Global Automotive Screenwash Products Market

Market Size in USD Billion

CAGR :

%

USD

2.06 Billion

USD

2.89 Billion

2024

2032

USD

2.06 Billion

USD

2.89 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 2.89 Billion | |

|

|

|

|

Automotive Screenwash Product Market Size

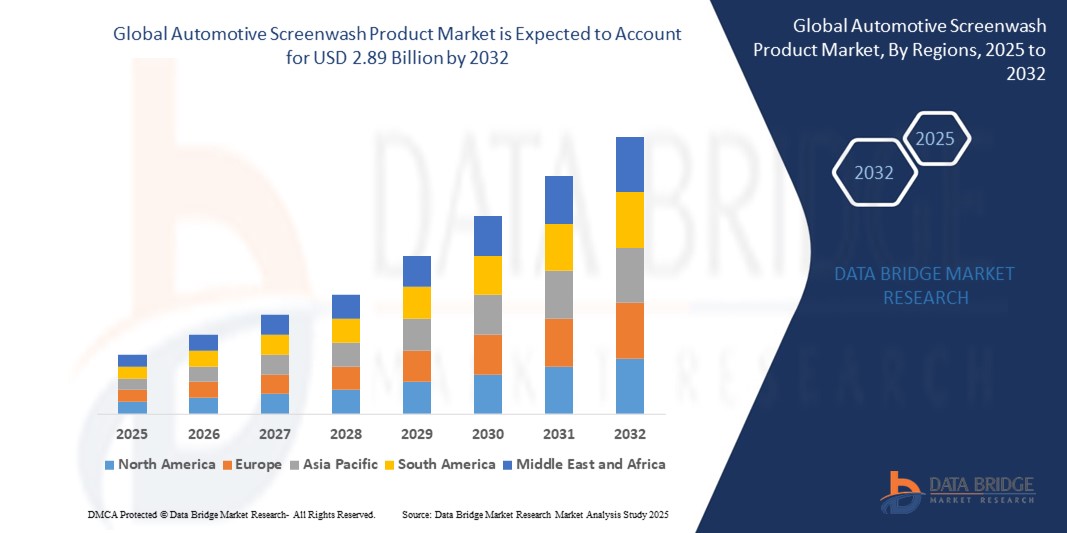

- The global automotive screenwash product market size was valued at USD 2.06 billion in 2024 and is expected to reach USD 2.89 billion by 2032, at a CAGR of 4.36% during the forecast period

- The market growth is primarily driven by increasing vehicle ownership worldwide, heightened consumer awareness of vehicle maintenance, and the need for enhanced visibility in diverse weather conditions

- The rising demand for high-quality, eco-friendly, and specialized screenwash solutions, coupled with the expansion of e-commerce and retail channels, is significantly boosting the industry's growth

Automotive Screenwash Product Market Analysis

- Automotive screenwash products, also known as windshield washer fluids, are liquid solutions designed to clean vehicle glass surfaces such as windshields, rear windows, and headlights, ensuring clear visibility and safe driving conditions

- The growing demand for screenwash products is fueled by increasing vehicle sales, rising awareness of road safety, and the need for effective cleaning solutions in varying climatic conditions, such as snow, rain, and insect-prone environments

- Europe dominated the automotive screenwash product market with the largest revenue share of 35.0% in 2024, driven by a well-established automotive industry, stringent road safety regulations, and high consumer emphasis on vehicle maintenance

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid urbanization, increasing disposable incomes, and a booming automotive sector in countries such as China and India

- The all-season automotive screenwash Products segment held the largest market revenue share of 45% in 2024, driven by its versatility in addressing diverse weather conditions, effectively removing dirt, grime, and light frost

Report Scope and Automotive Screenwash Product Market Segmentation

|

Attributes |

Automotive Screenwash Product Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Screenwash Product Market Trends

“Increasing Demand for Eco-Friendly and Biodegradable Formulations”

- The global automotive screenwash product market is experiencing a significant trend toward the development and adoption of eco-friendly and biodegradable screenwash solutions

- These formulations address growing consumer and regulatory demands for sustainable products, reducing environmental impact through non-toxic and biodegradable ingredients

- Advanced screenwash products are being developed with enhanced cleaning capabilities, such as improved grime and insect residue removal, while maintaining eco-friendly properties

- For instance, companies are innovating with concentrated screenwash solutions that require less packaging and offer cost efficiency, appealing to environmentally conscious consumers

- This trend is enhancing the market appeal of screenwash products, making them more attractive to both individual vehicle owners and fleet operators

- Manufacturers are also integrating smart dispensing systems and subscription-based models for screenwash products, improving accessibility and convenience through e-commerce platforms

Automotive Screenwash Product Market Dynamics

Driver

“Rising Vehicle Ownership and Emphasis on Road Safety”

- The increasing global vehicle ownership, particularly in emerging economies, is a major driver for the automotive screenwash product market

