Global Big Data Security Market

Market Size in USD Billion

CAGR :

%

USD

28.43 Billion

USD

75.07 Billion

2024

2032

USD

28.43 Billion

USD

75.07 Billion

2024

2032

| 2025 –2032 | |

| USD 28.43 Billion | |

| USD 75.07 Billion | |

|

|

|

|

Big Data Security Market Size

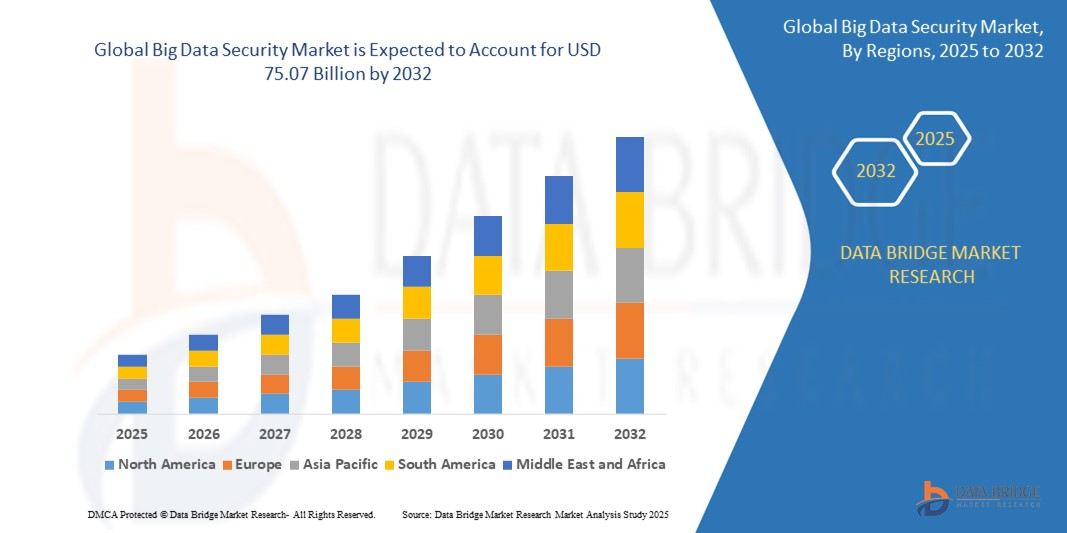

- The global big data security market size was valued at USD 28.43 billion in 2024 and is expected to reach USD 75.07 billion by 2032, at a CAGR of 12.90% during the forecast period

- Market growth is significantly driven by the increasing adoption and technological advancements in connected home devices and smart home technology, leading to greater digitalization in both residential and commercial sectors

- The rising consumer demand for secure, user-friendly, and integrated solutions, exemplified by the growing adoption of smart locks, is accelerating the uptake of big data security solutions within these interconnected environments

Big Data Security Market Analysis

- The increasing adoption of smart locks in residential and commercial settings highlights the growing need for robust security for interconnected devices and systems, which inherently generate and manage big data related to access control and user behavior

- The increasing volume, velocity, and variety of data generated across industries necessitate robust security measures to protect sensitive information, ensure compliance, and mitigate cyber threats within big data environments.

- The escalating sophistication of cyberattacks targeting large datasets and the critical insights derived from big data analytics are driving the demand for advanced security solutions capable of proactive threat detection and real-time response

- North America is projected to hold the largest revenue share (estimated above 30% in 2025) in the big data security market, fueled by its advanced technological infrastructure, stringent data protection regulations, and the presence of leading security vendors and early adopters of big data technologies. This regional dominance signifies a substantial market for securing extensive data assets

- The Asia-Pacific region is anticipated to be the fastest-growing market for big data security due to rapid digitalization, increasing adoption of cloud-based big data platforms, and growing awareness of cybersecurity risks across its expanding digital economies. This rapid growth will lead to a significant surge in the demand for big data security solutions in this region

