Market Analysis and Insights of Batter and Breader Premixes Market

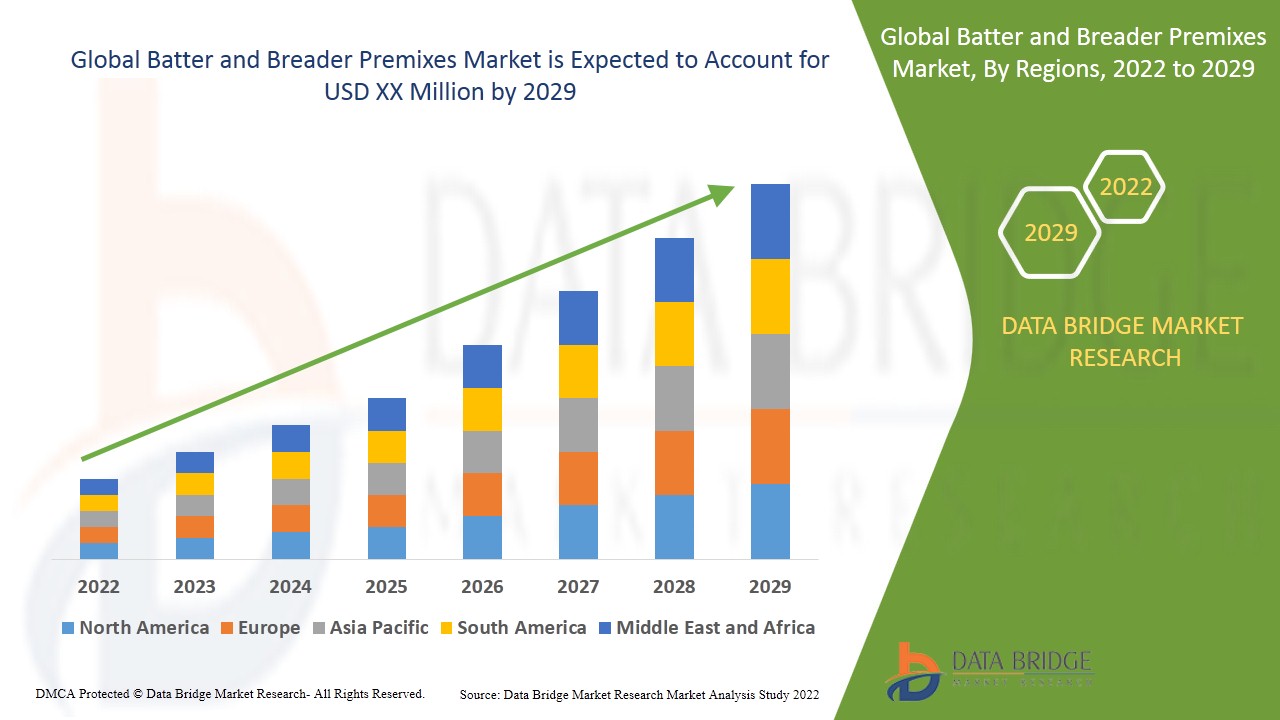

Data Bridge Market Research analyses that the global batter and breader premixes market will project a CAGR of 6.20% for the forecast period of 2022-2029. Growth and expansion of the food and beverages industry, growing number of product innovations by the major manufacturers and players, rising consumer demand for all kinds of meat related products around the globe, changings tastes and preferences of consumers, rising adoption of batter and premixes in frying meat, seafood, and poultry products at fast food joints and chains and increasing personal disposable income by the major companies are the major factors attributable to the growth of batter and breader premixes market.

Batter and breader premixes are the granulated flakes or powders that are used as food additives or coatings to enhance the taste and texture of food item. Batter and breader premixes help in retaining the moisture level and are utilized to prepare baked foods. Batter and breader premixes are extensively used in the kitchen applications for adding crispiness and texture to the food items.

Rising personal disposable income and growing consumer consciousness towards advantages of batter and breader premixes around the world are the major factors fostering the growth of the market. Changing lifestyle, westernization, rising research and development initiatives taken by major companies especially in the developing economies, increase in the customer preference for gluten-free and low- carbs food items and increase in the consumption of seafood and meat are acting as market growth determinants. Improving distribution channel, rise in foreign direct investment and growing adoption of urban lifestyle will further induce growth in the market value.

However, high costs associated with the manufactruing will pose a major challenge to the growth of the market. Fluctuations in the prices of raw materials and supply chain disruptions owing to the pandemic will further restrict the scope of growth for the market. Stringent regulations imposed by the government in certain economies, high risk of food contamination, adulteration of premixes by adding soy and wheat and lack of awareness in the backward areas will also hamper the market growth rate.

