Global Battery Swapping Charging Infrastructure Market

Market Size in USD Million

CAGR :

%

USD

255.50 Million

USD

1,445.98 Million

2024

2032

USD

255.50 Million

USD

1,445.98 Million

2024

2032

| 2025 –2032 | |

| USD 255.50 Million | |

| USD 1,445.98 Million | |

|

|

|

Battery Swapping Charging Infrastructure Market Analysis

The battery swapping charging infrastructure market is experiencing significant growth, driven by the rapid adoption of electric vehicles (EVs) and the increasing need for efficient charging solutions. Battery swapping technology allows users to quickly exchange depleted batteries for fully charged ones, offering a convenient alternative to traditional charging methods. This is especially beneficial in regions with limited charging infrastructure or where long charging times are impractical. Major advancements in the market include the development of automated battery swapping systems, improved battery technologies, and the integration of smart technologies such as IoT and AI for seamless operations. Leading companies, such as NIO, Gogoro, and SUN Mobility, have been at the forefront of deploying these solutions, enhancing EV user experiences while addressing range anxiety and charging infrastructure challenges. Moreover, key players are expanding battery swapping stations across urban and rural areas, particularly in Asia-Pacific, where electric two-wheelers and commercial EVs are gaining momentum. As governments push for sustainable transportation solutions and renewable energy integration, the market is expected to witness further innovation, making battery swapping a crucial component of the EV ecosystem and a viable solution for a sustainable future.

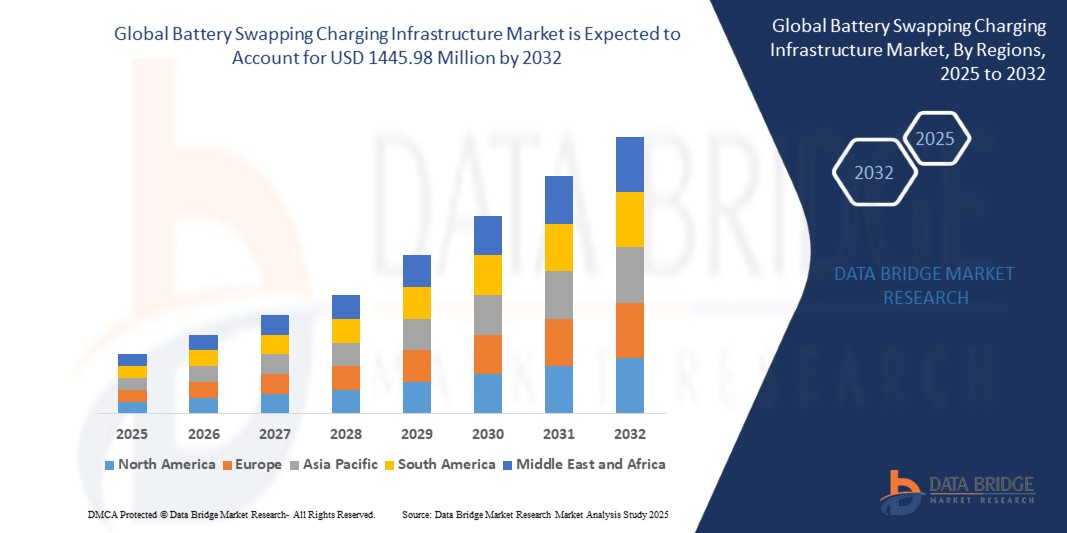

Battery Swapping Charging Infrastructure Market Size

The global battery swapping charging infrastructure market size was valued at USD 255.50 million in 2024 and is projected to reach USD 1445.98 million by 2032, with a CAGR of 24.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Battery Swapping Charging Infrastructure Market Trends

“Rapid Expansion of Automated Battery Swapping Stations”

A key trend in the battery swapping charging infrastructure market is the rapid expansion of automated battery swapping stations, driven by the need for faster, more efficient charging solutions for electric vehicles (EVs). Automated systems, such as those deployed by companies such as NIO and Gogoro, are transforming the EV charging landscape by allowing users to quickly swap depleted batteries for fully charged ones, reducing downtime and eliminating the need for long charging wait times. This innovation is particularly beneficial for electric two-wheelers and commercial vehicles, where efficiency is critical. For instance, Gogoro’s widespread deployment of battery swapping stations across Taiwan has greatly increased the convenience and adoption of electric scooters. As demand for EVs grows, especially in regions with dense urban populations and limited charging infrastructure, the shift toward automated battery swapping stations is gaining momentum. These advancements enhance the user experience, support large-scale EV adoption, and contribute to the development of a more sustainable transportation ecosystem.

