Global Automotive Telematics Market

Market Size in USD Billion

CAGR :

%

USD

91.81 Billion

USD

388.49 Billion

2024

2032

USD

91.81 Billion

USD

388.49 Billion

2024

2032

| 2025 –2032 | |

| USD 91.81 Billion | |

| USD 388.49 Billion | |

|

|

|

|

Automotive Telematics Market Size

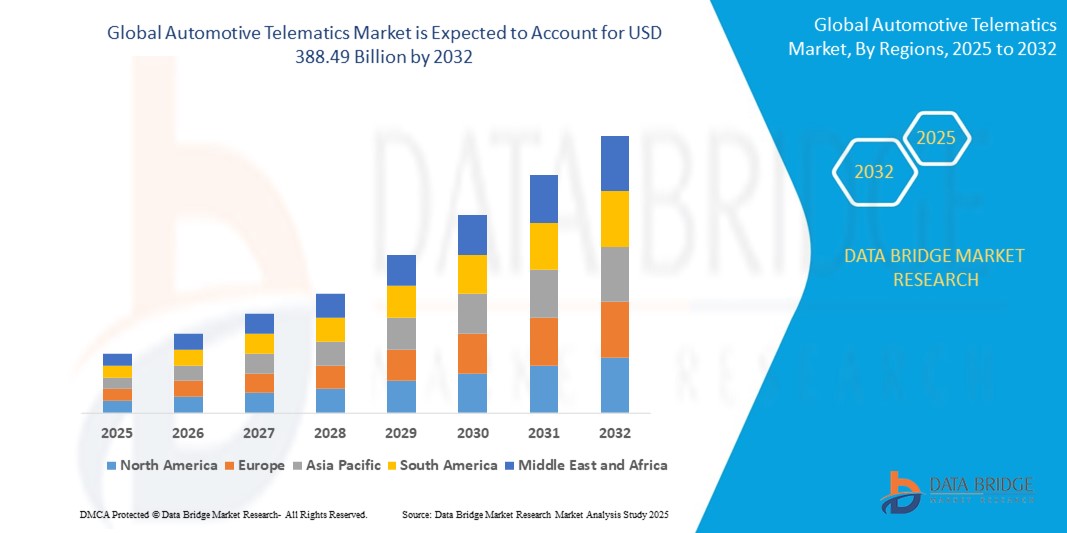

- The global Automotive Telematics market size was valued at USD 91.81 billion in 2024 and is expected to reach USD 388.49 billion by 2032, at a CAGR of 19.76% during the forecast period

- The market growth is largely fueled by the rising demand for connected vehicles, increasing adoption of IoT in the automotive sector, and continuous technological advancements in telematics solutions

- Growing demand for in-vehicle experiences and interactive features, along with increasing affordability of telematics features, are further propelling the demand for automotive telematics solutions

Automotive Telematics Market Analysis

- The automotive telematics market is witnessing rapid growth as more consumers and commercial entities prioritize vehicle connectivity, safety, and efficiency features

- Growing demand from both passenger car and commercial vehicle segments is encouraging manufacturers to innovate with advanced telematics solutions, including AI and cloud integration

- Asia-Pacific dominates the global automotive telematics market with the largest revenue share of 57.37% in 2024, driven by fast technology adoption, expanding telecommunication infrastructure, and aggressive connected vehicle services implementation

- North America is expected to witness significant growth of 20.6% from 2025 to 2032, driven by high adoption rates of advanced telematics systems, particularly in transportation, logistics, and government industries

- The passenger car segment dominated the market revenue share of 75.5% in 2024, owing to higher production volumes and stronger consumer demand for connectivity features in personal vehicles

Report Scope and Automotive Telematics Market Segmentation

|

Attributes |

Automotive Telematics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automotive Telematics Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The automotive telematics market is witnessing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into vehicle performance, driver behavior, and predictive maintenance needs

- AI-powered telematics solutions allow for more proactive problem-solving, identifying potential issues before they lead to costly repairs or vehicle downtime

- For instance, several companies are developing AI-driven platforms that analyze driving patterns to offer personalized insurance premiums or optimize fleet routes based on real-time traffic and weather conditions