This batter and breader premixes market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on batter and breader premixes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Batter and Breader Premixes Market Scope and Market Size

The batter and breader premixes market is segmented on the basis of type, application and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the batter and breader premixes market is segmented into crumbs and flakes, flour and starch, adhesion batter, thick batter, tempura batter, beer batter and customized batter.

- On the basis of application, the batter and breader premixes market is fragmented into meat, vegetables, seafood, chicken and others.

- On the basis of distribution channel, the batter and breader premixes market is segmented into online distribution channel and offline distribution channel. Online distribution channel segment is sub-segmented into e-commerce platforms and company owned websites. Offline distribution channel segment is sub-segmented into supermarkets and hypermarkets, specialty stores and others.

Batter and Breader Premixes Market Country Level Analysis

The batter and breader premixes market is analyses and market size, volume information is provided by country, type, application and distribution channel as referenced above.

The countries covered in the batter and breader premixes market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa(MEA) as a part of Middle East and Africa(MEA).

North America region dominates the batter and breader premixes market and will continue to flourish its trend of dominance during the forecast period owing to the rise in demand from the baking industry. Asia-Pacific region will score the highest growth rate owing to the rise in awareness about the benefits offered by batter and breader premixes, increase in the consumption of seafood and meat, and increasing personal disposable income.

The country section of the batter and breader premixes market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Batter and Breader Premixes Market Share Analysis

The batter and breader premixes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to batter and breader premixes market.

Some of the major players operating in the batter and breader premixes market are Associated British Foods plc, Cargill, Incorporated, ADM, Euroma, House-Autry., Kerry, Bunge Limited, McCormick & Company, General Mills, Inc., Showa Sangyo Co., Ltd., Newly Weds Foods., BLENDEX COMPANY, Bowman Ingredients., Bunge North America, Inc., Coalescence LLC., Solina, Ingredion., Prima Limited, PT Sriboga Raturaya and Thai Nisshin Technomic Co., Ltd (TNT) among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL BATTER AND BREADER PREMIXES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL BATTER AND BREADER PREMIXES MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL BATTER AND BREADER PREMIXES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5.4 GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

5.5 SHOPPING BEHAVIOUR AND DYNAMICS

5.5.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.5.2 RESEARCH

5.5.3 IMPULSIVE

5.5.4 ADVERTISEMENT

5.5.4.1. TELEVISION ADVERTISEMENT

5.5.4.2. ONLINE ADVERTISEMENT

5.5.4.3. IN-STORE ADVERTISEMENT

5.5.4.4. OUTDOOR ADVERTISEMENT

5.6 PRIVATE LABEL VS BRAND ANALYSIS

5.7 PROMOTIONAL ACTIVITIES

5.8 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.9 NEW PRODUCT LAUNCH STRATEGY

5.9.1 NUMBER OF NEW PRODUCT LAUNCH

5.9.1.1. LINE EXTENSTION

5.9.1.2. NEW PACKAGING

5.9.1.3. RE-LAUNCHED

5.9.1.4. NEW FORMULATION

5.1 CONSUMER LEVEL TRENDS

5.11 MEETING CONSUMER REQUIREMENT

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY TYPE, 2021-2030 (USD MILLION)

