Global Bike Tyre Market

Market Size in USD Billion

CAGR :

%

USD

2.85 Billion

USD

6.50 Billion

2024

2032

USD

2.85 Billion

USD

6.50 Billion

2024

2032

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 6.50 Billion | |

|

|

|

|

Bike Tyre Market Size

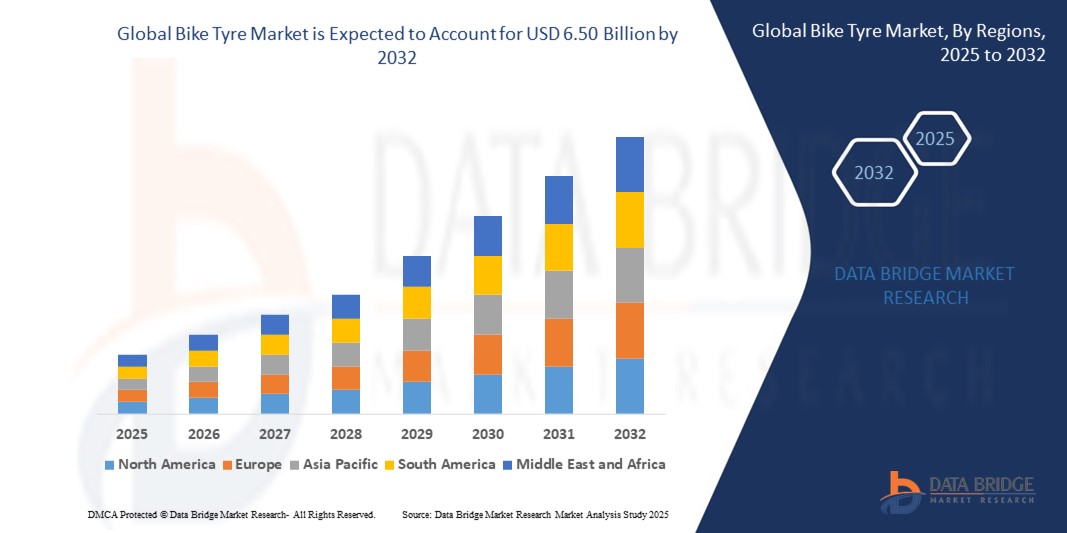

- The global bike tyre market size was valued at USD 2.85 billion in 2024 and is expected to reach USD 6.50 billion by 2032, at a CAGR of 10.83% during the forecast period

- The market growth is largely fueled by the increasing popularity of cycling as a sustainable mode of transportation and fitness activity, coupled with rising urbanization and infrastructure development supporting bicycle use

- Furthermore, growing consumer demand for durable, lightweight, and performance-enhancing tyre technologies especially in electric and sports bikes is establishing advanced bike tyres as a critical component of modern two-wheeler mobility. These converging factors are accelerating innovation and adoption in the bike tyre segment, thereby significantly boosting the industry's growth

Bike Tyre Market Analysis

- Bike tyres, essential components for bicycles across road, mountain, hybrid, and electric categories, are increasingly vital in supporting the global shift toward eco-friendly mobility, health-focused lifestyles, and recreational cycling across both developed and developing regions due to their impact on ride quality, safety, and performance

- The escalating demand for bike tyres is primarily fueled by the surge in cycling activities, rapid urbanization, government initiatives promoting sustainable transport, and the expanding use of electric and performance bikes that require advanced tyre technologies

- North America dominated the bike tyre market with the largest revenue share of 41.8% in 2024, characterized by strong consumer interest in fitness and leisure cycling, widespread availability of premium bicycles, and a high replacement rate of tyres, especially in the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the bike tyre market during the forecast period due to increasing disposable incomes, urban commuting trends, and a strong manufacturing base in countries such as China and India

- The tube tyre segment dominated the bike tyre market with a market share of 48.3% in 2024, supported by its cost-effectiveness, wide compatibility across bicycle types, and strong aftermarket demand, particularly in emerging economies

Report Scope and Bike Tyre Market Segmentation

|

Attributes |

Bike Tyre Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bike Tyre Market Trends

Rising Demand for E-Bike Tyres and Sustainable Materials

- A significant and accelerating trend in the global bike tyre market is the surging demand for e-bike specific tyres and the shift toward sustainable and eco-friendly materials in tyre manufacturing. As electric bikes gain popularity worldwide for urban commuting and recreational use, manufacturers are focusing on tyres that can withstand higher speeds, increased weight, and torque generated by electric drivetrains

