Global Automotive Third Party Logistics Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.88 Billion

2024

2032

USD

1.16 Billion

USD

1.88 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.88 Billion | |

|

|

|

|

Global Automotive Third Party Logistics Market Analysis

The global automotive third-party logistics (3PL) market is growing rapidly, driven by increasing demand for efficient supply chain solutions in the automotive industry. As manufacturers and suppliers seek to streamline operations, 3PL providers are offering specialized services such as warehousing, transportation, and value-added logistics to optimize the movement of automotive components and finished vehicles. This market is influenced by trends such as globalization, e-commerce growth, and the rising adoption of electric vehicles (EVs), which require complex logistics solutions. Recent developments include the integration of advanced technologies such as IoT, AI, and blockchain for enhanced tracking, automation, and transparency. For instance, partnerships between logistics firms and automotive manufacturers are focusing on reducing delivery times and costs. The market also benefits from regional trade agreements and infrastructure improvements, particularly in emerging economies. With these advancements, the automotive 3PL market is poised for sustained growth, supporting the evolving needs of the automotive sector.

Global Automotive Third Party Logistics Market Size

The global automotive third party logistics market size was valued at USD 1.16 billion in 2024 and is projected to reach USD 1.88 billion by 2032, with a CAGR of 6.20% during the forecast period of 206.20 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Global Automotive Third Party Logistics Market Trends

“Integration of IOT-Enabled Tracking Systems”

The global automotive third-party logistics (3PL) market is evolving rapidly, fueled by innovation and changing industry demands. As automotive supply chains become more complex, 3PL providers are leveraging advanced technologies to improve efficiency and transparency. Innovations such as AI-powered route optimization, IoT-enabled tracking systems, and blockchain for secure data sharing are reshaping logistics operations. A prominent trend is the growing integration of green logistics, as companies focus on reducing carbon footprints through electric fleets, sustainable packaging, and optimized transportation routes. This shift aligns with the automotive industry's push toward sustainability, particularly with the rise of electric vehicles (EVs). Overall, these advancements enhance service offerings, address environmental concerns, and position 3PL providers as key enablers of supply chain transformation.

Report Scope and Global Automotive Third Party Logistics Market Segmentation

|

Attributes |

Global Automotive Third Party Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Agility (Kuwait), PSA International Pte. Ltd. (Singapore), C.H. Robinson Worldwide, Inc. (U.S.), CEVA Logistics (France), DB SCHENKER (Germany), DSV (Denmark), DHL Group (Deutsche Post AG) (Germany), Expeditors International of Washington, Inc. (U.S.), FedEx (U.S.), Flexport Inc. (U.S.), J.B. Hunt Transport, Inc. (U.S.), KERRY LOGISTICS NETWORK LIMITED (Hong Kong), Kuehne+Nagel (Switzerland), LANDSTAR SYSTEM, INC. (U.S.), NIPPON EXPRESS HOLDINGS (Japan), GEODIS (France), Ryder System, Inc. (U.S.), Schneider National, Inc. (U.S.), United Parcel Service of America, Inc. (U.S.), XPO, Inc. (U.S.), YUSEN LOGISTICS CO., LTD. (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Automotive Third Party Logistics Market Definition

The global automotive third-party logistics (3PL) market refers to the outsourcing of logistics and supply chain management functions by automotive manufacturers and suppliers to specialized third-party service providers. These 3PL providers handle a range of activities, including transportation, warehousing, distribution, inventory management, and customs clearance, enabling automotive companies to streamline operations, reduce costs, and focus on core competencies. By leveraging advanced technologies and industry expertise, 3PL services ensure efficient movement and management of automotive parts, components, and finished vehicles across global supply chains.

Global Automotive Third Party Logistics Market Dynamics

Drivers

- Increasing Vehicle Production and Sales

The steady growth in global automotive production and sales has significantly increased the complexity of supply chains, driving the need for efficient third-party logistics (3PL) solutions. As manufacturers scale operations to meet rising consumer demand, they face challenges in managing procurement, transportation, and distribution of components and finished vehicles. 3PL providers offer expertise in streamlining these processes, ensuring timely deliveries and cost-efficient operations. In addition, the globalization of the automotive industry, with components sourced from diverse regions, further emphasizes the importance of reliable logistics solutions. This growing reliance on 3PL services highlights their critical role in sustaining the industry's dynamic growth.

- Expansion of Electric Vehicles (EVs)

The rapid expansion of the electric vehicle (EV) market has created a demand for specialized logistics solutions, particularly for the handling, storage, and transportation of EV batteries. These batteries require careful management due to their weight, size, and hazardous nature, necessitating adherence to strict safety and regulatory standards. Third-party logistics (3PL) providers are uniquely positioned to meet these requirements with their expertise and infrastructure, ensuring safe and efficient transportation. As EV manufacturers scale production and expand globally, the demand for 3PL services tailored to this niche continues to grow, driving their adoption and establishing them as vital players in the EV supply chain.