- The software segment is expected to maintain its dominance with 75% share in the big data security market in 2025. Within this segment, solutions for data auditing and monitoring and data encryption, tokenization, and masking are anticipated to hold significant shares due to the increasing need for robust data governance and protection against sophisticated cyber threats. The shift towards cloud-based deployment is also a prominent trend, suggesting strong growth in security solutions tailored for cloud environments

Report Scope and Big Data Security Market Segmentation

|

Attributes |

Big Data Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Big Data Security Market Trends

“Increasing Focus on Proactive Threat Detection and Response”

- A significant and accelerating trend in the global Big Data Security Market is the increasing emphasis on proactive measures to identify and respond to potential threats. This involves leveraging advanced analytics, including Artificial Intelligence (AI) and Machine Learning (ML), to analyze vast datasets and anticipate security risks before they materialize

- For instance, security solutions are increasingly employing behavioral analytics to establish baseline patterns of normal data access and usage. Deviations from these baselines trigger alerts, potentially indicating malicious activity or compromised accounts

- AI integration in big data security enables features such as learning normal network traffic patterns to identify anomalies indicative of cyberattacks. Similarly, machine learning algorithms can analyze historical attack data to predict future attack vectors and strengthen defenses accordingly

- The seamless integration of proactive threat detection capabilities within broader security platforms facilitates a more unified and automated security posture. Through a centralized system, organizations can monitor big data environments, receive intelligent alerts about potential threats, and initiate automated response mechanisms to contain and mitigate risks

- This trend towards more intelligent and automated threat detection and response systems is fundamentally reshaping how organizations approach big data security. Consequently, companies are developing solutions with features such as real-time risk scoring based on data analysis and automated incident response workflows triggered by identified threats

- The demand for big data security solutions that offer seamless integration of proactive threat detection and automated response is growing rapidly across various industries, as organizations increasingly prioritize minimizing the impact of cyberattacks and ensuring the integrity and availability of their critical data assets

Big Data Security Market Dynamics

Driver

“Increasing Regulatory Scrutiny and Compliance Requirements”

- A significant factor shaping the big data security market is the growing intensity of regulatory scrutiny and the proliferation of stringent compliance requirements across various regions and industries. Governments and regulatory bodies worldwide are enacting and enforcing stricter rules regarding data privacy, data governance, and data security, particularly concerning large datasets and personal information

- For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA) in the United States, and similar laws in other jurisdictions mandate specific security measures for organizations processing significant volumes of data. These regulations often include requirements for data encryption, access controls, data breach notifications, and data minimization

- The need for organizations to comply with these complex and evolving regulatory landscapes is creating a substantial demand for big data security solutions that can help them meet these obligations. This includes tools for data discovery and classification, consent management, data anonymization, and audit logging, all of which are critical for demonstrating compliance

- Furthermore, industry-specific regulations, such as HIPAA in healthcare and PCI DSS in the financial services sector, impose additional security requirements on organizations handling large amounts of sensitive data within those domains. This necessitates tailored big data security solutions that address these specific compliance mandates

- The potential for significant fines and reputational damage resulting from non-compliance is a powerful motivator for organizations to invest in robust big data security measures. This regulatory pressure acts as a consistent and growing influence on market dynamics and technology adoption

- Consequently, the big data security market is seeing increased demand for solutions that offer built-in compliance features, automated reporting capabilities, and frameworks for adhering to various data protection regulations, making regulatory compliance a crucial "other" factor driving market growth and solution development

Restraint/Challenge

“Shortage of Skilled Big Data Security Professionals”

- A persistent shortage of skilled professionals able to design, implement, and manage complex big data security solutions significantly impacts the big data security market's growth and effectiveness. The specialized knowledge needed to navigate the intricacies of securing large and diverse datasets, coupled with the rapidly evolving threat landscape and technological advancements, creates a significant demand for qualified personnel

