlock new growth avenues, enhancing sustainability, innovation, and regulatory compliance

Restraint/Challenge

“Recycling Complexities in Automotive Plastics”

- The multi-layered composition of automotive plastics, combined with additives and reinforcements, makes recycling difficult and limits the feasibility of a circular economy in the sector

- Automakers face challenges in separating, sorting, and reprocessing plastic components from end-of-life vehicles, increasing waste management costs

- Stricter government regulations on plastic waste disposal are pushing companies to invest in advanced recycling technologies, further raising operational expenses

For instance,

- In March 2024, Renault reported difficulties in recovering composite plastics from scrapped vehicles, impacting its sustainability goals

- Addressing recycling inefficiencies will be critical for the automotive industry, ensuring cost-effective plastic reuse while meeting global environmental regulations

Automotive Plastics Market Scope

The market is segmented on the basis of product type, vehicle type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Vehicle Type |

|

|

By Application |

|

Automotive Plastics Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Automotive Plastics Market”

- Asia-Pacific leads the global Automotive Plastics market, driven by rapid industrialization, increasing automobile production, and strong demand for lightweight materials

- China and India dominate the region due to their expanding automotive manufacturing, rising vehicle sales, and strong government incentives for fuel efficiency

- Advancements in polymer technology, increasing adoption of electric vehicles (EVs), and rising consumer preference for sustainable materials have further accelerated market growth

- In addition, the presence of major automotive suppliers, expanding OEM production, and growing investments in research & development contribute to the region’s market leadership

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the automotive plastics market, driven by rapid urbanization, increasing vehicle production, and growing demand for lightweight components

- China and India are emerging as key markets due to strong automotive manufacturing, supportive government policies, and rising investments in electric mobility

- China leads the region in automotive plastics production, with advanced polymer processing technologies and increasing adoption of sustainable materials for vehicle components

- India is experiencing strong market growth due to rising automobile exports, expanding EV infrastructure, and growing consumer preference for fuel-efficient vehicles

- Stringent emission regulations, increasing R&D in bioplastics, and strategic collaborations between automotive OEMs further contribute to Asia-Pacific’s market expansion

Automotive Plastics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Magna International Inc. (Canada)

- Lear (U.S.)

- Adient plc (Ireland)

- BASF (Germany)

- Borealis AG (Austria)

- Covestro AG (Germany)

- Evonik Industries AG (Germany)

- SABIC (Saudi Arabia)

- Antolin (Spain)

- TOYOTA BOSHOKU CORPORATION (Japan)

- FORVIA HELLA (Germany)

- TOYODA GOSEI Co., Ltd. (Japan)

- Sage Automotive Interiors, Inc. (U.S.)

- DSM (Netherlands)

- Dow (U.S.)

- Momentive Performance Materials (U.S.)

- TEIJIN LIMITED (Japan)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- CNR Group, LLC (U.S.)

Latest Developments in Global Automotive Plastics Market

- In June 2023, Borealis AG acquired Rialti S.p.A., a leading polypropylene (PP) compounding company specializing in recyclates in Italy’s Varese region. This acquisition strengthens Borealis' expertise and production capacity in PP compounding, particularly in increasing the volume of mechanically recycled PP compounds to enhance its specialized and circular portfolios

- In May 2023, Lear announced plans to establish a connection systems facility in Morocco, aimed at manufacturing components for automakers, suppliers, and its E-systems and seating units to expand its automotive technology capabilities

- In November 2022, Covestro AG collaborated with HASCO Vision to recycle post-industrial plastics. Through this partnership, Covestro collects used plastics from HASCO's production facilities, converts them into high-quality post-industrial recycled polycarbonates and polycarbonate blends, and supplies them back for manufacturing new automotive components

- In June 2021, Lyondellbasell entered a long-term agreement with Neste to source Neste RE, a feedstock made entirely from renewable sources such as residue oils, fats, and waste. This material is processed at Lyondellbasell's Wesseling, Germany, plant into polymers sold under the CirculenRenew brand

- In May 2021, Lyondellbasell commenced production of virgin-quality polymers using raw materials derived from plastic waste at its Wesseling, Germany, facility. These raw materials are converted into propylene and ethylene, which are further processed into polypropylene (PP) and polyethylene (PE) for plastics manufacturing

- In May 2021, ARKEMA completed the acquisition of Agiplast, a company specializing in the regeneration of high-performance polymers. This acquisition enables ARKEMA to become a fully integrated high-performance polymer manufacturer, focusing on both recycled and bio-based materials to drive sustainability and circular economy initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.