Global Automotive Transmission Engineering Services Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

14.24 Billion

USD

22.62 Billion

2022

2030

USD

14.24 Billion

USD

22.62 Billion

2022

2030

| 2023 –2030 | |

| USD 14.24 Billion | |

| USD 22.62 Billion | |

|

|

|

|

Automotive Transmission Engineering Services Outsourcing Market Analysis and Size

The automotive industry is changing significantly due to automakers implementing automation technologies. The need for outsourcing services is expanding as businesses vouch for the benefits of cutting-edge technologies. The governments of many nations are luring automakers with incentives and tax breaks for producing cars that strictly comply with carbon emission standards and ordering automakers to produce environmentally friendly vehicles as a result of growing environmental awareness. Therefore, the automotive transmission engineering services outsourcing market has a lucrative future ahead of it.

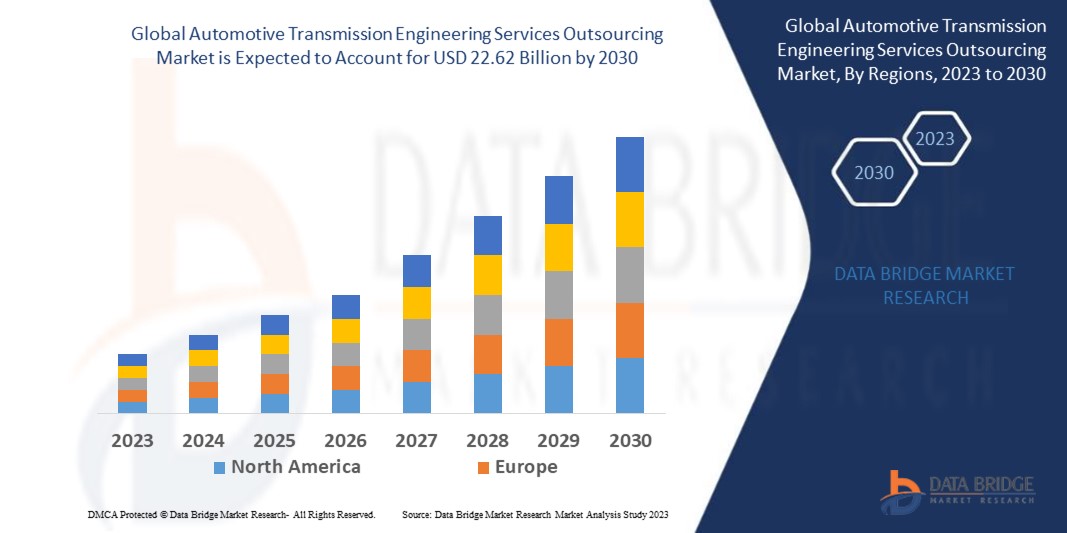

Data Bridge Market Research analyses that the automotive transmission engineering services outsourcing market, valued at USD 14.24 billion in 2022, will reach USD 22.62 billion by 2030, growing at a CAGR of 5.95% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis

Automotive Transmission Engineering Services Outsourcing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Transmission Type (Manual Transmission, Automatic Transmission), Powertrain Type (Hybrid Powertrain, Conventional Powertrain), Services (Designing, Prototyping, Testing, System Engineering and integration, Simulation) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

FEV Europe GmbH (Germany), AVL (Austria), IAV (Germany), Magna International Inc. (Canada), Smart Manufacturing Technology Ltd. (U.K.), Marelli Holdings Co., Ltd. (Italy), Horiba, Ltd (Japan), Porsche Engineering (Germany), Altair Engineering Inc. (U.S.), EDAG Group (Germany), Intertek Group plc (U.K.), TATA Consultancy Services Limited (India), AISIN CORPORATION (Japan) |

|

Market Opportunities |

|

Market Definition

Automotive transmission engineering is an important process in the production of automobiles. Automotive transmission in a vehicle ensures that power flows from the engine to the wheels, allowing the vehicle to move. Manual and automatic transmissions are the two major types of automotive transmission used. Designing, prototyping, testing, system engineering and integration, simulation, and designing are the main service categories for outsourcing automotive transmission engineering services.