- For instance, organizations often struggle to find individuals with a strong understanding of both big data technologies (like Hadoop, Spark, NoSQL databases) and security principles (like cryptography, network security, identity management). This skills gap makes it challenging for companies to effectively deploy and maintain robust security postures for their big data environments

- The complexity of big data security necessitates professionals with expertise in areas such as data governance, compliance, threat intelligence analysis, security analytics, and incident response, all within the context of massive data volumes. The lack of a sufficient talent pool in these specialized domains can slow down the adoption of advanced security measures and increase the risk of security vulnerabilities

- Furthermore, the rapid pace of innovation in both big data technologies and cybersecurity threats means that security professionals need to continuously update their skills and knowledge. The shortage of individuals willing and able to engage in this ongoing learning further exacerbates the problem

- This skills gap can lead to organizations delaying or scaling back their big data initiatives due to a lack of confidence in their ability to secure these environments effectively. It can also result in existing security teams being overwhelmed and potentially making errors due to the complexity and volume of security alerts generated in big data systems

- Consequently, the big data security market is being influenced by the need for more accessible training programs, industry certifications, and initiatives to cultivate a larger pool of qualified big data security professionals

Big Data Security Market Scope

The market is segmented on the basis of component, technology, deployment model, organization size, and verticals.

- By Component

On the basis of component, the big data security market is segmented into software and services. The software segment is expected to hold the largest market revenue share in 2025, driven by the fundamental need for tools to secure data, manage access, and detect threats within big data environments. This includes solutions for data encryption, data masking, data auditing and monitoring, data governance, and threat intelligence platforms. The increasing volume and complexity of data necessitate robust software solutions for its protection.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for specialized expertise in implementing, managing, and optimizing big data security solutions. This includes consulting services, managed security services, training, and support, as organizations often lack the in-house skills to effectively secure their big data infrastructure.

- By Technology

On the basis of technology, the big data security market is segmented into encryption and tokenization, data loss prevention (DLP), identity and access management (IAM), security intelligence and analytics, and others. Security intelligence and analytics is expected to hold the largest market revenue share in 2025, driven by the crucial need to analyze vast datasets for threat detection, anomaly identification, and incident response. This includes SIEM, UEBA, and advanced analytics platforms tailored for big data environments.

Encryption and tokenization is anticipated to witness the fastest CAGR from 2025 to 2032, driven by increasing data privacy regulations and the growing need to protect sensitive information at rest and in transit within big data systems. These technologies are essential for maintaining data confidentiality and complying with mandates like GDPR and CCPA.

- By Deployment Model

On the basis of deployment model, the big data security market is segmented into on-premises, cloud, and hybrid. The cloud segment is expected to hold the largest market revenue share in 2025, driven by the increasing adoption of cloud platforms for big data storage and analytics due to their scalability and cost-effectiveness. Securing big data in the cloud requires specialized solutions tailored to cloud-native architectures.

The hybrid segment is anticipated to witness a significant growth rate from 2025 to 2032, as many organizations adopt a blended approach, leveraging both on-premises and cloud infrastructure for their big data initiatives. This necessitates security solutions that can seamlessly operate and provide consistent protection across these diverse environments.

- By Organization Size

On the basis of organization size, the big data security market is segmented into large enterprises and small and medium-sized enterprises (SMEs). Large enterprises are expected to account for the largest market revenue share in 2025, driven by their extensive data volumes, complex IT infrastructures, and higher susceptibility to sophisticated cyberattacks. Their stringent regulatory requirements also contribute to significant security spending.

The SMEs segment is anticipated to witness a substantial growth rate from 2025 to 2032, as they increasingly adopt big data analytics to gain business insights and require scalable and cost-effective security solutions to protect their growing data assets. The availability of more user-friendly and cloud-based security options is facilitating this growth

- By Verticals

On the basis of verticals, the big data security market is segmented into BFSI, healthcare, government and defense, retail and e-commerce, IT and telecom, manufacturing, energy and utilities, and others. The BFSI sector is expected to hold the largest market revenue share in 2025, driven by the highly sensitive nature of financial data and the stringent regulatory requirements they face. Protecting customer information and ensuring transaction security are paramount.