10.1 OVERVIEW

10.2 BATTER PREMIXES

10.2.1 BATTER PREMIXES, BY TYPE

10.2.1.1. ADHESION BATTER

10.2.1.2. TEMPURA BATTER

10.2.1.3. THICK BATTER

10.2.1.4. CUSTOMIZED / SPECIALTY BATTER

10.2.1.5. SPICY BATTER PREMIX

10.2.1.6. PRE DUST PREMIX BATTER

10.2.1.7. BEER BATTER

10.2.1.8. OTHERS

10.2.2 BATTER PREMIXES, BY SOURCE

10.2.2.1. CEREALS

10.2.2.1.1. CEREALS, BY TYPE

10.2.2.1.2. WHEAT

10.2.2.1.3. RICE

10.2.2.1.4. CORN

10.2.2.1.5. SOY

10.2.2.1.6. OATS

10.2.2.1.7. BARLEY

10.2.2.1.8. OTHERS

10.2.2.2. NUTS

10.2.2.3. TAPIOCA

10.2.2.4. BLENDS

10.2.2.5. OTHERS

10.2.3 BATTER PREMIXES, BY NATURE

10.2.3.1. ORGANIC

10.2.3.2. CONVENTIONAL

10.3 BREADER PREMIXES

10.3.1 BREADER PREMIXES, BY TYPE

10.3.1.1. CRUMBS & FLAKES

10.3.1.1.1. CRUMBS & FLAKES, BY TYPE

10.3.1.1.1.1 DRY BREAD CRUMBS

10.3.1.1.1.2 FRESH BREAD CRUMBS

10.3.1.1.1.3 CRACKER CRUMBS

10.3.1.1.1.4 OTHERS

10.3.1.1.2. CRUMBS & FLAKES, BY SHAPE

10.3.1.1.2.1 CUBE

10.3.1.1.2.2 NEEDLE

10.3.1.1.2.3 GRANULE

10.3.1.1.2.4 FLAKES

10.3.1.1.3. CRUMBS & FLAKES, BY COLOR

10.3.1.1.3.1 WHITE

10.3.1.1.3.2 YELLOW

10.3.1.1.3.3 ORANGE

10.3.2 BREADER PREMIXES, BY NATURE

10.3.2.1. ORGANIC

10.3.2.2. CONVENTIONAL

11 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY NATURE, 2021-2030 (USD MILLION)

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

12.1 OVERVIEW

12.2 MEAT & POULTRY PRODUCTS

12.2.1 MEAT & POULTRY PRODUCTS, BY TYPE

12.2.1.1. PORK

12.2.1.2. LAMB

12.2.1.3. CHICKEN

12.2.1.4. GOAT

12.2.1.5. OTHERS

12.2.2 MEAT & POULTRY PRODUCTS, BY PRODUCT FORM

12.2.2.1. CUTLET

12.2.2.2. NUGGETS

12.2.2.3. DRUMS

12.2.2.4. FINGERS

12.2.2.5. OTHERS

12.2.3 MEAT & POULTRY PRODUCTS, BY PREMIXES TYPE

12.2.3.1. BATTER PREMIXES

12.2.3.2. BREADER PREMIXES

12.3 VEGETABLES

12.3.1 VEGETABLES, BY TYPE

12.3.1.1. ONION RINGS

12.3.1.2. POTATO

12.3.1.3. SWEET POTATO

12.3.1.4. MUSHROOMS

12.3.1.5. OTHERS

12.3.2 VEGETABLES, BY PREMIXES TYPE

12.3.2.1. BATTER PREMIXES

12.3.2.2. BREADER PREMIXES

12.4 SEAFOOD

12.4.1 SEAFOOD, BY TYPE

12.4.1.1. CRAB

12.4.1.2. SQUID

12.4.1.3. SHRIMP

12.4.1.4. FISH

12.4.1.5. PRAWNS

12.4.1.6. OTHERS

12.4.2 SEAFOOD, BY PREMIXES TYPE

12.4.2.1. BATTER PREMIXES

12.4.2.2. BREADER PREMIXES

12.5 OTHERS

13 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY END USER, 2021-2030 (USD MILLION)

13.1 OVERVIEW

13.2 HOUSEHOLD / RETAIL

13.3 FOOD SERVICE SECTOR

13.3.1 RESTAURANTS

13.3.1.1. RESTAURANTS, BY TYPE

13.3.1.1.1. CHAIN RESTAURANT

13.3.1.1.2. INDEPENDENT RESTAURANT

13.3.1.2. RESTAURANTS, BY SERVICE CATEGORY

13.3.1.2.1. QUICK SERVICE RESTAURANTS

13.3.1.2.2. FULL SERVICE RESTAURANTS

13.3.2 HOTELS

13.3.3 BARS

13.3.4 CAFÉ

13.3.5 CATERING

13.3.6 OTHERS

14 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

14.1 OVERVIEW

14.2 STORE BASED RETAILERS

14.2.1 HYPERMARKETS / SUPERMARKETS

14.2.2 GROCERY STORES

14.2.3 CONVENIENCE STORES

14.2.4 SPECIALTY STORES

14.2.5 OTHERS

14.3 NON-STORE BASED

14.3.1 COMPANY OWNED WEBSITES

14.3.2 E-COMMERCE WEBSITES

15 GLOBAL BATTER AND BREADER PREMIXES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16 GLOBAL BATTER AND BREADER PREMIXES MARKET, BY GEOGRAPHY, 2021-2030 (USD MILLION)

16.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.2 NORTH AMERICA

16.2.1 U.S.

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 U.K.

16.3.3 ITALY

16.3.4 FRANCE

16.3.5 SPAIN

16.3.6 SWITZERLAND

16.3.7 NETHERLANDS

16.3.8 BELGIUM

16.3.9 RUSSIA

16.3.10 DENMARK

16.3.11 SWEDEN

16.3.12 POLAND

16.3.13 TURKEY

16.3.14 NORWAY

16.3.15 FINLAND

16.3.16 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 JAPAN

16.4.2 CHINA

16.4.3 SOUTH KOREA

16.4.4 INDIA

16.4.5 AUSTRALIA

16.4.6 SINGAPORE

16.4.7 THAILAND

16.4.8 INDONESIA

16.4.9 MALAYSIA

16.4.10 PHILIPPINES

16.4.11 NEW ZEALAND

16.4.12 VIETNAM

16.4.13 TAIWAN

16.4.14 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SOUTH AFRICA

16.6.2 UAE

16.6.3 SAUDI ARABIA

16.6.4 OMAN

16.6.5 QATAR

16.6.6 KUWAIT

16.6.7 ISRAEL

16.6.8 BAHRAIN

16.6.9 EGYPT

16.6.10 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL BATTER AND BREADER PREMIXES MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL BATTER AND BREADER PREMIXES MARKET, COMPANY PROFILE

