Global Ballistic Protective Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.04 Billion

USD

7.56 Billion

2024

2032

USD

5.04 Billion

USD

7.56 Billion

2024

2032

| 2025 –2032 | |

| USD 5.04 Billion | |

| USD 7.56 Billion | |

|

|

|

|

What is the Global Ballistic Protective Equipment Market Size and Growth Rate?

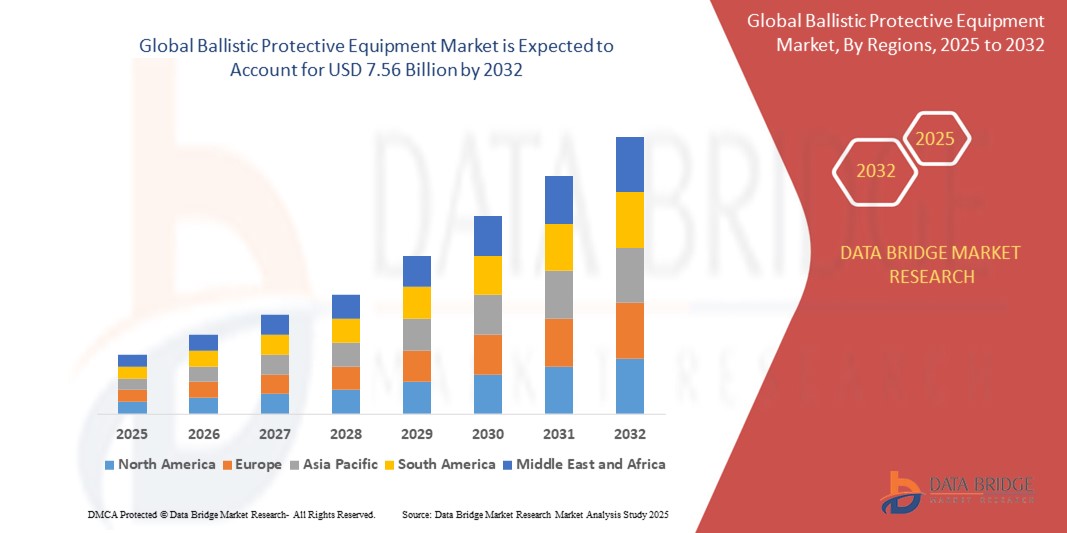

- The global ballistic protective equipment market size was valued at USD 5.04 billion in 2024 and is expected to reach USD 7.56 billion by 2032, at a CAGR of 5.20% during the forecast period

- The ballistic protective equipment market is experiencing significant growth, propelled by growing global security concerns and increasing military expenditures

- Factors such as escalating geopolitical tensions, rising crime rates, and the need for advanced protective gear in conflict zones are fueling market demand

What are the Major Takeaways of Ballistic Protective Equipment Market?

- Technological advancements, including the development of lightweight and more durable materials, are also propelling market growth

- The expansion of law enforcement agencies and security forces globally is driving the adoption of ballistic protective equipment. With a focus on innovation and product development, key market players are striving to meet the evolving demands of defense and security sectors, further contributing to market expansion

- North America dominated the ballistic protective equipment market with the largest revenue share of 38.5% in 2024, driven by increasing defense budgets, advanced protective technology development, and a strong presence of key manufacturers

- Asia-Pacific ballistic protective equipment market is projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, propelled by increased defense spending, rising geopolitical tensions, and growing awareness of personal protection across the region

- The Aramid segment dominated the market with the largest revenue share of 38.4% in 2024, driven by the superior strength, heat resistance, and lightweight properties of aramid fibers such as Kevlar, making them ideal for ballistic protection applications

Report Scope and Ballistic Protective Equipment Market Segmentation

|

Attributes |

Ballistic Protective Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Ballistic Protective Equipment Market?