- This trend is enhancing the value proposition of telematics systems, making them more attractive to both individual consumers and fleet operators

- AI algorithms can analyze a vast array of driver behaviors, including speeding, harsh braking, rapid acceleration, sudden turns, and even distracted driving

Automotive Telematics Market Dynamics

Driver

“Rising Demand for Connected Vehicles and Advanced Safety Features”

- The increasing consumer demand for connected car services, such as real-time navigation, remote diagnostics, and entertainment, is a major driver for the automotive telematics market

- Telematics systems enhance vehicle safety by providing features such as automatic crash notification, emergency roadside assistance, and stolen vehicle recovery

- Government mandates, particularly in regions such as Europe with the system, are also contributing to the widespread adoption of telematics

- The proliferation of IoT and the development of 5G technology are further enabling the expansion of telematics applications, offering faster data transmission and lower latency for more sophisticated in-vehicle services

- Automakers are increasingly offering factory-fitted telematics systems as standard or optional features to meet consumer expectations and enhance vehicle value

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The substantial initial investment required for hardware, software, and integration of telematics systems can be a significant barrier to adoption for many consumers and companies, especially in emerging markets

- Integrating telematics devices into existing vehicles can be complex and costly

- Additionally, data security and privacy concerns pose a major challenge. Telematics systems collect and transmit vast amounts of sensitive vehicle and driver data, raising concerns about potential breaches, misuse of information, and compliance with data protection regulations

- The fragmented regulatory landscape across different countries regarding data collection, storage, and usage further complicates operations for international manufacturers and service providers

- These factors can deter potential buyers and limit market expansion, particularly in regions where awareness of data privacy is high or where cost sensitivity is a significant factor

Automotive Telematics Market Scope

The market is segmented on the basis on-highway vehicle services, on-highway vehicle form factor, off-highway vehicle services, off-highway vehicles technology, hardware, and vehicle.

- By On-Highway Vehicle Services

On the basis of on-highway vehicle services, the automotive telematics market is segmented into emergency calling, navigation and infotainment, on-road assistance, remote diagnostics, and vehicle tracking/recovery. The fleet management segment (aligned with vehicle tracking/recovery) holds the largest market revenue share of 35% in 2023, driven by its widespread use in commercial vehicles for GPS tracking, driver behaviour analysis, and fuel management.

The navigation and infotainment segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for real-time navigation and immersive in-car entertainment. Advancements in connectivity and AI-powered interfaces further accelerate adoption, enhancing user experience and convenience.

- By On-Highway Vehicle Form Factor

On the basis of on-highway vehicle form factor, the automotive telematics market is segmented into embedded telematics solutions, integrated telematics solutions, and tethered telematics solutions. The embedded telematics solutions segment is expected to hold the largest market revenue share of 66.5% in 2024, primarily driven by their seamless integration during vehicle manufacturing, offering robust and reliable connectivity. OEMs are increasingly incorporating embedded telematics as standard features due to regulatory requirements and rising consumer demand for connected car services.

The tethered telematics solutions segment is expected to witness the fastest growth rate of 17.9% from 2025 to 2032 driven by seamless phone integration with Wi-Fi and Bluetooth for navigation. Rising demand for connected cars and telematics software enhances safety by preventing potential car crashes.

- By Off-Highway Vehicle Services

On the basis of off-highway vehicle services, the automotive telematics market is segmented into fuel management, location/usage tracking, maintenance and repair, navigation, diagnostics, and other services. The location/usage tracking segment is expected to hold the largest market revenue share of 43.5% in 2024, driven by the critical need for real-time monitoring of off-highway equipment for optimal fleet management, asset utilization, and theft prevention across industries such as construction, mining, and agriculture.

The maintenance and repair segment is anticipated to experience robust growth from 2025 to 2032. As off-highway vehicles are high-value assets operating in demanding environments, proactive maintenance driven by telematics diagnostics and usage data is crucial for maximizing uptime and minimizing costly breakdowns.