The healthcare sector is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing digitalization of patient data, the growing threat of ransomware attacks targeting healthcare organizations, and stringent regulations like HIPAA that mandate robust data security measures. The need to ensure patient privacy and the integrity of medical records is a key driver

Big Data Security Market Regional Analysis

- North America is projected to hold the largest revenue share in the global big data security market in 2025, estimated to be significantly over 30% based on current trends and the overall cybersecurity market share of the region

- This dominance is fueled by the region's advanced technological infrastructure, stringent data protection regulations (like CCPA), a high awareness of cybersecurity threats, and the strong presence of major technology vendors

- North American organizations are early adopters of big data analytics and consequently invest heavily in robust security solutions to protect their extensive data assets

U.S. Big Data Security Market Insight

The U.S. big data security market is set to capture the largest revenue share within North America in 2025. This dominance is driven by the widespread adoption of big data analytics across industries and a heightened focus on cybersecurity. Stringent regulatory requirements and increasing awareness of data breach risks further propel market expansion. The integration of AI-powered threat detection and robust data encryption, along with a strong culture of innovation, significantly contribute to the U.S. market's leading position.

Europe Big Data Security Market Insight

The European big data security market is projected to expand at a substantial CAGR due to stringent data protection regulations like GDPR. The escalating need for enhanced security for large datasets in enterprises and public sector organizations is a primary driver. Increasing digitalization and growing data volumes, coupled with heightened awareness of cyber threats, foster the adoption of advanced solutions. European organizations value compliance benefits and data sovereignty offered by robust security frameworks, leading to significant growth across various industries.

U.K. Big Data Security Market Insight

The U.K. big data security market is anticipated to grow at a noteworthy CAGR, driven by the escalating trend of digital transformation across industries and a strong emphasis on data protection and regulatory compliance, reflected in a projected CAGR of 12.8% for the overall UK cybersecurity market from 2025 to 2030. Concerns regarding cyberattacks and data breaches are encouraging both enterprises and government bodies to adopt robust security measures for their expanding big data environments. The U.K.'s embrace of cloud computing, alongside its well-established financial services and technology sectors, is expected to continue to stimulate market growth for advanced big data security solutions. The increasing adoption of data analytics for business intelligence and operational efficiency further underscores the need for comprehensive security frameworks to safeguard valuable data assets.

Germany Big Data Security Market Insight

The German big data security market is expected to expand at a considerable CAGR, driven by increasing awareness of digital security risks and demand for technologically advanced, secure, and privacy-focused solutions for large datasets. Its robust IT infrastructure and strong emphasis on data protection, including stringent regulations like GDPR, promote the adoption of robust security measures within key sectors like manufacturing and finance. The integration of big data analytics with Industry 4.0 initiatives and a growing focus on data sovereignty further align with local expectations, driving demand for sophisticated security solutions.

Asia-Pacific Big Data Security Market Insight

The Asia-Pacific big data security market is poised to grow at the fastest CAGR globally, estimated around 18% from 2024 to 2030. This rapid expansion is driven by increasing digitalization across its rapidly expanding economies and the rising adoption of cloud computing and big data analytics. A growing awareness of cybersecurity threats and the region's burgeoning digital infrastructure, supported by government initiatives promoting digitalization and smart cities, are further fueling demand for robust security solutions. As APAC becomes a hub for technology innovation, the need for effective data protection and regulatory compliance is expanding to a wider range of organizations, particularly in key countries like China, Japan, India, and South Korea, which are witnessing significant investments in big data security.