Opportunities

- Customization and Value-Added Services

The increasing demand for tailored logistics solutions presents a significant growth opportunity for third-party logistics (3PL) providers. Consumers and businesses alike are seeking customized services that can address unique supply chain challenges, including reverse logistics and last-mile delivery. Reverse logistics, which involves the return of goods from the consumer back to the manufacturer, is becoming more critical as e-commerce grows. Similarly, last-mile delivery solutions, which ensure timely and cost-effective delivery to the end consumer, are highly sought after. By offering these specialized services, 3PL providers can differentiate themselves in a competitive market and capture a larger share of the growing demand.

- Growth in Emerging Markets

Rapid industrialization and the growing automotive production in regions such as Asia-Pacific, Africa, and Latin America offer substantial opportunities for third-party logistics (3PL) providers. As these regions continue to develop their manufacturing capabilities, the demand for efficient logistics services to manage the transportation, warehousing, and distribution of automotive parts and finished vehicles is increasing. This growth creates a need for reliable and scalable logistics solutions that can handle complex supply chains and high volumes of goods. By establishing a strong presence in these emerging markets, 3PL providers can capitalize on the expanding automotive sector, positioning themselves for long-term growth.

Restraints/Challenges

- Labor Shortages and Skills Gap

The logistics industry is currently facing a significant shortage of skilled labor, particularly in critical areas such as supply chain management and technology integration. This gap in qualified workers is a major challenge for third-party logistics (3PL) providers, as it limits their capacity to efficiently manage the complex logistics demands of the automotive sector. As automotive production and sales increase, the need for advanced logistics solutions grows, making it essential for 3PL companies to have a well-trained workforce. The shortage of skilled professionals can lead to delays, inefficiencies, and reduced service quality, hindering the ability of providers to meet market demands.

- Rising Fuel and Transportation Costs

Volatile fuel prices and rising transportation costs are major constraints in the logistics industry, directly impacting the cost-efficiency of operations. For 3PL providers in the automotive sector, fluctuating fuel prices can significantly increase the cost of delivery and transportation, making it challenging to maintain profitability. As automotive companies push for cost reductions, 3PL providers are under pressure to offer competitive pricing while managing these unpredictable costs. This balance between keeping expenses low and maintaining high-quality services presents a significant restraint, as providers must continuously adapt to changing market conditions to remain competitive and profitable.

Global Automotive Third Party Logistics Market Scope

The market is segmented on the basis of transport and services. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Transport

- Roadways

- Railways

- Waterways

- Airways

Services

- Dedicated Contract Carriage (DCC) / Freight Forwarding

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Distribution

- Value-Added Logistics Services

Global Automotive Third Party Logistics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, transport, and services as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