- For instance, Continental offers the Contact Plus E tyre line specifically designed for e-bikes, providing puncture protection, high mileage, and enhanced grip. Similarly, Schwalbe’s Marathon E-Plus is engineered for e-bikes and meets European ECE-R75 certification standards

- In parallel, there is increasing momentum toward sustainable tyre solutions using natural rubber compounds, bio-based additives, and recycled materials. Companies such as Michelin and Vittoria are exploring green alternatives such as graphene and silica to reduce carbon emissions during production and extend tyre longevity

- The integration of intelligent design, including puncture-resistant layers, tubeless compatibility, and smart tread patterns for multiple terrains, is further elevating product performance. E-bike users particularly benefit from reinforced sidewalls and longer-lasting compounds, improving safety and reliability

- This trend toward durable, high-performance, and sustainable bike tyres is reshaping consumer expectations, particularly in urban mobility markets. Consequently, major players are investing in R&D to create tyres that balance environmental impact, durability, and performance under high-stress conditions, helping to establish a new standard for both e-bike and traditional cycling segments

- The growing interest in sustainable commuting, supported by government initiatives and improved cycling infrastructure, is accelerating demand for advanced bike tyre technologies across both developed and emerging markets

Bike Tyre Market Dynamics

Driver

Surging Popularity of Cycling and E-Bike Adoption

- The increasing adoption of bicycles as a primary or supplementary mode of transport, fitness tool, and recreational activity is a major driver of the global bike tyre market. This trend is particularly evident in urban areas, where concerns over pollution, traffic congestion, and personal health are encouraging a shift toward cycling

- For instance, in 2024, global e-bike sales saw double-digit growth, especially in Europe and North America, driven by environmental awareness, fuel savings, and supportive government subsidies. These developments are boosting demand for robust and high-quality tyres that cater to diverse terrain and performance needs

- In addition, rising disposable incomes and changing consumer lifestyles are promoting the use of high-end bikes, which in turn fuels demand for premium tyre technologies such as tubeless, puncture-resistant, and terrain-specific products

- The expanding cycling infrastructure, bike-sharing programs, and increased participation in cycling sports and events are further contributing to tyre replacement cycles and overall market expansion

- OEM partnerships with bike manufacturers and expanding online and offline aftermarket sales channels are making tyres more accessible and are stimulating growth, particularly in developing economies where bicycle ownership is rising rapidly

Restraint/Challenge

Raw Material Price Volatility and Counterfeit Product Infiltration

- The bike tyre market faces significant challenges from the fluctuating prices of raw materials such as natural and synthetic rubber, carbon black, and crude oil derivatives. These price swings impact production costs and profit margins, especially for smaller manufacturers with limited pricing flexibility

- For instance, geopolitical uncertainties, climate disruptions affecting rubber plantations, and supply chain constraints have all contributed to inconsistent pricing of key inputs since 2022, compelling tyre manufacturers to adopt cost-optimization strategies or raise product prices both of which can affect market competitiveness

- In addition, the global market is increasingly facing the issue of counterfeit and substandard tyres, particularly in price-sensitive regions. These products compromise rider safety and negatively impact the reputation of trusted brands

- While regulatory bodies are tightening standards and quality checks, lack of enforcement in some regions hampers effective market protection. This undermines consumer confidence and creates unfair competition for established players

- To overcome these challenges, companies are focusing on securing sustainable raw material supply chains, developing cost-efficient manufacturing technologies, and investing in brand protection through authentication technologies, certification, and awareness campaigns to reinforce trust and long-term growth

Bike Tyre Market Scope

The market is segmented on the basis of bicycle type, product type, tire size, and sales channel.

- By Bicycle Type

On the basis of bicycle type, the bike tyre market is segmented into mountain, hybrid, electric, comfort, youth, cruise, and road bikes. The road bike segment dominated the market with the largest revenue share of 32.4% in 2024, attributed to its widespread use for urban commuting, fitness, and long-distance travel. The increasing preference for lightweight and high-speed bicycles in cities, along with the growing number of cycling enthusiasts participating in road biking events, supports the segment's dominance.

The electric bike segment is anticipated to witness the fastest growth rate of 21.1% from 2025 to 2032, driven by the rising adoption of e-bikes worldwide. E-bikes require specialized tyres with enhanced durability, grip, and load-bearing capacity, prompting manufacturers to develop innovative e-bike-specific tyre solutions. Government incentives for e-mobility and infrastructure development for green transport also contribute to this segment’s rapid expansion.