“Integration of Lightweight Materials and Advanced Composite Technologies”

- A prominent and accelerating trend in the global ballistic protective equipment market is the increasing use of lightweight, high-strength materials, including ultra-high molecular weight polyethylene (UHMWPE), aramid fibers, and advanced ceramic composites to enhance protection while reducing weight and improving mobility

- Military, law enforcement, and civilian users demand protective equipment that offers both maximum ballistic resistance and enhanced comfort for extended wear, driving innovations in material science

- For instance, in 2023, BAE Systems, Plc unveiled new next-generation body armor solutions using lightweight composite plates designed to significantly reduce fatigue while maintaining high ballistic protection standards

- Manufacturers are also integrating modular designs, offering scalable protection levels based on mission requirements, along with ergonomic enhancements to improve user comfort and agility

- Companies such as Rheinmetall AG, Mehler Vario System, and MKU Limited are investing heavily in research to develop ballistic vests, helmets, and shields that meet strict international standards while minimizing weight

- This trend is fundamentally reshaping product development, with a strong focus on enhancing mobility, comfort, and survivability, ensuring that end-users have reliable, lightweight protective solutions across defense, law enforcement, and security applications

What are the Key Drivers of Ballistic Protective Equipment Market?

- Growing global security concerns, rising military modernization programs, and increasing instances of civil unrest are key drivers boosting demand for ballistic protective equipment worldwide

- For instance, in June 2023, Seyntex N.V. expanded its advanced ballistic gear offerings to cater to European defense forces, addressing the rising demand for lightweight, high-performance protective solutions

- The increasing participation of law enforcement agencies in anti-terrorism operations, urban policing, and border security activities is fueling the need for advanced ballistic helmets, body armor, and tactical gear

- Technological advancements in protective materials, offering enhanced strength-to-weight ratios, are making modern ballistic gear more effective and comfortable for users across military, police, and civilian security sectors

- The rising trend of multi-threat protection, where equipment defends against ballistic, stab, and spike threats, is gaining traction among security personnel operating in complex environments

- Moreover, with governments worldwide focusing on upgrading soldier protection systems, coupled with increasing defense budgets, the market is witnessing robust growth across North America, Europe, and Asia-Pacific

Which Factor is challenging the Growth of the Ballistic Protective Equipment Market?

- One of the primary challenges hindering the widespread adoption of ballistic protective equipment is the high cost of advanced materials and production technologies, limiting affordability for smaller defense agencies and price-sensitive regions

- For instance, while UHMWPE and ceramic composite armor offer superior protection at reduced weight, their manufacturing complexity often results in premium pricing, making it difficult for emerging economies to procure large quantities

- In addition, the bulkiness and heat retention of certain protective equipment can reduce user comfort, especially in hot climates or during prolonged operations, leading to reduced wear compliance among personnel

- Another barrier is the varying regulatory standards and testing protocols across regions, creating complexities for manufacturers aiming to supply equipment globally and increasing certification costs

- To overcome these challenges, manufacturers are focusing on scalable, cost-effective production methods, while governments are implementing procurement programs aimed at balancing affordability with high protection standards. Innovations focused on comfort, modularity, and durability will be critical to driving adoption and market expansion globally

How is the Ballistic Protective Equipment Market Segmented?

The market is segmented on the basis of raw material, product, and end-use.

- By Raw Material

On the basis of raw material, the ballistic protective equipment market is segmented into Aramid, Composites, UHMWPE, Steel, and Others. The Aramid segment dominated the market with the largest revenue share of 38.4% in 2024, driven by the superior strength, heat resistance, and lightweight properties of aramid fibers such as Kevlar, making them ideal for ballistic protection applications. Aramid-based materials offer an excellent balance of durability, flexibility, and high ballistic resistance, contributing to their extensive use across military, law enforcement, and civilian protective gear.

The UHMWPE (Ultra-High Molecular Weight Polyethylene) segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its high strength-to-weight ratio, flexibility, and increasing demand for lightweight ballistic protection. The growing emphasis on soldier mobility, comfort, and reduced fatigue is accelerating the adoption of UHMWPE in helmets, body armor, and shields globally.

