Global Baby Clinical Nutrition Market

Market Size in USD Billion

CAGR :

%

USD

53.40 Billion

USD

85.11 Billion

2024

2032

USD

53.40 Billion

USD

85.11 Billion

2024

2032

| 2025 –2032 | |

| USD 53.40 Billion | |

| USD 85.11 Billion | |

|

|

|

|

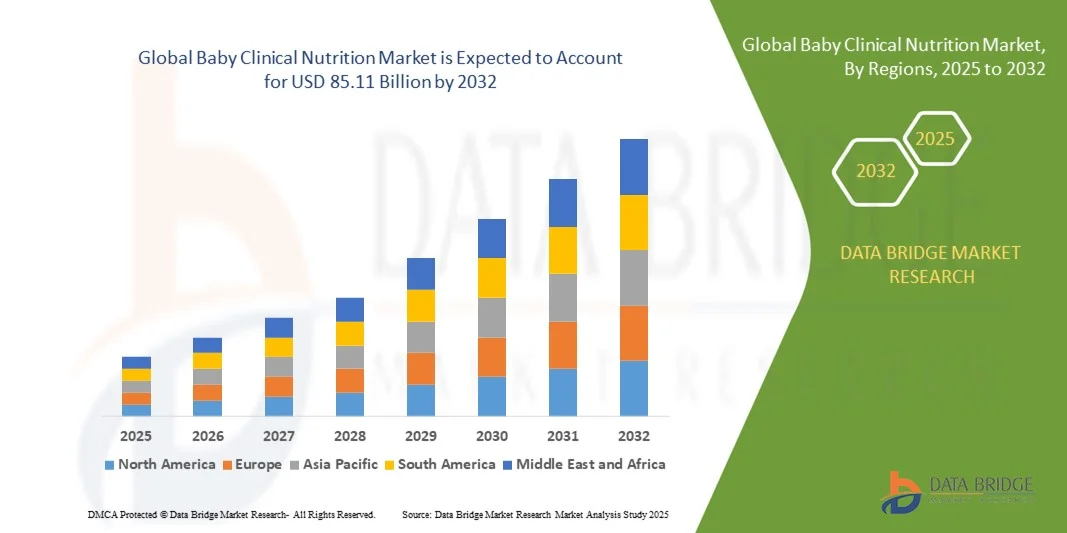

What is the Global Baby Clinical Nutrition Market Size and Growth Rate?

- The global baby clinical nutrition market size was valued at USD 53.40 billion in 2024 and is expected to reach USD 85.11 billion by 2032, at a CAGR of 6.00% during the forecast period

- The rise in developments made in the infant clinical nutrition such as providing mineral supplements along with human milk feeding, increasing protein supply and enhancing increasing protein supply and the increase in research and development activities to innovate new formula products offering potential of improving cognitive and metabolic outcomes are the major factors driving the baby clinical nutrition market

- The technological development in the nutritional screening tools for children on admission with the purpose of identifying infants who are at high risk of undernutrition coupled with those who are undernourished and the referral provided with the assistance of dietician in order to acquire complete nutritional assessment accelerate the baby clinical nutrition market growth

What are the Major Takeaways of Baby Clinical Nutrition Market?

- The growing emphasis on effective nutrition to infants and increasing researches on the neonatal care in order to improve long-term metabolic and long-term developmental outcomes and the implementation of standards made mandatory to screen all infant’s undernutrition post-birth coupled with periodic examinations also influence the baby clinical nutrition market

- In addition, the growing population, increase in birth rate, rising cases of premature births and prevalence of malnutrition in infants across the world positively affect the baby clinical nutrition market. Innovations in the baby nutrition field and screening tools and high purchasing powers in developed and developing nations extend profitable opportunities to the baby clinical nutrition market players

- Asia-Pacific dominated the baby clinical nutrition market with the largest revenue share of 41.5% in 2024, driven by the growing focus on infant health, rising disposable incomes, and increasing awareness about the importance of early-life nutrition

- The North America baby clinical nutrition market is poised to grow at the fastest CAGR of 12.7% from 2025 to 2032, driven by rising demand for personalized infant nutrition, strong healthcare spending, and growing consumer awareness about preventive healthcare

- The Oral Administration segment dominated the market with the largest revenue share of 61.3% in 2024, driven by its convenience, non-invasive nature, and suitability for a wide range of infant nutritional needs

Report Scope and Baby Clinical Nutrition Market Segmentation

|

Attributes |

Baby Clinical Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Baby Clinical Nutrition Market?

