Global Green And Bio Based Plastic Packaging Additives Market

Market Size in USD Billion

CAGR :

%

USD

2.69 Billion

USD

4.04 Billion

2024

2032

USD

2.69 Billion

USD

4.04 Billion

2024

2032

| 2025 –2032 | |

| USD 2.69 Billion | |

| USD 4.04 Billion | |

|

|

|

|

What is the Global Green and Bio-based Plastic Packaging Additives Market Size and Growth Rate?

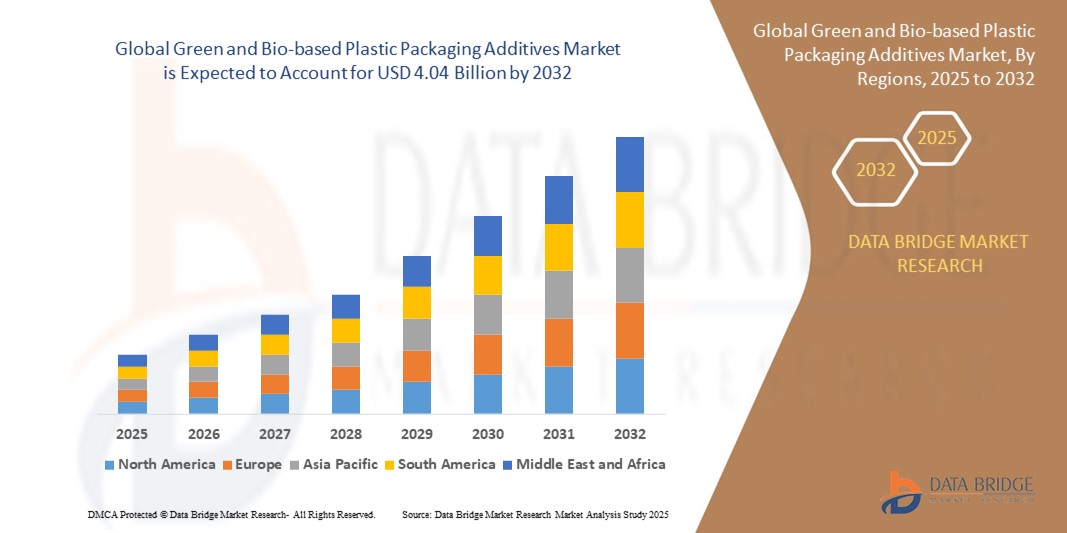

- The global Green and Bio-based Plastic Packaging Additives market size was valued at USD 2.69 billion in 2024 and is expected to reach USD 4.04 billion by 2032, at a CAGR of 5.20% during the forecast period

- Green and bio-based plastic packaging additives are driving market growth through advancements in sustainable materials and production technologies. Innovations include bio-resins and compostable additives, enhancing environmental benefits

- Companies are investing in research for improved performance and cost-efficiency. The market is expanding due to rising eco-conscious consumer demand and stricter regulations on plastic waste, offering substantial growth opportunities

What are the Major Takeaways of Green and Bio-based Plastic Packaging Additives Market?

- The growth in the organic and natural products market drives the demand for eco-friendly packaging solutions. As consumers increasingly seek organic items, companies require sustainable packaging to align with their eco-conscious brand image

- For instance, brands such as Unilever and Nestlé are adopting bio-based additives in their packaging to cater to this market shift, thus boosting the green and bio-based plastic packaging additives market

- North America dominated the green and bio-based plastic packaging additives market with the largest revenue share of 35.47% in 2024, fueled by robust sustainability regulations and rising adoption of bio-based alternatives in packaging applications

- Asia-Pacific region is projected to grow at the fastest CAGR of 12.05% during 2025–2032, driven by surging environmental regulations, rapid industrialization, and rising demand for sustainable packaging in e-commerce

- The Plasticizers segment dominated the market with the largest revenue share of 32.5% in 2024, driven by its widespread use in improving the flexibility, workability, and durability of bio-based plastics

Report Scope and Green and Bio-based Plastic Packaging Additives Market Segmentation

|

Attributes |

Green and Bio-based Plastic Packaging Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Green and Bio-based Plastic Packaging Additives Market?

“Sustainability-Driven Innovation in Packaging Additives”

- A major trend reshaping the global green and bio-based plastic packaging additives market is the rising emphasis on eco-friendly, biodegradable, and renewable materials. As consumer demand shifts toward sustainable living, industries are integrating green additives to reduce environmental impact without compromising performance

- For instance, BASF SE and Clariant AG have launched bio-based plasticizers and stabilizers designed for food-grade and compostable packaging, showcasing the industry's commitment to innovation with minimal ecological footprint

- These additives improve the mechanical strength, durability, and transparency of bioplastics and extend shelf life by enhancing barrier properties, making them ideal for food, beverage, and personal care packaging

- The use of plant-derived polymers such as PLA, PHA, and starch blends is gaining traction, and companies are increasingly incorporating antioxidants, antimicrobial agents, and UV stabilizers made from natural sources to meet regulatory compliance and consumer expectation

- This trend is accelerating with government bans on single-use plastics and extended producer responsibility (EPR) policies pushing industries toward sustainable alternatives

- As a result, green additives are becoming integral to circular economy initiatives, offering brands a marketable advantage and aligning with carbon neutrality goals across industries such as FMCG, cosmetics, and e-commerce

What are the Key Drivers of Green and Bio-based Plastic Packaging Additives market?