- By Product

On the basis of product, the ballistic protective equipment market is segmented into Head Protection, Soft Armor, and Hard Armor. The Soft Armor segment dominated the market with the largest revenue share of 41.7% in 2024, attributed to its lightweight, flexible nature and wide adoption across law enforcement, private security, and defense sectors. Soft armor products, such as bulletproof vests and ballistic panels, provide protection against small arms threats while ensuring wearer comfort and mobility, making them the preferred choice for personnel operating in urban and covert scenarios.

The Hard Armor segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing military modernization programs, heightened global conflicts, and the need for advanced protection against high-caliber ballistic threats. Hard armor, including ballistic plates and shields, is becoming essential for high-risk military operations, border security, and riot control.

- By End-Use

On the basis of end-use, the ballistic protective equipment market is segmented into Defense, Law Enforcement & Security, and Commercial. The Defense segment accounted for the largest market revenue share of 54.2% in 2024, fueled by rising defense spending, modernization initiatives, and increasing demand for advanced protective solutions for military personnel. Governments across key regions are prioritizing soldier survivability by procuring state-of-the-art helmets, body armor, and protective gear with enhanced performance and reduced weight.

The Law Enforcement & Security segment is anticipated to register the fastest growth rate from 2025 to 2032, supported by growing internal security challenges, terrorism threats, and the rising need for protective equipment for police, paramilitary forces, and private security personnel. Enhanced protective gear for law enforcement is gaining traction, ensuring safety during critical operations and urban deployments.

Which Region Holds the Largest Share of the Ballistic Protective Equipment Market?

- North America dominated the ballistic protective equipment market with the largest revenue share of 38.5% in 2024, driven by increasing defense budgets, advanced protective technology development, and a strong presence of key manufacturers. Heightened focus on soldier survivability, law enforcement modernization, and homeland security initiatives further support market dominance across the region

- The region benefits from the widespread adoption of lightweight, high-performance ballistic protective solutions such as body armor, helmets, and shields, catering to military, law enforcement, and civilian applications. Technological advancements, including smart textiles and next-generation materials, are accelerating product innovation

- The presence of established defense contractors, coupled with government initiatives to enhance personnel protection standards, continues to reinforce North America's leadership position in the global Ballistic Protective Equipment market

U.S. Ballistic Protective Equipment Market Insight

U.S. ballistic protective equipment market accounted for the largest revenue share in 2024 within North America, fueled by ongoing military modernization programs, increasing defense spending, and strong demand for advanced protective gear across security forces. The U.S. leads in R&D for lightweight body armor, ballistic helmets, and protective equipment tailored to evolving battlefield threats. In addition, the rising need for protective solutions in law enforcement and private security is contributing to consistent market expansion.

Europe Ballistic Protective Equipment Market Insight

Europe ballistic protective equipment market is projected to expand at a steady CAGR over the forecast period, driven by stringent safety regulations, increased defense collaboration among EU nations, and growing adoption of high-performance protective equipment for both military and civilian use. Rising geopolitical tensions, coupled with advancements in smart textiles, sustainable materials, and improved ballistic resistance, are fostering market growth in countries such as Germany, France, and the U.K.

U.K. Ballistic Protective Equipment Market Insight

U.K. ballistic protective equipment market is expected to register notable growth during the forecast period, supported by increased defense procurement, modernization of police and security forces, and rising demand for lightweight, ergonomic protective gear. The U.K.'s emphasis on innovation, combined with its strong defense manufacturing sector, is accelerating the integration of advanced materials and smart fabrics into body armor and protective clothing, enhancing comfort and protection.

Germany Ballistic Protective Equipment Market Insight

Germany ballistic protective equipment market is anticipated to experience significant growth, driven by its advanced engineering expertise, strong defense industry, and increasing demand for eco-conscious, high-performance protective equipment. With a growing focus on industrial safety, homeland security, and soldier protection, the German market is embracing next-generation ballistic materials and wearable technologies, reinforcing its position as a key contributor to Europe's market expansion.

Which Region is the Fastest Growing Region in the Ballistic Protective Equipment Market?