Japan Big Data Security Market Insight

The Japan big data security market is gaining momentum, projected to reach USD 5,833.2 Million by 2033 with a CAGR of 13.1% from 2025 to 2033. This growth is driven by the country's advanced technological infrastructure and strong emphasis on data security and privacy, influenced by regulations like the Act on the Protection of Personal Information (APPI). The increasing adoption of big data analytics across highly digitized industries like manufacturing, robotics, and finance further fuels demand for sophisticated security solutions. Integration of big data analytics with IoT and Industry 4.0 initiatives necessitates robust security frameworks to protect interconnected systems and vast datasets. Japan's focus on innovation and automation also spurs demand for secure and reliable big data management, solidifying its position in the global big data security landscape.

China Big Data Security Market Insight

The China big data security market accounted for the largest market revenue share in Asia Pacific in 2025, driven by its massive digital economy and rapid adoption of big data analytics across numerous sectors. Stringent government initiatives focused on cybersecurity and data sovereignty further propel this growth. As one of the largest generators and consumers of big data globally, China's vast e-commerce, technology, manufacturing, and government sectors critically rely on robust security solutions. The push towards smart cities, AI development, and the availability of advanced, domestically produced security technologies are key market drivers.

Big Data Security Market Share

The big data security is primarily led by well-established companies, including:

- FlexEnable Limited (U.K.)

- T+ink, Inc. (U.S.)

- Brewer Science, Inc. (U.S.)

- DuPont (U.S)

- Palo Alto Research Center (PARC) Inc. (U.S.)

- Interlink Electronics, Inc. (U.S)

- Thin Film Electronics ASA (Norway)

- ISORG (France)

- Peratech Holdco Ltd (U.K.)

- KWJ Engineering Inc., (U.S.)

- Fujifilm Holding Corporation (Japan)

- Canatu (Finland)

- Interlink Electronics, Inc. (U.S.)

- Tekscan, Inc. (U.S.)

- Imperva Inc. (U.S.)

Latest Developments in Global Big Data Security Market

- In June 2024, cybersecurity and observability leader Splunk Inc. announced significant security innovations aimed at bolstering threat detection and security operations across varied data landscapes. The unveiling included Splunk Enterprise 8.0, providing security teams with enhanced capabilities for proactive risk mitigation. Furthermore, Splunk introduced a new Federated Analytics feature, enabling the analysis of data at its origin point. This advancement facilitates more efficient and frequent threat detection and hunting by allowing security teams to gain insights without centralizing all data

- In April 2024, Trend Micro announced AI-driven cyber risk management enhancements to its Trend Vision One platform. This update integrates over ten security technology categories, offering a unified solution for proactive risk management. It simplifies the entire cyber risk lifecycle, from discovery and assessment to prioritization and remediation, exceeding the capabilities of traditional attack surface management tools

- In March 2024, Dell Technologies partnered with CrowdStrike to enhance their security offerings. Through this collaboration, Dell's customers gained access to their Managed Detection and Response (MDR) services, now enhanced by CrowdStrike's AI-native Falcon XDR platform. This integration aimed to provide a more robust defense for customers' systems against the increasingly complex landscape of cyberattacks by combining Dell's security expertise with CrowdStrike's advanced threat detection and response capabilities

- In December 2023, Thales Group finalized its acquisition of Imperva, a U.S.-based cybersecurity software and services company. This strategic move significantly bolstered Thales' global cybersecurity capabilities, catering to both government and enterprise clients. The acquisition broadened Thales' portfolio, particularly in application and data security, creating opportunities for enhanced solutions and market innovation within the cybersecurity landscape. This integration aimed to create a more comprehensive and robust offering to address the evolving challenges of digital security

- In November 2023, Broadcom Inc. finalized its acquisition of VMware, a prominent cloud computing and virtualization technology firm. This strategic merger combined Broadcom's extensive software portfolio with VMware's robust platform, creating an expanded suite of critical infrastructure solutions for their clientele. The integration aimed to deliver enhanced value and innovation by leveraging the strengths of both entities to address the evolving and complex needs of modern IT environments. This consolidation positioned the combined organization to offer a more comprehensive range of infrastructure software capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.