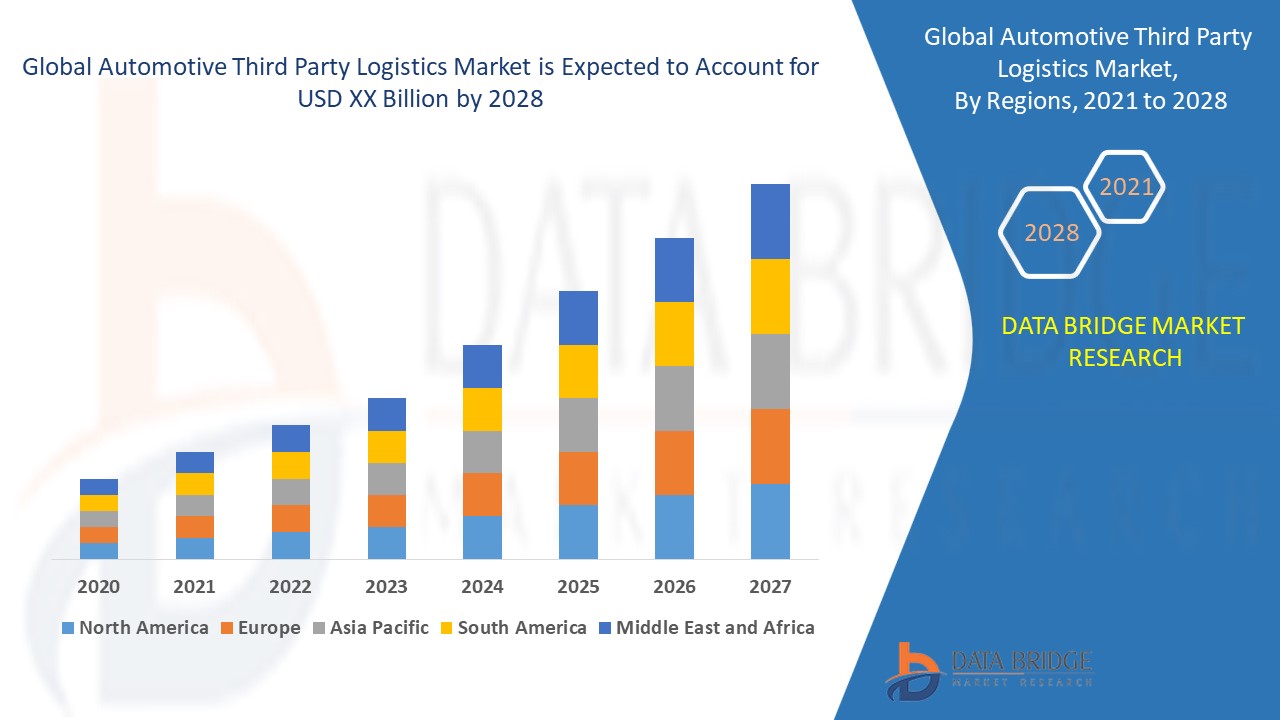

North America dominates the automotive third-party logistics market, driven by the presence of major industry players and advanced shipping services. The region benefits from a well-established logistics infrastructure and strong demand for efficient supply chain solutions. These factors contribute to North America's dominant position in the global automotive logistics sector.

Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) from 2025 to 2032, fueled by expanding trans-regional trade routes and logistics gateways. The strategic shift in the automotive sector across developing nations in the region is further boosting market growth. These factors position Asia-Pacific as a key player in the global automotive third-party logistics market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Automotive Third Party Logistics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Automotive Third Party Logistics Market Leaders Operating in the Market Are:

- Agility (Kuwait)

- PSA International Pte. Ltd. (Singapore)

- C.H. Robinson Worldwide, Inc. (U.S.)

- CEVA Logistics (France)

- DB SCHENKER (Germany)

- DSV (Denmark)

- DHL Group (Deutsche Post AG) (Germany)

- Expeditors International of Washington, Inc. (U.S.)

- FedEx (U.S.)

- Flexport Inc. (U.S.)

- J.B. Hunt Transport, Inc. (U.S.)

- KERRY LOGISTICS NETWORK LIMITED (Hong Kong)

- Kuehne+Nagel (Switzerland)

- LANDSTAR SYSTEM, INC. (U.S.)

- NIPPON EXPRESS HOLDINGS (Japan)

- GEODIS (France)

- Ryder System, Inc. (U.S.)

- Schneider National, Inc. (U.S.)

- United Parcel Service of America, Inc. (U.S.)

- XPO, Inc. (U.S.)

- YUSEN LOGISTICS CO., LTD. (Japan)

Latest Developments in Global Automotive Third Party Logistics Market

- In January 2023, CEVA Logistics, part of the CMA CGM group, completed the acquisition of GEFCO. Following the merger, CEVA announced the establishment of a dedicated finished vehicle logistics division to enhance its services. This strategic move aims to strengthen its position in the automotive logistics sector

- In December 2023, Yusen Logistics Co. Ltd. formed a strategic partnership with Pickle Robot Company, specializing in AI and robotic automation. The collaboration began with the deployment of Pickle Unload solutions at Yusen's Long Beach, California trans-loading operation. This partnership aims to reduce physical labor for employees, improve service reliability, and demonstrate Yusen's commitment to advancing robotics technology to enhance warehouse operations and customer service

- In September 2023, C.H. Robinson Worldwide, Inc. unveiled a new 400,000 sq. ft. warehouse, featuring 154 dock doors and space for up to 700 trailers. This expansion strengthens the company's trade operations along the Mexico border, enhancing its ability to diversify supply chains. The new facility also supports efficient logistics and transportation at The Port of Laredo.

- In June 2023, Honor Foods, a subsidiary of Burris Logistics, acquired Sunny Morning Foods, a prominent dairy brand and foodservice redistributor in Florida. This strategic acquisition strengthened Honor Foods' position in the dairy industry and expanded its supply chain capabilities. It also enabled the company to extend its operations into the Southeast U.S., South America, and the Caribbean, enhancing its market competitiveness

- In October 2022, Red Arts Capital announced that its portfolio company, Partners Warehouse, completed the acquisition of FLEX Logistics, a 3PL provider based in Southern California. This acquisition is part of Red Arts Capital’s strategy to expand its supply chain and logistics portfolio. FLEX Logistics’ expertise in warehouse management will enable clients to streamline their operations, focusing on core strategies while improving efficiency and cost-effectiveness for West Coast warehousing and distribution

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.