Asia-Pacific ballistic protective equipment market is projected to grow at the fastest CAGR of 11.4% from 2025 to 2032, propelled by increased defense spending, rising geopolitical tensions, and growing awareness of personal protection across the region. Countries such as China, India, South Korea, and Australia are investing heavily in advanced protective solutions for military and law enforcement, while expanding their domestic production capabilities. The demand for lightweight, cost-effective ballistic gear is rising alongside regional security concerns.

Japan Ballistic Protective Equipment Market Insight

Japan ballistic protective equipment market is witnessing steady growth, supported by the nation's advanced materials industry, stringent safety standards, and emphasis on technological innovation in protective equipment. Japan's focus on integrating smart fabrics, ergonomic designs, and sustainable materials into defense and law enforcement applications is fostering market development. In addition, demand for high-performance protective gear in civilian sectors is contributing to expansion.

China Ballistic Protective Equipment Market Insight

China ballistic protective equipment market captured the largest revenue share within Asia-Pacific in 2024, driven by rapid military modernization, expanding domestic production, and increased adoption of protective solutions across defense, law enforcement, and commercial sectors. China's strategic focus on enhancing soldier survivability, along with government-backed R&D in next-generation ballistic materials, is accelerating market growth. The rise of local manufacturers and international partnerships is further boosting accessibility to advanced protective equipment.

Which are the Top Companies in Ballistic Protective Equipment Market?

The ballistic protective equipment industry is primarily led by well-established companies, including:

- Seyntex N.V. (Belgium)

- Honeywell International, Inc. (U.S.)

- Tencate (Netherlands)

- Rheinmetall AG (Germany)

- BAE Systems, Plc (U.K.)

- Point Blank Enterprise, Inc. (U.S.)

- Morgan Advanced Materials (U.K.)

- ArmorSource LLC (U.S.)

- Craig International Ballistics (Australia)

- Survitec Group Ltd (U.K.)

- Verseidag-Indutex GmbH (Germany)

- Safe Life Defense (U.S.)

- Tactical Assault Gear (TAG) (U.S.)

- Hellweg International Pty. Ltd (Australia)

- MKU Limited (India)

- Mehler Vario System (Germany)

What are the Recent Developments in Global Ballistic Protective Equipment Market?

- In November 2023, MKU Limited unveiled its advanced Kavro Doma 360 ballistic helmet, engineered to provide protection against 7.62×39 mm MSC bullets from AK-47 rifles, as well as 7.62×51 mm and 5.56×45 mm NATO rounds. The helmet is compatible with accessories such as night vision devices, communication equipment, and protective masks, significantly enhancing its operational versatility. This innovation strengthens MKU's position in next-generation personal protection solutions

- In May 2023, GPC Investments completed the acquisition of Body Armor Outlet (BAO), a prominent supplier of protective equipment for law enforcement, military personnel, and civilians. While the financial specifics remain undisclosed, the acquisition is expected to accelerate BAO's product diversification and market expansion into new defense sectors, reinforcing its competitive standing

- In May 2022, TenCate Advanced Armor secured a contract from the Naval Surface Warfare Center to supply maritime buoyant plates as part of the Antiterrorism Afloat Equipage Program. This contract highlights TenCate's expertise in providing advanced ballistic protection solutions for naval operations, supporting mission readiness and safety

- In March 2022, BAE Systems was awarded a contract by the U.S. Marine Corps to deliver an Amphibious Combat Vehicle (ACV) Recovery variant, designed to offer direct maintenance and field support to the existing ACV fleet. This development enhances operational efficiency and reinforces BAE's role in delivering robust military mobility solutions

- In March 2022, BAE Systems also secured a contract from the U.S. Contracting Command to provide M109A7 self-propelled howitzers and M992A3 carrier ammunition tracked vehicles, supporting advanced artillery capabilities. This order strengthens BAE's contribution to U.S. defense modernization initiatives and next-generation armored vehicle programs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ballistic Protective Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ballistic Protective Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ballistic Protective Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.