Personalized Nutrition through AI and Data-Driven Insights

- A prominent and accelerating trend in the global baby clinical nutrition market is the integration of artificial intelligence (AI) and data analytics to create personalized nutrition plans for infants based on their unique growth patterns, dietary needs, and health conditions. This innovation is transforming the traditional approach to baby nutrition by enabling precision-based dietary formulations

- For instance, Nestlé Health Science introduced AI-powered nutrition tracking tools that analyze feeding data and growth metrics to recommend tailored formulas and supplements. Similarly, Danone utilizes AI-driven insights to develop specialized clinical nutrition products aimed at infants with allergies or metabolic disorders

- AI in baby clinical nutrition helps manufacturers assess real-time data from digital feeding devices and parental input apps to predict nutritional deficiencies and optimize ingredient compositions. Companies are also leveraging machine learning algorithms to analyze large datasets of infant health records, allowing them to refine formulations that meet region-specific nutritional needs

- The growing use of digital health platforms and connected baby care devices facilitates seamless data exchange between parents, healthcare professionals, and nutrition providers. Through these tools, clinicians can remotely monitor a baby’s nutritional progress and recommend timely adjustments to feeding plans

- This trend toward personalized, data-backed baby nutrition represents a major leap in clinical nutrition innovation. By offering highly targeted and effective nutritional solutions, companies such as Abbott and Fresenius Kabi USA are setting new benchmarks in the infant healthcare ecosystem

- The demand for AI-enhanced, clinically validated nutrition products is rising rapidly across hospitals, pediatric clinics, and households, reflecting a broader consumer shift toward smart healthcare and preventive wellness in early childhood

What are the Key Drivers of Baby Clinical Nutrition Market?

- The increasing prevalence of premature births, malnutrition, and metabolic disorders among infants is a key factor driving the demand for advanced clinical nutrition products. These specialized formulations ensure optimal growth, immune development, and recovery in infants with specific medical or nutritional needs

- For instance, in May 2024, Mead Johnson & Company, LLC expanded its range of Enfamil NeuroPro Infant Formulas designed for premature and underweight babies, integrating advanced lipids and DHA to support cognitive development. Such initiatives are expected to fuel market growth in the coming years

- Growing awareness of infant health and nutrition among parents and healthcare professionals is further contributing to the market expansion. Clinical nutrition products offer superior formulations enriched with proteins, prebiotics, vitamins, and minerals that are essential for infants’ growth and immunity

- The increasing hospitalization rate of newborns and the growing number of pediatric nutrition programs are also boosting the demand for therapeutic feeding solutions. These formulations play a crucial role in neonatal intensive care units (NICUs) and pediatric wards for infants with special nutritional needs

- In addition, technological advancements in infant formula manufacturing, such as hydrolyzed proteins and human milk oligosaccharides (HMOs), are enhancing product efficacy. The growing availability of ready-to-feed and easy-digest formulas is also driving adoption among working parents seeking convenient and clinically safe nutrition options for their babies

Which Factor is Challenging the Growth of the Baby Clinical Nutrition Market?

- One of the major challenges hindering the market’s growth is the high cost of clinical-grade infant nutrition products, which limits accessibility in developing regions. These premium formulations often require advanced ingredients, stringent manufacturing standards, and regulatory compliance, resulting in elevated retail prices

- For instance, clinical nutrition formulas containing HMOs and specialized amino acid blends can be significantly more expensive than standard infant formulas, creating affordability barriers for low-income families

- Another critical concern is regulatory complexity surrounding infant nutrition labeling and product approval. Varying regional standards and lengthy approval processes can delay product launches and increase development costs for manufacturers

- In addition, limited awareness among caregivers about the benefits of clinical nutrition compared to traditional feeding methods can restrain market adoption. Misconceptions about formula safety and reliance on traditional feeding practices in rural areas continue to impede widespread acceptance