- By Off-Highway Vehicles Technology

On the basis of off-highway vehicles technology, the automotive telematics market is segmented into cellular technology and satellite technology. The cellular technology segment is expected to hold the largest market revenue share of 61.5% in 2024, owing to its widespread coverage in diverse operating environments, enabling reliable communication and data transmission for off-highway vehicles. Its seamless integration with the IoT ecosystem also supports comprehensive telematics solutions.

The satellite technology is anticipated to witness significant growth from 2025 to 2032, particularly for operations in remote areas where cellular coverage is unreliable or non-existent. Its global reach ensures continuous connectivity, which is vital for monitoring and managing off-highway assets in diverse and isolated locations.

- By Hardware

On the basis of hardware, the automotive telematics market is segmented into infotainment display unit and telematics solutions control unit. The Telematics Solutions Control Unit segment is expected to hold the largest market revenue share of 56.5% in 2024, driven by its crucial role as the central processing unit for telematics systems, enabling data collection, processing, and communication for various services such as GPS tracking, remote diagnostics, and emergency calling.

The Infotainment Display Unit segment is expected to witness the fastest growth from 2025 to 2032. This is driven by the increasing consumer demand for a rich in-car experience, with large, interactive displays integrating navigation, media, connectivity, and vehicle information. The convergence of telematics data with user-friendly interfaces on infotainment units is enhancing usability and adoption.

- By Vehicle

On the basis of vehicle, the automotive telematics market is segmented into passenger car and commercial vehicles. The Passenger Car segment dominated the market revenue share of 75.5% in 2024, owing to the high volume of passenger vehicles worldwide and consumer focus on comfort, safety, and aesthetics. Passenger cars benefit from both aftermarket telematics installations and factory-installed systems by manufacturers aiming to enhance vehicle value.

The commercial vehicle segment is anticipated to witness rapid growth of 19.6% from 2025 to 2032, fueled by fueled by increasing adoption of automotive telematics in long-distance trucks for location tracking, vehicle diagnostics, and speed monitoring. Enhanced data analytics aids insurers in evaluating driver behaviour and efficiency.

Automotive Telematics Market Regional Analysis

- Asia-Pacific dominates the global automotive telematics market with the largest revenue share of 57.37% in 2024, driven by fast technology adoption, expanding telecommunication infrastructure, and aggressive connected vehicle services implementation

- Consumers and businesses in the region highly value the safety features, convenience, and operational efficiencies offered by telematics solutions, including emergency services, fleet optimization, and usage-based insurance

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and government initiatives promoting vehicle safety and intelligent transportation systems, establishing telematics as a favored solution across passenger and commercial vehicle segments

U.S. Automotive Telematics Market Insight

The U.S. is expected to witness the fastest growth rate in the North America automotive telematics market, fueled by strong aftermarket demand and growing consumer awareness of enhanced safety, navigation, and convenience benefits. The trend towards vehicle connectivity and increasing regulations promoting safer driving further boost market expansion. Automakers’ growing incorporation of factory-fitted telematics systems complements aftermarket sales, creating a diverse product ecosystem.

Europe Automotive Telematics Market Insight

The Europe automotive telematics market is expected to witness significant growth, supported by regulatory emphasis on vehicle safety and comfort, particularly the eCall mandate. Consumers seek telematics solutions that improve driving visibility, offer thermal insulation, and provide seamless connectivity. The growth is prominent in both new vehicle installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban traffic conditions.

U.K. Automotive Telematics Market Insight

The U.K. market for automotive telematics is expected to witness a healthy growth rate, driven by demand for improved passenger comfort, enhanced safety features, and fleet management solutions in urban and suburban settings. Increased interest in vehicle connectivity and rising awareness of benefits such as stolen vehicle recovery and remote diagnostics encourage adoption. In addition, evolving vehicle safety regulations influence consumer choices, balancing features with compliance.

Germany Automotive Telematics Market Insight

Germany is expected to witness significant growth in automotive telematics, attributed to its advanced automotive manufacturing sector and high consumer focus on vehicle comfort, energy efficiency, and technological innovation. German consumers prefer technologically advanced telematics systems that reduce cabin heat, contribute to lower fuel consumption through optimized routing, and provide advanced safety features. The integration of these systems in premium vehicles and robust aftermarket options supports sustained market growth.