- Screenwash products enhance driving safety by ensuring clear visibility through windshields, removing dirt, grime, insects, and frost, which is critical in diverse weather conditions

- Government regulations in regions such as Europe, emphasizing road safety and vehicle maintenance, are contributing to the widespread adoption of screenwash products

- The expansion of e-commerce and retail channels, such as automotive parts stores and online platforms, is making screenwash products more accessible, further driving market growth

- Automakers and aftermarket suppliers are increasingly offering specialized screenwash products, such as all-season, bug remover, de-icer, and water-repellent formulations, to meet consumer needs and enhance vehicle maintenance standards

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The substantial costs associated with developing and manufacturing high-quality screenwash products, particularly eco-friendly formulations, can be a barrier to market growth, especially in cost-sensitive emerging markets

- Incorporating advanced ingredients, such as biodegradable compounds or antifreeze agents, increases production costs, impacting affordability for some consumers

- Data privacy is not a direct concern, but regulatory compliance with environmental standards and chemical usage poses a significant challenge. The fragmented regulatory landscape across countries complicates compliance for manufacturers operating internationally

- Consumer awareness of product benefits, particularly in developing regions, remains limited, which can hinder market penetration and adoption

- These factors may deter potential buyers and limit market expansion, particularly in regions with high cost sensitivity or stringent environmental regulations

Automotive Screenwash Product market Scope

The market is segmented on the basis of product, sales channel, and end use.

- By Product

On the basis of product, the automotive screenwash product market is segmented into all-season automotive screenwash products, bug remover automotive screenwash products, de-icer automotive screenwash products, and water-repellent windshield washer fluid. The all-season automotive screenwash Products segment held the largest market revenue share of 45% in 2024, driven by its versatility in addressing diverse weather conditions, effectively removing dirt, grime, and light frost. Its widespread adoption is fueled by consumer preference for a single, year-round solution that ensures clear visibility.

The water-repellent windshield washer fluid segment is expected to witness the fastest growth rate of 15.8% from 2025 to 2032, propelled by increasing demand for advanced formulations that enhance visibility in adverse weather, particularly in regions with frequent rainfall. The integration of hydrophobic compounds that repel water and reduce glare is boosting consumer adoption, especially in premium and passenger vehicles.

- By Sales Channel

On the basis of sales channel, the automotive screenwash product market is segmented into direct sales and indirect sales. The indirect sales segment accounted for the largest market revenue share of 68% in 2024, driven by the extensive reach of retail channels, including automotive parts stores, supermarkets, and e-commerce platforms. The convenience of purchasing through established intermediaries and the availability of diverse product options contribute to its dominance.

The direct sales segment is anticipated to experience the fastest growth rate of 14.2% from 2025 to 2032, fueled by manufacturers’ increasing focus on engaging consumers directly through online platforms and subscription-based models. This channel allows for better consumer feedback, customized offerings, and stronger brand loyalty, particularly for eco-friendly and premium products.

- By End Use

On the basis of end use, the automotive screenwash product market is segmented into auto maintenance shops and personal use. The auto maintenance Shops segment dominated the market with a revenue share of 55% in 2024, driven by the high demand for screenwash products in professional settings to clean windshields, headlights, and windows during vehicle servicing. The rise in auto service stations, particularly in Europe and North America, further supports this segment’s growth.

The personal use segment is expected to witness rapid growth of 16.1% from 2025 to 2032, propelled by increasing consumer awareness of vehicle maintenance and safety, particularly in Asia Pacific. The growing trend of DIY vehicle care, coupled with the availability of eco-friendly and easy-to-use screenwash products through e-commerce, is driving adoption among individual vehicle owners.

Automotive Screenwash Product Market Regional Analysis

- Europe dominated the automotive screenwash product market with the largest revenue share of 35.0% in 2024, driven by a well-established automotive industry, stringent road safety regulations, and high consumer emphasis on vehicle maintenance

- Consumers prioritize screenwash products for enhancing visibility, removing contaminants, and ensuring safe driving in diverse weather conditions, particularly in regions with extreme climates

- Growth is supported by advancements in screenwash formulations, including eco-friendly and anti-freeze solutions, alongside rising adoption in both OEM and aftermarket segments

U.K. Automotive Screenwash Product Market Insight

The U.K. market for automotive screenwash products is expected to witness significant growth, driven by demand for enhanced visibility and safety in urban and suburban settings. Increased interest in vehicle maintenance and rising awareness of anti-freeze and bug removal benefits encourage adoption. Evolving vehicle safety regulations influence consumer choices, balancing product efficacy with compliance.

Germany Automotive Screenwash Product Market Insight

Germany is expected to witness robust growth in automotive screenwash products, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle safety and efficiency. German consumers prefer technologically advanced screenwash products that ensure clear visibility and contribute to vehicle maintenance. The integration of these products in premium vehicles and aftermarket options supports sustained market growth.