18.1 KERRY GROUP PLC

18.1.1 COMPANY OVERVIEW

18.1.2 GEOGRAPHICAL PRESENCE

18.1.3 PRODUCTION CAPACITY OVERVIEW

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 HOUSE-AUTRY.

18.2.1 COMPANY OVERVIEW

18.2.2 GEOGRAPHICAL PRESENCE

18.2.3 PRODUCTION CAPACITY OVERVIEW

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 NEWLY WEDS FOODS

18.3.1 COMPANY OVERVIEW

18.3.2 GEOGRAPHICAL PRESENCE

18.3.3 PRODUCTION CAPACITY OVERVIEW

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 BOWMAN INGREDIENTS

18.4.1 COMPANY OVERVIEW

18.4.2 GEOGRAPHICAL PRESENCE

18.4.3 PRODUCTION CAPACITY OVERVIEW

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 INGREDION

18.5.1 COMPANY OVERVIEW

18.5.2 GEOGRAPHICAL PRESENCE

18.5.3 PRODUCTION CAPACITY OVERVIEW

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 COALESCENCE

18.6.1 COMPANY OVERVIEW

18.6.2 GEOGRAPHICAL PRESENCE

18.6.3 PRODUCTION CAPACITY OVERVIEW

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 TATE & LYLE

18.7.1 COMPANY OVERVIEW

18.7.2 GEOGRAPHICAL PRESENCE

18.7.3 PRODUCTION CAPACITY OVERVIEW

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 HET H'EERLIJCKE HOLLANDSCHE HANDELSHUYS

18.8.1 COMPANY OVERVIEW

18.8.2 GEOGRAPHICAL PRESENCE

18.8.3 PRODUCTION CAPACITY OVERVIEW

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 PANAMA FOODS

18.9.1 COMPANY OVERVIEW

18.9.2 GEOGRAPHICAL PRESENCE

18.9.3 PRODUCTION CAPACITY OVERVIEW

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 SHIMAKYU

18.10.1 COMPANY OVERVIEW

18.10.2 GEOGRAPHICAL PRESENCE

18.10.3 PRODUCTION CAPACITY OVERVIEW

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 PRIMA FLOUR

18.11.1 COMPANY OVERVIEW

18.11.2 GEOGRAPHICAL PRESENCE

18.11.3 PRODUCTION CAPACITY OVERVIEW

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 BAKING TECHNICAL ADVICE PTY LTD

18.12.1 COMPANY OVERVIEW

18.12.2 GEOGRAPHICAL PRESENCE

18.12.3 PRODUCTION CAPACITY OVERVIEW

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 MEDALLION FOODS INC.

18.13.1 COMPANY OVERVIEW

18.13.2 GEOGRAPHICAL PRESENCE

18.13.3 PRODUCTION CAPACITY OVERVIEW

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 HELIOFOOD

18.14.1 COMPANY OVERVIEW

18.14.2 GEOGRAPHICAL PRESENCE

18.14.3 PRODUCTION CAPACITY OVERVIEW

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 MCCORMICK & COMPANY, INC.

18.15.1 COMPANY OVERVIEW

18.15.2 GEOGRAPHICAL PRESENCE

18.15.3 PRODUCTION CAPACITY OVERVIEW

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 GENERAL MILLS INC

18.16.1 COMPANY OVERVIEW

18.16.2 GEOGRAPHICAL PRESENCE

18.16.3 PRODUCTION CAPACITY OVERVIEW

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 BLENDEX COMPANY

18.17.1 COMPANY OVERVIEW

18.17.2 GEOGRAPHICAL PRESENCE

18.17.3 PRODUCTION CAPACITY OVERVIEW

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 SRIBOGA RATURAYA

18.18.1 COMPANY OVERVIEW

18.18.2 GEOGRAPHICAL PRESENCE

18.18.3 PRODUCTION CAPACITY OVERVIEW

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 THAI NISSHIN TECHNOMIC

18.19.1 COMPANY OVERVIEW

18.19.2 GEOGRAPHICAL PRESENCE

18.19.3 PRODUCTION CAPACITY OVERVIEW

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Batter And Breader Premixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Batter And Breader Premixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Batter And Breader Premixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.