Report Scope and Battery Swapping Charging Infrastructure Market Segmentation

|

Attributes |

Battery Swapping Charging Infrastructure Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

NIO (China), Gogoro (Taiwan), Leo Motors (South Korea), Yadea Technology Group Co., Ltd. (China), SUN Mobility (India), BYD Co. Ltd. (China), BattSwap Inc. (U.S.), KYMCO (Taiwan), Panasonic Corporation (Japan), Lithion Power Group Ltd. (India), Auton Motorized Systems (U.S.), EVgo Services LLC (U.S.), Ample (U.S.), Fortum (Finland), bp pulse (United Kingdom), Tesla (U.S.), IONITY GmbH (Germany), Geely Auto (China), Engie (France), and Shanghai Wanyou Electric (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Battery Swapping Charging Infrastructure Market Definition

Battery swapping charging infrastructure refers to a system that allows electric vehicles (EVs) to exchange depleted batteries for fully charged ones at dedicated stations, rather than waiting for the vehicle to charge. This method enables quick and efficient battery replacement, minimizing downtime and providing a convenient alternative to traditional charging methods. Battery swapping is particularly beneficial for vehicles such as electric two-wheelers, buses, and commercial fleets that require rapid turnaround times.

Battery Swapping Charging Infrastructure Market Dynamics

Drivers

- increasing Demand for Electric Vehicles (EVs)

The increasing demand for electric vehicles (EVs) is one of the key drivers for the expansion of battery swapping infrastructure. As electric vehicle sales soar worldwide, driven by the growing need for sustainable transportation, the demand for efficient charging solutions has become more pressing. Battery swapping, which enables quick replacement of depleted batteries with fully charged ones, is emerging as a convenient alternative to conventional charging methods. For instance, companies such as Gogoro in Taiwan have pioneered battery swapping stations for electric scooters, allowing users to swap batteries in under a minute, which is particularly beneficial for commuters in urban environments. This infrastructure is ideal for areas with high EV adoption but limited charging infrastructure. The rising popularity of electric vehicles, combined with the need for reduced downtime and faster turnaround times for charging, has accelerated the growth of battery swapping stations, making it a crucial market driver in the transition to electric mobility.

- Increasing Demand for Extended Range and Reduced Charging Times

The ability to offer extended range and reduced charging times is another significant driver for the adoption of battery swapping infrastructure. Unlike traditional charging, which can take several hours, battery swapping allows for almost instantaneous turnaround times, making it a highly appealing option for commercial fleets, delivery vehicles, and electric buses. For instance, in China, NIO, an electric vehicle manufacturer, has implemented a network of battery swapping stations for its electric cars, providing quick battery replacements that can be completed in under 3 minutes. This is particularly beneficial for businesses that rely on fleet vehicles for daily operations, such as delivery services and public transport, where time efficiency is critical. By reducing downtime and offering faster recharging, battery swapping helps keep commercial vehicles operational for longer hours, ultimately driving productivity and profitability. This enhanced convenience and efficiency are key factors contributing to the market growth of battery swapping infrastructure, especially in regions with a high concentration of commercial EVs.

Opportunities

- Growing Government Support and Favorable Policies

Government support and favorable policies are significant drivers for the growth of the battery swapping charging infrastructure market. Many governments around the world are pushing for the transition to green transportation and sustainable energy solutions, offering incentives, subsidies, and tax benefits to encourage the adoption of electric vehicles (EVs) and the infrastructure required to support them. For instance, in China, the government has been at the forefront of the electric mobility revolution, offering substantial investments in the expansion of EV infrastructure, including battery swapping stations. NIO, a major EV manufacturer in China, benefits from this initiative with a growing network of battery swapping stations. Similarly, in India, the government has launched initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which includes subsidies for building EV charging and swapping infrastructure. These policies make EV adoption more affordable for consumers create a robust ecosystem that supports battery swapping infrastructure, presenting a promising market opportunity for companies involved in EV infrastructure development.

- Increasing Demand for Convenience of Battery Swapping Stations

The convenience of battery swapping stations is a key market opportunity, especially for urban commuters in densely populated areas. In cities, many residents live in apartment complexes or rented accommodations where access to personal charging stations is limited or not feasible. Battery swapping offers a fast, convenient, and space-efficient alternative to traditional charging methods, which is particularly appealing for people living in such urban environments. For instance, in Taiwan, Gogoro has built an extensive network of battery swapping stations for its electric scooters, making it easy for urban dwellers to swap their depleted batteries for fully charged ones in seconds. This model has been widely embraced in cities where space is limited, and fast recharging solutions are essential. By catering to the needs of urban commuters who may not have access to home charging, battery swapping stations open up significant market potential, especially as the adoption of electric vehicles continues to grow in cities worldwide.