- Growing environmental concerns and stricter regulatory frameworks (such as the EU Green Deal and U.S. Plastics Pact) are compelling manufacturers to shift from petrochemical-based to renewable packaging materials

- For instance, in February 2024, TotalEnergies Corbion announced a strategic partnership to scale up production of bio-based PLA additives that support industrial compostability and low carbon emissions, reinforcing market momentum

- Rising consumer awareness and preference for non-toxic, food-safe packaging solutions is further increasing demand for additives that are BPA-free, phthalate-free, and biodegradable, especially in food and beverage applications

- In addition, industries are embracing green additives for their ability to enhance processing efficiency, reduce plastic content, and improve recyclability, aligning with the global push toward zero-waste packaging

- The cost-efficiency of bio-based feedstocks is also improving due to economies of scale, making these solutions increasingly competitive with synthetic additives

Which Factor is challenging the Growth of the Green and Bio-based Plastic Packaging Additives Market?

- Despite growing adoption, one key challenge is the cost competitiveness and limited performance range of certain green additives compared to conventional synthetic alternatives

- For instance, some bio-based antioxidants and plasticizers may underperform under high-temperature or high-moisture conditions, limiting their applicability in industrial or frozen food packaging

- Supply chain constraints for biomass feedstocks such as corn starch, sugarcane, and castor oil also lead to volatility in raw material prices, making long-term sourcing a concern for packaging companies

- Moreover, lack of standardization and limited global infrastructure for composting and recycling bio-based materials hampers their end-of-life value, leading to inconsistent disposal and undermining sustainability claims

- To overcome these barriers, companies must invest in R&D to improve thermal resistance and mechanical properties, while governments need to strengthen certification systems, labeling standards, and waste collection ecosystems to ensure scalability

- Addressing these issues will be crucial to driving mass adoption of green packaging additives and realizing their potential across sectors

How is the Green and Bio-based Plastic Packaging Additives Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Functionality Type

On the basis of functionality type, the green and bio-based plastic packaging additives market is segmented into Plasticizers, Antimicrobial Agents, Antistatic Agents, Flame-Retardants, Stabilizers, Reinforcing Agents, and Others. The Plasticizers segment dominated the market with the largest revenue share of 32.5% in 2024, driven by its widespread use in improving the flexibility, workability, and durability of bio-based plastics. Plasticizers play a crucial role in packaging applications where soft and pliable materials are needed, especially in food-grade films and flexible wraps. Their compatibility with biodegradable polymers such as PLA and starch-based plastics has made them a preferred choice for sustainable packaging solutions.

The Antimicrobial Agents segment is anticipated to witness the fastest growth rate of 20.9% from 2025 to 2032, fueled by increasing demand in food, medical, and personal care packaging. These additives help extend shelf life, prevent microbial contamination, and enhance hygiene — factors that are gaining importance due to growing health awareness and strict safety regulations.

- By Application

On the basis of application, the green and bio-based plastic packaging additives market is segmented into Packaging, Electronics, Medical Devices, Textiles, Consumer Goods, and Others. The Packaging segment accounted for the largest market revenue share of 47.8% in 2024, driven by the rising shift toward eco-friendly alternatives in food, beverage, and retail packaging. Increasing consumer preference for biodegradable and compostable packaging, supported by government bans on single-use plastics, has further fueled demand for green additives in this segment.

The Medical Devices segment is expected to witness the fastest CAGR from 2025 to 2032, owing to the increasing adoption of bio-based, non-toxic materials that meet stringent medical safety standards. The use of antimicrobial and biocompatible additives in disposable medical products, such as syringes and packaging films, is expanding rapidly to reduce hospital-acquired infections and environmental waste.

Which Region Holds the Largest Share of the Green and Bio-based Plastic Packaging Additives Market?

- North America dominated the green and bio-based plastic packaging additives market with the largest revenue share of 35.47% in 2024, fueled by robust sustainability regulations and rising adoption of bio-based alternatives in packaging applications

- Growing environmental awareness, strong investment in green technologies, and an expanding eco-conscious consumer base have significantly boosted the use of green additives in plastic packaging

- The region's established food & beverage, healthcare, and personal care industries, coupled with increasing demand for compostable and biodegradable packaging, are key drivers behind its market leadership

U.S. Green and Bio-based Plastic Packaging Additives Market Insight

The U.S. captured the largest revenue share in 2024 within North America, driven by the growing shift of major brands toward eco-friendly packaging to meet consumer expectations and regulatory standards. Initiatives such as the U.S. Plastics Pact and increasing investments in biodegradable plastic R&D have enhanced market traction. Moreover, the country's well-developed industrial base and support for circular economy frameworks continue to promote the adoption of bio-based plastic additives across diverse sectors.