Automotive Transmission Engineering Services Outsourcing Market Dynamics

Drivers

- Growing demand for hybrid has positively impacted the market growth

A hybrid electric vehicle (HEV) is a class of vehicle that combines an electric propulsion system with an internal combustion engine (ICE) drivetrain. The electric powertrain presence aims to either produce better performance or better fuel economy than a conventional vehicle. The advantage of a hybrid vehicle over a gasoline-powered vehicle is driving up the global demand for electric automotive vehicles and automotive transmission engineering services. Through their environmental friendliness, the growing demand for hybrid vehicles drives the market for outsourcing automotive transmission engineering services. Companies adopting new technological developments also create a significant growth opportunity in outsourcing automotive transmission engineering services.

- The growing popularity of outsourcing automotive services will boost the market growth

In the long term, engineering firms are rapidly shifting to outsourcing to save money, increase efficiency, or increase competence. Companies outsource engineering services for various reasons, including the need for quick delivery, flexibility, a lack of in-house specialists, and a limited budget. Furthermore, rising demand for electric vehicles, as well as increased adoption of electric vehicles, autonomous vehicle innovative technologies such as ADAS for vehicle and passenger safety, and lightweight vehicles are key factors that will drive market growth in the coming years.

Opportunities

- Tax breaks and subsidies for auto engineers to encourage the growth of the automotive industry

The governments of numerous nations are luring automakers with subsidies and tax breaks in exchange for creating vehicles that strictly comply with carbon emission standards. Through this factor, the market for outsourcing automotive transmission engineering services and demand for hybrid vehicles is growing. Hybrids, which combine the advantages of high fuel efficiency and low emissions, provide better power and fuel efficiency when compared to conventional vehicles. Automakers are focusing on creating fuel-efficient and environmentally friendly vehicles, which will fuel the expansion of the market for outsourcing automotive transmission engineering services.

Restraints/Challenges

- Automakers are skeptical of the production of hybrid vehicles due to their high cost

With the high cost of research and development, consumers cannot afford cars, and many countries do not have access to hybrid vehicles. The high costs impact outsourcing hybrid automotive transmission engineering services, preventing market expansion. The company's manufacturing and R&D costs are extremely high compared to conventional vehicle manufacturing. Vehicles become expensive and harder to afford due to the high manufacturing and development costs passed on to the consumer.

This automotive transmission engineering services outsourcing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. to gain more info on the automotive transmission engineering services outsourcing market contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2022, for quick and dependable development, manufacture, and service in industries requiring highly specialized debugging and visualization mechanisms for development and post-production product maintenance, Altair Engineering Inc. acquired Concept Engineering. Concept Engineering offers advanced visualization of electrical circuits, wire harnesses, and components. Automotive, aerospace and other sectors are among them.

Global Automotive Transmission Engineering Services Outsourcing Market Scope

The automotive transmission engineering services outsourcing market is segmented on the basis of transmission type, powertrain type, and service. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Transmission Type

- Manual Transmission

- Automatic Transmission

Powertrain Type

- Hybrid Powertrain

- Conventional Powertrain

Services

- Designing

- Prototyping

- Testing

- System Engineering & Integration

- Simulation

Automotive Transmission Engineering Services Outsourcing Market Regional Analysis/Insights

The automotive transmission engineering services outsourcing market is analysed and market size insights and trends are provided by country transmission type, powertrain type, and service as referenced above.

The countries covered in the automotive transmission engineering services outsourcing market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the market and will continue to flourish its trend of dominance during the forecast period. The major factors attributable to the region's dominance are the availability of low-cost labor, growing demand for fuel-efficient vehicles, and strict government regulations governing the production of low-emission vehicles.

North America will undergo the highest growth rate during the forecast period owing to the high demand from developing economies such as Canada and U.S. and the prevalence of advanced infrastructure for technological developments in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Automotive Transmission Engineering Services Outsourcing Market Share Analysis

The automotive transmission engineering services outsourcing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to automotive transmission engineering services outsourcing market.

Some of the major players operating in the automotive transmission engineering services outsourcing market are:

- FEV Europe GmbH (Germany)

- AVL (Austria)

- IAV (Germany)

- Magna International Inc (Canada)

- Smart Manufacturing Technology Ltd. (U.K.)

- Marelli Holdings Co., Ltd. (Italy)

- Horiba, Ltd (Japan)

- Porsche Engineering (Germany)

- Altair Engineering Inc. (U.S.)