Asia-Pacific Automotive Telematics Market Insight

The Asia-Pacific region is expected to dominate the market revenue share of 57.37 in 2024, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of safety, efficiency, and connectivity benefits is boosting demand. Government initiatives promoting smart cities and intelligent transportation systems further encourage the use of advanced telematics solutions.

Japan Automotive Telematics Market Insight

Japan’s automotive telematics market is expected to witness robust growth due to strong consumer preference for high-quality, technologically advanced telematics solutions that enhance driving comfort, safety, and connectivity. The presence of major automotive manufacturers and integration of telematics systems in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization and connected car services also contributes to growth.

China Automotive Telematics Market Insight

The China holds the largest share of the Asia-Pacific automotive telematics market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for connected and intelligent vehicle solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced telematics systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automotive Telematics Market Share

The automotive telematics industry is primarily led by well-established companies, including:

- Verizon (U.S.)

- Marelli Holdings Co., Ltd. (Italy)

- Intel Corporation (U.S.)

- MiX (South Africa)

- Robert Bosch GmbH (Germany)

- HARMAN International (U.S.)

- TomTom International BV (Netherlands)

- Masternaut Limited (U.K.)

- Visteon Corporation (U.S.)

- Teletrac Navman US Ltd (U.S.)

- Trimble Inc. (U.S.)

- Omnitracs (U.S.)

- Continental AG (Germany)

- Bridgestone Corporation (Japan)

- Delphi Technologies (U.K.)

Latest Developments in Global Automotive Telematics Market

-

In February 2025, Avery Dennison introduced its Encore Series automotive film portfolio, featuring three key variants: Encore Supreme, Encore Supreme IR, and Encore. These films offer superior heat rejection, glare reduction, and block over 99% of harmful UV rays, while also providing enhanced privacy and a durable, color-stable finish. The new product line addresses growing consumer demands for both comfort and aesthetics in vehicle tinting. By broadening its portfolio, Avery Dennison strengthens its competitive edge in the global automotive tinting market. This launch is expected to boost adoption rates in regions with high solar exposure, improving driver and passenger experience

- In February 2025, Luminous unveiled its Carbon Window Film in the MENA region via Al-Rabiya Auto Accessories. This innovative tint offers high durability, effective heat rejection, and robust UV protection, combined with an attractive aesthetic finish that appeals to style-conscious consumers. The product targets the growing demand for advanced window films in hot climates, where temperature control and sun protection are critical. By expanding its product range with Carbon Window Film, Luminous aims to capture a larger share of the Middle East and Africa automotive tinting market, reinforcing its regional presence and reputation for quality

- In January 2024, at CES 2024, Continental AG and Google Cloud unveiled a generative AI voice assistant integrated into Continental’s Smart Cockpit High-Performance Computer (HPC). This innovation enables natural, intuitive interactions between users and assistants, enhancing conversational navigation, driver personalization, and in-car control. Drivers can ask detailed vehicle-related questions, explore places of interest, and engage in dynamic conversations for a more immersive travel experience. The system leverages advanced AI to create a seamless and intelligent interface, improving convenience and connectivity in modern vehicles

- In August 2023, Solar Art completed the acquisition of Layr, a rapidly expanding window film company serving commercial customers in New York City. This move significantly strengthens Solar Art’s presence on the East Coast and enhances its operational infrastructure in a key commercial market. The acquisition enables Solar Art to offer a wider range of products and services, boosting its ability to meet diverse client needs. This strategic expansion supports Solar Art’s long-term growth ambitions by leveraging Layr’s established customer base and market expertise, positioning the company as a leading player in commercial automotive tinting solutions

- In May 2023, ZF Friedrichshafen AG unveiled its AxTrax 2 electric axle platform, engineered for commercial vehicle electrification. This modular e-powertrain system integrates braking, ADAS, and automated driving functions, ensuring seamless synchronization. The AxTrax 2 also enables efficient communication and data sharing via telematics systems and CAN bus connectivity. Designed to replace conventional powertrains, it enhances vehicle efficiency, performance, and sustainability. The platform supports zero-emission mobility, reinforcing ZF’s commitment to advanced transportation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Telematics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Telematics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Telematics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.