Europe Green and Bio-based Plastic Packaging Additives Market Insight

The Europe market is projected to expand at a significant CAGR throughout the forecast period, propelled by EU-level directives such as the Single-Use Plastics Directive (SUPD) and strong sustainability commitments by packaging producers. Consumers are increasingly choosing products with environmentally friendly labels, while companies across sectors—from retail to foodservice—are replacing conventional plastics with bio-based alternatives. The presence of key biopolymer manufacturers further bolsters the region’s dominance in the green additives space.

U.K. Green and Bio-based Plastic Packaging Additives Market Insight

The U.K. market is expected to grow at a robust pace during the forecast period, supported by governmental efforts to achieve net-zero emissions by 2050. The surge in demand for biodegradable films, recyclable pouches, and bio-additive resins is driven by rising environmental consciousness and pressure on businesses to reduce their carbon footprint. In addition, innovations in packaging technology and collaborations between material scientists and manufacturers are accelerating the country’s transition toward sustainable packaging.

Germany Green and Bio-based Plastic Packaging Additives Market Insight

Germany is anticipated to expand steadily due to its strong emphasis on innovation and environmental compliance. With increasing demand for sustainable materials in food, cosmetic, and industrial packaging, companies are rapidly incorporating bio-based stabilizers, plasticizers, and antistatic agents. The country’s reputation for engineering excellence, combined with favorable R&D funding and an advanced recycling infrastructure, positions it as a pivotal hub for green packaging innovations in Europe.

Which Region is the Fastest Growing in the Green and Bio-based Plastic Packaging Additives Market?

Asia-Pacific region is projected to grow at the fastest CAGR of 12.05% during 2025–2032, driven by surging environmental regulations, rapid industrialization, and rising demand for sustainable packaging in e-commerce, FMCG, and healthcare. Government incentives promoting biodegradable plastics, alongside a booming packaging industry, are encouraging adoption across China, Japan, India, and Southeast Asia. In addition, regional R&D and low-cost manufacturing capabilities are expanding access to affordable, eco-friendly additives.

Japan Green and Bio-based Plastic Packaging Additives Market Insight

Japan is witnessing strong market momentum, backed by national initiatives targeting plastic waste reduction and consumer demand for minimal environmental impact packaging. The country’s aging population and technological leadership contribute to increased interest in biodegradable, safe, and lightweight packaging formats, especially in food and pharmaceuticals. Major Japanese firms are investing in R&D partnerships to scale up biopolymer-based additive development and commercialization.

China Green and Bio-based Plastic Packaging Additives Market Insight

China held the largest market share in Asia Pacific in 2024, propelled by its growing middle class, urbanization, and large-scale industrial packaging demand. The government's ban on single-use plastics and ongoing transition to green manufacturing practices are accelerating the use of plant-based and biodegradable additives. In addition, China’s strong domestic production capabilities and public-private sustainability programs make it a leading force in the global green packaging movement.

Which are the Top Companies in Green and Bio-based Plastic Packaging Additives Market?

The green and bio-based plastic packaging additives industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- Honeywell International Inc. (U.S.)

- ProAmpac (U.S.)

- Mondi (U.K.)

- Berry Global Inc. (U.S.)

- Tetra Pak International S.A. (Sweden)

- Sonoco Products Company (U.S.)

- Sealed Air (U.S.)

- Coveris (U.K.)

- ALPLA (Austria)

- Huhtamäki Oyj (Finland)

- WINPAK LTD. (Canada)

- DS Smith (U.K.)

- Ball Corporation (U.S.)

- Tetra Laval International S.A. (Switzerland)

What are the Recent Developments in Global Green and Bio-based Plastic Packaging Additives Market?

- In October 2024, AIMPLAS, Novamont, TotalEnergies Corbion, Corbion, Sulapac, and Kaneka collaborated under the ReBioCycle project to advance bioplastic upcycling solutions across Europe. This initiative aims to promote the circular economy in packaging through cutting-edge recycling technologies. The partnership is expected to significantly boost sustainable innovation within the bioplastics industry

- In June 2024, scientists from the University of Copenhagen developed a fully biodegradable plastic made using barley starch and fibers extracted from sugar beet waste. This new material presents a potential alternative to conventional plastics in packaging. The innovation marks a key step toward reducing dependency on fossil-based polymers

- In November 2023, Sulzer expanded its bioplastics technology portfolio with the launch of CAPSUL, a high-performance system for producing polycaprolactone (PCL) grades. These PCL grades are primarily utilized in textile, horticultural, and agricultural packaging applications. This advancement enhances Sulzer’s position in sustainable packaging solutions

- In September 2023, BASF SE introduced the first biomass-balanced plastic additives, including Irganox 1076 FD BMBcert and Irganox 1010 BMBcert, both certified by TÜV Nord for ISCC PLUS mass balance compliance. These additives help transition away from fossil-based feedstocks. The move strengthens BASF’s commitment to climate-friendly and renewable materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Green And Bio Based Plastic Packaging Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Green And Bio Based Plastic Packaging Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Green And Bio Based Plastic Packaging Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.