Restraints/Challenges

- High Initial Investment Costs

High initial investment costs represent a significant barrier to the development of battery swapping charging infrastructure, as establishing a network of swapping stations requires substantial capital. For instance, building a battery swapping station involves expenses related to the land, installation of specialized equipment, and development of robust systems for battery management, charging, and maintenance. In regions such as China, where battery swapping technology is being tested, companies such as NIO have invested millions of dollars in building and expanding battery swapping stations. Smaller players in the market face challenges in securing funding, as the scale required to make these stations viable can be difficult to achieve without the backing of large investors or partnerships. This high upfront investment, combined with the need for continuous operational costs (such as battery replacements, charging, and maintenance), makes it difficult for companies to reach profitability quickly. For many, this financial burden becomes a major market challenge, as they struggle to justify these costs without immediate, widespread adoption of electric vehicles (EVs) and battery swapping.

- Competition from Other Charging Technologies

Competition from other charging technologies is a significant challenge for the battery swapping infrastructure market, as alternative EV charging solutions, such as fast-charging stations and home-based chargers, offer simpler and more widely adopted methods for recharging electric vehicles. Fast-charging stations, for instance, allow EV owners to quickly recharge their vehicles in a matter of minutes, providing convenience without the need for complex infrastructure or specialized equipment. Companies such as Tesla have led the way with their Supercharger network, offering ultra-fast charging that can rival the convenience of traditional refueling methods. In contrast, battery swapping systems, which require the physical exchange of batteries at dedicated stations, can be more logistically challenging and costly to scale. This competition from fast-charging networks and home charging options, which have lower upfront investment costs and are easier to deploy, creates a significant market challenge for battery swapping infrastructure. As a result, consumers may be more inclined to adopt the simpler, more familiar charging solutions, slowing the adoption and growth of battery swapping technology.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Battery Swapping Charging Infrastructure Market Scope

The market is segmented on the basis of technology, swap mechanism, battery type, application, and connectivity. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Supercapacitor-based systems

- Battery-based systems

Swap Mechanism

- Automated Guided Vehicle (AGV) based

- Robotic Arm-based

Battery Type

- Lithium-ion batteries

- Solid-state batteries

- Ultracapacitors

Application

- Electric vehicles

- E-scooters and E-bikes

- Other Applications

Connectivity

- Cellular connectivity

- Wi-Fi connectivity

- Bluetooth connectivity

Battery Swapping Charging Infrastructure Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, technology, swap mechanism, battery type, application, and connectivity as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the battery swapping charging infrastructure market due to rapid advancements in electric vehicle adoption and supportive government policies in countries such as China, India, and Japan. The region's growing focus on reducing carbon emissions and the need for efficient charging solutions further fuel market growth. With a significant increase in electric two- and three-wheeler usage, especially in urban areas, battery swapping infrastructure is becoming a preferred solution. In addition, large-scale investments from both private and public sectors are accelerating the deployment of battery swapping stations across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Battery Swapping Charging Infrastructure Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Battery Swapping Charging Infrastructure Market Leaders Operating in the Market Are:

- NIO (China)

- Gogoro (Taiwan)

- Leo Motors (South Korea)

- Yadea Technology Group Co., Ltd. (China)

- SUN Mobility (India)

- BYD Co. Ltd. (China)

- BattSwap Inc. (U.S.)

- KYMCO (Taiwan)

- Panasonic Corporation (Japan)

- Lithion Power Group Ltd. (India)

- Auton Motorized Systems (U.S.)

- EVgo Services LLC (U.S.)

- Ample (U.S.)

- Fortum (Finland)

- bp pulse (United Kingdom)

- Tesla (U.S.)

- IONITY GmbH (Germany)

- Geely Auto (China)

- Engie (France)

- Shanghai Wanyou Electric (China)

Latest Developments in Battery Swapping Charging Infrastructure Market

- In December 2024, SUN Mobility introduced its modular battery-swapping technology designed specifically for heavy electric vehicles (HEVs). The technology was unveiled during a workshop in Chennai, which saw over 100 private bus operators from Tamil Nadu in attendance. This solution aims to address the major challenges faced by commercial fleet operators, such as high upfront costs, insufficient charging infrastructure, and extended downtime associated with conventional charging methods

- In November 2024, Honda Power Pack Energy India Private Ltd (HEID) revealed plans to set up 500 battery-swapping stations across Bengaluru, Delhi, and Mumbai by March 2026. This initiative is part of Honda's e:Swap service, aimed at improving the accessibility and convenience of electric two-wheelers, with a particular focus on the newly launched Honda Activa e

- In June 2022, Blink Charging Co. acquired EB Charging, a U.K.-based company specializing in electric vehicle charging and sustainable energy solutions. The acquisition enables Blink to expand its presence in the U.K. market and further develop its portfolio, including the installation of nearly 1,150 EV charging points

- In May 2022, SUN Mobility entered into a battery technology partnership with Greaves Electric. This collaboration focuses on utilizing shared charging infrastructure to introduce swappable batteries for electric two-wheelers and three-wheelers

- In February 2021, Tesla launched a battery swapping station in California, offering a solution to swap out an EV's energy cells for fully charged ones. This system eliminates the need for electric vehicle owners to rely on fast-charging stations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.