North America Automotive Screenwash Product Market Insight

North America holds a significant share of the global automotive screenwash product market, driven by a mature automotive industry and high consumer demand for visibility and safety solutions. The region benefits from widespread adoption of screenwash products in both OEM and aftermarket segments, supported by advancements in de-icer and water-repellent formulations. The U.S. and Canada lead the market, with increasing awareness of vehicle maintenance and safety regulations boosting growth.

U.S. Automotive Screenwash Product Market Insight

The U.S. automotive screenwash product market market is expected to witness significant growth, fueled by strong aftermarket demand and growing consumer awareness of visibility and safety benefits. The trend towards vehicle maintenance and increasing regulations promoting safer screenwash standards further boost market expansion. Automakers’ growing incorporation of pre-installed washer fluid systems complements aftermarket sales, creating a diverse product ecosystem.

Asia-Pacific Automotive Screenwash Product Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of visibility, safety, and vehicle maintenance is boosting demand. Government initiatives promoting road safety and environmental sustainability further encourage the use of advanced screenwash products.

Japan Automotive Screenwash Product Market Insight

Japan’s automotive screenwash product market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced screenwash products that enhance driving safety and visibility. The presence of major automotive manufacturers and integration of screenwash systems in OEM vehicles accelerate market penetration. Rising interest in aftermarket maintenance also contributes to growth.

China Automotive Screenwash Product Market Insight

China holds the largest share of the Asia-Pacific automotive screenwash product market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for visibility and safety solutions. The country’s growing middle class and focus on vehicle maintenance support the adoption of advanced screenwash products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automotive Screenwash Product Market Share

The automotive screenwash product industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Turtle Wax, Inc. (U.S.)

- SONAX GmbH (Germany)

- The Darent Wax Company Ltd. (U.K.)

- Micro Powders, Inc. (U.S.)

- Sasol Chemicals (South Africa)

- Meguiar's (U.S.)

- SOFT99 Corporation (Japan)

- Blackboard, Inc. (U.S.)

- RINREI WAX CO., Ltd. (Japan)

- Zymol (U.S.)

- Car Brite (U.S.)

- EuroChem Group (Switzerland)

- Bullsone Co., Ltd. (South Korea)

- Marflo Detailing Products (China)

- Guangzhou Botny Chemical Co., Ltd. (China)

- China Petrochemical Corporation (Sinopec) (China)

- U-tron (South Korea)

- Chemical Guys (U.S.)

What are the Recent Developments in Global Automotive Screenwash Product Market?

- In June 2025, the OEM (Original Equipment Manufacturer) segment has emerged as a key growth driver in the automotive screenwash products market. By August 2024, leading vehicle manufacturers significantly ramped up production to meet surging global vehicle demand, directly boosting the need for factory-fill and service fluids such as screenwash. This trend is reinforced by stricter safety regulations, increasing vehicle ownership, and the integration of advanced windshield technologies, all of which require high-performance cleaning solutions. As a result, OEM partnerships are playing a pivotal role in shaping product development and distribution strategies

- In August 2024, the automotive industry has seen growing momentum in smart and self-cleaning glass technologies, with a notable surge in innovation by August 2024. These developments include self-heating washer fluids to prevent freezing, hydrophobic and photocatalytic coatings that repel dirt and water, and emerging sensor-integrated systems capable of detecting dirt levels and autonomously dispensing cleaning fluid. While still in various stages of commercialization, these technologies are poised to reshape demand for traditional screenwash products, pushing the market toward climate-adaptive and intelligent formulations

- In August 2024, the automotive screenwash market has experienced notable growth in specialized formulations tailored to diverse driving conditions and consumer preferences. By August 2024, manufacturers increasingly offered ready-to-use solutions for convenience, concentrated formulas for cost-effectiveness and customization, and targeted blends for specific needs such as bug removal, de-icing, and all-season performance. This trend reflects rising consumer awareness of vehicle maintenance, safety, and environmental impact. Innovations in biodegradable ingredients and climate-adaptive packaging are also shaping the market, aligning with global sustainability goals and evolving regulatory standards

- In May 2023, Liqui Moly expanded its product portfolio with a new line of advanced screenwash solutions, designed to meet the challenges of diverse weather conditions. These formulations feature enhanced de-icing and anti-fogging properties, ensuring clear visibility in both winter and humid environments. While primarily aimed at automotive use, the innovation reflects a broader industry trend toward specialized, climate-adaptive chemical products. This development underscores Liqui Moly’s commitment to safety, performance, and seasonal versatility in vehicle care

- In January 2023, Continental AG launched its next-generation AQUACTRL2 windshield wipers, featuring a redesigned coupler, improved adapter system, and enhanced wiping performance. The new series includes two options: DirectFit (pre-assembled sets tailored to specific vehicles) and MultiClip (single wipers with flexible adapters for broad compatibility). These innovations ensure better pressure distribution, quieter operation, and crystal-clear visibility in all weather conditions. While not a screenwash product, this development complements screenwash advancements by encouraging demand for high-performance, compatible cleaning solutions in modern vehicles

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.