- Ensuring stringent quality control, enhancing affordability through localized manufacturing, and educating parents and healthcare providers about the advantages of clinical nutrition are essential steps toward overcoming these challenges

- Companies such as Danone and Abbott are increasingly investing in research, digital education campaigns, and regional production facilities to make clinical nutrition products more accessible and trusted worldwide, thereby ensuring sustainable market growth

How is the Baby Clinical Nutrition Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Baby Clinical Nutrition market is segmented into Oral Administration, Enteral Administration, and Intravenous Administration. The Oral Administration segment dominated the market with the largest revenue share of 61.3% in 2024, driven by its convenience, non-invasive nature, and suitability for a wide range of infant nutritional needs. This segment primarily includes powdered and liquid formulations designed for easy feeding and quick absorption, making it the preferred choice for both home and hospital use. In addition, oral administration allows precise nutrient dosing and is ideal for infants with mild deficiencies or dietary supplementation needs.

The Enteral Administration segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for clinically supervised feeding in preterm and critically ill infants. Its controlled nutrient delivery and compatibility with medical devices in neonatal intensive care units (NICUs) make it essential for clinical nutrition support.

- By Application

On the basis of application, the Baby Clinical Nutrition market is segmented into Hospital, Nursery Garden, and Others. The Hospital segment accounted for the largest market revenue share of 68.5% in 2024, attributed to the rising number of neonatal admissions, premature births, and the growing need for specialized nutrition in critical care settings. Hospitals serve as the primary end-users for clinically formulated nutrition solutions, ensuring precise nutrient intake under medical supervision. In addition, the availability of advanced feeding equipment and professional monitoring further supports the segment’s dominance.

The Nursery Garden segment is projected to register the fastest growth rate from 2025 to 2032, driven by the increasing focus on early childhood nutrition and preventive health care. Growing partnerships between nutrition brands and childcare centers are enhancing access to fortified baby foods and supplements, promoting healthier growth outcomes in infants and toddlers.

Which Region Holds the Largest Share of the Baby Clinical Nutrition Market?

- Asia-Pacific dominated the baby clinical nutrition market with the largest revenue share of 41.5% in 2024, driven by the growing focus on infant health, rising disposable incomes, and increasing awareness about the importance of early-life nutrition. Countries such as China, Japan, and India are witnessing rapid advancements in pediatric healthcare infrastructure and clinical feeding technologies, boosting market demand

- Consumers in the region are showing strong preference for scientifically formulated baby nutrition products that support growth, immunity, and cognitive development, particularly for premature or low-birth-weight infants

- In addition, the expansion of hospital networks, coupled with government-backed initiatives to combat infant malnutrition, is reinforcing Asia-Pacific’s dominance in the global market. Partnerships between global nutrition giants and local healthcare providers further ensure wide accessibility and product innovation in the region

China Baby Clinical Nutrition Market Insight

The China baby clinical nutrition market captured the largest revenue share of 43% in 2024 within Asia-Pacific, supported by the country’s massive infant population, rapid urbanization, and growing preference for premium clinical-grade nutrition products. The presence of domestic manufacturers such as Feihe International, combined with strong competition from global brands such as Nestlé Health Science and Danone, fuels continuous innovation in product formulation and delivery formats. The government’s focus on improving child health outcomes through national nutrition programs is further strengthening the market.

Japan Baby Clinical Nutrition Market Insight

The Japan baby clinical nutrition market is expanding steadily, driven by a health-conscious population and an aging demographic of caregivers seeking convenient, medically validated nutrition solutions for infants. The country’s emphasis on technological innovation has led to the development of smart feeding solutions and AI-assisted nutritional monitoring systems. High disposable incomes and strong hospital infrastructure further encourage the adoption of premium clinical nutrition products.

India Baby Clinical Nutrition Market Insight

The India baby clinical nutrition market is projected to grow rapidly during the forecast period, fueled by rising awareness about infant nutrition, increasing birth rates, and expanding healthcare facilities in both urban and semi-urban regions. Government initiatives such as POSHAN Abhiyaan, which aims to improve maternal and child nutrition, are also driving demand. The growing presence of global and regional players offering affordable yet clinically proven baby nutrition solutions is enhancing market accessibility.