- By Product Type

On the basis of product type, the bike tyre market is segmented into tube tyre, tubeless tyre, and solid tyre. The tube tyre segment held the largest market revenue share of 48.3% in 2024, owing to its cost-effectiveness, ease of installation, and compatibility with a wide range of bicycles. Tube tyres are particularly prevalent in developing regions and are favored in the aftermarket due to their affordability and availability.

The tubeless tyre segment is projected to grow at the fastest CAGR from 2025 to 2032, as performance cyclists and e-bike users increasingly prefer them for their superior puncture resistance, better traction, and lower rolling resistance. Advancements in tyre sealants and rim compatibility are further promoting tubeless adoption in both OEM and aftermarket channels.

- By Tire Size

On the basis of tire size, the bike tyre market is segmented into up to 12 inch, 12 to 22 inch, and above 22 inch. The 12 to 22 inch segment dominated the market with a revenue share of 45.6% in 2024, due to its widespread usage across multiple bike categories such as youth, hybrid, and standard commuter bikes. These sizes offer versatility, making them suitable for both entry-level and mid-range bicycles.

The above 22 inch segment is expected to grow at the highest CAGR from 2025 to 2032, driven by the increasing popularity of performance and mountain bikes that require larger wheels for better control, speed, and off-road capability. The segment also benefits from growth in recreational cycling and competitive sports.

- By Sales Channel

On the basis of sales channel, the bike tyre market is segmented into OEM and aftermarket. The aftermarket segment led the market with the largest revenue share of 63.1% in 2024, supported by frequent tyre replacement needs due to wear, terrain changes, and performance upgrades. Growing consumer interest in customization, coupled with expanding online retail platforms, has further fueled aftermarket sales globally.

The OEM segment is expected to experience steady growth during forecast period, backed by increased production and sales of new bicycles, especially electric and hybrid variants. Strategic partnerships between tyre manufacturers and bike OEMs are boosting the demand for pre-installed, specialized tyre models.

Bike Tyre Market Regional Analysis

- North America dominated the bike tyre market with the largest revenue share of 41.8% in 2024, characterized by strong consumer interest in fitness and leisure cycling, widespread availability of premium bicycles, and a high replacement rate of tyres, especially in the U.S. and Canada

- Consumers in the region highly value durable, lightweight, and puncture-resistant tyres that enhance ride quality and support various terrains, particularly in urban and off-road settings

- This strong market presence is further supported by a well-developed cycling infrastructure, high consumer spending on premium bicycles and accessories, and increased awareness of health, sustainability, and eco-friendly transport options

U.S. Bike Tyre Market Insight

The U.S. bike tyre market captured the largest revenue share of 79% in 2024 within North America, fueled by a surge in recreational and fitness-oriented cycling, growing e-bike adoption, and well-developed cycling infrastructure. Consumers are increasingly investing in performance-driven and puncture-resistant tyres to enhance durability and ride quality across urban and off-road terrains. The rise in DIY bike maintenance and robust demand for premium aftermarket tyre options are further propelling the market. In addition, the expansion of e-commerce and specialty bike retailers supports product accessibility and customization.

Europe Bike Tyre Market Insight

The Europe bike tyre market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising environmental awareness, well-established cycling infrastructure, and supportive government policies promoting sustainable mobility. The increase in e-bike sales and urban commuting trends are fostering demand for high-performance and durable tyre solutions. Europe is experiencing strong growth across both commuter and leisure cycling categories, with tyres being upgraded or replaced frequently as part of growing aftermarket activity and consumer preference for enhanced performance and safety.

U.K. Bike Tyre Market Insight

The U.K. bike tyre market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of cycling as a daily transport and fitness activity. Government investments in cycle-friendly infrastructure and increased participation in recreational cycling are fueling tyre sales. Consumers are showing strong preference for road and hybrid bike tyres, especially those offering puncture resistance and high grip. In addition, the U.K.’s strong online retail network and enthusiasm for electric bikes are contributing to increased demand for specialized tyre products.

Germany Bike Tyre Market Insight

The Germany bike tyre market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong cycling culture, high e-bike penetration, and emphasis on sustainability. German consumers prioritize eco-conscious and high-durability products, driving innovation in tyre design and materials. The aftermarket segment remains strong due to frequent tyre replacements and customization among urban and touring cyclists. Integration with smart cycling technologies and a focus on safety and performance continue to influence purchasing behavior.