- EDAG Group (Germany)

- Intertek Group plc (U.K.)

- TATA Consultancy Services Limited (India)

- AISIN CORPORATION (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 PRICING ANALYSIS

6 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY TRANSMISSION TYPE

6.1 OVERVIEW

6.2 MANUAL TRANSMISSION

6.3 AUTOMATIC TRANSMISSION

7 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY POWERTRAIN TYPE

7.1 OVERVIEW

7.2 HYBRID POWERTRAIN

7.3 CONVENTIONAL POWERTRAIN

8 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY PROPULSION TYPE

8.1 OVERVIEW

8.2 INTERNAL COMBUSTION ENGINE (ICE)

8.3 ELECTRIC ENGINE

8.3.1 BATTERY ELECTRIC VEHICLES (BEV)

8.3.2 HYBRID ELECTRIC VEHICLES (HEV)

8.3.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

8.3.4 FUEL-CELL ELECTRIC VEHICLES (FCEV)

9 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY SERVICES

9.1 OVERVIEW

9.2 DESIGNING

9.3 PROTOTYPING & HOMOLOGATION

9.4 TESTING

9.5 SYSTEM ENGINEERING & INTEGRATION

9.6 SIMULATION

9.7 DURABILITY & LIGHTWEIGHTING

9.8 OTHERS

10 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 PASSENGER CARS, BY TYPE

10.2.1.1. SEDAN

10.2.1.2. SUV

10.2.1.3. MVP

10.2.1.4. HATCHBACK

10.2.1.5. COUPE

10.2.1.6. SPORTS CAR

10.2.1.7. CROSSOVER

10.2.1.8. CONVERTIBLE

10.2.1.9. OTHERS

10.3 COMMERCIAL VEHICLES

10.3.1 COMMERCIAL VEHICLES, BY TYPE

10.3.1.1. LIGHT COMMERCIAL VEHICLES (LCV)

10.3.1.1.1. VANS

10.3.1.1.1.1 PASSENGER VANS

10.3.1.1.1.2 CARGO VANS

10.3.1.1.2. COACHES

10.3.1.1.3. PICK UP TRUCKS

10.3.1.1.4. OTHERS

10.3.1.2. HEAVY COMMERCIAL VEHICLES

10.3.1.2.1. TRUCKS

10.3.1.2.1.1 DUMP TRUCKS

10.3.1.2.1.2 TOW TRUCKS

10.3.1.2.1.3 CEMENT TRUCKS

10.3.1.2.1.4 OTHERS

10.3.1.2.2. BUSES

10.3.1.2.3. OTHERS

10.4 OFF-HIGHWAY

10.5 OTHERS

11 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, BY GEOGRAPHY

GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 NETHERLANDS

11.2.10 NORWAY

11.2.11 FINLAND

11.2.12 SWITZERLAND

11.2.13 DENMARK

11.2.14 SWEDEN

11.2.15 POLAND

11.2.16 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA

11.3.6 NEW ZEALAND

11.3.7 SINGAPORE

11.3.8 THAILAND

11.3.9 MALAYSIA

11.3.10 INDONESIA

11.3.11 PHILIPPINES

11.3.12 TAIWAN

11.3.13 VIETNAM

11.3.14 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 OMAN

11.5.6 BAHRAIN

11.5.7 ISRAEL

11.5.8 KUWAIT

11.5.9 QATAR

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, SWOT & DBMR ANALYSIS

14 GLOBAL AUTOMOTIVE TRANSMISSION ENGINEERING SERVICES OUTSOURCING MARKET, COMPANY PROFILE

14.1 CAEPRO

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 AVL

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 RICARDO.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 FEV GROUP GMBH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 IAV

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 MAGNA INTERNATIONAL INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 HORIBA

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 EDAG GROUP

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 MBTECH GROUP GMBH & CO. KGAA (MEMBER OF AKKA TECHNOLOGIES)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.1 ALTEN GROUP

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 ALTAIR ENGINEERING INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENT

14.12 ROBERT BOSCH GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 RLE INTERNATIONAL GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 ASAP HOLDING GMBH

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENT

14.15 DR. ING. H.C. F. PORSCHE AG

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENT

14.16 INTERTEK GROUP PLC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.