Which Region is the Fastest Growing Region in the Baby Clinical Nutrition Market?

The North America baby clinical nutrition market is poised to grow at the fastest CAGR of 12.7% from 2025 to 2032, driven by rising demand for personalized infant nutrition, strong healthcare spending, and growing consumer awareness about preventive healthcare. The region’s focus on medical-grade baby formulas, fortified with DHA, probiotics, and HMOs, is creating new growth opportunities for manufacturers. In addition, advanced healthcare systems, high disposable incomes, and rapid technological integration in infant care solutions are propelling market expansion. The U.S. leads the regional growth with robust research in neonatal nutrition and increased hospital utilization of specialized feeding formulations for premature infants.

U.S. Baby Clinical Nutrition Market Insight

The U.S. baby clinical nutrition market accounted for the largest revenue share of 79% in 2024 within North America, driven by the growing adoption of scientifically formulated infant foods and increasing focus on addressing premature births. The presence of major market players such as Abbott, Mead Johnson & Company, and Nestlé Health Science ensures a continuous pipeline of innovation in clinical-grade nutrition. In addition, rising parental preference for high-quality, medical-grade nutrition and the expansion of neonatal intensive care units (NICUs) across hospitals are further supporting market growth.

Canada Baby Clinical Nutrition Market Insight

The Canada baby clinical nutrition market is projected to grow steadily during the forecast period, supported by an expanding pediatric healthcare sector and strong public awareness campaigns emphasizing early-life nutrition. The country’s regulatory environment, which encourages safety and quality in infant products, promotes consumer trust. Moreover, the increasing presence of global brands offering advanced nutrition products tailored for specific infant health conditions is expected to further stimulate market demand.

Which are the Top Companies in Baby Clinical Nutrition Market?

The baby clinical nutrition industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Baxter (U.S.)

- Danone (France)

- Fresenius Kabi USA (U.S.)

- Ingredion (U.S.)

- LAÏTA (France)

- Mead Johnson & Company, LLC (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- Nestlé Health Science (Switzerland)

- Nutricia North America (U.S.)

- B. Braun Melsungen AG (Germany)

- Claris Lifesciences Ltd. (India)

- Roquette Frères (France)

- The Menarini Group (Italy)

- AAK AB (Sweden)

- Arla Foods Ingredients Group (Denmark)

- Wyeth Nutrition (Switzerland)

- Carbery (Ireland)

What are the Recent Developments in Global Baby Clinical Nutrition Market?

- In April 2025, Abbott Laboratories introduced a new immunonutrition formula tailored for oncology patients undergoing chemotherapy, featuring a proprietary blend of arginine, omega-3 fatty acids, and nucleotides aimed at enhancing immune function during treatment. This launch reinforces Abbott’s commitment to advancing specialized nutrition solutions that address the unique needs of patients undergoing intensive therapies

- In March 2025, Nestlé Health Science completed the USD 1.2 billion acquisition of a specialized pediatric nutrition company, strengthening its portfolio in nutritional products for children with rare metabolic disorders. This strategic move underscores Nestlé’s long-term focus on expanding its expertise in clinical and pediatric nutrition across global markets

- In February 2025, Fresenius Kabi received FDA approval for its next-generation parenteral nutrition solution, which incorporates an improved lipid emulsion designed for greater stability and reduced inflammatory potential. This regulatory milestone marks a significant step forward in Fresenius Kabi’s mission to provide safer and more effective intravenous nutrition therapies

- In January 2025, Baxter International announced a USD 500 million investment to expand its clinical nutrition manufacturing facilities in the Asia-Pacific region, with a focus on meeting the growing demand in China and India. This expansion highlights Baxter’s strategic intent to strengthen its global supply network and better serve emerging healthcare markets

- In December 2024, Danone (Nutricia) launched a comprehensive digital platform for healthcare professionals to remotely monitor and manage patients on home enteral nutrition, featuring integration with electronic health records and real-time adjustment capabilities. This innovation demonstrates Danone’s commitment to advancing digital healthcare solutions that enhance patient outcomes and clinical efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Baby Clinical Nutrition Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Baby Clinical Nutrition Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Baby Clinical Nutrition Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.