Asia-Pacific Bike Tyre Market Insight

The Asia-Pacific bike tyre market is poised to grow at the fastest CAGR of 23.4% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and growing bicycle usage in countries such as China, India, and Indonesia. Increasing government support for non-motorized transport and smart city initiatives is boosting demand for both traditional and electric bicycle tyres. APAC’s role as a global manufacturing hub for bikes and components also ensures competitive pricing and broad product availability across markets.

Japan Bike Tyre Market Insight

The Japan bike tyre market is gaining momentum due to strong urban cycling culture, increasing interest in eco-friendly mobility, and rising use of electric bicycles. Japanese consumers prioritize quality, safety, and technological innovation, encouraging demand for advanced tyres with features such as puncture resistance, lightweight design, and smart compatibility. The integration of cycling into daily commutes and fitness routines, along with aging population needs, is driving demand for reliable and easy-to-maintain tyre options.

India Bike Tyre Market Insight

The India bike tyre market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to high bicycle ownership, affordability, and the country's rapidly growing urban population. The market is supported by a robust domestic manufacturing base, strong demand in both commuter and rural segments, and increasing popularity of electric and performance bikes. Government initiatives promoting cycling and affordable transport, along with growing awareness of health and environmental benefits, are expected to further fuel demand across both OEM and aftermarket channels.

Bike Tyre Market Share

The bike tyre industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Michelin (France)

- Pirelli & C. S.p.A. (Italy)

- Bridgestone Corporation (Japan)

- Ralf Bohle GmbH (Germany)

- Cheng Shin Rubber Ind. Co., Ltd. (Taiwan)

- Goodyear Bicycle Tires (U.S.)

- Kenda Rubber Industrial Co., Ltd. (Taiwan)

- Panaracer Corporation (Japan)

- Vittoria S.p.A. (Italy)

- Hutchinson S.A. (France)

- Trelleborg Group (Czech Republic)

- Innova Rubber Co., Ltd. (Thailand)

- Cheng Shin Tire (Taiwan)

- Inoue Rubber Co., Ltd. (Japan)

- Duro Tire & Wheel (Taiwan)

- Specialized Bicycle Components, Inc. (U.S.)

- Trek Bicycle Corporation (U.S.)

- Wilderness Trail Bikes (U.S.)

- Ralson India Ltd. (India)

What are the Recent Developments in Global Bike Tyre Market?

- In May 2023, Continental AG expanded its bicycle tyre production capacity at its Korbach plant in Germany, aiming to meet the growing global demand for high-performance and e-bike-specific tyres. This strategic investment underscores Continental’s focus on premium mobility solutions and its commitment to delivering cutting-edge tyre technologies tailored for safety, speed, and durability across diverse cycling categories, particularly in Europe and North America

- In April 2023, Michelin announced the launch of its new E-Wild range of mountain bike tyres, specifically engineered for electric mountain bikes (e-MTBs). These tyres offer enhanced grip, durability, and torque resistance, addressing the unique demands of e-MTB riders. The development reflects Michelin’s ongoing innovation in sustainable and performance-driven cycling solutions and highlights its effort to lead in the fast-growing e-bike segment

- In March 2023, JK Tyre & Industries Ltd., a prominent Indian tyre manufacturer, entered the premium bicycle tyre segment through the launch of its Blaze series. Designed for both commuter and performance bicycles, the series aims to cater to India’s rapidly expanding middle-class cycling demographic. The move signifies JK Tyre’s diversification strategy and its intention to capture a larger share of the two-wheeler mobility market

- In February 2023, Pirelli introduced its latest Scorpion XC RC tyres, targeting competitive cross-country mountain biking. The new product integrates SmartGRIP Compound and Lite Liner technology for superior puncture protection and low rolling resistance. This launch is aligned with Pirelli’s strategy of reinforcing its presence in high-performance cycling sports and appealing to professional and enthusiast cyclists globally

- In January 2023, Rubena Tyres (a brand under Trelleborg Group) launched a new line of eco-friendly bike tyres using partially recycled materials and bio-sourced rubber compounds. The product line caters to growing consumer demand for sustainable cycling components and reinforces Rubena’s commitment to environmental responsibility and innovation. The move supports broader industry trends toward greener mobility solutions without compromising performance or reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.